Key Insights

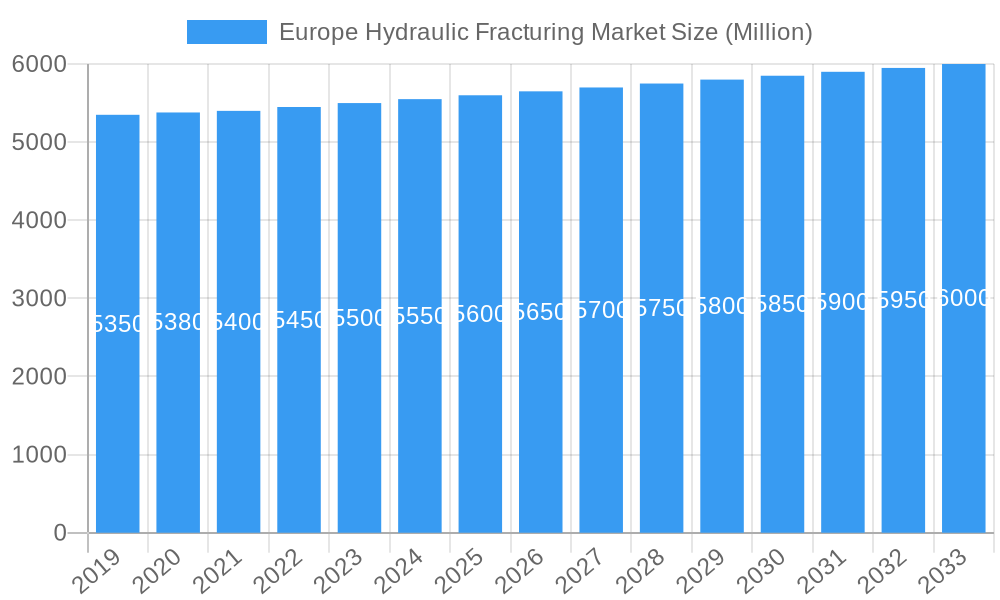

The Europe Hydraulic Fracturing Market is poised for significant expansion, projected to reach a market size of approximately USD 5,800 million by 2025, with a robust Compound Annual Growth Rate (CAGR) exceeding 0.66% through 2033. This growth is primarily fueled by the escalating demand for energy across the continent, coupled with the strategic imperative to enhance domestic oil and gas production to reduce reliance on imports. The ongoing geopolitical landscape further underscores the importance of bolstering indigenous energy reserves, making hydraulic fracturing a critical technology for unlocking previously uneconomical reserves. Furthermore, technological advancements in fracturing techniques, including the development of more environmentally conscious methods and improved efficiency in resource extraction, are contributing to market optimism. The market's trajectory is also influenced by supportive regulatory frameworks and increasing investments in exploration and production activities, particularly in regions with substantial shale gas potential.

Europe Hydraulic Fracturing Market Market Size (In Billion)

However, the market faces certain headwinds that may moderate its growth pace. Stringent environmental regulations and growing public concern regarding the potential ecological impact of hydraulic fracturing operations, such as water contamination and induced seismicity, present significant challenges. The high initial capital expenditure required for setting up fracturing infrastructure and the fluctuating prices of crude oil and natural gas can also impact investment decisions and overall market dynamics. Despite these restraints, the intrinsic need for energy security and the economic benefits derived from domestic resource utilization are expected to drive continued investment and innovation within the European hydraulic fracturing sector. The market is segmented by resource type into Oil and Natural Gas, with both segments expected to witness substantial activity as exploration efforts intensify.

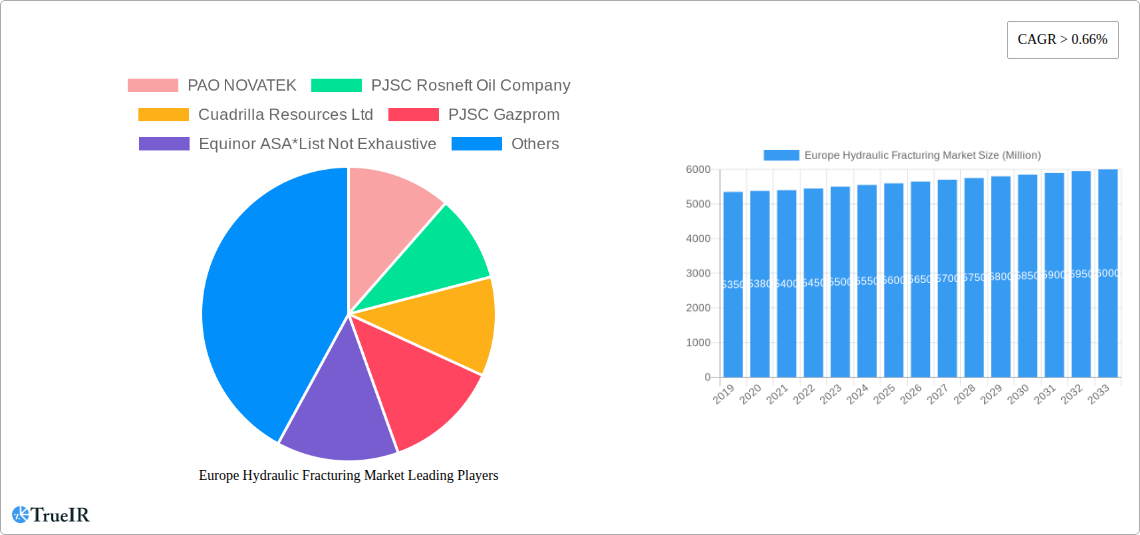

Europe Hydraulic Fracturing Market Company Market Share

Europe Hydraulic Fracturing Market: Unlocking Unconventional Reserves & Navigating Geopolitical Shifts (2019-2033)

Report Description:

Dive into the dynamic Europe hydraulic fracturing market, a crucial sector for unlocking unconventional hydrocarbon reserves and addressing evolving energy demands. This comprehensive report provides an in-depth analysis of the market's trajectory from 2019 to 2033, with a base year of 2025. We meticulously examine key segments including oil and natural gas fracturing, industry developments, and the competitive landscape shaped by leading players like PAO NOVATEK, PJSC Rosneft Oil Company, Cuadrilla Resources Ltd, PJSC Gazprom, Equinor ASA, IGas Energy Plc, Schlumberger, Halliburton, Weatherford International, and Baker Hughes.

With a significant focus on hydraulic fracturing technology, unconventional oil and gas extraction, and energy security in Europe, this report offers actionable insights for stakeholders. Understand the impact of regulatory frameworks, environmental concerns, and technological innovations on market growth. Explore the dominance of specific regions and resource types, and gain a clear understanding of the drivers, challenges, and future outlook for this pivotal energy market.

Europe Hydraulic Fracturing Market Market Structure & Competitive Landscape

The Europe hydraulic fracturing market exhibits a moderately concentrated structure, with key players like Schlumberger, Halliburton, and Baker Hughes holding substantial market share due to their technological prowess and established service networks. Innovation is a critical driver, fueled by the ongoing quest for more efficient, cost-effective, and environmentally responsible fracturing techniques. Regulatory impacts, particularly concerning environmental, social, and governance (ESG) factors and public perception, significantly influence operational decisions and market entry barriers. Product substitutes, such as advancements in traditional drilling or alternative energy sources, are being closely monitored, though hydraulic fracturing remains essential for maximizing recovery from existing and new unconventional reserves. End-user segmentation primarily revolves around exploration and production (E&P) companies, with varying demand patterns based on resource type and regional geological conditions. Merger and acquisition (M&A) activity in the European energy sector has been moderate, often driven by consolidation for operational efficiency and strategic asset acquisition. In the historical period (2019-2024), several smaller E&P companies have been acquired by larger entities seeking to expand their operational footprint in key fracturing regions. The current market concentration ratio is estimated at around 55%, indicating a degree of competition.

Europe Hydraulic Fracturing Market Market Trends & Opportunities

The Europe hydraulic fracturing market is poised for significant growth, driven by the increasing demand for natural gas as a transitional fuel and the sustained need for oil production to meet ongoing energy requirements. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 4.5% over the forecast period (2025–2033). Technological shifts are at the forefront, with a growing emphasis on waterless fracturing fluids, biodegradable proppants, and advanced real-time monitoring systems to optimize well performance and minimize environmental impact. These innovations are crucial for addressing public and regulatory concerns surrounding fracking environmental risks and water usage. Consumer preferences, though indirect, are influenced by the push for cleaner energy, which paradoxically bolsters the demand for natural gas extracted via hydraulic fracturing as a more environmentally friendly alternative to coal. Competitive dynamics are characterized by strategic partnerships between service providers and E&P companies, as well as ongoing research and development to differentiate offerings. Opportunities abound in the development of enhanced fracturing techniques for mature fields, improving recovery rates and extending the economic viability of existing wells. Furthermore, the evolving geopolitical landscape underscores the importance of domestic energy production, creating a favorable environment for hydraulic fracturing activities. The European energy transition, while promoting renewables, also necessitates a reliable baseload power source, positioning natural gas as a key component. Market penetration rates for advanced fracturing technologies are expected to rise, driven by cost-benefit analyses and performance improvements. The onshore oil and gas sector in Europe, particularly in regions with known unconventional reserves, presents substantial untapped potential for fracturing operations.

Dominant Markets & Segments in Europe Hydraulic Fracturing Market

Within the Europe hydraulic fracturing market, the Natural Gas segment is anticipated to exhibit stronger dominance and growth throughout the forecast period (2025–2033). This is largely attributed to Europe's strategic imperative to enhance energy security and diversify away from volatile import markets, with natural gas playing a pivotal role in this transition. Key growth drivers for natural gas fracturing include:

- Infrastructure Development: Ongoing investments in gas pipelines, liquefaction terminals (LNG), and storage facilities are crucial for the efficient transportation and utilization of domestically produced natural gas.

- Policy Support: Governments across Europe are implementing policies that favor domestic gas production as a means to reduce reliance on single suppliers and achieve energy independence, often providing incentives for E&P activities.

- Environmental Transition Goals: While renewables are the ultimate target, natural gas is increasingly viewed as a cleaner bridge fuel, supporting the transition away from coal-fired power generation, thereby boosting its demand.

- Technological Advancements in Extraction: Improved hydraulic fracturing techniques allow for the economic extraction of previously inaccessible shale gas reserves, unlocking significant potential.

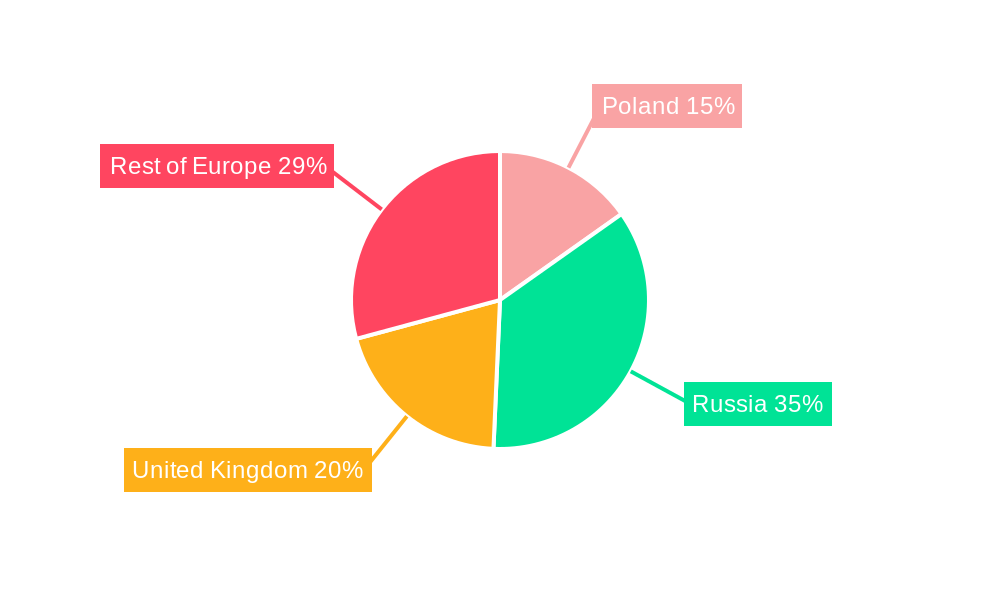

While the Oil segment remains important, its growth trajectory is more closely tied to global oil prices and the longer-term shift towards electrification in the transportation sector. However, in specific regions like the United Kingdom and potentially Poland, dedicated oil shale formations present opportunities for fracturing operations to meet regional demand. The dominant regions for hydraulic fracturing activity are likely to remain those with proven unconventional reserves and supportive regulatory environments. The United Kingdom, despite past controversies, possesses significant shale gas potential. Poland has also explored its shale gas resources extensively. The Eastern European region, with its established oil and gas infrastructure and the pressing need for energy security, is another area of potential growth for both oil and natural gas fracturing. The dominance of the natural gas segment is further reinforced by the increasing use of gas in industrial processes and power generation.

Europe Hydraulic Fracturing Market Product Analysis

The Europe hydraulic fracturing market is characterized by continuous product innovation aimed at enhancing efficiency, reducing environmental impact, and improving cost-effectiveness. Advancements in proppant technology, including the development of higher-strength ceramic and resin-coated sands, are crucial for maintaining fracture conductivity and maximizing hydrocarbon flow. The evolution of hydraulic fracturing fluids towards more environmentally benign formulations, such as those with reduced chemical additives or water-efficient alternatives, is a significant trend. Furthermore, the integration of digitalization and automation, including advanced downhole sensors, real-time data analytics, and AI-driven decision-making platforms, allows for optimized fracturing operations, minimizing waste and improving well performance. These technological advancements provide competitive advantages by enabling E&P companies to achieve higher production rates, lower operational costs, and meet stringent environmental regulations, thereby securing market fit for sophisticated hydraulic fracturing services.

Key Drivers, Barriers & Challenges in Europe Hydraulic Fracturing Market

Key Drivers:

- Energy Security Imperative: Growing geopolitical instability and the desire for energy independence are compelling European nations to explore and develop domestic hydrocarbon resources.

- Technological Advancements: Innovations in hydraulic fracturing techniques, including fluid formulations and proppant technology, are making unconventional resource extraction more viable and efficient.

- Natural Gas Demand: The role of natural gas as a transitional fuel in the energy mix, especially for power generation and industrial use, is a significant demand driver.

- Economic Benefits: Potential for job creation, revenue generation for governments, and reduced reliance on energy imports offer strong economic incentives.

Barriers & Challenges:

- Public Perception and Regulatory Hurdles: Significant public opposition and stringent environmental regulations, particularly concerning groundwater contamination and seismic activity, pose major challenges.

- Environmental Concerns: Issues related to water usage, wastewater disposal, and potential greenhouse gas emissions require careful management and mitigation strategies.

- High Operational Costs: Unconventional resource extraction via hydraulic fracturing can be capital-intensive, requiring substantial upfront investment.

- Geological Complexity: The complex and often challenging geological formations in Europe can necessitate specialized techniques and increase operational risks.

- Supply Chain Volatility: Fluctuations in the availability and cost of essential materials and specialized equipment can impact project timelines and profitability.

Growth Drivers in the Europe Hydraulic Fracturing Market Market

Several key factors are propelling the Europe hydraulic fracturing market. The foremost driver is the escalating need for enhanced energy security across Europe, spurred by geopolitical tensions and a desire to reduce reliance on imported fossil fuels. This is complemented by the growing demand for natural gas as a critical transitional fuel, bridging the gap between current energy needs and future renewable energy targets. Technological advancements play a crucial role, with innovations in hydraulic fracturing fluids, proppant technology, and digitalization enabling more efficient and environmentally responsible extraction of unconventional reserves. Furthermore, favorable government policies and incentives in certain regions aimed at boosting domestic energy production are significant growth catalysts. The economic benefits associated with indigenous oil and gas production, including job creation and tax revenues, also contribute to market expansion.

Challenges Impacting Europe Hydraulic Fracturing Market Growth

Despite promising growth drivers, the Europe hydraulic fracturing market faces substantial challenges. Paramount among these are regulatory complexities and public opposition, often rooted in environmental concerns, which can lead to lengthy permitting processes and operational moratoriums. Supply chain issues, including the availability and cost of specialized equipment, chemicals, and skilled labor, can create bottlenecks and impact project execution. Competitive pressures from alternative energy sources and the long-term global energy transition also present a challenge, necessitating cost-effectiveness and demonstrable environmental stewardship. Furthermore, the inherent environmental risks associated with hydraulic fracturing, such as potential groundwater contamination and induced seismicity, require robust mitigation strategies and continuous monitoring, adding to operational complexities and costs.

Key Players Shaping the Europe Hydraulic Fracturing Market Market

- PAO NOVATEK

- PJSC Rosneft Oil Company

- Cuadrilla Resources Ltd

- PJSC Gazprom

- Equinor ASA

- IGas Energy Plc

- Schlumberger

- Halliburton

- Weatherford International

- Baker Hughes

Significant Europe Hydraulic Fracturing Market Industry Milestones

- 2021: PAO NOVATEK announced the launch of a new hydraulic fracturing project in the Yamal Peninsula, signaling renewed investment in Russian Arctic hydrocarbon development.

- 2020: PJSC Rosneft Oil Company announced the completion of a new hydraulic fracturing well in the Eastern Siberian region, highlighting continued efforts to exploit unconventional reserves in Russia.

- 2019: Cuadrilla Resources Ltd announced the start of a new hydraulic fracturing project in the United Kingdom, representing a significant development in the UK's efforts to explore its domestic shale gas potential.

Future Outlook for Europe Hydraulic Fracturing Market Market

The future outlook for the Europe hydraulic fracturing market is cautiously optimistic, driven by the persistent need for energy security and the role of natural gas as a vital transitional fuel. Strategic opportunities lie in the development of advanced, environmentally friendly fracturing technologies and the exploration of untapped unconventional reserves in geologically favorable regions. Market growth will be heavily influenced by evolving regulatory landscapes and the ability of the industry to effectively address public concerns through transparent operations and robust environmental safeguards. The forecast period (2025–2033) is expected to witness a steady, albeit moderated, expansion, particularly in regions prioritizing domestic resource development. Innovations in water management, reduced chemical usage, and improved seismic monitoring will be critical for long-term sustainability and market acceptance. The market's trajectory will ultimately depend on balancing energy demands with environmental responsibilities.

Europe Hydraulic Fracturing Market Segmentation

-

1. Resource Type

- 1.1. Oil

- 1.2. Natural Gas

Europe Hydraulic Fracturing Market Segmentation By Geography

- 1. Poland

- 2. Russia

- 3. United Kingdom

- 4. Rest of Europe

Europe Hydraulic Fracturing Market Regional Market Share

Geographic Coverage of Europe Hydraulic Fracturing Market

Europe Hydraulic Fracturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Solar Energy4.; Reducing Solar Panel Costs and Associated Components for Solar Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Pure Silicon to make Solar PV Cells

- 3.4. Market Trends

- 3.4.1. Shale Gas to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Hydraulic Fracturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resource Type

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Poland

- 5.2.2. Russia

- 5.2.3. United Kingdom

- 5.2.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Resource Type

- 6. Poland Europe Hydraulic Fracturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resource Type

- 6.1.1. Oil

- 6.1.2. Natural Gas

- 6.1. Market Analysis, Insights and Forecast - by Resource Type

- 7. Russia Europe Hydraulic Fracturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resource Type

- 7.1.1. Oil

- 7.1.2. Natural Gas

- 7.1. Market Analysis, Insights and Forecast - by Resource Type

- 8. United Kingdom Europe Hydraulic Fracturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resource Type

- 8.1.1. Oil

- 8.1.2. Natural Gas

- 8.1. Market Analysis, Insights and Forecast - by Resource Type

- 9. Rest of Europe Europe Hydraulic Fracturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resource Type

- 9.1.1. Oil

- 9.1.2. Natural Gas

- 9.1. Market Analysis, Insights and Forecast - by Resource Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 PAO NOVATEK

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PJSC Rosneft Oil Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cuadrilla Resources Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PJSC Gazprom

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Equinor ASA*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IGas Energy Plc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schlumberger

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Halliburton

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Weatherford International

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Baker Hughes

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 PAO NOVATEK

List of Figures

- Figure 1: Europe Hydraulic Fracturing Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Hydraulic Fracturing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Resource Type 2020 & 2033

- Table 2: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Resource Type 2020 & 2033

- Table 3: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Resource Type 2020 & 2033

- Table 6: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Resource Type 2020 & 2033

- Table 7: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Resource Type 2020 & 2033

- Table 10: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Resource Type 2020 & 2033

- Table 11: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Resource Type 2020 & 2033

- Table 14: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Resource Type 2020 & 2033

- Table 15: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Resource Type 2020 & 2033

- Table 18: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Resource Type 2020 & 2033

- Table 19: Europe Hydraulic Fracturing Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Europe Hydraulic Fracturing Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Hydraulic Fracturing Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Europe Hydraulic Fracturing Market?

Key companies in the market include PAO NOVATEK, PJSC Rosneft Oil Company, Cuadrilla Resources Ltd, PJSC Gazprom, Equinor ASA*List Not Exhaustive, IGas Energy Plc, Schlumberger , Halliburton , Weatherford International, Baker Hughes .

3. What are the main segments of the Europe Hydraulic Fracturing Market?

The market segments include Resource Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Solar Energy4.; Reducing Solar Panel Costs and Associated Components for Solar Projects.

6. What are the notable trends driving market growth?

Shale Gas to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

4.; Availability of Pure Silicon to make Solar PV Cells.

8. Can you provide examples of recent developments in the market?

In 2021, PAO NOVATEK announced the launch of a new hydraulic fracturing project in the Yamal Peninsula.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Hydraulic Fracturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Hydraulic Fracturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Hydraulic Fracturing Market?

To stay informed about further developments, trends, and reports in the Europe Hydraulic Fracturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence