Key Insights

The global graphite market, projected at $31.59 billion in 2025, is set for significant expansion, propelled by the accelerating electric vehicle (EV) and energy storage sectors. The escalating demand for lithium-ion batteries, integral to EVs and renewable energy systems, is a primary market driver. Synthetic graphite, renowned for its superior purity and consistent attributes, is anticipated to lead market growth over natural graphite. Key applications encompass electrodes for batteries and electrochemical processes, refractories for high-temperature industrial applications, and lubricants benefiting from graphite's inherent lubricating qualities. The Asia-Pacific region, especially China, currently dominates the market due to its robust manufacturing infrastructure and extensive downstream industries. However, North America and Europe are poised for substantial growth, fueled by increased investments in renewable energy infrastructure and the expanding automotive industry. While supply chain disruptions and raw material price volatility present challenges, technological advancements aimed at enhancing graphite properties and broadening its applications are mitigating these restraints. The market is characterized by intense competition, with leading companies pursuing strategic alliances, mergers, and capacity expansions to secure their market standing.

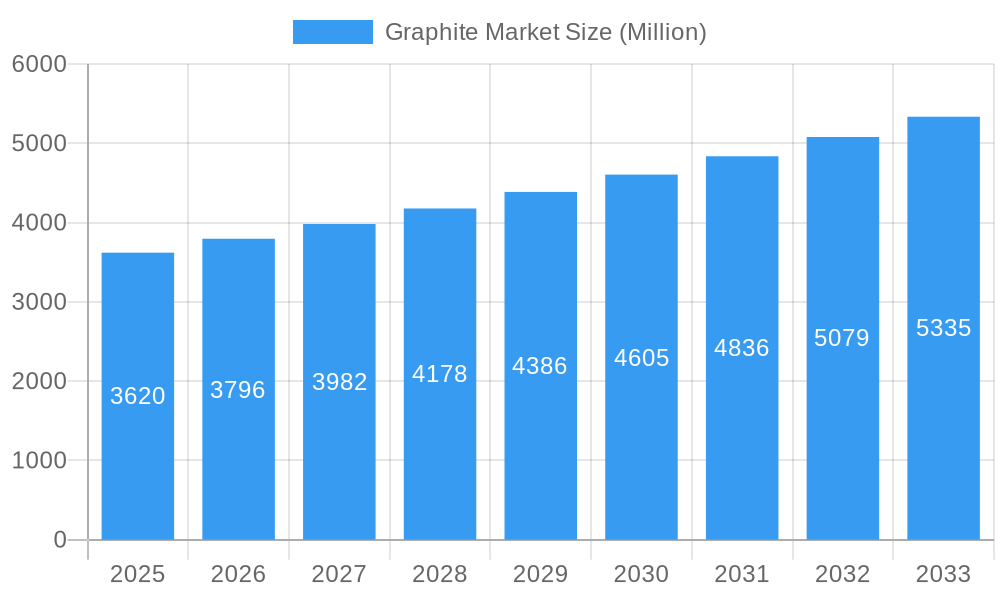

Graphite Market Market Size (In Billion)

The forecast period (2025-2033) indicates a sustained upward trend, driven by the ongoing electrification of transportation and the global transition to cleaner energy solutions. Growth will be further supported by governmental initiatives promoting sustainable technologies, advancements in battery technology enhancing energy density and lifespan, and the rising demand for high-performance materials across diverse industries. Although the market faces hurdles related to environmental regulations for graphite mining and processing, sustainable sourcing practices and innovative technologies are expected to alleviate these concerns. The continued development and adoption of graphite-based materials in emerging applications, such as advanced composites and thermal management systems, will contribute to future market growth, particularly in regions with strong government backing for green technologies and well-established manufacturing capabilities. The compound annual growth rate (CAGR) is estimated at 8.42%.

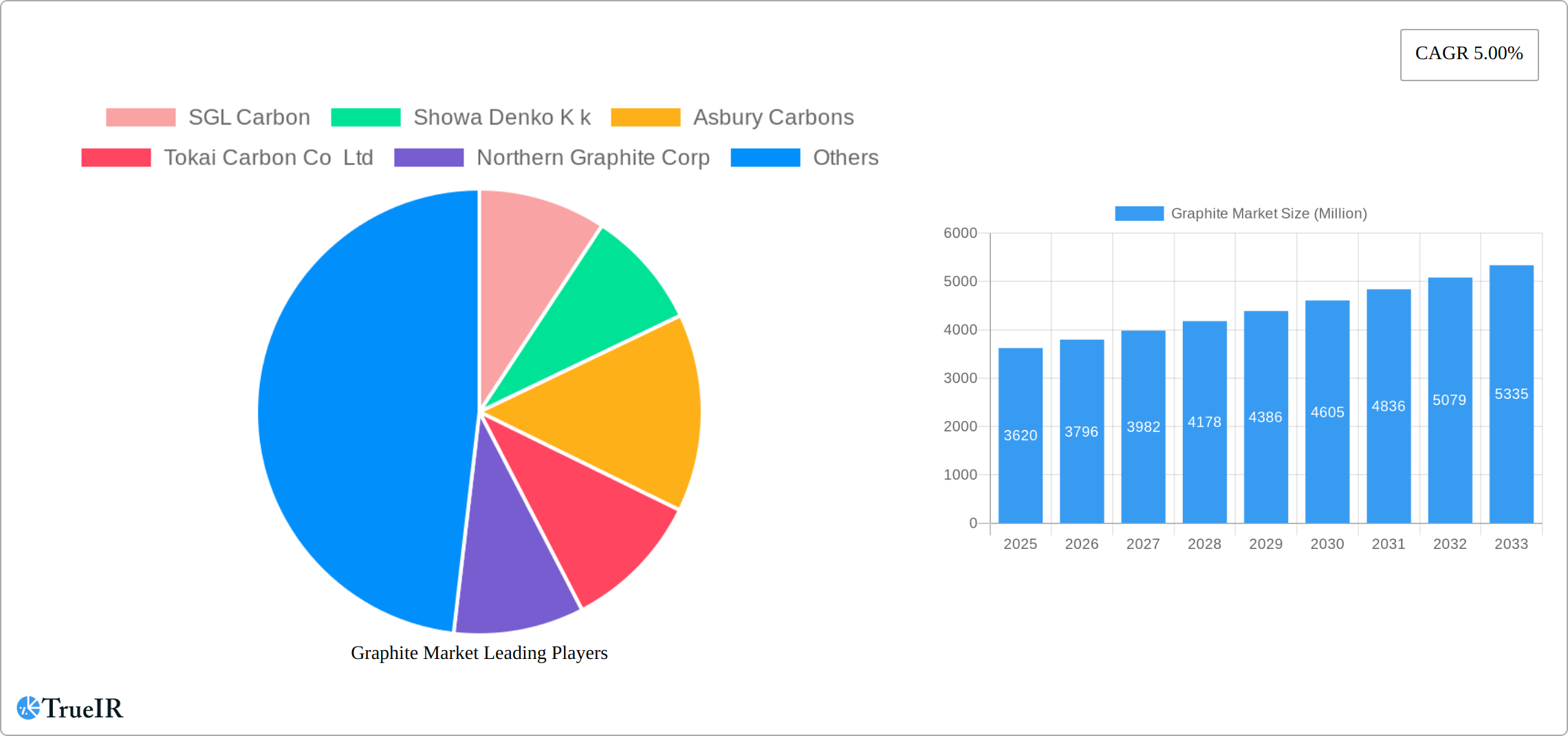

Graphite Market Company Market Share

Graphite Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Graphite Market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report delves into market size, segmentation, competitive landscape, and future trends. The study incorporates extensive data and qualitative analysis, enabling informed strategic decision-making.

Graphite Market Structure & Competitive Landscape

The Graphite Market exhibits a moderately concentrated structure, with key players like SGL Carbon, Showa Denko K.K., and Imerys holding significant market share. However, the market is also characterized by a growing number of smaller, specialized players, particularly in the natural graphite segment. The concentration ratio (CR4) is estimated at xx%, indicating moderate market consolidation. Innovation drives competition, with companies focusing on developing higher-performance graphite materials for emerging applications like electric vehicle batteries. Stringent environmental regulations related to mining and processing impact the industry significantly, forcing companies to adopt sustainable practices. Substitutes like carbon nanotubes and graphene are emerging, but their limited scalability currently restricts their market penetration.

The market displays strong end-user segmentation, with the automotive (especially EV/HEV), electronics, and metallurgy sectors being the key drivers. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a volume of approximately xx deals valued at xx Million annually during the historical period. These M&A activities often focus on securing raw material supplies, expanding geographic reach, and gaining access to advanced technologies.

- Market Concentration: Moderately concentrated, CR4 estimated at xx%.

- Innovation Drivers: Development of high-performance graphite for EV batteries and other advanced applications.

- Regulatory Impacts: Stringent environmental regulations impacting mining and processing.

- Product Substitutes: Emergence of carbon nanotubes and graphene, but limited scalability.

- End-User Segmentation: Automotive (EV/HEV), electronics, and metallurgy as key drivers.

- M&A Trends: Moderate activity, focused on securing resources and technologies.

Graphite Market Trends & Opportunities

The Graphite Market is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by the burgeoning demand for lithium-ion batteries in the electric vehicle (EV) and energy storage sectors. Technological advancements, including the development of high-performance graphite materials with improved electrochemical properties, are further fueling market expansion. Consumer preference for eco-friendly and sustainable products is indirectly impacting the demand for graphite in various applications. Intense competition among market players is leading to innovations in production processes and product offerings, further stimulating market growth. Market penetration rates are particularly high in the automotive and electronics sectors, expected to reach xx% by 2033. The increasing adoption of graphite in advanced applications such as fuel cells and aerospace components presents significant opportunities for market expansion.

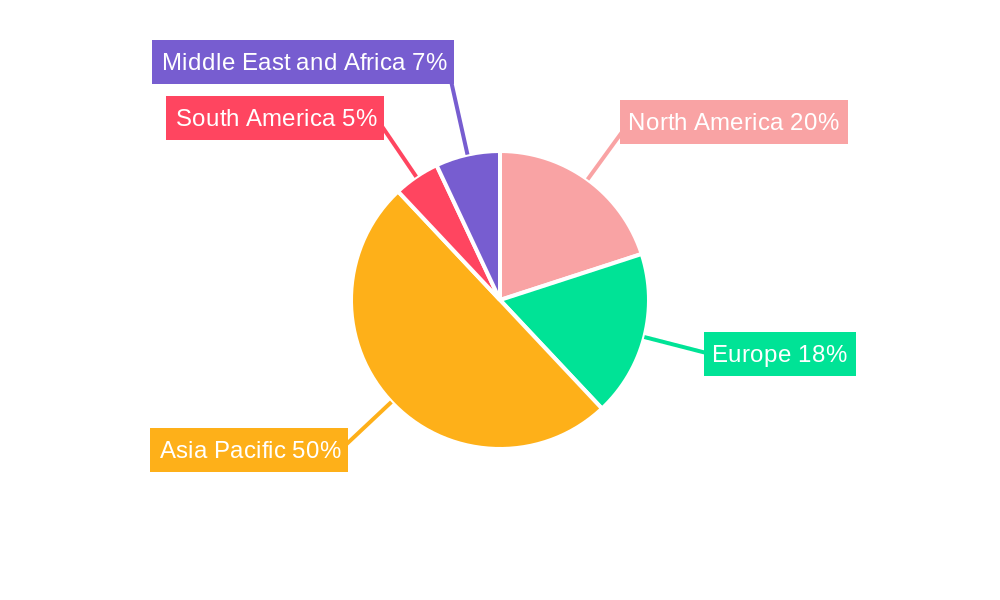

Dominant Markets & Segments in Graphite Market

The Asia-Pacific region continues to assert its dominance in the global graphite market, propelled by the substantial presence of leading battery manufacturers and a thriving electronics industry. Within this powerhouse region, China stands out as a pivotal player, contributing significantly to market demand and supply. The landscape of graphite types is increasingly characterized by the accelerated growth of synthetic graphite. This surge is directly attributable to its demonstrably superior electrochemical and physical properties, making it the preferred choice for advanced battery applications. The battery segment indisputably leads the application arena, fueled by the exponential rise in demand for electric vehicles (EVs) and sophisticated energy storage systems.

- Leading Region: Asia-Pacific, with a particular stronghold in China, driven by its advanced manufacturing capabilities and strong domestic demand.

- Leading Type: Synthetic graphite is outpacing natural graphite in growth, due to its enhanced performance characteristics essential for cutting-edge technologies.

- Leading Application: Batteries remain the dominant application, with the electric vehicle revolution and the expansion of grid-scale energy storage being primary catalysts.

- Key Growth Drivers (Asia-Pacific): A robust ecosystem of electronics and automotive manufacturing, substantial government backing for EV adoption and renewable energy initiatives, and the continuous expansion of renewable energy infrastructure are propelling growth.

Detailed Analysis of Market Dominance: The preeminence of the Asia-Pacific region is deeply rooted in its well-established and highly efficient manufacturing base for critical electronic components and automotive parts. China's formidable role is amplified by its immense domestic market for EVs, strategic government incentives for renewable energy deployment, and its established position as a global manufacturing powerhouse. The discernible shift towards synthetic graphite underscores the industry's imperative to meet the stringent performance and consistency demands of high-technology sectors, most notably battery production.

Graphite Market Product Analysis

Recent strides in graphite technology are intensely focused on elevating its electrochemical potential, thereby enhancing energy density and charge/discharge rates in batteries. Simultaneously, there's significant innovation aimed at improving its thermal conductivity for more efficient heat dissipation in high-power applications. These advancements are pivotal for meeting the exacting specifications of next-generation batteries, including solid-state batteries, and for expanding graphite's utility in advanced materials like composites and refractories. The competitive edge in the market is increasingly defined by the ability to produce higher-purity, precisely engineered graphite materials, tailored to the nuanced requirements of specific end-uses. This includes the meticulous development of specialized graphite grades optimized for distinct battery chemistries (e.g., silicon-graphite composites for anodes) and the refinement of existing anode materials for superior cycle life and faster charging capabilities.

Key Drivers, Barriers & Challenges in Graphite Market

Key Drivers: The relentless and escalating demand for high-performance lithium-ion batteries, primarily driven by the global transition to electric vehicles and the imperative for robust renewable energy storage solutions, stands as the paramount market driver. Continuous technological advancements in graphite processing techniques, leading to the creation of novel and high-performance graphite materials with enhanced properties, are further fueling market expansion. Concurrently, supportive government policies worldwide, which actively encourage the adoption of EVs and the deployment of renewable energy technologies, provide significant impetus for graphite demand.

Key Challenges: The graphite market grapples with persistent supply chain vulnerabilities, particularly in securing consistent access to high-quality raw materials and navigating complex processing stages. Growing environmental consciousness and increasingly stringent regulatory frameworks governing graphite mining and processing operations necessitate substantial investments in sustainable practices and pollution control, thereby impacting operational costs. Furthermore, the market is characterized by intense competition among a multitude of established and emerging players, leading to price pressures and a constant need for innovation and cost optimization. These collective factors can exert downward pressure on profitability and temper the pace of overall market growth.

Growth Drivers in the Graphite Market

The growing demand for lithium-ion batteries in electric vehicles and energy storage systems is a primary growth driver. Furthermore, technological advancements in the production of higher-quality graphite, improving its performance in various applications, are also contributing factors. Government incentives and regulations aimed at promoting the adoption of renewable energy and electric mobility create further favorable conditions for market expansion.

Challenges Impacting Graphite Market Growth

Supply chain bottlenecks, especially in securing raw materials, can disrupt production and hinder market growth. Strict environmental regulations and compliance costs add operational burdens for producers. Finally, the competitive landscape, with many players vying for market share, creates price pressures and challenges for profitability.

Key Players Shaping the Graphite Market

- SGL Carbon SE

- Showa Denko K.K. (Resonac Holdings Corporation)

- Asbury Carbons, Inc.

- Tokai Carbon Co., Ltd.

- Northern Graphite Corporation

- Mason Graphite Inc.

- Triton Minerals Limited

- BTR New Material Group Co., Ltd.

- Jiangxi Zichen Technology Co., Ltd.

- Imerys S.A.

- Shanghai Shanshan Technology Co., Ltd.

- Syrah Resources Limited

- Shenzhen Xiangfenghua Technology Co., Ltd.

- Nippon Kokuen Group

- Graphite India Limited

- Shandong Xinghe Graphite Co., Ltd.

Significant Graphite Market Industry Milestones

- October 2022: Syrah Resources Ltd. announced a supply agreement with LG Energy Solution Ltd. for 2 ktpa of graphite anode material (AAM) from 2025, increasing to at least 10 ktpa subsequently. This highlights the growing demand for graphite in the EV battery sector.

- October 2022: Imerys Graphite & Carbon launched the EMILI Project, expanding its lithium exploitation and solidifying its position as a leading supplier of Li-ion battery components. This demonstrates a strategic push to capitalize on the growing battery market.

Future Outlook for Graphite Market

The Graphite Market is on a trajectory of sustained and significant growth, primarily propelled by the insatiable demand for lithium-ion batteries that power the accelerating adoption of electric vehicles and the expansion of renewable energy storage infrastructure. Strategic investments in research and development will continue to be a cornerstone of market evolution, with a strong emphasis on fine-tuning graphite properties for next-generation battery technologies and pioneering novel applications in diverse industrial sectors. The global proliferation of EVs, coupled with increasingly stringent environmental regulations mandating cleaner energy solutions, will further amplify the market's potential. The overall outlook for the graphite market remains exceptionally optimistic, presenting substantial opportunities for technological innovation, strategic partnerships, and robust economic expansion in the coming years.

Graphite Market Segmentation

-

1. Type

- 1.1. Natural Graphite

- 1.2. Synthetic Graphite

-

2. Application

- 2.1. Electrodes

- 2.2. Refractories, Casting, and Foundries

- 2.3. Batteries

- 2.4. Lubricants

- 2.5. Other Applications

-

3. End-user Industry

- 3.1. Electronics

- 3.2. Metallurgy

- 3.3. Automotive (Includes EV/HEV Vehicles)

- 3.4. Other End-user Industries

Graphite Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Graphite Market Regional Market Share

Geographic Coverage of Graphite Market

Graphite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmenting Demand from the Burgeoning Lithium-ion Battery Industry; Increase In Steel Production in Asia and the Middle East

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. The Metallurgy Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Graphite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Graphite

- 5.1.2. Synthetic Graphite

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electrodes

- 5.2.2. Refractories, Casting, and Foundries

- 5.2.3. Batteries

- 5.2.4. Lubricants

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Electronics

- 5.3.2. Metallurgy

- 5.3.3. Automotive (Includes EV/HEV Vehicles)

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Graphite Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Natural Graphite

- 6.1.2. Synthetic Graphite

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Electrodes

- 6.2.2. Refractories, Casting, and Foundries

- 6.2.3. Batteries

- 6.2.4. Lubricants

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Electronics

- 6.3.2. Metallurgy

- 6.3.3. Automotive (Includes EV/HEV Vehicles)

- 6.3.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Graphite Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Natural Graphite

- 7.1.2. Synthetic Graphite

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Electrodes

- 7.2.2. Refractories, Casting, and Foundries

- 7.2.3. Batteries

- 7.2.4. Lubricants

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Electronics

- 7.3.2. Metallurgy

- 7.3.3. Automotive (Includes EV/HEV Vehicles)

- 7.3.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Graphite Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Natural Graphite

- 8.1.2. Synthetic Graphite

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Electrodes

- 8.2.2. Refractories, Casting, and Foundries

- 8.2.3. Batteries

- 8.2.4. Lubricants

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Electronics

- 8.3.2. Metallurgy

- 8.3.3. Automotive (Includes EV/HEV Vehicles)

- 8.3.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Graphite Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Natural Graphite

- 9.1.2. Synthetic Graphite

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Electrodes

- 9.2.2. Refractories, Casting, and Foundries

- 9.2.3. Batteries

- 9.2.4. Lubricants

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Electronics

- 9.3.2. Metallurgy

- 9.3.3. Automotive (Includes EV/HEV Vehicles)

- 9.3.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Graphite Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Natural Graphite

- 10.1.2. Synthetic Graphite

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Electrodes

- 10.2.2. Refractories, Casting, and Foundries

- 10.2.3. Batteries

- 10.2.4. Lubricants

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Electronics

- 10.3.2. Metallurgy

- 10.3.3. Automotive (Includes EV/HEV Vehicles)

- 10.3.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 SGL Carbon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Showa Denko K k

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Asbury Carbons

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tokai Carbon Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Northern Graphite Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mason Graphite Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Triton Minerals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BTR New Material Group Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jiangxi Zichen Technology Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Imerys

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shanghai Shanshan Technology Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Syrah Resources Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shenzhen Xiangfenghua Technology Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Nippon Kokuen Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 SGL Carbon

List of Figures

- Figure 1: Global Graphite Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Graphite Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Graphite Market Revenue (billion), by Type 2025 & 2033

- Figure 4: Asia Pacific Graphite Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Graphite Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Graphite Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Graphite Market Revenue (billion), by Application 2025 & 2033

- Figure 8: Asia Pacific Graphite Market Volume (K Tons), by Application 2025 & 2033

- Figure 9: Asia Pacific Graphite Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Graphite Market Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Graphite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Graphite Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Graphite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Graphite Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Graphite Market Revenue (billion), by Country 2025 & 2033

- Figure 16: Asia Pacific Graphite Market Volume (K Tons), by Country 2025 & 2033

- Figure 17: Asia Pacific Graphite Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Graphite Market Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Graphite Market Revenue (billion), by Type 2025 & 2033

- Figure 20: North America Graphite Market Volume (K Tons), by Type 2025 & 2033

- Figure 21: North America Graphite Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: North America Graphite Market Volume Share (%), by Type 2025 & 2033

- Figure 23: North America Graphite Market Revenue (billion), by Application 2025 & 2033

- Figure 24: North America Graphite Market Volume (K Tons), by Application 2025 & 2033

- Figure 25: North America Graphite Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: North America Graphite Market Volume Share (%), by Application 2025 & 2033

- Figure 27: North America Graphite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 28: North America Graphite Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 29: North America Graphite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: North America Graphite Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: North America Graphite Market Revenue (billion), by Country 2025 & 2033

- Figure 32: North America Graphite Market Volume (K Tons), by Country 2025 & 2033

- Figure 33: North America Graphite Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Graphite Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Graphite Market Revenue (billion), by Type 2025 & 2033

- Figure 36: Europe Graphite Market Volume (K Tons), by Type 2025 & 2033

- Figure 37: Europe Graphite Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe Graphite Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe Graphite Market Revenue (billion), by Application 2025 & 2033

- Figure 40: Europe Graphite Market Volume (K Tons), by Application 2025 & 2033

- Figure 41: Europe Graphite Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Europe Graphite Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Europe Graphite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 44: Europe Graphite Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: Europe Graphite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Europe Graphite Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Europe Graphite Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Europe Graphite Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: Europe Graphite Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Graphite Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Graphite Market Revenue (billion), by Type 2025 & 2033

- Figure 52: South America Graphite Market Volume (K Tons), by Type 2025 & 2033

- Figure 53: South America Graphite Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: South America Graphite Market Volume Share (%), by Type 2025 & 2033

- Figure 55: South America Graphite Market Revenue (billion), by Application 2025 & 2033

- Figure 56: South America Graphite Market Volume (K Tons), by Application 2025 & 2033

- Figure 57: South America Graphite Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Graphite Market Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Graphite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 60: South America Graphite Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 61: South America Graphite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: South America Graphite Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: South America Graphite Market Revenue (billion), by Country 2025 & 2033

- Figure 64: South America Graphite Market Volume (K Tons), by Country 2025 & 2033

- Figure 65: South America Graphite Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: South America Graphite Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Middle East and Africa Graphite Market Revenue (billion), by Type 2025 & 2033

- Figure 68: Middle East and Africa Graphite Market Volume (K Tons), by Type 2025 & 2033

- Figure 69: Middle East and Africa Graphite Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Middle East and Africa Graphite Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Middle East and Africa Graphite Market Revenue (billion), by Application 2025 & 2033

- Figure 72: Middle East and Africa Graphite Market Volume (K Tons), by Application 2025 & 2033

- Figure 73: Middle East and Africa Graphite Market Revenue Share (%), by Application 2025 & 2033

- Figure 74: Middle East and Africa Graphite Market Volume Share (%), by Application 2025 & 2033

- Figure 75: Middle East and Africa Graphite Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 76: Middle East and Africa Graphite Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 77: Middle East and Africa Graphite Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: Middle East and Africa Graphite Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: Middle East and Africa Graphite Market Revenue (billion), by Country 2025 & 2033

- Figure 80: Middle East and Africa Graphite Market Volume (K Tons), by Country 2025 & 2033

- Figure 81: Middle East and Africa Graphite Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Graphite Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Graphite Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Graphite Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Graphite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Graphite Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Graphite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Graphite Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Graphite Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Graphite Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Global Graphite Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Global Graphite Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Global Graphite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Graphite Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: Global Graphite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Graphite Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Graphite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Graphite Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: China Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: China Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: India Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Japan Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Japan Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: South Korea Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Global Graphite Market Revenue billion Forecast, by Type 2020 & 2033

- Table 28: Global Graphite Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 29: Global Graphite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Graphite Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 31: Global Graphite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Graphite Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Graphite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Global Graphite Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 35: United States Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: United States Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Canada Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Canada Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 39: Mexico Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Mexico Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Global Graphite Market Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Global Graphite Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 43: Global Graphite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Global Graphite Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 45: Global Graphite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Graphite Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Graphite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Graphite Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 49: Germany Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Germany Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Italy Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Italy Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: France Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: France Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Russia Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Russia Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Rest of Europe Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Rest of Europe Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Global Graphite Market Revenue billion Forecast, by Type 2020 & 2033

- Table 62: Global Graphite Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 63: Global Graphite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 64: Global Graphite Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 65: Global Graphite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 66: Global Graphite Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 67: Global Graphite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 68: Global Graphite Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Brazil Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Brazil Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Argentina Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Argentina Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of South America Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Rest of South America Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 75: Global Graphite Market Revenue billion Forecast, by Type 2020 & 2033

- Table 76: Global Graphite Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 77: Global Graphite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 78: Global Graphite Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 79: Global Graphite Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 80: Global Graphite Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 81: Global Graphite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 82: Global Graphite Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 83: Saudi Arabia Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Saudi Arabia Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: South Africa Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Africa Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 87: Rest of Middle East and Africa Graphite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: Rest of Middle East and Africa Graphite Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Graphite Market?

The projected CAGR is approximately 8.42%.

2. Which companies are prominent players in the Graphite Market?

Key companies in the market include SGL Carbon, Showa Denko K k, Asbury Carbons, Tokai Carbon Co Ltd, Northern Graphite Corp, Mason Graphite Inc, Triton Minerals, BTR New Material Group Co Ltd, Jiangxi Zichen Technology Co Ltd, Imerys, Shanghai Shanshan Technology Co Ltd, Syrah Resources Limited, Shenzhen Xiangfenghua Technology Co Ltd, Nippon Kokuen Group.

3. What are the main segments of the Graphite Market?

The market segments include Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.59 billion as of 2022.

5. What are some drivers contributing to market growth?

Augmenting Demand from the Burgeoning Lithium-ion Battery Industry; Increase In Steel Production in Asia and the Middle East.

6. What are the notable trends driving market growth?

The Metallurgy Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2022: Syrah Resources Ltd. announced it would supply a key lithium-ion battery component to South Korea's LG Energy Solution Ltd. According to the agreement, the company was to provide 2 kilotons per annum of graphite to LG Energy Solution Ltd. active anode material (AAM) from 2025 and increase it to at least 10 ktpa after its production capacity at its Vidalia facility in Louisiana.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Graphite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Graphite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Graphite Market?

To stay informed about further developments, trends, and reports in the Graphite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence