Key Insights

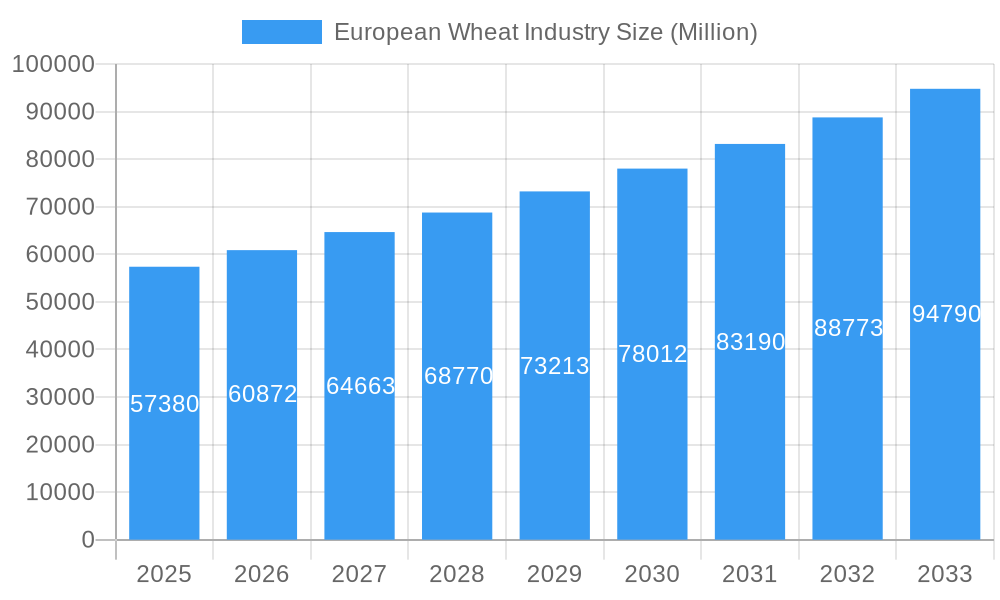

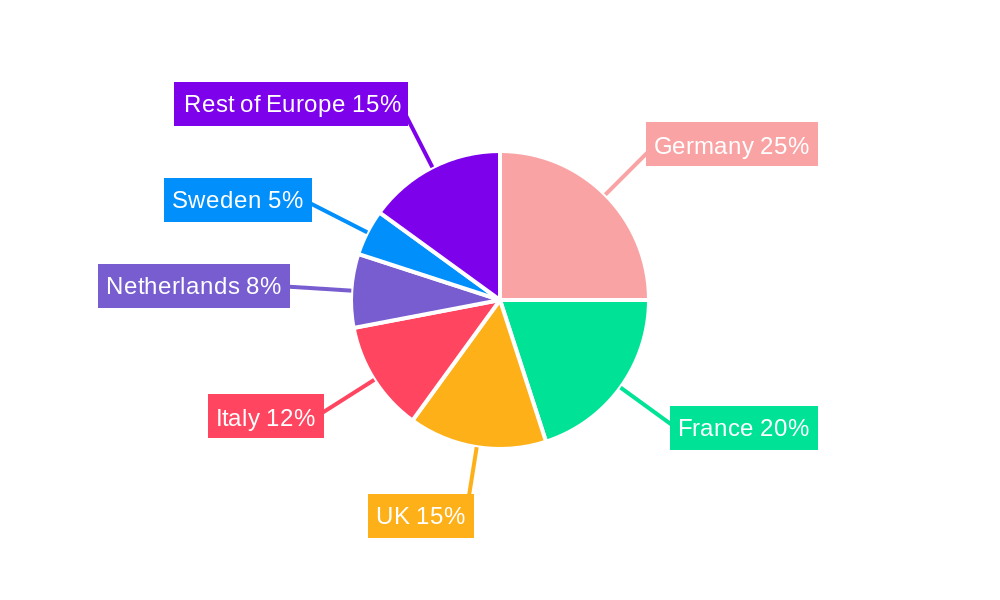

The European wheat industry, valued at €57.38 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.87% from 2025 to 2033. This expansion is fueled by several key factors. Increasing global demand for wheat-based products, driven by population growth and changing dietary habits, particularly in developing economies, creates a significant pull for European wheat exports. Simultaneously, advancements in agricultural technology, including improved seed varieties and precision farming techniques, are enhancing yields and overall efficiency within the European agricultural sector. Furthermore, the growing popularity of processed foods, including baked goods and confectionery, significantly contributes to the demand for milling and baking wheat. The European Union's agricultural policies also play a crucial role, supporting farmers and ensuring a stable supply of wheat. Specific regional variations exist, with Germany, France, and the UK representing the largest markets within Europe, although other nations like Italy and the Netherlands also contribute significantly to the overall production and consumption.

European Wheat Industry Market Size (In Billion)

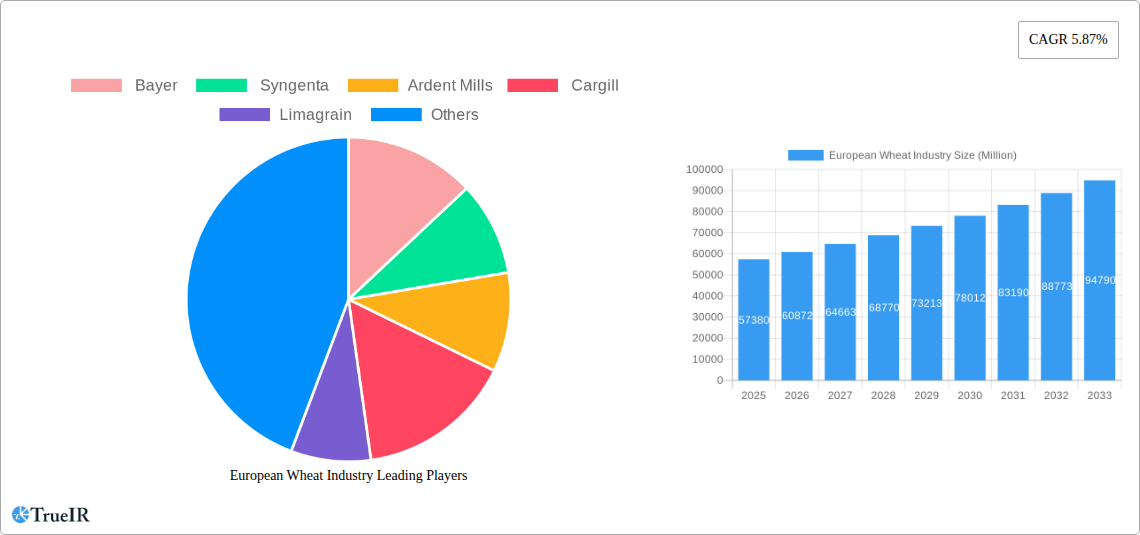

However, the industry also faces challenges. Climate change poses a significant threat, with unpredictable weather patterns impacting yields and potentially leading to price volatility. Fluctuations in global commodity prices and the increasing cost of inputs, such as fertilizers and pesticides, can negatively impact profitability. Additionally, competition from other grain producers in different regions of the world requires European wheat producers to remain competitive in terms of both price and quality. The industry's response involves diversification, with investment in value-added products and sustainable agricultural practices mitigating some of these risks. The increasing focus on organic and sustainably produced wheat offers opportunities for niche market expansion, alongside the development of innovative wheat varieties that are more resilient to climate change and disease. The segmentation of the market—by product type (milling, confectionery, baking, and feed wheat)—allows for a more targeted approach to market analysis and business strategies. Major players like Bayer, Syngenta, Ardent Mills, Cargill, and Limagrain are actively shaping the industry's landscape through research, development, and strategic partnerships.

European Wheat Industry Company Market Share

European Wheat Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European wheat industry, covering market size, segmentation, competitive landscape, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. This report is essential for businesses, investors, and policymakers seeking to understand and navigate this vital agricultural sector.

European Wheat Industry Market Structure & Competitive Landscape

The European wheat market is characterized by a moderately concentrated structure, featuring a mix of large, influential players and a significant number of smaller, regional producers. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be around **[Insert HHI Value Here]**, suggesting a moderately competitive landscape. Prominent entities such as Bayer, Syngenta, Ardent Mills, Cargill, and Limagrain wield considerable influence, primarily due to their established vertical integration, strong brand equity, and expansive distribution networks. Innovation remains a pivotal element, with companies channeling investments into developing novel wheat varieties that offer enhanced yield potential, superior disease resistance, and improved processing characteristics. The market's dynamics are also significantly shaped by evolving regulatory frameworks pertaining to pesticides, fertilizers, and international trade policies. While alternative grains and other food sources present some degree of competitive pressure, wheat's status as a fundamental crop ensures its continued dominance. End-user segmentation is largely dictated by wheat's diverse applications, spanning milling, confectionery, baking, and animal feed. Merger and acquisition (M&A) activity has been a notable feature in recent years, with an estimated **[Insert Deal Volume Here]** million in deal volume recorded between 2019 and 2024, reflecting strategic consolidation and expansion efforts aimed at bolstering market positions.

- Market Concentration: HHI estimated at [Insert HHI Value Here]

- Key Industry Players: Bayer, Syngenta, Ardent Mills, Cargill, Limagrain

- Innovation Focus: Development of high-yielding, disease-resistant, and quality-enhanced wheat varieties.

- Regulatory Influence: EU regulations on crop protection, genetic modification, and sustainable farming practices.

- Competitive Landscape: Presence of established leaders and numerous smaller producers, with competition driven by innovation and market reach.

- Product Substitutes: Other grains (e.g., barley, rye) and emerging alternative food sources.

- End-User Segmentation: Milling wheat, confectionery wheat, baking wheat, feed wheat.

- M&A Trends: Moderate activity, with [Insert Deal Volume Here] million in deal volume (2019-2024) indicating strategic consolidation.

European Wheat Industry Market Trends & Opportunities

The European wheat market is poised for consistent growth throughout the projected forecast period of 2025-2033. The market size is estimated to reach **[Insert Market Size 2025 Here]** million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of **[Insert CAGR Here]**% extending to 2033. This upward trajectory is propelled by a confluence of factors, including a burgeoning global population, escalating demand for wheat-derived food products, and rising disposable incomes across various European nations. Technological advancements in precision agriculture, encompassing GPS-guided machinery and sophisticated data analytics, are instrumental in enhancing operational efficiency and boosting crop yields. Consumer preferences are demonstrably shifting towards sustainably cultivated wheat, thereby spurring the adoption of organic farming methods and eco-friendly agricultural technologies. The competitive arena remains dynamic, with companies prioritizing product differentiation, robust brand building, and strategic alliances to secure and expand market share. Penetration rates for organic and specialty wheat varieties are on a steady ascent, mirroring the increasing consumer appetite for healthier and more environmentally responsible food choices. The proactive engagement of major corporations like Nestlé, exemplified by initiatives such as the Nestlé Wheat Plan, underscores a significant and positive movement towards environmentally conscious production methodologies.

Dominant Markets & Segments in European Wheat Industry

The dominant market segment within the European wheat industry is milling wheat, accounting for approximately xx% of total market value in 2025. France and Germany are the leading wheat-producing countries in Europe, together dominating the overall market share.

- Key Growth Drivers for Milling Wheat:

- Strong demand from the baking industry

- Established infrastructure for wheat processing and distribution

- Government support for agricultural production

- Large-scale farming operations

The baking wheat segment also holds significant importance, closely followed by feed wheat. Confectionery wheat holds a relatively smaller share, driven by specific needs of the confectionery industry. The overall regional distribution of the market is skewed toward Western and Central European regions, given the higher agricultural yields and established processing infrastructure compared to Eastern and Southern European regions.

European Wheat Industry Product Analysis

Technological innovation is a primary catalyst within the European wheat industry, with a concentrated effort on developing wheat varieties that are both high-yielding and resistant to diseases. These advancements are directly addressing the escalating demand for sustainable and efficient agricultural practices. Furthermore, significant investments are being directed towards creating wheat varieties specifically engineered for distinct end-use applications. This targeted development enhances product quality and optimizes functionality for diverse sectors, including baking and confectionery. Such a strategic focus on product differentiation fosters a competitive edge, attracting both consumers and manufacturers who seek superior performance and quality in their wheat-based products. The seamless integration of precision agriculture technologies into farming operations, coupled with advancements in wheat processing technologies, are key characteristics driving product innovation within this dynamic sector.

Key Drivers, Barriers & Challenges in European Wheat Industry

Key Drivers:

- Increasing global demand for wheat-based products

- Technological advancements in farming and processing

- Government support for agricultural research and development

- Growing consumer preference for sustainable and organic wheat

Challenges:

- Climate change and its impact on wheat yields (estimated xx% yield reduction in some regions by 2033)

- Fluctuations in global wheat prices

- Stringent regulations on pesticide use and environmental protection

- Increasing competition from other grain producers

Growth Drivers in the European Wheat Industry Market

The expansion of the European wheat industry is underpinned by several critical drivers. Foremost among these is the relentless global demand for wheat, a fundamental food staple worldwide, which provides a solid and consistent market for European producers. Technological breakthroughs in precision agriculture, encompassing the development of superior seed varieties, efficient irrigation systems, and advanced data analytics, play a pivotal role in augmenting yields and curtailing production expenditures. Furthermore, supportive European Union policies that champion sustainable agriculture and foster innovation contribute significantly to stimulating growth. Finally, a growing consumer consciousness regarding food provenance and sustainability is fueling an increased demand for wheat products that are ethically sourced and produced with minimal environmental impact.

Challenges Impacting European Wheat Industry Growth

The European wheat industry faces significant hurdles. Climate change, with its erratic weather patterns and increased frequency of extreme events, poses a major threat to crop yields. Furthermore, volatile global wheat prices create uncertainty and impact profitability. Stricter environmental regulations, while necessary, often lead to higher production costs. Lastly, intense competition, both domestically and internationally, necessitates continuous innovation and efficiency improvements for survival.

Significant European Wheat Industry Industry Milestones

- July 2022: RAGT Seed Group unveiled two novel hard-milling feed winter wheat varieties exhibiting resistance to BYDV and the orange wheat blossom midge. These varieties are slated for grower availability in autumn 2023 in the UK, marking a significant stride towards insecticide-free, sustainable wheat cultivation.

- June 2022: Nestlé Cereals launched the "Nestlé Wheat Plan," a strategic initiative aimed at promoting sustainable agricultural practices through collaborative partnerships with British wheat farmers. This endeavor underscores the intensifying emphasis on sustainable and ethically responsible sourcing throughout the industry.

Future Outlook for European Wheat Industry Market

The future of the European wheat industry appears promising, driven by consistent global demand, technological advancements, and a focus on sustainable practices. Strategic opportunities lie in developing high-value wheat varieties tailored to specific market needs, embracing precision agriculture technologies, and actively participating in sustainable farming initiatives. The market's potential for growth is significant, particularly within the segments focusing on organic and specialty wheat. However, navigating challenges like climate change and fluctuating commodity prices will be crucial for continued success.

European Wheat Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

European Wheat Industry Segmentation By Geography

- 1. Spain

- 2. France

- 3. United Kingdom

- 4. Germany

- 5. Russia

European Wheat Industry Regional Market Share

Geographic Coverage of European Wheat Industry

European Wheat Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Increase in the demand for Wheat based products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Wheat Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Spain

- 5.6.2. France

- 5.6.3. United Kingdom

- 5.6.4. Germany

- 5.6.5. Russia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Spain European Wheat Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. France European Wheat Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. United Kingdom European Wheat Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Germany European Wheat Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Russia European Wheat Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bayer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Syngenta

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ardent Mills

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cargill

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Limagrain

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Bayer

List of Figures

- Figure 1: European Wheat Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Wheat Industry Share (%) by Company 2025

List of Tables

- Table 1: European Wheat Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: European Wheat Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: European Wheat Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: European Wheat Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: European Wheat Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: European Wheat Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: European Wheat Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: European Wheat Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: European Wheat Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: European Wheat Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: European Wheat Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: European Wheat Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: European Wheat Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: European Wheat Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: European Wheat Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: European Wheat Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: European Wheat Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: European Wheat Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: European Wheat Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: European Wheat Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: European Wheat Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: European Wheat Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: European Wheat Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: European Wheat Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: European Wheat Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: European Wheat Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 27: European Wheat Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 28: European Wheat Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 29: European Wheat Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: European Wheat Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 31: European Wheat Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 32: European Wheat Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 33: European Wheat Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 34: European Wheat Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 35: European Wheat Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: European Wheat Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 37: European Wheat Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 38: European Wheat Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 39: European Wheat Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 40: European Wheat Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 41: European Wheat Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 42: European Wheat Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: European Wheat Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: European Wheat Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 45: European Wheat Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 46: European Wheat Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 47: European Wheat Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: European Wheat Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 49: European Wheat Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 50: European Wheat Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 51: European Wheat Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 52: European Wheat Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 53: European Wheat Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 54: European Wheat Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: European Wheat Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: European Wheat Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 57: European Wheat Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 58: European Wheat Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 59: European Wheat Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: European Wheat Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 61: European Wheat Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 62: European Wheat Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 63: European Wheat Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 64: European Wheat Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 65: European Wheat Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 66: European Wheat Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 67: European Wheat Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 68: European Wheat Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 69: European Wheat Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 70: European Wheat Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 71: European Wheat Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: European Wheat Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Wheat Industry?

The projected CAGR is approximately 5.87%.

2. Which companies are prominent players in the European Wheat Industry?

Key companies in the market include Bayer , Syngenta , Ardent Mills, Cargill , Limagrain .

3. What are the main segments of the European Wheat Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Increase in the demand for Wheat based products.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

July 2022: RAGT Seed Group developed two new hard-milling feed winter wheat varieties that it claims are resistant to BYDV and the orange wheat blossom midge. It is speeding up their multiplication so that growers can drill them next year and harvest them in 2024. It claimed that these insecticide-free winter wheat varieties are expected to be available for growers in autumn 2023 in the UK.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Wheat Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Wheat Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Wheat Industry?

To stay informed about further developments, trends, and reports in the European Wheat Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence