Key Insights

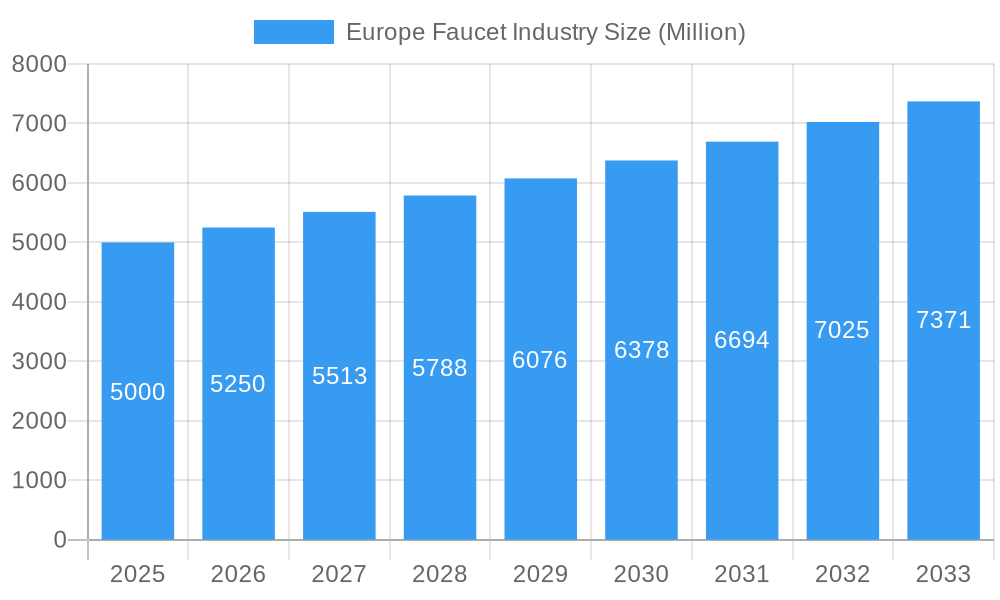

The European faucet market, projected at €21.1 billion in 2025, is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 8.3% from 2025 to 2033. This growth is propelled by increasing disposable incomes, driving demand for home renovations and new constructions. Consumer preference for aesthetically pleasing and technologically advanced faucets, including smart and water-saving models, is a key market influencer. Additionally, the EU's emphasis on water conservation further bolsters demand for efficient faucet solutions. Kitchen and bathroom segments lead market share, with stainless steel and chrome being preferred materials for their durability and visual appeal. The automatic faucet category exhibits significant growth due to technological adoption and convenience.

Europe Faucet Industry Market Size (In Billion)

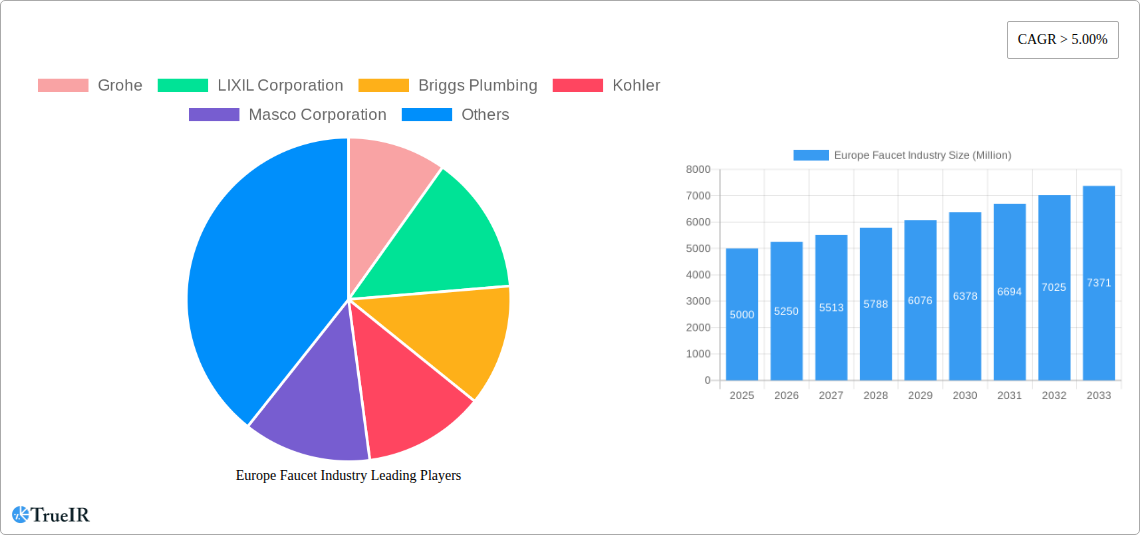

The European faucet market is highly competitive, featuring established brands such as Grohe, LIXIL Corporation, Kohler, and Masco Corporation, who utilize brand strength, broad distribution, and varied product ranges. Emerging specialized players are also gaining traction by targeting specific design or technology niches. Market challenges include potential fluctuations in raw material costs and broader economic impacts on construction and renovation. Despite these factors, the long-term forecast remains optimistic, supported by infrastructure investments, sustained consumer spending, and continuous innovation in water conservation and design. The market's diverse segmentation by product, technology, material, application, and end-use offers significant opportunities for specialized market capture.

Europe Faucet Industry Company Market Share

Europe Faucet Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe faucet industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Spanning the period from 2019 to 2033, with a focus on 2025, this report covers market size, competitive landscape, segment analysis, and future growth projections. Leveraging extensive data and expert analysis, it identifies key trends, growth drivers, and challenges impacting the industry. The report is crucial for strategic planning and informed decision-making within the European faucet market.

Europe Faucet Industry Market Structure & Competitive Landscape

The European faucet industry is characterized by a dynamic and moderately concentrated market structure. A select group of global leaders, including Grohe, LIXIL Corporation, Kohler, and Masco Corporation, command a significant portion of the market share. However, the landscape is enriched by a diverse array of smaller regional manufacturers and specialized niche players, collectively contributing to innovation and market vitality. A key driver of this industry is the relentless pursuit of water efficiency and the integration of advanced technologies into faucet design. Stringent European regulations, particularly those focused on water conservation and the safety of materials used, exert a profound influence on manufacturing processes, product development, and overall design philosophy. Furthermore, the market is experiencing a growing challenge from product substitutes, such as sophisticated sensor-based taps and integrated water filtration systems, which are redefining user expectations and traditional faucet functionalities.

Mergers and acquisitions (M&A) remain a prevalent strategy within the European faucet sector, enabling larger entities to broaden their product portfolios and extend their geographical reach. The period from 2019 to 2024 witnessed a notable volume of M&A transactions, with approximately [Insert Number] Million deals recorded, underscoring a clear trend towards industry consolidation. The market's demand is strategically segmented across residential, commercial, and industrial applications, each presenting distinct requirements and preferences. Residential consumers typically prioritize aesthetic appeal and user-friendliness, while commercial and industrial sectors place a premium on robustness, water-saving capabilities, and stringent hygiene standards.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the European faucet market is estimated at [Insert HHI Value], indicating a moderately concentrated market with a few dominant players alongside several smaller competitors.

- Innovation Drivers: Key drivers include the escalating demand for smart home integration, governmental and societal push for water conservation initiatives, and a growing consumer consciousness towards environmentally sustainable products.

- Regulatory Impacts: European Union directives on water efficiency standards and material safety regulations are pivotal in shaping product design, manufacturing practices, and the selection of raw materials.

- Product Substitutes: The increasing prevalence of sensor-activated faucets and advanced water purification systems presents a significant competitive challenge to conventional faucet designs.

- M&A Trends: The period between 2019 and 2024 saw approximately [Insert Number] Million M&A transactions, highlighting a strong consolidation momentum within the industry as companies seek strategic growth.

- End-User Segmentation: The diverse needs of residential (aesthetics, ease of use), commercial (durability, hygiene), and industrial (performance, efficiency) sectors drive varied product development and marketing strategies.

Europe Faucet Industry Market Trends & Opportunities

The European faucet industry is experiencing steady growth, driven by factors including rising disposable incomes, increasing urbanization, and the ongoing renovation and construction activity across the region. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements are transforming the market, with smart faucets equipped with features like touchless operation, water flow control, and voice activation gaining popularity. Consumer preferences are shifting towards sustainable and water-efficient products, leading to increased demand for low-flow faucets and those made from eco-friendly materials. Competitive dynamics are characterized by both price competition and innovation-led differentiation. Established players are leveraging their brand recognition and distribution networks, while emerging players are focusing on niche markets and innovative product offerings. Market penetration rates for smart faucets are expected to increase from xx% in 2024 to xx% by 2033, reflecting growing adoption.

Dominant Markets & Segments in Europe Faucet Industry

The report identifies Germany, France, and the UK as the dominant markets within the European faucet industry. These countries exhibit a high level of construction activity, robust consumer spending, and strong demand for premium and technologically advanced faucets.

- By Product Type: The disc faucet segment currently holds the largest market share due to its reliability and widespread usage. Cartridge faucets are also experiencing strong growth, driven by their ease of repair and maintenance.

- By Technology: The demand for automatic faucets is rapidly increasing, fueled by advancements in sensor technology and rising concerns about hygiene.

- By Material Used: Stainless steel and chrome faucets dominate the market due to their durability and aesthetics. However, the demand for bronze and plastic faucets is slowly increasing, with the latter particularly suitable for budget-conscious customers.

- By Application: Bathroom faucets comprise the largest segment, reflecting the high prevalence of bathrooms in residential and commercial spaces. Kitchen faucets are the second largest segment, fueled by design trends and rising consumer preference for stylish and functional kitchen fittings.

- By End Use: The residential sector constitutes the most significant portion of the market. However, commercial and industrial sectors are also witnessing noticeable growth, particularly driven by renovation and new construction projects in office spaces, hotels, and hospitals.

Key Growth Drivers:

- Significant investments in infrastructure development across Europe.

- Government initiatives promoting water conservation and energy efficiency.

- Rising construction activities, particularly in commercial and residential sectors.

Europe Faucet Industry Product Analysis

Product innovation within the European faucet industry is currently characterized by a pronounced emphasis on integrating smart technologies, maximizing water efficiency, and utilizing sustainable materials. Manufacturers are actively embedding features such as intuitive touchless operation, precise water flow regulation, and convenient voice activation controls to elevate the user experience and significantly contribute to water conservation efforts. The burgeoning popularity of sensor-based faucets is a direct reflection of a market shift towards enhanced hygiene and effortless convenience. Product differentiation is achieved through a dual approach: pioneering technological advancements coupled with sophisticated aesthetic design, catering to a diverse range of consumer tastes and lifestyle aspirations. The market offers an extensive spectrum of products, thoughtfully designed to meet various budgetary constraints and the specific requirements of different end-user segments.

Key Drivers, Barriers & Challenges in Europe Faucet Industry

Key Drivers: Technological advancements, rising urbanization, and government policies promoting water conservation are key drivers propelling market growth. The increasing adoption of smart home technology and rising disposable incomes further fuel demand for sophisticated and aesthetically pleasing faucet designs.

Key Challenges & Restraints: Supply chain disruptions, increased raw material costs, and intense competition from both established and emerging players pose significant challenges to industry growth. Stringent regulatory requirements related to water efficiency and material safety can increase manufacturing costs and complexity. Fluctuations in economic conditions can also influence consumer spending and overall market demand. For instance, during periods of economic downturn, demand for premium faucets might decline, leading to slower overall market growth.

Growth Drivers in the Europe Faucet Industry Market

Technological advancements, such as the introduction of smart faucets with water-saving features and improved durability, are driving the market. The rising trend of smart homes is significantly boosting adoption. Government regulations focusing on water conservation and sustainable practices have created new opportunities for manufacturers specializing in water-efficient models. Economic growth in several European nations fuels the construction industry and renovation projects, thus increasing demand for faucets.

Challenges Impacting Europe Faucet Industry Growth

The European faucet industry faces several inherent challenges that can impact its growth trajectory. Economic downturns can lead to a reduction in consumer spending on non-essential, high-value items like premium faucets. Furthermore, the industry is susceptible to supply chain disruptions stemming from global events or geopolitical instability, which can result in material shortages and escalated production costs, thereby affecting market stability. The intensely competitive environment, marked by numerous manufacturers offering a wide array of price points and feature sets, presents a continuous challenge in maintaining market share and ensuring profitability.

Key Players Shaping the Europe Faucet Industry Market

- Grohe

- LIXIL Corporation

- Briggs Plumbing

- Kohler

- Masco Corporation

- Lota Corporation

- Elkay

- Roka

- Toto

- Fortune Brands

Significant Europe Faucet Industry Industry Milestones

- March 2022: TOTO revolutionized the market with the introduction of two innovative automatic faucet sets featuring water-saving ECO CAP and SELFPOWER technologies, earning prestigious accolades such as the Red Dot and Green Design Awards.

- May 2020: TOTO further enhanced user convenience and hygiene by launching four new WASHLETTM models, including options with automated flush capabilities.

Future Outlook for Europe Faucet Industry Market

The European faucet industry is projected to continue its robust growth trajectory, propelled by sustained technological innovation, an escalating consumer demand for sustainable and smart home solutions, and ongoing construction and renovation activities across the continent. Significant opportunities lie in manufacturers' ability to adeptly leverage smart technology, champion sustainable materials, and introduce groundbreaking designs to secure and expand market share. The unwavering focus on water efficiency and enhanced hygiene will continue to be central to product development and will heavily influence consumer purchasing decisions. The market is anticipated to witness further consolidation through strategic mergers and acquisitions, as leading players aim to broaden their market presence and solidify their competitive positions.

Europe Faucet Industry Segmentation

-

1. product type

- 1.1. Ball

- 1.2. Disc

- 1.3. Cartridge

- 1.4. Compression

-

2. technology

- 2.1. Manual

- 2.2. Automatic

-

3. Material used

- 3.1. Stainless steel

- 3.2. Chrome

- 3.3. Bronze Plastic

- 3.4. Others

-

4. application

- 4.1. Bathroom

- 4.2. Kitchen

- 4.3. Others

-

5. end use

- 5.1. Residential

- 5.2. Commercial

- 5.3. Industrial

Europe Faucet Industry Segmentation By Geography

-

1. Europe

- 1.1. UK

- 1.2. Italy

- 1.3. France

- 1.4. Germany

- 1.5. Rest of Europe

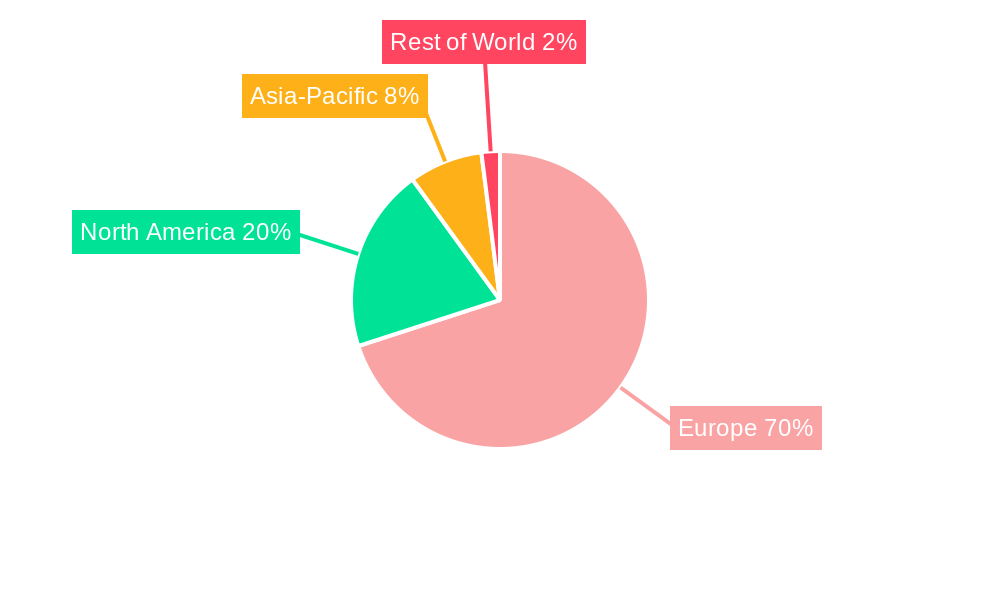

Europe Faucet Industry Regional Market Share

Geographic Coverage of Europe Faucet Industry

Europe Faucet Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Rising New Construction of Residential Apartment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Faucet Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by product type

- 5.1.1. Ball

- 5.1.2. Disc

- 5.1.3. Cartridge

- 5.1.4. Compression

- 5.2. Market Analysis, Insights and Forecast - by technology

- 5.2.1. Manual

- 5.2.2. Automatic

- 5.3. Market Analysis, Insights and Forecast - by Material used

- 5.3.1. Stainless steel

- 5.3.2. Chrome

- 5.3.3. Bronze Plastic

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by application

- 5.4.1. Bathroom

- 5.4.2. Kitchen

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by end use

- 5.5.1. Residential

- 5.5.2. Commercial

- 5.5.3. Industrial

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grohe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LIXIL Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Briggs Plumbing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kohler

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Masco Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lota Corporation**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Elkay

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roka

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toto

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fortune Brands

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Grohe

List of Figures

- Figure 1: Europe Faucet Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Faucet Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Faucet Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 2: Europe Faucet Industry Revenue billion Forecast, by technology 2020 & 2033

- Table 3: Europe Faucet Industry Revenue billion Forecast, by Material used 2020 & 2033

- Table 4: Europe Faucet Industry Revenue billion Forecast, by application 2020 & 2033

- Table 5: Europe Faucet Industry Revenue billion Forecast, by end use 2020 & 2033

- Table 6: Europe Faucet Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Faucet Industry Revenue billion Forecast, by product type 2020 & 2033

- Table 8: Europe Faucet Industry Revenue billion Forecast, by technology 2020 & 2033

- Table 9: Europe Faucet Industry Revenue billion Forecast, by Material used 2020 & 2033

- Table 10: Europe Faucet Industry Revenue billion Forecast, by application 2020 & 2033

- Table 11: Europe Faucet Industry Revenue billion Forecast, by end use 2020 & 2033

- Table 12: Europe Faucet Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: UK Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Europe Faucet Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Faucet Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Europe Faucet Industry?

Key companies in the market include Grohe, LIXIL Corporation, Briggs Plumbing, Kohler, Masco Corporation, Lota Corporation**List Not Exhaustive, Elkay, Roka, Toto, Fortune Brands.

3. What are the main segments of the Europe Faucet Industry?

The market segments include product type, technology, Material used, application, end use.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Rising New Construction of Residential Apartment.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

In March 2022, TOTO introduces two new automatic faucet sets that include the water-saving ECO CAP and SELFPOWER technologies. These series, which are ideal for hotel bathrooms and public restrooms, have each won the international Red Dot Award and Green Design Award for their exceptional designs. There is a great faucet for every washbasin, from self-rim and undercounter washbasins to furniture washbasins and vessels, and they are all available in a variety of various forms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Faucet Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Faucet Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Faucet Industry?

To stay informed about further developments, trends, and reports in the Europe Faucet Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence