Key Insights

The China energy storage battery market is poised for significant expansion, with an estimated market size of 223.3 billion by 2033, driven by a projected Compound Annual Growth Rate (CAGR) of 25.4% from a base year of 2024. This robust growth is attributed to China's aggressive renewable energy mandates, requiring substantial energy storage to stabilize intermittent solar and wind power. The escalating adoption of electric vehicles (EVs) further fuels demand for high-performance batteries. Supportive government policies championing energy efficiency and grid modernization are also key drivers. The market encompasses diverse technologies, including pumped hydro, electrochemical (led by lithium-ion advancements), molten salt, compressed air, and flywheel systems, serving residential, commercial, and industrial applications. Major manufacturers such as Contemporary Amperex Technology Co Limited (CATL) and BYD are investing heavily in research and development and production capacity. While high initial investment costs and the need for enhanced battery lifespan and safety present challenges, ongoing technological innovation and favorable government support ensure a strong long-term market outlook.

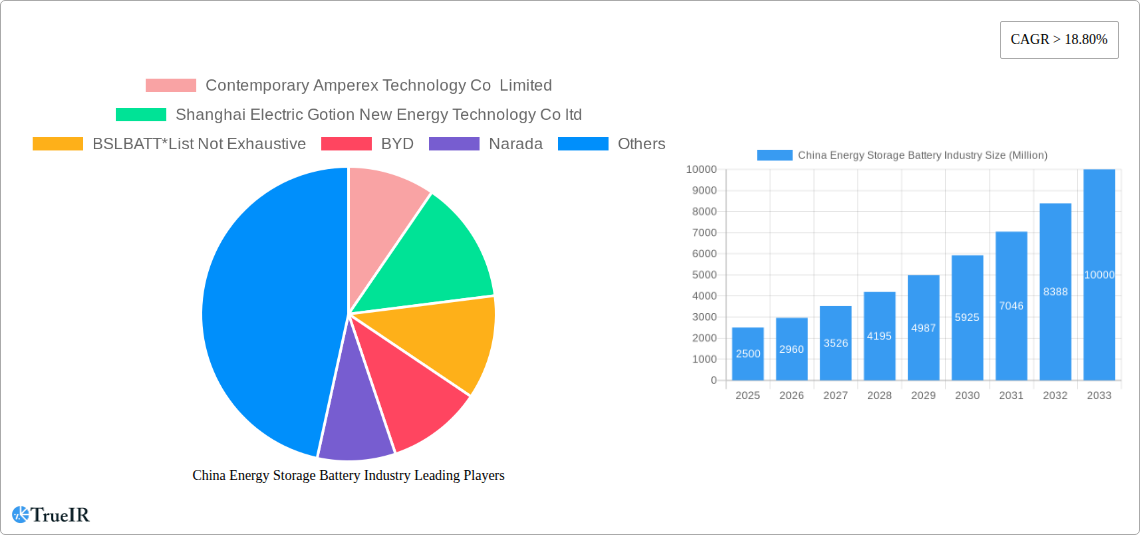

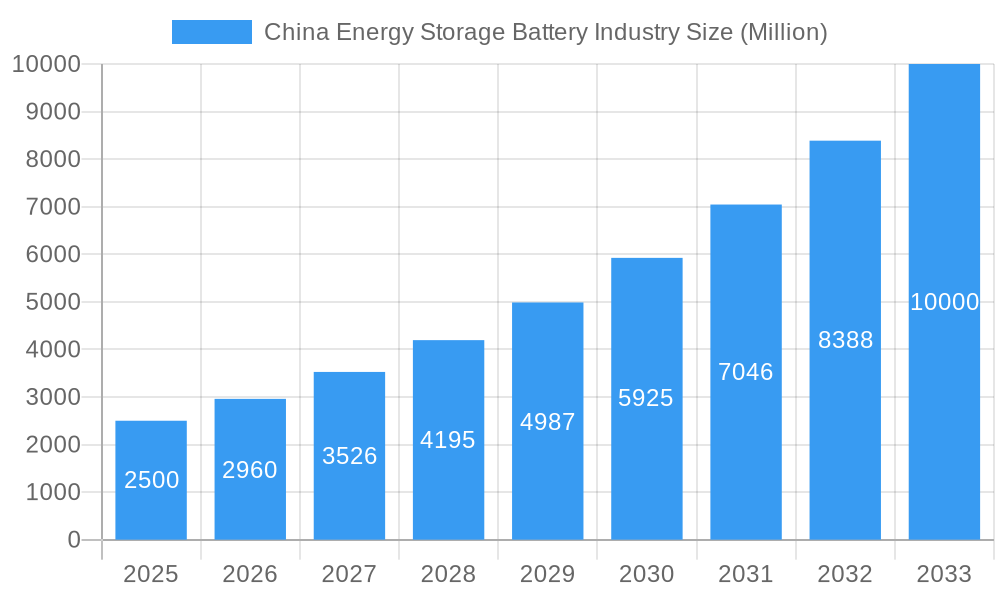

China Energy Storage Battery Industry Market Size (In Billion)

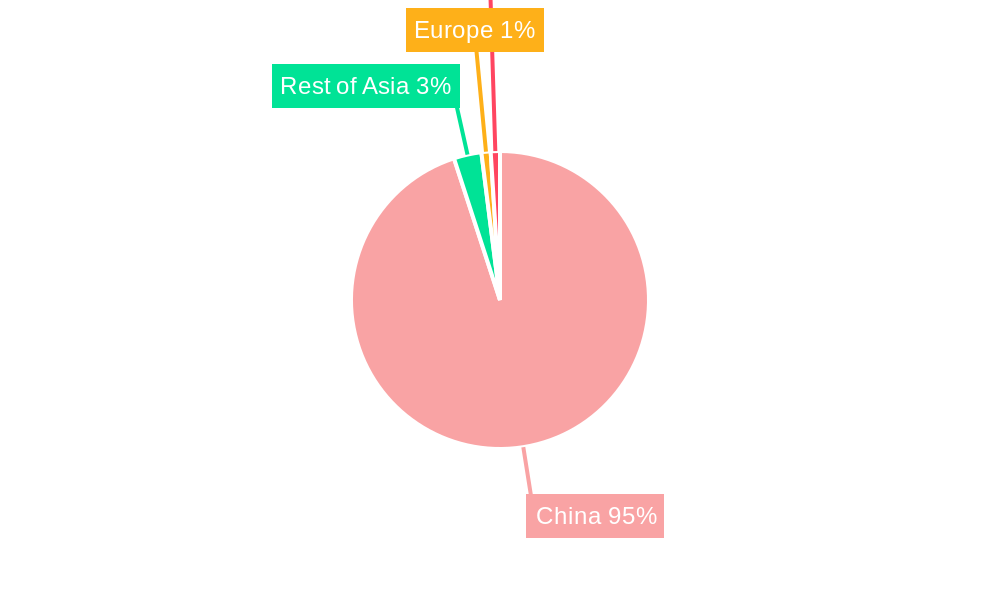

China's preeminence in energy storage battery manufacturing and deployment is a result of its strong industrial base, significant investments in renewable energy infrastructure, and strategic government policies. Current market concentration within China presents opportunities for international expansion. This domestic concentration facilitates economies of scale and efficient supply chains, enabling competitive global pricing for Chinese energy storage batteries. Broad applications across residential, commercial, and industrial sectors indicate extensive growth potential. Future market development will be shaped by continued innovation in battery chemistry, focusing on energy density, lifespan, and safety. Intense competition among industry leaders is spurring innovation and cost reductions, accelerating the global adoption of energy storage solutions.

China Energy Storage Battery Industry Company Market Share

China Energy Storage Battery Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic China energy storage battery industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis and expert insights to illuminate the current market landscape and future trajectory. The market is projected to reach xx Million by 2033, showcasing substantial growth potential.

China Energy Storage Battery Industry Market Structure & Competitive Landscape

The China energy storage battery market is characterized by a complex interplay of factors influencing its structure and competitive dynamics. Market concentration is moderate, with several key players holding significant market share, but also numerous smaller companies vying for position. The industry is experiencing rapid innovation, driven by advancements in battery chemistry, energy density, and cost reduction strategies. Government regulations play a crucial role, including incentives for renewable energy integration and safety standards for battery systems. Product substitution is limited, with electrochemical batteries currently dominating, though other technologies like pumped hydro are also relevant. End-user segmentation encompasses residential, commercial, and industrial applications, each with unique demands and growth trajectories. The M&A landscape reflects a dynamic environment with xx Million in deals recorded between 2019-2024, driven by consolidation efforts and technology acquisition strategies. Key players include:

- High Concentration: The top 5 players hold approximately xx% of the market share in 2025.

- Innovation Drivers: Advancements in LFP, lithium-ion, and solid-state battery technologies are key.

- Regulatory Impacts: Government policies promoting renewable energy and electric vehicles significantly influence demand.

- Product Substitutes: Pumped hydro and other storage technologies offer niche competition.

- End-User Segmentation: The industrial sector currently accounts for the largest share of demand, followed by commercial and residential.

- M&A Trends: Consolidation is expected to continue, with larger companies acquiring smaller players to expand their market reach and technological capabilities.

China Energy Storage Battery Industry Market Trends & Opportunities

The China energy storage battery market is experiencing robust growth, driven by several key factors. Market size expanded from xx Million in 2019 to xx Million in 2024, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing adoption of renewable energy sources, the burgeoning electric vehicle (EV) market, and government initiatives to improve grid stability and resilience. Technological advancements, such as improved energy density and lower production costs, are further accelerating market expansion. Consumer preferences are shifting towards more sustainable and efficient energy solutions, driving demand for energy storage systems. The competitive landscape is dynamic, with both established players and emerging companies vying for market share, resulting in continuous innovation and product diversification. Market penetration rates are increasing, particularly in the commercial and industrial sectors.

Dominant Markets & Segments in China Energy Storage Battery Industry

Within the China energy storage battery market, several segments exhibit particularly strong growth.

- Leading Region/Segment: The eastern coastal regions (e.g., Guangdong, Jiangsu, Zhejiang) dominate the market due to high concentrations of manufacturing, renewable energy projects, and robust infrastructure. Electrochemical batteries capture the largest market share across all applications, accounting for xx% in 2025.

Key Growth Drivers by Segment:

Electrochemical:

- High Energy Density: Continual advancements in lithium-ion battery technology result in greater energy storage capacity within smaller sizes.

- Cost Reduction: Economies of scale and technological innovation have significantly reduced the production cost of batteries, making them more accessible.

- Government Support: Policies promoting electric vehicles and renewable energy integration directly increase demand.

Pumped Hydro:

- Large-Scale Storage: Suitable for large-scale energy storage projects, addressing the intermittency of renewable energy sources.

- Mature Technology: Pumped hydro is a well-established technology with a proven track record.

Industrial Application:

- Grid Stability: Industrial applications are vital in enhancing grid stability, reducing reliance on fossil fuels, and improving energy efficiency.

- Backup Power: Energy storage is crucial for ensuring uninterrupted operation and avoiding costly production downtime.

China Energy Storage Battery Industry Product Analysis

Technological advancements are driving product innovation within the Chinese energy storage battery market. Lithium-ion batteries, particularly LFP, are currently dominant due to their cost-effectiveness, safety, and relatively high energy density. However, research and development efforts focus on improving solid-state batteries, promising enhanced energy density, safety, and longer lifespan. These advancements are improving the market fit of energy storage solutions across diverse applications, enabling higher penetration in both commercial and residential markets.

Key Drivers, Barriers & Challenges in China Energy Storage Battery Industry

Key Drivers:

- Government Policy: Significant government investment in renewable energy sources and electric vehicles directly propels demand for energy storage.

- Technological Advancements: Continuous innovation in battery chemistry, energy density, and production processes fuels market growth.

- Economic Growth: Rapid economic expansion creates higher electricity demand, necessitating improved grid management and increased energy storage capacity.

Challenges:

- Supply Chain Disruptions: Dependence on critical raw materials and manufacturing processes poses a risk to supply chain stability. This has the potential to decrease production by xx% during periods of disruption.

- Safety Concerns: Ensuring the safe operation and disposal of energy storage batteries remains crucial. Addressing these concerns requires increased investment in safety standards and recycling infrastructure.

- Competition: Intense competition among domestic and international players could lead to price wars and reduced profitability.

Growth Drivers in the China Energy Storage Battery Industry Market

The growth of the China energy storage battery industry is fueled by substantial government investment in renewable energy infrastructure, coupled with advancements in battery technology that make them more cost-effective and efficient. Policies promoting electric vehicles and smart grids are strong drivers of demand, alongside increasing awareness of sustainability and energy independence.

Challenges Impacting China Energy Storage Battery Industry Growth

The industry faces challenges including supply chain vulnerabilities related to raw materials, stringent safety regulations, and intense competition. These factors, along with the need for robust recycling infrastructure, could impede growth if not effectively addressed. Potential for price volatility in raw materials also poses a risk.

Key Players Shaping the China Energy Storage Battery Industry Market

- Contemporary Amperex Technology Co Limited

- Shanghai Electric Gotion New Energy Technology Co ltd

- BSLBATT

- BYD

- Narada

- Ganfeng Battery

- CALB

- EVE Energy Co Ltd

- Higee Enegry

- Tianjin Lishen Battery Joint-Stock Co Ltd

Significant China Energy Storage Battery Industry Industry Milestones

- April 2022: BSLBATT launched the BSL-BOX-HV high-voltage battery system, a modular LFP battery solution for solar energy storage, with capacities ranging from 15.36kWh to 35.84 kWh.

- March 2022: Construction began on China's first integrated flywheel and battery storage project in Shuozhou, with a budget of CNY 33.72 Million.

Future Outlook for China Energy Storage Battery Industry Market

The China energy storage battery market is poised for continued robust growth, driven by unwavering government support for renewable energy integration and the sustained expansion of the electric vehicle market. Strategic investments in research and development, coupled with ongoing advancements in battery technology, will unlock significant market potential and solidify China's position as a global leader in this vital sector. The market is expected to see continued consolidation and increased international collaboration.

China Energy Storage Battery Industry Segmentation

-

1. Type

- 1.1. Pumped Hydro

- 1.2. Electrochemical

- 1.3. Molten Salt

- 1.4. Compressed Air

- 1.5. Flywheel

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

China Energy Storage Battery Industry Segmentation By Geography

- 1. China

China Energy Storage Battery Industry Regional Market Share

Geographic Coverage of China Energy Storage Battery Industry

China Energy Storage Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Electrochemical Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Energy Storage Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pumped Hydro

- 5.1.2. Electrochemical

- 5.1.3. Molten Salt

- 5.1.4. Compressed Air

- 5.1.5. Flywheel

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Contemporary Amperex Technology Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanghai Electric Gotion New Energy Technology Co ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BSLBATT*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BYD

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Narada

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ganfeng Battery

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CALB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 EVE Energy Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Higee Enegry

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tianjin Lishen Battery Joint-Stock Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Contemporary Amperex Technology Co Limited

List of Figures

- Figure 1: China Energy Storage Battery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Energy Storage Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: China Energy Storage Battery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: China Energy Storage Battery Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: China Energy Storage Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Energy Storage Battery Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: China Energy Storage Battery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Energy Storage Battery Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: China Energy Storage Battery Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: China Energy Storage Battery Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: China Energy Storage Battery Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: China Energy Storage Battery Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: China Energy Storage Battery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Energy Storage Battery Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Energy Storage Battery Industry?

The projected CAGR is approximately 25.4%.

2. Which companies are prominent players in the China Energy Storage Battery Industry?

Key companies in the market include Contemporary Amperex Technology Co Limited, Shanghai Electric Gotion New Energy Technology Co ltd, BSLBATT*List Not Exhaustive, BYD, Narada, Ganfeng Battery, CALB, EVE Energy Co Ltd, Higee Enegry, Tianjin Lishen Battery Joint-Stock Co Ltd.

3. What are the main segments of the China Energy Storage Battery Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 223.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Petroleum Products Due to the Growth of the Local Economy4.; Government Initiatives to Boost the Production of Crude Oil and Natural Gas.

6. What are the notable trends driving market growth?

Electrochemical Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

On 9th April 2022, BSLBATT introduced the High Voltage Battery System (BSL-BOX-HV), and the system uses a lithium iron phosphate (LFP) battery. The BSL-BOX-HV is a high voltage battery system with a flexible modular design. The system does not have internal cables. The system is capable of stacking 3 to 7 battery modules. Furthermore, the system is available in various capacities ranging from 15.36kWh to 35.84 kWh and voltages from 153.6V to 358.4V. These battery systems have significant applications in solar energy storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Energy Storage Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Energy Storage Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Energy Storage Battery Industry?

To stay informed about further developments, trends, and reports in the China Energy Storage Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence