Key Insights

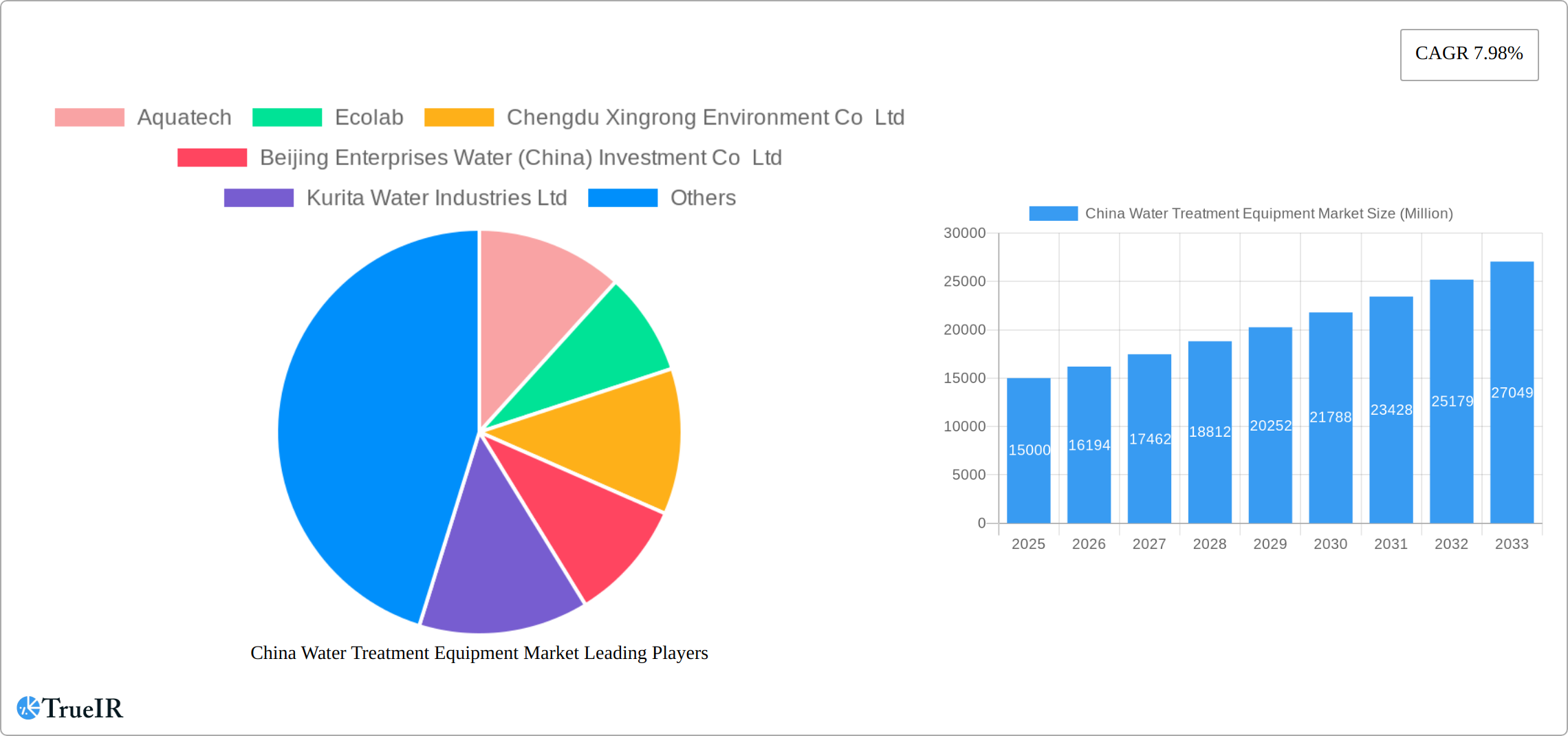

The China water treatment equipment market demonstrates strong expansion, propelled by industrial growth, stringent environmental mandates, and escalating demand for purified water across various sectors. Projected to achieve a Compound Annual Growth Rate (CAGR) of 8.54%, the market size, estimated at 14.07 billion in the base year 2025, is poised for continued advancement. Key growth drivers include the expanding food and beverage, chemical, and pulp and paper industries, necessitating efficient water treatment solutions. Furthermore, governmental initiatives promoting sustainable water management and pollution control actively stimulate market expansion. Municipal water treatment remains a dominant segment, with healthcare and aquaculture emerging as high-potential growth areas. The competitive arena features both global leaders such as SUEZ, Veolia, and Ecolab, alongside domestic enterprises like Beijing Enterprises Water and Chengdu Xingrong Environment, who are actively pursuing innovation and portfolio diversification to meet evolving market demands, including the adoption of advanced treatment technologies like membrane filtration and advanced oxidation processes.

China Water Treatment Equipment Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates sustained growth, driven by ongoing industrial development and heightened awareness of water scarcity. However, initial investment costs for advanced treatment technologies and potential economic volatilities may present challenges. Despite these factors, China's commitment to environmental sustainability and proactive water quality improvement efforts ensure a positive long-term outlook. Market segmentation by equipment type (treatment, process control, and pumps) and end-user industry facilitates targeted strategic approaches. This focused analysis on China provides a deep understanding of specific market dynamics and regulatory frameworks. Strategic alliances, technological innovations, and expansion into specialized sectors are expected to shape future competitive landscapes.

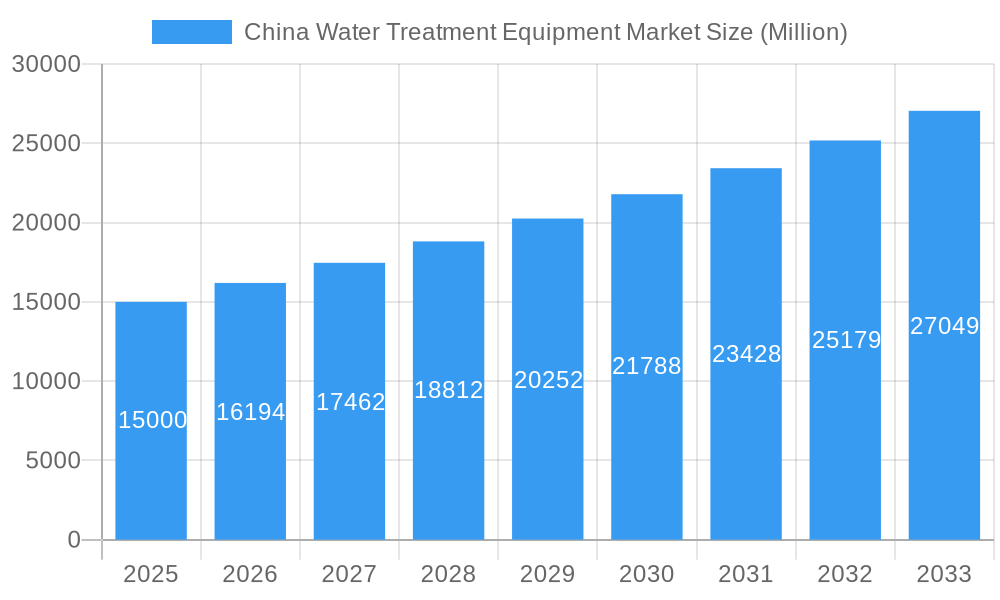

China Water Treatment Equipment Market Company Market Share

China Water Treatment Equipment Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report offers critical insights into the expanding China water treatment equipment market, catering to stakeholders, investors, and industry professionals. Covering the period 2019-2033, with detailed analysis for the base year 2025 and forecast period 2025-2033, this report is optimized with high-volume keywords such as "China water treatment," "water treatment equipment market," and "water treatment technology" for maximum search engine visibility. The market is projected to reach substantial figures by 2033, underscoring significant growth potential.

China Water Treatment Equipment Market Market Structure & Competitive Landscape

The China water treatment equipment market exhibits a moderately concentrated structure, with both domestic and international players vying for market share. The top five companies—Aquatech, Ecolab, Beijing Enterprises Water (China) Investment Co Ltd, Kurita Water Industries Ltd, and SUEZ—hold an estimated xx% market share in 2025, indicating room for both organic growth and potential mergers & acquisitions (M&A) activity. Innovation is a key driver, with companies investing heavily in advanced technologies like membrane filtration, reverse osmosis, and UV disinfection. Stringent government regulations, particularly concerning water quality and environmental protection, are significantly shaping market dynamics. The presence of substitute technologies, such as traditional water treatment methods, poses a moderate competitive threat.

The market is segmented by end-user industry, including Municipal (xx%), Food and Beverage (xx%), Pulp and Paper (xx%), Oil and Gas (xx%), Healthcare (xx%), Poultry and Aquaculture (xx%), Chemical (xx%), and Other End-user Industries (xx%). M&A activity is expected to intensify, driven by the desire for economies of scale and access to advanced technologies. The total M&A volume in the period 2019-2024 was estimated at xx Million, indicating a trend likely to continue.

China Water Treatment Equipment Market Market Trends & Opportunities

The China water treatment equipment market is experiencing robust growth, driven by increasing industrialization, urbanization, and rising environmental concerns. The market size is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), expanding from xx Million in 2025 to xx Million by 2033. Technological advancements are playing a pivotal role, with a shift towards automation, digitization, and sustainable solutions gaining traction. Consumer preferences are increasingly focused on energy efficiency, reduced water consumption, and environmentally friendly technologies. This shift is creating opportunities for companies offering advanced, sustainable water treatment solutions. The market's competitive dynamics are characterized by intense rivalry, with both domestic and international players vying for dominance through product innovation, strategic partnerships, and acquisitions. Market penetration rates for advanced treatment technologies are expected to rise significantly, fueled by government incentives and increasing awareness of water scarcity.

Dominant Markets & Segments in China Water Treatment Equipment Market

The China water treatment equipment market is experiencing robust growth, propelled by substantial government investments in infrastructure modernization and increasingly stringent water quality regulations. The municipal sector remains the dominant segment, accounting for the largest market share. This is driven by rapid urbanization, soaring water demand from a burgeoning population, and a heightened focus on environmental sustainability. Within the equipment types, treatment equipment holds the largest share, followed by process control equipment and pumps. Beyond the municipal sector, significant growth is observed in the food and beverage industry, driven by stringent safety and hygiene standards and the rising demand for processed foods and beverages. Other key end-user industries, such as power generation, pharmaceuticals, and manufacturing, also contribute significantly to market expansion, fueled by rising awareness of water conservation and sustainability.

Municipal Segment: This segment's growth is fueled by:

- Massive investments in upgrading and expanding water infrastructure projects across both urban and rural areas.

- Enforcement of stricter government regulations on water quality, pushing for advanced treatment solutions.

- Unprecedented urbanization and population growth leading to exponentially increasing water demand.

- Government initiatives promoting water reuse and recycling technologies.

Food and Beverage Segment: Key growth drivers include:

- Stringent hygiene and safety standards mandated by regulatory bodies, necessitating advanced water purification systems.

- The booming demand for processed food and beverages, requiring large-scale and efficient water treatment solutions.

- Growing consumer awareness regarding food safety and the importance of high-quality water in food production.

Industrial Segment (Beyond Food & Beverage): This sector is driven by:

- Rising awareness of water conservation and sustainability practices within manufacturing and industrial processes.

- Expansion of industrial activities across diverse sectors, creating a higher demand for industrial wastewater treatment.

- Government incentives and regulations promoting cleaner production methods and reduced industrial water footprint.

China Water Treatment Equipment Market Product Analysis

The market offers a diverse range of water treatment equipment, encompassing membrane filtration systems, reverse osmosis units, UV disinfection systems, and advanced oxidation processes. These technologies cater to various applications across diverse end-user industries, offering enhanced efficiency, reduced operating costs, and improved water quality. Technological advancements are continuously driving product innovation, with a focus on improved automation, data analytics, and energy-efficient designs. The competitive advantage lies in offering customized solutions, superior performance, and robust after-sales support.

Key Drivers, Barriers & Challenges in China Water Treatment Equipment Market

Key Drivers: Increasing urbanization, industrialization, and stringent government regulations are driving significant market expansion. Government initiatives aimed at water conservation and environmental protection further fuel the demand for advanced water treatment technologies. Technological advancements, such as AI-powered monitoring and automated control systems, are boosting efficiency and lowering operating costs.

Key Challenges: Supply chain disruptions caused by geopolitical factors and the COVID-19 pandemic pose a notable challenge. Regulatory complexities and stringent environmental standards can increase compliance costs. Intense competition from both domestic and international players necessitates continuous innovation and differentiation.

Growth Drivers in the China Water Treatment Equipment Market Market

The market's growth is spurred by increasing urbanization, stringent environmental regulations, and rising industrial water demand. Government initiatives promoting water conservation and investment in water infrastructure projects are key drivers. Technological innovations leading to more efficient and sustainable water treatment solutions further propel market growth.

Challenges Impacting China Water Treatment Equipment Market Growth

Challenges include navigating complex regulatory landscapes, ensuring consistent supply chain operations amid global uncertainties, and maintaining competitive pricing in a crowded market. The need for continuous innovation and adaptation to evolving technological demands also presents an ongoing challenge.

Key Players Shaping the China Water Treatment Equipment Market Market

- Aquatech

- Ecolab

- Chengdu Xingrong Environment Co Ltd

- Beijing Enterprises Water (China) Investment Co Ltd

- Kurita Water Industries Ltd

- Beijing Urban Drainage Group Co Ltd

- Evoqua Water Technologies LLC

- IDE Technologies

- Beijing Capital Co Ltd

- SUEZ

- DuPont

- Organo Corporation

- Anhui Guozhen Environment Protection Technology

- Veolia

- SafBon

- Chongqing Water Group Co Ltd

Significant China Water Treatment Equipment Market Industry Milestones

- 2020: Launch of several advanced water treatment technologies by key players.

- 2021: Introduction of stricter water quality regulations by the Chinese government.

- 2022: Several M&A activities among key players aiming for market consolidation and technology expansion.

- 2023: Significant investment in water infrastructure by the government.

- 2024: Several key players started partnering with local enterprises to extend their reach.

Future Outlook for China Water Treatment Equipment Market Market

The China water treatment equipment market is poised for continued robust growth, driven by sustained government investment in water infrastructure, stringent environmental regulations, and the increasing adoption of advanced water treatment technologies. Strategic partnerships, technological innovations, and a focus on sustainable solutions will be crucial for success in this dynamic and expanding market. The market's future trajectory is bright, presenting significant opportunities for both domestic and international players.

China Water Treatment Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Treatment Equipment

- 1.1.1. Oil/Water Separation

- 1.1.2. Suspended Solids Removal

- 1.1.3. Dissolved Solids Removal

- 1.1.4. Biological Treatment/Nutrient and Metals Recovery

- 1.1.5. Disinfection/Oxidation

- 1.1.6. Others

- 1.2. Process Control Equipment & Pumps

-

1.1. Treatment Equipment

-

2. End-user Industry

- 2.1. Municipal

- 2.2. Food and Beverage

- 2.3. Pulp and Paper

- 2.4. Oil and Gas

- 2.5. Healthcare

- 2.6. Poultry and Aquaculture

- 2.7. Chemical

- 2.8. Other End-user Industries

China Water Treatment Equipment Market Segmentation By Geography

- 1. China

China Water Treatment Equipment Market Regional Market Share

Geographic Coverage of China Water Treatment Equipment Market

China Water Treatment Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Industrial Sector; Increasing Regulations for Water and Wastewater Treatment; Other Drivers

- 3.3. Market Restrains

- 3.3.1. High Cost of Technology; Other Restraints

- 3.4. Market Trends

- 3.4.1. Treatment Equipment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Water Treatment Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Treatment Equipment

- 5.1.1.1. Oil/Water Separation

- 5.1.1.2. Suspended Solids Removal

- 5.1.1.3. Dissolved Solids Removal

- 5.1.1.4. Biological Treatment/Nutrient and Metals Recovery

- 5.1.1.5. Disinfection/Oxidation

- 5.1.1.6. Others

- 5.1.2. Process Control Equipment & Pumps

- 5.1.1. Treatment Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Municipal

- 5.2.2. Food and Beverage

- 5.2.3. Pulp and Paper

- 5.2.4. Oil and Gas

- 5.2.5. Healthcare

- 5.2.6. Poultry and Aquaculture

- 5.2.7. Chemical

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aquatech

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ecolab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chengdu Xingrong Environment Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beijing Enterprises Water (China) Investment Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kurita Water Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Beijing Urban Drainage Group Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evoqua Water Technologies LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDE Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Beijing Capital Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SUEZ

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DuPont

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Organo Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Anhui Guozhen Environment Protection Technology

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Veolia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SafBon

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Chongqing Water Group Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Aquatech

List of Figures

- Figure 1: China Water Treatment Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Water Treatment Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: China Water Treatment Equipment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 2: China Water Treatment Equipment Market Volume K Units Forecast, by Equipment Type 2020 & 2033

- Table 3: China Water Treatment Equipment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: China Water Treatment Equipment Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 5: China Water Treatment Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Water Treatment Equipment Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: China Water Treatment Equipment Market Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 8: China Water Treatment Equipment Market Volume K Units Forecast, by Equipment Type 2020 & 2033

- Table 9: China Water Treatment Equipment Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: China Water Treatment Equipment Market Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 11: China Water Treatment Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Water Treatment Equipment Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Water Treatment Equipment Market?

The projected CAGR is approximately 8.54%.

2. Which companies are prominent players in the China Water Treatment Equipment Market?

Key companies in the market include Aquatech, Ecolab, Chengdu Xingrong Environment Co Ltd, Beijing Enterprises Water (China) Investment Co Ltd, Kurita Water Industries Ltd, Beijing Urban Drainage Group Co Ltd, Evoqua Water Technologies LLC, IDE Technologies, Beijing Capital Co Ltd, SUEZ, DuPont, Organo Corporation, Anhui Guozhen Environment Protection Technology, Veolia, SafBon, Chongqing Water Group Co Ltd.

3. What are the main segments of the China Water Treatment Equipment Market?

The market segments include Equipment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Industrial Sector; Increasing Regulations for Water and Wastewater Treatment; Other Drivers.

6. What are the notable trends driving market growth?

Treatment Equipment to Dominate the Market.

7. Are there any restraints impacting market growth?

High Cost of Technology; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Water Treatment Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Water Treatment Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Water Treatment Equipment Market?

To stay informed about further developments, trends, and reports in the China Water Treatment Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence