Key Insights

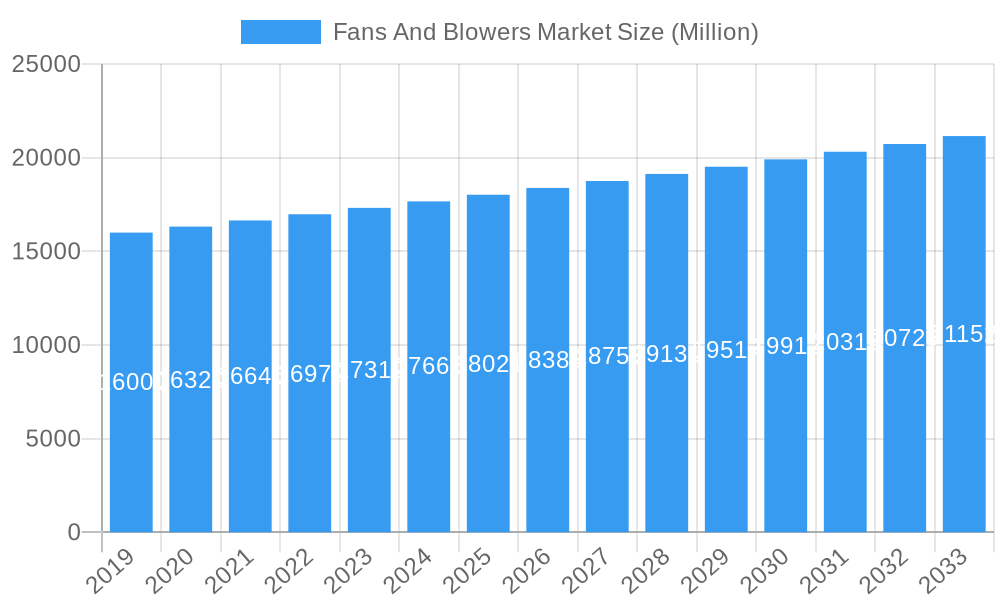

The global Fans and Blowers Market is experiencing robust growth, projected to reach an estimated market size of approximately $18,500 million by 2025. This expansion is driven by a confluence of factors, including escalating industrialization across emerging economies and the sustained demand from established sectors like power generation, oil and gas, and chemicals. The market's positive trajectory is further bolstered by increasing investments in infrastructure development, smart manufacturing initiatives, and the ongoing need for efficient ventilation and air movement solutions in both industrial and commercial settings. The inherent energy efficiency benefits of modern fans and blowers also contribute significantly to their adoption, aligning with global sustainability mandates and driving demand for technologically advanced and eco-friendly products.

Fans And Blowers Market Market Size (In Billion)

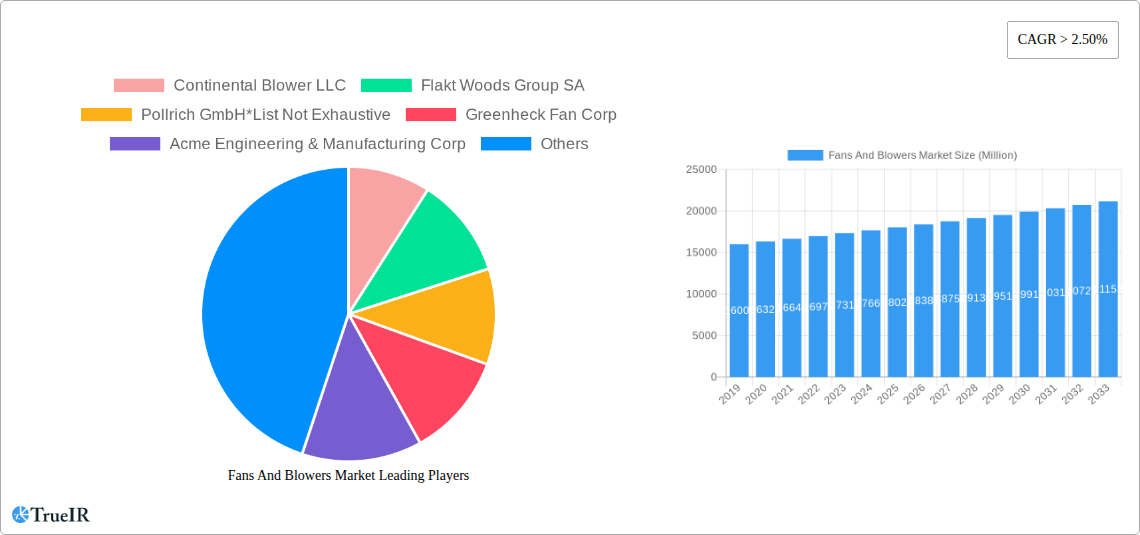

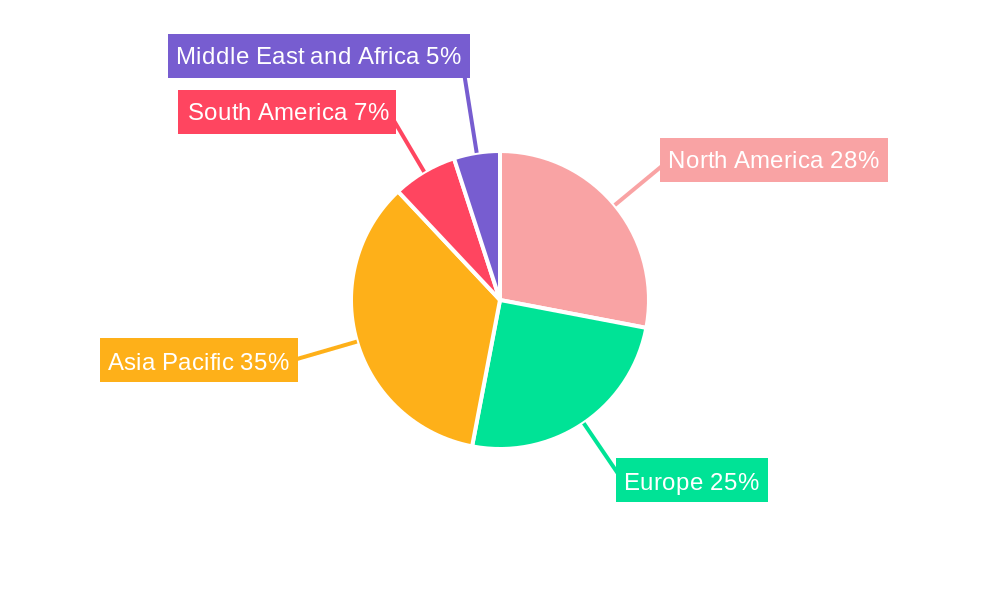

The market's growth is further underscored by a Compound Annual Growth Rate (CAGR) exceeding 2.50%, indicating a steady and reliable expansion over the forecast period of 2025-2033. Key technological trends such as the increasing adoption of centrifugal and axial fan technologies, renowned for their versatility and performance in diverse applications, are shaping market dynamics. The industrial segment is a dominant force, encompassing power generation, oil and gas, construction, iron and steel, chemicals, and mining. Commercial applications also represent a significant and growing segment. Leading companies like Continental Blower LLC, Flakt Woods Group SA, Pollrich GmbH, and Greenheck Fan Corp are actively innovating and expanding their product portfolios to cater to these evolving demands. Geographically, the Asia Pacific region is anticipated to emerge as a significant growth engine, fueled by rapid industrial development and substantial infrastructure projects, while North America and Europe will continue to represent mature yet vital markets.

Fans And Blowers Market Company Market Share

This comprehensive report delivers an in-depth analysis of the global fans and blowers market, exploring its current landscape, emerging trends, and future trajectory. Leveraging high-volume keywords such as "industrial fans," "commercial blowers," "HVAC solutions," "air movement systems," and "ventilation equipment," this report is meticulously designed for industry professionals seeking actionable insights and strategic guidance. The study encompasses a robust study period from 2019 to 2033, with a base year of 2025, and an estimated year also of 2025, followed by a detailed forecast period from 2025 to 2033, building upon a historical period from 2019 to 2024.

Fans And Blowers Market Market Structure & Competitive Landscape

The global fans and blowers market exhibits a moderately concentrated structure, with key players dominating significant market share. Innovation drivers are largely propelled by the demand for energy efficiency, compliance with stringent environmental regulations, and advancements in materials science leading to lighter and more durable fan and blower designs. Regulatory impacts, particularly concerning noise pollution and energy consumption standards, are shaping product development and market entry barriers. Product substitutes, while present in niche applications, are generally outpaced by the specialized performance and cost-effectiveness of traditional fans and blowers. End-user segmentation is critical, with industrial applications, particularly in Power Generation, Oil and Gas, Construction, Iron and Steel, Chemicals, and Mining, representing the largest and most dynamic segment. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, approximately 15-20% of market players are involved in M&A activities annually, aiming for consolidation and synergy realization. Concentration ratios (CR4) for the overall market are estimated to be around 40-50%, indicating a significant presence of the top four players.

Fans And Blowers Market Market Trends & Opportunities

The global fans and blowers market is poised for substantial growth, driven by increasing industrialization, urbanization, and a growing emphasis on indoor air quality and energy efficiency. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% to 6.5% during the forecast period (2025-2033). This growth is fueled by technological shifts towards more intelligent and energy-efficient systems, including variable speed drives (VSDs) and smart sensors that optimize performance and reduce energy consumption. Consumer preferences are increasingly leaning towards quieter, more reliable, and environmentally friendly solutions. In the industrial sector, the demand for high-performance fans and blowers in sectors like Oil and Gas and Chemicals is particularly robust due to the need for efficient ventilation, material handling, and process cooling. The increasing adoption of advanced manufacturing techniques and the development of novel alloys are contributing to product innovation, leading to enhanced durability and operational efficiency. Opportunities abound in emerging economies where infrastructure development and industrial expansion are accelerating. Furthermore, the growing awareness of the health impacts of poor indoor air quality is driving demand for advanced ventilation solutions in commercial and residential sectors. The market penetration of energy-efficient fans and blowers is expected to rise significantly, as government incentives and corporate sustainability goals align to promote greener technologies. The competitive landscape is characterized by continuous product development and strategic partnerships aimed at capturing market share.

Dominant Markets & Segments in Fans And Blowers Market

The Industrial segment stands as the dominant market within the global fans and blowers ecosystem, accounting for over 60% of the overall market revenue. Within the industrial deployment, sectors such as Power Generation, Oil and Gas, and Chemicals are the primary growth engines. These industries require robust and high-capacity fans and blowers for critical processes like combustion air supply, flue gas desulfurization, material conveying, and process ventilation. The Centrifugal technology segment is particularly prevalent in industrial applications due to its ability to generate high pressure and handle large volumes of air or gas, making it ideal for demanding operational environments. For instance, the Oil and Gas industry's insatiable demand for safe and efficient operations necessitates specialized centrifugal blowers for gas compression and ventilation in exploration, refining, and petrochemical facilities.

- Key Growth Drivers in Industrial Deployment:

- Infrastructure Development: Ongoing and planned infrastructure projects worldwide, particularly in emerging economies, necessitate significant investment in industrial equipment, including fans and blowers for construction, manufacturing, and energy production.

- Stringent Environmental Regulations: Growing global emphasis on reducing emissions and improving air quality is driving the adoption of advanced ventilation and pollution control systems, requiring high-efficiency industrial fans and blowers.

- Technological Advancements: The continuous evolution of materials and design, leading to more energy-efficient, durable, and specialized fans and blowers, is fostering their adoption across various industrial verticals.

- Energy Sector Expansion: Investments in new power generation facilities, including renewable energy projects and upgrades to existing thermal power plants, directly translate into demand for combustion air and ventilation fans.

The Commercial segment, while smaller than industrial, is also experiencing robust growth, driven by the increasing need for efficient HVAC systems in commercial buildings, hospitals, and data centers. Axial fans find significant application in commercial settings for general ventilation and cooling due to their ability to move large volumes of air at lower pressures.

Fans And Blowers Market Product Analysis

The fans and blowers market is characterized by continuous product innovation aimed at enhancing energy efficiency, reducing noise levels, and improving operational longevity. Key advancements include the integration of variable speed drives (VSDs) for precise airflow control, the development of advanced aerodynamic designs for higher efficiency, and the use of corrosion-resistant materials for extended service life in harsh environments. These innovations cater to a wide array of applications, from critical process ventilation in the Oil and Gas sector to general air circulation in commercial buildings. The competitive advantage often lies in offering customized solutions that meet specific operational requirements, coupled with superior energy performance and lower total cost of ownership.

Key Drivers, Barriers & Challenges in Fans And Blowers Market

The fans and blowers market is propelled by several key drivers including increasing industrialization and infrastructure development, a growing emphasis on energy efficiency and sustainability, and stringent regulations mandating improved air quality and emission control. For instance, government incentives promoting energy-efficient equipment directly boost demand. Technological advancements in motor efficiency and aerodynamic design also act as significant growth catalysts.

Conversely, challenges impacting market growth include volatile raw material prices, which can affect manufacturing costs and profit margins. Supply chain disruptions, as experienced in recent global events, can lead to production delays and increased lead times. Intense competition among manufacturers can lead to price wars, compressing profit margins. Furthermore, complex regulatory landscapes in different regions can pose barriers to market entry and product standardization.

Growth Drivers in the Fans And Blowers Market Market

The fans and blowers market is experiencing significant growth fueled by several critical factors. Increasing global industrialization, particularly in developing economies, is a primary driver, leading to heightened demand for ventilation and process air solutions in manufacturing, mining, and construction. The escalating emphasis on energy efficiency and environmental sustainability is another major catalyst; stricter government regulations on emissions and energy consumption are compelling industries to adopt more efficient fans and blowers, often equipped with variable speed drives. Technological advancements, such as improved aerodynamic designs and smart control systems, are further enhancing product performance and driving adoption. Economic factors, including increased capital expenditure by industries and government investments in infrastructure, also contribute to market expansion.

Challenges Impacting Fans And Blowers Market Growth

Several challenges are currently impacting the fans and blowers market. Supply chain vulnerabilities, including disruptions in the availability of key components and raw materials, can lead to production delays and increased costs. Intense competitive pressures among both established players and emerging manufacturers can lead to price erosion and reduced profit margins. Regulatory complexities, such as differing environmental standards and certification requirements across various regions, can hinder market penetration and increase compliance costs. Furthermore, the high initial investment cost for certain advanced or specialized fan and blower systems can act as a restraint, particularly for small and medium-sized enterprises with limited capital.

Key Players Shaping the Fans And Blowers Market Market

- Continental Blower LLC

- Flakt Woods Group SA

- Pollrich GmbH

- Greenheck Fan Corp

- Acme Engineering & Manufacturing Corp

- Airmaster Fan Company Inc

- CG Power and Industrial Solutions Limited

- Gardner Denver Inc

- DongKun Industrial Co Ltd

- Loren Cook Company

- Howden Group Ltd

Significant Fans And Blowers Market Industry Milestones

- March 2023: Saudi Aramco and its Chinese partners announced their aim to start full operations of a refinery and petrochemical project in northeast China in 2026, located in Liaoning province's city of Panjin, with an estimated cost of USD 10 billion. This development signifies a substantial increase in demand for industrial fans and blowers for petrochemical processing and refinery operations.

- December 2022: Saudi Arabian Oil Company and TotalEnergies announced the final investment decision for the construction of the 'Amiral' petrochemical facility in Saudi Arabia. This complex, owned, operated, and integrated with the existing SATORP refinery in Jubail, will require extensive air movement and ventilation solutions, impacting the industrial fans and blowers market.

Future Outlook for Fans And Blowers Market Market

The future outlook for the fans and blowers market is exceptionally positive, driven by sustained industrial growth, a global push for energy efficiency, and increasing awareness of indoor air quality. Strategic opportunities lie in the development of smart, IoT-enabled fans and blowers that offer predictive maintenance and real-time performance monitoring. The expansion of renewable energy projects, particularly wind and solar farms, will also create demand for specialized ventilation and cooling solutions. Furthermore, the ongoing urbanization and infrastructure development in emerging economies present significant market potential. The increasing adoption of advanced manufacturing techniques and materials will continue to drive product innovation, leading to more cost-effective and high-performance solutions.

Fans And Blowers Market Segmentation

-

1. Technology

- 1.1. Centrifugal

- 1.2. Axial

-

2. Deployment

-

2.1. Industrial

- 2.1.1. Power Generation

- 2.1.2. Oil and Gas

- 2.1.3. Construction

- 2.1.4. Iron and Steel

- 2.1.5. Chemicals

- 2.1.6. Mining

- 2.1.7. Other Industries

- 2.2. Commercial

-

2.1. Industrial

Fans And Blowers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Fans And Blowers Market Regional Market Share

Geographic Coverage of Fans And Blowers Market

Fans And Blowers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption Of Electric Vehicles4.; Growing Concern for Battery Waste Disposal and Stringent Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Recycling Operations

- 3.4. Market Trends

- 3.4.1. Industrial Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Centrifugal

- 5.1.2. Axial

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Industrial

- 5.2.1.1. Power Generation

- 5.2.1.2. Oil and Gas

- 5.2.1.3. Construction

- 5.2.1.4. Iron and Steel

- 5.2.1.5. Chemicals

- 5.2.1.6. Mining

- 5.2.1.7. Other Industries

- 5.2.2. Commercial

- 5.2.1. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Centrifugal

- 6.1.2. Axial

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Industrial

- 6.2.1.1. Power Generation

- 6.2.1.2. Oil and Gas

- 6.2.1.3. Construction

- 6.2.1.4. Iron and Steel

- 6.2.1.5. Chemicals

- 6.2.1.6. Mining

- 6.2.1.7. Other Industries

- 6.2.2. Commercial

- 6.2.1. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Centrifugal

- 7.1.2. Axial

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Industrial

- 7.2.1.1. Power Generation

- 7.2.1.2. Oil and Gas

- 7.2.1.3. Construction

- 7.2.1.4. Iron and Steel

- 7.2.1.5. Chemicals

- 7.2.1.6. Mining

- 7.2.1.7. Other Industries

- 7.2.2. Commercial

- 7.2.1. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Centrifugal

- 8.1.2. Axial

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Industrial

- 8.2.1.1. Power Generation

- 8.2.1.2. Oil and Gas

- 8.2.1.3. Construction

- 8.2.1.4. Iron and Steel

- 8.2.1.5. Chemicals

- 8.2.1.6. Mining

- 8.2.1.7. Other Industries

- 8.2.2. Commercial

- 8.2.1. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Centrifugal

- 9.1.2. Axial

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Industrial

- 9.2.1.1. Power Generation

- 9.2.1.2. Oil and Gas

- 9.2.1.3. Construction

- 9.2.1.4. Iron and Steel

- 9.2.1.5. Chemicals

- 9.2.1.6. Mining

- 9.2.1.7. Other Industries

- 9.2.2. Commercial

- 9.2.1. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Centrifugal

- 10.1.2. Axial

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Industrial

- 10.2.1.1. Power Generation

- 10.2.1.2. Oil and Gas

- 10.2.1.3. Construction

- 10.2.1.4. Iron and Steel

- 10.2.1.5. Chemicals

- 10.2.1.6. Mining

- 10.2.1.7. Other Industries

- 10.2.2. Commercial

- 10.2.1. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Continental Blower LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flakt Woods Group SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pollrich GmbH*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Greenheck Fan Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acme Engineering & Manufacturing Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airmaster Fan Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CG Power and Industrial Solutions Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gardner Denver Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DongKun Industrial Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Loren Cook Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Howden Group Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Continental Blower LLC

List of Figures

- Figure 1: Global Fans And Blowers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 17: Asia Pacific Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 18: Asia Pacific Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 21: South America Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 23: South America Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 24: South America Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 29: Middle East and Africa Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Middle East and Africa Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Fans And Blowers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 9: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 15: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fans And Blowers Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Fans And Blowers Market?

Key companies in the market include Continental Blower LLC, Flakt Woods Group SA, Pollrich GmbH*List Not Exhaustive, Greenheck Fan Corp, Acme Engineering & Manufacturing Corp, Airmaster Fan Company Inc, CG Power and Industrial Solutions Limited, Gardner Denver Inc, DongKun Industrial Co Ltd, Loren Cook Company, Howden Group Ltd.

3. What are the main segments of the Fans And Blowers Market?

The market segments include Technology, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption Of Electric Vehicles4.; Growing Concern for Battery Waste Disposal and Stringent Government Policies.

6. What are the notable trends driving market growth?

Industrial Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Recycling Operations.

8. Can you provide examples of recent developments in the market?

March 2023: Saudi Aramco and its Chinese partners announced that they aim to start full operations of a refinery and petrochemical project in northeast China in 2026. The project is located in Liaoning province's city of Panjin and is expected to cost USD 10 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fans And Blowers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fans And Blowers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fans And Blowers Market?

To stay informed about further developments, trends, and reports in the Fans And Blowers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence