Key Insights

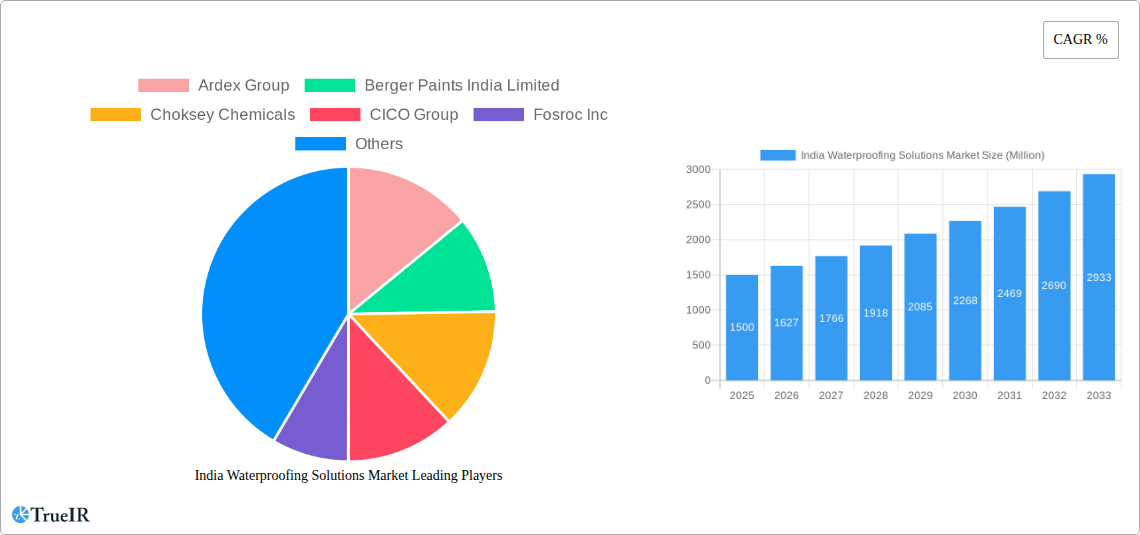

The Indian waterproofing solutions market is forecast for significant expansion, driven by robust construction sector growth and rising awareness of the long-term benefits of effective waterproofing. The market is projected to reach $1.21 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 8.13% from 2025 to 2033. This expansion is primarily propelled by burgeoning infrastructure development, including smart city initiatives, expanding transportation networks, and the increasing adoption of sustainable building practices across commercial, industrial, and residential sectors. Growing disposable incomes and rapid urbanization further fuel demand for premium waterproofing materials in residential construction.

India Waterproofing Solutions Market Market Size (In Billion)

Key market trends include a notable shift towards advanced waterproofing technologies, such as epoxy and polyurethane-based solutions, offering superior durability and performance. The growing preference for cold liquid-applied membranes and fully adhered sheet membranes highlights the industry’s focus on application ease and enhanced structural integrity. While the market exhibits a strong upward trajectory, potential challenges include the initial cost of premium solutions and regional skilled labor shortages. However, manufacturers’ concerted efforts to develop cost-effective products and implement training programs are expected to mitigate these restraints, ensuring sustained market growth. Leading companies such as Pidilite Industries Ltd, Sika AG, and Saint-Gobain are actively innovating and expanding their product offerings to meet the diverse demands of the Indian market.

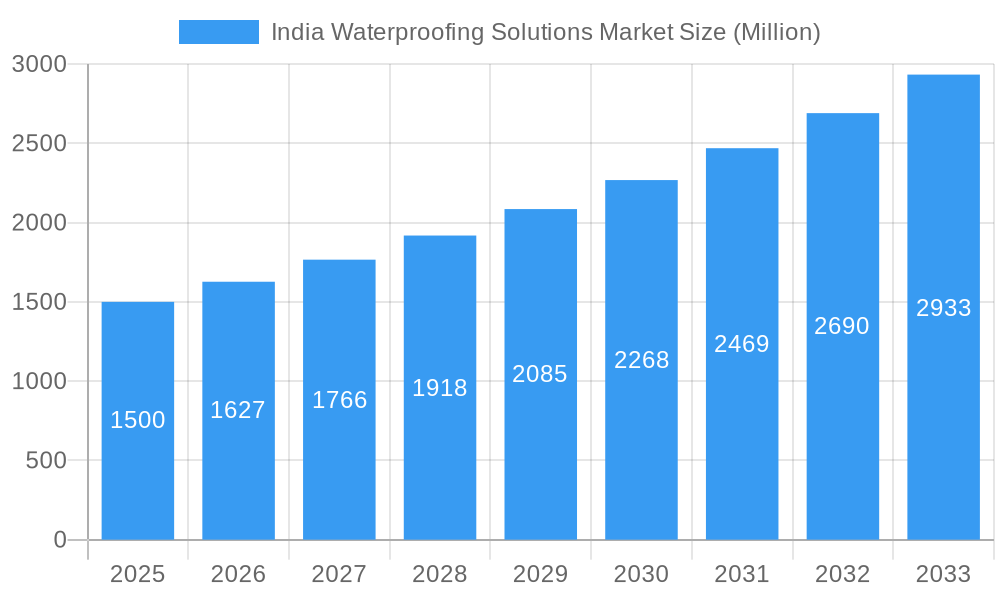

India Waterproofing Solutions Market Company Market Share

India Waterproofing Solutions Market: Comprehensive Market Analysis, Trends, and Forecast (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the India Waterproofing Solutions Market. Leveraging high-volume keywords such as "waterproofing chemicals India," "construction waterproofing," "waterproofing membranes India," and "building waterproofing solutions," this study is meticulously designed to engage industry professionals and enhance search engine rankings. We cover the India Waterproofing Solutions Market from 2019 to 2033, with a base year of 2025, offering a detailed historical overview and an extensive forecast period of 2025–2033. The report delves into the market structure, competitive landscape, evolving trends, dominant segments, product innovations, key drivers, barriers, and the future outlook for this rapidly growing sector.

India Waterproofing Solutions Market Market Structure & Competitive Landscape

The India Waterproofing Solutions Market is characterized by a moderately fragmented structure, with a blend of established global players and a significant number of domestic manufacturers. Innovation serves as a primary driver, fueled by the demand for advanced, sustainable, and cost-effective waterproofing technologies. Regulatory impacts, though evolving, are increasingly focusing on environmental compliance and material safety standards, influencing product development and adoption. Product substitutes, ranging from traditional methods to newer composite materials, present a dynamic competitive environment. End-user segmentation, encompassing Commercial, Industrial and Institutional, Infrastructure, and Residential sectors, dictates distinct market demands and growth trajectories. Mergers and Acquisitions (M&A) are a notable trend, with companies strategically consolidating to expand their product portfolios and geographical reach. For instance, recent M&A activities, such as Sika's acquisition of MBCC Group and Saint-Gobain's acquisition of GCP Applied Technologies Inc., underscore the consolidation trend and aim to bolster market presence. The concentration ratio in the India Waterproofing Solutions Market is estimated to be around 30-40%, indicating scope for both large-scale players and niche manufacturers.

India Waterproofing Solutions Market Market Trends & Opportunities

The India Waterproofing Solutions Market is poised for substantial growth, driven by rapid urbanization, increasing construction activities, and a growing awareness of the long-term benefits of effective waterproofing. The market size is projected to reach an impressive value, experiencing a Compound Annual Growth Rate (CAGR) of approximately 8-10% during the forecast period. Technological shifts are a significant trend, with a pronounced move towards eco-friendly, water-based, and high-performance waterproofing chemicals India and advanced waterproofing membranes India. Consumer preferences are evolving, with an increasing demand for durable, easy-to-apply, and aesthetically pleasing waterproofing solutions for both new constructions and retrofitting projects. Competitive dynamics are intensifying, as companies strive to differentiate through product innovation, superior technical support, and strategic pricing. The burgeoning real estate sector, coupled with significant government investments in infrastructure development, presents vast opportunities for construction waterproofing and building waterproofing solutions. The rising disposable incomes and the growing emphasis on sustainable building practices further contribute to the positive market outlook for waterproofing products India. The adoption of advanced technologies like nanotechnology in waterproofing is also gaining traction, offering enhanced performance and longevity.

Dominant Markets & Segments in India Waterproofing Solutions Market

The Infrastructure end-use sector stands as a dominant market within the India Waterproofing Solutions Market, propelled by extensive government spending on roads, bridges, airports, dams, and water treatment plants. This segment's growth is intrinsically linked to national development initiatives and the need for robust, long-lasting infrastructure resilient to environmental challenges. Within the Sub Product segment, Chemicals, particularly Polyurethane-based and Water-based technologies, are experiencing significant demand due to their superior performance, flexibility, and environmental compatibility. The ease of application and rapid curing times of these waterproofing chemicals India make them highly suitable for complex infrastructure projects.

Infrastructure Growth Drivers:

- Government focus on developing smart cities and upgrading existing infrastructure.

- Increased investment in transportation networks, including highways and railways.

- Demand for durable waterproofing solutions for tunnels, metro projects, and underground structures.

- Adherence to stringent building codes and standards requiring high-performance waterproofing.

Commercial Sector Expansion: The Commercial sector, encompassing retail spaces, office buildings, and hospitality, is another key growth area. The demand here is driven by the construction of modern commercial complexes and the retrofitting of older structures to meet contemporary standards. Waterproofing membranes India, especially cold liquid-applied variants, are widely adopted for flat roofs and basements in commercial buildings.

Residential Sector Importance: The Residential segment continues to be a substantial contributor, fueled by a growing population and increasing homeownership. Developers are increasingly incorporating effective waterproofing solutions into housing projects to enhance property value and longevity.

Industrial and Institutional Applications: The Industrial and Institutional segment, including factories, hospitals, and educational institutions, requires specialized waterproofing solutions to protect sensitive equipment, ensure hygiene, and maintain structural integrity.

Dominance of Water-based and Polyurethane Chemicals:

- Water-based waterproofing chemicals India are favored for their low VOC emissions and ease of use in residential and commercial applications.

- Polyurethane-based waterproofing chemicals India are crucial for infrastructure and industrial projects demanding high tensile strength, chemical resistance, and UV stability.

- Epoxy-based chemicals find applications in industrial flooring and concrete repair.

Membrane Technologies:

- Cold Liquid Applied Membranes are prevalent due to their seamless application and flexibility.

- Fully Adhered Sheet Membranes offer robust protection for critical areas.

India Waterproofing Solutions Market Product Analysis

The India Waterproofing Solutions Market is witnessing significant product innovation, with a focus on developing advanced, sustainable, and user-friendly solutions. Manufacturers are actively investing in R&D to create waterproofing chemicals India with enhanced properties such as superior adhesion, extreme temperature resistance, and extended durability. The development of waterproofing membranes India that are easier to install and offer superior performance against water ingress is a key competitive advantage. Product applications are diversifying, extending beyond traditional building protection to specialized uses in industrial facilities, water containment structures, and heritage building preservation. The market is seeing a surge in demand for low-VOC, solvent-free, and environmentally compliant building waterproofing solutions, aligning with global sustainability trends.

Key Drivers, Barriers & Challenges in India Waterproofing Solutions Market

Key Drivers, Barriers & Challenges in India Waterproofing Solutions Market

Key Drivers: The India Waterproofing Solutions Market is propelled by several key drivers. Rapid urbanization and a burgeoning construction industry, particularly in the residential and infrastructure sectors, create consistent demand for waterproofing products. Government initiatives promoting affordable housing and smart city development further fuel construction activities. Increasing awareness among consumers and developers about the long-term benefits of waterproofing, such as preventing structural damage, mold growth, and energy loss, is a significant driver. Technological advancements leading to the development of more efficient, eco-friendly, and durable waterproofing solutions, including waterproofing chemicals India and advanced waterproofing membranes India, also play a crucial role.

Barriers & Challenges: Despite the positive outlook, the market faces certain barriers and challenges. The presence of unorganized players and the prevalence of counterfeit products can impact market quality and pricing. Inconsistent application of building codes and standards across different regions can hinder the widespread adoption of premium building waterproofing solutions. Fluctuations in raw material prices, particularly for key components used in waterproofing chemicals India, can affect profit margins. Intense price competition among manufacturers, especially in the commodity segment, poses a challenge. Furthermore, a lack of skilled labor for the proper application of advanced waterproofing systems can sometimes limit market penetration. Supply chain disruptions, though often temporary, can also impact timely delivery of products.

Growth Drivers in the India Waterproofing Solutions Market Market

Growth in the India Waterproofing Solutions Market is primarily driven by robust expansion in the construction sector, encompassing both residential and commercial developments. Significant government investments in infrastructure projects, such as highways, bridges, and urban development, are creating substantial demand for effective waterproofing solutions. The increasing adoption of sustainable building practices and a growing awareness of the long-term economic and environmental benefits of preventing water damage are also key growth catalysts. Furthermore, technological advancements in waterproofing chemicals India and waterproofing membranes India, leading to improved performance, durability, and ease of application, are accelerating market penetration. The rising disposable incomes and a growing middle class are contributing to increased demand for better quality housing and commercial spaces, where effective waterproofing is a key consideration.

Challenges Impacting India Waterproofing Solutions Market Growth

Challenges impacting the India Waterproofing Solutions Market include the presence of a significant unorganized sector, which often leads to price undercutting and compromises on quality. Inconsistent enforcement of building codes and standards across different states can create uneven playing field. Volatility in raw material prices, a significant factor in the production of waterproofing chemicals India, can impact profitability and pricing strategies. Furthermore, the availability of skilled labor for the precise application of advanced building waterproofing solutions remains a concern in certain regions. The competitive landscape is also intensifying, with both domestic and international players vying for market share, leading to pricing pressures. Supply chain complexities and logistics can also pose challenges in ensuring timely delivery of products across the vast Indian subcontinent.

Key Players Shaping the India Waterproofing Solutions Market Market

- Ardex Group

- Berger Paints India Limited

- Choksey Chemicals

- CICO Group

- Fosroc Inc

- MAPEI S p A

- Pidilite Industries Ltd

- Saint-Gobain

- Sika AG

- Soprem

Significant India Waterproofing Solutions Market Industry Milestones

- October 2023: Berger Paints India Limited developed a range of waterproofing products named Berger DAMPSTOP that provide diverse solutions for various waterproofing demands, such as dampness, silane treatment, and salt leaching treatment, and ensure a simplified process for consumers. This development enhances product offerings for the residential and commercial sectors.

- May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand. This strategic acquisition significantly expands Sika's market presence and product portfolio in the waterproofing segment.

- September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials. This move aims to bolster Saint-Gobain's offerings in the construction chemicals and waterproofing domain.

Future Outlook for India Waterproofing Solutions Market Market

The India Waterproofing Solutions Market is projected to witness sustained and robust growth in the coming years. Key growth catalysts include the ongoing rapid urbanization, ambitious government spending on infrastructure development, and a growing emphasis on sustainable and energy-efficient buildings. The increasing consumer awareness regarding the importance of structural integrity and longevity of buildings will continue to drive demand for high-performance waterproofing chemicals India and waterproofing membranes India. Innovations in product technology, leading to the development of more durable, eco-friendly, and easier-to-apply solutions, will further shape the market. Strategic partnerships, mergers, and acquisitions are expected to continue as companies seek to consolidate their market positions and expand their geographical reach. The market presents significant strategic opportunities for companies focusing on advanced material science, sustainable product development, and comprehensive technical support for building waterproofing solutions.

India Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

India Waterproofing Solutions Market Segmentation By Geography

- 1. India

India Waterproofing Solutions Market Regional Market Share

Geographic Coverage of India Waterproofing Solutions Market

India Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Waterproofing Solutions Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ardex Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berger Paints India Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Choksey Chemicals

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CICO Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fosroc Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MAPEI S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pidilite Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saint-Gobain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sika AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Soprem

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ardex Group

List of Figures

- Figure 1: India Waterproofing Solutions Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Waterproofing Solutions Market Share (%) by Company 2025

List of Tables

- Table 1: India Waterproofing Solutions Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 2: India Waterproofing Solutions Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 3: India Waterproofing Solutions Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Waterproofing Solutions Market Revenue billion Forecast, by End Use Sector 2020 & 2033

- Table 5: India Waterproofing Solutions Market Revenue billion Forecast, by Sub Product 2020 & 2033

- Table 6: India Waterproofing Solutions Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Waterproofing Solutions Market?

The projected CAGR is approximately 8.13%.

2. Which companies are prominent players in the India Waterproofing Solutions Market?

Key companies in the market include Ardex Group, Berger Paints India Limited, Choksey Chemicals, CICO Group, Fosroc Inc, MAPEI S p A, Pidilite Industries Ltd, Saint-Gobain, Sika AG, Soprem.

3. What are the main segments of the India Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2023: Berger Paints India Limited developed a range of waterproofing products named Berger DAMPSTOP that provide diverse solutions for various waterproofing demands, such as dampness, silane treatment, and salt leaching treatment, and ensure a simplified process for consumers.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the India Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence