Key Insights

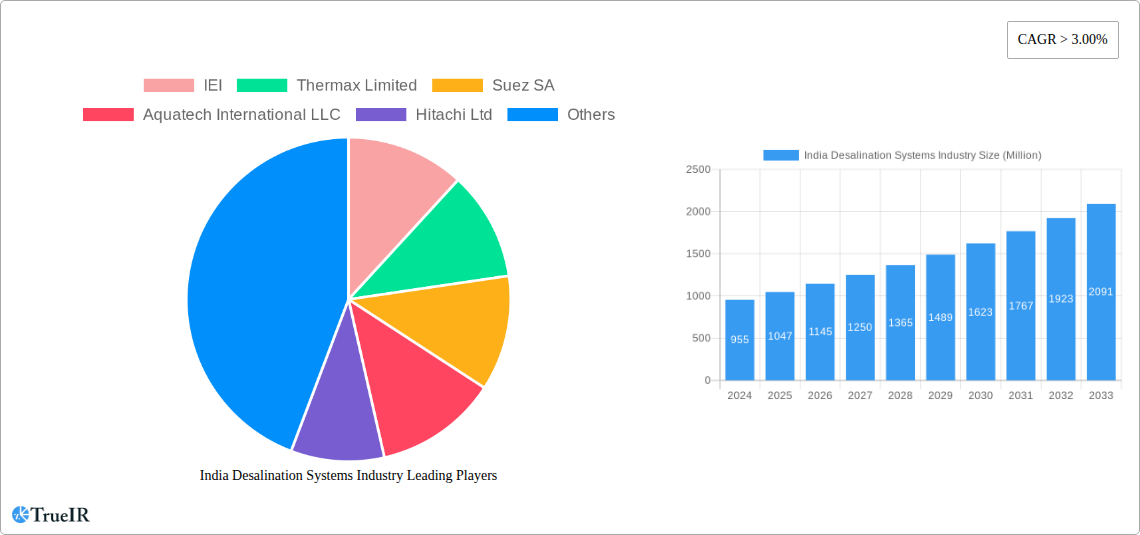

India's Desalination Systems Industry is poised for significant expansion, driven by the nation's increasing water scarcity and growing demand across municipal and industrial sectors. The market, valued at approximately $955 million in 2024, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 9.6% through 2033. This expansion is fueled by critical drivers such as rising populations, industrial development, and the pressing need for sustainable freshwater solutions in drought-prone regions. The adoption of advanced technologies, particularly within Membrane Technology such as Reverse Osmosis (RO) and Electrodialysis (ED), is expected to be a major catalyst. These technologies offer greater efficiency and cost-effectiveness compared to traditional thermal methods, further accelerating market penetration.

India Desalination Systems Industry Market Size (In Million)

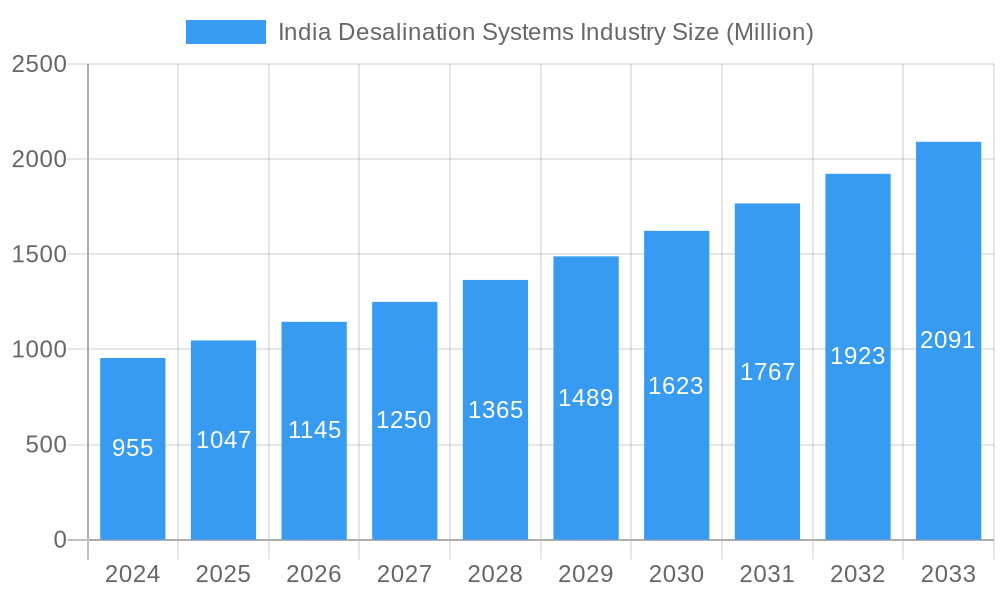

The market is segmented into key technology types, including Thermal Technology (comprising Multi-stage Flash Distillation (MSF) and Multi-effect Distillation (MED)) and Membrane Technology (including Electrodialysis (ED), Electrodialysis Reversal (EDR), and Reverse Osmosis (RO)). Applications are primarily categorized into Municipal and Industrial sectors, both witnessing substantial investment. While the industry benefits from strong demand, potential restraints include high initial capital costs for desalination plants and the energy intensity associated with some processes, though advancements in energy recovery systems are mitigating these concerns. Key players like IEI, Thermax Limited, Suez SA, Aquatech International LLC, and Veolia Environnement SA are actively contributing to market innovation and expansion within India.

India Desalination Systems Industry Company Market Share

Here is the dynamic, SEO-optimized report description for the India Desalination Systems Industry, designed for immediate use without modification:

India Desalination Systems Industry: Market Analysis, Trends, and Forecast to 2033

Gain unparalleled insights into India's burgeoning desalination systems market with this comprehensive report. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this analysis delves into market dynamics, technological advancements, key players, and future opportunities. With an estimated market size exceeding millions in the base year of 2025, this report provides critical intelligence for stakeholders navigating this vital sector.

India Desalination Systems Industry Market Structure & Competitive Landscape

The India desalination systems market is characterized by a moderate to high degree of concentration, with a few dominant players holding significant market share. Innovation is a key driver, fueled by increasing water scarcity and governmental initiatives promoting water security. Regulatory frameworks are evolving to support sustainable desalination practices, influencing investment and technology adoption. While product substitutes exist in the form of advanced water recycling and conservation methods, the unique advantages of desalination in providing a consistent fresh water supply remain compelling. End-user segmentation highlights strong demand from both municipal and industrial sectors, with rapid industrialization and urbanization bolstering these applications. Merger and acquisition (M&A) activities are on the rise as larger corporations seek to consolidate their market positions and expand their technological portfolios. The M&A volume is projected to exceed xx million in the forecast period.

- Market Concentration: Moderate to High

- Innovation Drivers: Water scarcity, government policies, technological advancements

- Regulatory Impacts: Evolving policies promoting sustainability and efficiency

- Product Substitutes: Water recycling, conservation technologies

- End-User Segmentation: Municipal, Industrial

- M&A Trends: Increasing consolidation and strategic partnerships

India Desalination Systems Industry Market Trends & Opportunities

The India desalination systems industry is poised for substantial growth, driven by an escalating demand for potable water and the imperative to address widespread water stress across the nation. Market size is projected to expand at a Compound Annual Growth Rate (CAGR) of over xx% from 2025 to 2033, reaching an estimated market value of over xx million. Technological shifts are a defining trend, with a discernible move towards more energy-efficient and environmentally friendly desalination processes. Membrane technologies, particularly Reverse Osmosis (RO), are gaining significant traction due to their cost-effectiveness and high recovery rates. Thermal technologies, while established, are seeing innovations aimed at reducing energy consumption. Consumer preferences are increasingly leaning towards solutions that offer lower operational costs and a reduced environmental footprint, such as systems powered by renewable energy sources. Competitive dynamics are intensifying, with both domestic and international players vying for market share through technological differentiation, strategic alliances, and competitive pricing. The increasing penetration of desalination solutions in previously underserved regions presents a significant opportunity for market expansion.

Dominant Markets & Segments in India Desalination Systems Industry

Within the Indian desalination landscape, Membrane Technology, particularly Reverse Osmosis (RO), stands out as the dominant segment. This dominance is underpinned by its superior energy efficiency, lower capital costs compared to traditional thermal methods, and its proven effectiveness in treating a wide range of feedwater sources. The application segment of Municipal water supply is experiencing the most significant growth, driven by rapid urbanization, population increase, and a growing awareness of the need for reliable and safe drinking water sources.

Leading Technology Segment: Membrane Technology (Reverse Osmosis - RO)

- Growth Drivers: Energy efficiency, cost-effectiveness, high recovery rates, technological advancements in membrane materials and system design.

- Market Dominance: RO systems are widely adopted for both large-scale municipal plants and smaller industrial applications due to their versatility and scalability.

Dominant Application Segment: Municipal

- Growth Drivers: Increasing urban populations, per capita water consumption rise, government initiatives for water security and smart cities, declining freshwater sources.

- Market Dominance: The demand for desalination to supplement existing municipal water supplies in coastal cities and water-stressed inland regions is immense and projected to escalate.

Emerging Trends in Thermal Technology: While membrane technology leads, thermal technologies like Multi-Stage Flash Distillation (MSF) and Multi-Effect Distillation (MED) remain relevant, especially in areas with abundant waste heat or where feedwater quality necessitates robust thermal treatment. Innovations are focused on improving energy recovery and reducing operational costs.

India Desalination Systems Industry Product Analysis

The India desalination systems market is witnessing a wave of product innovations aimed at enhancing efficiency, reducing energy consumption, and minimizing environmental impact. Reverse Osmosis (RO) systems, powered by advanced membrane technology, continue to dominate with their cost-effectiveness and high water recovery rates. Innovations in RO include energy recovery devices and improved membrane fouling resistance. Thermal technologies like MSF and MED are being refined with advanced heat transfer mechanisms. Electrodialysis (ED) and Electrodialysis Reversal (EDR) offer niche applications for brackish water treatment with specific advantages. The competitive advantage for manufacturers lies in offering integrated, plug-and-play solutions, smart monitoring capabilities, and systems powered by renewable energy sources.

Key Drivers, Barriers & Challenges in India Desalination Systems Industry

Key Drivers:

- Increasing Water Scarcity: Growing demand from a burgeoning population and industrial sectors is outstripping the availability of conventional freshwater sources, making desalination a necessity.

- Governmental Push for Water Security: National and state governments are actively promoting desalination as a strategic solution to ensure water availability, supported by favorable policies and investments.

- Technological Advancements: Continuous improvements in energy efficiency, cost reduction, and operational reliability of desalination technologies are making them more viable and attractive.

- Industrial Growth: Rapid industrialization across various sectors, including manufacturing, power generation, and pharmaceuticals, necessitates a stable and high-quality water supply, driving demand for industrial desalination solutions.

Barriers & Challenges:

- High Energy Consumption: Despite advancements, desalination remains an energy-intensive process, leading to high operational costs and environmental concerns if powered by fossil fuels.

- Brine Disposal and Environmental Concerns: The disposal of concentrated brine remains a significant environmental challenge, requiring careful management to prevent ecological damage to marine ecosystems.

- High Capital Costs: Initial investment for large-scale desalination plants can be substantial, posing a hurdle for certain municipalities and smaller industrial players.

- Skilled Workforce Shortage: The operation and maintenance of sophisticated desalination systems require a skilled workforce, the availability of which can be a limiting factor in certain regions.

Growth Drivers in the India Desalination Systems Industry Market

The India desalination systems industry is propelled by critical growth drivers. Foremost is the escalating deficit in freshwater availability due to over-extraction, pollution, and climate change impacts, creating an indispensable need for alternative water sources. Government initiatives and policy support, such as incentives for renewable energy integration and water infrastructure development, are actively fostering market expansion. Technological breakthroughs in energy efficiency and membrane performance are significantly reducing operational costs and environmental footprints, making desalination more economically feasible. The relentless growth of key industrial sectors like manufacturing, food and beverage, and power generation, which have high water demands, further fuels the adoption of desalination systems for reliable process water.

Challenges Impacting India Desalination Systems Industry Growth

Several challenges impact the growth trajectory of India's desalination systems industry. The significant energy intensity of desalination, leading to substantial operational costs and a reliance on the power grid, remains a primary concern, especially in regions with unreliable electricity supply. Environmental regulations surrounding brine discharge and its potential impact on marine ecosystems necessitate costly and complex mitigation strategies. High upfront capital investment for establishing desalination facilities can be a deterrent for many potential users, particularly smaller municipalities and industries. Furthermore, the availability of skilled personnel for the operation and maintenance of advanced desalination technologies can be a limiting factor in certain geographical areas.

Key Players Shaping the India Desalination Systems Industry Market

- IEI

- Thermax Limited

- Suez SA

- Aquatech International LLC

- Hitachi Ltd

- Evoqua Water Technologies

- Abengoa

- DuPont

- VA Tech Wabag Ltd

- Veolia Environnement SA

- IDE Technologies Ltd

Significant India Desalination Systems Industry Industry Milestones

- June 2022: ENOWA, the energy, water, and hydrogen subsidiary of NEOM, signed a Memorandum of Understanding (MoU) with ITOCHU and Veolia. As part of the MoU, the companies have agreed to collaborate to develop a first-of-its-kind selective desalination plant powered by 100% renewable energy in Oxagon, NEOM's advanced manufacturing and innovation city.

- April 2022: Veolia Water Technologies, a subsidiary of the Veolia Group and leading specialist in water treatment, announced the Asia Pacific launch of Barrel, an integrated plug-and-play reverse osmosis (RO) technology. With the increasing demand for fresh water and rising concerns over scarcity in the region, the Barrel meets the challenges and expectations of the desalination market while producing fresh water that complies with all water quality standards.

- January 2022: SUEZ finished buying Sentinel Monitoring Systems, a company based in Tucson, Arizona, that tracks microbes in real time. Sentinel Monitoring Systems develops products that provide real-time and near-real-time solutions to monitor the effectiveness of microbial control within life sciences, ultrapure water, and manufacturing processes. Under this purchase agreement, SUEZ has acquired all of Sentinel Monitoring Systems' business.

Future Outlook for India Desalination Systems Industry Market

The future outlook for the India desalination systems industry is exceptionally promising, driven by an unwavering demand for sustainable water solutions. Key growth catalysts include continued advancements in renewable energy integration, which will significantly reduce operational costs and environmental impact. Strategic partnerships and collaborations between technology providers, government bodies, and industrial users will accelerate the deployment of innovative desalination projects. The expansion of smart city initiatives and increasing focus on water circularity will further bolster the market. Opportunities abound in developing more energy-efficient and compact desalination units for diverse applications, alongside advancements in brine management technologies. The market is expected to witness sustained growth, transforming India's water security landscape.

India Desalination Systems Industry Segmentation

-

1. Technology

-

1.1. Thermal Technology

- 1.1.1. Multi-stage Flash Distillation (MSF)

- 1.1.2. Multi-effect Distillation (MED)

- 1.1.3. Vapor Compression Distillation

-

1.2. Membrane Technology

- 1.2.1. Electrodialysis (ED)

- 1.2.2. Electrodialysis Reversal (EDR)

- 1.2.3. Reverse Osmosis (RO)

- 1.2.4. Other Me

-

1.1. Thermal Technology

-

2. Application

- 2.1. Municipal

- 2.2. Industrial

India Desalination Systems Industry Segmentation By Geography

- 1. India

India Desalination Systems Industry Regional Market Share

Geographic Coverage of India Desalination Systems Industry

India Desalination Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Gap Between Water Supply and Demand; Lack of Existence of Water Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Cost Compared to Water Treatment Plant; Other Restraints

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Municipal Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Desalination Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Thermal Technology

- 5.1.1.1. Multi-stage Flash Distillation (MSF)

- 5.1.1.2. Multi-effect Distillation (MED)

- 5.1.1.3. Vapor Compression Distillation

- 5.1.2. Membrane Technology

- 5.1.2.1. Electrodialysis (ED)

- 5.1.2.2. Electrodialysis Reversal (EDR)

- 5.1.2.3. Reverse Osmosis (RO)

- 5.1.2.4. Other Me

- 5.1.1. Thermal Technology

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Municipal

- 5.2.2. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IEI

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thermax Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suez SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aquatech International LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Evoqua Water Technologies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abengoa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DuPont

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VA Tech Wabag Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Veolia Environnement SA*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IDE Technologies Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IEI

List of Figures

- Figure 1: India Desalination Systems Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Desalination Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: India Desalination Systems Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: India Desalination Systems Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: India Desalination Systems Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Desalination Systems Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: India Desalination Systems Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: India Desalination Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Desalination Systems Industry?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the India Desalination Systems Industry?

Key companies in the market include IEI, Thermax Limited, Suez SA, Aquatech International LLC, Hitachi Ltd, Evoqua Water Technologies, Abengoa, DuPont, VA Tech Wabag Ltd, Veolia Environnement SA*List Not Exhaustive, IDE Technologies Ltd.

3. What are the main segments of the India Desalination Systems Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Gap Between Water Supply and Demand; Lack of Existence of Water Infrastructure.

6. What are the notable trends driving market growth?

Rising Demand from the Municipal Segment.

7. Are there any restraints impacting market growth?

High Cost Compared to Water Treatment Plant; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2022: ENOWA, the energy, water, and hydrogen subsidiary of NEOM, signed a Memorandum of Understanding (MoU) with ITOCHU and Veolia. As part of the MoU, the companies have agreed to collaborate to develop a first-of-its-kind selective desalination plant powered by 100% renewable energy in Oxagon, NEOM's advanced manufacturing and innovation city.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Desalination Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Desalination Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Desalination Systems Industry?

To stay informed about further developments, trends, and reports in the India Desalination Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence