Key Insights

The India Battery Energy Storage Systems (BESS) market is projected for substantial expansion, driven by renewable energy integration, grid modernization, and escalating demand for reliable backup power. The market is anticipated to reach a size of 385 million by 2025, with a Compound Annual Growth Rate (CAGR) of 14% from 2025. Key growth drivers include supportive government policies for clean energy, declining lithium-ion battery costs, and heightened energy security awareness across residential, commercial, and industrial sectors. Segmentation by battery type (lithium-ion, lead-acid, flow) and connection type (on-grid, off-grid) highlights lithium-ion's dominance due to its superior energy density and lifespan. Leading states like Gujarat, Maharashtra, and Karnataka are at the forefront of adoption, facilitated by advanced infrastructure and significant renewable energy projects. Market dynamics are further shaped by workforce availability and charging infrastructure development. Major players, including Delta Electronics, Toshiba, Panasonic, Exide Industries, and AES Corporation, are actively influencing the competitive landscape through innovation and strategic alliances.

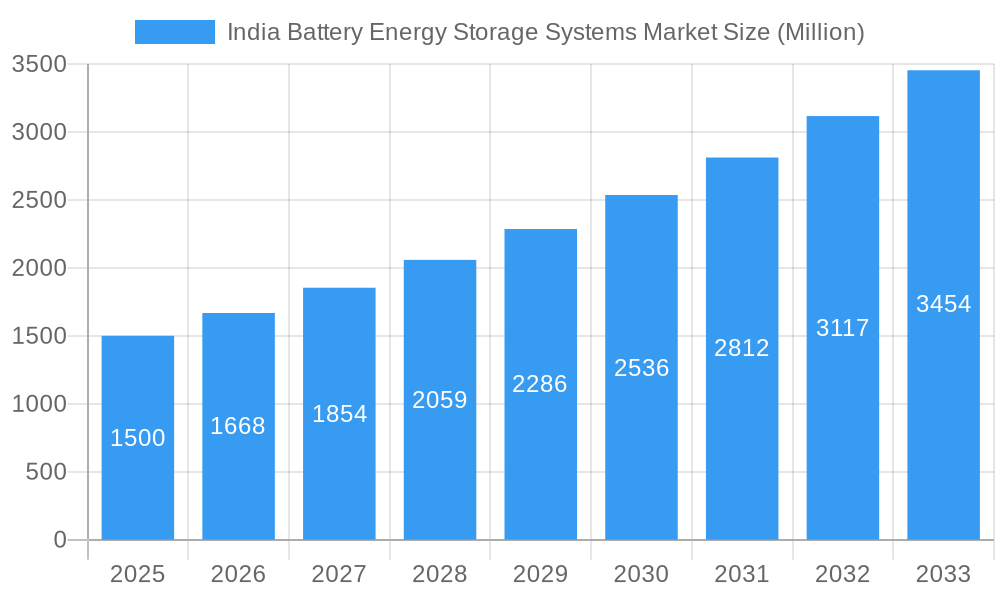

India Battery Energy Storage Systems Market Market Size (In Million)

The forecast period (2025-2033) predicts continued market growth, propelled by ongoing government support, technological advancements, and increased investment in large-scale energy storage projects. The off-grid segment is expected to see significant growth, particularly in areas with limited grid access. Initial investment costs and the need for robust regulatory frameworks for safe and efficient integration of storage technologies present challenges. Nevertheless, the India BESS market demonstrates a positive outlook with considerable potential for growth and innovation.

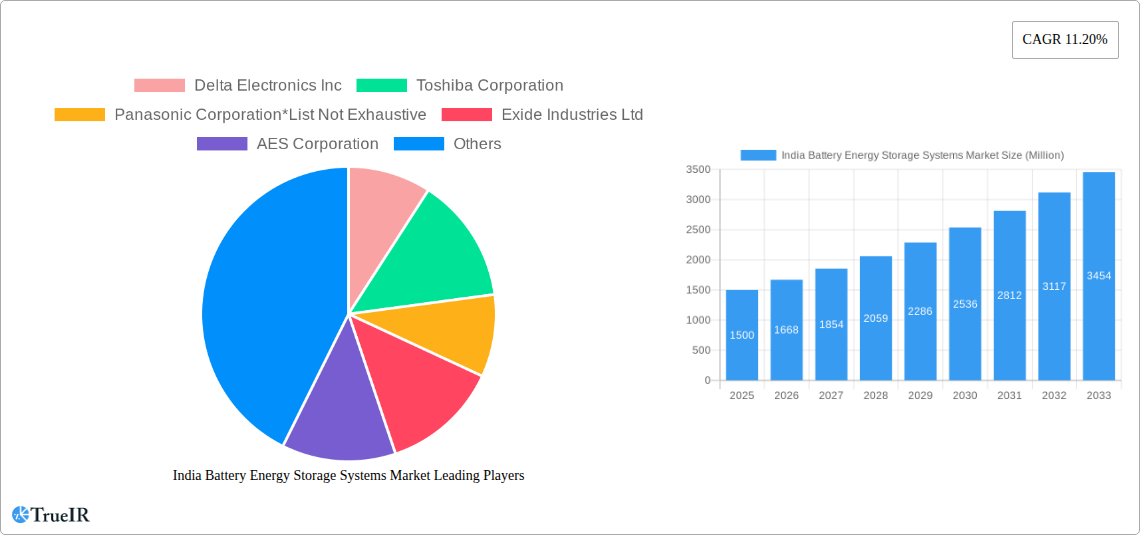

India Battery Energy Storage Systems Market Company Market Share

India Battery Energy Storage Systems Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the burgeoning India Battery Energy Storage Systems (BESS) market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. With a meticulous examination of market size, growth trajectories, technological advancements, and competitive dynamics, this report unveils the immense potential and challenges shaping the future of energy storage in India. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025 to 2033, and the historical period covers 2019-2024.

India Battery Energy Storage Systems Market Structure & Competitive Landscape

The Indian BESS market is characterized by a moderately concentrated landscape, with key players such as Delta Electronics Inc, Toshiba Corporation, Panasonic Corporation, Exide Industries Ltd, AES Corporation, and Amara Raja Group vying for market share. However, the market exhibits significant potential for new entrants due to ongoing technological advancements and supportive government policies. Innovation drivers include the rising demand for renewable energy integration, advancements in battery technologies (particularly Lithium-ion), and the decreasing cost of energy storage solutions. Regulatory impacts, while generally supportive, involve navigating complex approval processes and safety standards. Product substitutes, such as pumped hydro storage, present competition but are often limited by geographical constraints. End-user segmentation encompasses the utility, commercial & industrial, and residential sectors, each with unique requirements and growth potential. M&A activity in the sector has been moderate (xx deals in the last 5 years resulting in xx Million USD in transaction value), reflecting strategic consolidation and the expansion of market players. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated landscape.

India Battery Energy Storage Systems Market Market Trends & Opportunities

The India BESS market is experiencing robust growth, driven by increasing renewable energy capacity additions, improving grid infrastructure, and government initiatives aimed at promoting energy storage deployment. The market size is projected to reach xx Million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological shifts toward higher energy density and longer lifespan batteries (particularly Lithium-ion) are driving market penetration. Consumer preferences are leaning towards cost-effective, reliable, and safe energy storage solutions. Competitive dynamics are marked by fierce competition among established players and the emergence of innovative startups. Market penetration rates are currently at xx% in the utility sector and are expected to rise to xx% by 2033. The shift towards smart grids and microgrids is further fueling the demand for advanced BESS solutions. The increasing awareness of energy security and sustainability is also propelling market growth. Government incentives and policies are playing a vital role in accelerating adoption across different sectors.

Dominant Markets & Segments in India Battery Energy Storage Systems Market

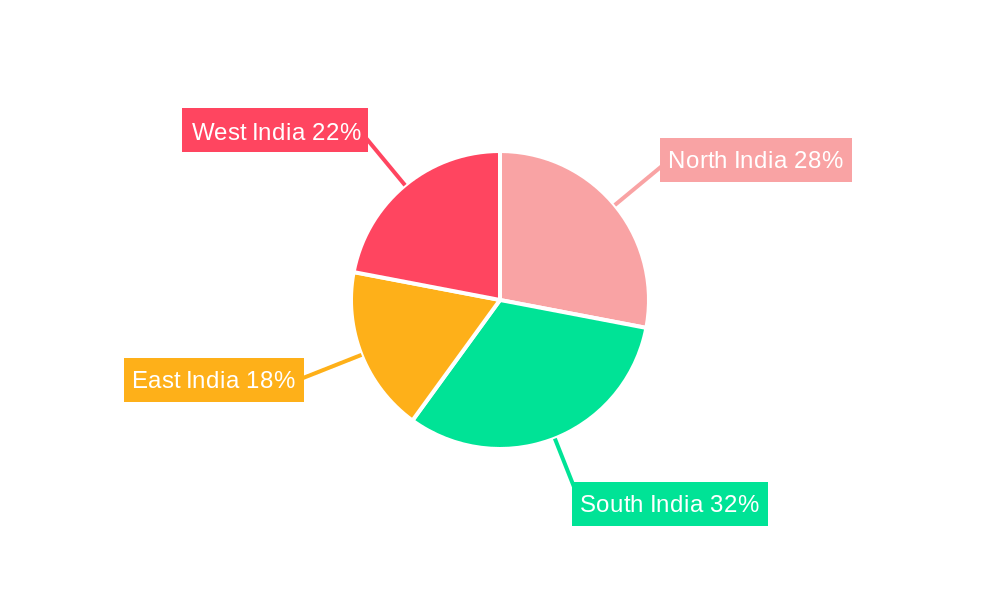

Leading Region/State: Maharashtra is currently the dominant market for BESS deployment due to its advanced grid infrastructure and proactive policies promoting renewable energy integration. Other states such as Gujarat, Karnataka, and Tamil Nadu are also emerging as key markets.

Battery Type: Lithium-ion batteries dominate the market due to their higher energy density and longer lifespan, though lead-acid batteries continue to maintain a significant share in the off-grid segment.

Connection Type: The on-grid segment is experiencing faster growth driven by grid stability and renewable energy integration needs, while the off-grid segment caters primarily to remote areas and backup power requirements.

Key Growth Drivers:

- Government policies and incentives: The recent USD 455.2 Million incentive scheme for battery storage projects significantly boosts market growth.

- Renewable energy integration: The increasing share of renewable energy necessitates effective energy storage solutions to ensure grid stability.

- Improving grid infrastructure: Investments in grid modernization are creating a favorable environment for BESS adoption.

- Falling battery costs: Technological advancements and economies of scale have reduced battery costs, making BESS solutions more economically viable.

India Battery Energy Storage Systems Market Product Analysis

The Indian BESS market offers a diverse range of products, encompassing various battery chemistries, power capacities, and connection types. Technological advancements focus on improving energy density, lifespan, safety, and reducing costs. Lithium-ion batteries are gaining prominence due to their superior performance characteristics, although lead-acid batteries remain competitive in specific applications. The market is witnessing the emergence of hybrid and integrated BESS solutions combining batteries with solar panels and power electronics. The market fit for each product varies depending on the end-user application (utility-scale, commercial, residential) and specific energy requirements.

Key Drivers, Barriers & Challenges in India Battery Energy Storage Systems Market

Key Drivers:

- Rapid growth of renewable energy sources.

- Government initiatives promoting energy storage.

- Falling battery costs.

- Increasing demand for grid stability and reliability.

Key Challenges & Restraints:

- High upfront capital costs for BESS systems.

- Limited awareness among end-users regarding the benefits of BESS.

- Supply chain bottlenecks and dependence on imports for certain components.

- Regulatory complexities and standardization issues. These factors, if not addressed effectively, could hinder the market's growth trajectory. The impact is estimated to reduce the market CAGR by approximately xx percentage points.

Growth Drivers in the India Battery Energy Storage Systems Market Market

The Indian BESS market is propelled by several key factors: the ambitious renewable energy targets set by the government; the increasing integration of intermittent renewable sources requiring stabilization; declining battery costs making them more cost-competitive; and supportive government policies, including financial incentives and streamlined approval processes. Technological advancements, especially in Lithium-ion battery technology, further fuel this growth.

Challenges Impacting India Battery Energy Storage Systems Market Growth

Challenges include the high initial investment costs associated with BESS deployment; the relatively nascent supply chain infrastructure; regulatory uncertainties, including standardization and safety regulations; and a lack of awareness among potential end-users about the economic and environmental benefits of BESS.

Key Players Shaping the India Battery Energy Storage Systems Market Market

- Delta Electronics Inc

- Toshiba Corporation

- Panasonic Corporation

- Exide Industries Ltd

- AES Corporation

- Amara Raja Group

Significant India Battery Energy Storage Systems Market Industry Milestones

June 2023: The Indian government announces USD 455.2 Million in incentives for 400 MWh of battery storage projects, signaling a strong commitment to energy storage deployment and renewable energy integration. This is expected to significantly accelerate market growth in the coming years.

April 2023: India Grid Trust completes its first BESS project at the Dhule substation in Maharashtra, demonstrating the feasibility and viability of large-scale battery storage integration with solar power. This successful project serves as a model for future deployments.

Future Outlook for India Battery Energy Storage Systems Market Market

The future of the India BESS market is exceptionally bright. Continued government support, technological innovation, falling battery prices, and the increasing need for grid stability and renewable energy integration will all contribute to significant market growth. Strategic opportunities exist for companies focused on developing advanced battery technologies, optimizing energy management systems, and providing comprehensive BESS solutions tailored to diverse customer needs. The market's potential is vast, and its trajectory is poised for continued expansion in the coming years, driven by both public policy and private sector investment.

India Battery Energy Storage Systems Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion

- 1.2. Lead-acid

- 1.3. Flow

- 1.4. Other Battery Types

-

2. Connection Type

- 2.1. On-grid

- 2.2. Off-grid

India Battery Energy Storage Systems Market Segmentation By Geography

- 1. India

India Battery Energy Storage Systems Market Regional Market Share

Geographic Coverage of India Battery Energy Storage Systems Market

India Battery Energy Storage Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Energy Storage Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion

- 5.1.2. Lead-acid

- 5.1.3. Flow

- 5.1.4. Other Battery Types

- 5.2. Market Analysis, Insights and Forecast - by Connection Type

- 5.2.1. On-grid

- 5.2.2. Off-grid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delta Electronics Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Toshiba Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Panasonic Corporation*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exide Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AES Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amara Raja Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Delta Electronics Inc

List of Figures

- Figure 1: India Battery Energy Storage Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Battery Energy Storage Systems Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 2: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 3: India Battery Energy Storage Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: India Battery Energy Storage Systems Market Revenue million Forecast, by Battery Type 2020 & 2033

- Table 5: India Battery Energy Storage Systems Market Revenue million Forecast, by Connection Type 2020 & 2033

- Table 6: India Battery Energy Storage Systems Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Energy Storage Systems Market?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the India Battery Energy Storage Systems Market?

Key companies in the market include Delta Electronics Inc, Toshiba Corporation, Panasonic Corporation*List Not Exhaustive, Exide Industries Ltd, AES Corporation, Amara Raja Group.

3. What are the main segments of the India Battery Energy Storage Systems Market?

The market segments include Battery Type, Connection Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 385 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Energy Storage Technologies4.; Government Initiatives to Promote Energy Storage Deployment.

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Uncertainty in the Rules Governing Energy Storage Operations and Ownership.

8. Can you provide examples of recent developments in the market?

June 2023: The Indian government shall offer USD 455.2 million as incentives to the companies for installing battery energy storage projects of 400 MWh. The government intends to reach its 2030 goal of 500 MW of renewable capacity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Energy Storage Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Energy Storage Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Energy Storage Systems Market?

To stay informed about further developments, trends, and reports in the India Battery Energy Storage Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence