Key Insights

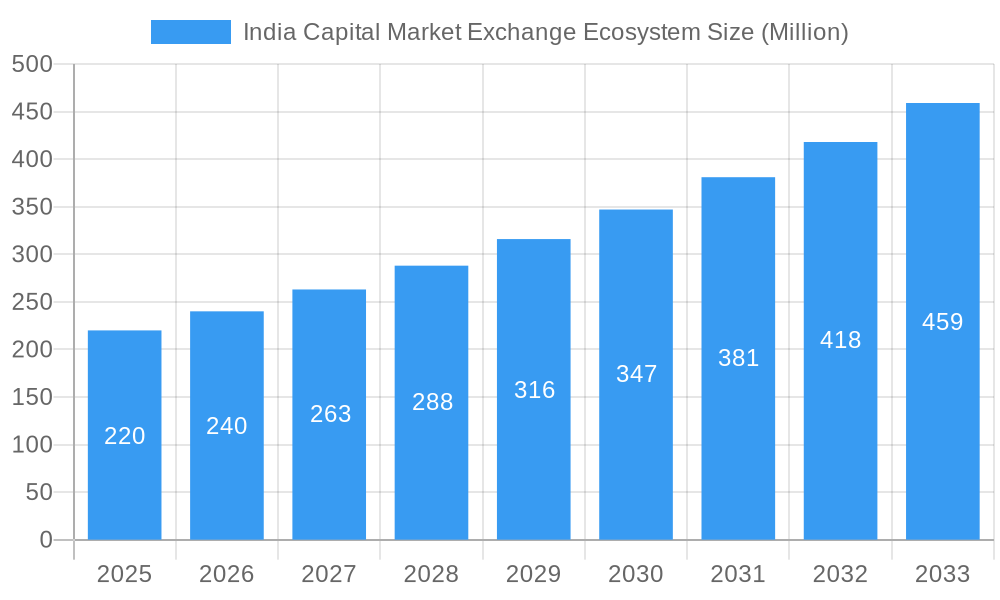

India's Capital Market Exchange Ecosystem is projected for significant expansion, driven by heightened retail investor engagement, advanced digital infrastructure, and government-led financial inclusion efforts. The market demonstrates a strong Compound Annual Growth Rate (CAGR) of 9%, indicating sustained expansion. Key growth drivers include rising disposable incomes, an expanding middle class actively pursuing investment avenues, and the widespread adoption of digital trading platforms. Supportive government deregulation and policies designed to attract foreign direct investment further bolster this positive outlook. The projected market size for 2025 is estimated at 124 billion USD, reflecting a steady upward trend throughout the forecast period. This projection considers potential market volatility and economic uncertainties.

India Capital Market Exchange Ecosystem Market Size (In Billion)

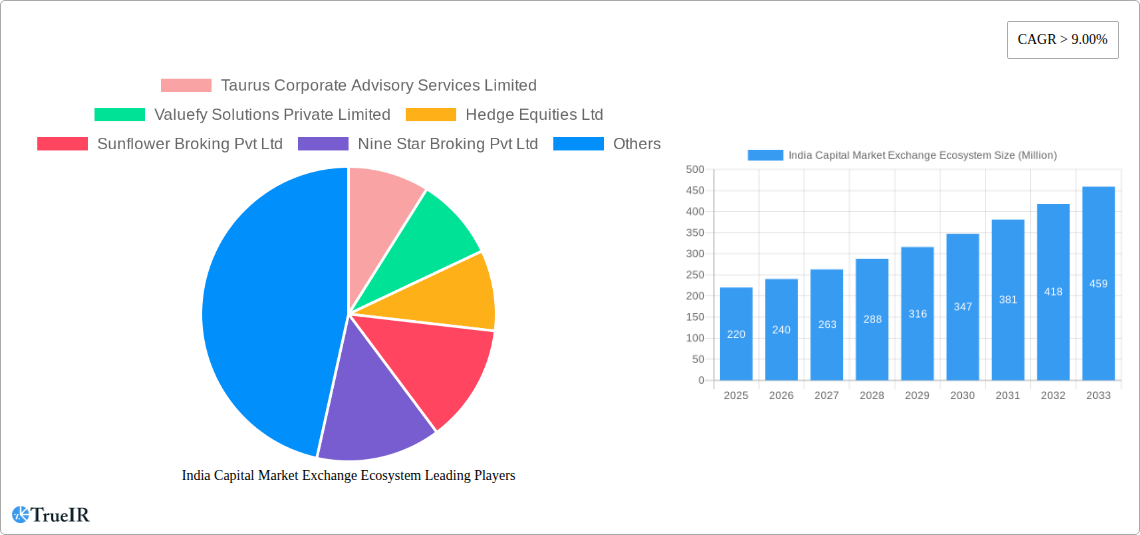

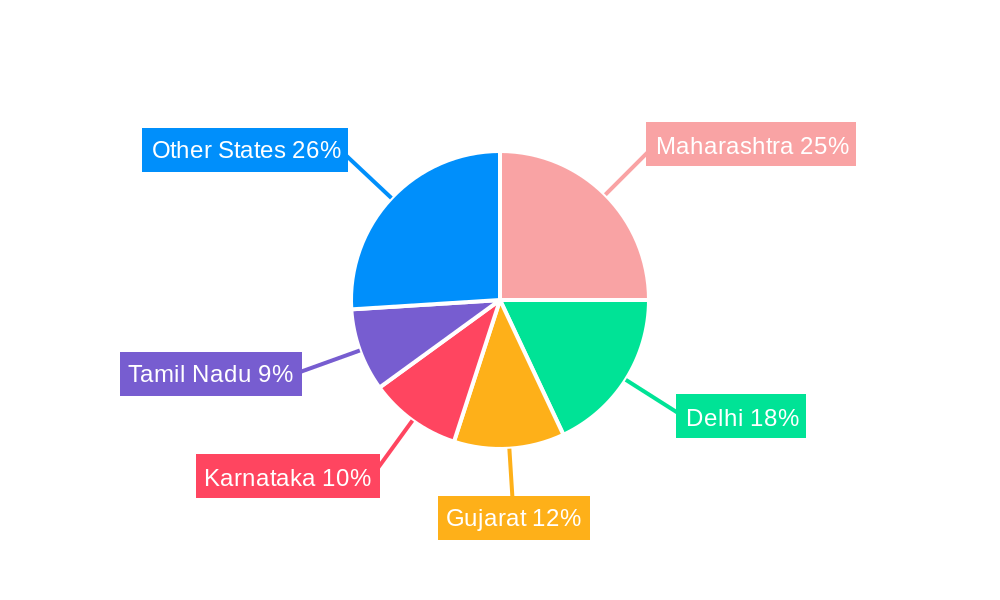

The competitive environment features established entities such as Taurus Corporate Advisory Services Limited alongside innovative fintech startups. Market segments are anticipated to encompass equities, derivatives, debt instruments, and mutual funds. While regional data is not explicitly detailed, significant activity is expected in major metropolitan centers, aligning with India's economic distribution. However, government initiatives targeting financial inclusion are likely to foster increased market penetration in Tier 2 and Tier 3 cities, leading to a more balanced regional market share. Enduring challenges such as market volatility, evolving regulations, and the imperative for comprehensive investor education will remain critical determinants of long-term growth.

India Capital Market Exchange Ecosystem Company Market Share

India Capital Market Exchange Ecosystem: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning India Capital Market Exchange Ecosystem, offering a comprehensive analysis of its market structure, competitive landscape, trends, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report is an invaluable resource for investors, industry players, and researchers seeking actionable insights into this rapidly evolving sector. The report leverages extensive market research and data analysis to provide a granular understanding of the market's size, growth trajectory, and key drivers, while also identifying potential challenges and opportunities. The report values are in Millions.

India Capital Market Exchange Ecosystem Market Structure & Competitive Landscape

The Indian capital market exchange ecosystem is characterized by a moderately concentrated market structure, with a few large players and numerous smaller participants. The Herfindahl-Hirschman Index (HHI) for 2024 was estimated at xx, indicating a moderately concentrated market. Innovation is driven primarily by technological advancements, such as the adoption of AI and machine learning in algorithmic trading and risk management. Regulatory changes, including those aimed at enhancing investor protection and market transparency, significantly influence market dynamics. Product substitutes, such as peer-to-peer lending platforms, are emerging but have limited impact on the overall market share. The end-user segment is diverse, encompassing institutional investors, retail investors, and corporations. M&A activity in the sector remains modest, with an estimated xx Million in deals in 2024.

- Market Concentration: Moderately concentrated, HHI (2024) estimated at xx.

- Innovation Drivers: AI, Machine Learning, Algorithmic Trading.

- Regulatory Impacts: Significant influence on market dynamics.

- Product Substitutes: Emerging, but limited market impact.

- End-User Segmentation: Institutional investors, retail investors, corporations.

- M&A Trends: Modest activity, estimated xx Million in 2024.

India Capital Market Exchange Ecosystem Market Trends & Opportunities

The Indian capital market exchange ecosystem is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during 2025-2033. This growth is fueled by increasing financial literacy, rising disposable incomes, a growing middle class, and favorable government policies promoting financial inclusion. Technological advancements, including the proliferation of mobile trading platforms and the adoption of blockchain technology, are reshaping consumer preferences and driving market penetration. The market is characterized by intense competition, with both established players and new entrants vying for market share. Opportunities exist in expanding financial services to underserved populations, leveraging technology to enhance efficiency and transparency, and catering to the growing demand for sophisticated investment products. Market penetration rate for online trading platforms is estimated to reach xx% by 2033.

Dominant Markets & Segments in India Capital Market Exchange Ecosystem

The dominant segment in the Indian capital market exchange ecosystem is the equity market, which accounts for the largest share of trading volume. Key growth drivers include:

- Robust Economic Growth: India's sustained economic growth provides a fertile ground for investment and market expansion.

- Government Initiatives: Government policies promoting financial inclusion and market development are stimulating market activity.

- Increasing Investor Participation: A rising middle class with increased disposable income fuels higher participation.

- Technological Advancements: The widespread adoption of technology simplifies trading and boosts market efficiency.

The major metropolitan areas of Mumbai, Delhi, Bangalore, and Chennai are the leading regional markets, due to their concentration of financial institutions, businesses, and high-net-worth individuals.

India Capital Market Exchange Ecosystem Product Analysis

The Indian capital market exchange ecosystem offers a diverse range of products and services, including equity trading, derivatives trading, debt trading, and investment banking services. Recent product innovations focus on improving user experience through mobile-first platforms, enhancing trading algorithms using AI and Machine Learning, and incorporating blockchain for enhanced security and transparency. The competitive advantage stems from a combination of superior technology, strong customer service, and competitive pricing strategies. Technological advancements are key to maintaining a competitive edge in this dynamic market.

Key Drivers, Barriers & Challenges in India Capital Market Exchange Ecosystem

Key Drivers:

- Government Initiatives: Favorable government policies supporting market development.

- Technological Advancements: Increased efficiency and accessibility through digital platforms.

- Economic Growth: A thriving economy encourages higher investment.

Challenges:

- Regulatory Complexities: Navigating regulatory hurdles adds complexity to business operations.

- Cybersecurity Risks: The digital nature of the market presents security concerns.

- Competition: Intense competition requires constant innovation and efficiency.

Growth Drivers in the India Capital Market Exchange Ecosystem Market

The expansion of the Indian Capital Market Exchange Ecosystem is propelled by a trifecta of factors: robust economic growth, governmental support for market liberalization and modernization, and increasingly sophisticated technological solutions enhancing market efficiency and accessibility for a broader range of investors. This synergistic effect fosters a dynamic and attractive investment environment.

Challenges Impacting India Capital Market Exchange Ecosystem Growth

Significant challenges include navigating regulatory complexities, addressing cybersecurity threats, and managing the intense competition within the sector. These factors, alongside maintaining investor confidence amidst market volatility, require robust risk management and adaptable strategies for sustained growth.

Key Players Shaping the India Capital Market Exchange Ecosystem Market

- Taurus Corporate Advisory Services Limited

- Valuefy Solutions Private Limited

- Hedge Equities Ltd

- Sunflower Broking Pvt Ltd

- Nine Star Broking Pvt Ltd

- Research Icon

- Agroy Finance and Investment Ltd

- United Stock Exchange of India

- Basan Equity Broking Ltd

- Indira Securities P Ltd

- List Not Exhaustive

Significant India Capital Market Exchange Ecosystem Industry Milestones

- 2020: Introduction of new regulations aimed at improving investor protection.

- 2021: Launch of several new mobile trading platforms.

- 2022: Increased adoption of algorithmic trading strategies.

- 2023: Significant investments in fintech companies focused on capital markets.

- 2024: Several mergers and acquisitions within the brokerage sector.

Future Outlook for India Capital Market Exchange Ecosystem Market

The future outlook for the Indian capital market exchange ecosystem is extremely positive. Continued economic growth, supportive government policies, and technological advancements are expected to drive significant market expansion. Strategic opportunities exist in expanding financial services to underserved segments of the population, developing innovative products, and leveraging technology to enhance market efficiency and transparency. The market is poised for substantial growth and remains an attractive investment destination.

India Capital Market Exchange Ecosystem Segmentation

-

1. Primary Markets

- 1.1. Equity Market

- 1.2. Debt Market

- 1.3. Corporate Governance and Compliance Monitoring

- 1.4. Corporate Restructuring

- 1.5. Intermediaries Associated

-

2. Secondary Markets

- 2.1. Cash Market

- 2.2. Equity Derivatives Markets

- 2.3. Commodity Derivatives Market

- 2.4. Currency Derivatives Market

- 2.5. Interest Rate Derivatives Market

- 2.6. Market Infrastructure Institutions

- 2.7. Intermediaries Associated

India Capital Market Exchange Ecosystem Segmentation By Geography

- 1. India

India Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of India Capital Market Exchange Ecosystem

India Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Equity Derivatives Occupied with Major Share in the Secondary Capital Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 5.1.1. Equity Market

- 5.1.2. Debt Market

- 5.1.3. Corporate Governance and Compliance Monitoring

- 5.1.4. Corporate Restructuring

- 5.1.5. Intermediaries Associated

- 5.2. Market Analysis, Insights and Forecast - by Secondary Markets

- 5.2.1. Cash Market

- 5.2.2. Equity Derivatives Markets

- 5.2.3. Commodity Derivatives Market

- 5.2.4. Currency Derivatives Market

- 5.2.5. Interest Rate Derivatives Market

- 5.2.6. Market Infrastructure Institutions

- 5.2.7. Intermediaries Associated

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Taurus Corporate Advisory Services Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valuefy Solutions Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hedge Equities Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunflower Broking Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nine Star Broking Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Research Icon

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agroy Finance and Investment Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Stock Exchange of India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Basan Equity Broking Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indira Securities P Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Taurus Corporate Advisory Services Limited

List of Figures

- Figure 1: India Capital Market Exchange Ecosystem Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 2: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 3: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 5: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 6: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Capital Market Exchange Ecosystem?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the India Capital Market Exchange Ecosystem?

Key companies in the market include Taurus Corporate Advisory Services Limited, Valuefy Solutions Private Limited, Hedge Equities Ltd, Sunflower Broking Pvt Ltd, Nine Star Broking Pvt Ltd, Research Icon, Agroy Finance and Investment Ltd, United Stock Exchange of India, Basan Equity Broking Ltd, Indira Securities P Ltd **List Not Exhaustive.

3. What are the main segments of the India Capital Market Exchange Ecosystem?

The market segments include Primary Markets, Secondary Markets.

4. Can you provide details about the market size?

The market size is estimated to be USD 124 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Equity Derivatives Occupied with Major Share in the Secondary Capital Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the India Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence