Key Insights

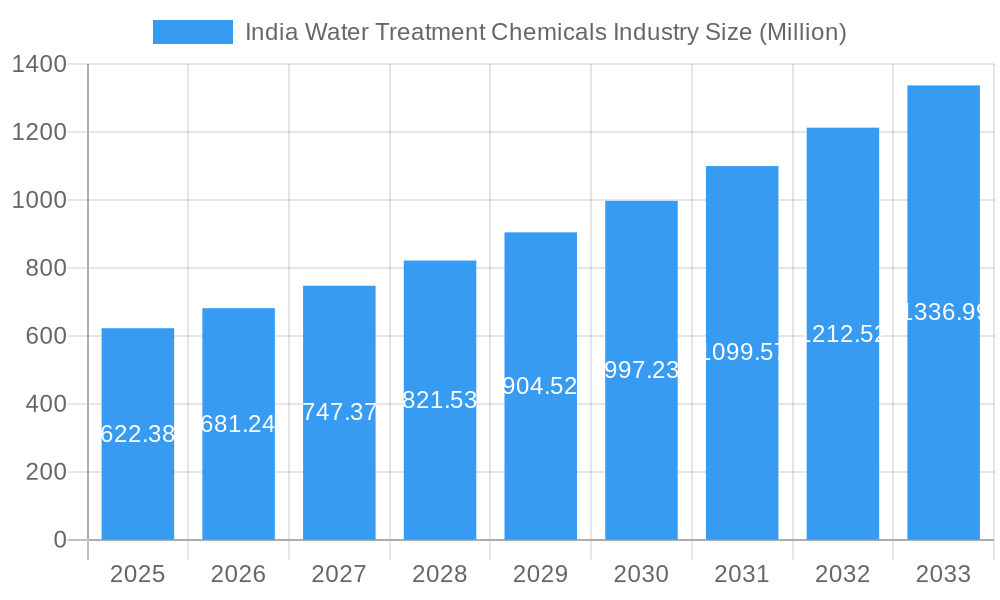

The India water treatment chemicals market is experiencing robust growth, projected to reach \$622.38 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 9% through 2033. This expansion is fueled by several key factors. Increasing industrialization and urbanization are driving higher water consumption, necessitating effective treatment to meet stringent regulatory standards and ensure safe water supply. The rising prevalence of waterborne diseases further emphasizes the need for advanced water treatment solutions. Furthermore, growing awareness of water scarcity and the importance of water conservation is prompting increased investment in water treatment infrastructure and technologies, thereby boosting demand for chemicals. Government initiatives promoting water conservation and improved sanitation are also significant contributors to market growth. Major players like Dow, Ecolab (Nalco), and Solvay are actively participating in this expansion, leveraging their technological expertise and established distribution networks.

India Water Treatment Chemicals Industry Market Size (In Million)

The market segmentation is likely diverse, encompassing various chemical types based on their application in different treatment processes (coagulation, flocculation, disinfection, etc.). Geographic variations in water quality and treatment needs will also influence regional market dynamics. While challenges exist, such as fluctuating raw material prices and potential regulatory hurdles, the long-term outlook for the India water treatment chemicals market remains highly positive, driven by sustained economic growth, increasing environmental consciousness, and proactive government policies. The competitive landscape is characterized by a mix of multinational corporations and domestic players, fostering innovation and ensuring a wide range of solutions to cater to diverse market segments and applications.

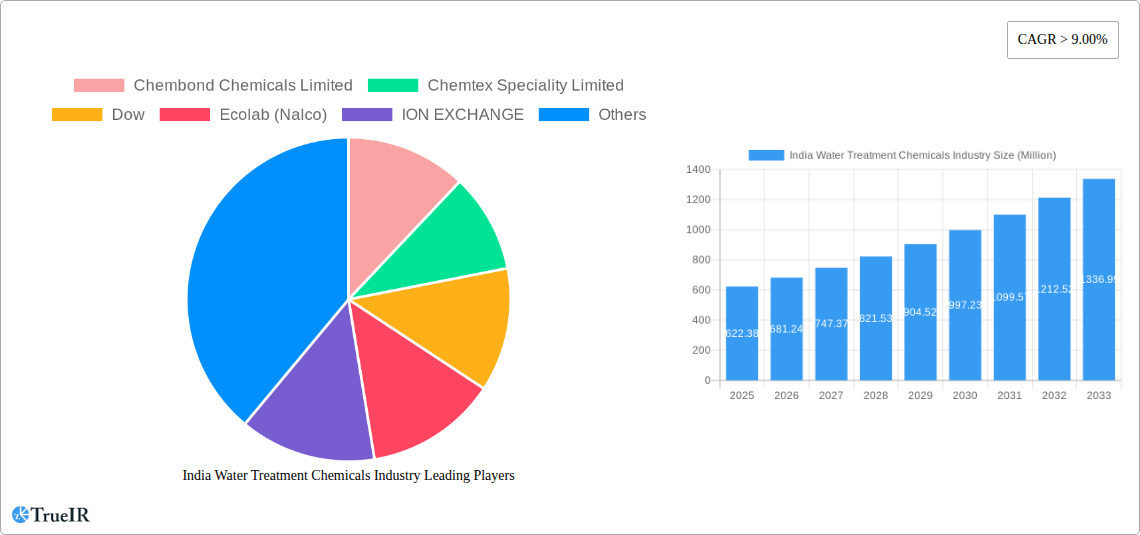

India Water Treatment Chemicals Industry Company Market Share

India Water Treatment Chemicals Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning India Water Treatment Chemicals Industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a meticulous analysis spanning the period 2019-2033, including a base year of 2025 and forecast period of 2025-2033, this report unveils the market's structure, trends, opportunities, and challenges. The market size is projected to reach XX Million by 2033, exhibiting a robust CAGR of XX% during the forecast period.

India Water Treatment Chemicals Industry Market Structure & Competitive Landscape

The Indian water treatment chemicals market is characterized by a moderately concentrated landscape, with both multinational corporations and domestic players vying for market share. The top 10 players account for approximately XX% of the market, indicating a relatively fragmented yet competitive environment. Concentration ratios are expected to fluctuate slightly throughout the forecast period due to anticipated mergers and acquisitions (M&A) activity. The market is influenced by several key factors, including:

- Innovation Drivers: The increasing demand for advanced water treatment technologies, driven by stringent regulatory norms and growing environmental awareness, fuels innovation in chemical formulations and treatment processes.

- Regulatory Impacts: Government regulations on water quality and discharge standards significantly influence market growth. Compliance requirements drive demand for effective and compliant water treatment chemicals. Stringent effluent discharge standards are pushing industries to adopt advanced treatment solutions.

- Product Substitutes: The availability of alternative technologies, such as membrane filtration and advanced oxidation processes, presents competitive pressure for chemical-based solutions.

- End-User Segmentation: The market is diverse, serving various end-use sectors including municipal water treatment, industrial wastewater treatment, and power generation. Industrial wastewater treatment is currently the leading segment, driven by a growing industrial base and stricter pollution control regulations.

- M&A Trends: Recent years have seen a rise in M&A activity, driven by the desire to expand market reach, integrate technologies, and achieve economies of scale. The number of M&A transactions within the last 5 years is estimated to be approximately XX. This trend is projected to continue, leading to further market consolidation.

India Water Treatment Chemicals Industry Market Trends & Opportunities

The Indian water treatment chemicals market is experiencing robust growth, driven by several factors. The escalating demand for clean water due to rapid urbanization, industrialization, and agricultural expansion is fueling market expansion. The market size was valued at approximately XX Million in 2024 and is expected to reach XX Million by 2033. This impressive growth trajectory is underpinned by:

- Technological Shifts: The adoption of advanced technologies such as AI-driven optimization, membrane filtration, and advanced oxidation processes is enhancing treatment efficiency and reducing chemical usage.

- Consumer Preferences: The increasing awareness of water quality and its impact on public health is influencing consumer preferences towards more sustainable and environmentally friendly water treatment solutions.

- Competitive Dynamics: The competitive landscape is dynamic, with both established players and new entrants constantly innovating and expanding their product offerings to meet evolving customer needs. This competition spurs innovation and enhances market efficiency.

- Government Initiatives: Government initiatives aimed at improving water infrastructure and promoting water conservation provide strong support for market growth.

Dominant Markets & Segments in India Water Treatment Chemicals Industry

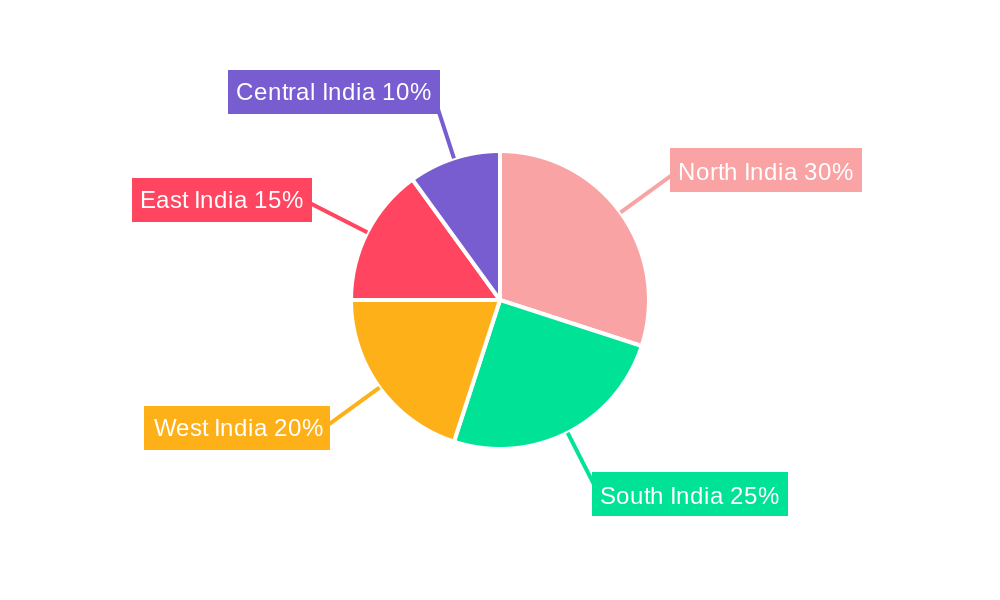

The Indian water treatment chemicals market is largely driven by the industrial sector, particularly manufacturing, power generation, and textiles. The northern and western regions of India demonstrate the highest growth due to rapid industrialization and urbanization.

- Key Growth Drivers:

- Expanding Industrial Base: India's robust industrial growth is a key driver, increasing demand for industrial wastewater treatment chemicals.

- Government Initiatives: Government policies and regulations related to water quality and pollution control are stimulating market growth.

- Infrastructure Development: Investments in water infrastructure projects are driving demand for water treatment chemicals.

- Rising Population: The growing population, particularly in urban areas, increases the demand for municipal water treatment.

The dominance of the industrial segment stems from stringent regulatory compliance requirements and the need for effective wastewater treatment solutions. This segment is expected to maintain its leading position throughout the forecast period, contributing significantly to the overall market growth.

India Water Treatment Chemicals Industry Product Analysis

The Indian water treatment chemicals market offers a wide array of products, including coagulants, flocculants, disinfectants, and corrosion inhibitors. Technological advancements focus on developing more efficient, environmentally friendly, and cost-effective solutions. Products emphasizing sustainability and reduced environmental impact are gaining traction. The market is witnessing the growing popularity of bio-based and less hazardous chemicals, meeting the demands of stricter environmental regulations.

Key Drivers, Barriers & Challenges in India Water Treatment Chemicals Industry

Key Drivers: Rapid urbanization, industrialization, increasing water scarcity, and stringent government regulations are the primary drivers of market growth. Technological advancements, especially in AI-powered optimization and membrane filtration, are further accelerating market expansion. Government investments in water infrastructure projects are also contributing positively.

Key Challenges: Fluctuations in raw material prices, supply chain disruptions, and intense competition can hinder market growth. Stringent regulatory compliance requirements also pose challenges to smaller players. Moreover, the need for skilled labor and effective implementation of water treatment technologies can be obstacles for some regions.

Growth Drivers in the India Water Treatment Chemicals Industry Market

The growth of the India water treatment chemicals market is primarily driven by increasing industrialization, urbanization, stringent environmental regulations, and government investments in water infrastructure development. The rising awareness of water quality and its impact on public health further accelerates the market's expansion.

Challenges Impacting India Water Treatment Chemicals Industry Growth

The industry faces challenges such as volatile raw material prices, supply chain complexities, and intense competition. Regulatory compliance requirements can be stringent and costly for smaller companies, hindering their growth. Addressing these challenges requires strategic planning, technological advancements, and sustainable sourcing practices.

Key Players Shaping the India Water Treatment Chemicals Industry Market

- Chembond Chemicals Limited

- Chemtex Speciality Limited

- Dow

- Ecolab (Nalco)

- ION EXCHANGE

- Lonza

- Nouryon

- SicagenChem

- SNF

- Solenis

- Solvay

- Thermax Limited

- VASU CHEMICALS LLP

Significant India Water Treatment Chemicals Industry Industry Milestones

- February 2024: Thermax Group's acquisition of a 51% stake in TSA Process Equipments signifies a move towards integrated water treatment solutions, catering to high-purity water demands across various sectors.

- October 2023: The WABAG Group's partnership with Pani Energy Inc. highlights the growing adoption of AI in optimizing water treatment plants, reducing operational costs and improving efficiency.

- September 2022: The establishment of the Toray India Water Research Center underscores the commitment to research and development in advanced water treatment technologies, addressing the surging demand.

Future Outlook for India Water Treatment Chemicals Industry Market

The future outlook for the India water treatment chemicals market remains extremely positive. Continued industrialization, urbanization, and supportive government policies will fuel market expansion. Technological advancements, particularly in sustainable and efficient treatment methods, will drive innovation and competition. Opportunities exist for companies to capitalize on the growing demand for high-quality water treatment solutions, focusing on sustainability, efficiency, and regulatory compliance.

India Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides and Disinfectants

- 1.2. Coagulants and Flocculants

- 1.3. Corrosion and Scale Inhibitors

- 1.4. Defoamers and Defoaming Agents

- 1.5. pH Adjuster and Softener

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Oil and Gas

- 2.3. Chemical Manufacturing (including Petrochemicals)

- 2.4. Mining and Mineral Processing

- 2.5. Municipal

- 2.6. Pulp and Paper

- 2.7. Other End-user Industries

India Water Treatment Chemicals Industry Segmentation By Geography

- 1. India

India Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of India Water Treatment Chemicals Industry

India Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 9.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Corrosion and Scale Inhibitors Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides and Disinfectants

- 5.1.2. Coagulants and Flocculants

- 5.1.3. Corrosion and Scale Inhibitors

- 5.1.4. Defoamers and Defoaming Agents

- 5.1.5. pH Adjuster and Softener

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Oil and Gas

- 5.2.3. Chemical Manufacturing (including Petrochemicals)

- 5.2.4. Mining and Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Pulp and Paper

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chembond Chemicals Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chemtex Speciality Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecolab (Nalco)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ION EXCHANGE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lonza

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nouryon

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SicagenChem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SNF

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Solenis

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Solvay

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Thermax Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VASU CHEMICALS LLP*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Chembond Chemicals Limited

List of Figures

- Figure 1: India Water Treatment Chemicals Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Water Treatment Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 3: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 5: India Water Treatment Chemicals Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Water Treatment Chemicals Industry Volume Million Forecast, by Region 2020 & 2033

- Table 7: India Water Treatment Chemicals Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Water Treatment Chemicals Industry Volume Million Forecast, by Product Type 2020 & 2033

- Table 9: India Water Treatment Chemicals Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: India Water Treatment Chemicals Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 11: India Water Treatment Chemicals Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Water Treatment Chemicals Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Water Treatment Chemicals Industry?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the India Water Treatment Chemicals Industry?

Key companies in the market include Chembond Chemicals Limited, Chemtex Speciality Limited, Dow, Ecolab (Nalco), ION EXCHANGE, Lonza, Nouryon, SicagenChem, SNF, Solenis, Solvay, Thermax Limited, VASU CHEMICALS LLP*List Not Exhaustive.

3. What are the main segments of the India Water Treatment Chemicals Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 622.38 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Corrosion and Scale Inhibitors Segment.

7. Are there any restraints impacting market growth?

Increasing Demand For Treated Water; Stringent Regulations Around Wastewater Treatment in Industrial Units; Other Drivers.

8. Can you provide examples of recent developments in the market?

February 2024: Thermax Group signs an agreement to acquire a 51% stake in TSA Process Equipments to offer a one-stop solution for high-purity water requirements of its customers in sectors such as pharma, biopharma, personal care, and food and beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the India Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence