Key Insights

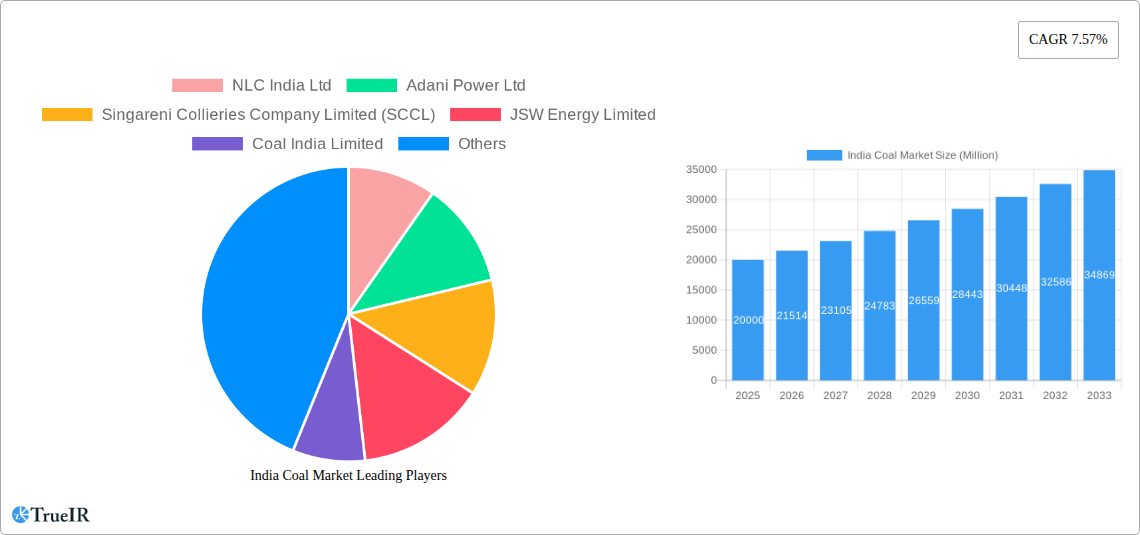

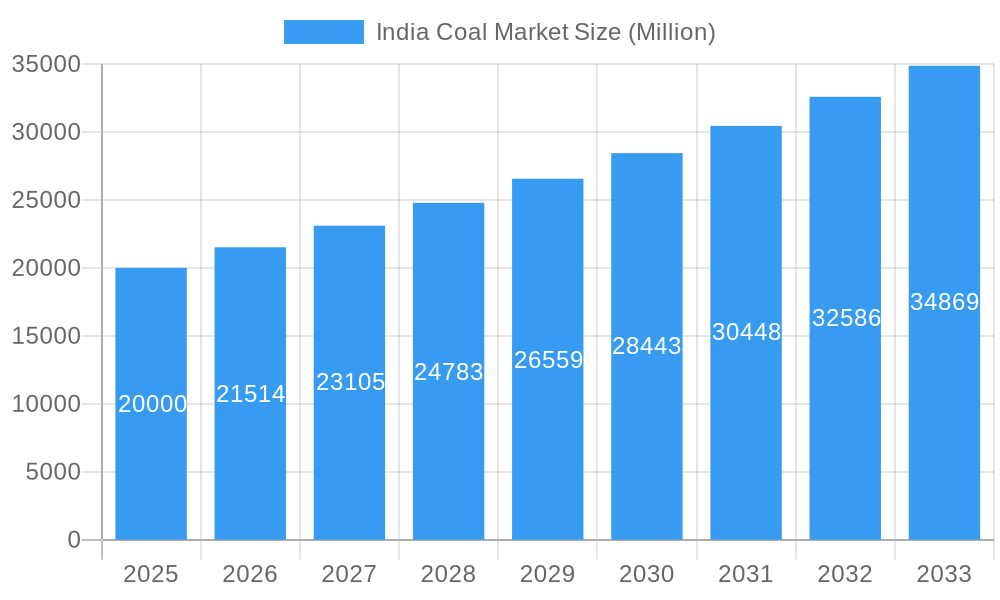

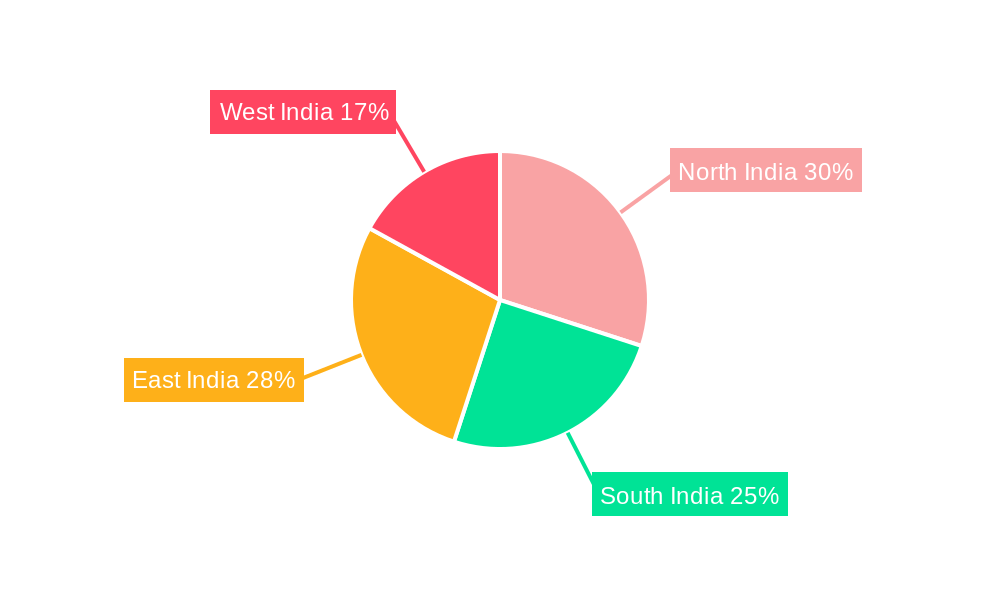

The Indian coal market is poised for substantial growth, with an estimated market size of 1.04 billion in the base year 2025. Projected to expand at a compound annual growth rate (CAGR) of 7.57% from 2025 to 2033, this growth is predominantly fueled by escalating energy requirements within India's expanding power generation sector, especially thermal coal-fired plants. Increased industrialization and steel production further elevate demand for coking coal as an essential feedstock. However, environmental considerations, particularly coal's carbon footprint, present market challenges, driving a shift towards renewable energy sources and stringent emission regulations. Government initiatives supporting cleaner energy alternatives and energy efficiency measures will temper overall market expansion. Market segmentation highlights a significant contribution from power generation (thermal coal) and coking feedstock (coking coal), underscoring coal's vital role in India's energy and industrial frameworks. Regional demand disparities are notable, with North and East India anticipated to experience higher growth rates due to concentrated industrial activity and power generation infrastructure. Leading companies such as Coal India Limited, Adani Power Ltd, and NTPC Ltd are expected to maintain market dominance, influencing production and distribution strategies.

India Coal Market Market Size (In Billion)

The forecast period, 2025-2033, presents both opportunities and challenges for the Indian coal market. While short to medium-term demand remains robust, long-term sustainability depends on responsible mining, effective environmental mitigation, and diversification into cleaner energy solutions. Companies must adapt to evolving regulations, invest in advanced technologies for enhanced efficiency and reduced emissions, and pursue strategic partnerships to navigate this dynamic market. Diversification across applications and regional markets offers growth potential, necessitating thorough analysis and targeted market entry strategies. The competitive landscape will feature a mix of established and emerging companies vying for market share, fostering a dynamic and rapidly evolving environment.

India Coal Market Company Market Share

India Coal Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the India Coal Market, encompassing historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). It leverages extensive research to offer critical insights into market structure, trends, opportunities, and challenges. The report is essential for investors, industry professionals, and policymakers seeking a comprehensive understanding of this vital sector. Key players like Coal India Limited, NTPC Ltd, and Adani Power Ltd are extensively profiled.

India Coal Market Market Structure & Competitive Landscape

The Indian coal market is characterized by a moderately concentrated structure, with Coal India Limited holding a significant market share. However, the landscape is evolving with increasing participation from private players like Adani Power Ltd and JSW Energy Limited. The market's dynamics are shaped by several factors:

- Market Concentration: Coal India Limited dominates, but the entry of private players is increasing competition. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in coal mining, transportation, and utilization (e.g., cleaner coal technologies) are driving innovation.

- Regulatory Impacts: Government policies on coal production, pricing, and environmental regulations significantly impact market operations. Stringent environmental norms are pushing the industry toward cleaner technologies.

- Product Substitutes: Renewable energy sources like solar and wind power pose a growing competitive threat to coal. The penetration rate of renewables is estimated at xx% in 2024, impacting coal demand.

- End-User Segmentation: The power generation sector is the largest consumer, followed by the steel industry (coking coal). The report details the market share of each segment.

- M&A Trends: The number of mergers and acquisitions in the coal sector during 2019-2024 totalled xx, with a value of xx Million USD. Consolidation is expected to continue.

India Coal Market Market Trends & Opportunities

The Indian coal market is projected to experience significant growth during the forecast period (2025-2033). Driven by robust demand from the power sector, coupled with industrial growth, the market size is expected to reach xx Million tons by 2033, exhibiting a CAGR of xx% from 2025. Key trends include:

- Increasing demand for thermal coal fueled by the growing power generation capacity.

- Technological advancements focusing on enhancing mining efficiency and reducing environmental impact.

- Government initiatives to improve infrastructure and logistics for coal transportation.

- Growing concerns regarding air pollution and the push for cleaner coal technologies.

- Competitive dynamics are influenced by the expansion of private sector participation and the increasing adoption of renewable energy sources. The market penetration of renewable energy sources is expected to increase further in the coming years, however, the demand for coal is expected to remain significant due to the country's large population and increasing energy needs. The market's growth trajectory hinges on the strategic implementation of various technological advancements. The continuous modernization of mining operations, the development of efficient coal transportation networks, and innovative approaches to coal utilization all play a role in shaping the market's growth trajectory.

Dominant Markets & Segments in India Coal Market

The power generation segment, specifically thermal coal, dominates the Indian coal market, accounting for xx% of total consumption in 2024. Key growth drivers for this segment include:

- Rapid expansion of electricity generation capacity: The increase in energy demand necessitates more coal-fired power plants.

- Government policies supporting power infrastructure development: Various schemes and incentives are driving investments in power projects.

- Relatively lower cost compared to other fuel sources: This makes coal a competitive fuel source for power generation.

The coking coal segment, crucial for the steel industry, is experiencing stable growth driven by India's robust steel production. Other segments include coal used for industrial applications. Geographically, the eastern and central regions of India dominate due to the high concentration of coal mines and power plants.

India Coal Market Product Analysis

Technological advancements are leading to the development of cleaner coal technologies, aimed at reducing emissions and improving efficiency. These innovations, along with improvements in mining and transportation techniques, enhance the overall competitiveness of Indian coal. The market is witnessing a shift toward higher-quality coal varieties, reflecting stringent environmental regulations and increased efficiency needs.

Key Drivers, Barriers & Challenges in India Coal Market

Key Drivers: Increased power generation capacity, industrial expansion, and infrastructure development are driving market growth. Government initiatives to improve mining efficiency and transportation are positive factors.

Challenges: Environmental concerns, stringent emission regulations, and the competition from renewable energy sources represent significant challenges. Supply chain inefficiencies and logistical bottlenecks also hinder market growth. For example, transportation constraints can lead to increased costs and delays, affecting the overall competitiveness of Indian coal. The impact of these constraints is estimated to reduce the market growth rate by approximately xx% in the forecast period.

Growth Drivers in the India Coal Market Market

The robust demand from the power sector, fueled by rapid industrialization and urbanization, acts as a primary growth driver. Government support for infrastructure projects and policies promoting the coal sector further stimulate market expansion. Technological advancements in mining and transportation play a crucial role in enhancing efficiency and reducing costs.

Challenges Impacting India Coal Market Growth

Environmental concerns and strict emission norms impose considerable challenges. These regulations necessitate significant investments in cleaner coal technologies and create operational complexities. Competition from renewable energy sources also poses a threat to the market's long-term growth. Further challenges include the lack of sufficient transportation infrastructure in some regions, hindering the efficient movement of coal.

Key Players Shaping the India Coal Market Market

Significant India Coal Market Industry Milestones

- November 2022: NTPC Ltd secured contracts for four additional coal-fired power projects, boosting capacity by 4.8 GW. This signifies a significant commitment to coal-based power generation despite the growing emphasis on renewable energy.

- February 2023: The inauguration of the 2600 MW Singareni Thermal Power Plant (STPP) marks a milestone for South India's public sector coal-based power generation. This expansion reinforces the importance of coal in meeting the region's energy demand.

Future Outlook for India Coal Market Market

The Indian coal market is expected to maintain steady growth, driven by sustained demand from the power sector and ongoing industrial expansion. However, the pace of growth may moderate due to the increasing penetration of renewable energy. Strategic investments in cleaner coal technologies and infrastructure improvements will be crucial for long-term market sustainability and competitiveness. Opportunities lie in improving mining efficiency, enhancing logistics, and embracing sustainable practices to minimize environmental impact.

India Coal Market Segmentation

-

1. Application

- 1.1. Power Generation (Thermal Coal)

- 1.2. Coking Feedstock (Coking Coal)

- 1.3. Others

India Coal Market Segmentation By Geography

- 1. India

India Coal Market Regional Market Share

Geographic Coverage of India Coal Market

India Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Coal Substituted with Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Increasing Thermal Power Generation is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Generation (Thermal Coal)

- 5.1.2. Coking Feedstock (Coking Coal)

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NLC India Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Power Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Singareni Collieries Company Limited (SCCL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JSW Energy Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coal India Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jindal Steel & Power Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NTPC Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NLC India Ltd

List of Figures

- Figure 1: India Coal Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Coal Market Share (%) by Company 2025

List of Tables

- Table 1: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: India Coal Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Coal Market Volume Billion Forecast, by Region 2020 & 2033

- Table 5: India Coal Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: India Coal Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: India Coal Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: India Coal Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Coal Market?

The projected CAGR is approximately 7.57%.

2. Which companies are prominent players in the India Coal Market?

Key companies in the market include NLC India Ltd, Adani Power Ltd, Singareni Collieries Company Limited (SCCL), JSW Energy Limited, Coal India Limited, Jindal Steel & Power Ltd, NTPC Ltd.

3. What are the main segments of the India Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.04 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Power Generation Capacity Plans and Increasing Electricity Demand4.; Rapidly Growing Industrial and Infrastructural Development Activities.

6. What are the notable trends driving market growth?

Increasing Thermal Power Generation is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Coal Substituted with Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

February 2023, the 2600 megawatt Singareni Thermal Power Plant (STPP) at Pegadapalli in Mancherial district is all set to become South India's first public sector coal-based power generating station and the country's first among State Public Sector Undertakings (PSU).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Coal Market?

To stay informed about further developments, trends, and reports in the India Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence