Key Insights

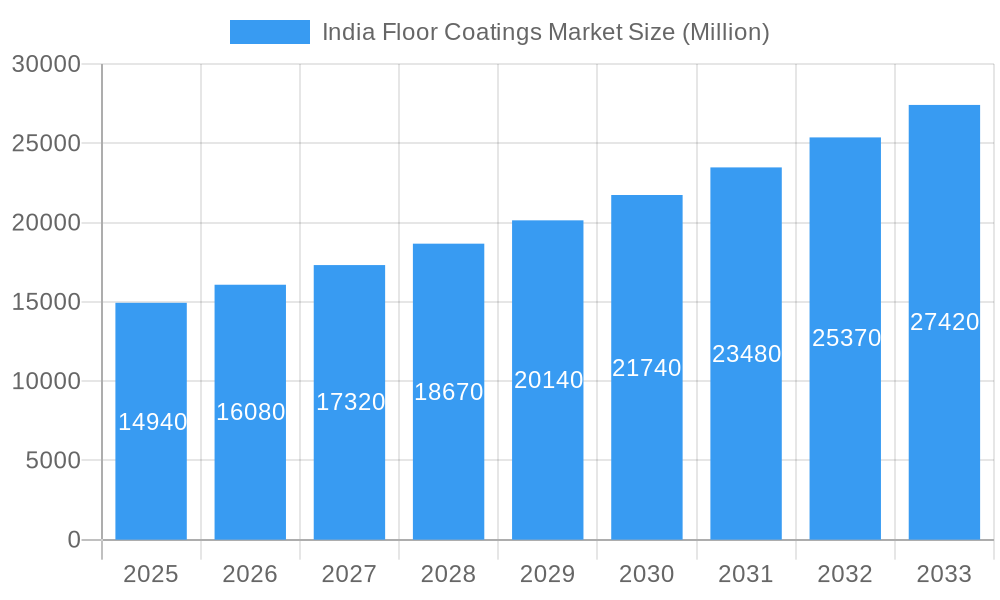

The India floor coatings market, valued at ₹14,940 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) exceeding 7% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning construction industry, particularly in residential and commercial sectors, is significantly boosting demand for durable and aesthetically pleasing floor coatings. Secondly, increasing awareness of the benefits of protective coatings – enhanced longevity, ease of maintenance, and improved hygiene – amongst both consumers and businesses is driving adoption. Thirdly, the government's infrastructure development initiatives further stimulate market growth by creating a larger demand for floor coatings in industrial and public spaces. Finally, the introduction of innovative, eco-friendly coating options, such as water-based and low-VOC formulations, is aligning with growing environmental concerns and attracting a broader customer base.

India Floor Coatings Market Market Size (In Billion)

However, challenges remain. Fluctuations in raw material prices, particularly resins and pigments, can impact profitability. Furthermore, the market is relatively fragmented, with several domestic and international players competing for market share. Nevertheless, the long-term outlook remains positive, driven by continued urbanization, rising disposable incomes, and a preference for modern, aesthetically advanced flooring solutions. The segment breakdown suggests strong demand across various product types (epoxy, polyaspartic, acrylic, polyurethane), floor materials (wood, concrete), and end-user industries, indicating diverse opportunities for growth within this dynamic market. Regional variations are likely, with potential for stronger growth in urban centers and regions experiencing rapid economic development. Further analysis could reveal specific opportunities in niche markets like specialized industrial coatings or sustainable solutions.

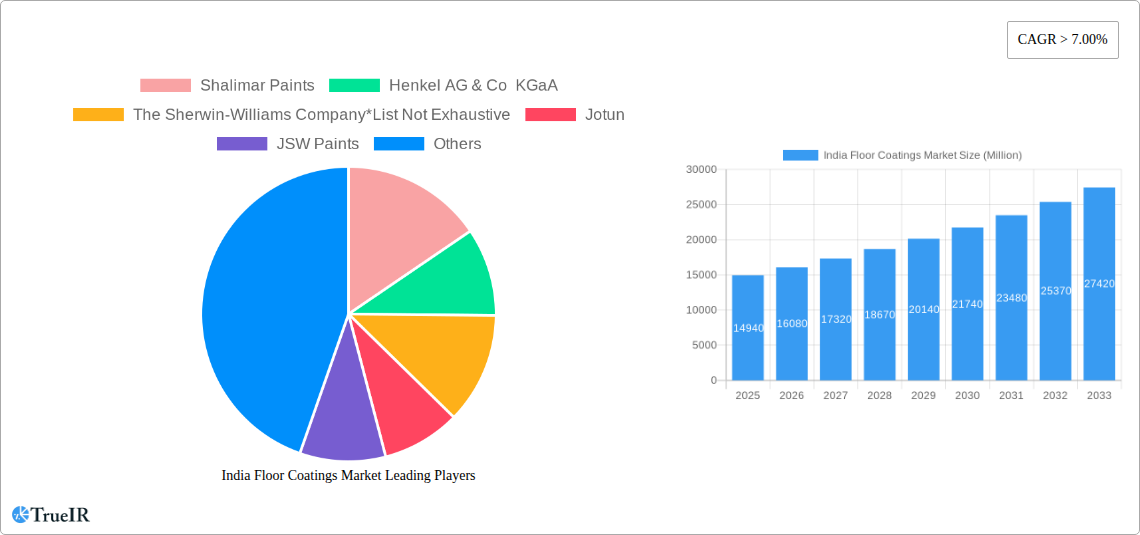

India Floor Coatings Market Company Market Share

India Floor Coatings Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the India Floor Coatings Market, offering invaluable insights for businesses, investors, and industry professionals. With a detailed examination of market trends, competitive dynamics, and future growth prospects, this report is essential for navigating this rapidly evolving sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

India Floor Coatings Market Market Structure & Competitive Landscape

The Indian floor coatings market is characterized by a moderately concentrated landscape, with key players like Asian Paints, Kansai Nerolac Paints Limited, Berger Paints India, and international giants such as Sherwin-Williams and Akzo Nobel vying for market share. The market concentration ratio (CR4) is estimated at xx%, indicating a competitive yet consolidated structure. Innovation is a key driver, with companies focusing on developing sustainable, high-performance coatings. Stringent environmental regulations are shaping product formulations, pushing the adoption of low-VOC and eco-friendly options. Product substitution is evident with the increasing popularity of epoxy and polyurethane coatings over traditional options. The market is segmented by product type (epoxy, polyaspartics, acrylic, polyurethane, others), floor material (wood, concrete, others), and end-user industry (residential, commercial, industrial). M&A activity has been moderate, with a few strategic acquisitions aimed at expanding product portfolios and geographic reach. The total M&A volume in the past 5 years is estimated at xx deals.

India Floor Coatings Market Market Trends & Opportunities

The India Floor Coatings Market is experiencing robust growth, driven by the nation's burgeoning construction and infrastructure development. Rapid urbanization, rising disposable incomes, and a growing preference for aesthetically pleasing and durable floor finishes are fueling demand. Technological advancements, including the introduction of self-leveling coatings and UV-cured systems, are enhancing product performance and efficiency. Consumer preferences are shifting towards eco-friendly and sustainable options, creating opportunities for manufacturers offering green coatings. The market witnesses intense competition, with companies focusing on branding, distribution networks, and product innovation to gain a competitive edge. The market penetration rate for high-performance coatings is expected to increase from xx% in 2025 to xx% by 2033. The market size is expected to witness significant growth, reaching xx Million by 2033.

Dominant Markets & Segments in India Floor Coatings Market

The commercial sector holds the largest market share, driven by the expansion of retail spaces, offices, and hospitality projects. The concrete floor material segment dominates due to its widespread use in construction. Among product types, epoxy coatings enjoy significant demand because of their durability and chemical resistance.

- Key Growth Drivers for Commercial Sector: Robust infrastructure development, expansion of retail and commercial spaces, government initiatives promoting infrastructure projects.

- Key Growth Drivers for Concrete Floor Material: Wide use in construction, cost-effectiveness, durability.

- Key Growth Drivers for Epoxy Coatings: Superior durability, chemical resistance, ease of application.

The industrial sector is also projected to witness significant growth due to expansion of manufacturing facilities and the adoption of high-performance coatings in factories. Regional dominance is observed in major metropolitan areas like Mumbai, Delhi, and Bangalore, reflecting higher construction activity in these regions.

India Floor Coatings Market Product Analysis

Recent product innovations focus on enhanced durability, ease of application, and eco-friendly formulations. Advancements in UV-cured and water-based coatings have improved performance and reduced environmental impact. Self-leveling and anti-slip coatings cater to specific application needs. The market is witnessing a growing demand for specialized coatings tailored to meet specific industrial and commercial needs, driving competition and innovation.

Key Drivers, Barriers & Challenges in India Floor Coatings Market

Key Drivers: Rapid urbanization, growing construction activity, government infrastructure projects, rising disposable incomes, increasing awareness of aesthetically pleasing and durable flooring solutions.

Challenges: Fluctuations in raw material prices, intense competition, stringent environmental regulations, supply chain disruptions, and the need for skilled labor. These challenges could impact the market growth rate by xx% by 2033.

Growth Drivers in the India Floor Coatings Market Market

The significant growth in the Indian construction and infrastructure sector is a major driver. Government initiatives promoting affordable housing and infrastructure development are further boosting market demand. Technological advancements leading to superior product performance and increased efficiency are also driving growth.

Challenges Impacting India Floor Coatings Market Growth

The volatile prices of raw materials (like resins and solvents) pose a major challenge. Competition from unorganized players and the need for highly skilled labor to achieve optimal product performance are also hindering the market's full potential. Stringent environmental regulations impact production costs and increase the complexity of the product development lifecycle.

Key Players Shaping the India Floor Coatings Market Market

- Shalimar Paints

- Henkel AG & Co KGaA

- The Sherwin-Williams Company

- Jotun

- JSW Paints

- Sheenlac Paints Ltd

- HMG Paints Limited

- Mapei

- Nippon Paint Holdings Co Ltd

- BASF SE

- Indigo Paints Ltd

- Kansai Nerolac Paints Limited

- Akzo Nobel N V

- Sto SE & Co KGaA

- Sika AG

- PPG Industries

- Asian Paints

Significant India Floor Coatings Market Industry Milestones

- October 2020: Kansai Nerolac Paints announced an investment of USD 54.3 Million to add capacity by 40,000 lakh liters at its plant in Amritsar, Punjab. This expansion significantly increased their production capacity, impacting market supply and competition.

Future Outlook for India Floor Coatings Market Market

The India Floor Coatings Market is poised for continued growth, driven by sustained infrastructure development, urbanization, and rising consumer demand for high-performance coatings. Strategic partnerships, product innovation focusing on sustainability, and expansion into underserved markets will be key to success. The market presents significant opportunities for both domestic and international players.

India Floor Coatings Market Segmentation

-

1. Product Type

- 1.1. Epoxy

- 1.2. Polyaspartics

- 1.3. Acrylic

- 1.4. Polyurethane

- 1.5. Other Product Types

-

2. Floor Material

- 2.1. Wood

- 2.2. Concrete

- 2.3. Other Floor Materials

-

3. End-user Industry

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

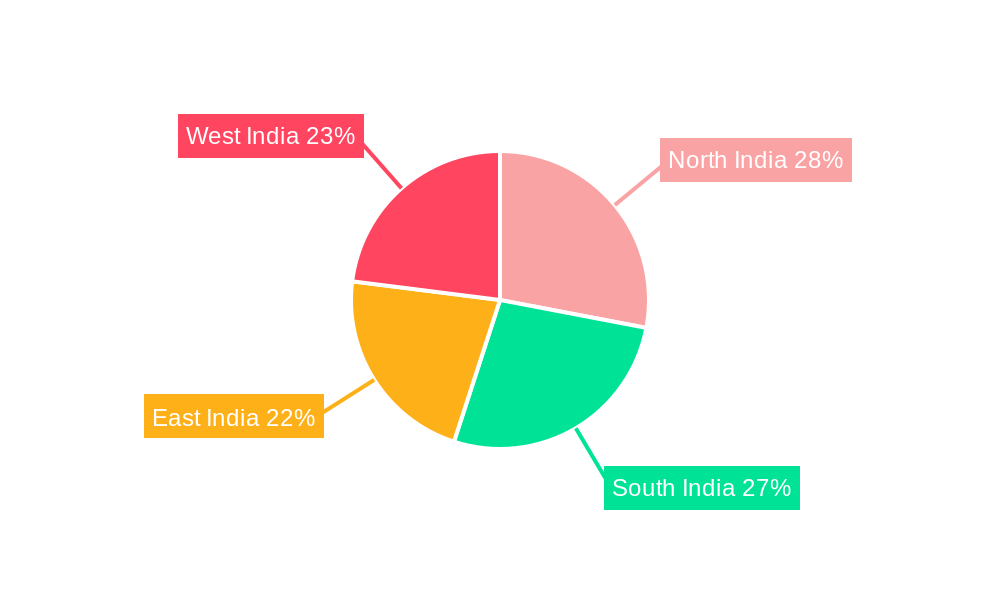

India Floor Coatings Market Segmentation By Geography

- 1. India

India Floor Coatings Market Regional Market Share

Geographic Coverage of India Floor Coatings Market

India Floor Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness about the Advantages of Floor Coatings; Increasing Construction Activities in India

- 3.3. Market Restrains

- 3.3.1. Harmful Environmental Impact of Conventional Coatings

- 3.4. Market Trends

- 3.4.1. Increasing Construction Activities in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Floor Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Epoxy

- 5.1.2. Polyaspartics

- 5.1.3. Acrylic

- 5.1.4. Polyurethane

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Floor Material

- 5.2.1. Wood

- 5.2.2. Concrete

- 5.2.3. Other Floor Materials

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Shalimar Paints

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Henkel AG & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Sherwin-Williams Company*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JSW Paints

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sheenlac Paints Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HMG Paints Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mapei

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippon Paint Holdings Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indigo Paints Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kansai Nerolac Paints Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Akzo Nobel N V

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sto SE & Co KGaA

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sika AG

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 PPG Industries

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Asian Paints

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Shalimar Paints

List of Figures

- Figure 1: India Floor Coatings Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Floor Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: India Floor Coatings Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Floor Coatings Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: India Floor Coatings Market Revenue Million Forecast, by Floor Material 2020 & 2033

- Table 4: India Floor Coatings Market Volume K Tons Forecast, by Floor Material 2020 & 2033

- Table 5: India Floor Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: India Floor Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: India Floor Coatings Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Floor Coatings Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: India Floor Coatings Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: India Floor Coatings Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: India Floor Coatings Market Revenue Million Forecast, by Floor Material 2020 & 2033

- Table 12: India Floor Coatings Market Volume K Tons Forecast, by Floor Material 2020 & 2033

- Table 13: India Floor Coatings Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: India Floor Coatings Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: India Floor Coatings Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Floor Coatings Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Floor Coatings Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the India Floor Coatings Market?

Key companies in the market include Shalimar Paints, Henkel AG & Co KGaA, The Sherwin-Williams Company*List Not Exhaustive, Jotun, JSW Paints, Sheenlac Paints Ltd, HMG Paints Limited, Mapei, Nippon Paint Holdings Co Ltd, BASF SE, Indigo Paints Ltd, Kansai Nerolac Paints Limited, Akzo Nobel N V, Sto SE & Co KGaA, Sika AG, PPG Industries, Asian Paints.

3. What are the main segments of the India Floor Coatings Market?

The market segments include Product Type, Floor Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14940 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness about the Advantages of Floor Coatings; Increasing Construction Activities in India.

6. What are the notable trends driving market growth?

Increasing Construction Activities in India.

7. Are there any restraints impacting market growth?

Harmful Environmental Impact of Conventional Coatings.

8. Can you provide examples of recent developments in the market?

October 2020: Kansai Nerolac Paints announced an investment of USD 54.3 million to add capacity by 40,000 lakh liter at its plant in Amritsar, Punjab.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Floor Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Floor Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Floor Coatings Market?

To stay informed about further developments, trends, and reports in the India Floor Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence