Key Insights

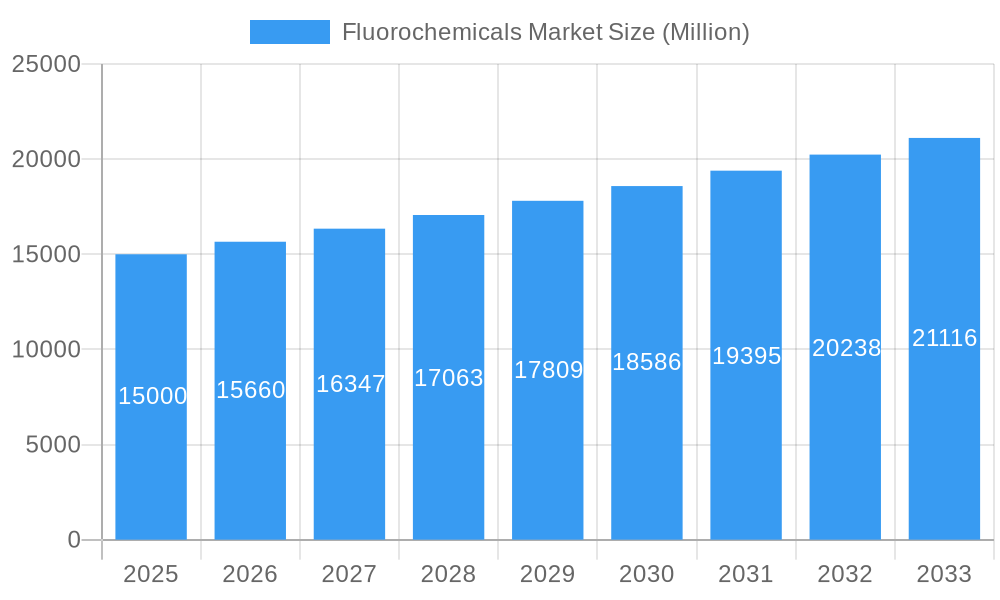

The global fluorochemicals market, currently valued at approximately $XX million (estimated based on available CAGR and market trends), is projected to experience robust growth, exceeding a 4.40% CAGR from 2025 to 2033. This expansion is driven by several key factors. The increasing demand from the refrigeration and air conditioning sector, fueled by rising global temperatures and stringent environmental regulations promoting energy-efficient refrigerants, is a significant contributor. Furthermore, the automotive industry's adoption of fluorochemicals in various components, coupled with the burgeoning electronics and semiconductor sectors relying on these materials for advanced applications, significantly boosts market growth. Growth is also fueled by the expanding pharmaceuticals and textile industries, which utilize fluorochemicals for their unique properties. While certain regulatory concerns regarding environmental impact might present restraints, technological advancements focusing on sustainable manufacturing processes and the development of eco-friendly fluorochemical alternatives are mitigating these challenges. The market is segmented by product type (fluorocarbon, fluoropolymer, specialty and inorganic chemicals, and other products) and application (refrigeration and air conditioning, automotive, electrical and electronics, pharmaceuticals, textile and chemicals, military and defense, space, and other end-user industries). Key players like Honeywell International Inc., Arkema, and 3M are strategically positioned to capitalize on this expanding market through innovation and expansion. The Asia-Pacific region, particularly China and India, is anticipated to lead market growth due to rapid industrialization and increasing demand across various sectors.

Fluorochemicals Market Market Size (In Billion)

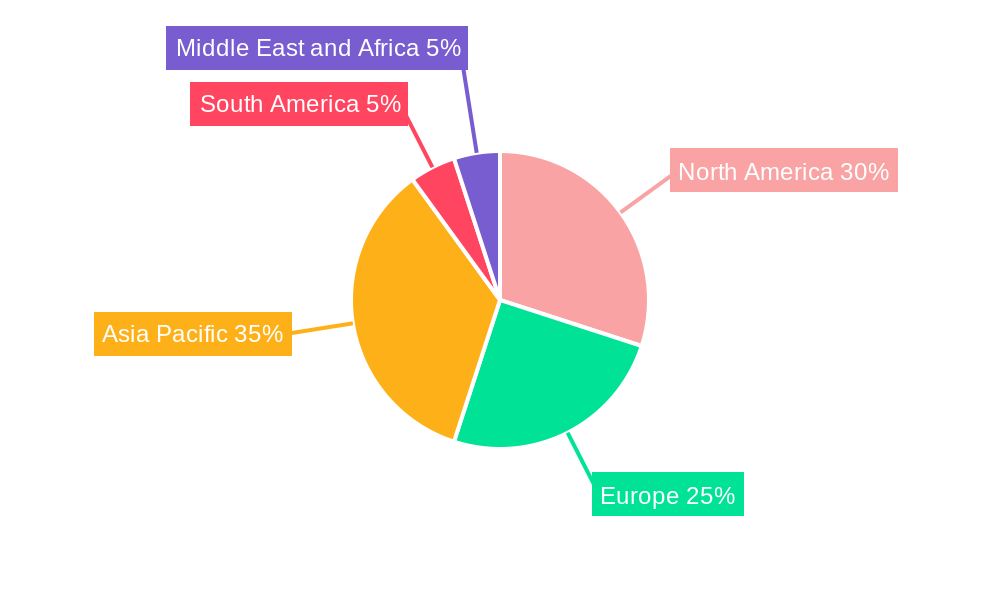

The competitive landscape is characterized by a mix of large multinational corporations and specialized regional players. Successful companies are focusing on research and development to create innovative fluorochemicals that meet stringent environmental and performance requirements. Strategic partnerships and acquisitions are also prevalent strategies for gaining market share. Regional variations in regulations and demand influence market dynamics; North America and Europe maintain strong market positions due to established industries, while the Asia-Pacific region is experiencing rapid expansion driven by rising industrial output. The forecast period suggests continued growth, albeit with potential fluctuations influenced by global economic trends and technological innovations. Continued focus on sustainability and the development of environmentally benign alternatives will significantly influence the trajectory of this market in the coming years.

Fluorochemicals Market Company Market Share

This comprehensive report provides a detailed analysis of the global fluorochemicals market, offering invaluable insights for businesses, investors, and researchers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current market dynamics, and future growth projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Fluorochemicals Market Structure & Competitive Landscape

The fluorochemicals market is characterized by a moderately concentrated competitive landscape, with several major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Key drivers of innovation include the ongoing development of new fluoropolymers with enhanced properties, such as higher temperature resistance and chemical inertness. Regulatory impacts, particularly concerning environmental concerns related to certain fluorochemicals, significantly influence market dynamics. The increasing stringency of regulations related to ozone depletion and greenhouse gas emissions is pushing companies towards the development of more sustainable alternatives. Product substitutes, such as silicone-based materials and other specialized polymers, pose a competitive challenge. However, the unique properties of fluorochemicals, such as their high thermal stability and chemical resistance, ensure continued demand in specific applications. End-user segmentation is diverse, spanning refrigeration, automotive, electronics, pharmaceuticals, and various other industries. The market has witnessed several mergers and acquisitions (M&A) activities in recent years, as companies consolidate their positions and expand their product portfolios. The volume of M&A transactions in the fluorochemicals market between 2019 and 2024 is estimated at xx deals.

Fluorochemicals Market Market Trends & Opportunities

The global fluorochemicals market is experiencing robust growth driven by expanding applications across diverse industries. The market size is projected to expand significantly over the forecast period. Technological advancements, such as the development of new polymerization techniques and the introduction of innovative fluorochemicals with enhanced properties, are fueling market growth. Consumer preferences for higher-performing and environmentally friendly products are also shaping market trends. The rising adoption of fluoropolymers in high-performance applications, like semiconductor manufacturing and aerospace, is a key driver. Furthermore, the increasing demand for specialized fluorochemicals in the pharmaceutical and electronics sectors presents significant growth opportunities. The market penetration rate of fluoropolymers in the electronics industry is estimated at xx% in 2025, projected to increase to xx% by 2033. Competitive dynamics are shaped by ongoing innovation, technological advancements, and strategic alliances.

Dominant Markets & Segments in Fluorochemicals Market

The North American and European regions currently dominate the fluorochemicals market, driven by robust demand from various end-use industries. However, the Asia-Pacific region is witnessing rapid growth, fueled by the expansion of manufacturing activities and increasing investments in infrastructure.

Key Growth Drivers by Segment:

Product: Fluoropolymers are the fastest-growing segment, propelled by their versatile applications across industries.

- Fluorocarbons: Strong demand in refrigeration and air conditioning applications.

- Fluoropolymers: High growth potential driven by semiconductor and aerospace industries.

- Specialty and Inorganic Fluorochemicals: Niche applications in pharmaceuticals and electronics.

Application:

- Refrigeration and Air Conditioning: Growing demand due to increasing adoption of environmentally friendly refrigerants.

- Electrical and Electronics (incl. Semiconductors): High-growth segment due to increasing electronics manufacturing.

- Pharmaceuticals: Steady demand due to the use of fluorochemicals as drug intermediates and excipients.

Fluorochemicals Market Product Analysis

Significant advancements in fluoropolymer technology have led to the development of high-performance materials with enhanced thermal stability, chemical resistance, and dielectric properties. These advancements are expanding the applications of fluorochemicals in various sectors, such as electronics, aerospace, and automotive industries. The focus on environmentally benign alternatives is also driving innovation, leading to the development of fluorochemicals with reduced environmental impact.

Key Drivers, Barriers & Challenges in Fluorochemicals Market

Key Drivers:

The growing demand for high-performance materials across multiple industries (semiconductors, automotive, aerospace) is a major driver. Furthermore, stringent environmental regulations are pushing the adoption of environmentally friendly fluorochemical alternatives. Technological advancements continually enhance the properties of existing materials and create new possibilities.

Challenges & Restraints:

High production costs and the complex manufacturing processes associated with fluorochemicals are significant barriers to entry and market expansion. Stricter environmental regulations and safety concerns are causing supply chain disruptions, increasing compliance costs. Intense competition among established players necessitates continual innovation to maintain market share. The estimated impact of these challenges on market growth is a reduction of xx% in CAGR.

Growth Drivers in the Fluorochemicals Market Market

Technological advancements continue to drive growth, particularly in fluoropolymer development, leading to novel applications. The increasing demand across multiple end-use industries, such as electronics and automotive, fuels steady market expansion. Favorable government policies and regulations are expected to further stimulate growth in specific segments.

Challenges Impacting Fluorochemicals Market Growth

Stringent environmental regulations and safety concerns pose challenges to market expansion. The complex manufacturing processes and high production costs create entry barriers. Competitive pressures, coupled with fluctuating raw material prices, can impact profitability and growth.

Key Players Shaping the Fluorochemicals Market Market

- Honeywell International Inc

- Arkema

- Derivados del Flúor S A U (MINERSA GROUP)

- Dynax Corporation

- Solvay

- Dongyue Group

- 3M

- Anupam Rasayan India Ltd (Tanfac Industries Ltd )

- DAIKIN INDUSTRIES Ltd

- SRF Limited

- AGC Chemicals Americas

- HaloPolymer

- Navin Fluorine International Limited

- The Chemours Company

- DIC CORPORATION

- Koura

- MAFLONS P A

- Gujarat Fluorochemicals Limited

Significant Fluorochemicals Market Industry Milestones

- November 2022: Gujarat Fluorochemicals Ltd announced plans to expand its AHF capacity from 120 tpd to 220 tpd, boosting supply for fluoropolymers, refrigerant gases, and battery chemicals. This expansion signals a significant investment in the fluorochemicals sector and will likely increase the market's overall capacity.

- September 2022: Gujarat Fluorochemicals Ltd. expressed optimism regarding growth opportunities in fluoropolymers and battery chemicals. Planned capacity expansions (7x in FKM, 4x in PVDF, and 4x in PFA) will significantly impact future revenue and market share.

Future Outlook for Fluorochemicals Market Market

The fluorochemicals market is poised for continued growth, driven by ongoing technological innovation, expanding applications in emerging sectors, and supportive government policies. Strategic partnerships and collaborations among industry players will play a key role in driving innovation and market expansion. The market presents attractive opportunities for companies focused on developing sustainable and high-performance fluorochemicals.

Fluorochemicals Market Segmentation

-

1. Product

- 1.1. Fluorocarbon

- 1.2. Fluoropolymer

- 1.3. Specialty and Inorganic

- 1.4. Other Products

-

2. Application

- 2.1. Refrigeration and Air Conditioning

- 2.2. Automotive

- 2.3. Electrical and Electronics (incl. Semiconductors)

- 2.4. Pharmaceuticals

- 2.5. Textile and Chemicals

- 2.6. Military and Defense

- 2.7. Space

- 2.8. Other End-user Industries

Fluorochemicals Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Fluorochemicals Market Regional Market Share

Geographic Coverage of Fluorochemicals Market

Fluorochemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from HVAC Systems

- 3.3. Market Restrains

- 3.3.1. Environmental Problems Associated with Fluorochemical

- 3.4. Market Trends

- 3.4.1. Fluorocarbon to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fluorochemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Fluorocarbon

- 5.1.2. Fluoropolymer

- 5.1.3. Specialty and Inorganic

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Refrigeration and Air Conditioning

- 5.2.2. Automotive

- 5.2.3. Electrical and Electronics (incl. Semiconductors)

- 5.2.4. Pharmaceuticals

- 5.2.5. Textile and Chemicals

- 5.2.6. Military and Defense

- 5.2.7. Space

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Asia Pacific Fluorochemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Fluorocarbon

- 6.1.2. Fluoropolymer

- 6.1.3. Specialty and Inorganic

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Refrigeration and Air Conditioning

- 6.2.2. Automotive

- 6.2.3. Electrical and Electronics (incl. Semiconductors)

- 6.2.4. Pharmaceuticals

- 6.2.5. Textile and Chemicals

- 6.2.6. Military and Defense

- 6.2.7. Space

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. North America Fluorochemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Fluorocarbon

- 7.1.2. Fluoropolymer

- 7.1.3. Specialty and Inorganic

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Refrigeration and Air Conditioning

- 7.2.2. Automotive

- 7.2.3. Electrical and Electronics (incl. Semiconductors)

- 7.2.4. Pharmaceuticals

- 7.2.5. Textile and Chemicals

- 7.2.6. Military and Defense

- 7.2.7. Space

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Fluorochemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Fluorocarbon

- 8.1.2. Fluoropolymer

- 8.1.3. Specialty and Inorganic

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Refrigeration and Air Conditioning

- 8.2.2. Automotive

- 8.2.3. Electrical and Electronics (incl. Semiconductors)

- 8.2.4. Pharmaceuticals

- 8.2.5. Textile and Chemicals

- 8.2.6. Military and Defense

- 8.2.7. Space

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. South America Fluorochemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Fluorocarbon

- 9.1.2. Fluoropolymer

- 9.1.3. Specialty and Inorganic

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Refrigeration and Air Conditioning

- 9.2.2. Automotive

- 9.2.3. Electrical and Electronics (incl. Semiconductors)

- 9.2.4. Pharmaceuticals

- 9.2.5. Textile and Chemicals

- 9.2.6. Military and Defense

- 9.2.7. Space

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Fluorochemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Fluorocarbon

- 10.1.2. Fluoropolymer

- 10.1.3. Specialty and Inorganic

- 10.1.4. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Refrigeration and Air Conditioning

- 10.2.2. Automotive

- 10.2.3. Electrical and Electronics (incl. Semiconductors)

- 10.2.4. Pharmaceuticals

- 10.2.5. Textile and Chemicals

- 10.2.6. Military and Defense

- 10.2.7. Space

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arkema

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Derivados del Flúor S A U (MINERSA GROUP)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dynax Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Solvay

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dongyue Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 3M

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Anupam Rasayan India Ltd (Tanfac Industries Ltd )

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DAIKIN INDUSTRIES Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SRF Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AGC Chemicals Americas

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 HaloPolymer

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Navin Fluorine International Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 The Chemours Company*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DIC CORPORATION

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Koura

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 MAFLONS P A

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Gujarat Fluorochemicals Limited

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Fluorochemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Fluorochemicals Market Revenue (undefined), by Product 2025 & 2033

- Figure 3: Asia Pacific Fluorochemicals Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: Asia Pacific Fluorochemicals Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Fluorochemicals Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Fluorochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Fluorochemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Fluorochemicals Market Revenue (undefined), by Product 2025 & 2033

- Figure 9: North America Fluorochemicals Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: North America Fluorochemicals Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America Fluorochemicals Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Fluorochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Fluorochemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Fluorochemicals Market Revenue (undefined), by Product 2025 & 2033

- Figure 15: Europe Fluorochemicals Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Fluorochemicals Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe Fluorochemicals Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Fluorochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Fluorochemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Fluorochemicals Market Revenue (undefined), by Product 2025 & 2033

- Figure 21: South America Fluorochemicals Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: South America Fluorochemicals Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Fluorochemicals Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Fluorochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Fluorochemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fluorochemicals Market Revenue (undefined), by Product 2025 & 2033

- Figure 27: Middle East and Africa Fluorochemicals Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Fluorochemicals Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Fluorochemicals Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Fluorochemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fluorochemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fluorochemicals Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Fluorochemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Fluorochemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Fluorochemicals Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Global Fluorochemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Fluorochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Fluorochemicals Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 13: Global Fluorochemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global Fluorochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Fluorochemicals Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 19: Global Fluorochemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Fluorochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: France Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Fluorochemicals Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 27: Global Fluorochemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global Fluorochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Fluorochemicals Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 33: Global Fluorochemicals Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global Fluorochemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Fluorochemicals Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fluorochemicals Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Fluorochemicals Market?

Key companies in the market include Honeywell International Inc, Arkema, Derivados del Flúor S A U (MINERSA GROUP), Dynax Corporation, Solvay, Dongyue Group, 3M, Anupam Rasayan India Ltd (Tanfac Industries Ltd ), DAIKIN INDUSTRIES Ltd, SRF Limited, AGC Chemicals Americas, HaloPolymer, Navin Fluorine International Limited, The Chemours Company*List Not Exhaustive, DIC CORPORATION, Koura, MAFLONS P A, Gujarat Fluorochemicals Limited.

3. What are the main segments of the Fluorochemicals Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from HVAC Systems.

6. What are the notable trends driving market growth?

Fluorocarbon to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Problems Associated with Fluorochemical.

8. Can you provide examples of recent developments in the market?

November 2022: Gujarat Fluorochemicals Ltd announced that the company plans to expand its AHF capacity from 120 tpd to 220 tpd, which will help supply key starting raw materials for fluoropolymer, refrigerant gas, and battery chemicals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fluorochemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fluorochemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fluorochemicals Market?

To stay informed about further developments, trends, and reports in the Fluorochemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence