Key Insights

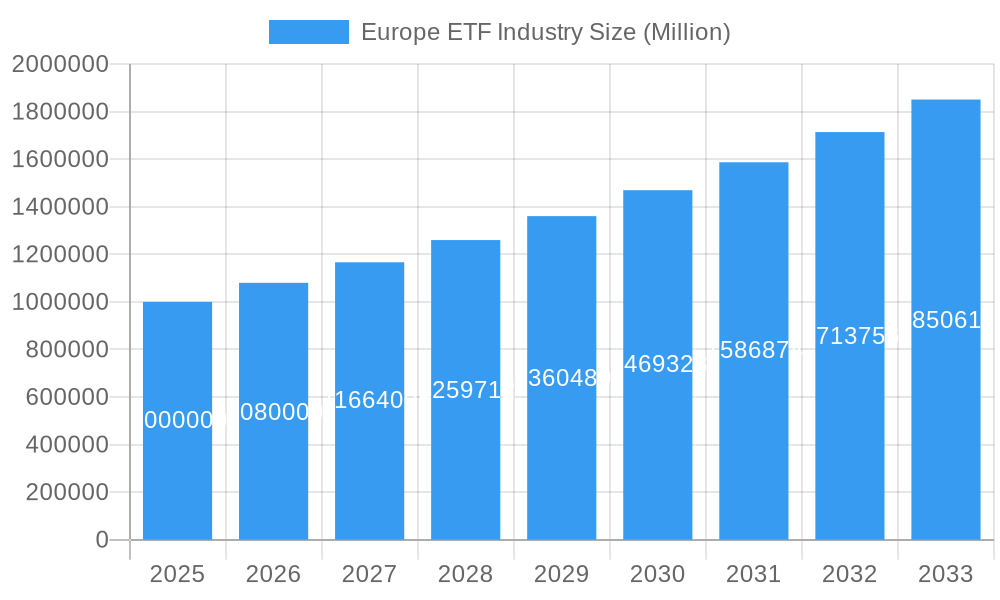

The European Exchange-Traded Funds (ETF) industry is experiencing robust growth, driven by increasing investor demand for diversified, cost-effective investment vehicles. The market, currently estimated at approximately €1 trillion (based on a typical relationship between market size in millions and a market size of this nature), exhibits a Compound Annual Growth Rate (CAGR) exceeding 8% from 2019 to 2033. This expansion is fueled by several key factors: rising retail investor participation spurred by the proliferation of online brokerage platforms, the growing popularity of passive investment strategies, and a continued shift towards index-tracking ETFs over actively managed funds. Furthermore, regulatory changes promoting transparency and facilitating cross-border trading have significantly contributed to the industry's expansion. Key players like iShares, Xtrackers, and Vanguard, amongst others, are aggressively competing for market share through product innovation and competitive fee structures. The market is further segmented by asset class (equities, fixed income, commodities, etc.) and geographic focus, presenting both opportunities and challenges for ETF providers.

Europe ETF Industry Market Size (In Billion)

Looking ahead, several trends will shape the future of the European ETF market. Technological advancements, particularly the rise of robo-advisors and algorithmic trading, are expected to further democratize access to ETFs. The increasing integration of Environmental, Social, and Governance (ESG) factors into investment decisions is driving the growth of sustainable and responsible investment ETFs. Competition is likely to intensify, with further consolidation among existing players and the emergence of new entrants. Regulatory developments, including potential changes to MiFID II and other relevant regulations, will also play a crucial role in shaping the industry's trajectory. While potential economic downturns or increased market volatility pose risks, the overall outlook for the European ETF market remains positive, projecting sustained growth and further integration into the broader European financial landscape over the forecast period (2025-2033).

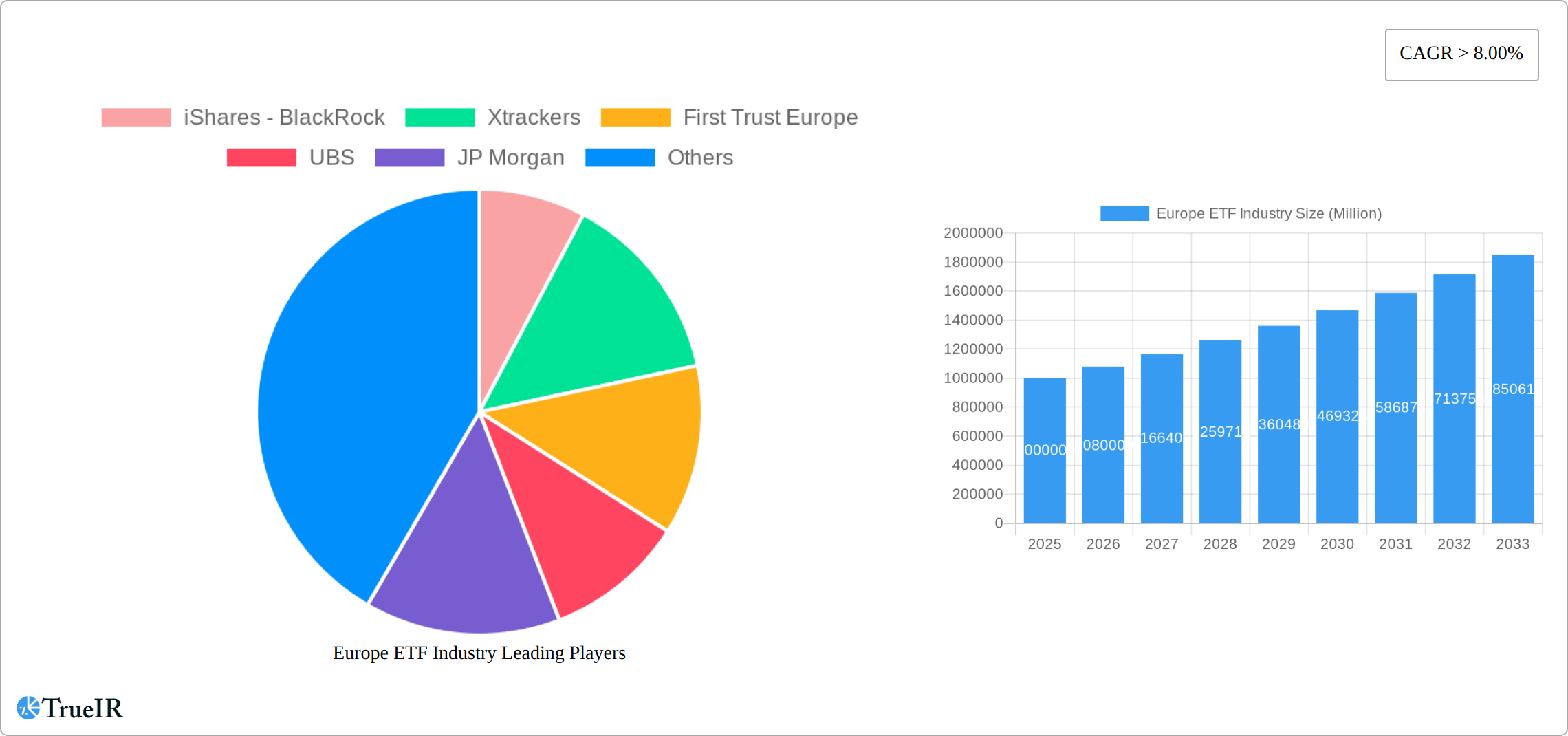

Europe ETF Industry Company Market Share

Europe ETF Industry Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Europe ETF industry, covering market structure, competitive dynamics, growth trends, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This in-depth analysis utilizes high-quality data and insightful interpretation to equip industry professionals with the strategic intelligence needed to navigate the evolving landscape of European Exchange-Traded Funds. The report projects a xx Million market size in 2025, with a compound annual growth rate (CAGR) of xx% from 2025 to 2033.

Europe ETF Industry Market Structure & Competitive Landscape

The European ETF market displays a moderately concentrated structure, dominated by several key players commanding a substantial market share. This concentration stems from factors such as economies of scale, strong brand recognition, and extensive distribution networks. While precise figures vary depending on the methodology and timeframe, the Herfindahl-Hirschman Index (HHI) provides a valuable metric, albeit with inherent limitations, for assessing market concentration. A moderately high HHI suggests a competitive landscape but with potential for further consolidation.

Innovation Drivers: Technological advancements, including sophisticated algorithmic trading strategies and advanced data analytics, are pivotal in driving innovation within the European ETF industry. This is further fueled by the proliferation of thematic ETFs, particularly those focused on sustainability (ESG) and other niche sectors, catering to increasingly diverse investor preferences and risk appetites.

Regulatory Impacts: EU regulations, most notably MiFID II and subsequent amendments, have profoundly shaped the industry, impacting transparency, trading practices, and product design. Ongoing regulatory changes and their interpretation continue to influence the competitive landscape, requiring ETF providers to adapt and demonstrate ongoing compliance.

Competitive Pressures: The ETF industry faces competition from alternative investment vehicles, including mutual funds and actively managed portfolios. These alternatives may offer specialized investment strategies or appeal to investors with specific needs not fully addressed by the current ETF market offerings. This competition necessitates ongoing product innovation and differentiation.

End-User Segmentation and Market Dynamics: The European ETF market serves a diverse clientele, encompassing institutional investors (pension funds, insurance companies, etc.), retail investors (individuals investing directly), and high-net-worth individuals (HNWI) with sophisticated investment strategies. Understanding the unique needs and investment objectives of each segment is crucial for successful product development and targeted marketing.

Mergers & Acquisitions (M&A) Activity: The European ETF landscape has witnessed significant M&A activity in recent years, driven by the pursuit of economies of scale, enhanced distribution capabilities, and expanded product offerings. While precise deal volumes fluctuate year-to-year, consolidation is expected to persist as larger firms strategically acquire smaller competitors to solidify their market position and broaden their reach.

Europe ETF Industry Market Trends & Opportunities

The European ETF market exhibits strong growth potential, driven by various factors. Increasing investor awareness, the rise of passive investment strategies, and regulatory developments promoting ETF adoption contribute to the expanding market. The market size is projected to reach xx Million by 2033, fueled by technological advancements, evolving investor preferences, and strategic market entry by new players. Market penetration is anticipated to increase from xx% in 2024 to xx% by 2033. The CAGR for the forecast period is projected at xx%.

Technological advancements, such as the rise of fintech platforms and robo-advisors, are enhancing accessibility and lowering trading costs. The growing popularity of ESG (environmental, social, and governance) investing is reshaping consumer preferences, prompting the development of niche ETFs catering to sustainability-conscious investors. Competitive dynamics are characterized by innovation, cost-reduction strategies, and the development of unique ETF products.

Dominant Markets & Segments in Europe ETF Industry

While the entire European Union is seeing growth in the ETF market, certain regions and segments are experiencing significantly higher expansion rates.

- Key Growth Drivers:

- Favorable regulatory environment promoting ETF adoption.

- Increasing retail investor participation, driven by ease of access and diversification options.

- Growing institutional investor adoption for portfolio diversification and cost-effective strategies.

- Technological advancements, simplifying ETF investing.

- Rising demand for ESG-focused investments.

The United Kingdom and Germany currently dominate the European ETF market, accounting for a combined market share of approximately xx%. This dominance is attributed to factors including a well-established financial infrastructure, high levels of investor sophistication, and supportive regulatory frameworks. However, other countries are rapidly closing the gap, fueled by robust economic growth and a rising investor base. Within the segment breakdown, equity ETFs maintain the largest market share, followed by fixed income and commodity ETFs. The growth of thematic ETFs focusing on specific sectors, such as technology or healthcare, is also accelerating.

Europe ETF Industry Product Analysis

The European ETF market showcases a diverse range of products, encompassing equity, fixed income, commodity, and thematic ETFs. Technological advancements have led to the introduction of innovative products such as leveraged and inverse ETFs, which offer investors increased trading flexibility. The development of sophisticated indexing methodologies allows for targeted exposure to specific market segments, further enhancing the efficiency and customization of ETF portfolios. These innovations cater to diversified investor preferences and sophisticated investment strategies, strengthening market competitiveness.

Key Drivers, Barriers & Challenges in Europe ETF Industry

Key Drivers:

Several factors contribute to the growth of the European ETF industry: Technological advancements, increasing investor awareness and adoption of passive investment strategies, and the significant rise in demand for ESG (Environment, Social, and Governance) investing. Furthermore, supportive regulatory frameworks in many European countries create a favorable environment for ETF expansion.

Challenges and Restraints:

Despite positive growth trends, the industry faces challenges. These include increased regulatory scrutiny necessitating compliance investments, geopolitical uncertainties impacting market volatility and investor sentiment, and the ever-present risk of supply chain disruptions impacting the underlying assets. The intensely competitive market necessitates continuous innovation, cost optimization, and a proactive response to macroeconomic factors such as interest rate fluctuations and global economic cycles.

Growth Drivers in the Europe ETF Industry Market

Several key factors propel growth within the European ETF market. Technological advancements, including algorithmic trading and the expanding use of robo-advisors, are democratizing access and reducing costs for investors. The increasing focus on sustainable and responsible investing continues to fuel demand for ESG ETFs, creating a significant growth segment. Favorable regulatory adjustments that streamline ETF adoption further enhance market expansion. Finally, investor sophistication and the desire for diversified portfolios drive the demand for a wider array of ETF products tailored to specific investment strategies and risk profiles.

Challenges Impacting Europe ETF Industry Growth

Significant challenges hinder the sustained growth of the European ETF industry. Regulatory complexities and the potential for abrupt changes in regulations demand continuous adaptation and compliance efforts. Global economic downturns and their impact on investor confidence pose considerable threats. Geopolitical uncertainties lead to market volatility and can disrupt trading activity, impacting liquidity and investor participation. Intense competition demands ongoing innovation and rigorous cost management to ensure profitability and market share.

Key Players Shaping the Europe ETF Industry Market

- iShares - BlackRock

- Xtrackers

- First Trust Europe

- UBS

- JP Morgan

- Vanguard

- Invesco

- State Street

- WisdomTree

- Franklin Templeton

Significant Europe ETF Industry Industry Milestones

- February 2023: Vontobel launches two emerging market bond funds, signaling increased investor interest in this asset class and diversification opportunities.

- February 2023: Mapfre Asset Management increases its stake in La Financière Responsable (LFR), boosting ESG capabilities and fund distribution in France, signifying the growing importance of ESG considerations in the European ETF market.

Future Outlook for Europe ETF Industry Market

The European ETF market is poised for sustained growth, driven by favorable regulatory environments, increasing investor awareness, and technological advancements. The expanding range of innovative ETF products and the increasing adoption of passive investment strategies suggest significant market potential. Strategic partnerships and acquisitions will likely shape the competitive landscape further.

Europe ETF Industry Segmentation

-

1. ETF type

- 1.1. Equity ETFs

- 1.2. Fixed Income ETFs

- 1.3. Commodity ETFs

- 1.4. Alternatives ETFs

- 1.5. Money Market ETFs

- 1.6. Mixed Assets ETFs

- 1.7. Others

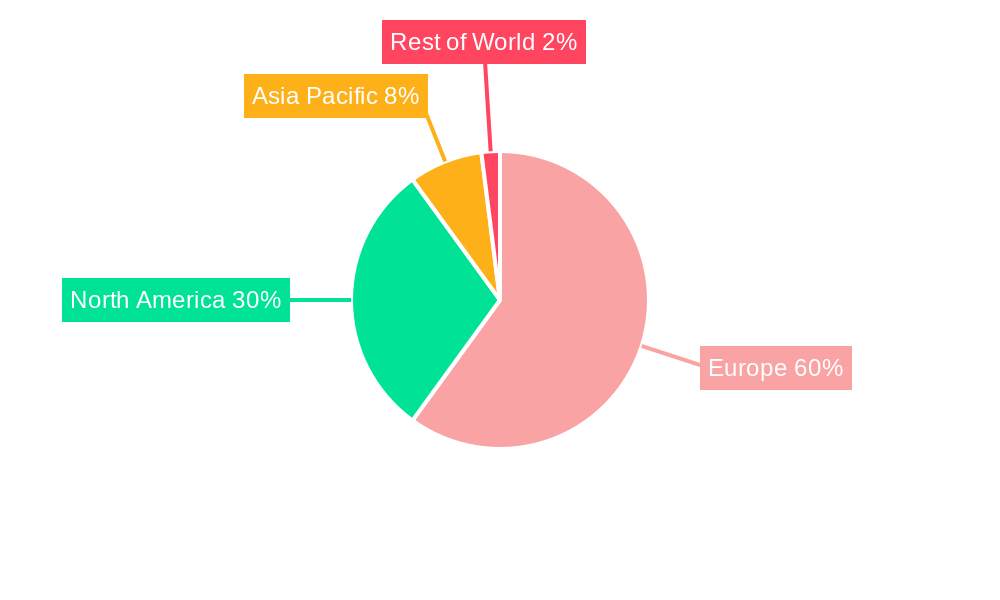

Europe ETF Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe ETF Industry Regional Market Share

Geographic Coverage of Europe ETF Industry

Europe ETF Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Equity Funds occupied the Major percentage in ETF Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe ETF Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by ETF type

- 5.1.1. Equity ETFs

- 5.1.2. Fixed Income ETFs

- 5.1.3. Commodity ETFs

- 5.1.4. Alternatives ETFs

- 5.1.5. Money Market ETFs

- 5.1.6. Mixed Assets ETFs

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by ETF type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 iShares - BlackRock

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Xtrackers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 First Trust Europe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 UBS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JP Morgan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vanguard

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Invesco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 State Street

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WisdomTree

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Franklin**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 iShares - BlackRock

List of Figures

- Figure 1: Europe ETF Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe ETF Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe ETF Industry Revenue Million Forecast, by ETF type 2020 & 2033

- Table 2: Europe ETF Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe ETF Industry Revenue Million Forecast, by ETF type 2020 & 2033

- Table 4: Europe ETF Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe ETF Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe ETF Industry?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Europe ETF Industry?

Key companies in the market include iShares - BlackRock, Xtrackers, First Trust Europe, UBS, JP Morgan, Vanguard, Invesco, State Street, WisdomTree, Franklin**List Not Exhaustive.

3. What are the main segments of the Europe ETF Industry?

The market segments include ETF type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Equity Funds occupied the Major percentage in ETF Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Vontobel launches two emerging market bond funds in response to increased investor interest. One of the two funds (Vontobel Fund - Emerging Markets Investment Grade) aims to provide clients with access to fixed income through a lower-risk version of Vontobel's existing hard currency funds. The other fund (Vontobel Fund - Asian Bond) is Asia-focused and primarily invests in corporate bonds across the region with different maturities in various hard currencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe ETF Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe ETF Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe ETF Industry?

To stay informed about further developments, trends, and reports in the Europe ETF Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence