Key Insights

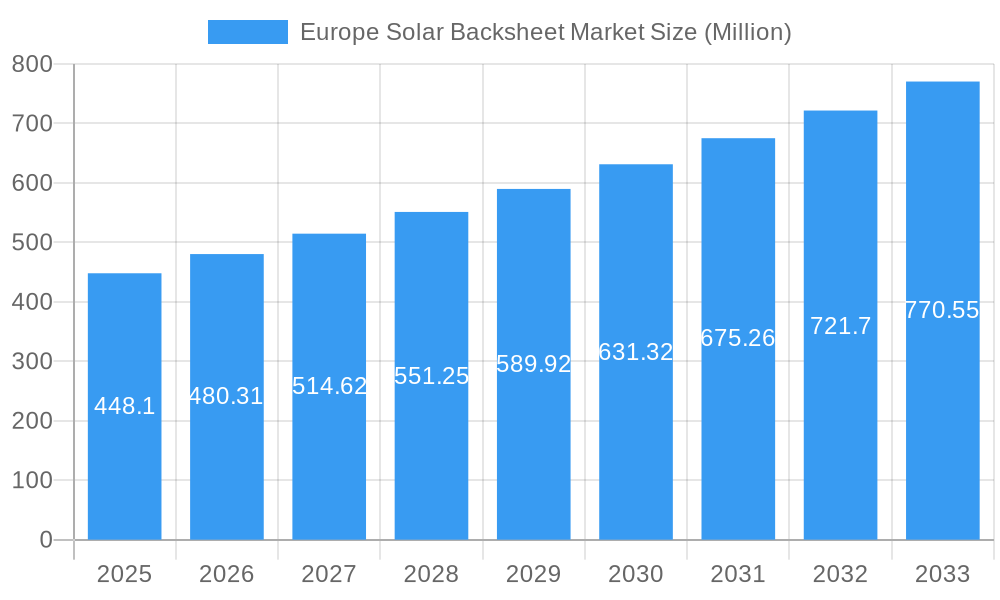

The European Solar Backsheet Market is poised for significant expansion, projected to reach a valuation of USD 448.10 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.20% during the forecast period of 2025-2033, indicating sustained demand and market dynamism. A primary driver for this upswing is the accelerating adoption of solar energy across Europe, fueled by ambitious renewable energy targets and government incentives aimed at decarbonization. The increasing awareness of climate change and the subsequent push for sustainable energy solutions are central to this market's expansion. Furthermore, technological advancements in solar panel manufacturing, leading to more efficient and durable backsheets, are also contributing to market growth. The market is segmented into Fluoropolymer and Non-fluoropolymer backsheets, with Fluoropolymer types likely dominating due to their superior weather resistance and longevity, crucial for the harsh environmental conditions often faced by solar installations. Key players like Isovoltaic AG, Arkema SA, and DuPont de Nemours Inc. are actively shaping the market through innovation and strategic investments.

Europe Solar Backsheet Market Market Size (In Million)

The European solar backsheet landscape is characterized by several emerging trends and restraining factors that will influence its trajectory. A significant trend is the increasing demand for high-performance backsheets that offer enhanced UV resistance, moisture barrier properties, and flame retardancy to meet stringent safety and performance standards. Innovations in materials science are leading to the development of advanced backsheet solutions, including those incorporating recycled content, aligning with the circular economy principles increasingly adopted by the industry. However, the market faces restraints such as fluctuating raw material prices, particularly for polymers, which can impact manufacturing costs and profit margins. Supply chain disruptions, geopolitical uncertainties, and evolving regulatory landscapes also present challenges. Despite these hurdles, the strong governmental support for renewable energy, coupled with the persistent drive for energy independence, will continue to propel the European solar backsheet market forward. The concentration of market activity is expected to be prominent in countries with established solar industries and favorable regulatory frameworks, such as Germany and France, while other regions also contribute to the overall market expansion.

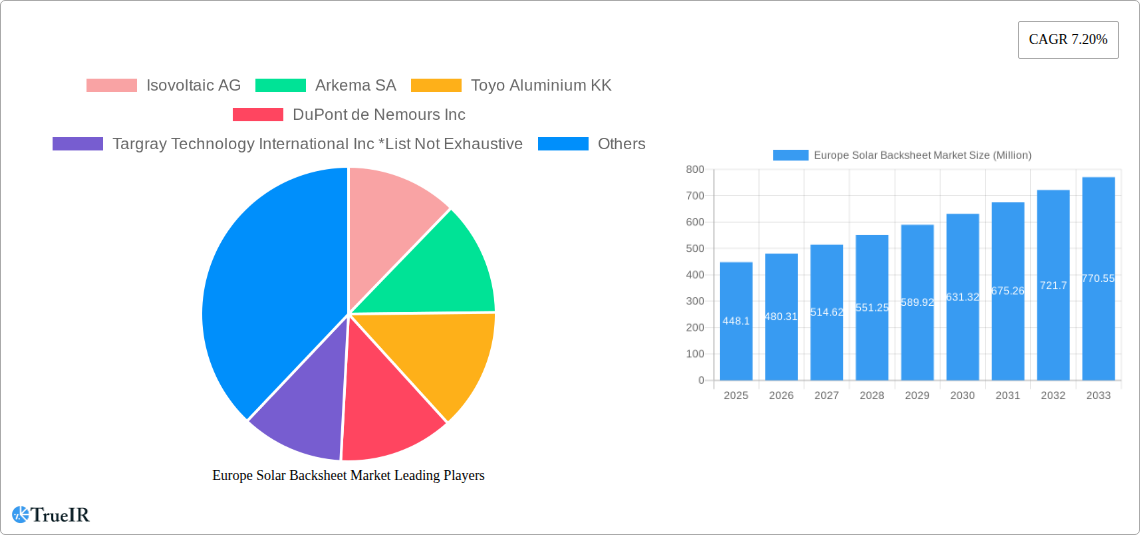

Europe Solar Backsheet Market Company Market Share

This in-depth report delivers a granular analysis of the Europe Solar Backsheet Market, providing critical insights into its current state and future trajectory. Spanning the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast period from 2025 to 2033, this study is an indispensable resource for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes in the European solar energy sector. We delve into key segments such as Fluoropolymer and Non-fluoropolymer backsheets, offering precise data and expert analysis to guide strategic decision-making.

Europe Solar Backsheet Market Market Structure & Competitive Landscape

The Europe Solar Backsheet Market exhibits a moderately consolidated structure, characterized by the presence of established global players and emerging regional manufacturers. Innovation remains a primary driver, with companies heavily investing in R&D to enhance backsheet durability, efficiency, and recyclability, crucial for meeting stringent European solar panel standards. Regulatory impacts are significant, with policies promoting renewable energy adoption and circular economy principles directly influencing material choices and product development. Product substitutes, while present, face challenges in matching the performance and longevity of advanced solar backsheets. End-user segmentation is primarily driven by the photovoltaic module manufacturing industry, with distinct preferences for backsheets based on application, climate resilience, and cost-effectiveness. Merger and acquisition (M&A) trends in recent years, evidenced by xx reported M&A deals with a cumulative value of approximately xx Million, underscore the industry's consolidation and strategic realignments aimed at expanding market reach and technological capabilities. The market concentration ratio for the top 5 players stands at approximately xx%.

Europe Solar Backsheet Market Market Trends & Opportunities

The Europe Solar Backsheet Market is poised for substantial growth, driven by the accelerating transition towards clean energy and the EU's ambitious renewable energy targets. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for high-performance and durable backsheets that can withstand diverse European climatic conditions, thereby enhancing the longevity and reliability of solar photovoltaic (PV) modules. Technological shifts are prominently focused on developing advanced materials that offer superior UV resistance, moisture barrier properties, and electrical insulation, directly impacting module performance and reducing degradation rates. Consumer preferences are increasingly leaning towards sustainable and eco-friendly solutions, pushing manufacturers to explore bio-based and recyclable backsheet materials. The competitive dynamics are intensifying, with companies differentiating themselves through product innovation, strategic partnerships, and a focus on supply chain resilience. Opportunities abound for players offering customized backsheet solutions tailored to specific PV module designs and applications, as well as those investing in the development of thinner, lighter, and more cost-effective backsheets without compromising performance. The growing emphasis on the circular economy within the EU also presents a significant opportunity for manufacturers who can develop and implement effective end-of-life management and recycling strategies for solar backsheets. Market penetration rates for advanced backsheet technologies are expected to rise from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in Europe Solar Backsheet Market

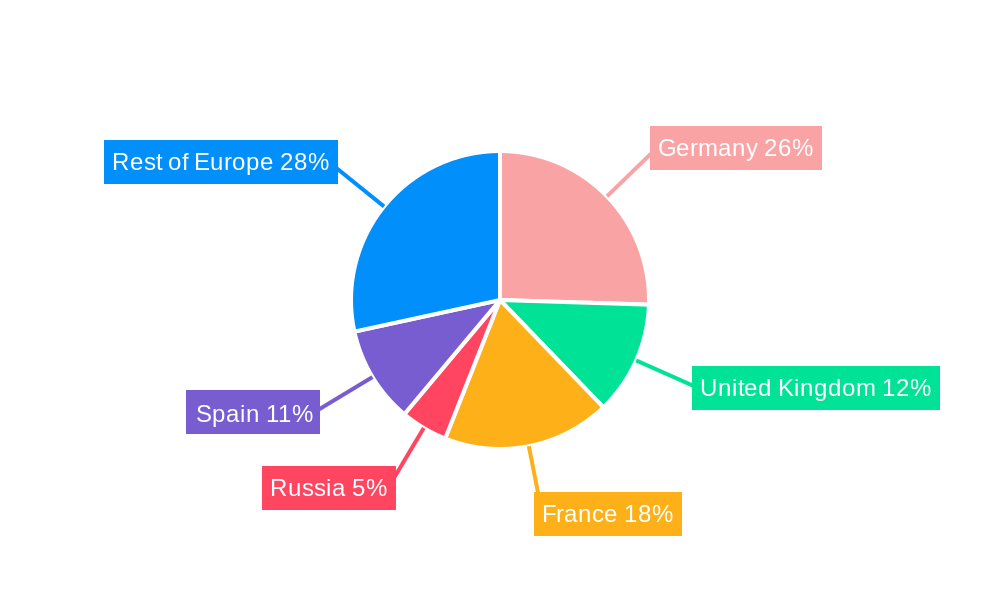

Within the Europe Solar Backsheet Market, Fluoropolymer backsheets currently hold a dominant position due to their exceptional durability, superior resistance to weathering, and long-term performance in demanding environments. This dominance is particularly pronounced in regions experiencing harsh climatic conditions. The leading regions for solar backsheet consumption are Germany, France, and Spain, driven by robust solar energy installations and supportive government policies.

- Key Growth Drivers in Dominant Markets:

- Germany: Ambitious renewable energy targets, significant government incentives for solar adoption, and a strong domestic solar manufacturing base contribute to sustained demand for high-quality backsheets. The country's commitment to R&D in solar technology further bolsters the market for advanced backsheet solutions.

- France: Favorable feed-in tariffs and renewable energy quotas are propelling the installation of new solar capacity, creating a consistent demand for reliable solar backsheets. Government initiatives aimed at promoting energy independence also play a crucial role.

- Spain: Its abundant sunshine and government support for utility-scale solar projects make Spain a key market. The need for durable backsheets capable of withstanding high temperatures and intense UV radiation is paramount, favoring fluoropolymer options.

The Non-fluoropolymer segment, while currently smaller, is experiencing significant growth. This is attributed to increasing cost pressures in the solar industry and advancements in non-fluoropolymer materials that are closing the performance gap with traditional fluoropolymers. Innovations in PET and other polymer composites are making them increasingly viable alternatives, especially in less extreme climate zones and for cost-sensitive projects. The market penetration of non-fluoropolymer backsheets is anticipated to grow from xx% in 2025 to xx% by 2033.

Europe Solar Backsheet Market Product Analysis

The Europe Solar Backsheet Market is characterized by a relentless pursuit of product innovation, focusing on enhanced durability, improved electrical insulation, and superior weather resistance. Key product advancements include the development of multi-layer backsheets incorporating advanced polymers and coatings for extended UV protection and moisture barrier properties, crucial for achieving the 40-year lifecycle targeted by new research initiatives. Competitive advantages are being carved out through enhanced fire retardancy, mechanical strength, and reduced degradation rates, leading to increased module efficiency and lifespan. The application spectrum is broad, spanning residential rooftops, commercial installations, and utility-scale solar farms, each with specific backsheet performance requirements.

Key Drivers, Barriers & Challenges in Europe Solar Backsheet Market

Key Drivers:

- Growing Renewable Energy Mandates: Ambitious EU targets for renewable energy integration are a primary catalyst, driving increased solar PV installations and, consequently, demand for solar backsheets.

- Technological Advancements: Continuous innovation in material science is leading to more durable, efficient, and cost-effective backsheet solutions.

- Long-Term Module Lifespan Demand: The industry's focus on achieving 25-40 year module lifecycles necessitates high-performance backsheets.

- Supportive Government Policies: Subsidies, tax incentives, and favorable regulatory frameworks for solar energy deployment accelerate market growth.

Barriers & Challenges:

- Supply Chain Volatility: Geopolitical factors and disruptions can impact the availability and pricing of key raw materials, such as fluoropolymers and specialty films, leading to price fluctuations estimated at up to xx% impacting production costs.

- Regulatory Hurdles: Evolving environmental regulations and stringent quality certifications require significant investment in compliance and R&D.

- Cost Pressures: The highly competitive nature of the solar PV market exerts constant pressure to reduce manufacturing costs, which can sometimes challenge the adoption of premium backsheet materials.

- Competition from Emerging Markets: Lower manufacturing costs in other regions can pose a competitive challenge to European producers.

Growth Drivers in the Europe Solar Backsheet Market Market

The Europe Solar Backsheet Market is experiencing robust growth driven by several key factors. The EU's commitment to decarbonization, evidenced by targets for increasing renewable energy share in its total energy mix, directly fuels demand for solar PV modules and their essential components, including backsheets. Technological innovation plays a pivotal role, with ongoing research and development focused on materials that enhance module durability, longevity, and performance under diverse climatic conditions, such as those encountered across Europe. Furthermore, government incentives and supportive policies, including subsidies and tax credits for solar installations, create a favorable investment climate. The increasing emphasis on achieving extended solar module lifecycles, aiming for 30-40 years, necessitates the use of high-performance backsheets that offer superior resistance to UV radiation, moisture ingress, and mechanical stress.

Challenges Impacting Europe Solar Backsheet Market Growth

Despite the positive growth trajectory, the Europe Solar Backsheet Market faces several challenges. Supply chain disruptions, including the availability and price volatility of critical raw materials like fluoropolymers, can significantly impact production costs and timelines. Manufacturers are also navigating complex and evolving regulatory landscapes, which require continuous adaptation and investment in compliance. Intense competition, both from established players and emerging manufacturers, exerts downward pressure on profit margins, necessitating a focus on cost-efficiency without compromising quality. Furthermore, the drive for cost reduction in the overall solar PV value chain can sometimes lead to the adoption of less premium, and potentially less durable, backsheet solutions, especially in price-sensitive market segments. The need for greater sustainability and recyclability in backsheet materials also presents a challenge, requiring innovative solutions and investments in circular economy practices.

Key Players Shaping the Europe Solar Backsheet Market Market

- Isovoltaic AG

- Arkema SA

- Toyo Aluminium KK

- DuPont de Nemours Inc

- Targray Technology International Inc

- Coveme SpA

- DUNMORE

- 3M Co

- Krempel GmbH

- Madico Inc

Significant Europe Solar Backsheet Market Industry Milestones

- November 2023: Germany's Fraunhofer Center for Silicon Photovoltaics (Fraunhofer CSP) launched the "Folie40" research project. This initiative focuses on exploring novel encapsulation techniques and backsheet designs for PV modules with lifecycles of at least 40 years. The project consortium includes Folienwerk Wolfen (Germany), Meyer Burger (Switzerland), Aluminum Féron (Spain), Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE), and the Anhalt University of Applied Sciences. This development signifies a strong European push towards ultra-long-life solar components.

- October 2022: Enel Green Power secured USD 126 Million in funding from the European Union Innovation Fund. This significant investment is earmarked to support projects aimed at reviving high-tech European solar manufacturing, anticipating a ripple effect of additional investments in related initiatives, including advancements in solar component technologies like backsheets.

Future Outlook for Europe Solar Backsheet Market Market

The future outlook for the Europe Solar Backsheet Market is exceptionally promising, driven by the EU's unwavering commitment to achieving net-zero emissions and its ambitious renewable energy targets. Strategic opportunities lie in the continuous development of next-generation backsheet materials that offer enhanced performance, greater durability, and improved sustainability credentials, aligning with the principles of the circular economy. The increasing demand for bifacial solar modules and emerging technologies like perovskite solar cells will also present new avenues for specialized backsheet solutions. Market potential is significant, with continued growth anticipated from residential, commercial, and utility-scale solar installations across the continent. The push for domestic solar manufacturing within Europe, supported by initiatives like the one funded by the EU Innovation Fund, is expected to foster innovation and create a more resilient supply chain, further solidifying the market's growth trajectory.

Europe Solar Backsheet Market Segmentation

-

1. Type

- 1.1. Fluoropolymer

- 1.2. Non-fluoropolymer

Europe Solar Backsheet Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Russia

- 5. Spain

- 6. Rest of Europe

Europe Solar Backsheet Market Regional Market Share

Geographic Coverage of Europe Solar Backsheet Market

Europe Solar Backsheet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Solar Energy4.; Reducing Solar Panel Costs and Associated Components for Solar Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Pure Silicon to make Solar PV Cells

- 3.4. Market Trends

- 3.4.1. Fluoropolymer to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fluoropolymer

- 5.1.2. Non-fluoropolymer

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Russia

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fluoropolymer

- 6.1.2. Non-fluoropolymer

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fluoropolymer

- 7.1.2. Non-fluoropolymer

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fluoropolymer

- 8.1.2. Non-fluoropolymer

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Russia Europe Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fluoropolymer

- 9.1.2. Non-fluoropolymer

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Spain Europe Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fluoropolymer

- 10.1.2. Non-fluoropolymer

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Europe Europe Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Fluoropolymer

- 11.1.2. Non-fluoropolymer

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Isovoltaic AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Arkema SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Toyo Aluminium KK

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DuPont de Nemours Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Targray Technology International Inc *List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Coveme SpA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 DUNMORE

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 3M Co

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Krempel GmbH

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Madico Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Isovoltaic AG

List of Figures

- Figure 1: Europe Solar Backsheet Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Solar Backsheet Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Solar Backsheet Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 3: Europe Solar Backsheet Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 5: Europe Solar Backsheet Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 7: Europe Solar Backsheet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 9: Europe Solar Backsheet Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 11: Europe Solar Backsheet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: Europe Solar Backsheet Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 15: Europe Solar Backsheet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 17: Europe Solar Backsheet Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 19: Europe Solar Backsheet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 21: Europe Solar Backsheet Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 23: Europe Solar Backsheet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Europe Solar Backsheet Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Type 2020 & 2033

- Table 27: Europe Solar Backsheet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Europe Solar Backsheet Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Solar Backsheet Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Europe Solar Backsheet Market?

Key companies in the market include Isovoltaic AG, Arkema SA, Toyo Aluminium KK, DuPont de Nemours Inc, Targray Technology International Inc *List Not Exhaustive, Coveme SpA, DUNMORE, 3M Co, Krempel GmbH, Madico Inc.

3. What are the main segments of the Europe Solar Backsheet Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 448.10 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Solar Energy4.; Reducing Solar Panel Costs and Associated Components for Solar Projects.

6. What are the notable trends driving market growth?

Fluoropolymer to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Availability of Pure Silicon to make Solar PV Cells.

8. Can you provide examples of recent developments in the market?

November 2023, Germany's Fraunhofer Center for Silicon Photovoltaics (Fraunhofer CSP) is leading "Folie40," a research project strived at exploring novel encapsulation techniques and backsheet designs for PV modules with lifecycles of at least 40 years. The project consortium comprises German backsheet maker Folienwerk Wolfen, Switzerland-based module manufacturer Meyer Burger, Spanish coating specialist Aluminum Féron, the Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE), and the Anhalt University of Applied Sciences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Solar Backsheet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Solar Backsheet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Solar Backsheet Market?

To stay informed about further developments, trends, and reports in the Europe Solar Backsheet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence