Key Insights

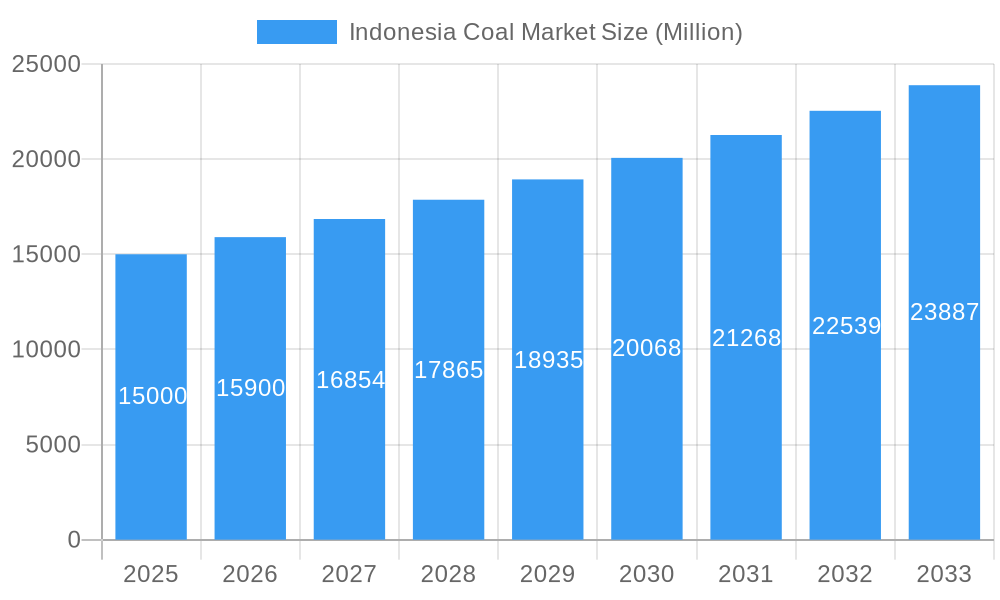

The Indonesian coal market is poised for robust growth, with an estimated market size exceeding $XX billion and a projected Compound Annual Growth Rate (CAGR) of over 6.00% between 2025 and 2033. This expansion is primarily driven by the sustained demand from the power generation sector, where coal remains a cornerstone for electricity production, particularly in a developing nation like Indonesia. The iron and steel industry also represents a significant driver, consuming substantial volumes of coal for its manufacturing processes. While specific driver details are not provided, it is reasonable to infer that increased industrialization and infrastructure development within Indonesia are directly fueling this demand. Furthermore, the report’s focus on the Indonesian market suggests that domestic consumption, coupled with export potential, underpins this positive outlook. The market value is expressed in millions, indicating a substantial financial scale for this commodity.

Indonesia Coal Market Market Size (In Billion)

Despite the strong growth trajectory, the Indonesian coal market is not without its challenges. Restraints likely stem from increasing global and domestic pressure to transition towards cleaner energy sources, driven by environmental concerns and climate change initiatives. Regulatory changes aimed at curbing emissions, promoting renewable energy, and potentially imposing stricter environmental standards on coal mining and usage could act as significant headwinds. However, the persistent demand from key sectors like electricity and iron/steel, combined with Indonesia's substantial coal reserves, suggests that these restraints will likely moderate rather than halt the market's upward momentum. The market segmentation into Electricity, Iron and Steel Industry, and Other Applications highlights the diverse consumption landscape, with electricity generation anticipated to be the largest segment. Key players such as PT Bayan Resources Tbk, Adani Group, and PT Adaro Energy Tbk are likely to play a pivotal role in shaping the market's dynamics through their production capacities and strategic investments.

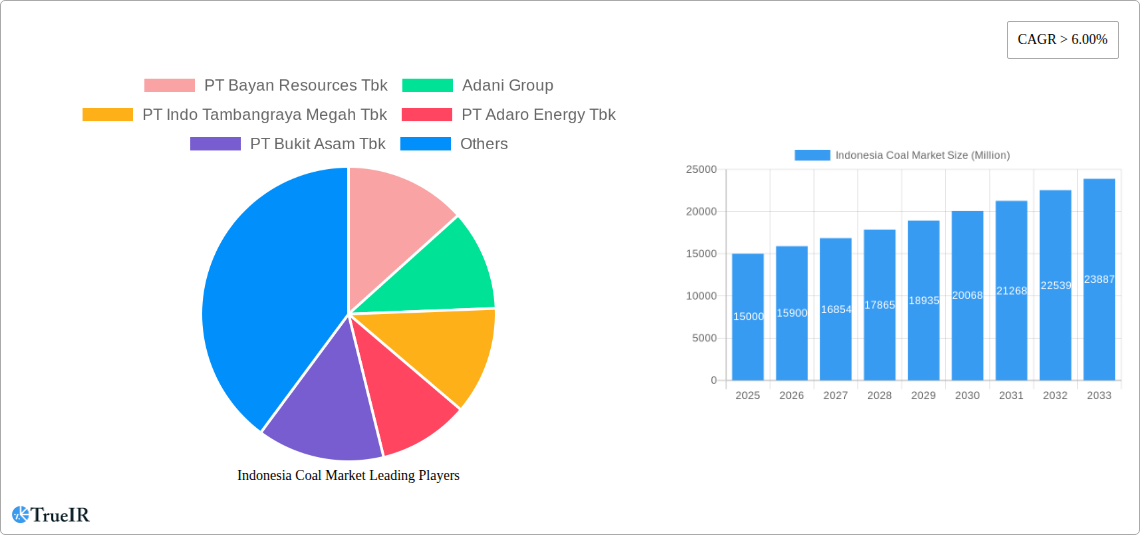

Indonesia Coal Market Company Market Share

Indonesia Coal Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock deep insights into the dynamic Indonesian coal market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market structure, trends, opportunities, dominant segments, product innovations, key drivers, challenges, competitive landscape, and future outlook.

Indonesia Coal Market Market Structure & Competitive Landscape

The Indonesian coal market exhibits a moderately concentrated structure, with a few major players holding significant market share. Key companies such as PT Adaro Energy Tbk, PT Bumi Resources Tbk, and PT Bayan Resources Tbk are instrumental in shaping the competitive dynamics. Innovation in this sector is largely driven by advancements in mining technology for increased efficiency and environmental mitigation, alongside efforts to enhance coal quality and explore new applications. Regulatory impacts, primarily from the government's resource nationalism policies and evolving environmental standards, play a crucial role in market access and operational strategies. While direct product substitutes are limited in large-scale energy generation, advancements in renewable energy sources and cleaner fuel technologies present an indirect competitive threat. End-user segmentation is dominated by the electricity generation sector, followed by the iron and steel industry. Mergers and acquisitions (M&A) activity, while not at an extremely high volume, are strategic, often involving consolidation of assets or diversification by existing players. For instance, recent M&A activities have seen companies like Golden Energy and Resources Limited strategically expanding their portfolios. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be in the range of 1500-2000, indicating moderate concentration. M&A deals in the historical period have averaged approximately USD 500 Million annually, signaling strategic realignments rather than widespread market consolidation.

Indonesia Coal Market Market Trends & Opportunities

The Indonesian coal market is poised for significant evolution, driven by a complex interplay of economic growth, energy demand, and shifting global and domestic policy landscapes. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 3.5% during the forecast period of 2025-2033, reaching an estimated value of over 600 Million Tons by 2033. This growth is underpinned by the nation's substantial coal reserves and its pivotal role as a major global coal exporter. Technological shifts are evident in the increasing adoption of more efficient mining techniques, such as advanced extraction methods and automation, aimed at improving productivity and reducing operational costs. Furthermore, there's a growing emphasis on developing technologies for cleaner coal utilization, including advanced combustion processes and carbon capture initiatives, albeit still in nascent stages for widespread implementation. Consumer preferences, particularly from export markets, are increasingly leaning towards higher-quality coal with lower impurity levels, influencing production strategies.

Domestically, the demand for coal in electricity generation remains robust, supported by government initiatives to ensure energy security and meet rising power needs. The iron and steel industry also represents a significant and stable demand source. Opportunities lie in the development of integrated coal complexes that offer enhanced logistics and processing capabilities. Moreover, as global pressure mounts for decarbonization, Indonesian coal producers have an opportunity to invest in and promote cleaner coal technologies and explore co-firing with biomass to reduce emissions. The market penetration rate of high-efficiency coal-fired power plants is expected to increase, driving demand for better quality coal. Competitive dynamics are characterized by a focus on cost leadership, operational efficiency, and long-term supply contracts. While the global energy transition poses a long-term challenge, the immediate to medium-term outlook for Indonesian coal, particularly for export markets in Asia, remains strong due to its cost-competitiveness and the existing energy infrastructure. The estimated market size in the base year of 2025 is around 550 Million Tons.

Dominant Markets & Segments in Indonesia Coal Market

The Electricity segment stands as the undisputed dominant market within Indonesia's coal industry. This dominance is fueled by a confluence of factors, including Indonesia's substantial energy deficit and its strategic reliance on coal for baseload power generation to meet the growing demands of its vast population and burgeoning industrial sector. The government's commitment to energy security and affordability further solidifies coal's position in the power generation mix.

- Key Growth Drivers for Electricity Segment:

- Expanding Power Infrastructure: Continued investment in building new power plants, particularly in remote and developing regions of Indonesia, directly translates into increased coal demand. The announced plan for 13 gigawatts of new coal plant capacity by 2030 is a significant indicator.

- Affordability and Accessibility: Coal remains the most cost-effective and readily available fuel source for large-scale electricity generation in Indonesia, making it the preferred choice for utilities seeking to keep electricity prices stable.

- Economic Growth: As Indonesia's economy expands, so does the demand for electricity across residential, commercial, and industrial sectors, creating a perpetual need for reliable power sources.

The Iron and Steel Industry represents the second most significant segment, driven by the country's industrial development ambitions. Indonesia is actively seeking to boost its domestic manufacturing capabilities, particularly in heavy industries.

- Key Growth Drivers for Iron and Steel Industry:

- Domestic Industrialization: The government's focus on downstream processing and value addition in mineral resources, including iron ore, directly boosts demand for metallurgical coal used in steel production.

- Infrastructure Development: Large-scale infrastructure projects, such as roads, bridges, and buildings, necessitate substantial quantities of steel, thereby driving coal consumption in its production.

- Export Competitiveness: Indonesia aims to become a regional hub for steel production, further necessitating a reliable and cost-effective supply of coal.

While Other Applications for coal exist, including cement production, fertilizers, and various chemical processes, these segments currently represent a smaller proportion of overall coal consumption compared to electricity and iron/steel. However, opportunities for diversification and growth exist, particularly in the development of coal-based chemical industries, provided that environmental regulations are met and technological advancements make these processes economically viable and sustainable.

Indonesia Coal Market Product Analysis

The Indonesian coal market primarily offers thermal coal, with varying calorific values (CV) and sulfur content catering to different applications. Innovations are focused on improving the efficiency of coal extraction and processing, leading to higher quality products with lower ash and moisture content. Companies like PT Adaro Energy Tbk are known for producing high-calorific value coal suitable for power generation, while others cater to the specific needs of the metallurgical coal market. Competitive advantages are derived from operational efficiency, economies of scale, and strategic access to logistical infrastructure, such as ports and railways. The market is also seeing nascent efforts in developing technologies for cleaner coal combustion and co-firing with biomass, aiming to reduce the environmental footprint of coal usage.

Key Drivers, Barriers & Challenges in Indonesia Coal Market

Key Drivers:

- Robust Domestic Energy Demand: Indonesia's growing population and expanding economy necessitate a consistent and affordable supply of energy, with coal remaining a cornerstone of its power generation mix.

- Cost-Competitiveness: Coal continues to be a cost-effective fuel source compared to many alternatives, especially for baseload power and industrial processes in the short to medium term.

- Abundant Reserves: Indonesia possesses vast coal reserves, ensuring a secure domestic supply and a strong export capacity, contributing significantly to foreign exchange earnings.

- Government Support for Energy Security: Policies aimed at ensuring national energy security often prioritize domestic fuel sources like coal, providing a supportive regulatory environment for the industry.

Key Barriers & Challenges:

- Environmental Concerns and Global Decarbonization Pressure: Increasing global momentum towards cleaner energy sources and stringent environmental regulations pose a significant long-term threat to coal demand.

- Logistical and Infrastructure Bottlenecks: While improving, transportation and port infrastructure can still present challenges in efficiently moving coal from mines to domestic consumers and export markets, impacting costs and delivery times.

- Regulatory Volatility and Policy Uncertainty: Changes in government policies related to domestic market obligations (DMO), export restrictions, and environmental standards can create uncertainty for investors and producers.

- Financing Challenges for Coal Projects: As global financial institutions become more risk-averse to coal-related investments due to ESG (Environmental, Social, and Governance) concerns, securing funding for new projects or expansions can become more difficult. The estimated impact of regulatory volatility on investment can be up to 15% fluctuation in project feasibility studies.

Growth Drivers in the Indonesia Coal Market Market

The Indonesian coal market's growth is primarily propelled by sustained domestic demand for electricity to fuel its rapidly developing economy and growing population. The cost-effectiveness of coal as an energy source, coupled with Indonesia's extensive and accessible coal reserves, ensures its continued relevance in the national energy mix. Government policies prioritizing energy security and domestic resource utilization further underpin this growth. Additionally, the ongoing expansion of the iron and steel industry, driven by infrastructure development and manufacturing growth, creates a consistent demand for metallurgical coal. The government's commitment to increasing coal power plant capacity, as evidenced by the 13 gigawatts plan, is a direct catalyst for increased thermal coal consumption.

Challenges Impacting Indonesia Coal Market Growth

The Indonesian coal market faces significant challenges, primarily stemming from increasing global environmental awareness and the worldwide push towards decarbonization. Stringent international climate agreements and growing pressure from ESG-conscious investors are creating headwinds for coal's long-term viability. Domestically, while coal remains crucial for energy security, regulatory complexities and the potential for policy shifts regarding its use can create uncertainty. Supply chain issues, including logistical bottlenecks in transportation and port infrastructure, can impact operational efficiency and cost-effectiveness. Furthermore, the competitive landscape is evolving with the increasing viability and adoption of renewable energy sources, presenting an alternative to coal-fired power generation, albeit with different cost and intermittency considerations.

Key Players Shaping the Indonesia Coal Market Market

- PT Bayan Resources Tbk

- Adani Group

- PT Indo Tambangraya Megah Tbk

- PT Adaro Energy Tbk

- PT Bukit Asam Tbk

- BlackGold Group

- Golden Energy and Resources Limited

- PT Bumi Resources Tbk

- PT Bhakti Energi Persada

Significant Indonesia Coal Market Industry Milestones

- November 2022: The Indonesian government announced plans to permit the construction of new coal power plants with a combined capacity of 13 gigawatts, already tendered out. This is part of the country's 10-year energy plan for 2021-2030, indicating a continued, albeit controlled, reliance on coal for future energy needs.

- November 2022: The Asian Development Bank and a private power firm agreed to collaborate on refinancing and prematurely retiring the 660-megawatt Cirebon 1 power plant in West Java. This deal, valued between USD 250 Million and USD 300 Million, is contingent on the plant ceasing operations 10 to 15 years before its scheduled end-of-life, signaling a growing trend towards early retirement of older coal assets with financial incentives, representing a shift towards cleaner energy transition strategies within the broader energy landscape.

Future Outlook for Indonesia Coal Market Market

The future outlook for the Indonesia Coal Market is shaped by a dual trajectory. On one hand, its role as a critical component of Indonesia's energy security and its cost-competitiveness in export markets will ensure continued demand in the short to medium term. The ongoing development of electricity infrastructure and the demand from the iron and steel sector will remain key growth catalysts. Strategic opportunities lie in enhancing operational efficiency, investing in cleaner coal technologies, and exploring diversification into coal-based chemical industries. However, the long-term outlook is intrinsically linked to global decarbonization efforts and Indonesia's own energy transition roadmap. The market will likely see increasing investment in technologies that mitigate environmental impact and a gradual shift towards a more diversified energy portfolio. The market is projected to maintain a stable, albeit moderated, growth trajectory, with an estimated market size of over 600 Million Tons by 2033.

Indonesia Coal Market Segmentation

-

1. Application

- 1.1. Electricity

- 1.2. Iron and Steel Industry

- 1.3. Other Applications

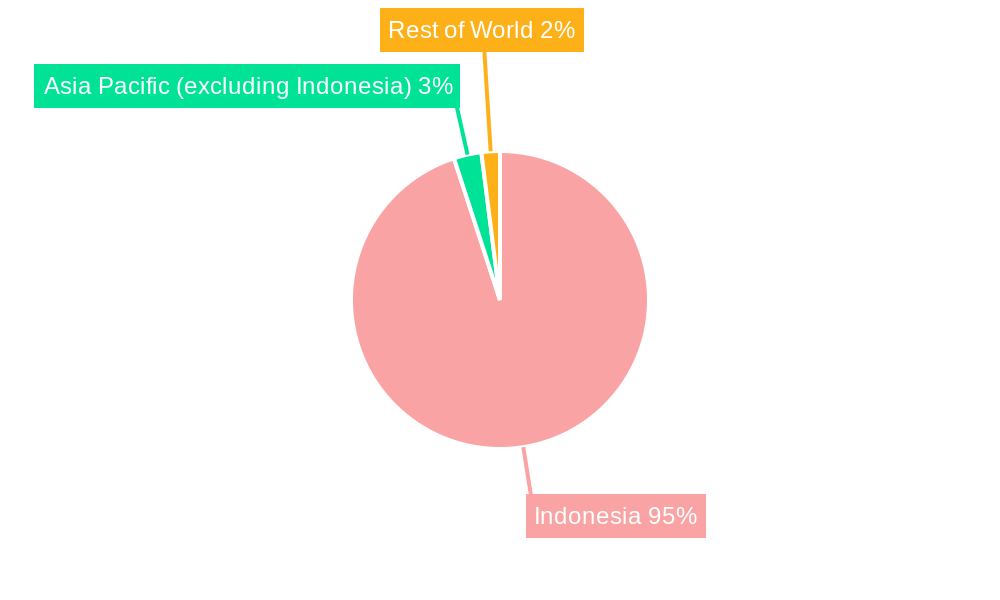

Indonesia Coal Market Segmentation By Geography

- 1. Indonesia

Indonesia Coal Market Regional Market Share

Geographic Coverage of Indonesia Coal Market

Indonesia Coal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Electricity Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Coal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electricity

- 5.1.2. Iron and Steel Industry

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Bayan Resources Tbk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Adani Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Indo Tambangraya Megah Tbk

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Adaro Energy Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Bukit Asam Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BlackGold Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Golden Energy and Resources Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Bumi Resources Tbk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Bhakti Energi Persada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 PT Bayan Resources Tbk

List of Figures

- Figure 1: Indonesia Coal Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Indonesia Coal Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Indonesia Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Indonesia Coal Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Indonesia Coal Market Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Indonesia Coal Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Indonesia Coal Market Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Indonesia Coal Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Indonesia Coal Market Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Coal Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Indonesia Coal Market?

Key companies in the market include PT Bayan Resources Tbk, Adani Group, PT Indo Tambangraya Megah Tbk, PT Adaro Energy Tbk, PT Bukit Asam Tbk, BlackGold Group, Golden Energy and Resources Limited, PT Bumi Resources Tbk, PT Bhakti Energi Persada.

3. What are the main segments of the Indonesia Coal Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Electricity Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

In November 2022, the Indonesian government announced that they would allow the construction of new coal plants, with a combined capacity of 13 gigawatts, that have already been tendered out. The plan is laid out in the country's 10-year energy plan for 2021-2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Coal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Coal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Coal Market?

To stay informed about further developments, trends, and reports in the Indonesia Coal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence