Key Insights

The Indonesia anchors and grouts market is experiencing robust growth, driven by the nation's burgeoning construction sector and increasing infrastructure development projects. This expansion is fueled by rising urbanization, government initiatives promoting infrastructure modernization, and a growing demand for high-performance construction materials. The market is segmented by type (chemical anchors, mechanical anchors, epoxy grouts, cement grouts, etc.), application (residential, commercial, industrial), and region. Key players like Arkema, Deltacretindo, Fosroc Inc, LATICRETE International Inc, MAPEI S p A, MBCC Group, Normet, Saint-Gobain, Sika AG, and Ultrachem Construction Chemical are actively competing to capture market share, leveraging their technological advancements and established distribution networks. The market's growth trajectory is projected to be significantly influenced by factors such as fluctuating raw material prices, technological innovations leading to the development of high-strength, durable, and eco-friendly grouts and anchors, and the increasing adoption of sustainable construction practices.

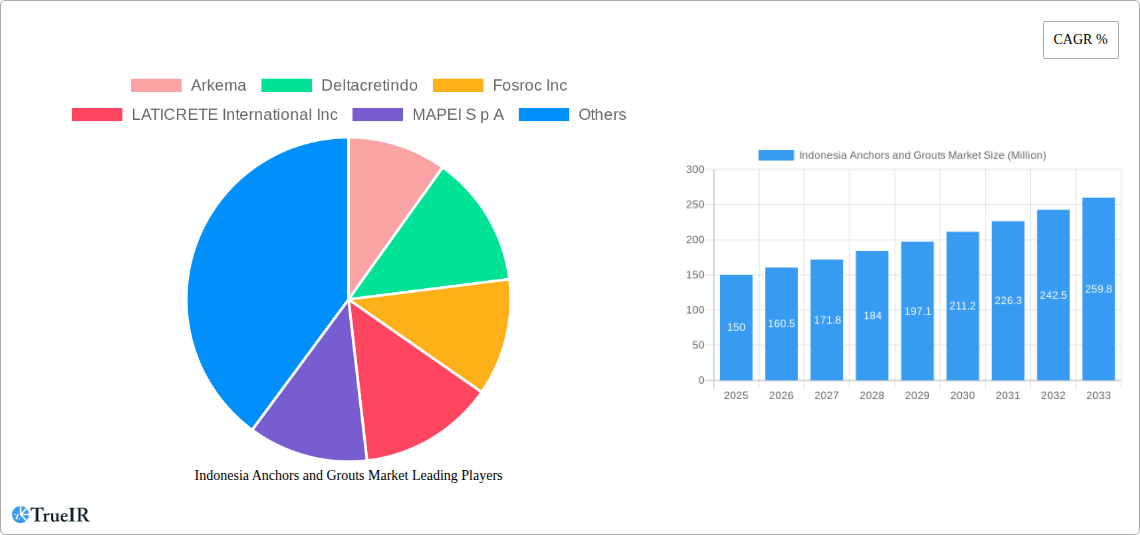

Indonesia Anchors and Grouts Market Market Size (In Million)

Despite these positive drivers, the market faces certain challenges. Competition among established players and the entry of new competitors can exert pressure on pricing. Furthermore, the market's susceptibility to economic fluctuations and potential supply chain disruptions necessitates careful market analysis and strategic planning for manufacturers and investors. Nevertheless, the long-term outlook for the Indonesian anchors and grouts market remains positive, with a projected sustained CAGR (assuming a conservative estimate of 7%) over the forecast period (2025-2033). This growth will be primarily driven by the continued investment in infrastructure projects and the country's overall economic expansion, creating a favorable landscape for market participants. We estimate the market size in 2025 to be approximately $150 million (this is an illustrative figure; actual data would be necessary for accurate assessment).

Indonesia Anchors and Grouts Market Company Market Share

This dynamic report provides a detailed analysis of the Indonesia Anchors and Grouts market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this report unveils market trends, competitive dynamics, and future growth projections, enabling informed strategies for success. The market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Indonesia Anchors and Grouts Market Market Structure & Competitive Landscape

The Indonesia anchors and grouts market is characterized by a moderately concentrated structure. While several large multinational players hold significant market share, a number of smaller, regional players also contribute significantly to the overall market volume. The Herfindahl-Hirschman Index (HHI) for the market in 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation in the sector is driven by the need for higher performance materials, improved sustainability, and specialized solutions for unique construction projects. Regulatory frameworks, particularly those focused on building codes and environmental standards, play a vital role in shaping market dynamics. Product substitution is limited due to the specialized nature of anchors and grouts, however, competition arises from alternative fastening and bonding methods.

The end-user segment is diverse, encompassing infrastructure projects (roads, bridges, buildings), industrial construction, and residential building. Mergers and acquisitions (M&A) activity has been significant, as illustrated by the recent acquisitions of MBCC Group by Sika and GCP Applied Technologies Inc. by Saint-Gobain. The total value of M&A deals in the Indonesian anchors and grouts market between 2019 and 2024 was approximately xx Million. These transactions highlight the consolidation trend within the industry and the pursuit of enhanced market share and technological capabilities.

- Market Concentration: Moderately Concentrated (HHI: xx in 2024)

- Innovation Drivers: Performance improvement, sustainability, specialized solutions.

- Regulatory Impacts: Building codes, environmental standards.

- Product Substitutes: Limited, but alternative fastening/bonding methods exist.

- End-User Segmentation: Infrastructure, industrial, residential.

- M&A Trends: Significant consolidation, driven by growth and technological advancement.

Indonesia Anchors and Grouts Market Market Trends & Opportunities

The Indonesian anchors and grouts market is experiencing robust growth, driven by several key factors. The country’s significant infrastructure development initiatives, including the construction of roads, bridges, buildings, and other projects, create substantial demand for high-performance anchoring and grouting solutions. Technological advancements, such as the development of self-leveling grouts and high-strength anchors, are enhancing product capabilities and creating new opportunities. Consumer preference is shifting towards sustainable and environmentally friendly products, influencing manufacturers to develop greener options. Intense competition amongst established players and new entrants is leading to innovation and price optimization, benefiting consumers and driving market expansion. The market is expected to reach xx Million by 2025 and xx Million by 2033, reflecting a strong CAGR of xx% during the forecast period. Market penetration rates vary across segments, with infrastructure projects exhibiting higher adoption rates compared to residential constructions. This disparity presents opportunities for targeted marketing and product development strategies. Several niche segments, such as offshore wind turbine installation, are emerging as high-growth areas.

Dominant Markets & Segments in Indonesia Anchors and Grouts Market

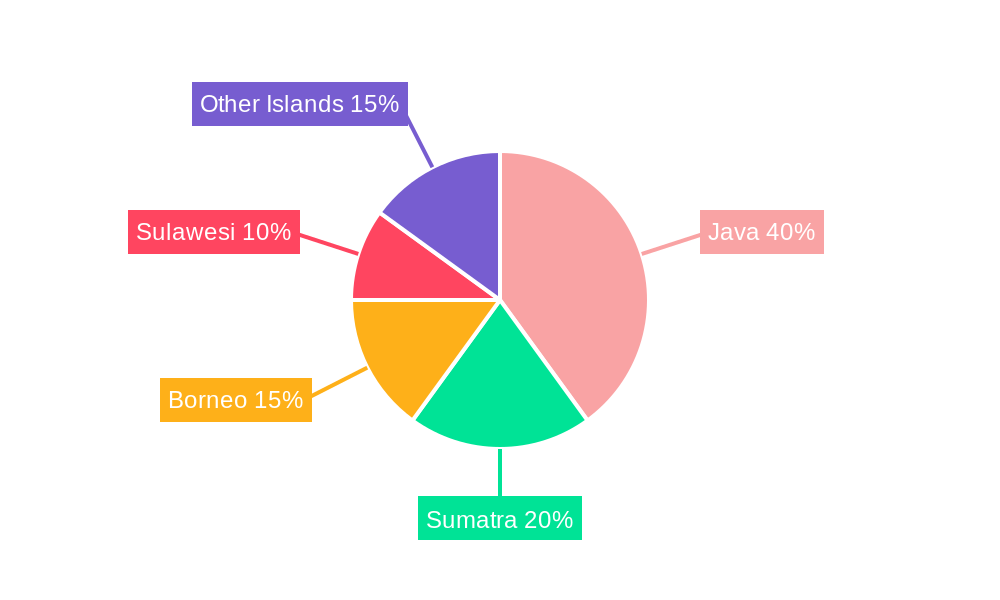

The Indonesian anchors and grouts market shows strong growth across various regions, reflecting the country’s diverse infrastructure development. However, Java Island, due to its high population density and significant infrastructure projects, dominates the market. The infrastructure segment constitutes the largest portion of the overall market demand, owing to government investment in major projects. Rapid urbanization and industrial expansion also propel growth.

- Key Growth Drivers:

- Massive Infrastructure Development Projects (roads, bridges, buildings)

- Rapid Urbanization and Industrial Expansion

- Government Initiatives Supporting Infrastructure Development

- Increasing Construction Activity in both Public and Private Sectors.

- Market Dominance Analysis: Java Island holds the largest market share, driven by high construction activity and population density. The infrastructure segment, particularly large-scale projects, accounts for the largest share of demand.

Indonesia Anchors and Grouts Market Product Analysis

The Indonesian anchors and grouts market offers a diverse range of products, including epoxy grouts, cement-based grouts, chemical anchors, and mechanical anchors. Technological advancements are leading to the development of high-strength, rapid-setting, and self-leveling grouts, improving construction efficiency and performance. These innovations cater to the specific needs of diverse applications, offering competitive advantages in terms of cost-effectiveness, durability, and ease of application. The market trend is towards specialized products designed for specific applications, such as seismic reinforcement or demanding environmental conditions.

Key Drivers, Barriers & Challenges in Indonesia Anchors and Grouts Market

Key Drivers: Increased government spending on infrastructure projects, rapid urbanization, industrial expansion, and technological advancements driving higher performance and efficiency in construction. The rising demand for sustainable and eco-friendly construction materials is also a significant driver.

Challenges and Restraints: Fluctuations in raw material prices, intense competition, regulatory complexities regarding building codes and environmental standards, and potential supply chain disruptions due to global economic factors can pose challenges to market growth. The complexity of some projects and the need for specialized expertise can also create barriers to entry for smaller players. These factors can collectively impact market growth by affecting project timelines, increasing costs, and hindering adoption of new technologies.

Growth Drivers in the Indonesia Anchors and Grouts Market Market

The Indonesian anchors and grouts market benefits from sustained growth driven by large-scale infrastructure projects funded by both public and private investments. Technological advancements leading to improved product performance and efficiency are key drivers, as is the increasing preference for sustainable construction materials.

Challenges Impacting Indonesia Anchors and Grouts Market Growth

Price volatility of raw materials, stringent regulations, and competition from established international and local players are major challenges impacting market growth. Supply chain disruptions and fluctuating economic conditions also pose risks.

Key Players Shaping the Indonesia Anchors and Grouts Market Market

- Arkema

- Deltacretindo

- Fosroc Inc

- LATICRETE International Inc

- MAPEI S p A

- MBCC Group

- Normet

- Saint-Gobain

- Sika AG

- Ultrachem Construction Chemical

Significant Indonesia Anchors and Grouts Market Industry Milestones

- September 2022: Saint-Gobain acquired GCP Applied Technologies Inc., expanding its presence in the construction chemicals market.

- February 2023: Master Builders Solutions (MBCC Group) opened a new offshore grout production plant in Taiwan, catering to the offshore wind turbine market.

- May 2023: Sika acquired MBCC Group, significantly altering the competitive landscape.

Future Outlook for Indonesia Anchors and Grouts Market Market

The Indonesian anchors and grouts market is poised for continued growth, driven by ongoing infrastructure development and rising urbanization. The focus on sustainable construction practices presents opportunities for manufacturers to introduce innovative, eco-friendly products. Strategic partnerships and investments in research and development will be crucial for maintaining competitiveness in this dynamic market. The market's future growth will depend on effective management of supply chain challenges and adaptation to evolving regulatory frameworks.

Indonesia Anchors and Grouts Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

- 2.1. Cementitious Fixing

-

2.2. Resin Fixing

-

2.2.1. By Technology

- 2.2.1.1. Epoxy Grout

- 2.2.1.2. Polyurethane (PU) Grout

-

2.2.1. By Technology

- 2.3. Other Types

Indonesia Anchors and Grouts Market Segmentation By Geography

- 1. Indonesia

Indonesia Anchors and Grouts Market Regional Market Share

Geographic Coverage of Indonesia Anchors and Grouts Market

Indonesia Anchors and Grouts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Anchors and Grouts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Cementitious Fixing

- 5.2.2. Resin Fixing

- 5.2.2.1. By Technology

- 5.2.2.1.1. Epoxy Grout

- 5.2.2.1.2. Polyurethane (PU) Grout

- 5.2.2.1. By Technology

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deltacretindo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fosroc Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LATICRETE International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MAPEI S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MBCC Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Normet

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saint-Gobain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sika AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ultrachem Construction Chemical

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: Indonesia Anchors and Grouts Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Anchors and Grouts Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 2: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 3: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by End Use Sector 2020 & 2033

- Table 5: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by Sub Product 2020 & 2033

- Table 6: Indonesia Anchors and Grouts Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Anchors and Grouts Market?

The projected CAGR is approximately 6.77%.

2. Which companies are prominent players in the Indonesia Anchors and Grouts Market?

Key companies in the market include Arkema, Deltacretindo, Fosroc Inc, LATICRETE International Inc, MAPEI S p A, MBCC Group, Normet, Saint-Gobain, Sika AG, Ultrachem Construction Chemical.

3. What are the main segments of the Indonesia Anchors and Grouts Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.February 2023: Master Builders Solutions, an MBCC Group brand, inaugurated a new offshore grout production plant in Taichung, Taiwan, in order to meet the ongoing demand of the offshore wind turbine market.September 2022: Saint-Gobain acquired GCP Applied Technologies Inc. to strengthen its market presence through a global platform with extensive expertise in cement additives, concrete admixtures, infrastructure, and commercial and residential building materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Anchors and Grouts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Anchors and Grouts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Anchors and Grouts Market?

To stay informed about further developments, trends, and reports in the Indonesia Anchors and Grouts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence