Key Insights

China's hydrogen and fuel cell market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 12.3% from a base year of 2025. This robust growth is propelled by strong government support for renewable energy, a strategic focus on carbon emission reduction, and increasing demand for clean energy solutions. Key sectors like portable power, stationary power generation, and transportation, particularly fuel cell electric vehicles (FCEVs), are driving market momentum. Polymer Electrolyte Membrane Fuel Cells (PEMFCs) currently lead due to their maturity, while Solid Oxide Fuel Cells (SOFCs) show promise for stationary applications due to higher efficiency. High initial investment costs and limited hydrogen refueling infrastructure are ongoing challenges, though strategic investments are mitigating these. Prominent players are actively innovating and forming partnerships to shape market development. The substantial market size in China, estimated at $12.94 billion in 2025, coupled with supportive policies and technological progress, positions China as a central force in the global hydrogen and fuel cell landscape.

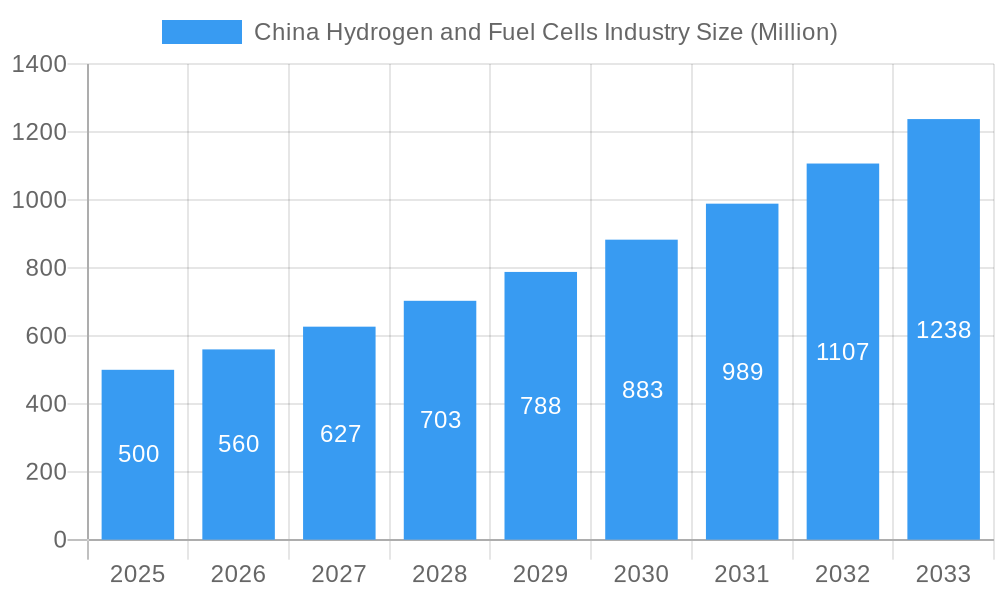

China Hydrogen and Fuel Cells Industry Market Size (In Billion)

China Hydrogen and Fuel Cells Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic China hydrogen and fuel cells industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, technological advancements, and future growth prospects. The report leverages extensive data analysis and expert insights to provide a clear and actionable understanding of this rapidly evolving market. Projected market value surpasses xx Million by 2033, representing a significant growth opportunity.

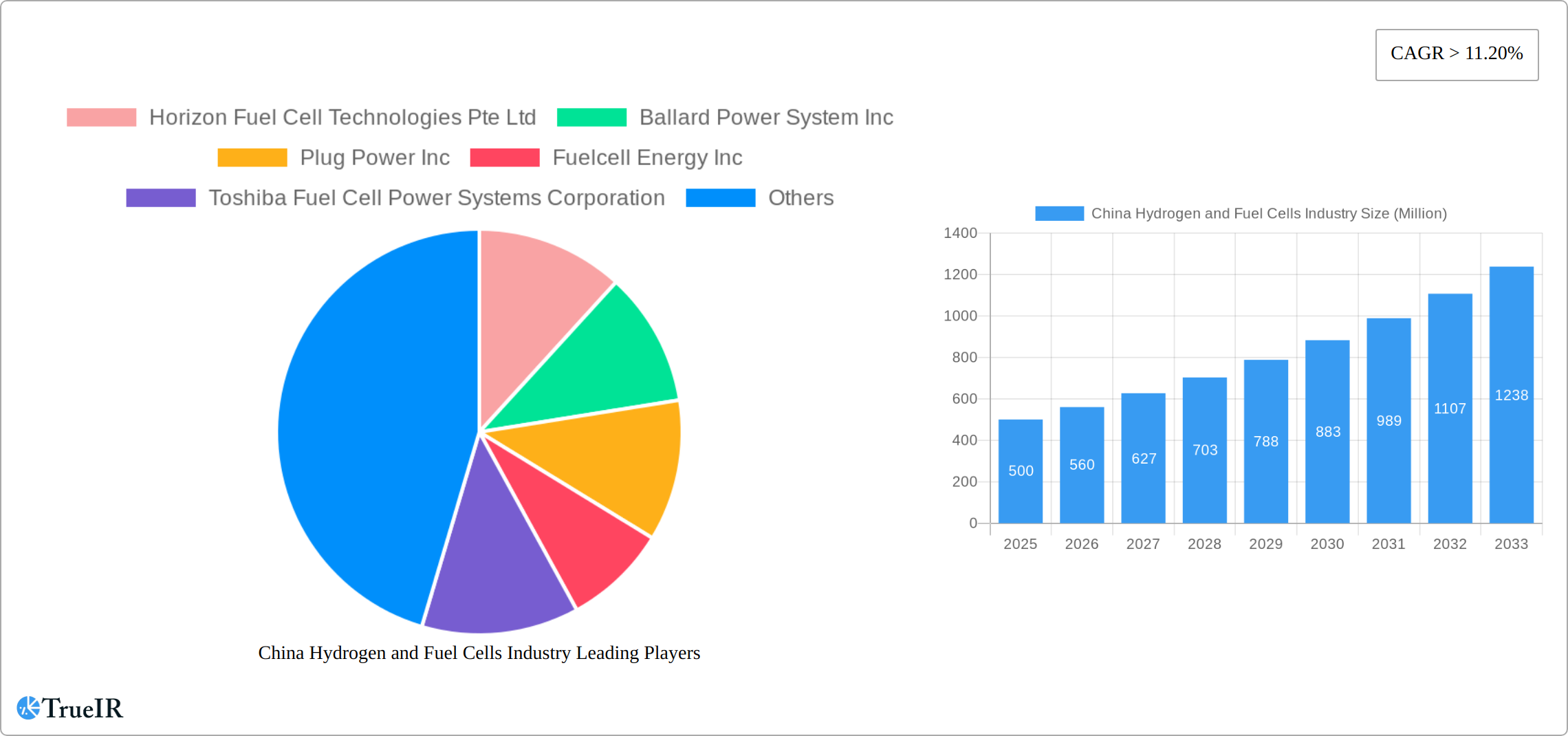

China Hydrogen and Fuel Cells Industry Company Market Share

China Hydrogen and Fuel Cells Industry Market Structure & Competitive Landscape

The China hydrogen and fuel cell market exhibits a moderately concentrated structure, with a few dominant players and a growing number of smaller, specialized firms. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is driven primarily by government initiatives promoting clean energy technologies, alongside substantial R&D investments by leading companies. Regulatory frameworks, including emission standards and subsidies, play a pivotal role in shaping market dynamics. Product substitutes, such as traditional fossil fuel-based power generation, pose a significant challenge, although the increasing awareness of environmental concerns is gradually shifting the balance in favor of hydrogen and fuel cell technologies.

End-user segmentation is crucial, with the transportation sector showing the strongest growth potential, driven by the burgeoning electric vehicle market and the need for efficient energy storage solutions. Mergers and acquisitions (M&A) activity has been steadily increasing in recent years, with a total M&A volume estimated at xx Million in 2024, consolidating market share and fostering technological advancements. Key M&A trends include strategic partnerships between fuel cell manufacturers and automotive companies to integrate fuel cell systems into vehicles and the acquisition of smaller technology companies by larger players to enhance their technology portfolio.

- Market Concentration: HHI of xx in 2024.

- Innovation Drivers: Government incentives, R&D investments.

- Regulatory Impact: Emission standards, subsidies significantly influence market growth.

- Product Substitutes: Traditional fossil fuels.

- End-User Segmentation: Transportation, stationary, portable applications.

- M&A Trends: Strategic partnerships, acquisitions of smaller tech firms.

China Hydrogen and Fuel Cells Industry Market Trends & Opportunities

The China hydrogen and fuel cell market is experiencing robust growth, driven by increasing demand for clean energy solutions and supportive government policies. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: technological advancements leading to increased efficiency and reduced costs of fuel cell systems, a growing preference for environmentally friendly energy sources among consumers and businesses, and government initiatives aimed at promoting the adoption of hydrogen and fuel cell technologies. Market penetration rates are increasing steadily, particularly in the transportation and stationary power generation sectors. Competitive dynamics are characterized by intense innovation, strategic partnerships, and increasing investments in R&D. Key opportunities lie in developing cost-effective fuel cell systems, improving hydrogen production and storage technologies, and expanding the infrastructure needed to support the widespread adoption of hydrogen fuel cells.

Dominant Markets & Segments in China Hydrogen and Fuel Cells Industry

The transportation segment currently dominates the China hydrogen and fuel cell market, driven by government policies promoting electric vehicles and the inherent advantages of fuel cell electric vehicles (FCEVs) in terms of range and refueling time. The Polymer Electrolyte Membrane Fuel Cell (PEMFC) technology holds a significant market share due to its suitability for various applications, including transportation and portable power. However, Solid Oxide Fuel Cells (SOFC) are gaining traction in stationary power applications, owing to their higher efficiency.

- Key Growth Drivers in Transportation: Government support for FCEVs, increasing demand for long-range EVs.

- Key Growth Drivers in PEMFC: Versatility, suitability for various applications.

- Key Growth Drivers in SOFC: High efficiency for stationary power generation.

- Leading Regions: Concentrated in major industrial and urban areas.

The dominance of these segments is underpinned by supportive government policies, including financial incentives, tax breaks, and infrastructure development initiatives focused on hydrogen production, storage, and distribution networks. These policies aim to accelerate the adoption of hydrogen and fuel cell technologies across various sectors, ensuring sustained market growth in the coming years.

China Hydrogen and Fuel Cells Industry Product Analysis

The Chinese hydrogen and fuel cell market is experiencing rapid growth, driven by significant innovation in product development. Advancements in Proton Exchange Membrane Fuel Cell (PEMFC) technology have resulted in smaller, lighter, and more powerful fuel cell stacks, broadening their applicability across diverse sectors. Solid Oxide Fuel Cell (SOFC) systems are undergoing optimization for enhanced thermal management and reduced degradation, leading to increased lifespan and reliability. These improvements, coupled with refined materials and streamlined manufacturing processes, are steadily enhancing the cost-competitiveness and overall performance of hydrogen and fuel cell technologies compared to traditional power generation methods. Market penetration is expanding significantly, with increasing integration into transportation, stationary power generation, and portable power applications, fueling substantial market growth.

Key Drivers, Barriers & Challenges in China Hydrogen and Fuel Cells Industry

Key Drivers:

- Government Support: Substantial government investments and supportive policies are accelerating market growth.

- Environmental Concerns: Growing awareness of environmental pollution is pushing the adoption of clean energy solutions.

- Technological Advancements: Continuous innovation is leading to improved efficiency and reduced costs of fuel cell systems.

Challenges:

- High Initial Costs: The high capital investment required for fuel cell systems remains a barrier to widespread adoption.

- Hydrogen Infrastructure: Limited hydrogen refueling infrastructure hinders the growth of FCEVs.

- Supply Chain Bottlenecks: Challenges exist in securing a consistent supply of critical materials and components. This leads to production delays and increased costs, impacting market growth by an estimated xx% annually.

Growth Drivers in the China Hydrogen and Fuel Cells Industry Market

Government support plays a pivotal role, with substantial subsidies, tax incentives, and favorable policies directly stimulating the adoption of hydrogen fuel cell technologies. Alongside government initiatives, technological advancements, particularly in PEMFC and SOFC efficiency and durability, are key drivers. The increasing environmental consciousness among consumers and businesses is also significantly bolstering demand for cleaner energy alternatives, further propelling market expansion.

Challenges Impacting China Hydrogen and Fuel Cells Industry Growth

High initial capital expenditures for hydrogen production and fuel cell systems remain a significant barrier to wider adoption. The current limitations in hydrogen infrastructure, encompassing production, storage, and distribution networks, hinder widespread commercialization. Furthermore, reliance on imported materials for fuel cell manufacturing creates vulnerabilities in the supply chain and potentially contributes to increased costs. Addressing these challenges through strategic investments in infrastructure and domestic material production is crucial for sustained market growth.

Key Players Shaping the China Hydrogen and Fuel Cells Industry Market

Significant China Hydrogen and Fuel Cells Industry Industry Milestones

- 2021-Q4: Launch of a xx MW fuel cell power plant in Shanghai.

- 2022-Q2: Government announcement of a xx Million investment in hydrogen infrastructure development.

- 2023-Q1: Partnership between a major automaker and a fuel cell manufacturer to develop FCEVs for mass production.

- 2024-Q3: Successful demonstration of a next-generation SOFC system with improved efficiency.

Future Outlook for China Hydrogen and Fuel Cells Industry Market

The China hydrogen and fuel cell industry is poised for significant growth, driven by continuous technological advancements, supportive government policies, and increasing consumer demand for clean energy solutions. The expanding applications across various sectors and strategic investments in research and development present considerable growth opportunities. Further infrastructure development, particularly in hydrogen production and distribution, will play a crucial role in unlocking the full potential of this market. The market is projected to reach xx Million by 2033, representing a substantial increase from its current size.

China Hydrogen and Fuel Cells Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

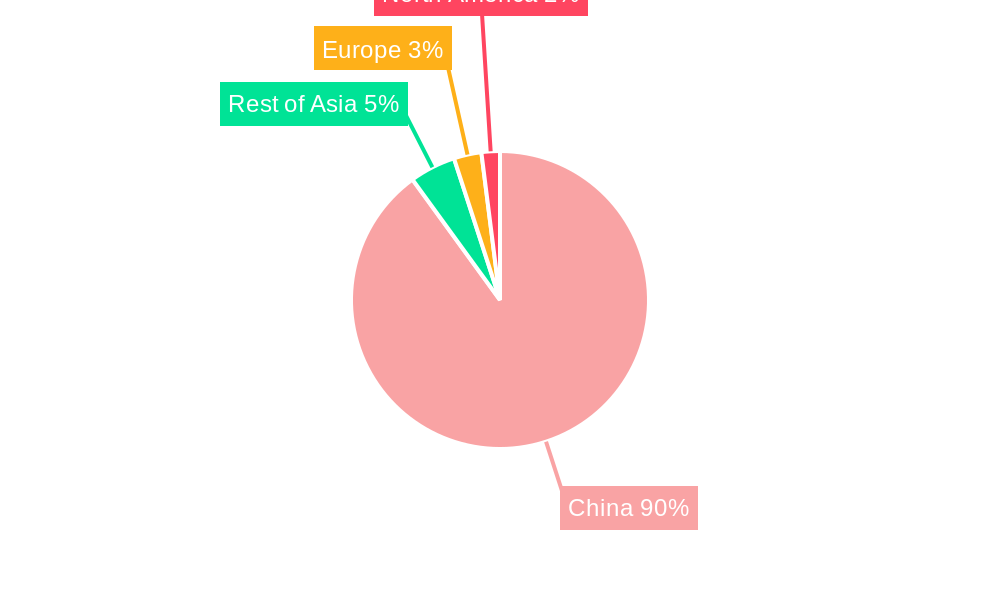

China Hydrogen and Fuel Cells Industry Segmentation By Geography

- 1. China

China Hydrogen and Fuel Cells Industry Regional Market Share

Geographic Coverage of China Hydrogen and Fuel Cells Industry

China Hydrogen and Fuel Cells Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Trend of Renewable Power Generation

- 3.4. Market Trends

- 3.4.1. Transportation Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Hydrogen and Fuel Cells Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Horizon Fuel Cell Technologies Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ballard Power System Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plug Power Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fuelcell Energy Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toshiba Fuel Cell Power Systems Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Horizon Fuel Cell Technologies Pte Ltd

List of Figures

- Figure 1: China Hydrogen and Fuel Cells Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Hydrogen and Fuel Cells Industry Share (%) by Company 2025

List of Tables

- Table 1: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 6: China Hydrogen and Fuel Cells Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Hydrogen and Fuel Cells Industry?

The projected CAGR is approximately 12.3%.

2. Which companies are prominent players in the China Hydrogen and Fuel Cells Industry?

Key companies in the market include Horizon Fuel Cell Technologies Pte Ltd, Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, Toshiba Fuel Cell Power Systems Corporation.

3. What are the main segments of the China Hydrogen and Fuel Cells Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.94 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Uninterrupted and Reliable Power Supply and Heavy Deployment of DG (diesel generator) Set4.; Improvement in Technology of Diesel Generator.

6. What are the notable trends driving market growth?

Transportation Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Trend of Renewable Power Generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Hydrogen and Fuel Cells Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Hydrogen and Fuel Cells Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Hydrogen and Fuel Cells Industry?

To stay informed about further developments, trends, and reports in the China Hydrogen and Fuel Cells Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence