Key Insights

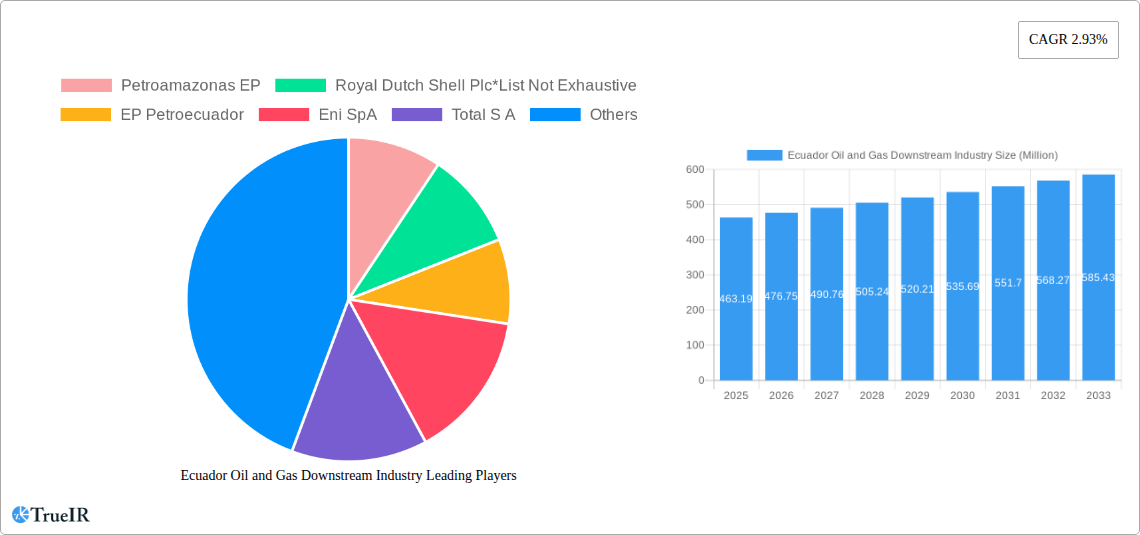

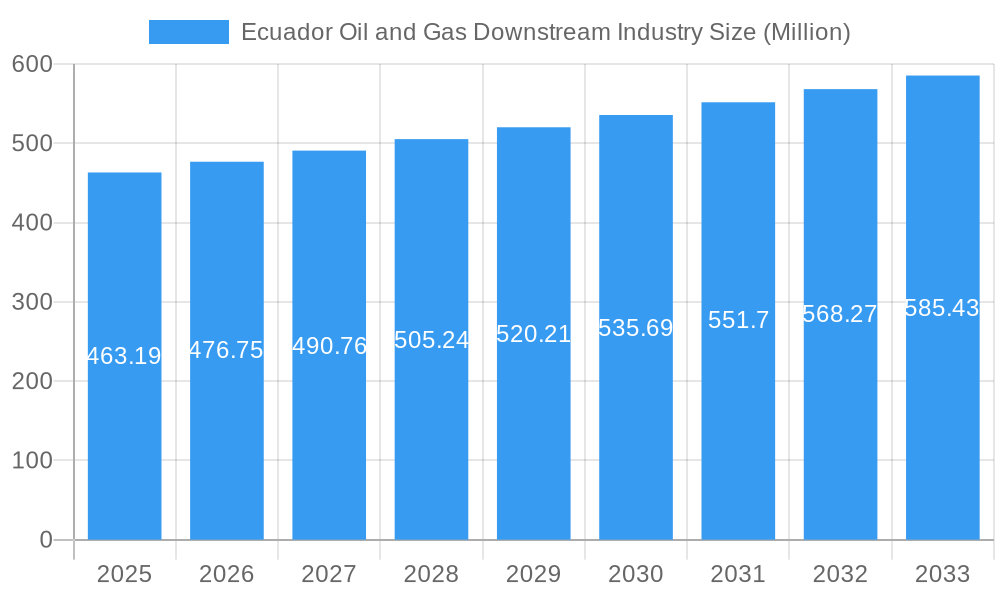

The Ecuador Oil and Gas Downstream Industry is projected to reach a market size of approximately USD 463.19 million by 2025, demonstrating a steady growth trajectory. The industry is expected to expand at a Compound Annual Growth Rate (CAGR) of 2.93% during the forecast period from 2025 to 2033. This growth is primarily driven by increasing domestic demand for refined petroleum products, such as gasoline, diesel, and jet fuel, fueled by a growing population and expanding transportation and industrial sectors. Furthermore, government initiatives aimed at modernizing refining infrastructure and enhancing energy security are expected to play a pivotal role in supporting market expansion. Investments in upgrading existing facilities and exploring new downstream processing technologies will be crucial for meeting evolving market needs and maintaining competitiveness.

Ecuador Oil and Gas Downstream Industry Market Size (In Million)

Key trends shaping the Ecuador Oil and Gas Downstream Industry include a growing emphasis on operational efficiency and cost optimization within refineries and petrochemical plants. Companies are likely to focus on implementing advanced technologies to improve yield, reduce energy consumption, and minimize environmental impact. The strategic importance of petrochemical production, leveraging existing crude oil resources, is also anticipated to rise, potentially leading to increased investment in value-added products. However, the industry faces certain restraints, including the potential for volatile crude oil prices impacting profitability, and evolving environmental regulations that may necessitate significant capital expenditure for compliance. The presence of major players like Petroamazonas EP, Royal Dutch Shell Plc, and EP Petroecuador highlights a competitive landscape where innovation and strategic partnerships will be vital for sustained success in this dynamic market.

Ecuador Oil and Gas Downstream Industry Company Market Share

Ecuador Oil and Gas Downstream Industry: Market Analysis and Future Outlook 2019-2033

This comprehensive report delves into the dynamic Ecuador Oil and Gas Downstream Industry, providing in-depth analysis and forecasting for the period 2019–2033. Leveraging high-volume keywords such as "Ecuador oil and gas downstream," "refining capacity," "petrochemicals Ecuador," "energy market analysis," and "oil and gas investment," this report is meticulously crafted for industry professionals seeking actionable insights. The study encompasses the Base Year of 2025, with detailed analysis for the Historical Period (2019–2024) and the Forecast Period (2025–2033).

Ecuador Oil and Gas Downstream Industry Market Structure & Competitive Landscape

The Ecuador oil and gas downstream market exhibits a moderate to high concentration, with state-owned entities like EP Petroecuador and Petroamazonas EP playing a pivotal role. Innovation drivers are largely focused on efficiency improvements in refining processes and the expansion of petrochemical product lines to capture higher value. Regulatory impacts are significant, with government policies dictating investment frameworks and environmental standards. Product substitutes are limited within the core refining and petrochemical sectors, but the long-term shift towards cleaner energy sources presents an indirect substitutive threat. End-user segmentation spans transportation fuels, industrial chemicals, and agricultural inputs. Merger and acquisition (M&A) trends are expected to see consolidation among smaller independent players and potential strategic partnerships with international technology providers. The market structure is characterized by substantial capital investment requirements and complex operational demands, influencing the competitive landscape. Key players invest heavily in upgrading existing facilities to meet evolving demand and environmental regulations. For instance, the planned modernization of the Esmeraldas refinery signifies a strategic move to enhance operational efficiency and product quality, impacting market dynamics. The competitive intensity is driven by the need for operational excellence and cost competitiveness in a volatile global energy market.

Ecuador Oil and Gas Downstream Industry Market Trends & Opportunities

The Ecuador oil and gas downstream industry is poised for significant evolution, driven by a confluence of market trends and strategic opportunities. The market size for refined products and petrochemicals is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 3.5% during the forecast period, fueled by sustained domestic energy demand and potential export growth. Technological shifts are a critical theme, with a growing emphasis on advanced refining technologies to optimize crude oil processing and maximize the yield of higher-value products. This includes the adoption of catalytic cracking, hydrotreating, and isomerization processes to produce cleaner fuels and specialized petrochemical feedstocks. Furthermore, investments in digitalization and automation are transforming operational efficiency, predictive maintenance, and supply chain management across refineries and petrochemical plants. Consumer preferences are subtly shifting towards more environmentally friendly fuels, prompting downstream players to explore cleaner fuel formulations and bio-based alternatives where feasible. Competitive dynamics are intensifying, characterized by strategic alliances between national oil companies and international technology and service providers, aiming to enhance operational capabilities and introduce cutting-edge technologies. Opportunities abound in the modernization of existing infrastructure, such as the Esmeraldas refinery upgrade, which represents a significant step towards enhancing refining capacity and product diversity. The development of new petrochemical complexes, driven by abundant domestic feedstock, presents another lucrative avenue for growth and value addition. The integration of downstream operations with upstream production aims to create a more resilient and cost-effective value chain. The increasing global demand for specific petrochemical derivatives, such as polyethylene and polypropylene, offers substantial potential for Ecuador to expand its market share. The report forecasts a market penetration rate of over 80% for essential refined fuels by 2033, underscoring the foundational role of the downstream sector in the nation's energy security. Investments in research and development for novel chemical products and advanced materials are also gaining traction, signaling a move towards a more diversified and innovation-led industry.

Dominant Markets & Segments in Ecuador Oil and Gas Downstream Industry

Within the Ecuador oil and gas downstream industry, Refineries currently represent the dominant segment, reflecting the nation's primary focus on processing crude oil into essential fuels and intermediate products. The strategic importance of refineries is underscored by ongoing efforts to enhance their capacity and efficiency, such as the tender launched in October 2022 for the modernization and upgradation of the 110,000 bbl/day capacity Esmeraldas refinery. This initiative alone signifies a substantial investment and a commitment to boosting refining capabilities.

- Key Growth Drivers for Refineries:

- Domestic Energy Demand: A steadily growing population and expanding economy necessitate a consistent supply of transportation fuels (gasoline, diesel, jet fuel) and heating oils.

- Infrastructure Investment: Government-led initiatives and private sector engagement in upgrading and expanding refinery infrastructure are critical. The recent surpassed crude oil output of over 400,000 bpd by Petroecuador in its refinery segment demonstrates an upward trend in operational capacity.

- Energy Security: Maintaining a robust refining sector is paramount for national energy security, reducing reliance on imported refined products.

- Value Addition to Crude: Refineries serve as the primary gateway for adding value to Ecuador's crude oil production before it enters the market.

While Petrochemical Plants are a vital component of the downstream sector, their current market share is smaller compared to refineries. However, this segment holds immense potential for future growth, particularly in light of Ecuador's abundant hydrocarbon resources, which can serve as feedstocks for a wide range of petrochemical products.

- Key Growth Drivers for Petrochemical Plants:

- Feedstock Availability: Proximity to crude oil and natural gas reserves provides a competitive advantage for petrochemical production.

- Diversification Strategy: Developing a stronger petrochemical base allows Ecuador to diversify its export portfolio beyond crude oil and basic refined products.

- Global Demand for Petrochemicals: Increasing global demand for plastics, fertilizers, synthetic fibers, and other chemical intermediates creates significant export opportunities.

- Government Support and Policy Frameworks: Favorable policies, tax incentives, and investment in infrastructure (e.g., pipelines, storage facilities) are crucial for attracting investment in petrochemical projects.

The dominance of the refining segment is a reflection of historical development and immediate energy needs. However, the strategic imperative to move up the value chain points towards a significant expansion of the petrochemical sector in the coming years. The development of integrated refining and petrochemical complexes is likely to emerge as a key trend.

Ecuador Oil and Gas Downstream Industry Product Analysis

The Ecuador oil and gas downstream industry primarily focuses on the production of essential fuels and basic petrochemical building blocks. Key products include gasoline, diesel, aviation fuel, LPG, and fuel oil derived from refining operations. Petrochemical outputs encompass a range of intermediates such as naphtha, which serves as feedstock for further processing. Technological advancements are driving improvements in fuel quality, with a focus on reducing sulfur content and meeting stricter environmental standards. The competitive advantage lies in optimizing refining processes to maximize yield and minimize operational costs, while exploring opportunities to produce higher-value specialty chemicals.

Key Drivers, Barriers & Challenges in Ecuador Oil and Gas Downstream Industry

Key Drivers:

The Ecuador oil and gas downstream industry is propelled by several key drivers. Firstly, growing domestic energy demand for transportation fuels and industrial applications provides a foundational market. Secondly, government initiatives and investment incentives aimed at modernizing and expanding refining capacity, such as the Esmeraldas refinery tender, are crucial. Thirdly, ** Ecuador's substantial crude oil reserves** offer a readily available and cost-effective feedstock for downstream operations. Finally, the strategic imperative to add value to its hydrocarbon resources by moving beyond crude export to refined products and petrochemicals is a significant growth catalyst.

Barriers & Challenges:

Despite these drivers, the industry faces significant barriers and challenges. Regulatory complexities and policy uncertainty can deter long-term investment. Aging infrastructure in some facilities requires substantial capital for upgrades and maintenance, impacting operational efficiency. Volatility in global crude oil prices directly affects profitability and investment decisions. Environmental regulations and the push for decarbonization necessitate investments in cleaner technologies and may lead to shifts in demand for traditional products. Furthermore, logistical challenges and infrastructure limitations in transportation and storage can hinder the efficient movement of products.

Growth Drivers in the Ecuador Oil and Gas Downstream Industry Market

The Ecuador oil and gas downstream industry is propelled by several key growth drivers. Increasing domestic demand for refined petroleum products, driven by economic growth and a rising vehicle fleet, forms a core impetus. Strategic government investment and policy support, exemplified by initiatives to modernize refineries and attract foreign direct investment, are critical enablers. The abundance of domestic crude oil reserves provides a stable and competitive feedstock, reducing import reliance and optimizing production costs. Furthermore, a growing emphasis on value addition by transforming raw crude into higher-value refined products and petrochemicals is a significant strategic driver for revenue diversification and economic development.

Challenges Impacting Ecuador Oil and Gas Downstream Industry Growth

Several challenges impact the growth of Ecuador's oil and gas downstream industry. Aging infrastructure and the need for substantial capital investment for modernization and upgrades present a significant hurdle. Global price volatility of crude oil and refined products can create revenue uncertainty and impact profitability. Increasingly stringent environmental regulations and the global energy transition towards cleaner alternatives necessitate significant adaptation and investment in new technologies. Operational complexities and potential supply chain disruptions, influenced by both domestic and international factors, can also hinder smooth operations and expansion plans.

Key Players Shaping the Ecuador Oil and Gas Downstream Industry Market

- Petroamazonas EP

- Royal Dutch Shell Plc

- EP Petroecuador

- Eni SpA

- Total S A

- Repsol S.A.

- Enap Sipetrol

- Schlumberger Limited

- Halliburton Company

- Chevron Corporation

Significant Ecuador Oil and Gas Downstream Industry Industry Milestones

- December 2023: Ecuador's state oil company, Petroecuador, reported that crude oil output in its refinery segment surpassed 400,000 bpd for the first time since January 2021. Crude oil production reached 401,852 barrels, with barrels of oil equivalent reaching 411,873, including natural gas and associated gas, signaling a strong operational performance.

- October 2022: Ecuador launched a tender inviting investment for the modernization and upgradation of its largest refinery, the 110,000 bbl/day capacity Esmeraldas refinery, indicating a strategic push to enhance refining capabilities and efficiency.

- February 2022: Petroecuador signed a 15-year contract for the receipt, storage, transport, and dispatch of petroleum products with Abastecedora Ecuatoriana de Combustibles. This agreement ensures comprehensive management of fuels through Petroecuador's extensive infrastructure, including pipelines, terminals, refineries, and oil docks, solidifying its central role in fuel logistics.

Future Outlook for Ecuador Oil and Gas Downstream Industry Market

The future outlook for Ecuador's oil and gas downstream industry is characterized by a strategic imperative for modernization and value addition. Key growth catalysts include significant investments in upgrading existing refining infrastructure to improve efficiency and product quality, as well as the development of new petrochemical facilities to capitalize on abundant feedstocks. The market is expected to see increased integration across the value chain, fostering greater resilience and competitiveness. Strategic opportunities lie in expanding the portfolio of higher-value petrochemical products, catering to both domestic and international demand. The ongoing energy transition will also necessitate a focus on cleaner fuel technologies and potentially the exploration of biofuels and other sustainable energy solutions within the broader energy landscape, positioning Ecuador to adapt and thrive in the evolving global energy market.

Ecuador Oil and Gas Downstream Industry Segmentation

-

1. Process Type

- 1.1. Refineries

- 1.2. Petrochemical Plants

Ecuador Oil and Gas Downstream Industry Segmentation By Geography

- 1. Ecuador

Ecuador Oil and Gas Downstream Industry Regional Market Share

Geographic Coverage of Ecuador Oil and Gas Downstream Industry

Ecuador Oil and Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Demand for Refined Petroleum Products

- 3.2.2 Coupled with the Rise in Population

- 3.2.3 Urbanization

- 3.2.4 and Industrialization in Ecuador

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Share of Fuel-Efficient Vehicles and the Increasing Penetration of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Refining sector is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ecuador Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Refineries

- 5.1.2. Petrochemical Plants

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Ecuador

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Petroamazonas EP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Royal Dutch Shell Plc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EP Petroecuador

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eni SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Repsol S.A.

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Enap Sipetrol

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schlumberger Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Halliburton Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chevron Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Petroamazonas EP

List of Figures

- Figure 1: Ecuador Oil and Gas Downstream Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Ecuador Oil and Gas Downstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Process Type 2020 & 2033

- Table 2: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Process Type 2020 & 2033

- Table 3: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Process Type 2020 & 2033

- Table 6: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Process Type 2020 & 2033

- Table 7: Ecuador Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Ecuador Oil and Gas Downstream Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ecuador Oil and Gas Downstream Industry?

The projected CAGR is approximately 2.93%.

2. Which companies are prominent players in the Ecuador Oil and Gas Downstream Industry?

Key companies in the market include Petroamazonas EP, Royal Dutch Shell Plc*List Not Exhaustive, EP Petroecuador, Eni SpA, Total S A, Repsol S.A. , Enap Sipetrol , Schlumberger Limited , Halliburton Company , Chevron Corporation.

3. What are the main segments of the Ecuador Oil and Gas Downstream Industry?

The market segments include Process Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 463.19 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Refined Petroleum Products. Coupled with the Rise in Population. Urbanization. and Industrialization in Ecuador.

6. What are the notable trends driving market growth?

Refining sector is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Growing Share of Fuel-Efficient Vehicles and the Increasing Penetration of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

December 2023: Ecuador's state oil company, Petroecuador, stated that in the company's refinery segment, crude oil output surpassed 400,000 bpd for the first time since January 2021. In a statement, Petroecuador said crude oil production reached 401,852 barrels while barrels of oil equivalent reached 411,873, including natural gas and associated gas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ecuador Oil and Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ecuador Oil and Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ecuador Oil and Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Ecuador Oil and Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence