Key Insights

The East Africa Battery Market is projected for substantial growth, expected to reach a market size of $4.1 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 6.6%. This expansion is driven by increasing demand for reliable power solutions across industrial and portable applications, fueled by electrification initiatives, infrastructure development, and the expanding consumer electronics sector. Key growth factors include the need for uninterrupted industrial power, the rise of renewable energy storage, and sustained demand for batteries in consumer electronics and electric mobility. Advancements in Lithium-ion battery technology, offering superior energy density and lifespan, are a significant market influence, alongside the continued use of Lead-acid batteries in cost-sensitive industrial segments.

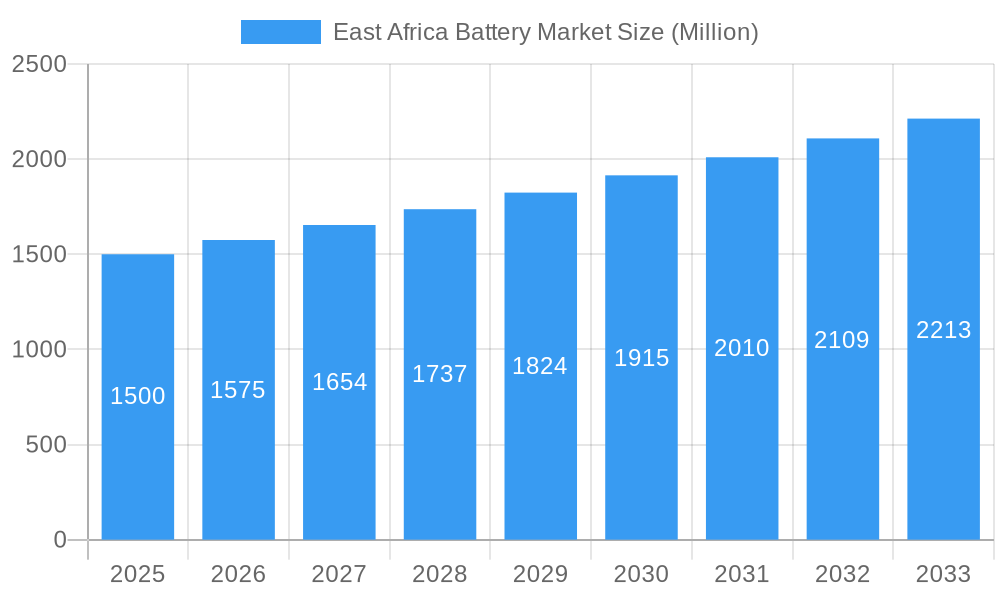

East Africa Battery Market Market Size (In Billion)

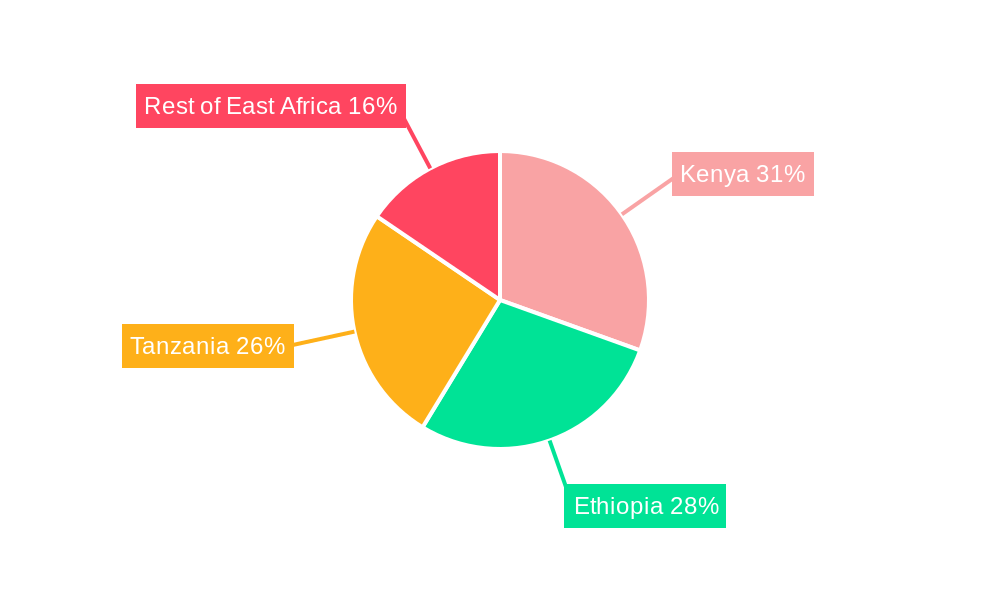

Market growth may be moderated by challenges such as fluctuating raw material prices, underdeveloped charging and recycling infrastructure, and the initial cost of advanced battery technologies. The market is segmented by battery type: primary batteries for single-use applications and secondary batteries (Lithium-ion, Lead-acid) for rechargeable applications in energy storage and portable devices. Kenya, Ethiopia, and Tanzania are anticipated to lead market growth, supported by economic development and industrial expansion. Key players, including Exide Industries, Toshiba Corporation, and Panasonic Corporation, are actively shaping the market through innovation and strategic partnerships.

East Africa Battery Market Company Market Share

This comprehensive report delivers an SEO-optimized analysis of the East Africa Battery Market, utilizing high-volume keywords to enhance search visibility. Covering the period from 2019 to 2033, with a base year of 2024, this report provides critical insights into market structure, trends, dominant segments, product innovations, key drivers, challenges, and the competitive landscape. The market is projected to reach 4.1 billion by 2024, exhibiting a robust CAGR of 6.6% during the forecast period.

East Africa Battery Market Market Structure & Competitive Landscape

The East Africa battery market is characterized by a moderate to high concentration ratio, with a few dominant players holding significant market share. Innovation drivers are primarily fueled by the growing demand for renewable energy integration, increasing electrification rates, and the continuous development of more efficient and cost-effective battery technologies. Regulatory impacts, while still evolving, are becoming more influential, with governments prioritizing energy security and sustainable development. Product substitutes, such as traditional generators and grid expansion in some urban areas, exist but are increasingly being outcompeted by the versatility and environmental benefits of battery solutions. End-user segmentation reveals a strong demand from the industrial sector for grid stabilization and backup power, alongside a rapidly expanding portable battery segment driven by consumer electronics and off-grid energy solutions. Mergers and acquisitions (M&A) trends are expected to increase as established players seek to expand their regional footprint and acquire new technologies, with an estimated xx M&A deals anticipated over the forecast period.

- Market Concentration: Dominated by a mix of global manufacturers and emerging regional players.

- Innovation Drivers: Renewable energy storage, electric mobility, and off-grid power solutions.

- Regulatory Impacts: Increasing focus on energy independence, emissions reduction, and local manufacturing incentives.

- Product Substitutes: Traditional generators, grid expansion, alternative energy sources.

- End-User Segmentation: Industrial (energy storage, backup), Portable (consumer electronics, off-grid), Automotive (emerging).

- M&A Trends: Strategic acquisitions for market access, technological integration, and capacity expansion.

East Africa Battery Market Market Trends & Opportunities

The East Africa battery market is experiencing significant growth and transformation, driven by a confluence of factors including increasing energy demand, a strong push towards renewable energy adoption, and advancements in battery technology. The overall market size is projected to expand from an estimated xx Million USD in 2025 to xx Million USD by 2033, showcasing a compelling Compound Annual Growth Rate (CAGR) of xx%. This upward trajectory is underpinned by the region's burgeoning population, rapid urbanization, and a growing recognition of the critical role of reliable energy storage in powering economic development and improving quality of life. Technological shifts are a major trend, with a noticeable move towards Lithium-ion batteries due to their higher energy density, longer lifespan, and improved safety features, gradually displacing traditional Lead-acid batteries in certain applications, though Lead-acid batteries will continue to hold a significant share in cost-sensitive segments.

Consumer preferences are also evolving, with a greater demand for eco-friendly, long-lasting, and intelligent battery solutions that can support the increasing penetration of solar energy systems in both residential and commercial sectors. The competitive dynamics are intensifying as international battery manufacturers vie for market share against an increasing number of local and regional players who are benefiting from government support for domestic production and localized supply chains. Opportunities abound in the development of smart grids, electric vehicle (EV) charging infrastructure, and comprehensive energy storage solutions for telecommunications towers and other critical infrastructure. The significant unmet energy needs across large swathes of the East African population present a substantial market penetration opportunity for affordable and reliable battery-powered solutions, particularly in rural and peri-urban areas. The trend towards hybrid mini-grids, as exemplified by projects in Rwanda, further underscores the immense potential for integrated battery storage systems to provide stable and sustainable power. The growth in portable electronics and the increasing adoption of off-grid solar systems for homes and businesses are also major contributors to the sustained expansion of the portable battery segment. Furthermore, the evolving industrial landscape, with a growing need for uninterrupted power supply for manufacturing and data centers, is a key driver for industrial battery demand.

Dominant Markets & Segments in East Africa Battery Market

Within the East Africa battery market, Kenya is emerging as a dominant region, propelled by its robust economic growth, strong government initiatives promoting renewable energy, and a well-established industrial base. Ethiopia and Tanzania also represent significant growth markets, driven by their large populations and increasing energy demands. The Secondary Battery segment is expected to dominate the market throughout the forecast period, largely due to its extensive use in applications requiring rechargeable power, such as solar energy storage, portable electronics, and emerging electric mobility solutions. Within secondary batteries, Lithium-ion Battery technology is witnessing the fastest growth, driven by its superior energy density, longer cycle life, and declining manufacturing costs.

- Dominant Geography: Kenya, characterized by strong infrastructure development and favorable government policies.

- Leading Segment: Secondary Batteries, owing to their widespread application in recurring power needs.

- Key Growth Technology: Lithium-ion Battery, driven by advancements and cost reductions.

- Dominant Application: Industrial Batteries, crucial for grid stabilization, backup power, and renewable energy integration.

- Key Growth Drivers:

- Infrastructure Development: Expansion of renewable energy projects and grid modernization.

- Government Policies: Incentives for renewable energy adoption, local manufacturing, and energy independence.

- Electrification Rates: Increasing access to electricity, especially in rural areas, driving demand for off-grid solutions.

- Technological Advancements: Falling costs and improved performance of Lithium-ion batteries.

- Economic Growth: Increased industrial activity and consumer spending.

East Africa Battery Market Product Analysis

The East Africa battery market is characterized by a growing sophistication in product offerings. Innovations are heavily focused on enhancing energy density, improving charge/discharge cycles, and increasing safety features, particularly in Lithium-ion battery chemistries. Applications are diversifying from traditional industrial backup power to sophisticated energy storage systems for solar micro-grids, consumer electronics, and burgeoning electric mobility sectors. Competitive advantages are increasingly being built on cost-effectiveness, reliability, and the ability to tailor solutions to specific regional requirements, such as resilience to varying environmental conditions.

Key Drivers, Barriers & Challenges in East Africa Battery Market

Key Drivers:

- Growing Renewable Energy Penetration: The surge in solar and wind power installations necessitates robust battery storage solutions for grid stability and off-grid power.

- Increasing Electrification Rates: Expanding access to electricity across East Africa fuels demand for portable and industrial batteries to power homes, businesses, and infrastructure.

- Government Support and Policy Frameworks: Favorable policies promoting renewable energy, energy independence, and local manufacturing are significant growth catalysts.

- Technological Advancements: Continuous improvements in battery technology, particularly Lithium-ion, are leading to higher performance and declining costs.

- Economic Growth and Urbanization: Rising incomes and expanding urban centers drive demand for consumer electronics and reliable power solutions.

Barriers and Challenges:

- High Initial Capital Costs: The upfront investment for battery storage systems can be a significant barrier for individuals and businesses in lower-income brackets.

- Supply Chain Volatility and Import Dependence: Reliance on imported raw materials and finished battery products exposes the market to global price fluctuations and logistical challenges.

- Inadequate Grid Infrastructure: Inconsistent power supply and underdeveloped grid infrastructure in some areas can limit the effective deployment and utilization of battery storage.

- Regulatory Complexities and Lack of Standardization: Evolving and sometimes inconsistent regulatory frameworks can create uncertainty for investors and manufacturers.

- Technical Expertise and Skilled Labor Shortages: A lack of trained personnel for installation, maintenance, and repair of advanced battery systems can hinder market growth.

Growth Drivers in the East Africa Battery Market Market

Key growth drivers in the East Africa Battery Market are predominantly technological, economic, and regulatory. The exponential growth of the renewable energy sector, particularly solar power, is a primary catalyst, creating a massive demand for battery storage to ensure consistent power supply. Economically, increasing disposable incomes and a growing middle class are fueling the demand for consumer electronics and off-grid power solutions. Furthermore, government policies in countries like Kenya and Rwanda are actively promoting battery integration through incentives and renewable energy targets. The rapid urbanization across the region is also a significant factor, driving the need for reliable power for expanding cities and infrastructure.

Challenges Impacting East Africa Battery Market Growth

Challenges impacting East Africa Battery Market growth are multifaceted, including significant regulatory complexities and a lack of standardized frameworks, which can deter investment and slow down project development. Supply chain issues, such as the reliance on imported components and raw materials, create vulnerabilities to global price volatility and logistical disruptions, impacting cost and availability. Competitive pressures from established global players and the emergence of local manufacturers also shape the market dynamics. Furthermore, the absence of adequate and consistent grid infrastructure in many areas presents a substantial barrier to the seamless integration and effective utilization of advanced battery storage solutions.

Key Players Shaping the East Africa Battery Market Market

- Exide Industries Ltd

- Toshiba Corporation

- Murata Manufacturing Co Ltd

- Panasonic Corporation

- Duracell Inc

- ABM Group

- Trojan Battery Company

- Uganda Batteries Limited

- Bodawerk International Ltd

Significant East Africa Battery Market Industry Milestones

- February 2021: Winch Energy, an off-grid utility provider, completed funding for solar mini-grid projects in 49 villages across Uganda and Sierra Leone, installing 6,000 portable batteries to provide clean electricity to off-grid communities.

- December 2021: Development Bank of Rwanda (BRD) announced plans to develop solar PV and hydro mini-grids ranging from 10 kW to 1 MW in Rwanda, with hybrid mini-grids coupled with battery storage planned by Rwandan authorities.

Future Outlook for East Africa Battery Market Market

The future outlook for the East Africa battery market is exceptionally positive, driven by powerful growth catalysts. The increasing adoption of renewable energy, coupled with ongoing efforts to expand electrification across the region, will continue to fuel demand for advanced battery storage solutions. Strategic opportunities lie in the development of localized manufacturing capabilities, the establishment of robust recycling infrastructure, and the innovation of affordable and scalable battery technologies tailored to the specific needs of East African consumers and industries. The market is poised for significant expansion as it plays a crucial role in powering sustainable development, enhancing energy security, and improving the quality of life for millions.

East Africa Battery Market Segmentation

-

1. Type

- 1.1. Primary Battery

- 1.2. Secondary Battery

-

2. Technology

- 2.1. Lithium-ion Battery

- 2.2. Lead-acid Battery

- 2.3. Other Technologies

-

3. Application

- 3.1. Industrial Batteries

- 3.2. Portable Batteries

- 3.3. Other Applications

-

4. Geography

- 4.1. Kenya

- 4.2. Ethiopia

- 4.3. Tanzania

- 4.4. Rest of East Africa

East Africa Battery Market Segmentation By Geography

- 1. Kenya

- 2. Ethiopia

- 3. Tanzania

- 4. Rest of East Africa

East Africa Battery Market Regional Market Share

Geographic Coverage of East Africa Battery Market

East Africa Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment Expected to be the Fastest-growing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global East Africa Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary Battery

- 5.1.2. Secondary Battery

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Lithium-ion Battery

- 5.2.2. Lead-acid Battery

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Industrial Batteries

- 5.3.2. Portable Batteries

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Kenya

- 5.4.2. Ethiopia

- 5.4.3. Tanzania

- 5.4.4. Rest of East Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Kenya

- 5.5.2. Ethiopia

- 5.5.3. Tanzania

- 5.5.4. Rest of East Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kenya East Africa Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Primary Battery

- 6.1.2. Secondary Battery

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Lithium-ion Battery

- 6.2.2. Lead-acid Battery

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Industrial Batteries

- 6.3.2. Portable Batteries

- 6.3.3. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Kenya

- 6.4.2. Ethiopia

- 6.4.3. Tanzania

- 6.4.4. Rest of East Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Ethiopia East Africa Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Primary Battery

- 7.1.2. Secondary Battery

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Lithium-ion Battery

- 7.2.2. Lead-acid Battery

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Industrial Batteries

- 7.3.2. Portable Batteries

- 7.3.3. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Kenya

- 7.4.2. Ethiopia

- 7.4.3. Tanzania

- 7.4.4. Rest of East Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Tanzania East Africa Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Primary Battery

- 8.1.2. Secondary Battery

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Lithium-ion Battery

- 8.2.2. Lead-acid Battery

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Industrial Batteries

- 8.3.2. Portable Batteries

- 8.3.3. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Kenya

- 8.4.2. Ethiopia

- 8.4.3. Tanzania

- 8.4.4. Rest of East Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of East Africa East Africa Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Primary Battery

- 9.1.2. Secondary Battery

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Lithium-ion Battery

- 9.2.2. Lead-acid Battery

- 9.2.3. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Industrial Batteries

- 9.3.2. Portable Batteries

- 9.3.3. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Kenya

- 9.4.2. Ethiopia

- 9.4.3. Tanzania

- 9.4.4. Rest of East Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Exide Industries Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toshiba Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Murata Manufacturing Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Panasonic Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Duracell Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ABM Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Trojan Battery Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Uganda Batteries Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bodawerk International Ltd*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Exide Industries Ltd

List of Figures

- Figure 1: Global East Africa Battery Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Kenya East Africa Battery Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Kenya East Africa Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Kenya East Africa Battery Market Revenue (billion), by Technology 2025 & 2033

- Figure 5: Kenya East Africa Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: Kenya East Africa Battery Market Revenue (billion), by Application 2025 & 2033

- Figure 7: Kenya East Africa Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: Kenya East Africa Battery Market Revenue (billion), by Geography 2025 & 2033

- Figure 9: Kenya East Africa Battery Market Revenue Share (%), by Geography 2025 & 2033

- Figure 10: Kenya East Africa Battery Market Revenue (billion), by Country 2025 & 2033

- Figure 11: Kenya East Africa Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Ethiopia East Africa Battery Market Revenue (billion), by Type 2025 & 2033

- Figure 13: Ethiopia East Africa Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Ethiopia East Africa Battery Market Revenue (billion), by Technology 2025 & 2033

- Figure 15: Ethiopia East Africa Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Ethiopia East Africa Battery Market Revenue (billion), by Application 2025 & 2033

- Figure 17: Ethiopia East Africa Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Ethiopia East Africa Battery Market Revenue (billion), by Geography 2025 & 2033

- Figure 19: Ethiopia East Africa Battery Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Ethiopia East Africa Battery Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Ethiopia East Africa Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Tanzania East Africa Battery Market Revenue (billion), by Type 2025 & 2033

- Figure 23: Tanzania East Africa Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Tanzania East Africa Battery Market Revenue (billion), by Technology 2025 & 2033

- Figure 25: Tanzania East Africa Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Tanzania East Africa Battery Market Revenue (billion), by Application 2025 & 2033

- Figure 27: Tanzania East Africa Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Tanzania East Africa Battery Market Revenue (billion), by Geography 2025 & 2033

- Figure 29: Tanzania East Africa Battery Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Tanzania East Africa Battery Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Tanzania East Africa Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of East Africa East Africa Battery Market Revenue (billion), by Type 2025 & 2033

- Figure 33: Rest of East Africa East Africa Battery Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Rest of East Africa East Africa Battery Market Revenue (billion), by Technology 2025 & 2033

- Figure 35: Rest of East Africa East Africa Battery Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Rest of East Africa East Africa Battery Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Rest of East Africa East Africa Battery Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Rest of East Africa East Africa Battery Market Revenue (billion), by Geography 2025 & 2033

- Figure 39: Rest of East Africa East Africa Battery Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of East Africa East Africa Battery Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of East Africa East Africa Battery Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global East Africa Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global East Africa Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Global East Africa Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global East Africa Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Global East Africa Battery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global East Africa Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global East Africa Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 8: Global East Africa Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global East Africa Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Global East Africa Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global East Africa Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global East Africa Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 13: Global East Africa Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global East Africa Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Global East Africa Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global East Africa Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global East Africa Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 18: Global East Africa Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global East Africa Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global East Africa Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global East Africa Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global East Africa Battery Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 23: Global East Africa Battery Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global East Africa Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Global East Africa Battery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the East Africa Battery Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the East Africa Battery Market?

Key companies in the market include Exide Industries Ltd, Toshiba Corporation, Murata Manufacturing Co Ltd, Panasonic Corporation, Duracell Inc, ABM Group, Trojan Battery Company, Uganda Batteries Limited, Bodawerk International Ltd*List Not Exhaustive.

3. What are the main segments of the East Africa Battery Market?

The market segments include Type, Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment Expected to be the Fastest-growing Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In February 2021, Winch Energy, an off-grid utility provider, completed the funding for solar mini-grid projects in 49 villages across Uganda and Sierra Leone. The project includes 6,000 portable batteries installed through the project to provide people outside of the mini-grid catchment area with clean electricity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "East Africa Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the East Africa Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the East Africa Battery Market?

To stay informed about further developments, trends, and reports in the East Africa Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence