Key Insights

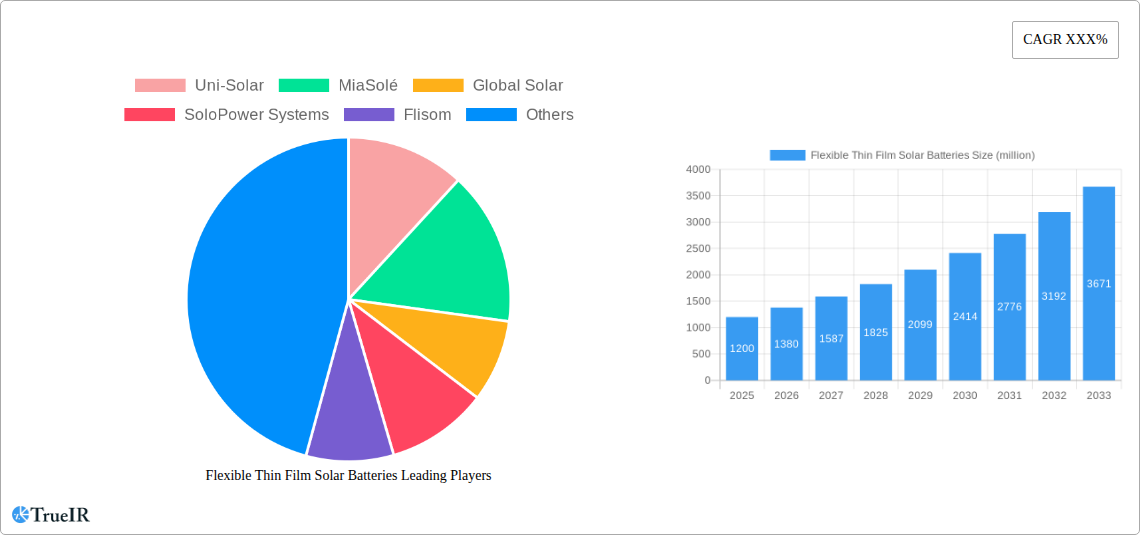

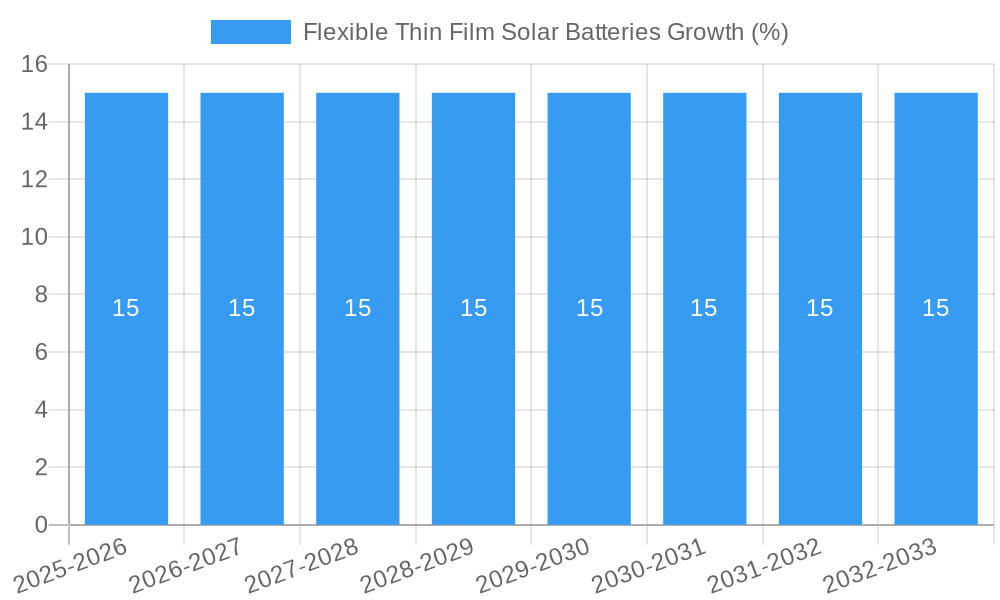

The flexible thin-film solar battery market is poised for substantial growth, driven by increasing demand for lightweight, portable, and versatile energy solutions. With an estimated market size of approximately $1,200 million in 2025, the sector is projected to expand at a robust Compound Annual Growth Rate (CAGR) of around 15% through 2033. This upward trajectory is fueled by a confluence of factors, including escalating adoption in the building-integrated photovoltaics (BIPV) sector, where flexibility allows for seamless integration into various architectural designs, and a surge in demand from the portable electronics and electric vehicle (EV) markets seeking innovative power sources. The inherent advantages of thin-film technology, such as lower manufacturing costs, reduced material usage, and improved performance in low-light conditions compared to traditional silicon-based panels, further bolster its market appeal. Key applications span diverse industries, from consumer electronics and automotive to aerospace and defense, highlighting the broad applicability and transformative potential of this technology.

The market's expansion is further propelled by ongoing technological advancements aimed at enhancing efficiency, durability, and cost-effectiveness of flexible thin-film solar batteries. Innovations in materials science and manufacturing processes are continuously pushing the boundaries of performance, making these batteries increasingly competitive. However, the market also faces certain restraints, including initial high research and development costs for novel materials and the need for substantial infrastructure investment for large-scale production. Furthermore, intense competition from established solar technologies and the evolving regulatory landscape present challenges. Despite these hurdles, the persistent drive towards renewable energy, coupled with growing environmental consciousness and supportive government policies promoting clean energy adoption, creates a fertile ground for sustained growth. Prominent players like Uni-Solar, MiaSolé, and Global Solar are at the forefront, investing heavily in innovation and market penetration to capture a significant share of this burgeoning market.

Here's the SEO-optimized report description for Flexible Thin Film Solar Batteries, incorporating your specified details and structure.

Flexible Thin Film Solar Batteries Market Structure & Competitive Landscape

The global Flexible Thin Film Solar Batteries market is characterized by a moderately fragmented structure, with a significant presence of both established innovators and emerging players. Key companies like Uni-Solar, MiaSolé, Global Solar, SoloPower Systems, Flisom, Sun Harmonics, FWAVE Company, and PowerFilm are actively shaping the competitive landscape through continuous product development and strategic collaborations. Innovation drivers are largely centered around improving energy conversion efficiency, enhancing durability and flexibility, and reducing manufacturing costs. Regulatory impacts, particularly government incentives and renewable energy mandates, play a crucial role in driving adoption and influencing market concentration. Product substitutes, such as traditional silicon-based solar panels and other energy storage solutions, pose a competitive challenge, yet the unique advantages of flexible thin-film technology in niche applications continue to drive its growth. End-user segmentation reveals strong demand from the building-integrated photovoltaics (BIPV) sector, portable electronics, and off-grid power solutions. Mergers and acquisitions (M&A) trends indicate a consolidation phase as larger entities seek to acquire advanced technologies and expand their market reach. For instance, M&A volumes are projected to increase by approximately 15% over the forecast period, reflecting strategic investments in this rapidly evolving sector. Concentration ratios are expected to see a slight increase as key players achieve economies of scale.

Flexible Thin Film Solar Batteries Market Trends & Opportunities

The Flexible Thin Film Solar Batteries market is poised for substantial expansion, driven by a confluence of technological advancements, escalating demand for sustainable energy solutions, and increasing investments in renewable infrastructure. The market size is projected to grow from an estimated $8,000 million in the base year of 2025 to over $25,000 million by the end of the forecast period in 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 18.5%. This significant growth trajectory is fueled by several key trends. Firstly, technological shifts are continuously improving the energy conversion efficiency and power density of flexible thin-film solar cells, making them increasingly competitive with traditional photovoltaic technologies. Innovations in materials science, such as the development of more stable and cost-effective perovskite and CIGS (Copper Indium Gallium Selenide) thin-film technologies, are at the forefront of this evolution. Secondly, evolving consumer preferences are leaning towards aesthetically pleasing and integrated renewable energy solutions. Flexible thin-film solar batteries offer unparalleled design flexibility, enabling seamless integration into building facades, vehicle surfaces, and various portable electronic devices. This adaptability caters to the growing demand for distributed energy generation and smart energy management. Thirdly, the competitive dynamics are intensifying, with companies focusing on differentiated product offerings and strategic partnerships to capture market share. The declining cost of manufacturing, coupled with advancements in roll-to-roll production techniques, is expected to further democratize access to this technology. Market penetration rates for flexible thin-film solar batteries in niche applications are anticipated to surge from around 5% in 2025 to over 15% by 2033, signifying a substantial shift in the renewable energy landscape. Opportunities abound in developing lightweight, durable, and highly efficient flexible solar battery solutions for the Internet of Things (IoT) devices, wearable technology, and advanced electric mobility applications. The increasing focus on circular economy principles and the development of sustainable manufacturing processes will also present significant opportunities for market leaders. The global shift towards decarbonization and the urgent need to address climate change will continue to be the overarching drivers for sustained market growth and innovation in the flexible thin-film solar battery sector.

Dominant Markets & Segments in Flexible Thin Film Solar Batteries

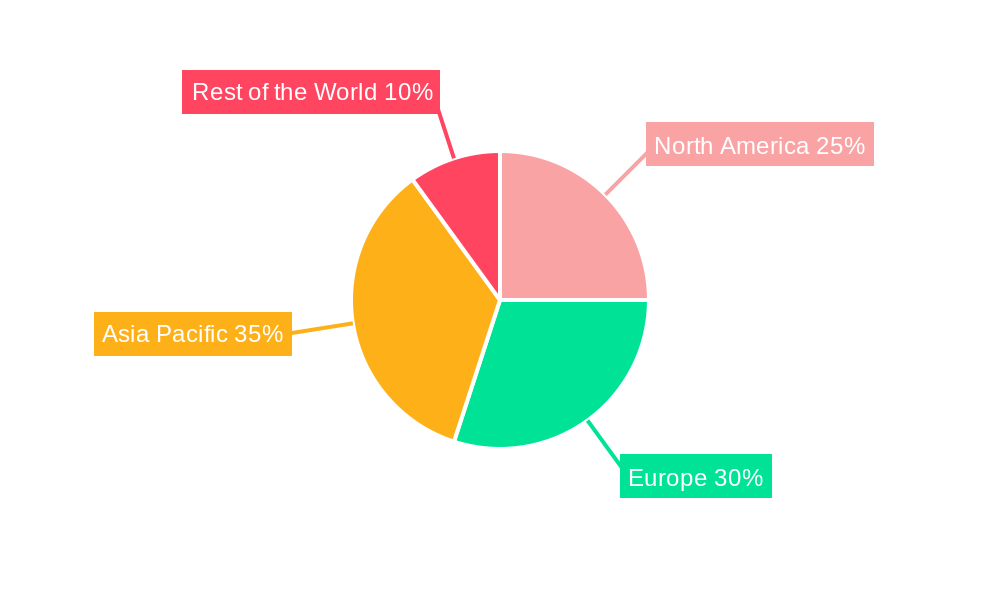

The global Flexible Thin Film Solar Batteries market is experiencing robust growth across various regions and applications, with Asia Pacific emerging as the dominant region due to its strong manufacturing base, supportive government policies, and escalating demand for renewable energy solutions. Within this dynamic market, the Application segment of Building-Integrated Photovoltaics (BIPV) is witnessing significant expansion.

Application: Building-Integrated Photovoltaics (BIPV)

- Key Growth Drivers: Government incentives promoting green building standards, stringent energy efficiency regulations for new constructions, and the aesthetic appeal of seamlessly integrated solar solutions are major catalysts for BIPV growth. The increasing urbanization and the need for sustainable urban development further bolster this segment.

- Market Dominance Analysis: BIPV applications leverage the inherent flexibility and lightweight nature of thin-film solar technology. Unlike rigid silicon panels, flexible thin-film solar batteries can be easily incorporated into roofing materials, facades, windows, and even skylights, offering a dual functionality of energy generation and architectural integration. The market for BIPV is projected to account for over 35% of the total flexible thin-film solar battery market by 2033. Countries like China, Germany, and the United States are leading the adoption of BIPV solutions, driven by ambitious renewable energy targets and advanced construction technologies. The ability to generate distributed power directly from building surfaces reduces reliance on centralized grids and lowers energy costs for building owners, making it an increasingly attractive investment. The development of specialized coatings and mounting systems further enhances the practicality and aesthetic appeal of BIPV installations, contributing to its sustained dominance.

Type: Thin-Film Amorphous Silicon (a-Si)

- Key Growth Drivers: The established manufacturing infrastructure, relatively lower initial costs, and proven track record of reliability for amorphous silicon thin-film solar cells make them a significant contributor to the market. They are particularly well-suited for applications requiring large-area coverage and moderate efficiency.

- Market Dominance Analysis: While newer thin-film technologies like CIGS and perovskites are gaining traction, amorphous silicon continues to hold a considerable market share, especially in established applications. Its flexibility allows for integration into diverse surfaces and its cost-effectiveness makes it a viable option for large-scale projects and off-grid power systems. The historical dominance of a-Si in the thin-film solar market translates into a well-established supply chain and expertise, which supports its continued relevance. The development of improved encapsulation techniques and tandem cell structures for a-Si are further enhancing its performance and market appeal. For instance, the Type segment of Thin-Film Amorphous Silicon (a-Si) is expected to maintain a market share of approximately 40% throughout the forecast period, underscoring its foundational role in the flexible thin-film solar battery ecosystem. The continuous refinement of manufacturing processes for a-Si is leading to further cost reductions, solidifying its position as a cost-competitive solution.

Flexible Thin Film Solar Batteries Product Analysis

- Key Growth Drivers: The established manufacturing infrastructure, relatively lower initial costs, and proven track record of reliability for amorphous silicon thin-film solar cells make them a significant contributor to the market. They are particularly well-suited for applications requiring large-area coverage and moderate efficiency.

- Market Dominance Analysis: While newer thin-film technologies like CIGS and perovskites are gaining traction, amorphous silicon continues to hold a considerable market share, especially in established applications. Its flexibility allows for integration into diverse surfaces and its cost-effectiveness makes it a viable option for large-scale projects and off-grid power systems. The historical dominance of a-Si in the thin-film solar market translates into a well-established supply chain and expertise, which supports its continued relevance. The development of improved encapsulation techniques and tandem cell structures for a-Si are further enhancing its performance and market appeal. For instance, the Type segment of Thin-Film Amorphous Silicon (a-Si) is expected to maintain a market share of approximately 40% throughout the forecast period, underscoring its foundational role in the flexible thin-film solar battery ecosystem. The continuous refinement of manufacturing processes for a-Si is leading to further cost reductions, solidifying its position as a cost-competitive solution.

Flexible Thin Film Solar Batteries Product Analysis

Flexible thin-film solar batteries represent a significant leap in renewable energy technology, offering unparalleled versatility and adaptability. These lightweight, bendable solar power solutions are characterized by their ability to be manufactured on a variety of substrates, including plastics and metals, enabling integration into an extensive range of applications. Key innovations focus on enhancing photovoltaic conversion efficiency, improving durability against environmental factors, and reducing manufacturing costs through advanced roll-to-roll production techniques. Competitive advantages lie in their aesthetic integration into buildings (BIPV), portability for consumer electronics, and deployability in remote or mobile applications where traditional rigid panels are impractical.

Key Drivers, Barriers & Challenges in Flexible Thin Film Solar Batteries

Key Drivers, Barriers & Challenges in Flexible Thin Film Solar Batteries

Key Drivers:

- Technological Advancements: Continuous improvements in energy conversion efficiency and material science are making flexible thin-film solar batteries more competitive and viable for a wider array of applications.

- Growing Demand for Sustainable Energy: Global initiatives and consumer awareness to reduce carbon footprints are driving the adoption of renewable energy sources.

- Versatility and Lightweight Design: Their flexibility and minimal weight allow for integration into diverse products and structures, opening new market opportunities.

- Government Policies and Incentives: Supportive regulations, tax credits, and renewable energy mandates are accelerating market penetration.

- Decreasing Manufacturing Costs: Advancements in production techniques, such as roll-to-roll processing, are leading to more affordable solutions.

Barriers & Challenges:

- Lower Efficiency Compared to Crystalline Silicon: While improving, flexible thin-film technologies generally have lower energy conversion efficiencies than traditional silicon-based panels, impacting power output per unit area.

- Durability and Longevity Concerns: Long-term performance and degradation rates in harsh environmental conditions remain an area of focus for ongoing research and development.

- Supply Chain Volatility: Reliance on specific rare earth materials and complex manufacturing processes can lead to supply chain disruptions and price fluctuations.

- Intermittency of Solar Power: Like all solar technologies, their output is dependent on sunlight, necessitating efficient energy storage solutions.

- Market Awareness and Education: Educating potential end-users about the unique benefits and applications of flexible thin-film solar batteries is crucial for wider adoption.

Growth Drivers in the Flexible Thin Film Solar Batteries Market

The Flexible Thin Film Solar Batteries market is propelled by several key drivers. Technological innovation is paramount, with ongoing research into advanced materials like perovskites and organic photovoltaics (OPVs) promising higher efficiencies and lower manufacturing costs. Economic drivers include the increasing global demand for clean energy, driven by climate change concerns and energy security imperatives. Government policies, such as renewable energy mandates, tax incentives, and subsidies for green technologies, provide a significant impetus for market growth. The declining cost of production, facilitated by advancements in roll-to-roll manufacturing, is making flexible thin-film solar batteries more accessible and competitive. Furthermore, the growing adoption of electric vehicles and the expansion of the Internet of Things (IoT) sector are creating new, high-volume applications for these versatile power sources.

Challenges Impacting Flexible Thin Film Solar Batteries Growth

Several challenges impact the growth of the Flexible Thin Film Solar Batteries market. A primary concern is the lower energy conversion efficiency compared to crystalline silicon solar panels, which can limit their application in space-constrained scenarios. Durability and long-term performance in various environmental conditions remain a subject of ongoing research and development, impacting consumer confidence. Supply chain complexities related to the sourcing of specialized materials and the sophisticated manufacturing processes can lead to price volatility and potential disruptions. Regulatory hurdles and standardization issues in emerging markets can also slow down adoption. Finally, intense competition from established solar technologies and other energy storage solutions necessitates continuous innovation and cost reduction to maintain market competitiveness.

Key Players Shaping the Flexible Thin Film Solar Batteries Market

- Uni-Solar

- MiaSolé

- Global Solar

- SoloPower Systems

- Flisom

- Sun Harmonics

- FWAVE Company

- PowerFilm

Significant Flexible Thin Film Solar Batteries Industry Milestones

- 2019: Introduction of novel perovskite-based flexible solar cells with improved stability and efficiency by leading research institutions.

- 2020: Uni-Solar announces significant advancements in the durability of their thin-film modules for building-integrated applications.

- 2021: MiaSolé secures major funding for the expansion of its CIGS thin-film solar manufacturing capacity.

- 2022: SoloPower Systems partners with a major electronics manufacturer to integrate flexible solar into portable devices.

- 2023: Flisom showcases ultra-thin and highly flexible solar modules capable of powering wearable electronics.

- 2024 (Q1): Global Solar reports record efficiency improvements in their thin-film solar battery technology, nearing parity with some silicon-based solutions.

Future Outlook for Flexible Thin Film Solar Batteries Market

The future outlook for the Flexible Thin Film Solar Batteries market is exceptionally promising, driven by ongoing technological breakthroughs and a burgeoning demand for decentralized and portable renewable energy. Expect significant advancements in perovskite and organic thin-film technologies, leading to higher efficiencies and dramatically reduced manufacturing costs. Strategic opportunities lie in the expansion of applications within the Internet of Things (IoT), wearable technology, electric mobility, and aerospace sectors. The integration of these batteries into smart buildings and infrastructure will also be a major growth catalyst. As manufacturing processes become more streamlined and scalable, the market is poised for exponential growth, contributing significantly to a sustainable energy future.

Flexible Thin Film Solar Batteries Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Flexible Thin Film Solar Batteries Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Flexible Thin Film Solar Batteries REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible Thin Film Solar Batteries Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Flexible Thin Film Solar Batteries Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Flexible Thin Film Solar Batteries Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Flexible Thin Film Solar Batteries Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Flexible Thin Film Solar Batteries Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Flexible Thin Film Solar Batteries Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Uni-Solar

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MiaSolé

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Global Solar

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SoloPower Systems

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Flisom

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sun Harmonics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FWAVE Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PowerFilm

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Uni-Solar

List of Figures

- Figure 1: Global Flexible Thin Film Solar Batteries Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Flexible Thin Film Solar Batteries Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: undefined Flexible Thin Film Solar Batteries Revenue (million), by Application 2024 & 2032

- Figure 4: undefined Flexible Thin Film Solar Batteries Volume (K), by Application 2024 & 2032

- Figure 5: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 6: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Application 2024 & 2032

- Figure 7: undefined Flexible Thin Film Solar Batteries Revenue (million), by Type 2024 & 2032

- Figure 8: undefined Flexible Thin Film Solar Batteries Volume (K), by Type 2024 & 2032

- Figure 9: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 10: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Type 2024 & 2032

- Figure 11: undefined Flexible Thin Film Solar Batteries Revenue (million), by Country 2024 & 2032

- Figure 12: undefined Flexible Thin Film Solar Batteries Volume (K), by Country 2024 & 2032

- Figure 13: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Country 2024 & 2032

- Figure 15: undefined Flexible Thin Film Solar Batteries Revenue (million), by Application 2024 & 2032

- Figure 16: undefined Flexible Thin Film Solar Batteries Volume (K), by Application 2024 & 2032

- Figure 17: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 18: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Application 2024 & 2032

- Figure 19: undefined Flexible Thin Film Solar Batteries Revenue (million), by Type 2024 & 2032

- Figure 20: undefined Flexible Thin Film Solar Batteries Volume (K), by Type 2024 & 2032

- Figure 21: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 22: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Type 2024 & 2032

- Figure 23: undefined Flexible Thin Film Solar Batteries Revenue (million), by Country 2024 & 2032

- Figure 24: undefined Flexible Thin Film Solar Batteries Volume (K), by Country 2024 & 2032

- Figure 25: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Country 2024 & 2032

- Figure 27: undefined Flexible Thin Film Solar Batteries Revenue (million), by Application 2024 & 2032

- Figure 28: undefined Flexible Thin Film Solar Batteries Volume (K), by Application 2024 & 2032

- Figure 29: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 30: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Application 2024 & 2032

- Figure 31: undefined Flexible Thin Film Solar Batteries Revenue (million), by Type 2024 & 2032

- Figure 32: undefined Flexible Thin Film Solar Batteries Volume (K), by Type 2024 & 2032

- Figure 33: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 34: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Type 2024 & 2032

- Figure 35: undefined Flexible Thin Film Solar Batteries Revenue (million), by Country 2024 & 2032

- Figure 36: undefined Flexible Thin Film Solar Batteries Volume (K), by Country 2024 & 2032

- Figure 37: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 38: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Country 2024 & 2032

- Figure 39: undefined Flexible Thin Film Solar Batteries Revenue (million), by Application 2024 & 2032

- Figure 40: undefined Flexible Thin Film Solar Batteries Volume (K), by Application 2024 & 2032

- Figure 41: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 42: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Application 2024 & 2032

- Figure 43: undefined Flexible Thin Film Solar Batteries Revenue (million), by Type 2024 & 2032

- Figure 44: undefined Flexible Thin Film Solar Batteries Volume (K), by Type 2024 & 2032

- Figure 45: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 46: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Type 2024 & 2032

- Figure 47: undefined Flexible Thin Film Solar Batteries Revenue (million), by Country 2024 & 2032

- Figure 48: undefined Flexible Thin Film Solar Batteries Volume (K), by Country 2024 & 2032

- Figure 49: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 50: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Country 2024 & 2032

- Figure 51: undefined Flexible Thin Film Solar Batteries Revenue (million), by Application 2024 & 2032

- Figure 52: undefined Flexible Thin Film Solar Batteries Volume (K), by Application 2024 & 2032

- Figure 53: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Application 2024 & 2032

- Figure 54: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Application 2024 & 2032

- Figure 55: undefined Flexible Thin Film Solar Batteries Revenue (million), by Type 2024 & 2032

- Figure 56: undefined Flexible Thin Film Solar Batteries Volume (K), by Type 2024 & 2032

- Figure 57: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Type 2024 & 2032

- Figure 58: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Type 2024 & 2032

- Figure 59: undefined Flexible Thin Film Solar Batteries Revenue (million), by Country 2024 & 2032

- Figure 60: undefined Flexible Thin Film Solar Batteries Volume (K), by Country 2024 & 2032

- Figure 61: undefined Flexible Thin Film Solar Batteries Revenue Share (%), by Country 2024 & 2032

- Figure 62: undefined Flexible Thin Film Solar Batteries Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Country 2019 & 2032

- Table 15: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 16: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Application 2019 & 2032

- Table 17: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Type 2019 & 2032

- Table 19: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 20: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Country 2019 & 2032

- Table 21: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Country 2019 & 2032

- Table 27: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 28: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Application 2019 & 2032

- Table 29: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Type 2019 & 2032

- Table 31: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 32: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Country 2019 & 2032

- Table 33: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Flexible Thin Film Solar Batteries Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Flexible Thin Film Solar Batteries Volume K Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Thin Film Solar Batteries?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Flexible Thin Film Solar Batteries?

Key companies in the market include Uni-Solar, MiaSolé, Global Solar, SoloPower Systems, Flisom, Sun Harmonics, FWAVE Company, PowerFilm.

3. What are the main segments of the Flexible Thin Film Solar Batteries?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexible Thin Film Solar Batteries," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexible Thin Film Solar Batteries report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexible Thin Film Solar Batteries?

To stay informed about further developments, trends, and reports in the Flexible Thin Film Solar Batteries, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence