Key Insights

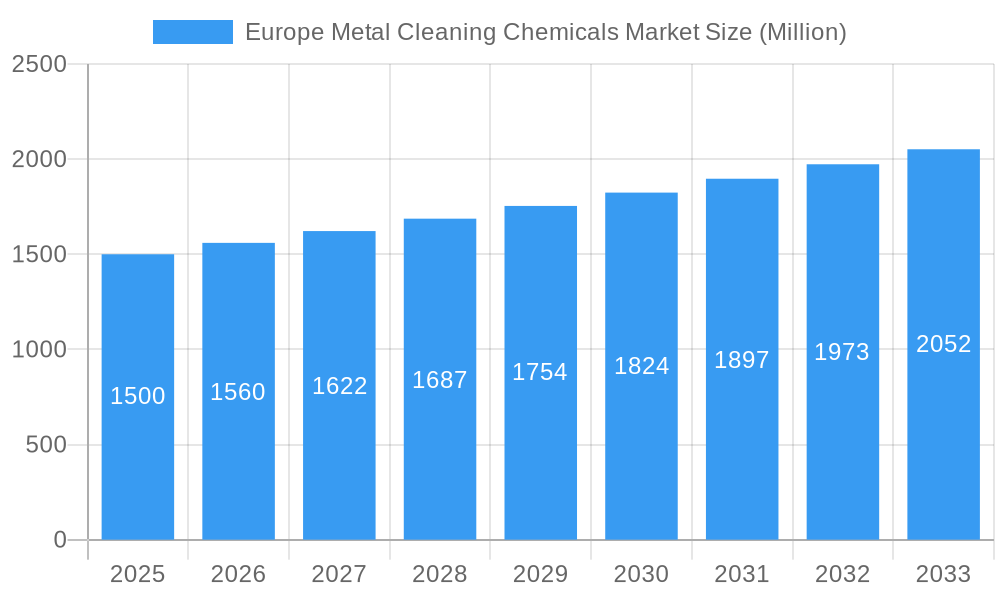

The European metal cleaning chemicals market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 4.9%. This robust growth, anticipated from a market size of 15.1 billion in the base year 2024, is propelled by escalating demand from key industries. The automotive and aerospace sectors' requirement for pristine component performance and extended lifespan is a primary driver. Furthermore, the precision demands of the electronics and medical device industries, necessitating rigorous cleanliness, are fueling market ascent. The increasing adoption of advanced cleaning technologies, including ultrasonic cleaning and electropolishing, alongside stringent environmental regulations favoring sustainable chemistries, further underpins this growth. Aqueous-based solutions are currently dominant due to their favorable safety and disposal profiles, with a concurrent surge in demand for specialized additives such as corrosion inhibitors and surfactants. Acidic metal cleaning chemicals, known for their effectiveness in removing persistent contaminants, are experiencing particularly strong segment growth. Germany, France, and the United Kingdom lead the European market, supported by their established industrial infrastructure and strong manufacturing output.

Europe Metal Cleaning Chemicals Market Market Size (In Billion)

Despite a positive market outlook, challenges persist. Volatile raw material pricing and evolving regulatory compliance complexities present potential obstacles. The continuous development of environmentally conscious cleaning alternatives mandates ongoing innovation. The competitive arena features a blend of multinational corporations and specialized niche providers, all striving for market distinction through unique product and service offerings. Nevertheless, sustained industrialization, technological breakthroughs, and heightened quality standards across various end-use sectors suggest a promising long-term growth trajectory for the European metal cleaning chemicals market.

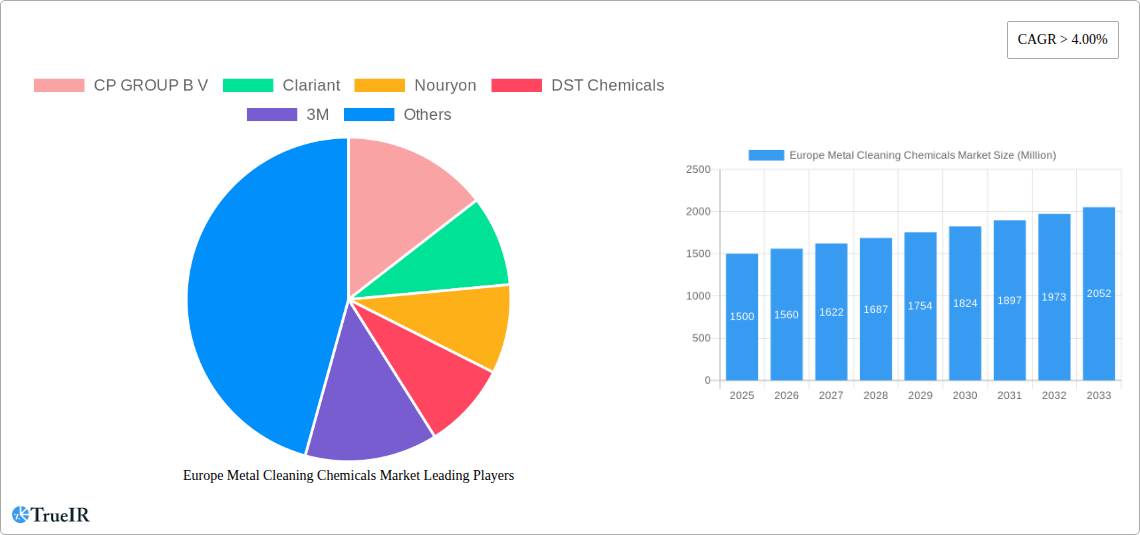

Europe Metal Cleaning Chemicals Market Company Market Share

Europe Metal Cleaning Chemicals Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the European metal cleaning chemicals market, offering invaluable insights for industry stakeholders, investors, and researchers. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report leverages extensive market research and data analysis to forecast market trends and opportunities through 2033. Expect detailed analysis of market segmentation, competitive landscape, key drivers, challenges, and future outlook, empowering informed decision-making and strategic planning. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Metal Cleaning Chemicals Market Structure & Competitive Landscape

The European metal cleaning chemicals market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players such as CP GROUP B V, Clariant, Nouryon, DST Chemicals, 3M, Hubbard-Hall, MKS Instruments, BASF SE, Dow, Eastman Chemical Company, Elmer Wallace Ltd, Evonik industries, Stepan Company, KYZEN CORPORATION, Quaker Chemical Corporation, and BP contribute significantly to the overall market volume. The Herfindahl-Hirschman Index (HHI) for this market is estimated at xx, indicating a moderately concentrated market.

Several factors shape the competitive landscape:

- Innovation: Continuous innovation in chemical formulations drives competition, focusing on enhanced cleaning efficiency, eco-friendliness, and reduced environmental impact. This includes advancements in surfactant technology, corrosion inhibitors, and chelating agents.

- Regulatory Impacts: Stringent environmental regulations in Europe influence the development and adoption of sustainable metal cleaning chemicals, presenting both challenges and opportunities for innovation. REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, for example, significantly affect product formulations and manufacturing processes.

- Product Substitutes: The availability of alternative cleaning methods, such as ultrasonic cleaning and electropolishing, presents competitive pressure. However, chemical cleaning often remains preferred for its effectiveness and cost-efficiency in specific applications.

- End-User Segmentation: The market is diverse, with significant contributions from the transportation, electrical and electronics, chemical and pharmaceutical, and oil and gas industries. Variations in cleaning requirements across these sectors influence product demand and market segmentation.

- M&A Trends: The market has witnessed significant M&A activity in recent years. For example, the 2022 acquisition of Atotech by MKS Instruments and the 2021 acquisition of Coventya Holding SAS by Element Solutions Inc. demonstrates the strategic importance of consolidating market share and expanding product portfolios. The volume of M&A deals in the past five years is estimated to be xx.

Europe Metal Cleaning Chemicals Market Market Trends & Opportunities

The European metal cleaning chemicals market is experiencing robust growth, driven by several key trends and opportunities:

The market size, valued at xx Million in 2025, is projected to expand significantly due to increasing industrial activity, particularly within the automotive, electronics, and renewable energy sectors. This expansion is further fueled by a rising demand for advanced cleaning solutions that meet stringent environmental and safety regulations. Technological advancements, including the development of biodegradable and environmentally friendly cleaning chemicals, are gaining traction and are expected to significantly impact market dynamics in the coming years. The adoption of sustainable practices across various end-user industries, coupled with stringent environmental regulations, presents a lucrative opportunity for manufacturers offering eco-friendly solutions. The market penetration rate for sustainable cleaning chemicals is currently at xx% and is expected to increase to xx% by 2033. The increasing demand for higher cleaning efficiency and improved surface finishing across various applications has created a considerable market opportunity for advanced chemical formulations. The CAGR of the market is projected to remain strong at xx% for the forecast period (2025-2033), demonstrating a continued demand for specialized cleaning chemicals.

Dominant Markets & Segments in Europe Metal Cleaning Chemicals Market

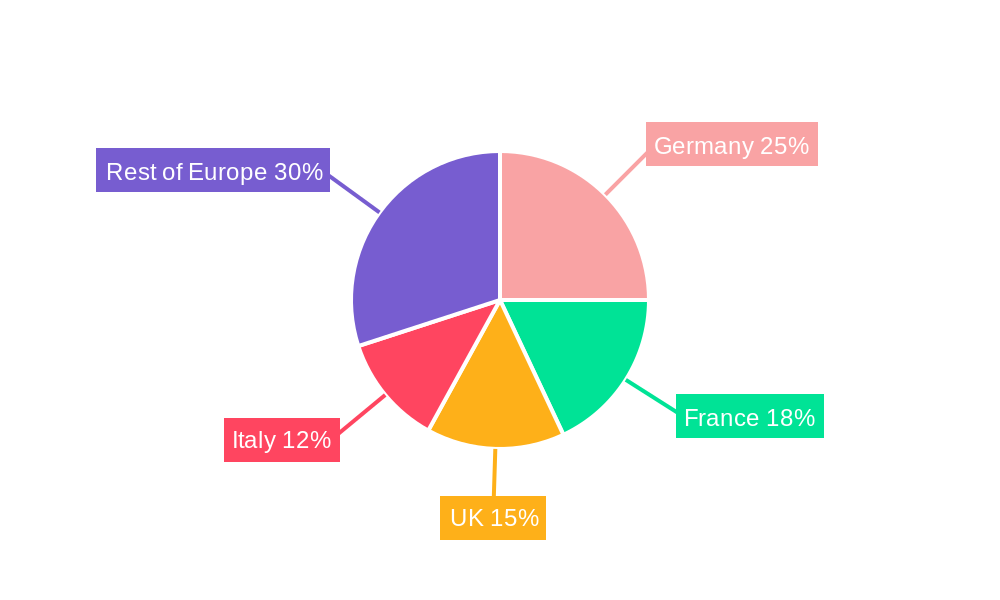

The German market currently holds the largest share within the European metal cleaning chemicals market, followed by the UK and France. This dominance is attributed to a well-established industrial base, particularly in the automotive and manufacturing sectors.

Key growth drivers for dominant segments include:

- Aqueous Form: This segment dominates due to its cost-effectiveness, ease of use, and relatively low environmental impact compared to solvent-based alternatives. Stringent environmental regulations further support its dominance.

- Acidic Type: The acidic type of cleaning chemicals are widely preferred for their effectiveness in removing various contaminants from metal surfaces.

- Surfactants as Functional Additives: Surfactants are essential components in metal cleaning chemicals, enhancing cleaning efficiency and improving wetting properties.

- Transportation End-user Industry: The automotive and aerospace industries represent significant consumers of metal cleaning chemicals due to the high standards of cleanliness required in their manufacturing processes.

Detailed Analysis of Market Dominance: Germany's robust manufacturing sector, coupled with its substantial automotive and machinery industries, fuels high demand for metal cleaning chemicals. Strict environmental regulations in the region drive adoption of eco-friendly formulations, further influencing market growth. The UK's similar industrial profile contributes to its significant market share.

Europe Metal Cleaning Chemicals Market Product Analysis

The European metal cleaning chemicals market is witnessing innovation in product formulations, focusing on improved performance, reduced environmental impact, and enhanced safety. Advancements include the development of biodegradable surfactants, environmentally friendly chelating agents, and advanced corrosion inhibitors. These innovations cater to the growing demand for sustainable and high-performance cleaning solutions, which are tailored to specific applications and end-user needs. The market is seeing an increasing demand for specialized cleaning chemicals that can address specific challenges, such as removing difficult-to-remove contaminants or cleaning delicate metal components.

Key Drivers, Barriers & Challenges in Europe Metal Cleaning Chemicals Market

Key Drivers:

Technological advancements in chemical formulations, increased industrial activity across various sectors, and stringent environmental regulations are major drivers for market growth. The growing demand for higher cleaning efficiency and improved surface finishes is creating opportunities for specialized cleaning solutions. Government initiatives promoting sustainable industrial practices are also positively impacting the market.

Challenges & Restraints:

Fluctuations in raw material prices, stringent regulatory compliance requirements, and intense competition among existing players pose significant challenges. Supply chain disruptions, coupled with the increasing costs of raw materials, can affect production costs and profitability. Additionally, the adoption of alternative cleaning methods may present some level of competitive pressure.

Growth Drivers in the Europe Metal Cleaning Chemicals Market Market

Technological advancements, particularly in sustainable chemical formulations, coupled with the expanding industrial sector in Europe, strongly propel market growth. Stringent environmental regulations incentivize the use of eco-friendly cleaning solutions. Furthermore, government support for sustainable manufacturing contributes significantly.

Challenges Impacting Europe Metal Cleaning Chemicals Market Growth

Strict environmental regulations, fluctuating raw material costs, and competitive pressures from alternative cleaning methods create challenges. Supply chain disruptions and logistical difficulties can impact production and market availability.

Key Players Shaping the Europe Metal Cleaning Chemicals Market Market

- CP GROUP B V

- Clariant

- Nouryon

- DST Chemicals

- 3M

- Hubbard-Hall

- MKS Instruments

- BASF SE

- Dow

- Eastman Chemical Company

- Elmer Wallace Ltd

- Evonik industries

- Stepan Company

- KYZEN CORPORATION

- Quaker Chemical Corporation

- BP

Significant Europe Metal Cleaning Chemicals Market Industry Milestones

- September 2021: Element Solutions Inc. acquired Coventya Holding SAS, expanding its reach into various end markets.

- August 2022: MKS Instruments' acquisition of Atotech strengthened its position in the metal cleaning market.

Future Outlook for Europe Metal Cleaning Chemicals Market Market

The European metal cleaning chemicals market is poised for continued growth, driven by technological advancements, increasing industrialization, and the rising demand for sustainable cleaning solutions. Strategic opportunities lie in developing innovative, eco-friendly formulations and expanding into niche market segments. The market's future prospects remain positive, fueled by ongoing industrial activity and a commitment to environmentally responsible practices.

Europe Metal Cleaning Chemicals Market Segmentation

-

1. Form

- 1.1. Aqueous

- 1.2. Solvent

-

2. Type

- 2.1. Acidic

- 2.2. Basic

- 2.3. Neutral

-

3. Functional Additives

- 3.1. Surfactants

- 3.2. Corrosion Inhibitors

- 3.3. Chelating Agents

- 3.4. PH Regulators

-

4. End-user Industries

- 4.1. Transportation

- 4.2. Electrical and Electronics

- 4.3. Chemical and Pharmaceutical

- 4.4. Oil and Gas

- 4.5. Other End-user Industries

Europe Metal Cleaning Chemicals Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Metal Cleaning Chemicals Market Regional Market Share

Geographic Coverage of Europe Metal Cleaning Chemicals Market

Europe Metal Cleaning Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries

- 3.3. Market Restrains

- 3.3.1. Stringent Environments Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Transportation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Aqueous

- 5.1.2. Solvent

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Acidic

- 5.2.2. Basic

- 5.2.3. Neutral

- 5.3. Market Analysis, Insights and Forecast - by Functional Additives

- 5.3.1. Surfactants

- 5.3.2. Corrosion Inhibitors

- 5.3.3. Chelating Agents

- 5.3.4. PH Regulators

- 5.4. Market Analysis, Insights and Forecast - by End-user Industries

- 5.4.1. Transportation

- 5.4.2. Electrical and Electronics

- 5.4.3. Chemical and Pharmaceutical

- 5.4.4. Oil and Gas

- 5.4.5. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. United Kingdom

- 5.5.3. France

- 5.5.4. Italy

- 5.5.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Aqueous

- 6.1.2. Solvent

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Acidic

- 6.2.2. Basic

- 6.2.3. Neutral

- 6.3. Market Analysis, Insights and Forecast - by Functional Additives

- 6.3.1. Surfactants

- 6.3.2. Corrosion Inhibitors

- 6.3.3. Chelating Agents

- 6.3.4. PH Regulators

- 6.4. Market Analysis, Insights and Forecast - by End-user Industries

- 6.4.1. Transportation

- 6.4.2. Electrical and Electronics

- 6.4.3. Chemical and Pharmaceutical

- 6.4.4. Oil and Gas

- 6.4.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. United Kingdom Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Aqueous

- 7.1.2. Solvent

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Acidic

- 7.2.2. Basic

- 7.2.3. Neutral

- 7.3. Market Analysis, Insights and Forecast - by Functional Additives

- 7.3.1. Surfactants

- 7.3.2. Corrosion Inhibitors

- 7.3.3. Chelating Agents

- 7.3.4. PH Regulators

- 7.4. Market Analysis, Insights and Forecast - by End-user Industries

- 7.4.1. Transportation

- 7.4.2. Electrical and Electronics

- 7.4.3. Chemical and Pharmaceutical

- 7.4.4. Oil and Gas

- 7.4.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. France Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Aqueous

- 8.1.2. Solvent

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Acidic

- 8.2.2. Basic

- 8.2.3. Neutral

- 8.3. Market Analysis, Insights and Forecast - by Functional Additives

- 8.3.1. Surfactants

- 8.3.2. Corrosion Inhibitors

- 8.3.3. Chelating Agents

- 8.3.4. PH Regulators

- 8.4. Market Analysis, Insights and Forecast - by End-user Industries

- 8.4.1. Transportation

- 8.4.2. Electrical and Electronics

- 8.4.3. Chemical and Pharmaceutical

- 8.4.4. Oil and Gas

- 8.4.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Italy Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Aqueous

- 9.1.2. Solvent

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Acidic

- 9.2.2. Basic

- 9.2.3. Neutral

- 9.3. Market Analysis, Insights and Forecast - by Functional Additives

- 9.3.1. Surfactants

- 9.3.2. Corrosion Inhibitors

- 9.3.3. Chelating Agents

- 9.3.4. PH Regulators

- 9.4. Market Analysis, Insights and Forecast - by End-user Industries

- 9.4.1. Transportation

- 9.4.2. Electrical and Electronics

- 9.4.3. Chemical and Pharmaceutical

- 9.4.4. Oil and Gas

- 9.4.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Rest of Europe Europe Metal Cleaning Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Aqueous

- 10.1.2. Solvent

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Acidic

- 10.2.2. Basic

- 10.2.3. Neutral

- 10.3. Market Analysis, Insights and Forecast - by Functional Additives

- 10.3.1. Surfactants

- 10.3.2. Corrosion Inhibitors

- 10.3.3. Chelating Agents

- 10.3.4. PH Regulators

- 10.4. Market Analysis, Insights and Forecast - by End-user Industries

- 10.4.1. Transportation

- 10.4.2. Electrical and Electronics

- 10.4.3. Chemical and Pharmaceutical

- 10.4.4. Oil and Gas

- 10.4.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CP GROUP B V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nouryon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DST Chemicals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hubbard-Hall

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MKS Instruments

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BASF SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dow

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eastman Chemical Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Elmer Wallace Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Evonik industries

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Stepan Company*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 KYZEN CORPORATION

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Quaker Chemical Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 BP

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 CP GROUP B V

List of Figures

- Figure 1: Europe Metal Cleaning Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Metal Cleaning Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 4: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 5: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 7: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 9: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 10: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 12: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 14: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 15: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 17: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 19: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 20: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 22: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 24: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 25: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Form 2020 & 2033

- Table 27: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Functional Additives 2020 & 2033

- Table 29: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 30: Europe Metal Cleaning Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Metal Cleaning Chemicals Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Europe Metal Cleaning Chemicals Market?

Key companies in the market include CP GROUP B V, Clariant, Nouryon, DST Chemicals, 3M, Hubbard-Hall, MKS Instruments, BASF SE, Dow, Eastman Chemical Company, Elmer Wallace Ltd, Evonik industries, Stepan Company*List Not Exhaustive, KYZEN CORPORATION, Quaker Chemical Corporation, BP.

3. What are the main segments of the Europe Metal Cleaning Chemicals Market?

The market segments include Form, Type, Functional Additives, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Concern Towards Industrial Cleaning and Maintenance; Increasing Demand for Metal Cleaners from Manufacturing Industries.

6. What are the notable trends driving market growth?

Increasing Usage in the Transportation Industry.

7. Are there any restraints impacting market growth?

Stringent Environments Regulations.

8. Can you provide examples of recent developments in the market?

August 2022: MKS Instruments completed the acquisition of Atotech, a global player in producing surface treatment and processing chemicals for various metals. The acquisition may strengthen the position of MKS Instruments in the metal cleaning market across the world, including Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Metal Cleaning Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Metal Cleaning Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Metal Cleaning Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Metal Cleaning Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence