Key Insights

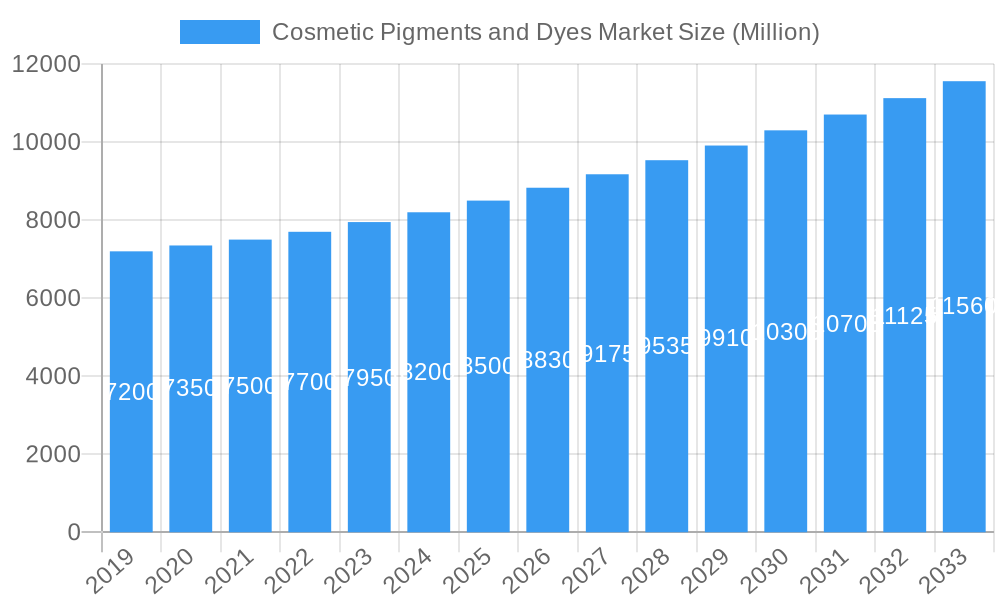

The global Cosmetic Pigments and Dyes Market is projected for significant expansion, expected to reach $666 million by 2025, with a Compound Annual Growth Rate (CAGR) of 5% through 2033. This growth is driven by rising consumer demand for enhanced aesthetics and continuous beauty industry innovation. Key factors include the popularity of personalized beauty, increased demand for natural and organic ingredients, and advancements in synthetic dye technology. Growing global disposable incomes, particularly in emerging economies, further stimulate spending on cosmetic products. Social media influence and beauty trends also encourage R&D for novel color formulations.

Cosmetic Pigments and Dyes Market Market Size (In Million)

The market is segmented by type into Natural Dyes and Synthetic Dyes, and by application across Hair Color Products, Facial Makeup, Eye Makeup, Lip Products, Nail Products, Toiletries, and Other Applications. While synthetic dyes offer consistency, demand for natural dyes is increasing due to health and environmental concerns. Challenges include stringent regulatory compliance and raw material price fluctuations. However, the market outlook is positive, driven by product innovation and expanding reach, especially in the Asia Pacific region. The dynamic nature of this industry promises sustained growth.

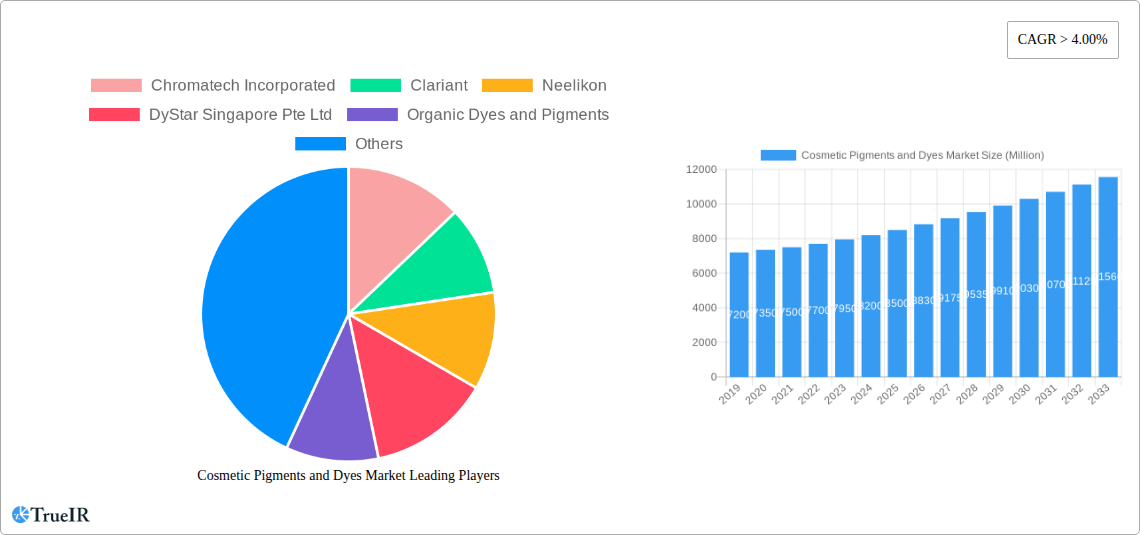

Cosmetic Pigments and Dyes Market Company Market Share

This report offers a strategic analysis of the global Cosmetic Pigments and Dyes Market, covering 2019-2024, with a base year of 2025 and projections through 2033. This SEO-optimized description provides comprehensive insights for industry professionals and strategists.

Cosmetic Pigments and Dyes Market Market Structure & Competitive Landscape

The Cosmetic Pigments and Dyes Market exhibits a moderate to high degree of market concentration, with a few key players holding significant market share. Innovation is a primary driver, fueled by increasing demand for natural ingredients, enhanced performance, and sustainable sourcing. Regulatory impacts, particularly concerning safety and environmental standards, are substantial, influencing product formulations and market entry strategies. Product substitutes, while present, face challenges in matching the performance and cost-effectiveness of established pigments and dyes. End-user segmentation is diverse, with applications spanning facial makeup, hair color products, and toiletries. Mergers and acquisitions (M&A) are a recurring trend, as companies seek to expand their product portfolios, gain market access, and achieve economies of scale. The estimated volume of M&A activities in the past five years is in the range of 50-75 transactions, with an estimated total deal value exceeding $500 Million. Concentration ratios for the top five players are estimated to be around 40-50%, indicating a competitive yet consolidated landscape.

- Key aspects of market structure:

- Market concentration and key player dominance.

- Influence of innovation in product development.

- Impact of regulatory frameworks on market access.

- Analysis of product substitutability and competitive differentiation.

- Segmentation by end-user application and consumer demographics.

- Trends in mergers, acquisitions, and strategic partnerships.

Cosmetic Pigments and Dyes Market Market Trends & Opportunities

The Cosmetic Pigments and Dyes Market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated market size of $15,000 Million by 2033. This growth is propelled by evolving consumer preferences towards clean beauty and natural ingredients, driving the demand for natural dyes. Simultaneously, synthetic dyes continue to dominate due to their superior color vibrancy, stability, and cost-effectiveness, especially in high-performance makeup and hair color applications. Technological advancements are enabling the development of novel pigments with enhanced properties, such as improved lightfastness, heat resistance, and multi-dimensional effects. The increasing disposable income in emerging economies is also a significant growth catalyst, boosting demand for a wider range of cosmetic products. The market penetration rate for cosmetic pigments and dyes currently stands at around 85% globally, with significant room for growth in underserved regions. Opportunities abound in the development of eco-friendly and biodegradable colorants, as well as specialized pigments for niche applications like 3D printing in cosmetics. The burgeoning men's grooming segment also presents an untapped avenue for growth. The market is witnessing a trend towards personalization and customization, where pigments and dyes play a crucial role in creating unique shades and effects tailored to individual consumer needs.

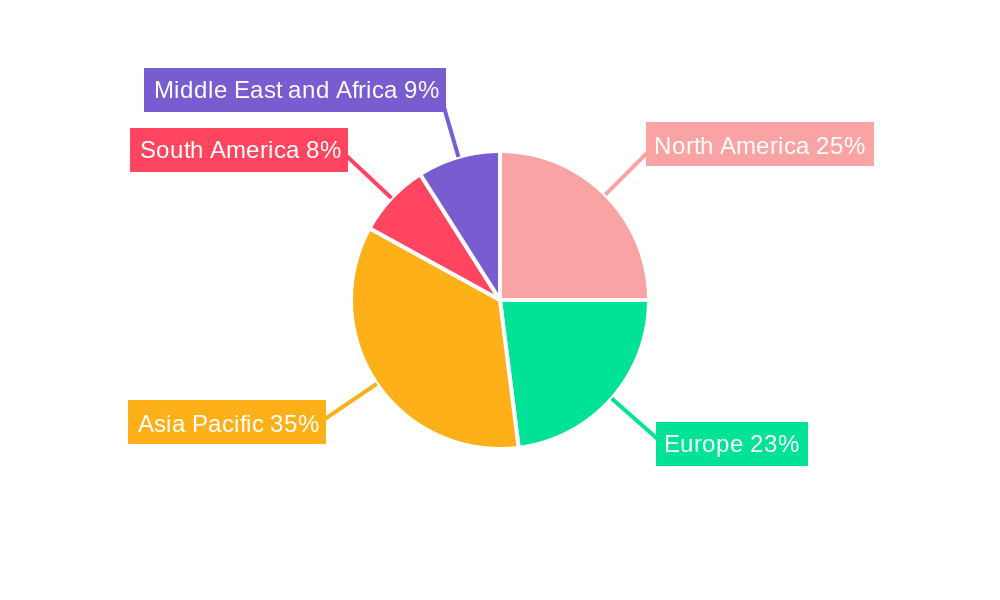

Dominant Markets & Segments in Cosmetic Pigments and Dyes Market

The global Cosmetic Pigments and Dyes Market is significantly influenced by regional demands and segment-specific growth trajectories. Asia Pacific currently holds a dominant position, projected to account for approximately 35% of the global market share by 2025. This dominance is attributed to the region's large and rapidly growing population, increasing urbanization, and a burgeoning middle class with a rising disposable income, leading to higher consumption of cosmetic products. Countries like China, India, and South Korea are key contributors to this growth. Within product types, Synthetic Dyes currently command the largest market share, estimated at around 70% of the total market value in 2025. Their widespread use in hair color products, facial makeup, and eye makeup, owing to their cost-effectiveness, stability, and wide color palette, underpins this dominance. However, Natural Dyes are experiencing a remarkable surge in demand, with a projected CAGR of over 9% during the forecast period, driven by the "clean beauty" trend and consumer preference for sustainable and ethically sourced ingredients.

In terms of applications, Hair Color Products represent the largest segment, estimated to constitute about 30% of the market value in 2025. This is followed closely by Facial Makeup and Eye Makeup, both significant contributors to market revenue. The demand for vibrant and long-lasting colors in these applications continues to fuel the growth of both synthetic and, increasingly, high-performance natural pigments. The Nail Products segment is also showing robust growth, driven by evolving fashion trends and consumer interest in nail art.

- Dominant Regions and Countries:

- Asia Pacific: Leading market share due to population, economic growth, and rising cosmetic consumption.

- North America and Europe: Mature markets with a strong focus on premium and innovative products.

- Leading Product Segments:

- Synthetic Dyes: Dominant due to performance, cost, and wide application.

- Natural Dyes: Experiencing rapid growth driven by consumer demand for clean and sustainable beauty.

- Key Application Segments:

- Hair Color Products: Largest segment, driven by innovation and consumer trends.

- Facial Makeup and Eye Makeup: Significant contributors with continuous demand for color variety and performance.

- Nail Products: Emerging growth area fueled by fashion and personal expression.

Cosmetic Pigments and Dyes Market Product Analysis

Product innovation in the cosmetic pigments and dyes market is characterized by a dual focus on enhancing performance and sustainability. Companies are investing heavily in the development of pigments offering superior lightfastness, heat stability, and unique optical effects like pearlescence and iridescence. The integration of nanotechnology is leading to pigments with finer particle sizes, improving texture and application smoothness in makeup. Simultaneously, there is a significant push towards natural and biodegradable colorants derived from plant sources and mineral deposits, aligning with the growing consumer demand for clean beauty. Key competitive advantages lie in the ability to offer a wide spectrum of stable and safe colors, meet stringent regulatory requirements, and provide customized solutions for specific cosmetic formulations. The market is also witnessing the introduction of multi-functional pigments that offer UV protection or skincare benefits in addition to color.

Key Drivers, Barriers & Challenges in Cosmetic Pigments and Dyes Market

Key Drivers: The cosmetic pigments and dyes market is primarily propelled by the escalating global demand for beauty and personal care products, driven by increasing consumer awareness, evolving fashion trends, and a growing emphasis on self-grooming. Technological advancements in pigment synthesis and formulation are enabling the creation of innovative colors with enhanced properties, such as improved durability, vibrancy, and unique visual effects. The rising disposable income in emerging economies further fuels this demand, making a wider range of cosmetic products accessible to a larger consumer base. The growing popularity of the "clean beauty" movement and a preference for natural, organic, and sustainably sourced ingredients are creating significant opportunities for natural dyes and pigments.

Barriers & Challenges: Despite robust growth, the market faces several challenges. Stringent regulatory requirements and evolving safety standards for cosmetic ingredients worldwide necessitate substantial investment in research, development, and compliance, potentially increasing production costs. Supply chain disruptions, as experienced in recent years, can impact the availability and cost of raw materials, affecting manufacturing processes and market stability. Intense competition among established players and emerging manufacturers can lead to price pressures and market fragmentation. Furthermore, the development and adoption of novel, sustainable pigments can be capital-intensive and face resistance from manufacturers accustomed to traditional ingredients. The consistent need for innovation to meet rapidly changing consumer preferences also presents an ongoing challenge.

Growth Drivers in the Cosmetic Pigments and Dyes Market Market

The Cosmetic Pigments and Dyes Market is experiencing substantial growth fueled by a confluence of technological, economic, and consumer-driven factors. Advancements in chemical synthesis and biotechnology are enabling the creation of novel pigments with enhanced functionalities, such as superior color payoff, longevity, and unique textural effects. Economically, the rising disposable incomes across emerging markets, particularly in Asia Pacific and Latin America, are translating into increased consumer spending on beauty and personal care products, thereby boosting the demand for cosmetic colorants. The global surge in the "clean beauty" movement and a heightened consumer awareness regarding the safety and sustainability of cosmetic ingredients are significantly propelling the demand for natural and organic dyes and pigments. Furthermore, the continuous innovation in makeup and hair color products, driven by fashion trends and celebrity influence, creates a sustained demand for a diverse palette of vibrant and stable pigments.

Challenges Impacting Cosmetic Pigments and Dyes Market Growth

The growth trajectory of the Cosmetic Pigments and Dyes Market is not without its hurdles. Regulatory complexities, including ever-evolving safety standards and ingredient restrictions across different geographical regions, pose significant challenges for manufacturers, requiring substantial investment in compliance and product testing. Supply chain volatility, influenced by geopolitical factors and the availability of raw materials, can lead to price fluctuations and potential shortages, impacting production schedules and cost-effectiveness. Intense competition within the market, characterized by the presence of both large multinational corporations and numerous smaller players, often results in price pressures and the need for continuous innovation to maintain market share. The development and adoption of novel, sustainable pigments can be capital-intensive and may face resistance from established industry practices. Moreover, the rapid pace of changing consumer preferences for beauty trends necessitates constant adaptation and product development, which can be resource-intensive.

Key Players Shaping the Cosmetic Pigments and Dyes Market Market

- Chromatech Incorporated

- Clariant

- Neelikon

- DyStar Singapore Pte Ltd

- Organic Dyes and Pigments

- Pylam Products Company Inc

- Aakash Chemicals

- Sensient Cosmetic Technologies

- Koel Colours Private Limited

- Goldmann Group

Significant Cosmetic Pigments and Dyes Market Industry Milestones

- 2019 May: Launch of a new line of natural, plant-derived pigments by Sensient Cosmetic Technologies, catering to the growing clean beauty trend.

- 2020 January: Clariant announces a strategic partnership with a sustainable sourcing initiative to enhance the traceability of raw materials for its cosmetic pigments.

- 2021 March: Neelikon introduces a range of high-performance synthetic dyes with improved lightfastness for long-wear makeup applications.

- 2022 September: DyStar Singapore Pte Ltd expands its portfolio of specialty pigments for the nail polish segment, focusing on unique color effects.

- 2023 April: Pylam Products Company Inc acquires a smaller competitor specializing in natural colorants, strengthening its position in the organic segment.

- 2024 February: Aakash Chemicals unveils a new biodegradable pigment technology, addressing growing environmental concerns in the cosmetics industry.

Future Outlook for Cosmetic Pigments and Dyes Market Market

The future outlook for the Cosmetic Pigments and Dyes Market is exceptionally promising, driven by continued innovation, expanding consumer bases, and a growing emphasis on sustainability. Strategic opportunities lie in the development of advanced, multi-functional pigments that offer skincare benefits, UV protection, and unique sensory experiences. The increasing demand for personalization in cosmetics will further fuel the need for specialized pigment formulations and custom color solutions. The burgeoning e-commerce channels for beauty products will also play a crucial role in market expansion, enabling wider reach and direct consumer engagement. Furthermore, the ongoing shift towards eco-friendly manufacturing processes and biodegradable ingredients will be a significant growth catalyst, presenting lucrative avenues for companies committed to sustainable practices. The projected market size of $15,000 Million by 2033 underscores the significant growth potential and enduring demand for high-quality cosmetic pigments and dyes.

Cosmetic Pigments and Dyes Market Segmentation

-

1. Type

- 1.1. Natural Dyes

- 1.2. Synthetic Dyes

-

2. Application

- 2.1. Hair Color Products

- 2.2. Facial Makeup

- 2.3. Eye Makeup

- 2.4. Lip Products

- 2.5. Nail Products

- 2.6. Toiletries

- 2.7. Other Applications

Cosmetic Pigments and Dyes Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Cosmetic Pigments and Dyes Market Regional Market Share

Geographic Coverage of Cosmetic Pigments and Dyes Market

Cosmetic Pigments and Dyes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Cosmetic Products; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Policies Related to its Usage; Unfavorable Conditions Arising Due to the COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Hair Color Products Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetic Pigments and Dyes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Dyes

- 5.1.2. Synthetic Dyes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Hair Color Products

- 5.2.2. Facial Makeup

- 5.2.3. Eye Makeup

- 5.2.4. Lip Products

- 5.2.5. Nail Products

- 5.2.6. Toiletries

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Cosmetic Pigments and Dyes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural Dyes

- 6.1.2. Synthetic Dyes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Hair Color Products

- 6.2.2. Facial Makeup

- 6.2.3. Eye Makeup

- 6.2.4. Lip Products

- 6.2.5. Nail Products

- 6.2.6. Toiletries

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Cosmetic Pigments and Dyes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural Dyes

- 7.1.2. Synthetic Dyes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Hair Color Products

- 7.2.2. Facial Makeup

- 7.2.3. Eye Makeup

- 7.2.4. Lip Products

- 7.2.5. Nail Products

- 7.2.6. Toiletries

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Cosmetic Pigments and Dyes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural Dyes

- 8.1.2. Synthetic Dyes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Hair Color Products

- 8.2.2. Facial Makeup

- 8.2.3. Eye Makeup

- 8.2.4. Lip Products

- 8.2.5. Nail Products

- 8.2.6. Toiletries

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Cosmetic Pigments and Dyes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural Dyes

- 9.1.2. Synthetic Dyes

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Hair Color Products

- 9.2.2. Facial Makeup

- 9.2.3. Eye Makeup

- 9.2.4. Lip Products

- 9.2.5. Nail Products

- 9.2.6. Toiletries

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Cosmetic Pigments and Dyes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural Dyes

- 10.1.2. Synthetic Dyes

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Hair Color Products

- 10.2.2. Facial Makeup

- 10.2.3. Eye Makeup

- 10.2.4. Lip Products

- 10.2.5. Nail Products

- 10.2.6. Toiletries

- 10.2.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chromatech Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Neelikon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DyStar Singapore Pte Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Organic Dyes and Pigments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pylam Products Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aakash Chemicals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sensient Cosmetic Technologies*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koel Colours Private Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Goldmann Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Chromatech Incorporated

List of Figures

- Figure 1: Global Cosmetic Pigments and Dyes Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Cosmetic Pigments and Dyes Market Revenue (million), by Type 2025 & 2033

- Figure 3: Asia Pacific Cosmetic Pigments and Dyes Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Cosmetic Pigments and Dyes Market Revenue (million), by Application 2025 & 2033

- Figure 5: Asia Pacific Cosmetic Pigments and Dyes Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Cosmetic Pigments and Dyes Market Revenue (million), by Country 2025 & 2033

- Figure 7: Asia Pacific Cosmetic Pigments and Dyes Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Cosmetic Pigments and Dyes Market Revenue (million), by Type 2025 & 2033

- Figure 9: North America Cosmetic Pigments and Dyes Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Cosmetic Pigments and Dyes Market Revenue (million), by Application 2025 & 2033

- Figure 11: North America Cosmetic Pigments and Dyes Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Cosmetic Pigments and Dyes Market Revenue (million), by Country 2025 & 2033

- Figure 13: North America Cosmetic Pigments and Dyes Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cosmetic Pigments and Dyes Market Revenue (million), by Type 2025 & 2033

- Figure 15: Europe Cosmetic Pigments and Dyes Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Cosmetic Pigments and Dyes Market Revenue (million), by Application 2025 & 2033

- Figure 17: Europe Cosmetic Pigments and Dyes Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Cosmetic Pigments and Dyes Market Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Cosmetic Pigments and Dyes Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Cosmetic Pigments and Dyes Market Revenue (million), by Type 2025 & 2033

- Figure 21: South America Cosmetic Pigments and Dyes Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Cosmetic Pigments and Dyes Market Revenue (million), by Application 2025 & 2033

- Figure 23: South America Cosmetic Pigments and Dyes Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Cosmetic Pigments and Dyes Market Revenue (million), by Country 2025 & 2033

- Figure 25: South America Cosmetic Pigments and Dyes Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Cosmetic Pigments and Dyes Market Revenue (million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Cosmetic Pigments and Dyes Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Cosmetic Pigments and Dyes Market Revenue (million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Cosmetic Pigments and Dyes Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Cosmetic Pigments and Dyes Market Revenue (million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Cosmetic Pigments and Dyes Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Japan Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Application 2020 & 2033

- Table 14: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Country 2020 & 2033

- Table 15: United States Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Type 2020 & 2033

- Table 19: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: Germany Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Italy Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: France Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Type 2020 & 2033

- Table 27: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Application 2020 & 2033

- Table 28: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Country 2020 & 2033

- Table 29: Brazil Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Application 2020 & 2033

- Table 34: Global Cosmetic Pigments and Dyes Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Cosmetic Pigments and Dyes Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Pigments and Dyes Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Cosmetic Pigments and Dyes Market?

Key companies in the market include Chromatech Incorporated, Clariant, Neelikon, DyStar Singapore Pte Ltd, Organic Dyes and Pigments, Pylam Products Company Inc, Aakash Chemicals, Sensient Cosmetic Technologies*List Not Exhaustive, Koel Colours Private Limited, Goldmann Group.

3. What are the main segments of the Cosmetic Pigments and Dyes Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 666 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Cosmetic Products; Other Drivers.

6. What are the notable trends driving market growth?

Hair Color Products Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Policies Related to its Usage; Unfavorable Conditions Arising Due to the COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetic Pigments and Dyes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetic Pigments and Dyes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetic Pigments and Dyes Market?

To stay informed about further developments, trends, and reports in the Cosmetic Pigments and Dyes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence