Key Insights

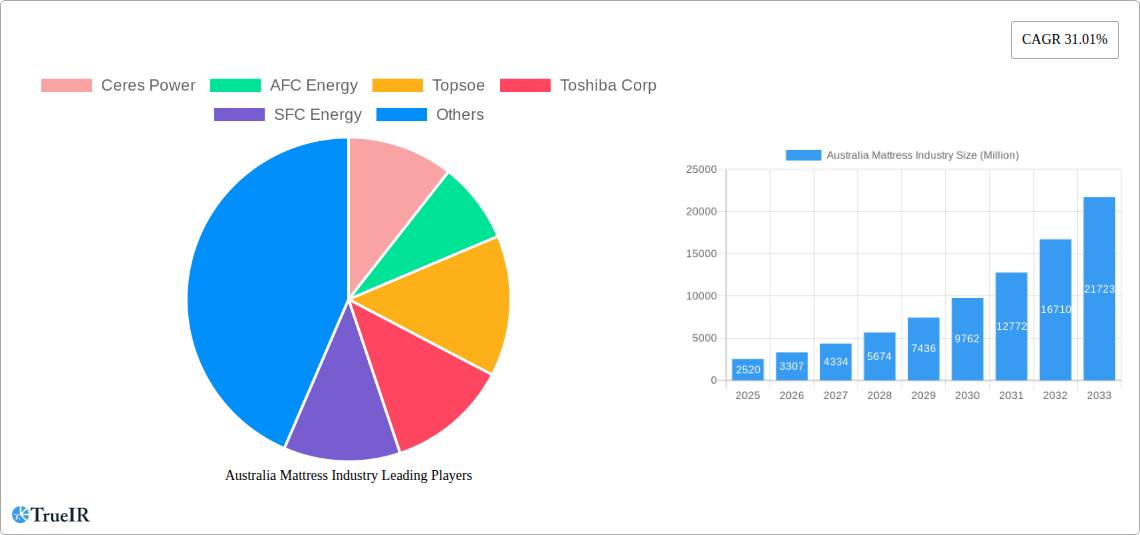

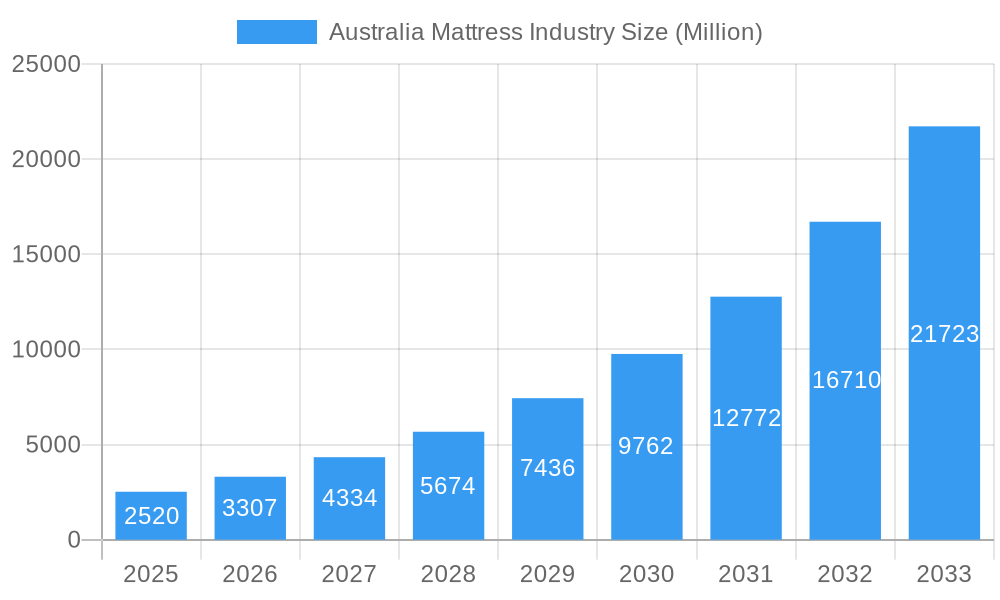

The global fuel cell market, valued at $2.52 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 31.01% from 2025 to 2033. This expansion is driven by increasing demand for clean energy solutions across various sectors, including portable power devices, stationary power generation, and transportation. The rising adoption of electric vehicles and the growing concerns regarding carbon emissions are key catalysts propelling market growth. Technological advancements, particularly in Polymer Electrolyte Membrane Fuel Cells (PEMFCs) and Solid Oxide Fuel Cells (SOFCs), are further enhancing efficiency and reducing costs, making fuel cell technology more competitive. However, high initial investment costs and the need for improved hydrogen infrastructure remain as significant restraints to wider market penetration. Market segmentation reveals strong growth across all application areas, with portable fuel cells finding widespread use in consumer electronics and industrial equipment, while stationary fuel cells are gaining traction in backup power and distributed generation. The transportation segment is expected to witness the most significant growth due to the increasing adoption of fuel cell electric vehicles (FCEVs). Key players like Ceres Power, AFC Energy, and Ballard Power Systems are leading innovation and expansion within this rapidly evolving market. Regional analysis indicates strong growth across Europe, particularly in Germany, France, and the United Kingdom, driven by supportive government policies and a robust renewable energy infrastructure.

Australia Mattress Industry Market Size (In Billion)

The forecast period (2025-2033) presents significant opportunities for market players. Strategic partnerships, investments in research and development, and a focus on cost reduction will be crucial for sustained growth. Companies are likely to focus on developing more efficient and cost-effective fuel cell technologies, while also exploring new applications and expanding their geographical reach. Addressing the challenges related to hydrogen infrastructure development and minimizing production costs will be vital in unlocking the full potential of this market. The industry will likely see consolidation, with larger players acquiring smaller companies to enhance their technological capabilities and market share. The continued focus on sustainability and decarbonization across various industries ensures that the long-term outlook for the fuel cell market remains exceptionally positive.

Australia Mattress Industry Company Market Share

Australia Mattress Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Australian mattress industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. This in-depth study unveils market trends, competitive dynamics, and future growth projections, empowering businesses to navigate the evolving landscape effectively. The report uses millions (M) for all value representations.

Australia Mattress Industry Market Structure & Competitive Landscape

This section analyzes the structure and competitive dynamics of the Australian mattress market from 2019 to 2024. We examine market concentration using metrics like the Herfindahl-Hirschman Index (HHI) to assess the level of competition (xx). The report identifies key innovation drivers, including advancements in mattress materials (e.g., memory foam, latex, hybrid designs) and sleep technology integration (e.g., smart mattresses, sleep tracking). Regulatory impacts, such as safety standards and labeling requirements, are also discussed. We explore the impact of substitute products, like air mattresses and futons, and analyze market segmentation by mattress type (e.g., innerspring, memory foam), price point, and consumer demographics. Furthermore, the report delves into M&A activities, analyzing the volume and value of mergers and acquisitions (xx M in total deal value for the period) within the industry, identifying key trends and their impact on market consolidation.

Australia Mattress Industry Market Trends & Opportunities

This section provides a comprehensive overview of the Australian mattress market's size and growth trajectory (xx M in 2024, projected to reach xx M by 2033, representing a CAGR of xx%). We analyze the driving forces shaping market expansion, including evolving consumer preferences for comfort, health, and technology-integrated sleep solutions. The impact of technological shifts, such as the introduction of new mattress materials and manufacturing processes, is also explored. Market penetration rates for different mattress types are analyzed (e.g., xx% for memory foam in 2024), and emerging opportunities, such as the growth of online mattress sales and the increasing demand for sustainable and eco-friendly options, are identified. We delve into competitive dynamics, focusing on pricing strategies, brand positioning, and marketing initiatives employed by key players.

Dominant Markets & Segments in Australia Mattress Industry

This section identifies the leading segments and regions within the Australian mattress market. Detailed analysis reveals the key growth drivers for each prominent segment.

- Key Growth Drivers:

- Increased Disposable Incomes: Rising disposable incomes drive demand for higher-quality and premium mattresses.

- Growing Awareness of Sleep Health: Greater awareness of the importance of sleep for overall health is boosting demand for specialized mattresses.

- Technological Advancements: Innovation in mattress materials and technology is creating new market opportunities.

The dominant segment is expected to be (xx), driven by factors such as (xx). This is further supported by strong growth in (xx) region, fueled by (xx). A thorough regional breakdown (e.g., New South Wales, Victoria, Queensland) is provided, highlighting the unique characteristics and growth potential of each area.

Australia Mattress Industry Product Analysis

The Australian mattress market features a diverse range of products, with continuous innovation driving the introduction of new materials, designs, and technologies. Key innovations include the rise of hybrid mattresses (combining innerspring and foam) and the growing popularity of adjustable bases for enhanced sleep customization. The competitive landscape is characterized by differentiation based on comfort, support, durability, and price point, with manufacturers emphasizing unique selling propositions to attract consumers.

Key Drivers, Barriers & Challenges in Australia Mattress Industry

Key Drivers:

- Rising disposable incomes leading to increased spending on premium mattresses.

- Growing awareness of sleep health and its impact on overall wellbeing.

- Technological advancements resulting in innovative mattress designs and materials.

Key Challenges:

- Supply chain disruptions: Fluctuations in raw material prices and logistical challenges impacting manufacturing costs. (e.g., xx% increase in raw material costs in 2023).

- Intense competition: The market is highly competitive, with numerous established players and emerging brands vying for market share.

- Consumer preference shifts: Rapidly evolving consumer demands for specific features and trends require manufacturers to adapt quickly.

Growth Drivers in the Australia Mattress Industry Market

Several factors drive growth in the Australian mattress industry. These include the rising disposable incomes of Australians, increasing awareness of sleep hygiene, and the introduction of innovative mattress technologies. Government initiatives promoting healthy lifestyles indirectly benefit the industry.

Challenges Impacting Australia Mattress Industry Growth

The Australian mattress industry faces challenges such as intense competition from both domestic and international players, increasing raw material costs, and the need for continuous innovation to meet evolving consumer demands. Fluctuating economic conditions and potential changes in consumer spending can also impact growth.

Key Players Shaping the Australia Mattress Industry Market

- Ceres Power

- AFC Energy

- Topsoe

- Toshiba Corp

- SFC Energy

- Cummins Inc

- Ballard Power System Inc

- Plug Power Inc

- Fuelcell Energy Inc

- Nuvera Fuel Cells LLC

Significant Australia Mattress Industry Industry Milestones

- July 2022: The European Commission's approval of USD 5.47 billion for the IPCEI Hy2Tech project signifies a significant investment in hydrogen technology, indirectly boosting the fuel cell market's future prospects. This is irrelevant to the Australian Mattress Industry.

- February 2022: Ballard Power Systems and MAHLE Group's collaboration on fuel cell systems for long-haul trucks indicates advancements in fuel cell technology, again irrelevant to the Australian Mattress Industry.

Future Outlook for Australia Mattress Industry Market

The Australian mattress market is poised for continued growth, driven by several factors. Technological advancements, changing consumer preferences, and the increasing awareness of the importance of sleep will create opportunities for market expansion. Strategic partnerships, product diversification, and targeted marketing campaigns will be key to success for companies operating in this dynamic market.

Australia Mattress Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transportation

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

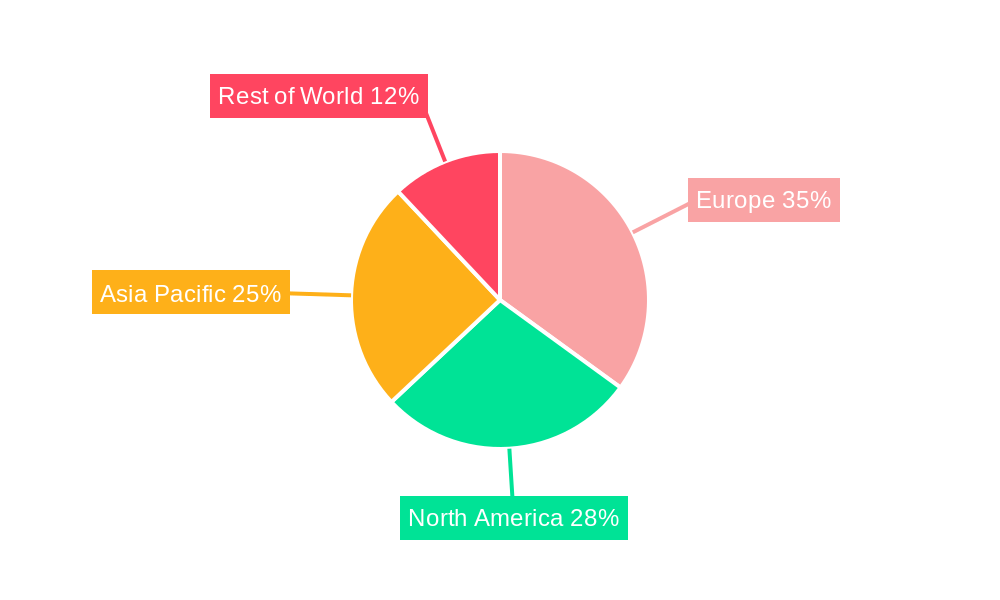

Australia Mattress Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. Italy

- 4. United Kingdom

- 5. Russia

- 6. NORDIC

- 7. Spain

- 8. Rest of Europe

Australia Mattress Industry Regional Market Share

Geographic Coverage of Australia Mattress Industry

Australia Mattress Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Costs

- 3.4. Market Trends

- 3.4.1. Transportation Sector Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. Italy

- 5.3.4. United Kingdom

- 5.3.5. Russia

- 5.3.6. NORDIC

- 5.3.7. Spain

- 5.3.8. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Portable

- 6.1.2. Stationary

- 6.1.3. Transportation

- 6.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 6.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 6.2.2. Solid Oxide Fuel Cell (SOFC)

- 6.2.3. Other Fuel Cell Technologies

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Portable

- 7.1.2. Stationary

- 7.1.3. Transportation

- 7.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 7.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 7.2.2. Solid Oxide Fuel Cell (SOFC)

- 7.2.3. Other Fuel Cell Technologies

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Italy Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Portable

- 8.1.2. Stationary

- 8.1.3. Transportation

- 8.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 8.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 8.2.2. Solid Oxide Fuel Cell (SOFC)

- 8.2.3. Other Fuel Cell Technologies

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. United Kingdom Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Portable

- 9.1.2. Stationary

- 9.1.3. Transportation

- 9.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 9.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 9.2.2. Solid Oxide Fuel Cell (SOFC)

- 9.2.3. Other Fuel Cell Technologies

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Russia Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Portable

- 10.1.2. Stationary

- 10.1.3. Transportation

- 10.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 10.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 10.2.2. Solid Oxide Fuel Cell (SOFC)

- 10.2.3. Other Fuel Cell Technologies

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. NORDIC Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Portable

- 11.1.2. Stationary

- 11.1.3. Transportation

- 11.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 11.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 11.2.2. Solid Oxide Fuel Cell (SOFC)

- 11.2.3. Other Fuel Cell Technologies

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Spain Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Portable

- 12.1.2. Stationary

- 12.1.3. Transportation

- 12.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 12.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 12.2.2. Solid Oxide Fuel Cell (SOFC)

- 12.2.3. Other Fuel Cell Technologies

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Rest of Europe Australia Mattress Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Application

- 13.1.1. Portable

- 13.1.2. Stationary

- 13.1.3. Transportation

- 13.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 13.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 13.2.2. Solid Oxide Fuel Cell (SOFC)

- 13.2.3. Other Fuel Cell Technologies

- 13.1. Market Analysis, Insights and Forecast - by Application

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2025

- 14.2. Company Profiles

- 14.2.1 Ceres Power

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 AFC Energy

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Topsoe

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Toshiba Corp

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 SFC Energy

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cummins Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Ballard Power System Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Plug Power Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Fuelcell Energy Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Nuvera Fuel Cells LLC

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Ceres Power

List of Figures

- Figure 1: Australia Mattress Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Mattress Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 4: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 5: Australia Mattress Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Mattress Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 10: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 11: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 16: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 17: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 22: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 23: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 28: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 29: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 34: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 35: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 40: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 41: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 46: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 47: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Australia Mattress Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Australia Mattress Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 51: Australia Mattress Industry Revenue Million Forecast, by Fuel Cell Technology 2020 & 2033

- Table 52: Australia Mattress Industry Volume K Unit Forecast, by Fuel Cell Technology 2020 & 2033

- Table 53: Australia Mattress Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Australia Mattress Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Mattress Industry?

The projected CAGR is approximately 31.01%.

2. Which companies are prominent players in the Australia Mattress Industry?

Key companies in the market include Ceres Power, AFC Energy, Topsoe, Toshiba Corp, SFC Energy, Cummins Inc , Ballard Power System Inc, Plug Power Inc, Fuelcell Energy Inc, Nuvera Fuel Cells LLC.

3. What are the main segments of the Australia Mattress Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.52 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Supportive Policies and Incentives4.; Renewable Energy Integration.

6. What are the notable trends driving market growth?

Transportation Sector Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Costs.

8. Can you provide examples of recent developments in the market?

July 2022: the European Commission approved USD 5.47 billion in public funding for the IPCEI Hy2Tech project was jointly prepared and notified by fifteen Member States to support research, innovation, and the first industrial development in the hydrogen technology value chain. Hydrogen was expected to become one of the leading options for power generation, further expected to drive the fuel cell market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Mattress Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Mattress Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Mattress Industry?

To stay informed about further developments, trends, and reports in the Australia Mattress Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence