Key Insights

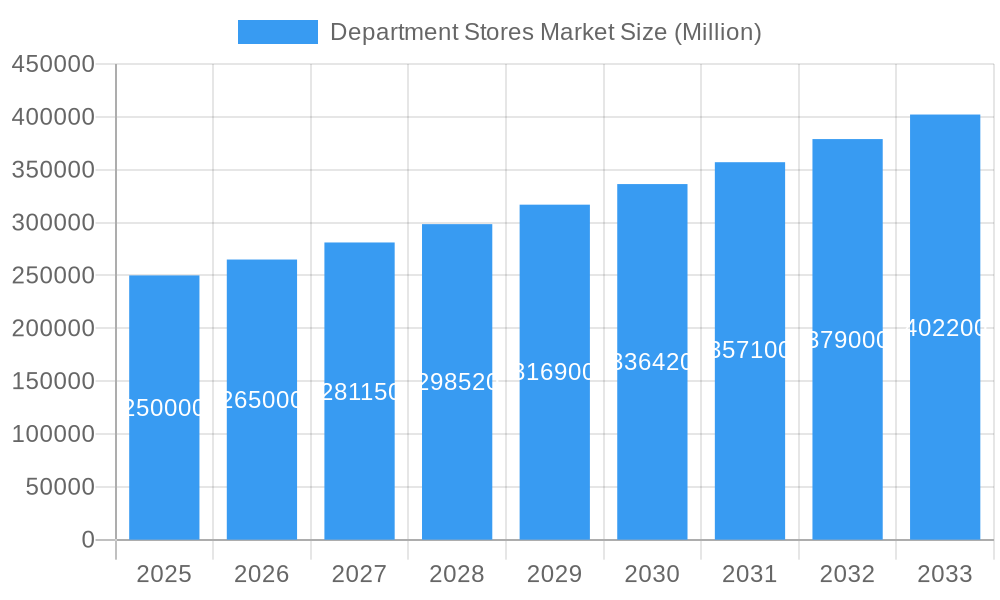

The global department store market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing preference for experiential retail, where shopping becomes an enjoyable activity rather than a mere transaction, is a significant factor. Department stores, with their ability to offer a wide range of products, diverse brands, and in-store services like personal styling and events, are well-positioned to capitalize on this trend. Furthermore, strategic initiatives such as omnichannel integration, enhancing online presence with seamless delivery and returns, and leveraging loyalty programs are boosting customer engagement and driving sales. The growing middle class in emerging economies also contributes significantly to market expansion, providing a wider customer base for department store offerings. However, challenges remain, including the rise of e-commerce giants and the increasing preference for specialized stores catering to niche segments. Department stores need to adapt continuously by focusing on exclusive brands, personalized experiences, and innovative strategies to differentiate themselves and maintain a competitive edge.

Department Stores Market Market Size (In Billion)

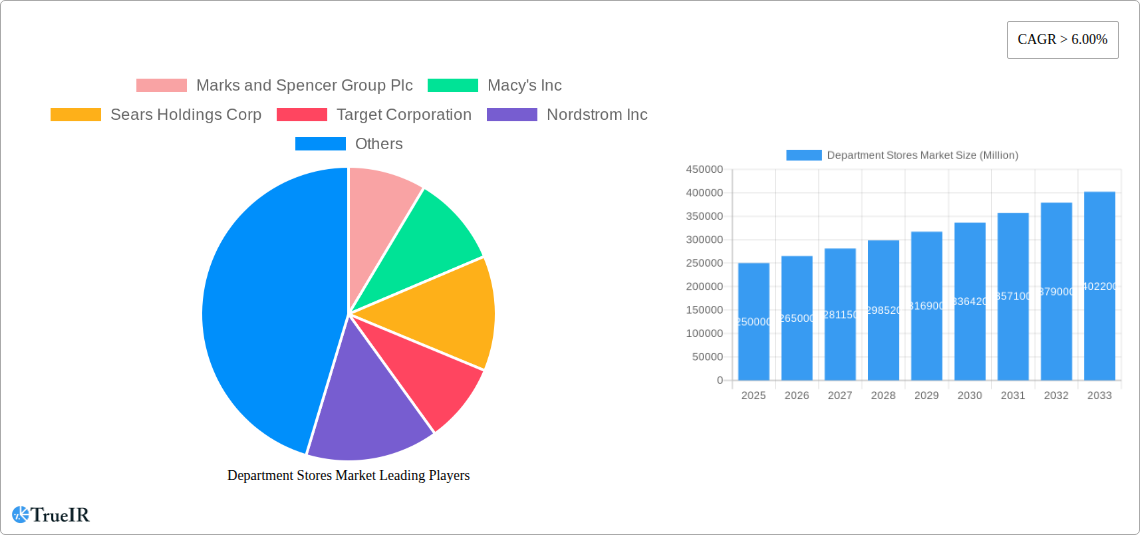

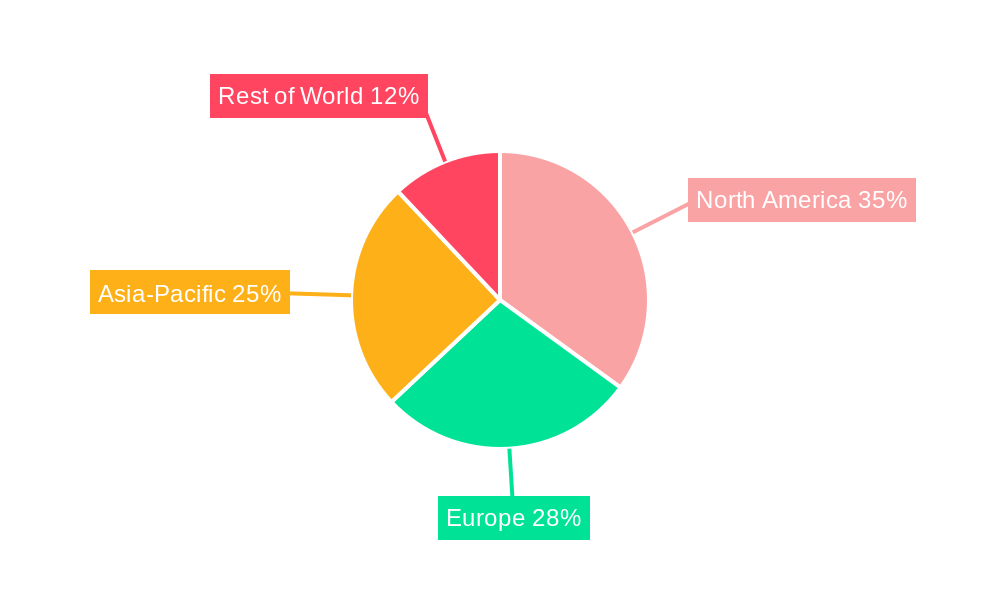

The competitive landscape is dominated by established players like Macy's, Nordstrom, and Walmart, who are constantly adapting their business models. However, the market also witnesses increased competition from online retailers and smaller, specialized boutiques. Successful department stores will need to carefully manage inventory, leverage data analytics to personalize customer interactions, and invest in technology to streamline operations and improve efficiency. Regional variations exist, with North America and Europe holding substantial market shares, but emerging markets in Asia and Latin America present promising growth opportunities. The continued success of department stores will hinge on their ability to evolve and offer a compelling retail experience that surpasses the convenience and price advantages of purely online alternatives. This requires focusing on a unique brand identity, customer loyalty programs, and providing unparalleled levels of customer service.

Department Stores Market Company Market Share

Department Stores Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the Department Stores Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive data analysis covering the period 2019-2033 (Historical Period: 2019-2024; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025-2033), this report projects a market valued at xx Million in 2025, experiencing robust growth throughout the forecast period.

Department Stores Market Market Structure & Competitive Landscape

The Department Stores Market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, the market is characterized by intense competition, driven by factors such as increasing consumer demand for personalized experiences and the rise of e-commerce. The market structure is influenced by various factors, including:

- Market Concentration: The top five players account for approximately xx% of the total market revenue in 2025 (estimated), indicating a moderately concentrated market. The Herfindahl-Hirschman Index (HHI) is estimated at xx, suggesting a moderately consolidated market.

- Innovation Drivers: Continuous innovation in product offerings, customer service, and technological integration play a key role in shaping market dynamics. This includes the introduction of new brands, loyalty programs, and omnichannel strategies.

- Regulatory Impacts: Government regulations related to consumer protection, labor laws, and environmental sustainability significantly impact operational costs and business strategies. Specific regulations vary across different regions.

- Product Substitutes: The increasing popularity of online marketplaces and specialized retailers presents substantial competition and presents a strong substitutive force for department stores.

- End-User Segmentation: Department stores cater to a diverse customer base, segmented by demographics, income levels, and shopping preferences. Understanding these segments is crucial for tailoring marketing strategies and product offerings.

- M&A Trends: Consolidation within the industry is ongoing, with several mergers and acquisitions observed in recent years. The total value of M&A transactions in the department store industry between 2019 and 2024 is estimated at xx Million.

Department Stores Market Market Trends & Opportunities

The Department Stores Market is experiencing dynamic shifts, driven by evolving consumer preferences, technological advancements, and competitive pressures. Market size is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching a value of xx Million by 2033. Key market trends include:

- E-commerce Integration: Department stores are increasingly investing in their online presence, providing seamless omnichannel experiences for customers. Market penetration rates for online sales within the department store sector are expected to reach xx% by 2033.

- Experiential Retail: Department stores are focusing on creating unique and engaging shopping experiences to attract and retain customers. This involves incorporating events, personalized services, and innovative store designs.

- Personalization and Data Analytics: The use of data analytics enables personalized marketing and targeted promotions, enhancing customer engagement and driving sales.

- Sustainability and Ethical Sourcing: Growing consumer consciousness around environmental and social issues is driving a focus on sustainable practices and ethical sourcing within the department store sector.

- Private Label Expansion: Many department stores are developing and expanding their private label offerings to differentiate themselves from competitors and enhance profitability.

Dominant Markets & Segments in Department Stores Market

The North American market currently holds the largest share of the global Department Stores Market, followed by Europe and Asia. Within these regions, specific countries like the United States, Japan, and the United Kingdom display strong growth potential.

- Key Growth Drivers in North America: A robust economy, high consumer spending, and a well-developed retail infrastructure drive market growth.

- Key Growth Drivers in Europe: Expanding online sales channels and increasing consumer preference for experiential shopping are contributing to market expansion.

- Key Growth Drivers in Asia: A rapidly expanding middle class and rising disposable incomes are fueling strong growth in the Asian market.

The luxury segment demonstrates robust growth due to increasing demand for high-end products and brands. Conversely, the mass-market segment experiences moderate growth due to strong competition from discount retailers.

Department Stores Market Product Analysis

Product innovation within the department store sector is driven by the need to enhance customer experience and offer unique value propositions. This includes improvements in product quality, design, and sustainability. Technological advancements are shaping product offerings, with a focus on smart retail technologies and personalized product recommendations. The successful integration of online and offline channels is crucial for enhancing customer engagement and driving sales.

Key Drivers, Barriers & Challenges in Department Stores Market

Key Drivers:

- Technological advancements: Enhanced e-commerce platforms, personalized shopping experiences, and improved supply chain management drive market growth.

- Economic growth: Rising disposable incomes and consumer spending boost sales and market expansion.

- Favorable government policies: Supportive regulations and incentives promote investment and market development.

Challenges:

- Intense competition: The emergence of e-commerce and specialized retailers creates intense pressure on traditional department stores.

- Supply chain disruptions: Global supply chain issues negatively impact product availability and lead to increased costs. The impact is estimated at xx Million in lost revenue in 2024.

- Economic downturns: Recessions or economic instability can significantly reduce consumer spending, impacting sales and profitability.

Growth Drivers in the Department Stores Market Market

Growth within the Department Stores Market is fueled by several key factors including technological advancements (e.g., omnichannel integration, personalized shopping), economic growth (increased disposable incomes), and favorable government policies that support retail development. The increasing preference for unique shopping experiences, including events and personalization, also significantly contributes to market growth.

Challenges Impacting Department Stores Market Growth

Significant challenges include intense competition from e-commerce platforms, rising operating costs, and supply chain disruptions. Economic downturns can significantly impact consumer spending, and regulatory changes can affect operational costs and business strategies. These challenges require adaptive strategies and investments in technology and customer experience to mitigate risks.

Key Players Shaping the Department Stores Market Market

- Marks and Spencer Group Plc

- Macy's Inc

- Sears Holdings Corp

- Target Corporation

- Nordstrom Inc

- Walmart Inc

- Isetan Mitsukoshi Holdings Ltd

- Kohl's Corporation

- Chongqing Department Store Co Ltd

- Lotte Department Store

- List Not Exhaustive

Significant Department Stores Market Industry Milestones

- February 2023: Macy's launches PATTERN Beauty, expanding its hair care product portfolio and demonstrating strategic partnerships to attract new customer segments.

- January 2023: Marks and Spencer announces a nearly half-billion investment in UK store upgrades and expansion, creating jobs and enhancing the customer experience. This highlights a significant investment in physical retail despite the rise of e-commerce.

Future Outlook for Department Stores Market Market

The Department Stores Market is poised for continued growth, driven by ongoing technological advancements, strategic investments in customer experience, and adaptation to evolving consumer preferences. Opportunities exist for department stores to leverage data analytics for personalized marketing, expand private label offerings, and enhance their omnichannel strategies to maintain a strong competitive position in the changing retail landscape. The market is expected to continue its upward trajectory, driven by both the online and offline channels, creating significant opportunities for innovative and adaptable players.

Department Stores Market Segmentation

-

1. Product Type

- 1.1. Apparel and Accessories

- 1.2. FMCG

- 1.3. Hardline and Softline

Department Stores Market Segmentation By Geography

-

1. North America

- 1.1. U

-

2. Canada

- 2.1. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. Italy

- 3.4. U

-

4. Spain

- 4.1. Rest of Europe

-

5. Asia Pacific

- 5.1. China

- 5.2. Japan

- 5.3. South Korea

- 5.4. India

- 5.5. Australia

- 5.6. Rest of Asia Pacific

-

6. Middle East and Africa

- 6.1. Saudi Arab

- 6.2. South Africa

- 6.3. UAE

- 6.4. Rest of Middle East and Africa

-

7. South America

- 7.1. Brazil

- 7.2. Mexico

- 7.3. Rest of South America

Department Stores Market Regional Market Share

Geographic Coverage of Department Stores Market

Department Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Retail E-Commerce Sales have the Negative Impact on Department Stores Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Apparel and Accessories

- 5.1.2. FMCG

- 5.1.3. Hardline and Softline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Canada

- 5.2.3. Europe

- 5.2.4. Spain

- 5.2.5. Asia Pacific

- 5.2.6. Middle East and Africa

- 5.2.7. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Apparel and Accessories

- 6.1.2. FMCG

- 6.1.3. Hardline and Softline

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Apparel and Accessories

- 7.1.2. FMCG

- 7.1.3. Hardline and Softline

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Apparel and Accessories

- 8.1.2. FMCG

- 8.1.3. Hardline and Softline

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Apparel and Accessories

- 9.1.2. FMCG

- 9.1.3. Hardline and Softline

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Apparel and Accessories

- 10.1.2. FMCG

- 10.1.3. Hardline and Softline

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Apparel and Accessories

- 11.1.2. FMCG

- 11.1.3. Hardline and Softline

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. South America Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Apparel and Accessories

- 12.1.2. FMCG

- 12.1.3. Hardline and Softline

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Marks and Spencer Group Plc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Macy's Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sears Holdings Corp

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Target Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nordstrom Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Walmart Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Isetan Mitsukoshi Holdings Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kohl's Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Chongqing Department Store Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Lotte Department Store**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Marks and Spencer Group Plc

List of Figures

- Figure 1: Global Department Stores Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Canada Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 7: Canada Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: Canada Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Canada Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: Europe Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Spain Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Spain Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Spain Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Spain Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Middle East and Africa Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East and Africa Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 29: South America Department Stores Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Department Stores Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: U Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Rest of North America Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Germany Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Italy Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: U Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Rest of Europe Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: China Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Australia Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Saudi Arab Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: South Africa Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: UAE Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 33: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Brazil Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Mexico Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Department Stores Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Department Stores Market?

Key companies in the market include Marks and Spencer Group Plc, Macy's Inc, Sears Holdings Corp, Target Corporation, Nordstrom Inc, Walmart Inc, Isetan Mitsukoshi Holdings Ltd, Kohl's Corporation, Chongqing Department Store Co Ltd, Lotte Department Store**List Not Exhaustive.

3. What are the main segments of the Department Stores Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Retail E-Commerce Sales have the Negative Impact on Department Stores Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Macy's launches PATTERN Beauty with the brand's extensive assortment of washes, treatments, styling tools, and more. As the brand's first-ever department store partner, PATTERN expands Macy's portfolio of hair care products, specifically in the curl category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Department Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Department Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Department Stores Market?

To stay informed about further developments, trends, and reports in the Department Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence