Key Insights

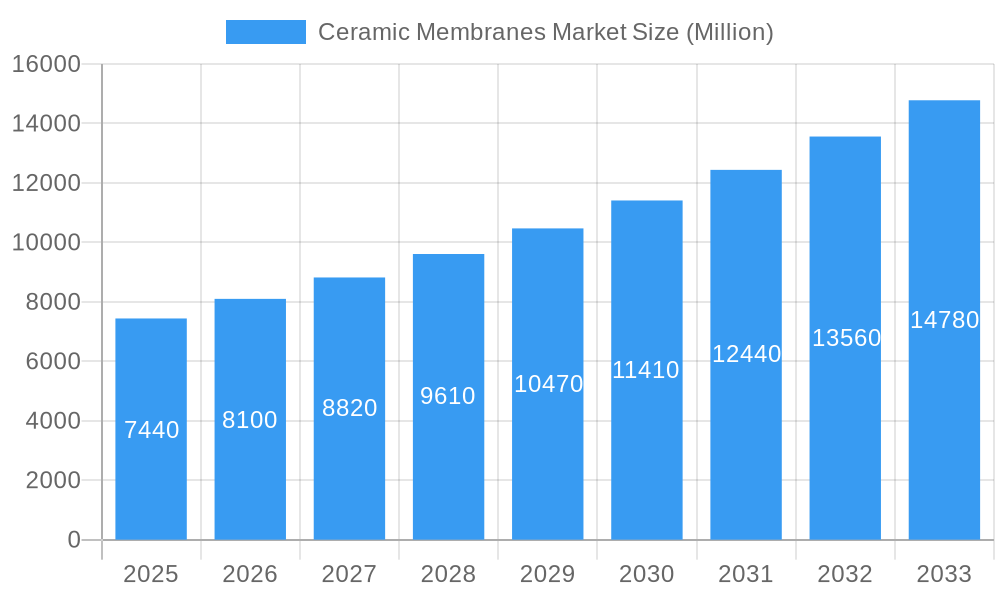

The global ceramic membranes market, valued at $7.44 billion in 2025, is projected to experience robust growth, driven by increasing demand across various end-user industries. A compound annual growth rate (CAGR) of 8.91% from 2025 to 2033 indicates a significant expansion, reaching an estimated market value exceeding $16 billion by 2033. This growth is fueled by several key factors. The rising adoption of ceramic membranes in water and wastewater treatment is a major driver, owing to their superior chemical resistance, thermal stability, and longer lifespan compared to polymeric membranes. The food and beverage industry's increasing focus on hygiene and product purity is also boosting demand. Furthermore, the chemical and pharmaceutical industries rely heavily on precise filtration and separation processes, making ceramic membranes an essential technology for maintaining product quality and safety. Technological advancements leading to improved membrane performance, reduced fouling, and enhanced cost-effectiveness are further accelerating market expansion. While the initial investment cost can be higher than other membrane types, the long-term operational benefits and reduced replacement costs contribute to a positive return on investment.

Ceramic Membranes Market Market Size (In Billion)

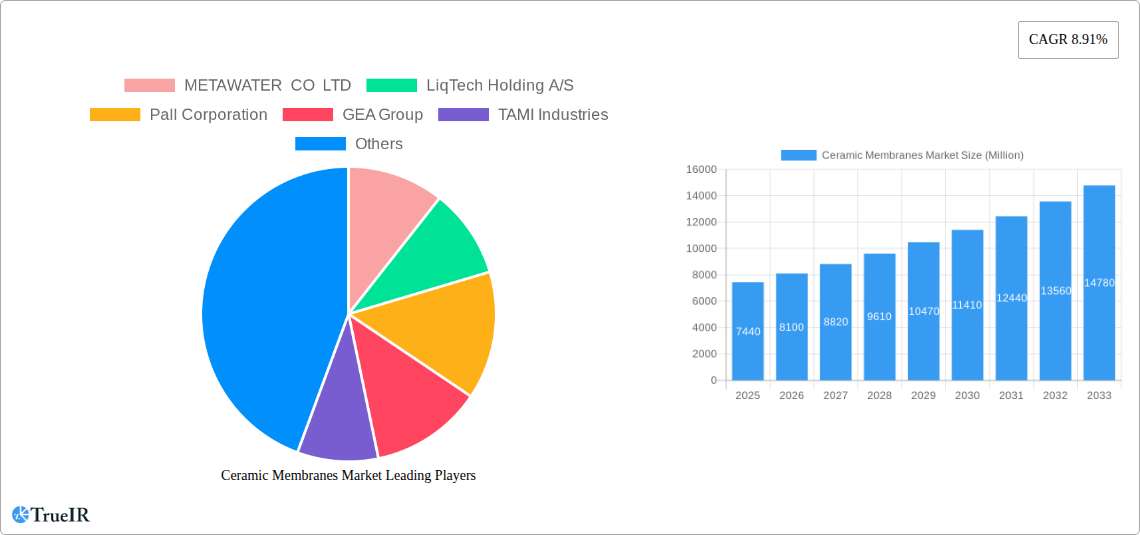

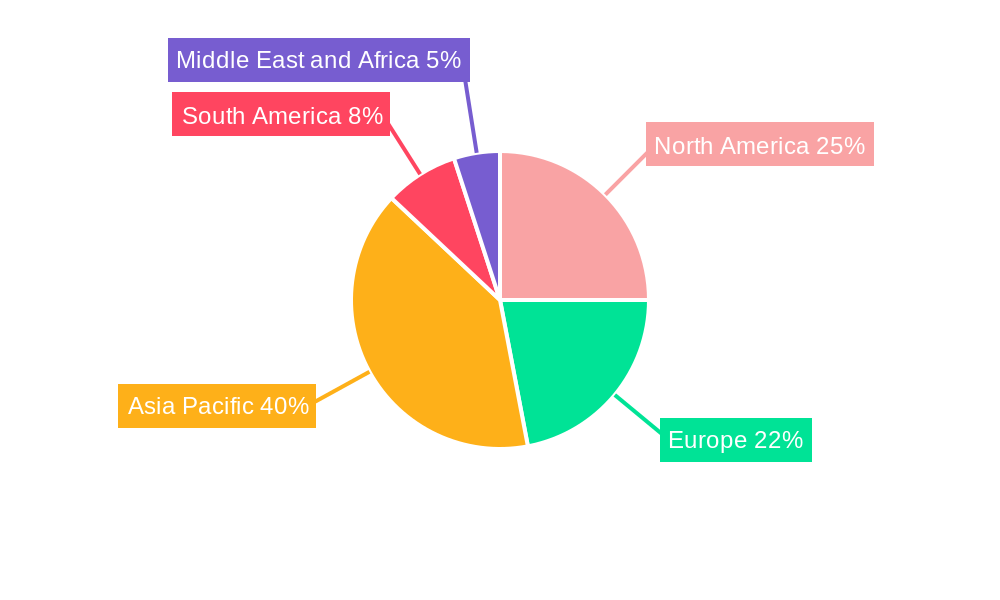

Regional growth is expected to vary, with the Asia-Pacific region, particularly China and India, anticipated to lead the expansion due to rapid industrialization and increasing environmental concerns. North America and Europe will also contribute significantly, driven by stringent environmental regulations and a focus on sustainable water management practices. The market segmentation by material type reflects the diverse application needs. Alumina, silica, and titania are prominent materials, each offering unique properties tailored to specific applications. Zirconium oxide and other specialized materials like silicon carbide and glassy materials cater to niche applications requiring exceptional durability or specific chemical resistance. Competitive landscape analysis reveals a mix of established players like Pall Corporation and GEA Group, alongside emerging innovative companies developing advanced ceramic membrane technologies. This dynamic interplay will likely shape market trends in the coming years, fostering innovation and driving further market growth.

Ceramic Membranes Market Company Market Share

Ceramic Membranes Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the global Ceramic Membranes Market, offering invaluable insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a focus on the base year 2025, this report meticulously examines market size, growth drivers, competitive dynamics, and future trends. The report leverages extensive data analysis and qualitative insights to offer a holistic understanding of this rapidly evolving market. The global Ceramic Membranes market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Ceramic Membranes Market Structure & Competitive Landscape

The Ceramic Membranes market exhibits a moderately concentrated structure, with key players holding significant market share. However, the presence of numerous smaller players and ongoing innovation signifies a dynamic competitive landscape. The market concentration ratio (CR4) is estimated at xx%, indicating a moderate level of consolidation. Several factors influence market competitiveness, including:

- Innovation Drivers: Continuous advancements in material science, manufacturing techniques, and membrane design are driving innovation and product differentiation. This includes the development of higher-performing membranes with enhanced selectivity, durability, and resistance to fouling.

- Regulatory Impacts: Stringent environmental regulations concerning water and wastewater treatment, along with increasing awareness of water scarcity, are driving the demand for advanced filtration solutions, thus creating substantial market opportunities.

- Product Substitutes: While ceramic membranes offer unique advantages, they face competition from other membrane technologies like polymeric membranes. However, ceramic membranes’ inherent robustness and resistance to harsh chemicals offer a competitive edge in specific applications.

- End-User Segmentation: The market is segmented across diverse end-user industries, including Water and Wastewater Treatment (the largest segment), Food and Beverage, Chemical Industry, Pharmaceutical, and others. The varying needs of each industry influence market demand and product specifications.

- M&A Trends: The Ceramic Membranes market has witnessed a moderate level of mergers and acquisitions (M&A) activity in recent years, with xx M&A deals recorded between 2019 and 2024. These transactions aim to expand market reach, enhance technological capabilities, and consolidate market share.

Ceramic Membranes Market Trends & Opportunities

The Ceramic Membranes market is experiencing robust growth fueled by several key factors:

The global market size for ceramic membranes was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is driven by the increasing demand for clean water and efficient wastewater treatment solutions globally. Technological advancements, such as the development of high-performance ceramic membranes with enhanced fouling resistance and longer lifespan, are further fueling market expansion. Consumer preference for sustainable and environmentally friendly water treatment technologies also contributes significantly. The competitive landscape is characterized by both established players and emerging companies investing in research and development, driving further innovation and market expansion. Market penetration rates are increasing, particularly in developing economies experiencing rapid industrialization and urbanization, leading to a greater demand for efficient water and wastewater treatment solutions. These trends indicate a positive outlook for the Ceramic Membranes market, presenting lucrative opportunities for companies operating in this sector.

Dominant Markets & Segments in Ceramic Membranes Market

The Water and Wastewater Treatment segment continues to be the undisputed leader in the Ceramic Membranes market, projected to account for a significant share of the global market in the coming years. This dominance is fueled by increasingly stringent environmental regulations worldwide, a growing awareness of water scarcity, and the critical need for efficient industrial effluent management. Geographically, developed economies in North America and Europe remain key demand centers due to their established industrial bases and proactive environmental policies. However, the Asia Pacific region is poised for substantial growth, driven by rapid industrialization, expanding urban populations, and significant investments in modernizing water and wastewater infrastructure.

Key Growth Drivers and Leading Segments:

- Water and Wastewater Treatment: Essential for meeting regulatory compliance, addressing water scarcity challenges, and ensuring public health by removing contaminants from both municipal and industrial water sources.

- Food and Beverage Processing: Crucial for achieving high levels of purity required in beverage production, dairy processing, and the clarification of edible oils, ensuring product quality and compliance with stringent food safety standards.

- Chemical and Petrochemical Industry: Increasingly adopted for product recovery, catalyst separation, solvent dehydration, and the effective treatment of challenging chemical effluents, leading to process optimization and reduced environmental impact.

- Pharmaceutical and Biotechnology: Indispensable for producing highly purified water for drug manufacturing, sterile filtration, cell harvesting, and the separation of biomolecules, where absolute purity and biosecurity are paramount.

- Energy Sector: Finding applications in enhanced oil recovery, filtration of drilling fluids, and water treatment for power generation facilities.

Dominant Material Types: Currently, membranes made from Alumina (Al2O3) and Zirconium Oxide (ZrO2) hold a commanding position. Their exceptional chemical inertness, high thermal stability, mechanical robustness, and resistance to harsh operating conditions make them ideal for demanding industrial applications.

Ceramic Membranes Market Product Analysis

Ceramic membranes represent a superior alternative to conventional filtration technologies, offering unparalleled advantages in terms of chemical resistance, thermal stability, and long-term durability. Ongoing research and development are intensely focused on refining membrane performance through advancements in material science and fabrication techniques. This includes tailoring porosity, achieving precise pore size distributions, and developing innovative surface modifications to combat fouling effectively. These improvements translate directly into enhanced filtration efficiency, significant reductions in operational expenditures through less frequent cleaning and longer membrane lifecycles, and the ability to handle more aggressive process streams. The inherent versatility of ceramic membranes allows for their successful deployment across a wide spectrum of industrial processes, reinforcing their strong market fit and growing adoption.

Key Drivers, Barriers & Challenges in Ceramic Membranes Market

Key Drivers:

- Stringent environmental regulations are pushing industries to adopt more efficient and eco-friendly water treatment technologies.

- Increasing water scarcity in many parts of the world is driving demand for advanced water purification solutions.

- Technological advancements are leading to the development of higher-performance ceramic membranes with enhanced efficiency and durability.

Challenges and Restraints:

- High initial investment costs associated with ceramic membrane systems can hinder adoption, especially in developing countries.

- Complexities in membrane cleaning and maintenance can increase operational costs.

- Competition from alternative membrane technologies (e.g., polymeric membranes) adds pressure on market share.

Growth Drivers in the Ceramic Membranes Market Market

The Ceramic Membranes market is primarily propelled by growing environmental concerns, strict regulatory frameworks, and technological innovations. Specifically, stringent regulations on wastewater discharge are forcing industries to adopt advanced treatment technologies, driving demand for ceramic membranes. The scarcity of clean water resources is pushing for efficient water purification solutions, while technological advances in membrane design and manufacturing are enhancing efficiency and lowering costs, making ceramic membranes more attractive.

Challenges Impacting Ceramic Membranes Market Growth

Despite their significant advantages, the widespread adoption of ceramic membranes faces certain hurdles. The high initial capital investment for ceramic membrane systems often presents a barrier compared to less advanced filtration methods. Furthermore, the specialized knowledge and procedures required for effective cleaning and maintenance can contribute to increased operational complexity and costs, potentially deterring some end-users. The competitive landscape, featuring other established membrane technologies, and the constant threat of disruptive innovations also pose ongoing challenges that the ceramic membrane industry must continually address to maintain its growth trajectory.

Key Players Shaping the Ceramic Membranes Market Market

- METAWATER CO LTD

- LiqTech Holding A/S

- Pall Corporation

- GEA Group

- TAMI Industries

- JIUWU HI-TECH Membrane Technology

- Nanostone

- atech innovations GmbH

- Qua Group LLC

- Veolia

- ALSYS

Significant Ceramic Membranes Market Industry Milestones

- October 2022: METAWATER Co., Ltd. achieved a major milestone with the announcement of the construction of the world's largest ceramic membrane filtration water treatment plant in the United Kingdom. This project not only underscores the scalability of ceramic membrane technology but also significantly elevates its visibility and acceptance for large-scale municipal water treatment applications.

- September 2022: Nanostone's advanced ceramic ultrafiltration membrane technology received official approval for drinking water treatment in the United Kingdom. This validation from a key regulatory body confirms the safety and efficacy of their product, paving the way for expanded market opportunities in the potable water sector.

- Ongoing Innovation: Continuous advancements in manufacturing processes, such as single-step sintering and the development of novel composite materials, are contributing to reduced production costs and improved membrane properties, making ceramic membranes more competitive.

Future Outlook for Ceramic Membranes Market Market

The future trajectory for the Ceramic Membranes market is exceptionally promising, underpinned by robust and sustained demand from the critical water treatment sector and a growing number of other key end-user industries. Strategic investments in research and development are expected to yield next-generation membrane materials and designs, further enhancing performance and application scope. Increased governmental support for sustainable water management initiatives and stringent environmental regulations globally will continue to be powerful catalysts for market expansion. The development of more cost-effective manufacturing processes, coupled with the inherent benefits of durability and efficiency, will further solidify ceramic membranes' competitive edge and broaden their appeal across diverse industrial landscapes. This positive outlook signals substantial growth potential and attractive opportunities for companies innovating and operating within this dynamic and essential market.

Ceramic Membranes Market Segmentation

-

1. Material Type

- 1.1. Alumina

- 1.2. Silica

- 1.3. Titania

- 1.4. Zirconium Oxide

- 1.5. Other Ma

-

2. End-user Industry

- 2.1. Water and Wastewater Treatment

- 2.2. Food and Beverage

- 2.3. Chemical Industry

- 2.4. Pharmaceutical

- 2.5. Other En

Ceramic Membranes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Turkey

- 3.7. Russia

- 3.8. NORDIC Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Nigeria

- 5.3. Qatar

- 5.4. Egypt

- 5.5. United Arab Emirates

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Ceramic Membranes Market Regional Market Share

Geographic Coverage of Ceramic Membranes Market

Ceramic Membranes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Food and Beverage Industry; Rising Demand for Ceramic Membranes from Water Purification Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Ceramic Membranes Manufacturing; Other Restraints

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Treatment Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ceramic Membranes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Alumina

- 5.1.2. Silica

- 5.1.3. Titania

- 5.1.4. Zirconium Oxide

- 5.1.5. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Water and Wastewater Treatment

- 5.2.2. Food and Beverage

- 5.2.3. Chemical Industry

- 5.2.4. Pharmaceutical

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Asia Pacific Ceramic Membranes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Alumina

- 6.1.2. Silica

- 6.1.3. Titania

- 6.1.4. Zirconium Oxide

- 6.1.5. Other Ma

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Water and Wastewater Treatment

- 6.2.2. Food and Beverage

- 6.2.3. Chemical Industry

- 6.2.4. Pharmaceutical

- 6.2.5. Other En

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. North America Ceramic Membranes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Alumina

- 7.1.2. Silica

- 7.1.3. Titania

- 7.1.4. Zirconium Oxide

- 7.1.5. Other Ma

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Water and Wastewater Treatment

- 7.2.2. Food and Beverage

- 7.2.3. Chemical Industry

- 7.2.4. Pharmaceutical

- 7.2.5. Other En

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe Ceramic Membranes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Alumina

- 8.1.2. Silica

- 8.1.3. Titania

- 8.1.4. Zirconium Oxide

- 8.1.5. Other Ma

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Water and Wastewater Treatment

- 8.2.2. Food and Beverage

- 8.2.3. Chemical Industry

- 8.2.4. Pharmaceutical

- 8.2.5. Other En

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. South America Ceramic Membranes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Alumina

- 9.1.2. Silica

- 9.1.3. Titania

- 9.1.4. Zirconium Oxide

- 9.1.5. Other Ma

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Water and Wastewater Treatment

- 9.2.2. Food and Beverage

- 9.2.3. Chemical Industry

- 9.2.4. Pharmaceutical

- 9.2.5. Other En

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Ceramic Membranes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Alumina

- 10.1.2. Silica

- 10.1.3. Titania

- 10.1.4. Zirconium Oxide

- 10.1.5. Other Ma

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Water and Wastewater Treatment

- 10.2.2. Food and Beverage

- 10.2.3. Chemical Industry

- 10.2.4. Pharmaceutical

- 10.2.5. Other En

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 METAWATER CO LTD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LiqTech Holding A/S

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pall Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GEA Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TAMI Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JIUWU HI-TECH Membrane Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nanostone

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 atech innovations GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Qua Group LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Veolia*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ALSYS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 METAWATER CO LTD

List of Figures

- Figure 1: Global Ceramic Membranes Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Ceramic Membranes Market Revenue (Million), by Material Type 2025 & 2033

- Figure 3: Asia Pacific Ceramic Membranes Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: Asia Pacific Ceramic Membranes Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Ceramic Membranes Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Ceramic Membranes Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Ceramic Membranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Ceramic Membranes Market Revenue (Million), by Material Type 2025 & 2033

- Figure 9: North America Ceramic Membranes Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: North America Ceramic Membranes Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Ceramic Membranes Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Ceramic Membranes Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Ceramic Membranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Ceramic Membranes Market Revenue (Million), by Material Type 2025 & 2033

- Figure 15: Europe Ceramic Membranes Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Europe Ceramic Membranes Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Ceramic Membranes Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Ceramic Membranes Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Ceramic Membranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Ceramic Membranes Market Revenue (Million), by Material Type 2025 & 2033

- Figure 21: South America Ceramic Membranes Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: South America Ceramic Membranes Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Ceramic Membranes Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Ceramic Membranes Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Ceramic Membranes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Ceramic Membranes Market Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Middle East and Africa Ceramic Membranes Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East and Africa Ceramic Membranes Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Ceramic Membranes Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Ceramic Membranes Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Ceramic Membranes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ceramic Membranes Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Ceramic Membranes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Ceramic Membranes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Ceramic Membranes Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global Ceramic Membranes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Ceramic Membranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Thailand Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Ceramic Membranes Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 17: Global Ceramic Membranes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Ceramic Membranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United States Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Ceramic Membranes Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 23: Global Ceramic Membranes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Ceramic Membranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: France Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Spain Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Turkey Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Russia Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: NORDIC Countries Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Ceramic Membranes Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 35: Global Ceramic Membranes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 36: Global Ceramic Membranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Colombia Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Global Ceramic Membranes Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 42: Global Ceramic Membranes Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Ceramic Membranes Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Saudi Arabia Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Nigeria Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Qatar Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Egypt Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: United Arab Emirates Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Africa Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Middle East and Africa Ceramic Membranes Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ceramic Membranes Market?

The projected CAGR is approximately 8.91%.

2. Which companies are prominent players in the Ceramic Membranes Market?

Key companies in the market include METAWATER CO LTD, LiqTech Holding A/S, Pall Corporation, GEA Group, TAMI Industries, JIUWU HI-TECH Membrane Technology, Nanostone, atech innovations GmbH, Qua Group LLC, Veolia*List Not Exhaustive, ALSYS.

3. What are the main segments of the Ceramic Membranes Market?

The market segments include Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Food and Beverage Industry; Rising Demand for Ceramic Membranes from Water Purification Industry; Other Drivers.

6. What are the notable trends driving market growth?

Water and Wastewater Treatment Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Costs Associated with Ceramic Membranes Manufacturing; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2022: METAWATER Co., Ltd announced the construction of the world's largest ceramic membrane filtration water treatment plant in the United Kingdom. The Hampton Loade Water Treatment Plant, located near Bridgnorth in the West Midlands, United Kingdom, has a capacity to produce 210,000 cubic meters of water per day (equivalent to 55 million gallons daily) and can supply up to 700,000 people. The plant is presently undergoing renovation, and upon completion, it will become the world's largest ceramic membrane water treatment plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ceramic Membranes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ceramic Membranes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ceramic Membranes Market?

To stay informed about further developments, trends, and reports in the Ceramic Membranes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence