Key Insights

The European Capital Market Exchange Ecosystem, featuring prominent players such as Euronext, Nasdaq Nordic, and the London Stock Exchange, is poised for substantial expansion. Driven by increasing cross-border investment within the EU, enhanced digitalization and fintech adoption fostering efficient trading, and the burgeoning sustainable finance sector, the market is projected to reach 151.36 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.8%. The rising volume of Initial Public Offerings (IPOs) and increased institutional investor participation are also key growth catalysts. While regulatory adjustments for transparency and investor protection may present short-term hurdles, they are anticipated to foster long-term market stability.

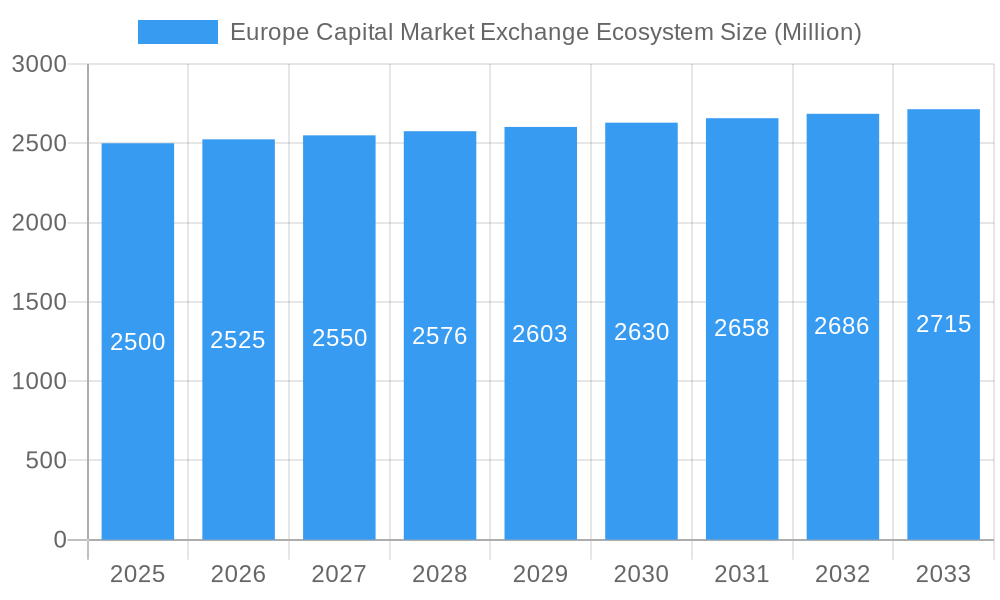

Europe Capital Market Exchange Ecosystem Market Size (In Million)

Despite positive growth trajectories, the market confronts potential headwinds. Geopolitical instability, particularly in Eastern Europe, poses a risk to investor sentiment and trading volumes. Moreover, competition from alternative trading platforms and the dynamic technological landscape demand continuous innovation from established exchanges to preserve market share. Market segmentation is expected across asset classes (equities, bonds, derivatives), investor types (retail, institutional), and geographies. The forecast period (2025-2033) anticipates sustained growth, though subject to global macroeconomic fluctuations. Comprehensive analysis of individual exchange performance within this ecosystem is vital for strategic investment and business planning.

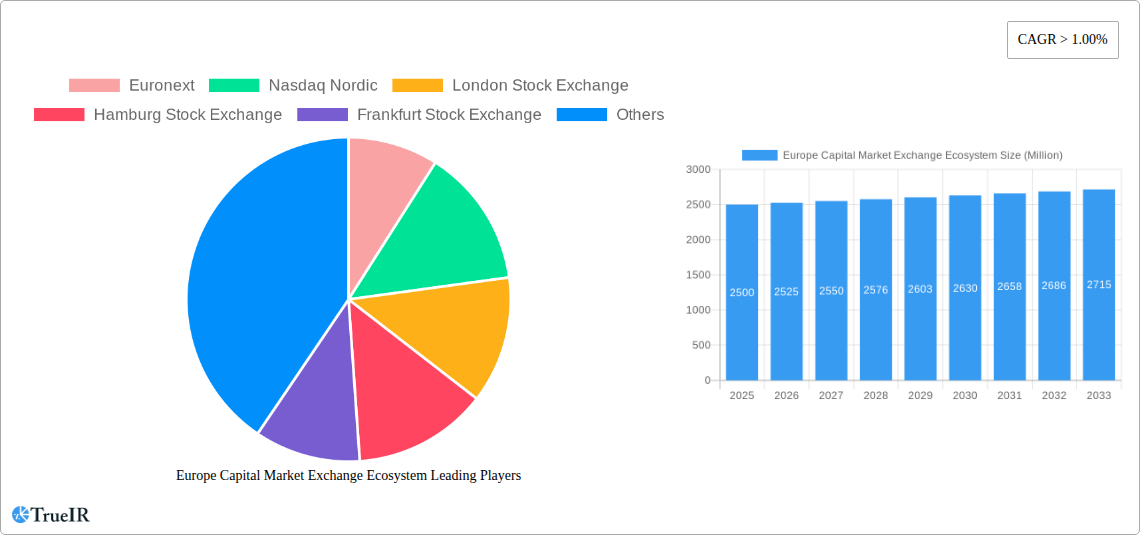

Europe Capital Market Exchange Ecosystem Company Market Share

Europe Capital Market Exchange Ecosystem Market Report: 2019-2033

This comprehensive report delivers an in-depth analysis of the dynamic Europe Capital Market Exchange Ecosystem, providing crucial insights for investors, businesses, and policymakers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report leverages extensive market research and data analysis to offer a precise understanding of the market's current state and its future trajectory. The report size is approximately 2,000 words. The estimated market size in 2025 is xx Million. The Compound Annual Growth Rate (CAGR) for the forecast period is projected at xx%.

Europe Capital Market Exchange Ecosystem Market Structure & Competitive Landscape

This section analyzes the competitive landscape of the European capital market exchange ecosystem, encompassing market concentration, innovation drivers, regulatory influences, substitute products, end-user segmentation, and mergers & acquisitions (M&A) trends. The market is characterized by a moderate level of concentration, with key players like Euronext, London Stock Exchange, and Deutsche Börse (Frankfurt Stock Exchange) holding significant market share. However, the presence of numerous regional and niche exchanges fosters competition.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the European capital market exchange ecosystem in 2024 is estimated at xx, indicating a moderately concentrated market. This is further influenced by the level of cross-border trading and the emergence of new trading platforms.

- Innovation Drivers: Technological advancements, including the rise of high-frequency trading, algorithmic trading, and blockchain technology, are primary innovation drivers. Regulatory changes, such as MiFID II, also contribute to innovation by encouraging competition and transparency.

- Regulatory Impacts: Regulations like MiFID II and the Market Abuse Regulation (MAR) significantly shape the market structure by influencing trading practices, transparency requirements, and market surveillance. Brexit also continues to impact market dynamics.

- Product Substitutes: Alternative trading platforms and over-the-counter (OTC) markets represent potential substitutes for traditional exchanges, although these often lack the transparency and regulatory oversight of established exchanges.

- End-User Segmentation: The market caters to a diverse range of end-users, including institutional investors (pension funds, mutual funds), retail investors, corporations raising capital, and financial intermediaries (broker-dealers).

- M&A Trends: The European capital market exchange ecosystem has witnessed a moderate level of M&A activity in recent years, driven by efforts to achieve economies of scale, expand market reach, and enhance technological capabilities. The total M&A volume in the sector from 2019-2024 is estimated at xx Million.

Europe Capital Market Exchange Ecosystem Market Trends & Opportunities

The European capital market exchange ecosystem is undergoing significant transformation driven by technological advancements, evolving investor preferences, and shifting regulatory landscapes. Market size is projected to grow from xx Million in 2025 to xx Million by 2033, driven by increased trading volumes, the growth of digital assets, and the expansion of sustainable finance initiatives. Technological advancements such as AI-powered trading platforms and blockchain-based clearing and settlement systems are revolutionizing market operations, enhancing efficiency and reducing costs. The increasing adoption of ESG (Environmental, Social, and Governance) investing significantly impacts investment decisions, with companies prioritizing transparency and sustainability.

The market is witnessing increased competition from alternative trading platforms and fintech companies. The rising popularity of digital assets and cryptocurrencies presents both opportunities and challenges for traditional exchanges. The integration of fintech solutions and the expansion of cross-border trading will define growth opportunities.

Dominant Markets & Segments in Europe Capital Market Exchange Ecosystem

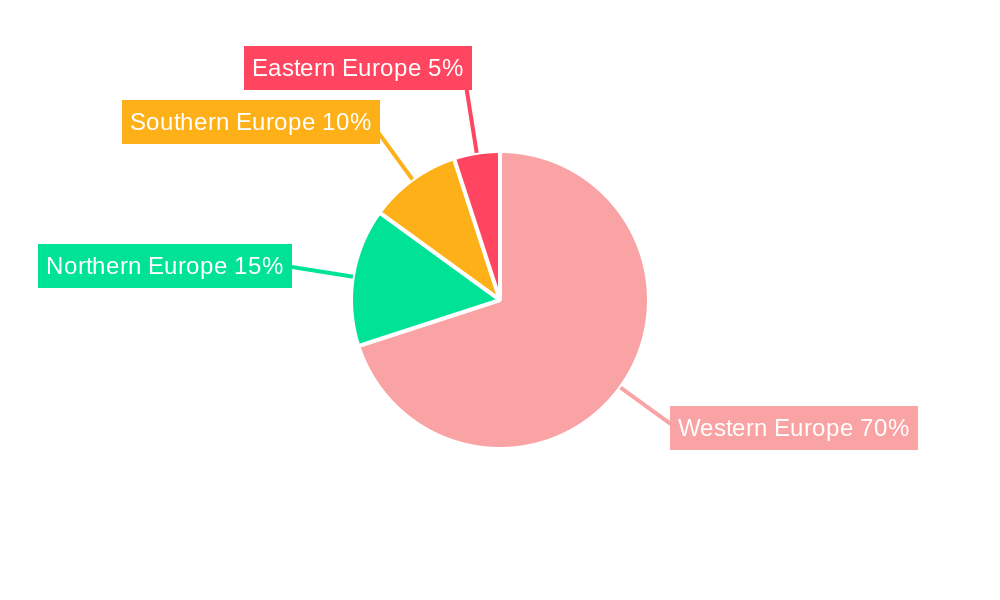

The United Kingdom, Germany, and France represent the dominant markets in the European capital market exchange ecosystem due to their strong financial infrastructure, deep liquidity pools, and presence of major exchanges. However, other countries in the EU are also showing robust growth. The equities segment currently holds the largest share of the market, though fixed income and derivatives are also significant and growing.

- Key Growth Drivers for Dominant Markets:

- Robust financial infrastructure: Well-developed regulatory frameworks, sophisticated trading technologies, and experienced market professionals.

- Deep liquidity pools: High trading volumes contribute to efficient price discovery and reduced transaction costs.

- Attractive investment climate: Favorable tax regimes, political stability, and investor-friendly policies.

- Presence of major exchanges: Leading exchanges attract considerable trading activity and market participants.

Europe Capital Market Exchange Ecosystem Product Analysis

The product offerings within the European capital market exchange ecosystem are constantly evolving, driven by technological advancements and shifting market demands. Innovations include high-frequency trading platforms, advanced order management systems, and the integration of blockchain technology for improved transparency and security. These products offer competitive advantages by providing enhanced trading speed, reduced latency, and improved operational efficiency. Furthermore, many exchanges are incorporating ESG data and analytics into their platforms to cater to the growing demand for sustainable investing.

Key Drivers, Barriers & Challenges in Europe Capital Market Exchange Ecosystem

Key Drivers:

- Technological advancements (high-frequency trading, AI, blockchain) are boosting efficiency and reducing costs.

- Growing regulatory focus on transparency and investor protection attracts more capital.

- The rise of sustainable finance is driving demand for ESG-compliant investments.

Key Challenges & Restraints:

- Regulatory complexities and fragmented regulatory landscape across Europe create compliance challenges.

- Increased competition from alternative trading platforms and fintech firms is squeezing margins.

- Geopolitical uncertainties (e.g., Brexit, the war in Ukraine) are creating market volatility and investor uncertainty. The estimated impact of geopolitical factors on market growth is a reduction of xx Million in the next 5 years.

Growth Drivers in the Europe Capital Market Exchange Ecosystem Market

Technological advancements, such as AI-driven trading platforms and blockchain-based solutions, are key drivers. The expanding focus on sustainable finance, coupled with favorable regulatory developments, is fostering growth. Increased participation from retail investors and the expansion of cross-border trading also contribute significantly.

Challenges Impacting Europe Capital Market Exchange Ecosystem Growth

Regulatory complexities, particularly post-Brexit, and the increasing competition from alternative trading platforms pose significant challenges. Geopolitical instability, cybersecurity threats, and evolving market preferences are further factors that impact growth. Supply chain disruptions within the financial technology sector could lead to delays in implementing crucial upgrades.

Key Players Shaping the Europe Capital Market Exchange Ecosystem Market

- Euronext

- Nasdaq Nordic

- London Stock Exchange

- Hamburg Stock Exchange

- Frankfurt Stock Exchange

- Italian Stock Exchange

- SIX Swiss Exchange

- Budapest Stock Exchange

- Moscow Exchange

- Ukrainian Exchange

Significant Europe Capital Market Exchange Ecosystem Industry Milestones

- October 2023: Euronext introduced a new VaR-based margin methodology on the Euronext Milan equities, ETF, and financial derivatives markets, improving risk management.

- March 2023: Innovate UK and the London Stock Exchange partnered to improve financial access for innovative businesses, unlocking EUR 6 trillion in long-term capital for UK growth.

Future Outlook for Europe Capital Market Exchange Ecosystem Market

The future of the European capital market exchange ecosystem is bright, characterized by continued technological innovation, increased regulatory scrutiny, and the growing importance of ESG investing. Strategic opportunities lie in leveraging technological advancements to enhance efficiency, improve risk management, and expand into new markets. The market's potential is substantial, fueled by the increasing integration of European capital markets and the growth of sustainable finance.

Europe Capital Market Exchange Ecosystem Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

-

3. Investors

- 3.1. Retail Investors

- 3.2. Institutional Investors

Europe Capital Market Exchange Ecosystem Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of Europe Capital Market Exchange Ecosystem

Europe Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Significance of Primary Market in European Capital Market Exchange Ecosystem

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Investors

- 5.3.1. Retail Investors

- 5.3.2. Institutional Investors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Euronext

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nasdaq Nordic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 London Stock Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hamburg Stock Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frankfurt Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Italian Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIX Swiss Exchange

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Budapest Stock Exchange

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Moscow Exchange

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ukrainian Exchange**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Euronext

List of Figures

- Figure 1: Europe Capital Market Exchange Ecosystem Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Type of Market 2020 & 2033

- Table 2: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Financial Instruments 2020 & 2033

- Table 3: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Investors 2020 & 2033

- Table 4: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Type of Market 2020 & 2033

- Table 6: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Financial Instruments 2020 & 2033

- Table 7: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Investors 2020 & 2033

- Table 8: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Capital Market Exchange Ecosystem?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Europe Capital Market Exchange Ecosystem?

Key companies in the market include Euronext, Nasdaq Nordic, London Stock Exchange, Hamburg Stock Exchange, Frankfurt Stock Exchange, Italian Stock Exchange, SIX Swiss Exchange, Budapest Stock Exchange, Moscow Exchange, Ukrainian Exchange**List Not Exhaustive.

3. What are the main segments of the Europe Capital Market Exchange Ecosystem?

The market segments include Type of Market, Financial Instruments, Investors.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.36 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Significance of Primary Market in European Capital Market Exchange Ecosystem.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Euronext introduced a new VaR-based margin methodology on the Euronext Milan equities, ETF and financial derivatives markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the Europe Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence