Key Insights

The global Intelligent Pigging Market is projected for substantial growth, estimated to reach $800.019 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.19%. This expansion is driven by the critical need for robust asset integrity management and the early detection of pipeline anomalies. The increasing age and complexity of existing pipeline infrastructure across oil & gas, water, and wastewater sectors necessitate advanced inspection methodologies. Innovations in Magnetic Flux Leakage (MFL) and ultrasonic pigging technologies are enhancing inspection accuracy and efficiency, thus accelerating market adoption. Furthermore, a growing emphasis on stringent safety regulations and environmental protection mandates compels pipeline operators to invest in sophisticated intelligent pigging solutions to mitigate leak risks and ensure operational integrity.

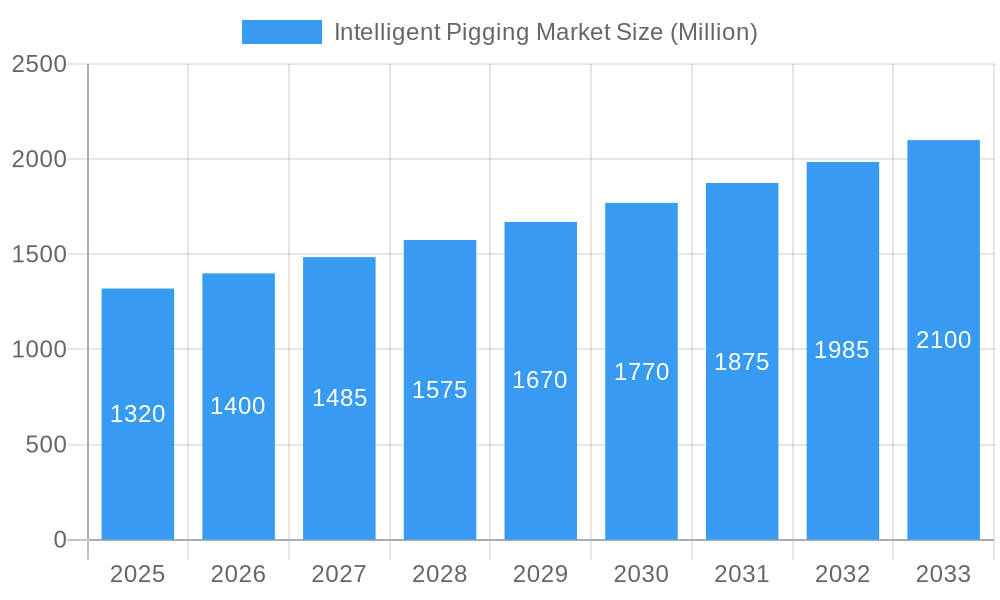

Intelligent Pigging Market Market Size (In Million)

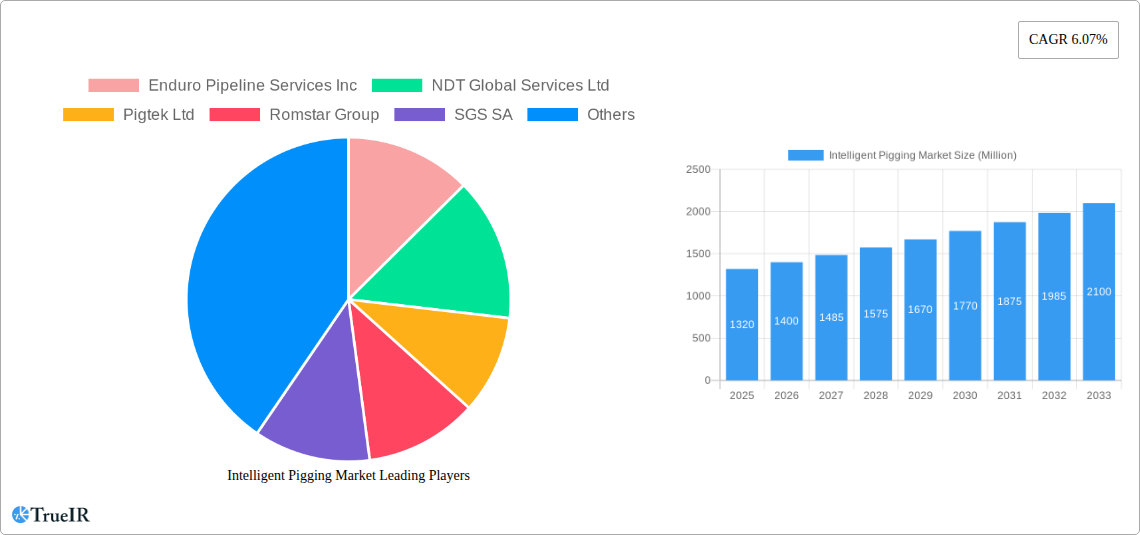

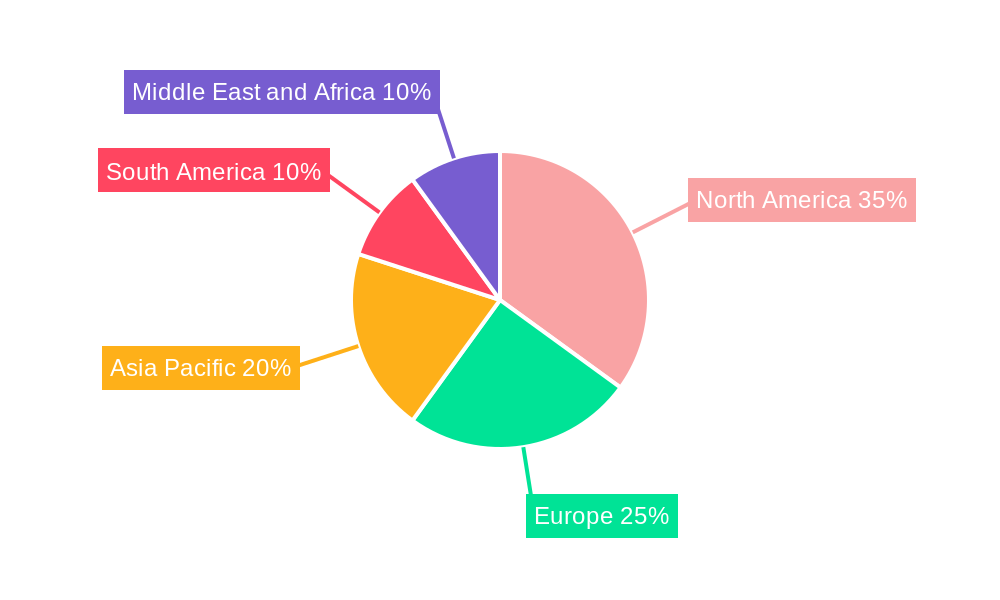

Key market segments include Magnetic Flux Leakage Pigs and Ultrasonic Pigs, recognized for their superior capabilities in identifying diverse pipeline defects. Leading companies such as Enduro Pipeline Services Inc., NDT Global Services Ltd., and SGS SA are at the forefront, offering comprehensive intelligent pigging services. Geographically, North America, led by the United States and Canada, is anticipated to hold a dominant market share, supported by extensive pipeline networks and rigorous regulatory frameworks. The Asia Pacific region offers significant growth potential, fueled by developing infrastructure and escalating investments in the oil and gas industry. While strong market drivers exist, challenges may include the initial investment cost of advanced pigging technology and the availability of skilled personnel for operation and data analysis. However, the persistent focus on enhanced pipeline safety, operational efficiency, and environmental stewardship indicates a positive market outlook for intelligent pigging solutions.

Intelligent Pigging Market Company Market Share

Intelligent Pigging Market Report: In-Depth Analysis & Future Outlook (2019-2033)

This comprehensive Intelligent Pigging Market report delivers a meticulously researched analysis of the global pipeline integrity management landscape. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report provides unparalleled insights into market dynamics, competitive strategies, and emerging opportunities. Leveraging high-volume SEO keywords such as "intelligent pigging," "pipeline inspection," "integrity management," "magnetic flux leakage pigs," "ultrasonic pigs," and "caliper pigs," this report is engineered to enhance search rankings and engage a broad spectrum of industry professionals, including pipeline operators, service providers, technology developers, and investors. Understand the critical role of intelligent pigging in ensuring the safety, efficiency, and longevity of vital energy and industrial infrastructure.

Intelligent Pigging Market Market Structure & Competitive Landscape

The global Intelligent Pigging Market is characterized by a moderately consolidated structure, driven by the necessity for advanced technological expertise and significant capital investment. Innovation remains a primary driver, with companies continuously investing in R&D to enhance the accuracy, speed, and data analysis capabilities of their pigging solutions. Regulatory frameworks, particularly concerning pipeline safety and environmental protection, exert a substantial influence, mandating regular inspections and the adoption of sophisticated integrity management techniques. Product substitutes, such as external visual inspections and non-destructive testing (NDT) methods, exist but often lack the comprehensive internal assessment capabilities offered by intelligent pigging.

The end-user segmentation is predominantly influenced by the oil and gas industry, followed by water, wastewater, and chemical sectors. Mergers and acquisitions (M&A) trends are observable as larger players seek to consolidate market share, expand their service offerings, and acquire innovative technologies. While specific M&A volumes fluctuate, recent years have seen strategic consolidations aimed at creating integrated service providers. The competitive landscape is shaped by a blend of established global entities and specialized regional players, each vying for market dominance through technological differentiation and customer-centric service delivery. Key players are focused on providing end-to-end solutions, from in-line inspection (ILI) to data interpretation and remediation recommendations, solidifying their competitive advantage in this critical infrastructure sector.

Intelligent Pigging Market Market Trends & Opportunities

The Intelligent Pigging Market is poised for robust growth, driven by an increasing global demand for reliable and safe pipeline infrastructure. The market size is projected to witness a significant expansion, with an estimated Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological shifts are at the forefront of market evolution, with continuous advancements in sensor technology, data acquisition, and artificial intelligence (AI) for data interpretation revolutionizing the capabilities of intelligent pigs. Companies are investing heavily in developing pigs that can detect a wider range of defects, operate in more challenging environments, and transmit data in real-time, thereby enhancing operational efficiency and reducing downtime.

Consumer preferences are increasingly shifting towards integrated solutions that offer comprehensive pipeline integrity management rather than standalone inspection services. Operators are seeking partners who can provide end-to-end services, from inspection to data analysis, risk assessment, and maintenance planning. This trend is creating opportunities for service providers to expand their service portfolios and offer value-added solutions. Competitive dynamics are intensifying, with a focus on innovation, cost-effectiveness, and the ability to adapt to evolving regulatory landscapes. The growing emphasis on environmental sustainability and the prevention of pipeline leaks is also a significant market catalyst, driving the adoption of advanced inspection technologies.

Furthermore, the expansion of pipeline networks in emerging economies, coupled with the aging infrastructure in developed regions, presents substantial opportunities for market growth. The increasing complexity of pipelines, including those carrying hazardous materials or operating under extreme pressures and temperatures, necessitates the deployment of sophisticated intelligent pigging technologies to ensure operational integrity and safety. Market penetration rates are expected to rise as awareness of the benefits of intelligent pigging grows and as regulatory bodies continue to enforce stringent safety standards. The integration of digital technologies, such as the Internet of Things (IoT) and big data analytics, is further enhancing the value proposition of intelligent pigging, enabling predictive maintenance and proactive risk management.

Dominant Markets & Segments in Intelligent Pigging Market

The Intelligent Pigging Market is dominated by regions with extensive existing pipeline networks and significant ongoing infrastructure development. North America and Europe currently lead in terms of market share, owing to their mature oil and gas industries, stringent regulatory environments, and early adoption of advanced inspection technologies. However, the Asia-Pacific region is emerging as a high-growth market, propelled by massive investments in pipeline infrastructure for energy transportation and water distribution, coupled with increasing government focus on industrial safety and environmental protection. Countries like China and India are witnessing substantial expansion in their pipeline networks, creating a strong demand for intelligent pigging services.

Within the technology segment, Magnetic Flux Leakage (MFL) Pigs remain a dominant force, widely recognized for their effectiveness in detecting corrosion and metal loss in ferrous pipelines. Their widespread adoption is attributed to their maturity, reliability, and relatively lower cost compared to some advanced technologies. Caliper Pigs, essential for assessing pipeline deformation, ovality, and dents, also hold a significant market share, particularly in applications where mechanical integrity is a primary concern. Ultrasonic Pigs are gaining considerable traction due to their superior ability to detect and characterize a broader range of defects, including cracks, pitting, and wall thinning, even in complex geometries and non-ferrous materials. The increasing sophistication and miniaturization of ultrasonic transducers are further driving their adoption.

Key growth drivers in these dominant markets and segments include:

- Infrastructure Development: Continuous investment in new pipeline construction for oil, gas, and water transmission fuels the demand for inspection services from the outset.

- Aging Infrastructure: The need to maintain and monitor aging pipelines, prone to corrosion and structural degradation, drives the demand for regular intelligent pigging operations to prevent failures.

- Stringent Regulations: Evolving safety and environmental regulations worldwide mandate routine and advanced inspections, making intelligent pigging indispensable for compliance.

- Technological Advancements: The development of more precise, faster, and versatile intelligent pigging technologies makes them more attractive and accessible for a wider range of applications.

- Focus on Asset Integrity: A growing emphasis on proactive asset management and risk mitigation strategies encourages operators to invest in comprehensive integrity assessment tools like intelligent pigs.

The market dominance of specific technologies is often dictated by the material of the pipeline, the type of fluid being transported, and the nature of the anticipated defects. For instance, MFL pigs are standard for most liquid hydrocarbon pipelines, while ultrasonic pigs are increasingly preferred for their versatility and ability to detect a wider array of flaws.

Intelligent Pigging Market Product Analysis

Intelligent pigging products, commonly referred to as In-Line Inspection (ILI) tools or "pigs," represent sophisticated technological solutions designed for the internal inspection of pipelines. These devices are equipped with various sensors, including Magnetic Flux Leakage (MFL), ultrasonic, eddy current, and caliper systems, to detect and record anomalies such as corrosion, pitting, cracks, dents, and ovality. Product innovations are primarily focused on enhancing detection accuracy, improving data resolution, increasing inspection speed, and enabling real-time data transmission. Advancements in miniaturization and modularity allow for pigs to be deployed in pipelines with tighter bends and smaller diameters. The competitive advantage of these products lies in their ability to provide comprehensive, internal pipeline assessments that are crucial for maintaining asset integrity, preventing failures, and ensuring regulatory compliance. Applications span across the oil and gas, water, wastewater, and chemical industries, where the safe and efficient transportation of fluids is paramount.

Key Drivers, Barriers & Challenges in Intelligent Pigging Market

The Intelligent Pigging Market is propelled by several key drivers that underpin its growth trajectory. The increasing global demand for energy necessitates the expansion and maintenance of extensive pipeline networks, driving the need for robust integrity management solutions. Growing regulatory mandates for pipeline safety and environmental protection are paramount, compelling operators to invest in advanced inspection technologies. Technological advancements in sensor technology, data analytics, and AI are continuously improving the capabilities and cost-effectiveness of intelligent pigs. Furthermore, the rising awareness among operators regarding the economic benefits of proactive maintenance and the prevention of costly failures serves as a significant growth catalyst.

- Technological Advancements: Development of higher resolution sensors, AI-powered data analysis, and real-time data transmission capabilities.

- Regulatory Compliance: Strict safety and environmental regulations worldwide mandate regular pipeline inspections.

- Infrastructure Expansion: Growing global demand for energy leads to new pipeline construction projects.

- Asset Integrity Management: Increased focus on preventing costly failures and ensuring operational reliability.

Conversely, the market faces significant challenges and restraints. The high upfront cost of intelligent pigging equipment and services can be a barrier, especially for smaller operators or in emerging markets. The complexity of data interpretation requires specialized expertise, and a shortage of skilled personnel can hinder the effective utilization of inspection data. Supply chain disruptions, particularly for specialized components and manufacturing, can impact delivery times and costs. Moreover, the operational challenges of deploying and retrieving pigs in certain pipeline configurations or environments, coupled with the potential for product substitution by less comprehensive but cheaper methods, present ongoing hurdles.

- High Initial Investment: The cost of intelligent pigs and associated services can be prohibitive for some operators.

- Data Interpretation Expertise: Requirement for highly skilled professionals to analyze complex inspection data.

- Operational Complexities: Challenges in deploying and retrieving pigs in difficult pipeline configurations.

- Supply Chain Vulnerabilities: Potential disruptions in the supply of specialized components.

- Product Substitution: Competition from less sophisticated, lower-cost inspection methods.

Growth Drivers in the Intelligent Pigging Market Market

The Intelligent Pigging Market is experiencing significant growth driven by a confluence of technological, economic, and policy factors. The relentless pursuit of enhanced pipeline safety and environmental protection by regulatory bodies worldwide is a primary growth catalyst. This is evident in regions implementing stricter inspection protocols and demanding comprehensive integrity assessments. Economically, the increasing global energy demand necessitates the expansion and optimization of pipeline infrastructure, directly translating into higher demand for intelligent pigging services. Technologically, continuous innovation in sensor technology, data processing, and artificial intelligence is creating smarter, faster, and more accurate inspection tools. For instance, the development of pigs capable of detecting micro-cracks and providing real-time diagnostics significantly boosts their adoption. The growing emphasis on proactive asset management and the prevention of catastrophic failures, which can incur massive financial and environmental costs, further fuels market expansion as operators invest in these advanced integrity solutions.

Challenges Impacting Intelligent Pigging Market Growth

Despite its promising growth, the Intelligent Pigging Market faces several critical barriers and restraints that warrant attention. The substantial capital expenditure required for acquiring state-of-the-art intelligent pigs and the associated operational costs can be a significant hurdle, particularly for smaller pipeline operators or those in price-sensitive markets. Regulatory complexities, while a driver, can also be a challenge if inconsistencies exist across different jurisdictions or if implementation timelines are not aligned with technological readiness. Supply chain issues, including the availability of specialized components and the manufacturing capacity for advanced pigs, can lead to delays and increased costs. Furthermore, the competitive pressure from alternative, albeit less comprehensive, inspection methods, and the persistent need for highly specialized personnel to operate and interpret data from these sophisticated tools, represent ongoing challenges that impact market growth.

Key Players Shaping the Intelligent Pigging Market Market

- Enduro Pipeline Services Inc

- NDT Global Services Ltd

- Pigtek Ltd

- Romstar Group

- SGS SA

- A Hak Industrial Services B V

- PipeSurvey International

- Decon International Technologies

- Rosen Australia Pty Ltd

- Penspen Limited

Significant Intelligent Pigging Market Industry Milestones

- January 2023: CDI introduced the Qube, a groundbreaking device transforming the pipeline pig tracking approach. The Qube is an innovative, compact, and robust above-ground monitoring (AGM) solution specifically designed for the oil and gas industry. Its primary function is to detect the presence of pipeline pigs as they traverse the pipelines. Equipped with GPS and magnetic data sensors, the Qube offers remarkable capabilities, allowing it to identify up to eight frequencies of magnetic transmitters attached to the pipeline pigs. Additionally, it can detect MFL magnetizers. With its industrial-grade construction, the Qube ensures reliable performance in demanding environments. This revolutionary device is set to redefine and enhance the efficiency of pipeline pig tracking operations.

- January 2022: KPTL secured a contract from JSW Utkal Steel Ltd. to install an iron ore slurry pipeline (Spread I) in Odisha Mines. The scope of work includes the laying, testing, pre-commissioning, and commissioning of a 32" x 131 km slurry pipeline. The project also involves the construction of five Pressure Monitoring Stations and two Intermediate Pigging Stations along the pipeline route.

Future Outlook for Intelligent Pigging Market Market

The future outlook for the Intelligent Pigging Market is exceptionally positive, driven by an unwavering global commitment to pipeline safety, infrastructure integrity, and environmental protection. Market growth will be significantly propelled by advancements in artificial intelligence and machine learning, which will enable more sophisticated data analysis, predictive maintenance, and autonomous inspection capabilities. The increasing deployment of IoT sensors integrated with intelligent pigs will facilitate real-time data streaming and enhanced monitoring. Furthermore, the expansion of pipeline networks in emerging economies and the ongoing need to manage aging infrastructure in developed regions will continue to create substantial market opportunities. Strategic partnerships, mergers, and acquisitions are expected to shape the competitive landscape, leading to integrated service providers offering comprehensive pipeline integrity management solutions. The continuous innovation in pigging technologies, designed to operate in increasingly challenging environments and detect an even wider array of defects with greater accuracy, will solidify intelligent pigging's indispensable role in safeguarding critical energy and industrial infrastructure.

Intelligent Pigging Market Segmentation

-

1. Technology

- 1.1. Magnetic Flux Leakage Pigs

- 1.2. Caliper Pigs

- 1.3. Ultrasonic Pigs

Intelligent Pigging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Russia

- 2.2. United Kingdom

- 2.3. Norway

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Malaysia

- 3.5. Indonesia

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Venezuela

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Nigeria

- 5.4. Egypt

- 5.5. Iran

- 5.6. Rest of Middle East and Africa

Intelligent Pigging Market Regional Market Share

Geographic Coverage of Intelligent Pigging Market

Intelligent Pigging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Upcoming Pipeline Projects4.; Increasing Focus on Pipeline Safety

- 3.3. Market Restrains

- 3.3.1. 4.; Upcoming Pipeline Projects4.; Increasing Focus on Pipeline Safety

- 3.4. Market Trends

- 3.4.1. Caliper Pigging Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Intelligent Pigging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Magnetic Flux Leakage Pigs

- 5.1.2. Caliper Pigs

- 5.1.3. Ultrasonic Pigs

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Intelligent Pigging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Magnetic Flux Leakage Pigs

- 6.1.2. Caliper Pigs

- 6.1.3. Ultrasonic Pigs

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Intelligent Pigging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Magnetic Flux Leakage Pigs

- 7.1.2. Caliper Pigs

- 7.1.3. Ultrasonic Pigs

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Intelligent Pigging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Magnetic Flux Leakage Pigs

- 8.1.2. Caliper Pigs

- 8.1.3. Ultrasonic Pigs

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Intelligent Pigging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Magnetic Flux Leakage Pigs

- 9.1.2. Caliper Pigs

- 9.1.3. Ultrasonic Pigs

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Intelligent Pigging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Magnetic Flux Leakage Pigs

- 10.1.2. Caliper Pigs

- 10.1.3. Ultrasonic Pigs

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Enduro Pipeline Services Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NDT Global Services Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pigtek Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Romstar Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SGS SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 A Hak Industrial Services B V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PipeSurvey International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Decon International Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rosen Australia Pty Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Penspen Limited*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Enduro Pipeline Services Inc

List of Figures

- Figure 1: Global Intelligent Pigging Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Intelligent Pigging Market Revenue (million), by Technology 2025 & 2033

- Figure 3: North America Intelligent Pigging Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Intelligent Pigging Market Revenue (million), by Country 2025 & 2033

- Figure 5: North America Intelligent Pigging Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Intelligent Pigging Market Revenue (million), by Technology 2025 & 2033

- Figure 7: Europe Intelligent Pigging Market Revenue Share (%), by Technology 2025 & 2033

- Figure 8: Europe Intelligent Pigging Market Revenue (million), by Country 2025 & 2033

- Figure 9: Europe Intelligent Pigging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Intelligent Pigging Market Revenue (million), by Technology 2025 & 2033

- Figure 11: Asia Pacific Intelligent Pigging Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Asia Pacific Intelligent Pigging Market Revenue (million), by Country 2025 & 2033

- Figure 13: Asia Pacific Intelligent Pigging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Intelligent Pigging Market Revenue (million), by Technology 2025 & 2033

- Figure 15: South America Intelligent Pigging Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: South America Intelligent Pigging Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America Intelligent Pigging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Intelligent Pigging Market Revenue (million), by Technology 2025 & 2033

- Figure 19: Middle East and Africa Intelligent Pigging Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Middle East and Africa Intelligent Pigging Market Revenue (million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Intelligent Pigging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Intelligent Pigging Market Revenue million Forecast, by Technology 2020 & 2033

- Table 2: Global Intelligent Pigging Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Intelligent Pigging Market Revenue million Forecast, by Technology 2020 & 2033

- Table 4: Global Intelligent Pigging Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Global Intelligent Pigging Market Revenue million Forecast, by Technology 2020 & 2033

- Table 9: Global Intelligent Pigging Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: Russia Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Norway Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Italy Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Global Intelligent Pigging Market Revenue million Forecast, by Technology 2020 & 2033

- Table 16: Global Intelligent Pigging Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: China Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: India Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Australia Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Indonesia Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Global Intelligent Pigging Market Revenue million Forecast, by Technology 2020 & 2033

- Table 24: Global Intelligent Pigging Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: Brazil Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Argentina Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Venezuela Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Rest of South America Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Global Intelligent Pigging Market Revenue million Forecast, by Technology 2020 & 2033

- Table 30: Global Intelligent Pigging Market Revenue million Forecast, by Country 2020 & 2033

- Table 31: Saudi Arabia Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: United Arab Emirates Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Nigeria Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Egypt Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Iran Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Intelligent Pigging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intelligent Pigging Market?

The projected CAGR is approximately 5.19%.

2. Which companies are prominent players in the Intelligent Pigging Market?

Key companies in the market include Enduro Pipeline Services Inc, NDT Global Services Ltd, Pigtek Ltd, Romstar Group, SGS SA, A Hak Industrial Services B V, PipeSurvey International, Decon International Technologies, Rosen Australia Pty Ltd, Penspen Limited*List Not Exhaustive.

3. What are the main segments of the Intelligent Pigging Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 800.019 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Upcoming Pipeline Projects4.; Increasing Focus on Pipeline Safety.

6. What are the notable trends driving market growth?

Caliper Pigging Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Upcoming Pipeline Projects4.; Increasing Focus on Pipeline Safety.

8. Can you provide examples of recent developments in the market?

January 2023: CDI introduced the Qube, a groundbreaking device transforming the pipeline pig tracking approach. The Qube is an innovative, compact, and robust above-ground monitoring (AGM) solution specifically designed for the oil and gas industry. Its primary function is to detect the presence of pipeline pigs as they traverse the pipelines. Equipped with GPS and magnetic data sensors, the Qube offers remarkable capabilities, allowing it to identify up to eight frequencies of magnetic transmitters attached to the pipeline pigs. Additionally, it can detect MFL magnetizers. With its industrial-grade construction, the Qube ensures reliable performance in demanding environments. This revolutionary device is set to redefine and enhance the efficiency of pipeline pig tracking operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Intelligent Pigging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Intelligent Pigging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Intelligent Pigging Market?

To stay informed about further developments, trends, and reports in the Intelligent Pigging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence