Key Insights

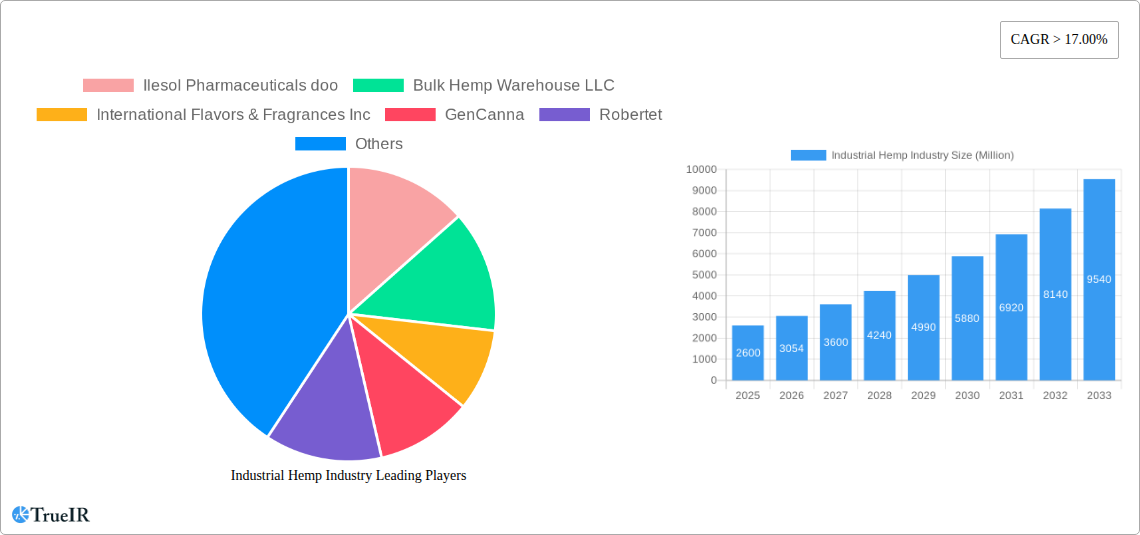

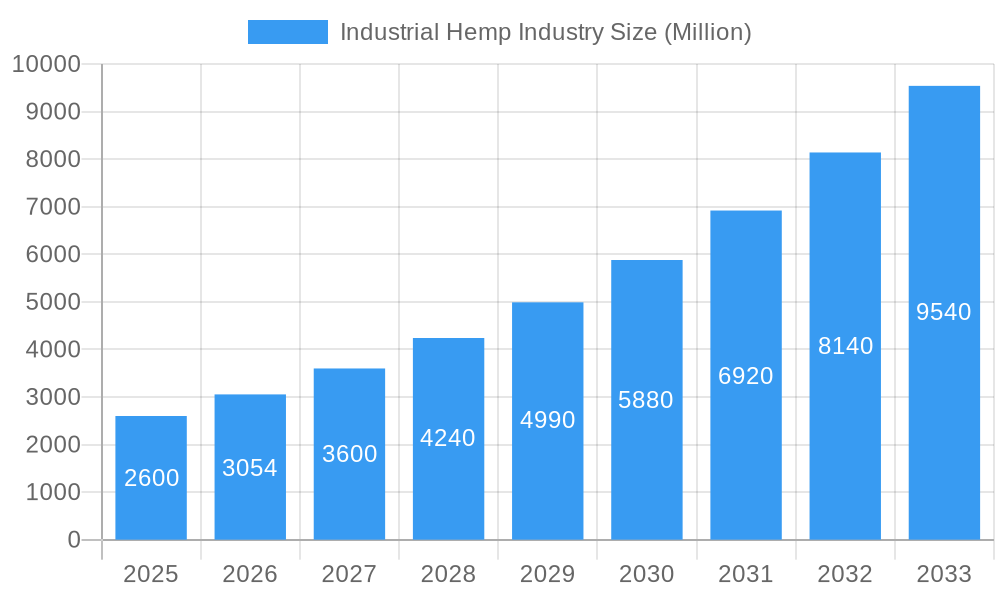

The industrial hemp market, valued at $2.6 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 17% from 2025 to 2033. This surge is driven by the increasing demand for hemp-derived products across diverse sectors. The burgeoning CBD market, fueled by consumer interest in wellness and natural remedies, is a significant contributor. Furthermore, the growing use of hemp in textiles, construction materials (hempcrete), and bioplastics is further accelerating market expansion. Government regulations and support for hemp cultivation are also playing a crucial role in fostering industry growth. While challenges remain, such as inconsistent regulations across different regions and the need for further research and development to optimize hemp production and processing, the overall market outlook remains extremely positive.

Industrial Hemp Industry Market Size (In Billion)

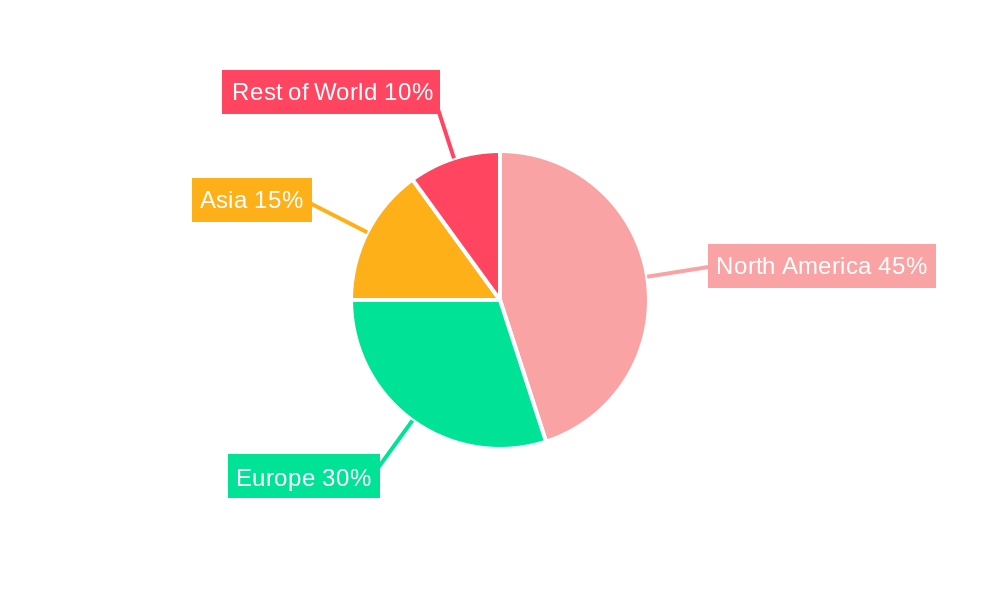

Despite some regional variations in regulations and market penetration, the industrial hemp sector is witnessing widespread adoption. Key players like Ilesol Pharmaceuticals, Bulk Hemp Warehouse, and International Flavors & Fragrances are leading the innovation and expansion within their respective segments. The North American market currently holds a significant share, driven by early adoption and supportive policy environments. However, Europe and Asia are rapidly emerging as significant markets, presenting lucrative opportunities for existing and new entrants. The continuous development of new applications for hemp, coupled with improvements in cultivation and processing technologies, will likely solidify the long-term growth trajectory of this industry. Further diversification into areas like hemp food products and animal feed is expected to further contribute to market expansion.

Industrial Hemp Industry Company Market Share

Industrial Hemp Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Industrial Hemp Industry, projecting a market valuation exceeding $XX Million by 2033. Leveraging data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study offers invaluable insights for investors, industry players, and stakeholders seeking to navigate this rapidly evolving market.

Industrial Hemp Industry Market Structure & Competitive Landscape

The industrial hemp market exhibits a moderately fragmented structure, with several key players competing across various segments. While large multinational corporations like International Flavors & Fragrances Inc and Firmenich SA contribute significantly to the market value, a substantial number of smaller companies such as 33 Supply LLC, Silver Lion Farms, and Hemp Acres USA also hold significant market share. The industry's concentration ratio (CR4 or CR8) is estimated at xx%, indicating a relatively competitive landscape.

Innovation Drivers: Significant innovation is driven by advancements in extraction technologies, genetic engineering for high-yield strains, and the development of new applications in various sectors.

Regulatory Impacts: Fluctuations in regulations across different jurisdictions significantly influence market growth. Harmonization of regulations and clarity around the legal status of hemp derivatives are crucial for market expansion.

Product Substitutes: The market faces competition from synthetic alternatives for certain hemp-derived products, impacting market share in specific applications.

End-User Segmentation: The end-user segments vary widely, including food and beverage, textiles, construction, cosmetics, and pharmaceuticals. Understanding market demand within each sector is critical for strategic decision-making.

M&A Trends: The industry has witnessed a significant increase in mergers and acquisitions (M&A) activities in recent years. For example, the acquisition of Green Growth Group Inc. and Kind Therapeutics USA LLC by MariMed Inc. in January 2022 demonstrates the ongoing consolidation trend. The total M&A volume during the period 2019-2024 is estimated to be $XX Million.

Industrial Hemp Industry Market Trends & Opportunities

The global industrial hemp market is experiencing robust growth, driven by increasing consumer awareness of hemp's sustainability and versatility. The market size is expected to reach $XX Million by 2033, registering a compound annual growth rate (CAGR) of xx% during the forecast period. Technological advancements in extraction and processing are further boosting efficiency and lowering production costs. The market penetration rate for hemp-derived products in key sectors such as textiles and construction remains relatively low, representing a significant opportunity for market expansion. Changing consumer preferences towards sustainable and eco-friendly products are favorable trends for the industry. However, stiff competition from synthetic materials and variations in consumer perception and adoption rates across regions pose challenges.

Dominant Markets & Segments in Industrial Hemp Industry

North America, particularly the United States and Canada, currently dominates the global industrial hemp market. This dominance is largely attributed to favorable regulatory environments and established cultivation infrastructure.

- Key Growth Drivers in North America:

- Relaxation of regulations surrounding hemp cultivation and processing.

- Significant investments in research and development for hemp-based products.

- Growing consumer acceptance of hemp-derived products in various sectors.

- Development of robust supply chains to support growing demand.

While North America leads, Europe and Asia Pacific regions are showing promising growth potential, fuelled by increasing investments in the hemp industry and rising consumer awareness of its benefits. This rapid development is also seen in other countries, though to a lesser extent. The market share for Europe is predicted to be $XX Million by 2033.

Industrial Hemp Industry Product Analysis

The industrial hemp market offers a diverse range of products, including CBD oil, hemp seeds, hemp fiber, and hemp-based bioplastics. Ongoing technological advancements focus on optimizing extraction processes, improving product quality, and enhancing the functional properties of hemp derivatives. The increasing applications of hemp in diverse sectors are further contributing to the market growth.

Key Drivers, Barriers & Challenges in Industrial Hemp Industry

Key Drivers: The key drivers for market growth include increasing consumer demand for sustainable products, favorable government policies promoting hemp cultivation, technological advancements in extraction and processing, and growing applications in various sectors (food, textiles, construction, bioplastics, etc.).

Key Challenges: The industry faces significant challenges, including inconsistent regulations across regions, supply chain complexities resulting in fluctuating prices, and intense competition from established players and synthetic substitutes. These factors limit large-scale adoption and profitability. Moreover, the lack of standardized quality control and concerns about potential contamination in some products are affecting consumer confidence.

Growth Drivers in the Industrial Hemp Industry Market

Continued technological advancements in cultivation, extraction, and processing techniques remain pivotal for unlocking cost-efficiency and scalability. Favorable governmental policies are crucial for reducing regulatory complexities and fostering further industry development. Additionally, an increase in consumer awareness and adoption of hemp-derived products due to their sustainability and versatility is a major market driver.

Challenges Impacting Industrial Hemp Industry Growth

Inconsistent and evolving regulations across various jurisdictions represent a key hurdle for market expansion. These regulatory inconsistencies create uncertainty and increase the cost of compliance for businesses. Supply chain inefficiencies, including the lack of standardized practices and fluctuating prices of raw materials, contribute to the cost of production. Furthermore, competitive pressures from synthetic alternatives and established players create challenges for new entrants.

Key Players Shaping the Industrial Hemp Industry Market

- Ilesol Pharmaceuticals doo

- Bulk Hemp Warehouse LLC

- International Flavors & Fragrances Inc

- GenCanna

- Robertet

- Firmenich SA

- Charlotte's Web Holdings Inc

- True Terpenes

- Puricon

- PharmaCielo Ltd

- Silver Lion Farms

- Bomar Agra Estates LLC

- Colorado Breeders Depot

- 33 Supply LLC

- Green Passion (Canway Schweiz GmbH)

- Victory Hemp Foods

- Hemp Oil Canada

- Manitoba Harvest (Tilray)

- HempFlax Group BV

- Entoura

- Bedrocan

- Signature Products

- Nutiva hemp Oil

- Temp Co Canada

- Hemp Acres USA

*List Not Exhaustive

Significant Industrial Hemp Industry Industry Milestones

- January 2022: MariMed Inc. acquires Green Growth Group Inc., expanding its presence in the Illinois cannabis market.

- January 2022: MariMed Inc. acquires Kind Therapeutics USA LLC, strengthening its vertical integration in the Maryland cannabis market.

These acquisitions signal a trend of consolidation within the industry, leading to larger, more diversified players with increased market power.

Future Outlook for Industrial Hemp Industry Market

The industrial hemp market is poised for significant expansion, driven by continued innovation, favorable regulatory shifts, and increasing consumer demand. Strategic partnerships, further research and development initiatives, and increased market penetration in diverse sectors are key catalysts for future growth. This presents compelling opportunities for businesses that can adapt quickly and efficiently to market dynamics. The market is set for strong growth in the coming decade, reaching $XX Million by 2033.

Industrial Hemp Industry Segmentation

-

1. Type

- 1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 1.2. Hemp Seed Oil

- 1.3. Cannabidiol (CBD) Hemp Oil

- 1.4. Hemp Protein (Supplement)

- 1.5. Hemp Extract (Without CBD)

-

2. Application

- 2.1. Food and Beverages

- 2.2. Healthcare Supplements

- 2.3. Other Applications

Industrial Hemp Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Turkey

- 3.7. Russia

- 3.8. NORDIC Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Nigeria

- 5.3. Qatar

- 5.4. Egypt

- 5.5. United Arab Emirates

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Industrial Hemp Industry Regional Market Share

Geographic Coverage of Industrial Hemp Industry

Industrial Hemp Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 17.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Huge Demand for Industrial Hemp Products Across Diverse Applications; High Functional Application in Health Care Sector

- 3.3. Market Restrains

- 3.3.1. Huge Demand for Industrial Hemp Products Across Diverse Applications; High Functional Application in Health Care Sector

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Food and Beverage Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 5.1.2. Hemp Seed Oil

- 5.1.3. Cannabidiol (CBD) Hemp Oil

- 5.1.4. Hemp Protein (Supplement)

- 5.1.5. Hemp Extract (Without CBD)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.2. Healthcare Supplements

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 6.1.2. Hemp Seed Oil

- 6.1.3. Cannabidiol (CBD) Hemp Oil

- 6.1.4. Hemp Protein (Supplement)

- 6.1.5. Hemp Extract (Without CBD)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.2. Healthcare Supplements

- 6.2.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 7.1.2. Hemp Seed Oil

- 7.1.3. Cannabidiol (CBD) Hemp Oil

- 7.1.4. Hemp Protein (Supplement)

- 7.1.5. Hemp Extract (Without CBD)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.2. Healthcare Supplements

- 7.2.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 8.1.2. Hemp Seed Oil

- 8.1.3. Cannabidiol (CBD) Hemp Oil

- 8.1.4. Hemp Protein (Supplement)

- 8.1.5. Hemp Extract (Without CBD)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.2. Healthcare Supplements

- 8.2.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 9.1.2. Hemp Seed Oil

- 9.1.3. Cannabidiol (CBD) Hemp Oil

- 9.1.4. Hemp Protein (Supplement)

- 9.1.5. Hemp Extract (Without CBD)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverages

- 9.2.2. Healthcare Supplements

- 9.2.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Industrial Hemp Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hemp Seed (Consumed Raw, Cooked or Roasted)

- 10.1.2. Hemp Seed Oil

- 10.1.3. Cannabidiol (CBD) Hemp Oil

- 10.1.4. Hemp Protein (Supplement)

- 10.1.5. Hemp Extract (Without CBD)

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverages

- 10.2.2. Healthcare Supplements

- 10.2.3. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ilesol Pharmaceuticals doo

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bulk Hemp Warehouse LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 International Flavors & Fragrances Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GenCanna

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Robertet

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Firmenich SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Charlotte's Web Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 True Terpenes

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Puricon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PharmaCielo Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Silver Lion Farms

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bomar Agra Estates LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Colorado Breeders Depot

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 33 Supply LLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Green Passion (Canway Schweiz GmbH)

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Victory Hemp Foods

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Hemp Oil Canada

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Manitoba Harvest (Tilray)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 HempFlax Group BV

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Entoura

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Bedrocan

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Signature Products

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Nutiva hemp Oil

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Temp Co Canada

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Hemp Acres USA*List Not Exhaustive

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Ilesol Pharmaceuticals doo

List of Figures

- Figure 1: Global Industrial Hemp Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Industrial Hemp Industry Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 5: Asia Pacific Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 8: Asia Pacific Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 9: Asia Pacific Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: Asia Pacific Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: Asia Pacific Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 17: North America Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 20: North America Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 21: North America Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: North America Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: North America Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 25: North America Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 29: Europe Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 32: Europe Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 33: Europe Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 41: South America Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: South America Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 45: South America Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: South America Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Industrial Hemp Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Industrial Hemp Industry Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East and Africa Industrial Hemp Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Industrial Hemp Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Industrial Hemp Industry Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Industrial Hemp Industry Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East and Africa Industrial Hemp Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Industrial Hemp Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Industrial Hemp Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Industrial Hemp Industry Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Industrial Hemp Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Industrial Hemp Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Industrial Hemp Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Industrial Hemp Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: China Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: India Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Japan Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: South Korea Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Malaysia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Malaysia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Thailand Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Thailand Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Vietnam Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Vietnam Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United States Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United States Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Canada Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Canada Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Mexico Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Mexico Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 45: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 47: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Germany Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Germany Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: United Kingdom Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: United Kingdom Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: France Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: France Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Italy Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Italy Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Spain Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Spain Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Turkey Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Turkey Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Russia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Russia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: NORDIC Countries Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: NORDIC Countries Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of Europe Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Europe Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 68: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 69: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 70: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 71: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 73: Brazil Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Argentina Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Colombia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Colombia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Rest of South America Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of South America Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Global Industrial Hemp Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 82: Global Industrial Hemp Industry Volume Billion Forecast, by Type 2020 & 2033

- Table 83: Global Industrial Hemp Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 84: Global Industrial Hemp Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 85: Global Industrial Hemp Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 86: Global Industrial Hemp Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 87: Saudi Arabia Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Saudi Arabia Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Nigeria Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Nigeria Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Qatar Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Qatar Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: Egypt Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: Egypt Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: United Arab Emirates Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: United Arab Emirates Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: South Africa Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Africa Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: Rest of Middle East and Africa Industrial Hemp Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: Rest of Middle East and Africa Industrial Hemp Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Hemp Industry?

The projected CAGR is approximately > 17.00%.

2. Which companies are prominent players in the Industrial Hemp Industry?

Key companies in the market include Ilesol Pharmaceuticals doo, Bulk Hemp Warehouse LLC, International Flavors & Fragrances Inc, GenCanna, Robertet, Firmenich SA, Charlotte's Web Holdings Inc, True Terpenes, Puricon, PharmaCielo Ltd, Silver Lion Farms, Bomar Agra Estates LLC, Colorado Breeders Depot, 33 Supply LLC, Green Passion (Canway Schweiz GmbH), Victory Hemp Foods, Hemp Oil Canada, Manitoba Harvest (Tilray), HempFlax Group BV, Entoura, Bedrocan, Signature Products, Nutiva hemp Oil, Temp Co Canada, Hemp Acres USA*List Not Exhaustive.

3. What are the main segments of the Industrial Hemp Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Huge Demand for Industrial Hemp Products Across Diverse Applications; High Functional Application in Health Care Sector.

6. What are the notable trends driving market growth?

Increasing Demand from the Food and Beverage Segment.

7. Are there any restraints impacting market growth?

Huge Demand for Industrial Hemp Products Across Diverse Applications; High Functional Application in Health Care Sector.

8. Can you provide examples of recent developments in the market?

January 2022: MariMed Inc. signed a definitive agreement to acquire Green Growth Group Inc., holder of a provisional Cannabis Craft License in Illinois.January 2022: MariMed Inc. entered a definitive agreement to acquire Kind Therapeutics USA LLC, a leading vertically integrated cannabis business in Maryland.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Hemp Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Hemp Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Hemp Industry?

To stay informed about further developments, trends, and reports in the Industrial Hemp Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence