Key Insights

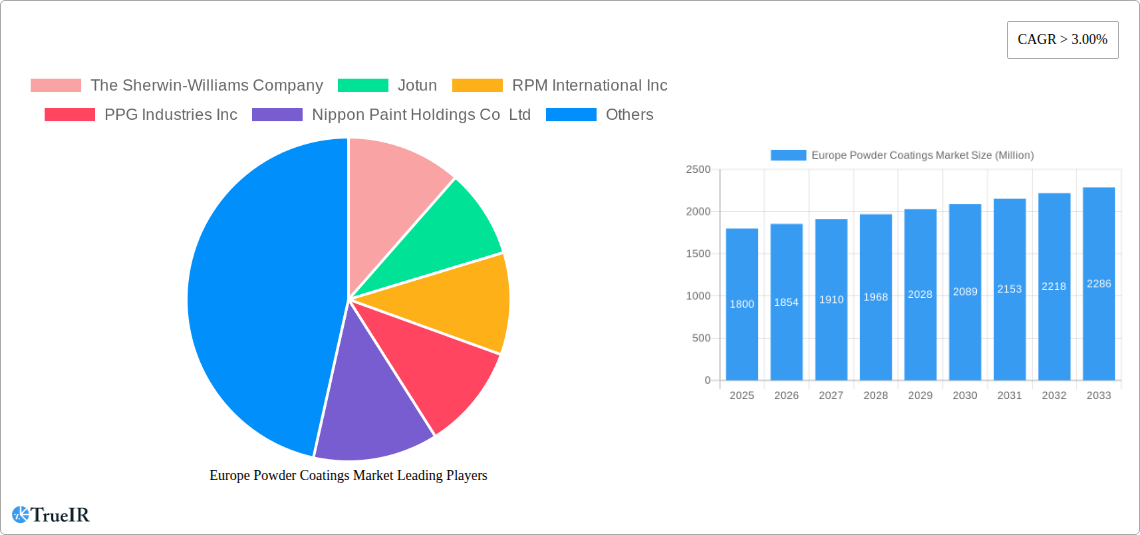

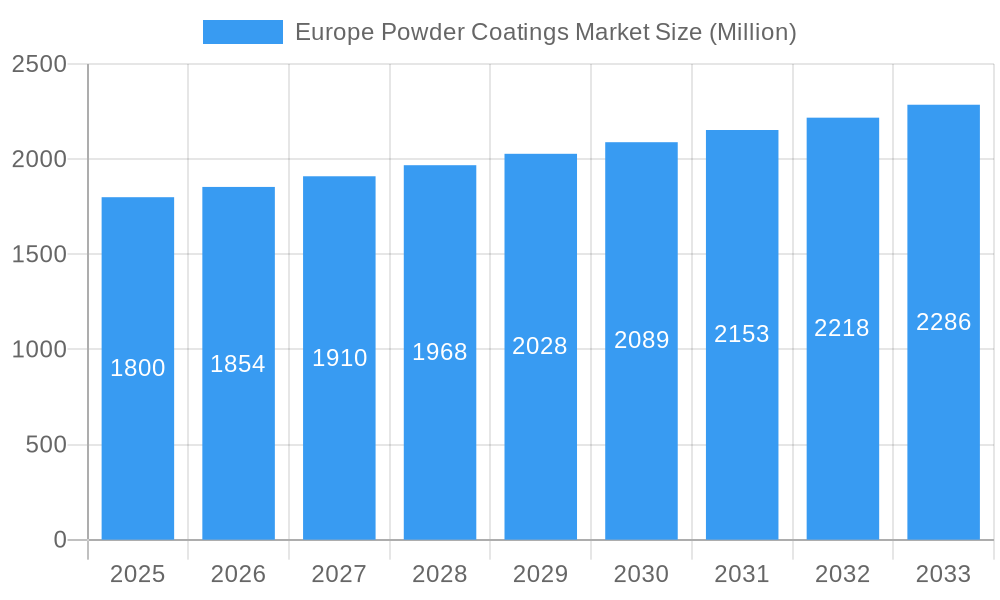

The European powder coatings market is a dynamic and expanding sector, poised for significant growth over the forecast period. Valued at an estimated 1.8 million in the base year of 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) exceeding 3.00% through 2033. This upward trajectory is primarily propelled by a confluence of compelling market drivers. A significant catalyst is the escalating demand for durable, environmentally friendly, and aesthetically pleasing coatings across various end-user industries. The architectural and decorative segment, driven by new construction and renovation projects, is a major contributor, seeking finishes that offer both longevity and visual appeal. The automotive sector's continuous innovation, with a focus on lightweight materials and enhanced protective coatings, also plays a crucial role in market expansion. Furthermore, industrial applications, including machinery, appliances, and general metal fabrication, are increasingly adopting powder coatings for their superior performance characteristics and reduced environmental impact compared to traditional liquid coatings. This shift is reinforced by stringent environmental regulations across Europe, favoring low-VOC (Volatile Organic Compound) solutions like powder coatings.

Europe Powder Coatings Market Market Size (In Billion)

The market is also shaped by evolving trends and strategic initiatives from key industry players. Innovations in resin technology, leading to improved application properties, greater color variety, and enhanced functional benefits such as anti-microbial or self-cleaning surfaces, are driving adoption. The growing emphasis on sustainability is further fueling the demand for eco-friendly powder coating formulations, including those with lower curing temperatures and recycled content. While the market exhibits strong growth, certain restraints warrant attention. The initial capital investment for powder coating application equipment can be a barrier for smaller enterprises. Additionally, the specialized application process and the need for robust surface preparation can pose challenges. However, the long-term benefits of reduced waste, energy efficiency, and superior finish quality are increasingly outweighing these initial hurdles. Leading companies are actively investing in research and development to address these challenges and capitalize on emerging opportunities, ensuring the continued expansion and evolution of the European powder coatings landscape.

Europe Powder Coatings Market Company Market Share

Europe Powder Coatings Market: Comprehensive Analysis and Future Outlook (2019–2033)

Unlock unparalleled insights into the burgeoning Europe Powder Coatings Market with our in-depth report. This comprehensive study, covering the historical period from 2019 to 2024, a base and estimated year of 2025, and a robust forecast period of 2025–2033, provides a dynamic, SEO-optimized analysis of market dynamics, segmentation, key players, and future trends. Leveraging high-volume keywords such as "powder coatings Europe," "architectural coatings," "automotive coatings," "industrial coatings," and specific resin types like "epoxy powder coatings" and "polyester powder coatings," this report is engineered to enhance search rankings and engage industry professionals seeking critical market intelligence. Dive deep into market structure, innovation drivers, regulatory landscapes, dominant segments, and pivotal industry developments, all presented with exceptional clarity and actionable data.

Europe Powder Coatings Market Market Structure & Competitive Landscape

The Europe powder coatings market exhibits a moderately concentrated structure, characterized by the strategic presence of several multinational giants alongside a growing number of regional and specialized manufacturers. Innovation serves as a key driver, with companies consistently investing in R&D to develop coatings with enhanced performance, reduced environmental impact, and lower curing temperatures. Regulatory impacts, particularly those driven by stringent environmental directives across the EU, are shaping product development, favoring low-VOC and solvent-free solutions. The threat of product substitutes, while present from liquid coatings and other surface treatment technologies, is mitigated by the inherent advantages of powder coatings, such as durability, efficiency, and aesthetics. End-user segmentation reveals a robust demand from the Architecture and Decorative and Industrial sectors, with the Automotive industry also presenting significant opportunities. Mergers and acquisitions (M&A) remain a prevalent strategy for market consolidation and expansion, with several significant deals observed in recent years, indicating a drive for enhanced market share and technological integration. For instance, the acquisition volumes are estimated to be in the hundreds of millions of Euros annually, reflecting the strategic importance of consolidation in this competitive arena.

Europe Powder Coatings Market Market Trends & Opportunities

The Europe powder coatings market is experiencing a period of sustained growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period. This robust expansion is fueled by an increasing awareness and adoption of sustainable coating solutions, driven by stringent environmental regulations across the European Union. Powder coatings, inherently low in volatile organic compounds (VOCs) and virtually emission-free during application, are gaining significant traction as a preferred alternative to traditional liquid coatings. Technological shifts are predominantly focused on energy efficiency and enhanced performance. Innovations such as low-temperature curing powder coatings are gaining momentum, addressing the industry's need to reduce energy consumption and operational costs. This trend is particularly beneficial for the architectural sector, where energy savings during the curing process can be substantial, estimated to reduce energy consumption by as much as 20%. Consumer preferences are increasingly leaning towards durable, aesthetically pleasing, and environmentally responsible products, directly benefiting the powder coatings industry. The automotive sector, in its pursuit of lightweight materials and improved corrosion resistance, is a significant contributor to this trend, with powder coatings offering superior protection and finish. The industrial segment, encompassing applications from appliances to furniture and general metal fabrication, continues to demonstrate steady demand, driven by economic growth and infrastructure development. The competitive dynamics within the market are intensifying, with established players focusing on product differentiation, strategic partnerships, and geographical expansion. Emerging players are also carving out niches by specializing in high-performance or niche application coatings. The market penetration rates for powder coatings in Europe are steadily increasing, reflecting their growing acceptance and superior value proposition. Opportunities abound in the development of specialized powder coatings for emerging applications, such as electric vehicle components, renewable energy infrastructure, and advanced architectural designs. The circular economy initiatives within Europe also present a significant opportunity for the development of recyclable and sustainable powder coating solutions.

Dominant Markets & Segments in Europe Powder Coatings Market

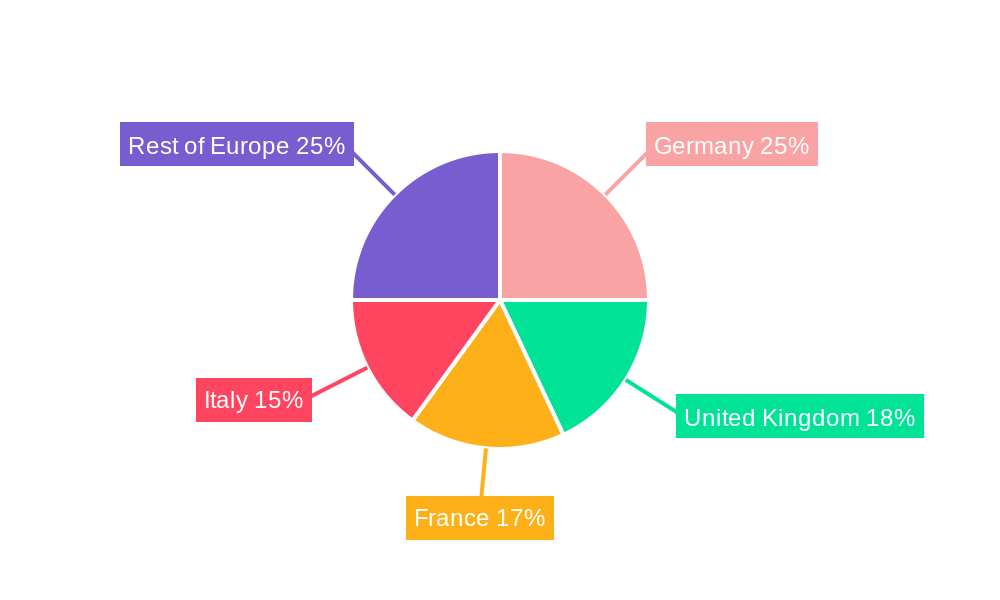

The Architecture and Decorative end-user industry segment stands out as a dominant force within the Europe powder coatings market, driven by substantial growth in construction and renovation activities across key European nations. Countries like Germany, France, the UK, and Italy are leading this charge, fueled by significant infrastructure investments and a rising demand for aesthetically pleasing and durable building materials. The inherent properties of powder coatings, such as their excellent weatherability, corrosion resistance, and wide range of color and texture options, make them ideal for architectural applications, including window profiles, facade panels, and interior design elements. The stringent European building codes and a growing emphasis on sustainable construction practices further bolster the demand for these eco-friendly coatings.

- Key Growth Drivers in Architecture and Decorative:

- Urbanization and Infrastructure Development: Continued investment in urban renewal projects and public infrastructure across Europe fuels demand for durable and attractive architectural finishes.

- Green Building Initiatives: The increasing focus on sustainable and energy-efficient buildings promotes the use of low-VOC powder coatings.

- Renovation and Refurbishment Trends: An aging building stock in many European countries necessitates regular renovation and refurbishment, creating ongoing demand for high-performance coatings.

- Aesthetic Versatility: The ability of powder coatings to achieve a wide spectrum of finishes, from matte to high gloss and textured effects, caters to evolving architectural design trends.

Among the Resin Types, Polyester powder coatings command a significant market share, particularly in outdoor applications due to their exceptional UV resistance and durability. They are widely used in architectural aluminum extrusions, garden furniture, and automotive components. Epoxy powder coatings are predominantly used in industrial applications requiring superior chemical resistance and adhesion, such as for pipelines, machinery, and appliances. The Epoxy-Polyester hybrid segment offers a cost-effective solution for interior applications where a balance of performance and economics is desired, making it popular for metal furniture and office equipment. While Acrylic and Polyurethane powder coatings serve more niche applications requiring specific properties like excellent flexibility or scratch resistance, their market share is smaller compared to polyester and epoxy-based formulations. The continuous development of new resin technologies aimed at improving performance characteristics and reducing curing temperatures is expected to further shape the dominance of these segments.

Europe Powder Coatings Market Product Analysis

Product innovation in the Europe powder coatings market is primarily centered on enhancing environmental sustainability, improving application efficiency, and expanding performance capabilities. Key advancements include the development of low-cure temperature powder coatings, enabling energy savings and broader substrate compatibility, and formulations with enhanced UV resistance and corrosion protection for extended product lifespans. Applications are diversifying beyond traditional metal finishing to include wood, plastics, and composites, opening new market avenues. Competitive advantages are gained through superior durability, ease of application, and compliance with evolving environmental regulations, such as REACH.

Key Drivers, Barriers & Challenges in Europe Powder Coatings Market

Key Drivers: The Europe powder coatings market is propelled by a confluence of technological, economic, and policy-driven factors. Growing environmental consciousness across the continent, coupled with increasingly stringent regulations on VOC emissions, acts as a significant catalyst, favoring the inherently low-VOC nature of powder coatings. Economic recovery and ongoing investments in infrastructure, construction, and automotive manufacturing stimulate demand. Technological advancements, such as low-temperature curing coatings, enhance energy efficiency and application versatility, further driving adoption. The desire for durable, aesthetically appealing, and long-lasting finishes across various end-user industries also contributes to market expansion.

Barriers & Challenges: Despite robust growth, the market faces several hurdles. The initial capital investment required for powder coating application equipment can be a barrier for smaller enterprises. Fluctuations in raw material prices, particularly for key resins and pigments, can impact profitability and product pricing. While improving, the energy-intensive nature of the curing process, especially for high-temperature cure coatings, remains a consideration. Competitive pressures from established players and the emergence of novel coating technologies present ongoing challenges. Supply chain disruptions and geopolitical uncertainties can also affect the availability and cost of raw materials, posing risks to market stability.

Growth Drivers in the Europe Powder Coatings Market Market

The Europe powder coatings market is experiencing a significant uplift driven by several interconnected factors. Environmental regulations, particularly the EU's focus on reducing VOC emissions, are a primary growth engine, making powder coatings the environmentally superior choice. The automotive industry's continuous demand for corrosion resistance, durability, and lightweight solutions, alongside the architectural sector's emphasis on aesthetic appeal and weatherability in construction, further fuels market expansion. Technological advancements, such as the development of low-energy curing powder coatings that reduce operational costs and carbon footprints, are critical growth enablers. The growing preference for sustainable and eco-friendly products among consumers and businesses alike is a substantial market driver, aligning perfectly with the inherent benefits of powder coatings.

Challenges Impacting Europe Powder Coatings Market Growth

Several challenges continue to shape the trajectory of the Europe powder coatings market. The initial capital expenditure for implementing powder coating systems can be a significant deterrent for small to medium-sized enterprises, limiting broader market penetration. Fluctuations in raw material costs, particularly for key resins and pigments derived from petrochemicals, can create price volatility and impact profit margins. While advancements in low-cure technology are mitigating this, the energy intensity of the curing process still remains a concern for some applications. Intense competition from both established global players and specialized regional manufacturers necessitates continuous innovation and cost optimization. Furthermore, supply chain disruptions and logistical complexities, amplified by recent global events, can impact the timely availability of raw materials and finished products.

Key Players Shaping the Europe Powder Coatings Market Market

- The Sherwin-Williams Company

- Jotun

- RPM International Inc

- PPG Industries Inc

- Nippon Paint Holdings Co Ltd

- BASF SE

- DSM

- Akzo Nobel N V

- Primatek Coatings

- Sika AG

- Axalta Coating Systems LLC

- Asian Paints

- TIGER Coatings GmbH & Co KG

- Kansai Paint Co Ltd

Significant Europe Powder Coatings Market Industry Milestones

- November 2023: AkzoNobel launched a low-energy powder coating for architectural applications, capable of curing at temperatures as low as -150°C while maintaining Qualicoat class one certification. This innovation is projected to reduce customer energy consumption by up to 20%.

- December 2022: AkzoNobel N.V. finalized the acquisition of Lankwitzer Lackfabrik GmbH's wheel liquid coatings business, aiming to strengthen its global powder coatings portfolio.

- June 2022: The Sherwin-Williams Company announced its agreement to acquire Gross & Perthun GmbH, a German developer, manufacturer, and distributor of coatings, enhancing its European market presence.

- April 2022: PPG Industries Inc completed the acquisition of Arsonsisi's powder coatings manufacturing business in Italy, bolstering its automated powder production capabilities for both small and large batch production.

Future Outlook for Europe Powder Coatings Market Market

The future outlook for the Europe powder coatings market is exceptionally promising, driven by an unwavering commitment to sustainability and continuous technological innovation. Strategic opportunities lie in the expansion of applications into emerging sectors such as electric vehicle components and renewable energy infrastructure. The growing emphasis on circular economy principles will foster the development of recyclable and bio-based powder coatings. Market potential will be further unlocked by advancements in smart coatings offering enhanced functionality and by the increasing demand for customized aesthetic solutions. Continued investment in R&D, strategic partnerships, and a focus on energy-efficient curing technologies will be pivotal for players aiming to capitalize on the robust growth trajectory of this dynamic market.

Europe Powder Coatings Market Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Epoxy

- 1.3. Polyester

- 1.4. Polyurethane

- 1.5. Epoxy-Polyester

- 1.6. Other Re

-

2. End-user Industry

- 2.1. Architecture and Decorative

- 2.2. Automotive

- 2.3. Industrial

- 2.4. Other En

Europe Powder Coatings Market Segmentation By Geography

- 1. Germany

- 2. United Kinfdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Powder Coatings Market Regional Market Share

Geographic Coverage of Europe Powder Coatings Market

Europe Powder Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Usage of Powder Coatings in Automotive Industry; The Favorable Government Initiatives Promoting the Use of Powder Coatings; Recycling Property of Powder Coatings

- 3.3. Market Restrains

- 3.3.1. Difficulty in Obtaining Thin Film of Powder Coating; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from Automotive Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Epoxy

- 5.1.3. Polyester

- 5.1.4. Polyurethane

- 5.1.5. Epoxy-Polyester

- 5.1.6. Other Re

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Architecture and Decorative

- 5.2.2. Automotive

- 5.2.3. Industrial

- 5.2.4. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kinfdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Germany Europe Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Acrylic

- 6.1.2. Epoxy

- 6.1.3. Polyester

- 6.1.4. Polyurethane

- 6.1.5. Epoxy-Polyester

- 6.1.6. Other Re

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Architecture and Decorative

- 6.2.2. Automotive

- 6.2.3. Industrial

- 6.2.4. Other En

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. United Kinfdom Europe Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Acrylic

- 7.1.2. Epoxy

- 7.1.3. Polyester

- 7.1.4. Polyurethane

- 7.1.5. Epoxy-Polyester

- 7.1.6. Other Re

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Architecture and Decorative

- 7.2.2. Automotive

- 7.2.3. Industrial

- 7.2.4. Other En

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. France Europe Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Acrylic

- 8.1.2. Epoxy

- 8.1.3. Polyester

- 8.1.4. Polyurethane

- 8.1.5. Epoxy-Polyester

- 8.1.6. Other Re

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Architecture and Decorative

- 8.2.2. Automotive

- 8.2.3. Industrial

- 8.2.4. Other En

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Italy Europe Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Acrylic

- 9.1.2. Epoxy

- 9.1.3. Polyester

- 9.1.4. Polyurethane

- 9.1.5. Epoxy-Polyester

- 9.1.6. Other Re

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Architecture and Decorative

- 9.2.2. Automotive

- 9.2.3. Industrial

- 9.2.4. Other En

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Rest of Europe Europe Powder Coatings Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Acrylic

- 10.1.2. Epoxy

- 10.1.3. Polyester

- 10.1.4. Polyurethane

- 10.1.5. Epoxy-Polyester

- 10.1.6. Other Re

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Architecture and Decorative

- 10.2.2. Automotive

- 10.2.3. Industrial

- 10.2.4. Other En

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Sherwin-Williams Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jotun

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RPM International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PPG Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nippon Paint Holdings Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DSM

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Akzo Nobel N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Primatek Coatings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sika AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Axalta Coating Systems LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Asian Paints

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TIGER Coatings GmbH & Co KG*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kansai Paint Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 The Sherwin-Williams Company

List of Figures

- Figure 1: Europe Powder Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Powder Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Powder Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 2: Europe Powder Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 3: Europe Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Powder Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Powder Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Powder Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Powder Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 8: Europe Powder Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 9: Europe Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Powder Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Powder Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Powder Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 14: Europe Powder Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 15: Europe Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Europe Powder Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 17: Europe Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Europe Powder Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Powder Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 20: Europe Powder Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 21: Europe Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Europe Powder Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Europe Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Powder Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Powder Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 26: Europe Powder Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 27: Europe Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Europe Powder Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 29: Europe Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Europe Powder Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Europe Powder Coatings Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 32: Europe Powder Coatings Market Volume K Tons Forecast, by Resin Type 2020 & 2033

- Table 33: Europe Powder Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Europe Powder Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 35: Europe Powder Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Powder Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Powder Coatings Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Europe Powder Coatings Market?

Key companies in the market include The Sherwin-Williams Company, Jotun, RPM International Inc, PPG Industries Inc, Nippon Paint Holdings Co Ltd, BASF SE, DSM, Akzo Nobel N V, Primatek Coatings, Sika AG, Axalta Coating Systems LLC, Asian Paints, TIGER Coatings GmbH & Co KG*List Not Exhaustive, Kansai Paint Co Ltd.

3. What are the main segments of the Europe Powder Coatings Market?

The market segments include Resin Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Usage of Powder Coatings in Automotive Industry; The Favorable Government Initiatives Promoting the Use of Powder Coatings; Recycling Property of Powder Coatings.

6. What are the notable trends driving market growth?

Growing Demand from Automotive Segment.

7. Are there any restraints impacting market growth?

Difficulty in Obtaining Thin Film of Powder Coating; Other Restraints.

8. Can you provide examples of recent developments in the market?

November 2023: AkzoNobel launched low energy powder coating. Architectural powder coating, which can be cured at temperatures as low as -150◦C while still being Qualicoat class one certified. It can help customers cut energy consumption by as much as 20%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Powder Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Powder Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Powder Coatings Market?

To stay informed about further developments, trends, and reports in the Europe Powder Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence