Key Insights

The German Combined Heat and Power (CHP) market is projected to reach €32.02 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.3% from 2025 to 2033. This growth is propelled by Germany's robust energy efficiency and decarbonization policies, promoting localized generation and reduced transmission losses. Key drivers include favorable government incentives for renewable energy integration and escalating demand for energy-efficient solutions across residential, commercial, and industrial sectors. The imperative for sustainability and reduced carbon footprints, coupled with utilities leveraging CHP for grid stability and meeting demand sustainably, further fuels market expansion.

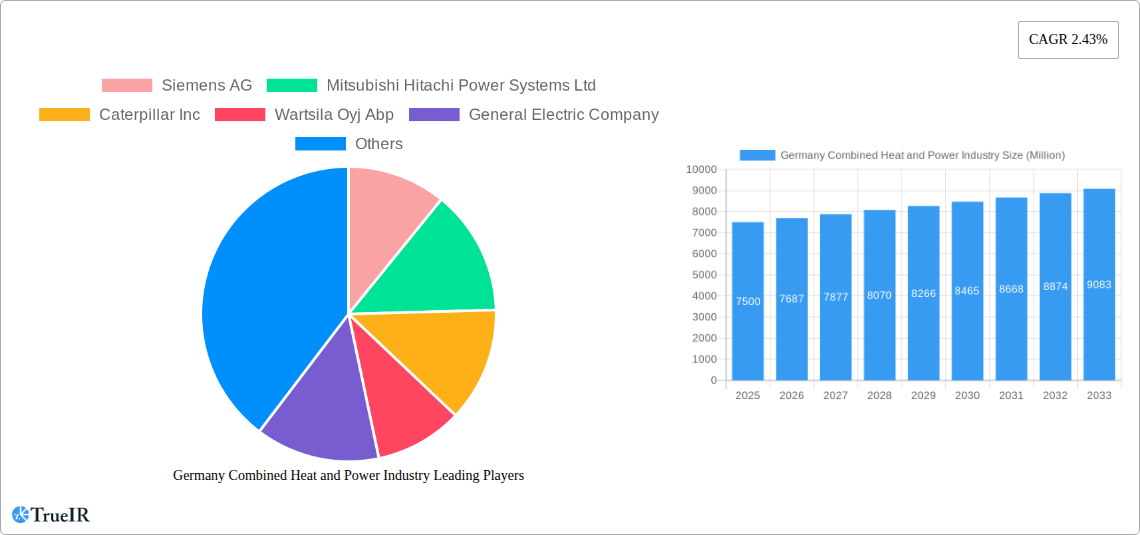

Germany Combined Heat and Power Industry Market Size (In Billion)

Natural gas remains a dominant fuel in the German CHP market due to its relatively lower emissions and availability. However, a significant trend is the integration of renewable fuels like biomass and biogas, aligning with national renewable energy objectives. While strong policy support and technological advancements bolster the market, potential restraints include high upfront capital investment and an evolving regulatory environment. Leading companies such as Siemens AG, Mitsubishi Hitachi Power Systems Ltd, Caterpillar Inc, and Wartsila Oyj Abp are pioneering advanced CHP solutions. The market is segmenting by application (Residential, Commercial, Industrial, Utility), emphasizing optimized energy performance and environmental impact.

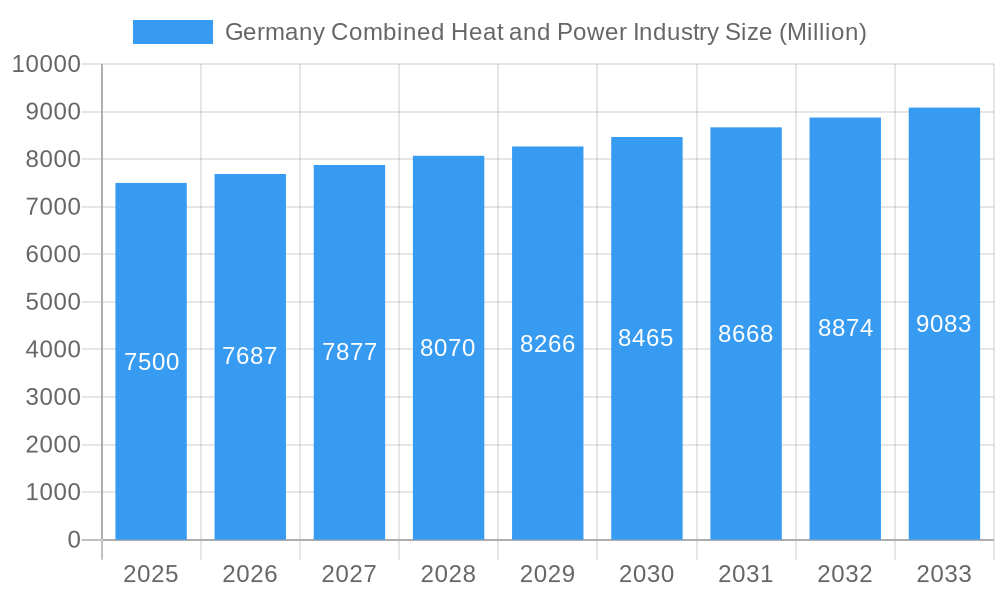

Germany Combined Heat and Power Industry Company Market Share

This report provides an in-depth analysis and future projections for the German Combined Heat and Power (CHP) industry. With a study period spanning 2019 to 2033, and 2025 identified as the base year, this research offers critical insights for stakeholders navigating this dynamic sector. The forecast period of 2025-2033 anticipates significant market shifts driven by policy, technological innovation, and increasing demand for efficient energy solutions.

Germany Combined Heat and Power Industry Market Structure & Competitive Landscape

The German Combined Heat and Power (CHP) market exhibits a moderately concentrated structure, characterized by the presence of both large, established international players and specialized domestic companies. Innovation drivers are primarily focused on enhancing efficiency, reducing emissions, and integrating renewable energy sources into CHP systems. Regulatory impacts, particularly the German Energy Efficiency Directive and carbon pricing mechanisms, significantly shape market dynamics, encouraging the adoption of cleaner and more efficient CHP technologies. Product substitutes, such as standalone power generation and heating systems, are increasingly challenged by the inherent cost and environmental benefits of integrated CHP solutions. End-user segmentation reveals strong demand across Residential, Commercial, Industrial, and Utility applications, each with distinct energy needs and adoption patterns. Mergers and acquisitions (M&A) trends are notable, with strategic consolidations aimed at expanding market reach, technological portfolios, and service offerings. For instance, recent M&A volumes are estimated to be in the hundreds of millions, reflecting a growing appetite for market share. Key market players, including Siemens AG, Mitsubishi Hitachi Power Systems Ltd, Caterpillar Inc, Wartsila Oyj Abp, General Electric Company, MAN Energy Solutions, 2G Energy AG, Viessmann Group, Bosch Thermotechnology, and BHKW-Infozentrum, actively compete through product development, strategic partnerships, and service enhancements.

Germany Combined Heat and Power Industry Market Trends & Opportunities

The Germany Combined Heat and Power (CHP) industry is poised for substantial growth, driven by a confluence of policy support, technological innovation, and an increasing demand for energy efficiency. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of approximately 4.5% over the forecast period of 2025–2033. This growth is underpinned by Germany's ambitious climate targets and its commitment to decarbonization, which strongly favors the energy-efficient and lower-emission characteristics of CHP. Technological shifts are paramount, with a growing emphasis on advanced gas engines, fuel cell technology, and the integration of renewable fuels such as hydrogen and biogas. This evolution is not merely about improving existing systems but about developing next-generation CHP solutions that align with a fully renewable energy future. Consumer preferences are increasingly leaning towards sustainable and cost-effective energy solutions. For residential and commercial users, this translates to a demand for smaller, modular CHP units that can reduce energy bills and environmental footprints. In the industrial sector, the focus is on large-scale CHP plants that provide reliable and cost-competitive heat and power for manufacturing processes, often integrated with district heating networks. The competitive dynamics are intensifying, with established players investing heavily in R&D to stay ahead of technological curves and emerging competitors. Opportunities abound for companies offering innovative CHP solutions, comprehensive energy management services, and expertise in integrating CHP with other renewable energy sources. The market penetration rate of CHP is expected to rise steadily, particularly in urban areas and industrial clusters, as awareness of its benefits grows and supportive policies remain in place. The continuous drive for energy independence and grid stability further bolsters the appeal of decentralized CHP generation.

Dominant Markets & Segments in Germany Combined Heat and Power Industry

The Industrial application segment is a dominant force in the German Combined Heat and Power (CHP) industry, driven by its substantial energy requirements and the direct economic benefits derived from on-site generation. Industrial facilities, from manufacturing plants to chemical complexes, rely heavily on consistent and cost-effective heat and electricity for their operations. CHP systems offer a significant advantage by simultaneously producing these essential utilities, leading to considerable operational cost savings and a reduced carbon footprint.

- Key Growth Drivers in the Industrial Segment:

- High Energy Intensity: Many industrial processes are energy-intensive, making the efficiency gains from CHP particularly impactful.

- Process Heat Demand: The continuous need for process heat in sectors like food and beverage, pharmaceuticals, and textiles aligns perfectly with CHP's inherent heat output.

- Decentralized Energy Generation: Industrial CHP plants contribute to energy security and reduce reliance on the central grid, mitigating risks associated with price volatility and supply disruptions.

- Government Incentives: Policies aimed at promoting energy efficiency and reducing CO2 emissions often provide financial incentives for industrial CHP installations.

Within Fuel Type, Natural Gas continues to be the predominant fuel source for CHP systems in Germany, a trend expected to persist throughout the forecast period. Its widespread availability, relatively stable pricing, and lower emission profile compared to coal and oil make it the fuel of choice for most CHP applications.

- Key Growth Drivers for Natural Gas CHP:

- Infrastructure Availability: Germany possesses a well-established natural gas pipeline network, ensuring reliable supply.

- Technological Maturity: Natural gas engines and turbines are highly efficient and well-understood technologies, offering reliable performance.

- Lower Emissions: Compared to coal and oil, natural gas combustion produces fewer greenhouse gases and particulate matter, aligning with environmental regulations.

- Flexibility: Natural gas-fired CHP units can be ramped up or down relatively quickly, providing flexibility to meet fluctuating energy demands.

While other fuel types such as coal and oil are gradually being phased out due to environmental concerns and policy restrictions, there is a growing interest in "Other Fuel Types" that includes biogas and hydrogen. The increasing focus on renewable energy sources is driving research and development into these alternative fuels for CHP applications, presenting a significant long-term opportunity.

Germany Combined Heat and Power Industry Product Analysis

The German Combined Heat and Power (CHP) industry is characterized by a strong focus on technological advancement and diverse product offerings designed for optimal efficiency and minimal environmental impact. Innovations are centered on enhancing energy conversion rates, reducing emissions through advanced combustion technologies and exhaust gas treatment, and developing modular, scalable systems for various applications. Key product advantages include significant fuel savings, lower CO2 emissions compared to separate heat and power generation, and enhanced energy security. The market is seeing a rise in intelligent control systems that optimize CHP unit operation based on real-time energy demand and grid conditions.

Key Drivers, Barriers & Challenges in Germany Combined Heat and Power Industry

Key Drivers:

- Government Policies and Subsidies: The German government's commitment to energy efficiency and emissions reduction, through frameworks like the Combined Heat and Power Act (KWKG), provides significant financial incentives and mandates for CHP adoption.

- Energy Efficiency Demand: Growing awareness and regulatory pressure to reduce energy consumption and operational costs are compelling businesses and utilities to invest in efficient energy solutions like CHP.

- Decarbonization Targets: Germany's ambitious climate goals necessitate a shift towards cleaner energy sources, and CHP, when fueled by natural gas or increasingly by biogas and hydrogen, plays a crucial role in reducing the carbon intensity of energy supply.

- Grid Stability and Security: Decentralized CHP generation contributes to a more resilient energy infrastructure by reducing reliance on long-distance transmission and providing local power and heat.

Barriers and Challenges:

- High Initial Investment Costs: The upfront capital expenditure for installing CHP systems can be substantial, posing a barrier for smaller businesses and residential users.

- Regulatory Complexities and Uncertainty: While supportive policies exist, navigating the intricate web of regulations, permits, and grid connection requirements can be challenging and time-consuming.

- Availability and Cost of Renewable Fuels: The widespread adoption of biogas and hydrogen as CHP fuels is contingent on the development of robust supply chains and competitive pricing, which are still evolving.

- Competition from Renewable Energy Sources: The rapidly falling costs of solar and wind power, coupled with advancements in energy storage, present alternative pathways for decarbonization, creating competitive pressure for CHP.

Growth Drivers in the Germany Combined Heat and Power Industry Market

Growth in the Germany Combined Heat and Power (CHP) industry is primarily fueled by strong government support through feed-in tariffs, tax incentives, and renewable energy quotas that favor efficient generation. The persistent demand for energy efficiency and cost reduction across residential, commercial, and industrial sectors acts as a significant economic driver. Technological advancements, particularly in engine efficiency, fuel flexibility (including biogas and hydrogen integration), and smart control systems, are enhancing the attractiveness and viability of CHP solutions. Furthermore, Germany's robust commitment to reducing its carbon footprint and achieving its climate targets necessitates the deployment of technologies like CHP that offer lower emissions compared to traditional separate heat and power generation.

Challenges Impacting Germany Combined Heat and Power Industry Growth

Despite its strengths, the Germany Combined Heat and Power industry faces several challenges. High initial capital investment costs remain a considerable barrier, particularly for small and medium-sized enterprises and residential consumers. Regulatory hurdles, including complex permitting processes and grid connection procedures, can slow down project development and implementation. The ongoing transition to a fully renewable energy system presents a dynamic competitive landscape, with rapidly evolving solar, wind, and energy storage technologies offering alternative decarbonization pathways. Furthermore, the consistent and cost-effective supply of renewable fuels like biogas and green hydrogen is still under development, impacting the long-term sustainability and environmental credentials of future CHP installations.

Key Players Shaping the Germany Combined Heat and Power Industry Market

- Siemens AG

- Mitsubishi Hitachi Power Systems Ltd

- Caterpillar Inc

- Wartsila Oyj Abp

- General Electric Company

- MAN Energy Solutions

- 2G Energy AG

- Viessmann Group

- BHKW-Infozentrum

- Bosch Thermotechnology

Significant Germany Combined Heat and Power Industry Industry Milestones

- Year/Month: Not Specified - TotalEnergies acquired Quadra Energy, a leading German renewable electricity aggregator with a 9 GW virtual power plant. This strategic move significantly strengthens TotalEnergies' presence in Germany's renewable energy market, potentially impacting the integration and operation of distributed energy resources, including CHP systems, through enhanced grid management and aggregation capabilities.

Future Outlook for Germany Combined Heat and Power Industry Market

The future outlook for the Germany Combined Heat and Power industry is positive, driven by the persistent demand for energy efficiency and the nation's robust decarbonization agenda. Strategic opportunities lie in the continued integration of renewable fuels such as biogas and hydrogen into CHP systems, positioning them as key enablers of a low-carbon energy future. Advancements in smart grid technology and energy management systems will further enhance the flexibility and value proposition of CHP, enabling better integration with intermittent renewable sources. The market potential is significant, particularly in industrial clusters and district heating networks, where the co-generation of heat and power offers substantial economic and environmental benefits. Continued government support and a focus on innovation will be crucial for sustained growth.

Germany Combined Heat and Power Industry Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial and Utility

-

2. Fuel Type

- 2.1. Natural Gas

- 2.2. Coal

- 2.3. Oil

- 2.4. Other Fuel Types

Germany Combined Heat and Power Industry Segmentation By Geography

- 1. Germany

Germany Combined Heat and Power Industry Regional Market Share

Geographic Coverage of Germany Combined Heat and Power Industry

Germany Combined Heat and Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Industries such as sugar

- 3.2.2 chemicals

- 3.2.3 and paper & pulp require a consistent and efficient power supply. CHP systems meet this demand by providing both electricity and heat

- 3.2.4 enhancing operational efficiency and reducing energy costs.

- 3.3. Market Restrains

- 3.3.1 The increasing cost of natural gas poses a challenge to the economic viability of natural gas-based CHP systems

- 3.3.2 potentially deterring investment and adoption.

- 3.4. Market Trends

- 3.4.1 There's a growing trend to transition CHP systems from natural gas to renewable fuels like green hydrogen. Germany plans to construct gas-fired power plants that are hydrogen-ready

- 3.4.2 aligning with its broader energy transition goals.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Combined Heat and Power Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial and Utility

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Natural Gas

- 5.2.2. Coal

- 5.2.3. Oil

- 5.2.4. Other Fuel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Hitachi Power Systems Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Caterpillar Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Wartsila Oyj Abp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MAN Energy Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 2G Energy AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Viessmann Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BHKW-Infozentrum

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bosch Thermotechnology

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Siemens AG

List of Figures

- Figure 1: Germany Combined Heat and Power Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Combined Heat and Power Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Germany Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 3: Germany Combined Heat and Power Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Combined Heat and Power Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Germany Combined Heat and Power Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 6: Germany Combined Heat and Power Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Combined Heat and Power Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Germany Combined Heat and Power Industry?

Key companies in the market include Siemens AG, Mitsubishi Hitachi Power Systems Ltd, Caterpillar Inc, Wartsila Oyj Abp, General Electric Company, MAN Energy Solutions, 2G Energy AG, Viessmann Group, BHKW-Infozentrum, Bosch Thermotechnology.

3. What are the main segments of the Germany Combined Heat and Power Industry?

The market segments include Application, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Industries such as sugar. chemicals. and paper & pulp require a consistent and efficient power supply. CHP systems meet this demand by providing both electricity and heat. enhancing operational efficiency and reducing energy costs..

6. What are the notable trends driving market growth?

There's a growing trend to transition CHP systems from natural gas to renewable fuels like green hydrogen. Germany plans to construct gas-fired power plants that are hydrogen-ready. aligning with its broader energy transition goals..

7. Are there any restraints impacting market growth?

The increasing cost of natural gas poses a challenge to the economic viability of natural gas-based CHP systems. potentially deterring investment and adoption..

8. Can you provide examples of recent developments in the market?

TotalEnergies acquired Quadra Energy, a leading German renewable electricity aggregator with a 9 GW virtual power plant. This move aligns with TotalEnergies' strategy to expand its footprint in Germany's renewable energy market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Combined Heat and Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Combined Heat and Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Combined Heat and Power Industry?

To stay informed about further developments, trends, and reports in the Germany Combined Heat and Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence