Key Insights

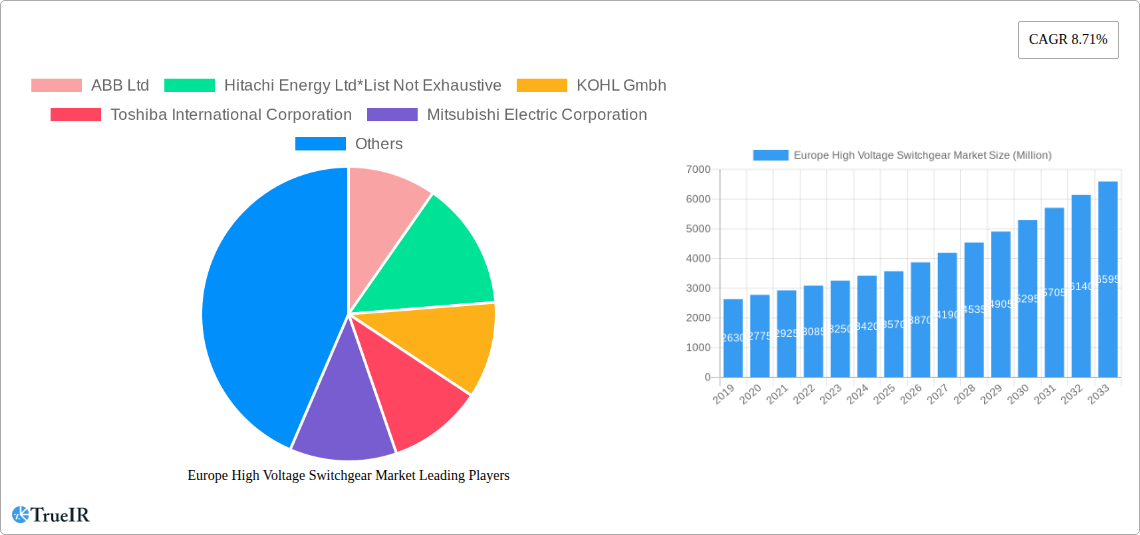

The European High Voltage Switchgear Market is poised for robust expansion, projected to reach a substantial size driven by escalating demand for reliable power distribution and transmission infrastructure. With an estimated market value of $3.57 billion and a compelling Compound Annual Growth Rate (CAGR) of 8.71%, this sector is set to experience significant value appreciation over the forecast period of 2025-2033. Key drivers fueling this growth include the ongoing modernization of aging power grids, the increasing integration of renewable energy sources requiring advanced grid management solutions, and the expanding industrial sector’s need for dependable high-voltage power infrastructure. Furthermore, stringent safety regulations and the drive towards smart grid technologies are compelling utilities and industrial players to invest in state-of-the-art high voltage switchgear. The market is segmented into Air-insulated, Gas-insulated, and Other Types, with Gas-insulated switchgear likely to witness substantial demand due to its superior performance characteristics and environmental benefits, particularly in densely populated urban areas and substations.

Europe High Voltage Switchgear Market Market Size (In Billion)

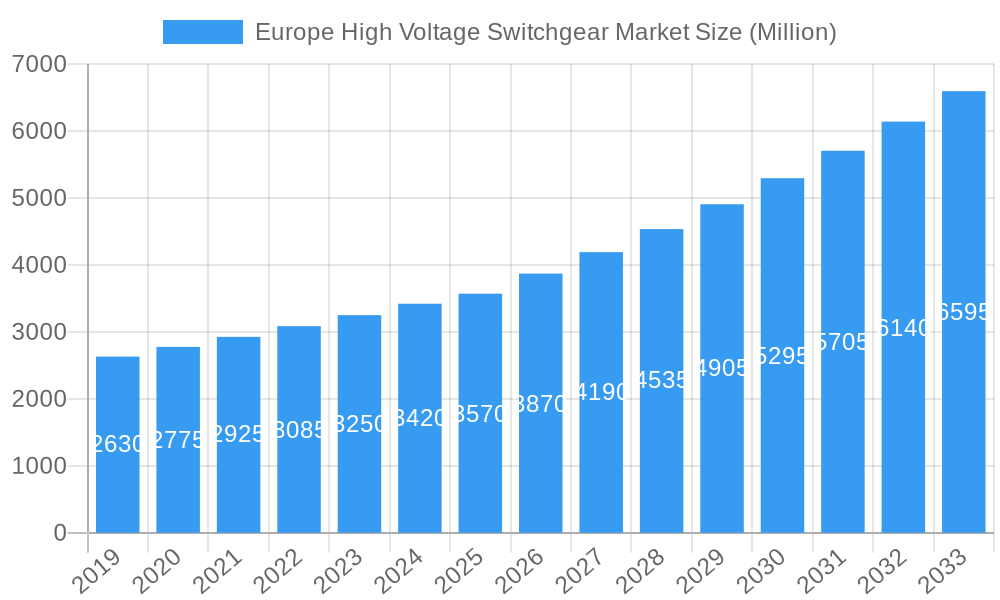

The competitive landscape is characterized by the presence of major global players such as Siemens AG, ABB Ltd, and Hitachi Energy Ltd, alongside other significant contributors like Toshiba International Corporation and General Electric Company. These companies are actively engaged in research and development, focusing on innovative technologies like SF6-free switchgear, advanced monitoring systems, and digital solutions to enhance grid efficiency and reliability. Geographically, Europe, with a focus on key markets like Germany, the United Kingdom, Italy, and France, represents a critical region for high voltage switchgear deployment. The region's commitment to renewable energy targets and its well-established industrial base create a sustained demand for sophisticated switchgear solutions. While the market benefits from strong growth drivers, potential restraints such as the high initial investment costs for advanced switchgear and complex regulatory frameworks in certain sub-regions may pose challenges. However, the overarching trend towards grid modernization and decarbonization is expected to outweigh these limitations, ensuring a dynamic and growing market for high voltage switchgear in Europe.

Europe High Voltage Switchgear Market Company Market Share

Gain unparalleled insights into the Europe High Voltage Switchgear Market, a critical sector powering the continent's energy infrastructure. This in-depth report, spanning the historical period of 2019-2024 and forecasting through 2033, provides a definitive analysis of market dynamics, technological advancements, and competitive strategies. With a base year of 2025 and an estimated market value projected at XX Million, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving European high voltage switchgear landscape. Explore key segments such as Air-insulated Switchgear and Gas-insulated Switchgear, and understand the influence of industry giants like ABB Ltd and Siemens AG.

Europe High Voltage Switchgear Market Market Structure & Competitive Landscape

The Europe High Voltage Switchgear Market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Innovation remains a primary driver, fueled by increasing demand for grid modernization, renewable energy integration, and the urgent need for more sustainable and environmentally friendly solutions. Regulatory impacts, particularly those concerning greenhouse gas emissions and grid resilience, are reshaping product development and market entry strategies. Product substitutes, while limited in high-voltage applications due to stringent performance requirements, are emerging in niche areas, pushing manufacturers to continually enhance their offerings. End-user segmentation highlights the substantial reliance of the power transmission and distribution sector, with industrial and renewable energy projects also contributing significantly. Merger and acquisition (M&A) trends are expected to continue, as larger companies seek to expand their technological capabilities and market reach within this vital segment of the electrical infrastructure industry. The overall M&A volume for the forecast period is anticipated to be XX Million, reflecting strategic consolidations and partnerships aimed at strengthening competitive positions.

Europe High Voltage Switchgear Market Market Trends & Opportunities

The Europe High Voltage Switchgear Market is experiencing robust growth, driven by a confluence of factors including the accelerating transition to renewable energy sources, the imperative for grid modernization, and the ongoing electrification of various industries. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% over the forecast period (2025-2033), reaching an estimated value of over XX Million. Technological shifts are predominantly focused on the development of SF6-free switchgear solutions, in response to increasing environmental regulations and a global push towards sustainability. Consumer preferences are increasingly leaning towards intelligent, digitally enabled switchgear systems that offer enhanced monitoring, control, and diagnostic capabilities, thereby improving grid reliability and operational efficiency. Competitive dynamics are intensifying, with a focus on innovation, cost-effectiveness, and the ability to meet stringent performance and environmental standards. Opportunities abound in the deployment of high-voltage switchgear for offshore wind farms, smart grid initiatives, and the upgrading of aging substations across Europe. Market penetration rates for advanced switchgear technologies are expected to climb as utilities and grid operators prioritize long-term investments in resilient and efficient energy infrastructure. The increasing demand for enhanced grid stability and the integration of distributed energy resources are creating significant opportunities for manufacturers offering flexible and future-proof switchgear solutions.

Dominant Markets & Segments in Europe High Voltage Switchgear Market

The Gas-insulated Switchgear (GIS) segment is currently the dominant force within the Europe High Voltage Switchgear Market, holding a significant market share estimated at over XX% in 2025. This dominance is attributed to GIS's superior performance characteristics, including its compact design, enhanced safety, and suitability for urban environments where space is a premium. Key growth drivers for GIS include:

- Infrastructure Development: Continuous investment in new high-voltage transmission lines and substations across Europe to accommodate growing energy demand and the integration of renewable energy sources.

- Renewable Energy Integration: The increasing need for reliable and robust switchgear solutions to connect large-scale renewable energy projects, such as offshore wind farms and large solar parks, to the national grid.

- Grid Modernization: Upgrades to existing substations to enhance their capacity, efficiency, and resilience, often requiring the deployment of advanced GIS technology.

- Environmental Regulations: While SF6 is a potent greenhouse gas, the high performance and reliability of GIS continue to drive its adoption. However, ongoing research and development into SF6-free alternatives is a significant trend.

The Air-insulated Switchgear (AIS) segment, while historically significant, is experiencing a slower growth trajectory compared to GIS. However, AIS remains crucial for specific applications, particularly in less congested areas and for lower voltage levels within the high-voltage spectrum. Key growth drivers for AIS include:

- Cost-Effectiveness: AIS generally offers a more economical solution for certain applications where space and environmental concerns are less critical.

- Established Infrastructure: The vast existing installed base of AIS systems necessitates ongoing maintenance and upgrades, creating a steady demand.

- Technological Advancements: Innovations in AIS technology, such as the development of more efficient insulating materials and circuit breakers, are helping to maintain its competitiveness.

The Other Types segment, which includes vacuum-insulated and solid-insulated switchgear, is anticipated to witness the highest growth rate. This is primarily driven by the global push for SF6-free solutions and advancements in insulation technologies.

- SF6-Free Alternatives: Increasing regulatory pressure and environmental consciousness are accelerating the adoption of vacuum and solid insulation technologies as viable replacements for SF6.

- Compact and Eco-Friendly Designs: These technologies offer the potential for smaller footprints and reduced environmental impact, aligning with sustainability goals.

Europe High Voltage Switchgear Market Product Analysis

The Europe High Voltage Switchgear Market is witnessing a surge in product innovations centered around enhancing grid efficiency, reliability, and environmental sustainability. Key advancements include the development of SF6-free switchgear solutions, leveraging vacuum and solid insulation technologies to mitigate greenhouse gas emissions. These innovative products offer competitive advantages through smaller footprints, improved safety features, and extended operational lifespans, catering to the growing demand for eco-friendly and high-performance grid infrastructure. Applications span critical areas such as power transmission, distribution, industrial power systems, and the integration of renewable energy sources, where reliable and advanced switchgear is paramount for seamless energy flow and grid stability.

Key Drivers, Barriers & Challenges in Europe High Voltage Switchgear Market

Key Drivers:

- Grid Modernization and Expansion: Significant investments in upgrading and expanding Europe's high-voltage transmission and distribution networks to meet growing energy demands and integrate renewable energy sources are a primary growth catalyst.

- Renewable Energy Integration: The rapid growth of offshore wind, solar, and other renewable energy projects necessitates robust high-voltage switchgear for grid connection and stability.

- Technological Advancements: Development of SF6-free switchgear, intelligent grid technologies, and enhanced automation are driving demand for modern solutions.

- Aging Infrastructure Replacement: The need to replace aging and outdated high-voltage switchgear across Europe to ensure grid reliability and prevent failures.

Barriers & Challenges:

- High Initial Investment Costs: Advanced high-voltage switchgear, particularly SF6-free alternatives, can involve substantial upfront capital expenditure for utilities.

- Stringent Environmental Regulations: While driving innovation, the evolving regulatory landscape regarding greenhouse gases like SF6 can create compliance complexities and increase R&D costs for manufacturers.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of critical components and raw materials, leading to production delays and increased costs.

- Skilled Workforce Shortage: The need for specialized technicians and engineers for the installation, operation, and maintenance of complex high-voltage switchgear systems presents a challenge.

- Permitting and Siting Challenges: Obtaining permits and securing suitable locations for new high-voltage substations and transmission lines can be a lengthy and complex process.

Growth Drivers in the Europe High Voltage Switchgear Market Market

The Europe High Voltage Switchgear Market is propelled by several key drivers. Technologically, the imperative to reduce greenhouse gas emissions is fueling significant investment in SF6-free alternatives, such as vacuum and solid-insulated switchgear. Economically, the ongoing expansion of renewable energy capacity, particularly offshore wind, requires substantial deployment of high-voltage switchgear to connect these sources to the grid. Furthermore, the need to modernize and upgrade aging grid infrastructure across European nations to enhance reliability and capacity is a constant demand driver. Regulatory factors, such as the European Union's ambitious climate targets and directives on grid resilience, are creating a supportive environment for the adoption of advanced and sustainable switchgear solutions.

Challenges Impacting Europe High Voltage Switchgear Market Growth

The growth of the Europe High Voltage Switchgear Market faces several significant barriers. Regulatory complexities surrounding the phase-out of fluorinated gases, while driving innovation, also introduce uncertainty and can lead to increased compliance costs. Supply chain issues, including the availability of raw materials and components, can cause production delays and impact project timelines. Competitive pressures from both established players and emerging innovators necessitate continuous investment in R&D and cost optimization. Furthermore, the high initial capital investment required for advanced switchgear systems can be a deterrent for some utilities, especially in periods of economic uncertainty. The long lead times for infrastructure projects and the stringent testing and certification processes for high-voltage equipment also contribute to longer market adoption cycles.

Key Players Shaping the Europe High Voltage Switchgear Market Market

- ABB Ltd

- Hitachi Energy Ltd

- KOHL Gmbh

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Larson & Turbo Limited

- General Electric Company

- SGC SwitchGear Company

Significant Europe High Voltage Switchgear Market Industry Milestones

- March 2023: The European Parliament discussed the matter of the phase-out of fluorinated gases (F-gases). Among the "F-gases" is sulfur hexafluoride (short: SF6), a gas often employed in electrical switchgear because of its chemical qualities as an insulator. Switchgear guarantees the European energy grid's safety and reliability. This discussion signals a strong regulatory push towards SF6-free alternatives, impacting R&D and product roadmaps.

- February 2022: More than the 100-year-old facility of Siemens Energy started to design and build high-voltage switchgear and systems free of SF6 and other strong greenhouse gases at the Switchgear Plant Berlin, which represents industrial history. This milestone highlights a concrete industry move towards sustainable switchgear manufacturing and innovation.

Future Outlook for Europe High Voltage Switchgear Market Market

The future outlook for the Europe High Voltage Switchgear Market is overwhelmingly positive, characterized by sustained growth driven by the ongoing energy transition and grid modernization initiatives. Strategic opportunities lie in the continued development and adoption of SF6-free switchgear technologies, catering to increasing environmental mandates and sustainability demands. The expansion of renewable energy infrastructure, particularly offshore wind farms and distributed energy resources, will create a continuous need for advanced and reliable high-voltage switchgear solutions. Furthermore, the digitalization of the grid, with the integration of smart technologies and IoT capabilities into switchgear, presents significant potential for enhanced grid management and operational efficiency. Investments in substations and transmission networks are expected to remain robust, ensuring a healthy demand pipeline for market participants.

Europe High Voltage Switchgear Market Segmentation

-

1. Type

- 1.1. Air-insulated

- 1.2. Gas-insulated

- 1.3. Other Types

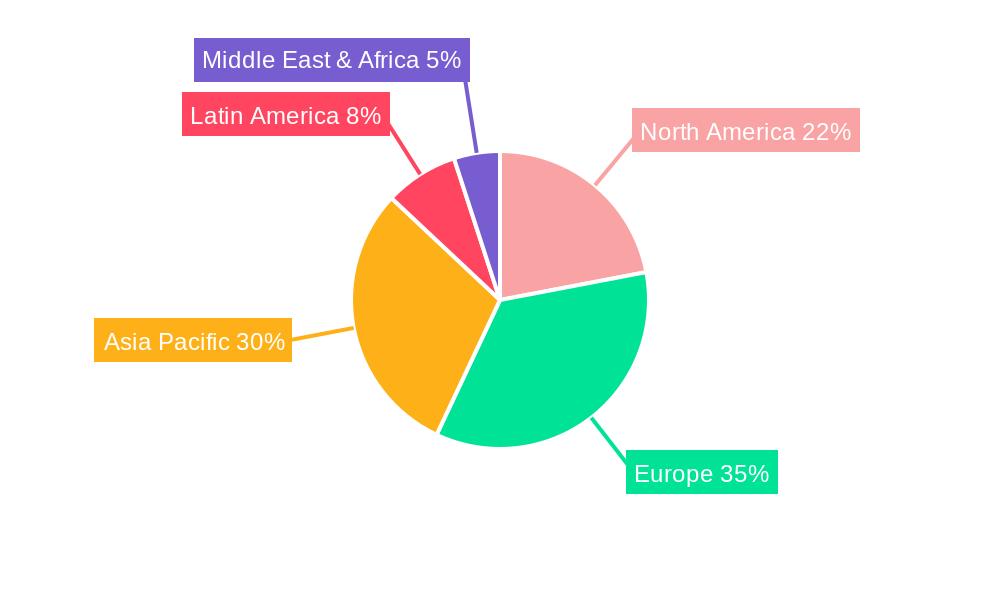

Europe High Voltage Switchgear Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. Italy

- 1.4. France

- 1.5. Rest of the Europe

Europe High Voltage Switchgear Market Regional Market Share

Geographic Coverage of Europe High Voltage Switchgear Market

Europe High Voltage Switchgear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Transmission & Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Strict Environmental Regulations and Concerns Regarding the Use of SF6 Gas

- 3.4. Market Trends

- 3.4.1. Gas-Insulated Switchgear is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe High Voltage Switchgear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Air-insulated

- 5.1.2. Gas-insulated

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hitachi Energy Ltd*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KOHL Gmbh

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba International Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Larson & Turbo Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SGC SwitchGear Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Europe High Voltage Switchgear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe High Voltage Switchgear Market Share (%) by Company 2025

List of Tables

- Table 1: Europe High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe High Voltage Switchgear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe High Voltage Switchgear Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Europe High Voltage Switchgear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Germany Europe High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: United Kingdom Europe High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Italy Europe High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: France Europe High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of the Europe Europe High Voltage Switchgear Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe High Voltage Switchgear Market?

The projected CAGR is approximately 8.71%.

2. Which companies are prominent players in the Europe High Voltage Switchgear Market?

Key companies in the market include ABB Ltd, Hitachi Energy Ltd*List Not Exhaustive, KOHL Gmbh, Toshiba International Corporation, Mitsubishi Electric Corporation, Siemens AG, Larson & Turbo Limited, General Electric Company, SGC SwitchGear Company.

3. What are the main segments of the Europe High Voltage Switchgear Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.57 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Transmission & Distribution Infrastructure.

6. What are the notable trends driving market growth?

Gas-Insulated Switchgear is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Strict Environmental Regulations and Concerns Regarding the Use of SF6 Gas.

8. Can you provide examples of recent developments in the market?

March 2023: The European Parliament discussed the matter of the phase-out of fluorinated gases (F- gases). Among the "F-gases" is sulfur hexafluoride (short: SF6), a gas often employed in electrical switchgear because of its chemical qualities as an insulator. Switchgear guarantees the European energy grid's safety and reliability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe High Voltage Switchgear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe High Voltage Switchgear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe High Voltage Switchgear Market?

To stay informed about further developments, trends, and reports in the Europe High Voltage Switchgear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence