Key Insights

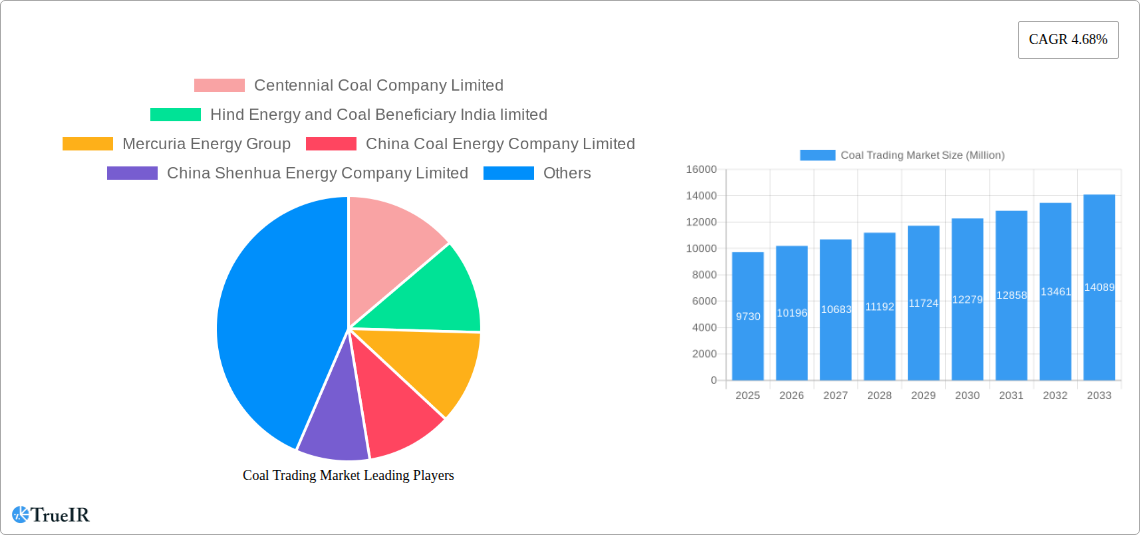

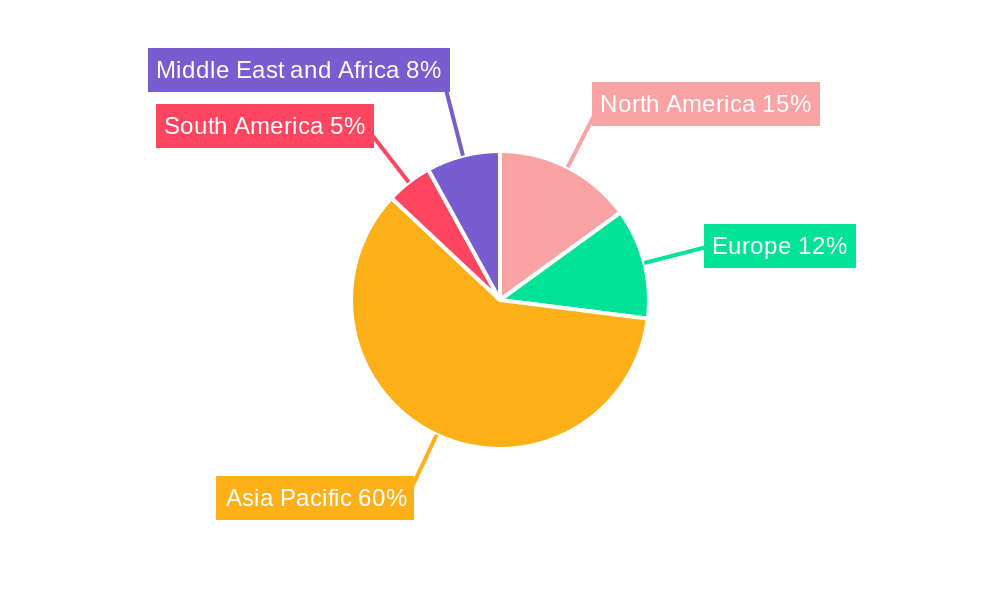

The global coal trading market, valued at $9.73 billion in 2025, is projected to experience steady growth, driven by persistent energy demands, particularly in developing economies experiencing rapid industrialization. While the transition to renewable energy sources is underway, coal remains a significant energy source, especially for electricity generation in many regions. The market's 4.68% CAGR from 2019 to 2024 suggests continued, albeit moderate, expansion through 2033. Key drivers include increasing energy consumption in Asia-Pacific, particularly in China and India, and the relatively lower cost of coal compared to other energy sources in the short to medium term. However, stringent environmental regulations aimed at reducing carbon emissions pose a significant restraint, pushing coal traders to adopt sustainable practices and explore cleaner coal technologies. The market segmentation reveals the dominance of steam coal due to its widespread use in power plants, while the coking coal segment benefits from its essential role in steel production. Importer-dominated trade reflects the global distribution nature of coal, with major players like Glencore, Mercuria, and Vitol holding significant market share. Regional analysis shows Asia-Pacific as the largest market, fueled by strong demand from China and India, followed by North America and Europe. The geographical distribution of coal resources and the global trade network further contribute to the market's complexity.

Coal Trading Market Market Size (In Billion)

The forecast period (2025-2033) anticipates a continuation of these trends. While renewable energy adoption gradually increases, the global coal market is likely to witness a period of consolidation, with major players optimizing their operations, focusing on efficiency, and potentially diversifying into related businesses like carbon capture and storage. The growth rate may slow slightly as environmental pressures intensify and alternative energy sources become increasingly competitive. However, the immediate-term outlook remains positive due to consistent demand in emerging markets and the established infrastructure for coal transportation and utilization. The competitive landscape will likely remain concentrated, with large multinational companies dominating the market, employing sophisticated logistics and trading strategies to navigate fluctuating prices and geopolitical uncertainties. Technological advancements in coal beneficiation and cleaner combustion technologies could offer opportunities for growth within the sector.

Coal Trading Market Company Market Share

This dynamic report provides a comprehensive analysis of the Coal Trading Market, offering invaluable insights for industry stakeholders, investors, and researchers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to illuminate key market trends, opportunities, and challenges. The report covers crucial aspects, including market size and growth, competitive landscape, segment analysis, and future outlook. It also highlights significant industry milestones and the roles of key players like Glencore PLC, China Coal Energy Company Limited, and others.

Coal Trading Market Structure & Competitive Landscape

The global coal trading market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) for the market in 2024 was estimated at xx, indicating a moderately consolidated landscape. Innovation within the coal trading market is largely focused on enhancing supply chain efficiency, risk management, and optimizing logistics. Stringent environmental regulations, particularly concerning greenhouse gas emissions, pose a significant challenge, driving the adoption of cleaner coal technologies and stricter compliance measures. Substitute energy sources, such as natural gas and renewable energy, represent a significant threat, impacting the overall demand for coal.

The market is segmented by coal type (steam coal, coking coal, lignite) and trader type (importer, exporter). Market players are increasingly focused on vertical integration, extending their reach across the entire value chain. Mergers and acquisitions (M&A) activity in the coal trading market has been relatively high in recent years, with an estimated xx Million in M&A volume during 2022-2024, primarily driven by consolidation efforts and expansion strategies.

- Market Concentration: Moderately concentrated, with HHI estimated at xx in 2024.

- Innovation Drivers: Supply chain efficiency, risk management, technological advancements in coal handling and transportation.

- Regulatory Impacts: Stringent environmental regulations impacting coal demand and transportation.

- Product Substitutes: Natural gas, renewable energy sources (solar, wind, hydro).

- End-User Segmentation: Power generation, steel production, cement manufacturing.

- M&A Trends: Significant activity in recent years, driven by consolidation and expansion.

Coal Trading Market Trends & Opportunities

The global coal trading market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven primarily by the sustained demand from power generation sectors, particularly in developing economies. Technological advancements are improving coal extraction, processing, and transportation efficiencies, leading to cost reductions and optimized operations. However, increasing environmental concerns and government regulations are impacting the market's growth trajectory. Consumer preferences are shifting towards cleaner energy sources, posing a significant challenge to the coal industry. The market's competitive dynamics are largely influenced by fluctuating coal prices, geopolitical factors, and the ever-changing regulatory landscape. Market penetration rates for coking coal in the steel industry remain high but are slightly decreasing due to increased steel production using alternative methods. Steam coal still maintains a substantial market share in power generation, with penetration rates expected to remain steady during the forecast period.

Dominant Markets & Segments in Coal Trading Market

The Asia-Pacific region, particularly China and India, dominates the global coal trading market, accounting for a significant portion of global coal consumption. Growth in these regions is driven by rapidly expanding power generation capacity and industrialization.

Key Growth Drivers (Asia-Pacific):

- Robust Infrastructure Development: Extensive power grid expansions and improved transportation networks.

- Favorable Government Policies: Government support for coal-fired power plants in certain regions (although this is changing).

- Growing Energy Demand: Rapid industrialization and increasing population driving up energy needs.

Key Growth Drivers (Steam Coal):

- Power Generation: Steam coal remains the primary fuel source for many power plants globally.

- Cost-Effectiveness: Steam coal generally has a lower cost compared to other fuels in many regions.

Key Growth Drivers (Coking Coal):

- Steel Production: Coking coal is essential for steel manufacturing, a critical sector in many economies.

Key Growth Drivers (Exporter Segment):

- Abundant Coal Reserves: Several countries possess large coal reserves and thus have a competitive advantage in the export market.

- Global Demand: The global demand for coal continues to support exporter market growth (although this is decreasing due to sustainable energy initiatives).

Analysis of market dominance reveals that China and India's strong economies and power requirements make them pivotal markets. The steam coal segment maintains a substantial share due to its prevalent use in power generation. The exporter segment benefits from countries with substantial coal resources and global demand (although this is changing).

Coal Trading Market Product Analysis

The global coal trading market encompasses a diverse range of coal products, primarily categorized into steam coal (used for power generation), coking coal (essential for steel production), and lignite (a lower-grade coal often used locally for power). Emerging technological advancements are pivotal in shaping the sector's future. These include sophisticated beneficiation processes designed to enhance coal quality by removing impurities, thereby increasing its energy content and reducing environmental impact. Furthermore, the optimization of transportation logistics, leveraging advanced rail networks and efficient maritime shipping solutions, is crucial for cost-effective and timely delivery. Significant investment is also directed towards carbon capture, utilization, and storage (CCUS) technologies to mitigate the environmental footprint of coal combustion. The market demonstrates a particularly strong demand for high-quality, low-sulfur coal, driven by increasingly stringent environmental regulations and a growing global emphasis on sustainable energy solutions. These collective advancements are geared towards bolstering operational efficiency, reducing overall costs, and fostering a more sustainable trajectory for the coal trading industry.

Key Drivers, Barriers & Challenges in Coal Trading Market

Key Drivers:

Growing energy demand in developing countries, particularly in Asia, drives market expansion. The established infrastructure for coal transportation and utilization further fuels growth. Government policies supporting coal-fired power plants, at least in certain regions, contribute to the market's positive momentum.

Challenges & Restraints:

Stringent environmental regulations focusing on reducing greenhouse gas emissions significantly impact the coal market. The rising cost of coal transportation and logistics adds to the overall cost. Increasingly popular substitute fuels, such as renewable energy sources and natural gas, pose significant competition. The predicted 10% decline in global coal demand by 2030 represents a major hurdle for the industry. Supply chain disruptions and geopolitical instability can heavily impact coal availability and prices.

Growth Drivers in the Coal Trading Market Market

The expansion of coal-fired power plants in emerging economies continues to be a significant driver of growth. Infrastructure development and the improvement of logistics systems help ensure the smooth transportation of coal. Government support and policies in several countries further contribute to market expansion.

Challenges Impacting Coal Trading Market Growth

The increasing adoption of sustainable energy sources is a significant challenge. Environmental regulations, especially those focused on emission reduction, exert pressure on the industry. Fluctuations in coal prices and supply chain disruptions add to market instability.

Key Players Shaping the Coal Trading Market Market

- Centennial Coal Company Limited

- Hind Energy and Coal Beneficiary India limited

- Mercuria Energy Group

- China Coal Energy Company Limited

- China Shenhua Energy Company Limited

- Glencore PLC

- Trafigura Group Pte Ltd

- Borneo Coal Trading

- Vitol Holding BV

- Mitsubishi Corporation RtM Japan Ltd

Significant Coal Trading Market Industry Milestones

- January 2022: The securing of a substantial contract by Adani to supply 1 million tons of coal to NTPC, India's primary state-owned electricity generator, underscored the persistent and considerable demand for coal in key Asian energy markets.

- February 2022: A landmark intergovernmental agreement was announced between Russia and China, outlining the supply of 100 million tons of coal. This agreement highlighted the strategic importance of coal within the energy portfolios of Asia-Pacific nations, signaling its continued relevance in meeting near-term energy requirements.

Future Outlook for Coal Trading Market Market

Despite the challenges posed by environmental concerns and the rise of renewable energy, the coal trading market is expected to maintain a degree of stability, particularly in regions with strong demand and existing infrastructure. Strategic opportunities lie in optimizing supply chains, improving coal quality through beneficiation, and developing technologies to reduce the environmental impact of coal combustion. However, long-term growth is likely to be constrained by the global shift towards cleaner energy sources. The market's future trajectory will depend heavily on geopolitical factors, government regulations, and the pace of technological advancements in the energy sector.

Coal Trading Market Segmentation

-

1. Coal Type

- 1.1. Steam Coal

- 1.2. Coaking Coal

- 1.3. Lignite

-

2. Traders Type

- 2.1. Importer

- 2.2. Exporter

Coal Trading Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Coal Trading Market Regional Market Share

Geographic Coverage of Coal Trading Market

Coal Trading Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Coal Based Power Generation Sector4.; Ease of Availability of Coal for Various Sectors

- 3.2.2 Such as Transport

- 3.2.3 Residential

- 3.2.4 Commercial and Others

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Importer and Exporter to Maintain an Equal Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coal Type

- 5.1.1. Steam Coal

- 5.1.2. Coaking Coal

- 5.1.3. Lignite

- 5.2. Market Analysis, Insights and Forecast - by Traders Type

- 5.2.1. Importer

- 5.2.2. Exporter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Coal Type

- 6. North America Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coal Type

- 6.1.1. Steam Coal

- 6.1.2. Coaking Coal

- 6.1.3. Lignite

- 6.2. Market Analysis, Insights and Forecast - by Traders Type

- 6.2.1. Importer

- 6.2.2. Exporter

- 6.1. Market Analysis, Insights and Forecast - by Coal Type

- 7. Europe Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coal Type

- 7.1.1. Steam Coal

- 7.1.2. Coaking Coal

- 7.1.3. Lignite

- 7.2. Market Analysis, Insights and Forecast - by Traders Type

- 7.2.1. Importer

- 7.2.2. Exporter

- 7.1. Market Analysis, Insights and Forecast - by Coal Type

- 8. Asia Pacific Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coal Type

- 8.1.1. Steam Coal

- 8.1.2. Coaking Coal

- 8.1.3. Lignite

- 8.2. Market Analysis, Insights and Forecast - by Traders Type

- 8.2.1. Importer

- 8.2.2. Exporter

- 8.1. Market Analysis, Insights and Forecast - by Coal Type

- 9. South America Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coal Type

- 9.1.1. Steam Coal

- 9.1.2. Coaking Coal

- 9.1.3. Lignite

- 9.2. Market Analysis, Insights and Forecast - by Traders Type

- 9.2.1. Importer

- 9.2.2. Exporter

- 9.1. Market Analysis, Insights and Forecast - by Coal Type

- 10. Middle East and Africa Coal Trading Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coal Type

- 10.1.1. Steam Coal

- 10.1.2. Coaking Coal

- 10.1.3. Lignite

- 10.2. Market Analysis, Insights and Forecast - by Traders Type

- 10.2.1. Importer

- 10.2.2. Exporter

- 10.1. Market Analysis, Insights and Forecast - by Coal Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Centennial Coal Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hind Energy and Coal Beneficiary India limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mercuria Energy Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Coal Energy Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China Shenhua Energy Company Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Glencore PLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trafigura Group Pte Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Borneo Coal Trading

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vitol Holding BV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Corporation RtM Japan Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Centennial Coal Company Limited

List of Figures

- Figure 1: Global Coal Trading Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 3: North America Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 4: North America Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 5: North America Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 6: North America Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 9: Europe Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 10: Europe Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 11: Europe Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 12: Europe Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 15: Asia Pacific Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 16: Asia Pacific Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 17: Asia Pacific Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 18: Asia Pacific Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 21: South America Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 22: South America Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 23: South America Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 24: South America Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Coal Trading Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Coal Trading Market Revenue (Million), by Coal Type 2025 & 2033

- Figure 27: Middle East and Africa Coal Trading Market Revenue Share (%), by Coal Type 2025 & 2033

- Figure 28: Middle East and Africa Coal Trading Market Revenue (Million), by Traders Type 2025 & 2033

- Figure 29: Middle East and Africa Coal Trading Market Revenue Share (%), by Traders Type 2025 & 2033

- Figure 30: Middle East and Africa Coal Trading Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Coal Trading Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 2: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 3: Global Coal Trading Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 5: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 6: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 11: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 12: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 18: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 19: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 26: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 27: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Coal Trading Market Revenue Million Forecast, by Coal Type 2020 & 2033

- Table 32: Global Coal Trading Market Revenue Million Forecast, by Traders Type 2020 & 2033

- Table 33: Global Coal Trading Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Saudi Arabia Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: United Arab Emirates Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Coal Trading Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coal Trading Market?

The projected CAGR is approximately 4.68%.

2. Which companies are prominent players in the Coal Trading Market?

Key companies in the market include Centennial Coal Company Limited, Hind Energy and Coal Beneficiary India limited, Mercuria Energy Group, China Coal Energy Company Limited, China Shenhua Energy Company Limited, Glencore PLC, Trafigura Group Pte Ltd, Borneo Coal Trading, Vitol Holding BV, Mitsubishi Corporation RtM Japan Ltd.

3. What are the main segments of the Coal Trading Market?

The market segments include Coal Type, Traders Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.73 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Coal Based Power Generation Sector4.; Ease of Availability of Coal for Various Sectors. Such as Transport. Residential. Commercial and Others.

6. What are the notable trends driving market growth?

Importer and Exporter to Maintain an Equal Share in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Renewable Energy.

8. Can you provide examples of recent developments in the market?

February 2022: Russia and China announced the development of an intergovernmental agreement on the supply of coal in the amount of 100 million tons. According to the government of Russia, the Asia-Pacific region has a significant market for coal till 2030. The countries have started working on the agreement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coal Trading Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coal Trading Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coal Trading Market?

To stay informed about further developments, trends, and reports in the Coal Trading Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence