Key Insights

Chile's Wind Energy Market is set for significant expansion, forecast to reach $2.34 billion by 2024, driven by a Compound Annual Growth Rate (CAGR) of 9.6%. This growth is fueled by supportive government initiatives, escalating demand for renewable energy to meet climate objectives, and substantial investments in wind power infrastructure. Chile's dedication to decarbonization, combined with its exceptional wind resources in areas such as the Atacama Desert and its coastline, presents a compelling investment environment. Technological advancements in turbine efficiency and cost reduction further enhance market prospects, with trends toward larger turbines and the exploration of offshore wind capacity serving as key growth drivers.

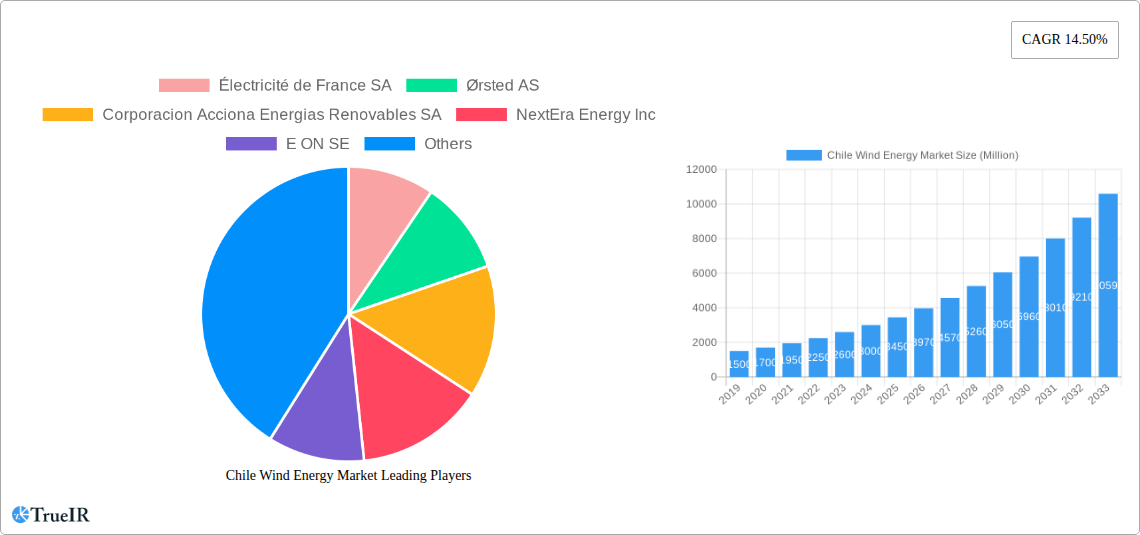

Chile Wind Energy Market Market Size (In Billion)

The market faces challenges including the substantial capital required for large-scale projects, complexities in integrating intermittent renewable energy sources into the grid, and environmental impact assessments for new installations. However, the strong momentum towards sustainable energy and Chile's ambitious renewable energy targets are expected to overcome these obstacles. The market is segmented by deployment type, with both onshore and offshore projects contributing to growth. Leading companies such as Électricité de France SA, Ørsted AS, and Siemens Gamesa Renewable Energy SA are instrumental in driving innovation and project development in Chile's wind energy sector.

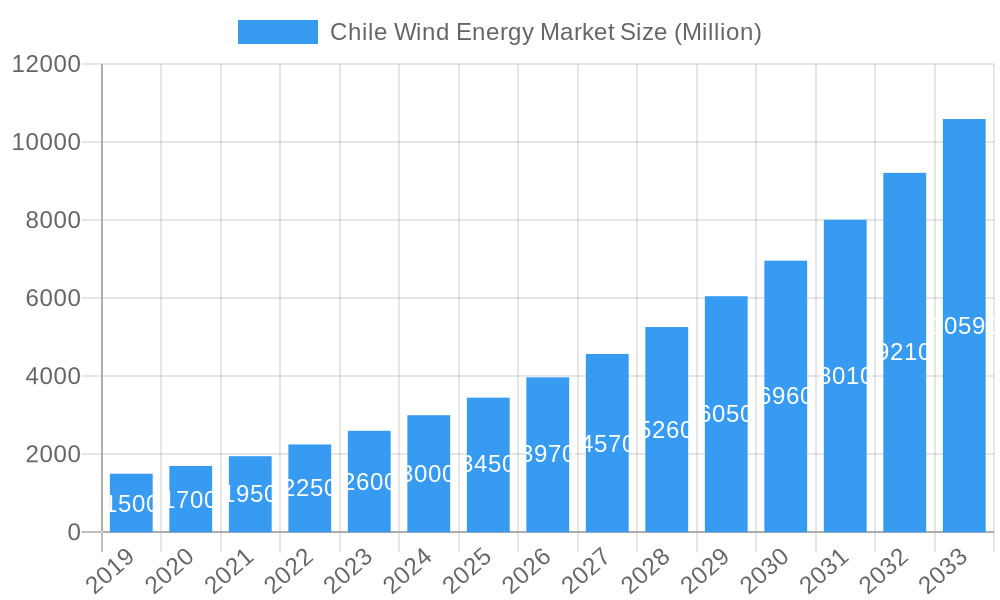

Chile Wind Energy Market Company Market Share

Chile Wind Energy Market: Comprehensive Analysis and Forecast (2019-2033)

Unlock critical insights into the booming Chile wind energy market with this in-depth report. Analyze market size, key drivers, technological advancements, and competitive dynamics shaping the future of renewable power in Chile. This report provides an actionable roadmap for stakeholders looking to capitalize on the significant growth opportunities in the Chilean wind sector.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Chile Wind Energy Market Market Structure & Competitive Landscape

The Chile wind energy market is characterized by a moderately concentrated competitive landscape, driven by significant investment from both domestic and international players. Innovation is primarily focused on increasing turbine efficiency, optimizing energy storage solutions, and improving grid integration capabilities. Regulatory frameworks, such as renewable energy auctions and tax incentives, play a crucial role in shaping market entry and expansion. Product substitutes, while emerging in other renewable sectors, are currently outpaced by the cost-effectiveness and maturity of wind technology for large-scale power generation. End-user segmentation primarily revolves around utility-scale power generation, with growing interest from industrial consumers seeking to decarbonize their operations. Merger and acquisition (M&A) activity is a key trend, with larger entities acquiring smaller developers to consolidate market share and leverage economies of scale. For instance, in the historical period of 2019-2024, an estimated USD 5,000 Million in M&A transactions have occurred within the Chilean renewable energy sector, with wind projects being a significant component. Concentration ratios for the top three players are estimated to be around 45% of installed capacity as of the base year 2025.

Chile Wind Energy Market Market Trends & Opportunities

The Chile wind energy market is poised for substantial expansion, driven by robust government support, declining technology costs, and a growing commitment to sustainability. Market size growth is projected to accelerate, with a compound annual growth rate (CAGR) estimated at 15% for the forecast period 2025–2033. Technological shifts are increasingly favoring larger, more efficient wind turbines, with a growing emphasis on offshore wind potential despite current onshore dominance. Consumer preferences are strongly leaning towards cleaner energy sources, propelled by public awareness campaigns and corporate sustainability goals. Competitive dynamics are intensifying, with established players expanding their portfolios and new entrants vying for market share through innovative project development and financing strategies. The market penetration rate for wind energy is expected to reach 30% of the total electricity generation mix by 2033. Opportunities lie in the development of hybrid projects combining wind power with battery energy storage systems (BESS) to enhance grid stability and provide ancillary services. Furthermore, the exploration of Chile's extensive coastline for offshore wind farms presents a significant, yet nascent, growth avenue with the potential to unlock gigawatts of clean energy. The ongoing energy transition in Chile, coupled with its favorable wind resources, creates a fertile ground for continued investment and innovation.

Dominant Markets & Segments in Chile Wind Energy Market

The Onshore segment currently dominates the Chile wind energy market, driven by established infrastructure, favorable land availability in key regions like the Atacama Desert, and a mature supply chain for onshore turbine technology. Policies supporting distributed generation and utility-scale projects have historically favored onshore deployments. The Atacama region, in particular, benefits from exceptionally high wind speeds and consistent resource availability, making it a prime location for large-scale wind farm development.

- Key Growth Drivers for Onshore Dominance:

- Exceptional Wind Resources: Regions like the Atacama Desert offer some of the best wind resources globally, leading to higher capacity factors and improved project economics.

- Established Infrastructure: Decades of development have led to robust grid connections and transportation networks suitable for onshore wind components.

- Cost-Effectiveness: Onshore wind technology is mature and cost-competitive, making it the go-to solution for new renewable energy capacity additions.

- Supportive Policies: Government auctions and incentives have consistently favored onshore wind projects, driving significant investment.

While onshore remains dominant, the Offshore wind segment represents a significant, albeit nascent, growth opportunity for the future. Chile's extensive coastline offers immense untapped potential for offshore wind development, which could significantly bolster its renewable energy capacity. The development of offshore wind farms is expected to gain traction in the latter half of the forecast period, driven by advancements in floating offshore wind technology, which is well-suited to Chile's deep-water continental shelf. Early-stage feasibility studies and pilot projects are anticipated to pave the way for larger-scale offshore deployments, potentially transforming Chile's energy landscape. The transition towards offshore wind will require substantial investment in specialized infrastructure, port facilities, and a dedicated supply chain, presenting both challenges and immense opportunities for strategic players.

Chile Wind Energy Market Product Analysis

The Chile wind energy market is characterized by the deployment of increasingly sophisticated wind turbine technologies. Innovations focus on enhancing energy capture through larger rotor diameters, higher hub heights, and advanced aerodynamic designs. Hybrid solutions integrating wind turbines with battery energy storage systems (BESS) are gaining significant traction, addressing intermittency and providing grid stability services. Competitive advantages are derived from technological superiority, cost-efficiency in installation and maintenance, and the ability to offer integrated energy solutions. The market fit for these advanced products is driven by Chile's ambitious renewable energy targets and the growing demand for reliable and sustainable power generation.

Key Drivers, Barriers & Challenges in Chile Wind Energy Market

Key Drivers:

- Favorable Government Policies & Targets: Chile's commitment to decarbonization and renewable energy targets, evidenced by its National Energy Policy, is a primary growth catalyst.

- Abundant Renewable Resources: The country boasts some of the world's best wind and solar resources, making renewable energy projects highly economically viable.

- Declining Technology Costs: Continual advancements in wind turbine technology and economies of scale have made wind power increasingly cost-competitive with traditional energy sources.

- Growing Investor Confidence: The stable regulatory environment and successful project execution have attracted significant domestic and international investment.

Barriers & Challenges:

- Grid Integration & Infrastructure Limitations: As renewable penetration increases, grid capacity and stability can become challenges, requiring significant investment in grid upgrades and smart grid technologies.

- Permitting & Social Acceptance: Complex permitting processes and potential local community concerns can lead to project delays.

- Supply Chain Constraints: While improving, sourcing specific components and skilled labor for large-scale projects can sometimes pose challenges.

- Intermittency Management: While BESS is emerging, managing the inherent intermittency of wind power remains a key operational challenge.

Growth Drivers in the Chile Wind Energy Market Market

The Chile wind energy market is propelled by a confluence of factors. Government mandates for renewable energy targets, such as achieving 60% renewable energy in the generation mix by 2030, provide a strong policy impetus. Economic drivers include the declining levelized cost of energy (LCOE) for wind projects, making them increasingly competitive against fossil fuels, with an estimated LCOE of USD 40-60 per MWh for new onshore wind farms. Technological advancements in turbine efficiency and reliability are crucial, enabling higher energy yields. Furthermore, a growing emphasis on energy security and independence from volatile global fuel markets is a significant economic and strategic driver.

Challenges Impacting Chile Wind Energy Market Growth

Challenges impacting Chile's wind energy growth include the need for significant grid modernization to accommodate increased renewable energy penetration. Ensuring grid stability with the variable nature of wind power requires substantial investment in energy storage solutions, with the cost of utility-scale battery storage still a consideration, estimated between USD 300-500 per kWh. Regulatory complexities and the time-consuming nature of permitting processes can lead to project delays. Supply chain disruptions and the availability of specialized equipment and skilled labor for large-scale projects can also pose constraints. Competition from other renewable sources, particularly solar power, also influences market dynamics, requiring wind projects to remain highly competitive on cost and performance.

Key Players Shaping the Chile Wind Energy Market Market

- Électricité de France SA

- Ørsted AS

- Corporacion Acciona Energias Renovables SA

- NextEra Energy Inc

- E ON SE

- Siemens Gamesa Renewable Energy SA

- Trident Winds Inc

- Duke Energy Corporation

- EnBW Energie Baden-Wurttemberg AG

- Enel Green Power Chile

- ACCIONA Energy

Significant Chile Wind Energy Market Industry Milestones

- February 2023: Ibereolica Repsol Renovables Chile began producing electricity at the 165-MW Atacama wind farm, aiming to generate around 450 GWh annually and avert 320,000 metric tons of CO2 emissions.

- December 2022: FairWind was chosen as the installation partner for the Horizonte Wind Park, the largest onshore wind farm in Latin America under development, involving the installation of 140 Enercon E-160 EP5 wind turbines.

- November 2022: Enel's renewables division commenced work on a project in Chile combining wind turbines (224.8 MW) with a 34-MW battery energy storage system (BESS), representing a USD 190 million investment.

Future Outlook for Chile Wind Energy Market Market

The future outlook for the Chile wind energy market is exceptionally promising, driven by sustained policy support and a strong commitment to achieving ambitious renewable energy targets. Strategic opportunities lie in the continued expansion of onshore wind capacity, particularly in regions with optimal wind resources, and the burgeoning development of offshore wind projects. The integration of advanced energy storage solutions will be critical to enhancing grid stability and maximizing the value of wind power. Investments in grid modernization and the development of a robust supply chain will further accelerate market growth. Chile's position as a leader in renewable energy adoption in Latin America will continue to attract foreign investment, fostering innovation and driving down costs, thereby ensuring a robust and sustainable future for wind energy in the country. The market is projected to see continued strong growth, with installed capacity expected to exceed 10,000 MW by 2033.

Chile Wind Energy Market Segmentation

-

1. BY LOCATION OF DEPLOYMENT

- 1.1. Onshore

- 1.2. Offshore

Chile Wind Energy Market Segmentation By Geography

- 1. Chile

Chile Wind Energy Market Regional Market Share

Geographic Coverage of Chile Wind Energy Market

Chile Wind Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternate Energy Sources

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile Wind Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY LOCATION OF DEPLOYMENT

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by BY LOCATION OF DEPLOYMENT

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Électricité de France SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ørsted AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Corporacion Acciona Energias Renovables SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NextEra Energy Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 E ON SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens Gamesa Renewable Energy SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Trident Winds Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Duke Energy Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EnBW Energie Baden-Wurttemberg AG*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Enel Green Power Chile

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ACCIONA Energy

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Électricité de France SA

List of Figures

- Figure 1: Chile Wind Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Chile Wind Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Chile Wind Energy Market Revenue billion Forecast, by BY LOCATION OF DEPLOYMENT 2020 & 2033

- Table 2: Chile Wind Energy Market Volume gigawatt Forecast, by BY LOCATION OF DEPLOYMENT 2020 & 2033

- Table 3: Chile Wind Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Chile Wind Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 5: Chile Wind Energy Market Revenue billion Forecast, by BY LOCATION OF DEPLOYMENT 2020 & 2033

- Table 6: Chile Wind Energy Market Volume gigawatt Forecast, by BY LOCATION OF DEPLOYMENT 2020 & 2033

- Table 7: Chile Wind Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Chile Wind Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile Wind Energy Market?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Chile Wind Energy Market?

Key companies in the market include Électricité de France SA, Ørsted AS, Corporacion Acciona Energias Renovables SA, NextEra Energy Inc, E ON SE, Siemens Gamesa Renewable Energy SA, Trident Winds Inc, Duke Energy Corporation, EnBW Energie Baden-Wurttemberg AG*List Not Exhaustive, Enel Green Power Chile , ACCIONA Energy.

3. What are the main segments of the Chile Wind Energy Market?

The market segments include BY LOCATION OF DEPLOYMENT.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.34 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternate Energy Sources.

8. Can you provide examples of recent developments in the market?

In February 2023, Ibereolica Repsol Renovables Chile began producing electricity at the 165-MW Atacama wind farm. It plans to generate around 450 GWh per year, equivalent to the annual consumption of more than 150,000 Chilean families and avert 320,000 metric tons of CO2 emissions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile Wind Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile Wind Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile Wind Energy Market?

To stay informed about further developments, trends, and reports in the Chile Wind Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence