Key Insights

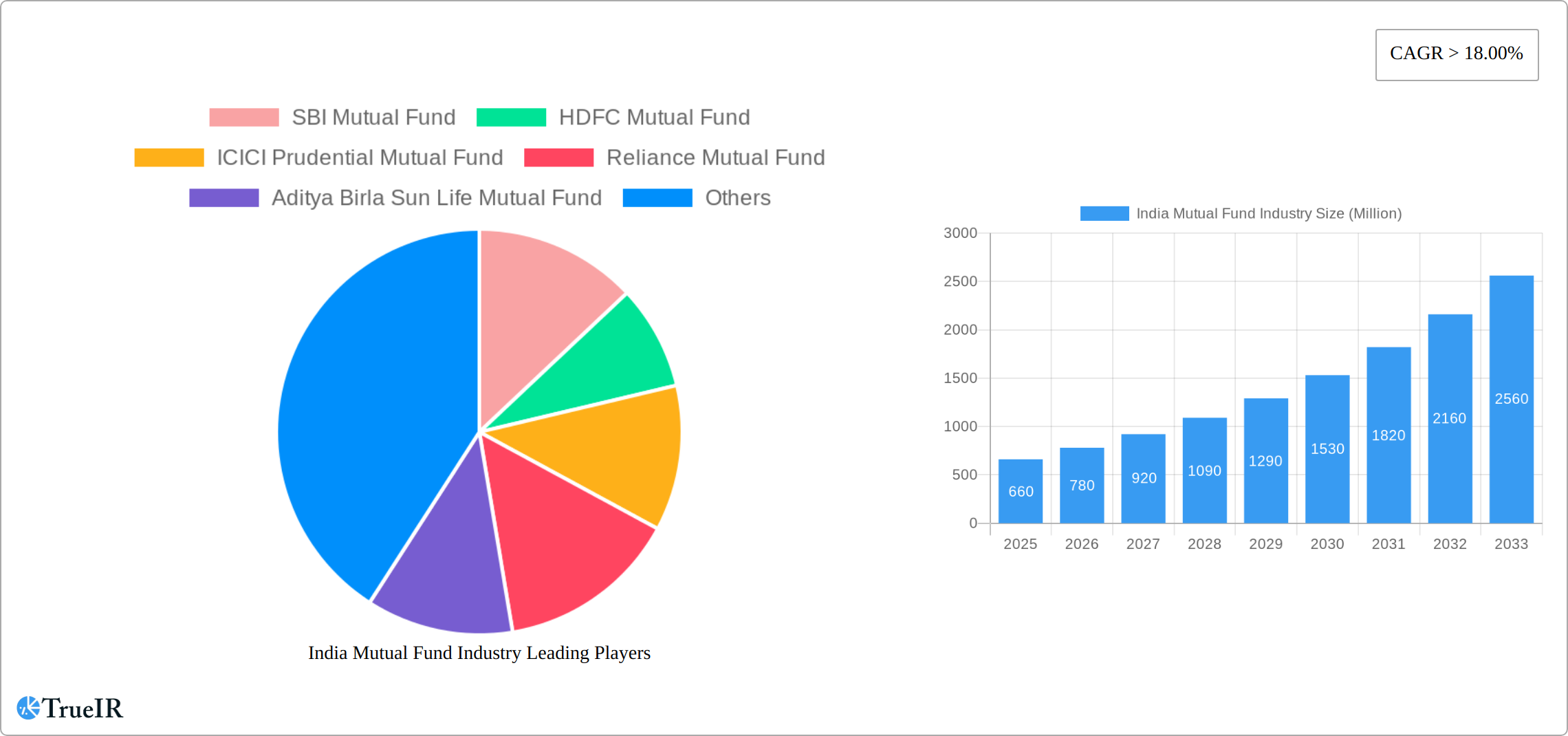

The India Mutual Fund Industry is experiencing robust growth, projected to reach a market size of approximately ₹660 million (assuming "0.66" refers to billions, adjusted to millions for consistency) in 2025. A Compound Annual Growth Rate (CAGR) exceeding 18% from 2019 to 2033 indicates a significant expansion in the coming years. This surge is driven by several factors, including increasing financial literacy among the burgeoning middle class, favorable government policies promoting financial inclusion, and the rising popularity of systematic investment plans (SIPs) as a convenient and disciplined investment avenue. Furthermore, the diversification offered by mutual funds, catering to various risk appetites and investment goals, contributes to their appeal. Competitive pricing strategies by leading players like SBI Mutual Fund, HDFC Mutual Fund, and ICICI Prudential Mutual Fund further fuel market penetration. However, the industry also faces challenges such as market volatility, regulatory changes, and the need to enhance investor education to mitigate risks associated with investment decisions.

India Mutual Fund Industry Market Size (In Million)

Looking ahead to 2033, the market is poised for substantial growth, driven by a young and increasingly financially aware population. The industry's success will hinge on its ability to innovate product offerings to meet evolving investor needs, strengthen investor trust through transparency and ethical practices, and effectively manage risks associated with volatile market conditions. Continued government support and robust regulatory oversight will play crucial roles in ensuring sustainable growth and maintaining investor confidence in the Indian mutual fund sector. Strategic partnerships with fintech companies can significantly amplify distribution channels and reach a wider audience, further boosting market expansion.

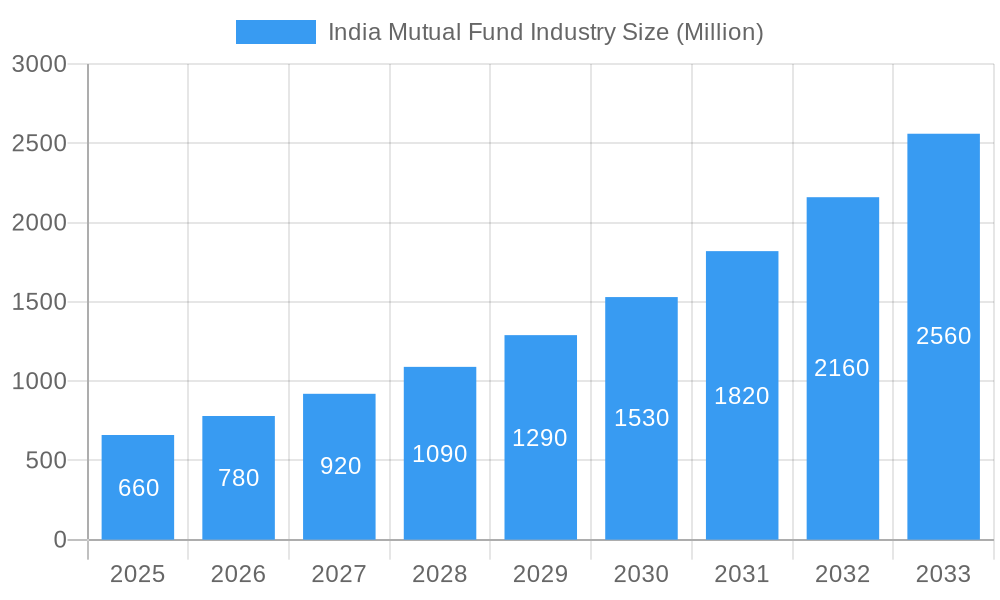

India Mutual Fund Industry Company Market Share

India Mutual Fund Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the India Mutual Fund Industry, covering market structure, competitive landscape, growth trends, and future outlook from 2019 to 2033. Leveraging extensive data and insights, this report is essential for investors, industry professionals, and anyone seeking to understand this rapidly evolving sector. The report features a meticulous analysis based on historical data (2019-2024), an estimated year (2025), and a forecast period extending to 2033, with 2025 serving as the base year.

India Mutual Fund Industry Market Structure & Competitive Landscape

The Indian mutual fund industry presents a moderately concentrated market structure. While a few dominant players command a significant portion of the market, a diverse range of participants ensures healthy competition. As of 2024, the top 10 players (including but not limited to SBI Mutual Fund, HDFC Mutual Fund, ICICI Prudential Mutual Fund, Reliance Mutual Fund, Aditya Birla Sun Life Mutual Fund, DSP BlackRock Mutual Fund, Kotak Mutual Fund, IDFC Mutual Fund, Tata Mutual Fund, Invesco Mutual Fund, and Sundaram Mutual Fund) control approximately [Insert Percentage]% of the total Assets Under Management (AUM). This concentration, while indicating a moderately competitive landscape, still leaves room for smaller players to expand their presence and market share.

Driving innovation within the industry are the introduction of new investment products tailored to various investor risk tolerances, the increasing utilization of digital technologies to improve customer experience and accessibility, and a growing focus on thematic investing strategies. Regulatory frameworks, primarily those established by the Securities and Exchange Board of India (SEBI), heavily influence market dynamics, impacting both product offerings and operational standards. Alternative investment vehicles, such as direct equity investments, fixed deposits, and government bonds, serve as key substitutes for mutual fund products. The industry's customer base is segmented into retail investors, high-net-worth individuals (HNIs), and institutional investors, each with distinct investment objectives and preferences. Mergers and acquisitions (M&A) activity within the industry has been relatively subdued in recent years, with approximately [Insert Number] deals concluded between 2019 and 2024, totaling approximately ₹[Insert Amount] Million. Further consolidation is anticipated, particularly amongst smaller players seeking to enhance their market share and competitiveness.

India Mutual Fund Industry Market Trends & Opportunities

The Indian mutual fund industry has demonstrated robust growth over the past five years. In 2024, the market size, as measured by AUM, reached approximately ₹[Insert Amount] Million, exhibiting a Compound Annual Growth Rate (CAGR) of [Insert Percentage]% during the period from 2019 to 2024. This expansion is fueled by several key factors: increasing financial literacy among the population, rising disposable incomes, and government initiatives aimed at promoting financial inclusion. The market penetration rate was estimated at [Insert Percentage]% in 2024, revealing substantial untapped potential for growth, especially in rural and semi-urban areas. Technological advancements, including the adoption of mobile-first investing platforms, the rise of robo-advisors, and the implementation of AI-driven personalized investment solutions, are transforming customer interactions and investment strategies. A notable trend is the increasing consumer preference for passively managed index funds and exchange-traded funds (ETFs), driven largely by their lower expense ratios and simplified investment approaches. The competitive landscape remains dynamic, characterized by established players continually innovating and emerging fintech companies disrupting traditional business models. Looking ahead to the forecast period (2025-2033), continued market growth is projected, with AUM expected to reach ₹[Insert Amount] Million by 2033. This projected growth is fueled by increased digital adoption, product diversification, and sustained economic growth in India.

Dominant Markets & Segments in India Mutual Fund Industry

While the Indian mutual fund industry displays robust growth across various regions and segments, equity funds and debt funds consistently stand out as top performers. These fund categories have experienced significant growth in assets under management (AUM) due to their adaptability to evolving investor preferences and prevailing market conditions.

- Key Growth Drivers for Equity Funds: Strong equity market performance, rising investor confidence, and a notable shift towards active investment strategies.

- Key Growth Drivers for Debt Funds: Stable returns compared to equity investments, a lower risk profile making them attractive to risk-averse investors, and a diverse range of debt instruments catering to various investment time horizons.

- Key Growth Drivers for Hybrid Funds: The appealing combination of equity and debt exposure, attracting investors seeking a balance between growth potential and stability. Furthermore, increased awareness and a better understanding of hybrid funds' benefits among investors contribute to their growth.

The growth trajectory of these dominant segments is propelled by a favorable regulatory environment, heightened investor awareness of investment diversification, and the increasing availability of financial information through numerous channels.

India Mutual Fund Industry Product Analysis

The Indian mutual fund industry provides a diverse range of products designed to meet the varying needs and risk profiles of investors. This includes equity funds, debt funds, hybrid funds, and index funds. Recent innovative offerings include thematic funds focused on specific sectors such as technology or sustainability, and the expanding utilization of Exchange Traded Funds (ETFs). Many of these products leverage technology to enable seamless online transactions and portfolio management. Key competitive advantages stem from factors such as lower expense ratios, superior investment performance, strong brand recognition, and advanced digital platforms that enhance the overall customer experience.

Key Drivers, Barriers & Challenges in India Mutual Fund Industry

Key Drivers:

- Rising Disposable Incomes: Increased affluence leads to higher investment capacities and interest in mutual funds.

- Government Initiatives: Policies promoting financial inclusion and awareness boost mutual fund penetration.

- Technological Advancements: Digital platforms and online investment options enhance accessibility and convenience.

Challenges:

- Regulatory Complexities: Navigating regulatory changes and compliance requirements presents ongoing operational challenges.

- Competitive Pressures: Intense competition among numerous players necessitates continuous innovation and differentiation.

- Market Volatility: Fluctuations in the stock and bond markets affect investor sentiment and returns, impacting fund performance.

Growth Drivers in the India Mutual Fund Industry Market

The growth of the Indian mutual fund industry is propelled by a confluence of factors: the burgeoning middle class with increasing disposable incomes, supportive government policies encouraging financial inclusion, and technological advancements enabling wider access and convenience. Furthermore, the rising popularity of passive investment strategies, coupled with the introduction of innovative fund products tailored to specific investor segments, promises robust growth in the coming years.

Challenges Impacting India Mutual Fund Industry Growth

The Indian mutual fund industry faces several challenges that could potentially impede its growth trajectory. Regulatory complexities, particularly concerning compliance and reporting requirements, present significant operational hurdles. Fierce competition from numerous players, including disruptive fintech companies, necessitates continuous innovation and strategic differentiation to maintain market share. Furthermore, economic downturns and market volatility can negatively impact investor confidence and the performance of various fund categories, potentially hindering the industry's overall growth.

Key Players Shaping the India Mutual Fund Industry Market

Significant India Mutual Fund Industry Industry Milestones

- April 2023: ICICI Prudential Mutual Fund launched the ICICI Prudential Innovation Fund, an open-ended thematic equity scheme focusing on companies benefiting from innovation strategies. This broadened the product offerings and catered to investors interested in thematic investing.

- April 2023: HDFC Mutual Fund introduced three index funds (HDFC S&P BSE 500 Index Fund, HDFC NIFTY Midcap 150 Index Fund, and HDFC NIFTY Smallcap 250 Index Fund), offering investors exposure to broader market segments at competitive costs. This increased the availability of passively managed investment options.

Future Outlook for India Mutual Fund Industry Market

The Indian mutual fund industry is poised for sustained growth, driven by several key catalysts. Increasing financial literacy, a growing middle class, and favorable regulatory policies will continue to fuel market expansion. Furthermore, technological advancements, particularly in digital platforms and robo-advisory services, will significantly enhance accessibility and convenience for investors. The industry will witness increased product diversification, with a focus on thematic investing and specialized solutions catering to unique investor needs. The long-term outlook remains optimistic, with significant potential for market expansion and value creation in the coming decade.

India Mutual Fund Industry Segmentation

-

1. Asset Class/Scheme Type

- 1.1. Debt-oriented Schemes

- 1.2. Equity-oriented Schemes

- 1.3. Money Market

- 1.4. ETFs and FoFs

-

2. Source of Funds

- 2.1. Banks

- 2.2. Insurance Companies

- 2.3. Retail Investors

- 2.4. Indian Institutional Investors

- 2.5. FIIs and FPIs

- 2.6. Other Sources

India Mutual Fund Industry Segmentation By Geography

- 1. India

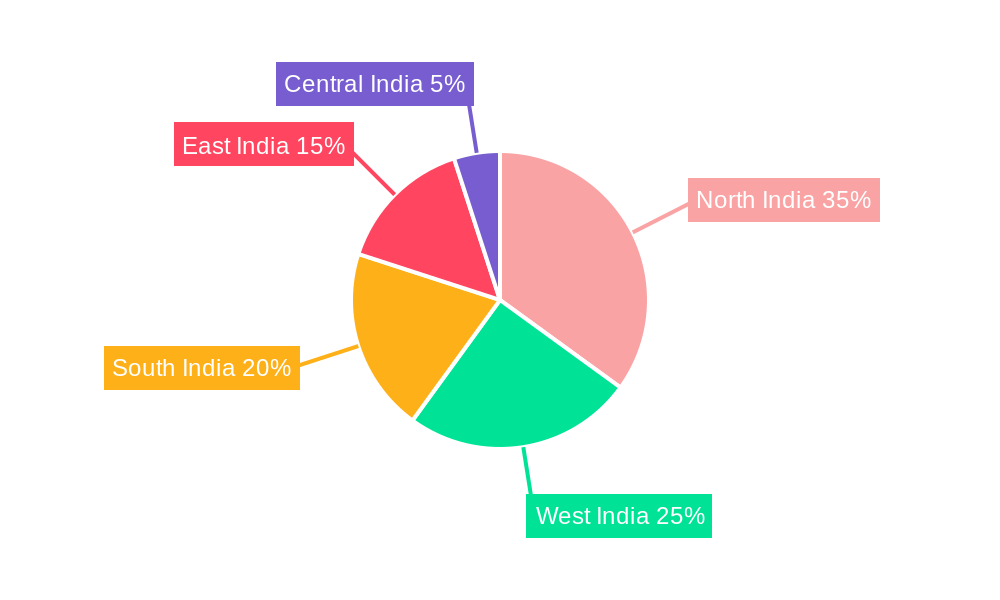

India Mutual Fund Industry Regional Market Share

Geographic Coverage of India Mutual Fund Industry

India Mutual Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 18.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth and Investor Awareness

- 3.3. Market Restrains

- 3.3.1. Economic Growth and Investor Awareness

- 3.4. Market Trends

- 3.4.1. Hike in Mutual Fund Assets is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Mutual Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Asset Class/Scheme Type

- 5.1.1. Debt-oriented Schemes

- 5.1.2. Equity-oriented Schemes

- 5.1.3. Money Market

- 5.1.4. ETFs and FoFs

- 5.2. Market Analysis, Insights and Forecast - by Source of Funds

- 5.2.1. Banks

- 5.2.2. Insurance Companies

- 5.2.3. Retail Investors

- 5.2.4. Indian Institutional Investors

- 5.2.5. FIIs and FPIs

- 5.2.6. Other Sources

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Asset Class/Scheme Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SBI Mutual Fund

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HDFC Mutual Fund

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ICICI Prudential Mutual Fund

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Reliance Mutual Fund

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aditya Birla Sun Life Mutual Fund

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DSP BlackRock Mutual Fund

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kotak Mutual Fund

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IDFC Mutual Fund

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tata Mutual Fund

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Invesco Mutual Fund

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sundaram Mutual Fund**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 SBI Mutual Fund

List of Figures

- Figure 1: India Mutual Fund Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Mutual Fund Industry Share (%) by Company 2025

List of Tables

- Table 1: India Mutual Fund Industry Revenue Million Forecast, by Asset Class/Scheme Type 2020 & 2033

- Table 2: India Mutual Fund Industry Volume Trillion Forecast, by Asset Class/Scheme Type 2020 & 2033

- Table 3: India Mutual Fund Industry Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 4: India Mutual Fund Industry Volume Trillion Forecast, by Source of Funds 2020 & 2033

- Table 5: India Mutual Fund Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Mutual Fund Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: India Mutual Fund Industry Revenue Million Forecast, by Asset Class/Scheme Type 2020 & 2033

- Table 8: India Mutual Fund Industry Volume Trillion Forecast, by Asset Class/Scheme Type 2020 & 2033

- Table 9: India Mutual Fund Industry Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 10: India Mutual Fund Industry Volume Trillion Forecast, by Source of Funds 2020 & 2033

- Table 11: India Mutual Fund Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Mutual Fund Industry Volume Trillion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Mutual Fund Industry?

The projected CAGR is approximately > 18.00%.

2. Which companies are prominent players in the India Mutual Fund Industry?

Key companies in the market include SBI Mutual Fund, HDFC Mutual Fund, ICICI Prudential Mutual Fund, Reliance Mutual Fund, Aditya Birla Sun Life Mutual Fund, DSP BlackRock Mutual Fund, Kotak Mutual Fund, IDFC Mutual Fund, Tata Mutual Fund, Invesco Mutual Fund, Sundaram Mutual Fund**List Not Exhaustive.

3. What are the main segments of the India Mutual Fund Industry?

The market segments include Asset Class/Scheme Type, Source of Funds.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth and Investor Awareness.

6. What are the notable trends driving market growth?

Hike in Mutual Fund Assets is Driving the Market.

7. Are there any restraints impacting market growth?

Economic Growth and Investor Awareness.

8. Can you provide examples of recent developments in the market?

April 2023: ICICI Prudential Mutual Fund announced the launch of ICICI Prudential Innovation Fund. This open-ended thematic equity scheme will predominantly invest in equity, equity-related securities of companies, and units of global mutual funds/ETFs that can benefit from innovation strategies and themes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Mutual Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Mutual Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Mutual Fund Industry?

To stay informed about further developments, trends, and reports in the India Mutual Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence