Key Insights

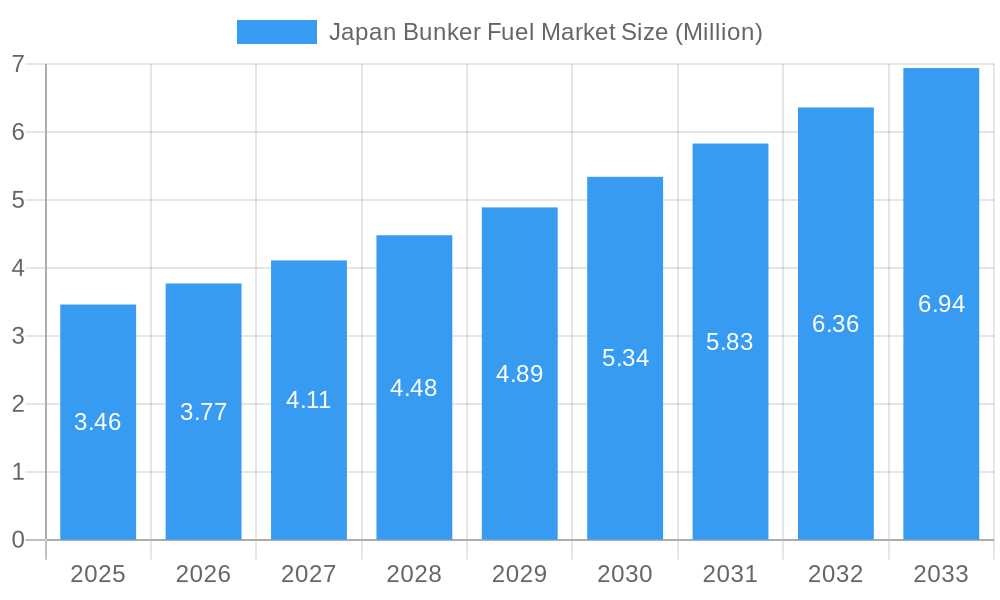

The Japan Bunker Fuel Market is poised for significant expansion, projecting a market size of approximately USD 3.46 million in 2025 with a robust Compound Annual Growth Rate (CAGR) of 9.11%. This growth trajectory, extending through 2033, is underpinned by a confluence of influential drivers and evolving market trends. A primary driver is the increasing global trade volume, necessitating enhanced maritime activity and consequently, greater demand for bunker fuels. Furthermore, stringent environmental regulations, particularly concerning sulfur content in marine fuels, are actively reshaping the market landscape. This regulatory pressure is a significant catalyst for the adoption of cleaner fuel alternatives like Very-low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO), contributing to the market's upward momentum. The continuous modernization of Japan's extensive port infrastructure and its strategic location as a key transit hub within the Asia-Pacific region further solidify its importance in the global maritime supply chain, thereby fueling demand for bunkering services.

Japan Bunker Fuel Market Market Size (In Million)

The market's dynamism is further illustrated by its segmentation. On the fuel type front, a discernible shift towards VLSFO and MGO is expected, driven by regulatory compliance and environmental consciousness, while High Sulfur Fuel Oil (HSFO) will likely see a gradual decline. In terms of vessel types, Container ships and Tankers are anticipated to remain the dominant consumers of bunker fuel, owing to their substantial and consistent operational volumes in international trade. The competitive landscape features key players such as Cosco Shipping Lines Co Ltd, Ocean Bunkering Services (Pte) Ltd, and Shell Eastern Trading (Pte) Ltd, indicating a consolidated yet competitive environment. Restraints, such as the volatility of crude oil prices and the ongoing geopolitical uncertainties that can impact shipping routes and fuel availability, will need to be navigated. However, the overarching trend towards greener shipping and the sustained economic activity in the region are strong indicators of a healthy and growing market.

Japan Bunker Fuel Market Company Market Share

Japan Bunker Fuel Market: Comprehensive Analysis, Trends, and Future Outlook (2019-2033)

This report provides an in-depth analysis of the Japan bunker fuel market, covering market structure, competitive landscape, trends, opportunities, dominant segments, product analysis, key drivers, barriers, challenges, and the future outlook. With a study period spanning from 2019 to 2033 and a base year of 2025, this report offers critical insights for stakeholders navigating this dynamic sector.

Japan Bunker Fuel Market Market Structure & Competitive Landscape

The Japan bunker fuel market exhibits a moderately concentrated structure, driven by a blend of established global energy giants and regional players. Innovation is primarily spurred by the increasing demand for lower-emission fuels and the stringent regulatory environment imposed by the International Maritime Organization (IMO) and Japanese authorities. Regulatory impacts are significant, with the IMO 2020 sulphur cap and the ongoing push for decarbonization compelling fuel suppliers to adapt their product offerings. Product substitutes are emerging, particularly in the form of alternative fuels like LNG and biofuels, presenting both opportunities and challenges for traditional bunker fuel suppliers.

End-user segmentation includes a diverse range of vessel types, with containers and tankers representing the largest share due to high traffic volumes. Ship owners are increasingly prioritizing fuel efficiency and environmental compliance in their purchasing decisions. Mergers and acquisitions (M&A) trends are less pronounced in recent years, with companies focusing on organic growth and strategic partnerships to navigate the evolving market. The estimated market concentration ratio for the top 3 players is around 35%, indicating a degree of competition. M&A volumes in the past two years have been minimal, estimated at under 50 Million.

Japan Bunker Fuel Market Market Trends & Opportunities

The Japan bunker fuel market is poised for significant growth, driven by a confluence of factors including robust maritime trade, stringent environmental regulations, and the increasing adoption of cleaner fuel alternatives. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033, expanding from an estimated value of 15,000 Million in 2025 to over 21,000 Million by 2033. Technological shifts are central to this evolution, with a noticeable trend towards Very-low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO) to comply with IMO regulations.

Consumer preferences are increasingly leaning towards sustainable and cost-effective bunkering solutions. Ship owners are actively seeking partners who can provide reliable supply chains for compliant fuels and are exploring long-term contracts that offer price stability. The competitive dynamics are intensifying, with fuel suppliers investing heavily in infrastructure and research and development to offer a wider range of fuel options, including biofuels and LNG. Opportunities lie in developing and scaling up the production and supply of these alternative fuels, establishing robust bunkering infrastructure in key Japanese ports, and offering integrated maritime services that encompass fuel management, emissions tracking, and compliance consulting. The market penetration rate for VLSFO is estimated to be over 70% by 2025, highlighting its dominance.

Dominant Markets & Segments in Japan Bunker Fuel Market

The dominant segments within the Japan bunker fuel market are characterized by specific fuel types and vessel categories that represent the bulk of demand and supply.

Fuel Type Dominance:

- Very-low Sulfur Fuel Oil (VLSFO): This segment holds the largest market share, estimated at around 60%, due to the global mandate for low-sulfur fuels in shipping. Its widespread adoption is driven by regulatory compliance and the availability of supply infrastructure.

- Marine Gas Oil (MGO): While smaller in volume than VLSFO, MGO commands a significant share, approximately 25%, particularly for vessels operating in sensitive emission control areas or those requiring higher fuel quality. Its cleaner burning properties and lower sulfur content make it a preferred choice for many operators.

- High Sulfur Fuel Oil (HSFO): While its market share is declining, estimated at around 10%, HSFO remains relevant for certain vessels equipped with exhaust gas cleaning systems (scrubbers).

- Other Fuel Types: This segment, comprising alternative fuels like LNG and biofuels, is experiencing rapid growth, though its current market share is around 5%. However, its potential for future dominance is substantial.

Vessel Type Dominance:

- Containers: This segment represents the largest demand for bunker fuel, estimated at 40%, due to the high volume of international containerized trade transiting through Japanese ports.

- Tankers: Tankers, including crude oil and product tankers, constitute another significant segment, accounting for approximately 30% of the bunker fuel demand, driven by the transport of oil and refined products.

- Bulk Carrier: Bulk carriers, vital for the transport of raw materials and commodities, represent about 20% of the demand.

- General Cargo: This segment accounts for roughly 5% of the bunker fuel demand.

- Other Vessel Types: Smaller vessels and specialized craft make up the remaining 5%.

Key growth drivers in the dominant segments include the expansion of international shipping routes calling at Japanese ports, government initiatives promoting cleaner shipping technologies, and the continuous development of bunkering infrastructure to accommodate a wider range of fuel types. The establishment of dedicated LNG bunkering facilities and the increasing availability of blended biofuels are crucial for the growth of these nascent segments.

Japan Bunker Fuel Market Product Analysis

The Japan bunker fuel market is characterized by a spectrum of product innovations driven by the global imperative for cleaner maritime transportation. The primary focus remains on the evolution of compliant fuels, with Very-low Sulfur Fuel Oil (VLSFO) becoming the standard for most vessels. Significant advancements are also being made in the development and supply of marine biofuels, offering a sustainable alternative to conventional bunker fuels. These biofuels, often blended with VLSFO (e.g., B24 blends), represent a crucial step towards decarbonization, offering reduced greenhouse gas emissions without requiring extensive modifications to existing vessel engines. The competitive advantage lies in a supplier's ability to offer a consistent, reliable, and competitively priced supply of these cleaner fuel options, alongside robust technical support and adherence to international quality standards.

Key Drivers, Barriers & Challenges in Japan Bunker Fuel Market

Key Drivers:

- Stringent Environmental Regulations: The IMO 2020 sulphur cap and the global push for decarbonization are major catalysts, driving demand for VLSFO, MGO, and alternative fuels.

- Robust Maritime Trade: Japan's strategic location and its role as a key hub for international shipping ensure consistent demand for bunker fuels.

- Technological Advancements: Innovations in fuel blending, production of biofuels, and the development of LNG as a marine fuel are opening new market avenues.

- Government Support and Incentives: Policies aimed at promoting cleaner shipping and reducing emissions can significantly influence market growth.

Barriers & Challenges:

- Volatile Fuel Prices: Fluctuations in crude oil prices directly impact bunker fuel costs, creating uncertainty for both suppliers and end-users.

- Infrastructure Development for Alternative Fuels: The widespread adoption of LNG and advanced biofuels requires significant investment in bunkering infrastructure, which can be a slow and costly process.

- Supply Chain Complexities: Ensuring a stable and consistent supply of compliant fuels, especially biofuels, across diverse geographical locations can be challenging.

- Cost Competitiveness of Alternative Fuels: Currently, alternative fuels like LNG and biofuels often come at a premium compared to traditional fuels, posing a barrier to widespread adoption.

- Regulatory Ambiguity: Evolving regulations and the potential for future mandates can create uncertainty for long-term investment decisions.

Growth Drivers in the Japan Bunker Fuel Market Market

The Japan bunker fuel market is propelled by a multi-faceted set of growth drivers. Technologically, the increasing availability and refinement of very-low sulfur fuel oil (VLSFO) and marine gas oil (MGO) are paramount, directly responding to IMO 2020 regulations. Economically, Japan's enduring status as a major maritime trading nation, with extensive port infrastructure and high vessel traffic, provides a consistent and substantial demand base. Regulatory factors, such as governmental push towards decarbonization and potential future mandates for cleaner fuels, are significant growth catalysts. For instance, government incentives for the adoption of biofuels and LNG infrastructure development are actively shaping the market. The continuous demand from container ships, tankers, and bulk carriers ensures a steady market for bunker fuels, and the increasing adoption of scrubber technology also supports demand for certain fuel types.

Challenges Impacting Japan Bunker Fuel Market Growth

Several challenges impact the growth trajectory of the Japan bunker fuel market. Regulatory complexities, including the evolving nature of international and domestic environmental standards and the potential for future carbon pricing mechanisms, can create uncertainty for long-term investment and operational planning. Supply chain issues, particularly concerning the consistent availability and quality assurance of alternative fuels like biofuels and LNG, remain a significant hurdle. For example, the scalability of biofuel production and its global availability can be a constraint. Competitive pressures are also intense, with a mix of global energy majors and regional suppliers vying for market share. Furthermore, the significant capital investment required for developing infrastructure for new fuel types, such as LNG bunkering facilities, can be a substantial barrier to entry and expansion, especially for smaller players, potentially slowing down the transition to cleaner fuels.

Key Players Shaping the Japan Bunker Fuel Market Market

- Cosco Shipping Lines Co Ltd

- Ocean Bunkering Services (Pte) Ltd

- The Great Eastern Shipping Co Ltd

- Equatorial Marine Fuel Management Services

- Shell Eastern Trading (Pte) Ltd

- Sentek Marine & Trading Pte Ltd

- Parakou Group

- PetroChina Company Limited

- Orient Overseas Container Line (OOCL)

- Mediterranean Shipping Company

- Nan Fung Group

Significant Japan Bunker Fuel Market Industry Milestones

- July 2023: Asahi Tanker completed bunkering with marine biofuel (B24) and liquefied natural gas (LNG) for the oceangoing LPG tanker Buena Reina. Marine biofuel comprises roughly 24% of biofuel and conventional bunker fuel oil (VLSFO). The most significant port in Japan, Tokyo Bay, hosted the operation of Buena Reina, which Marubeni Corporation chartered. This milestone highlights the growing adoption and practical application of blended marine biofuels and LNG in Japan.

- May 2023: A very large gas carrier (VLGC) in the United Arab Emirates (UAE) received a B24 biofuel bunker from Japanese LPG trader and importer Astomos Energy Corporation and compatriot energy business Inpex Corporation. According to the deal, Inpex used a bunker ship run by the oil and shipping business Monjasa at the Khor Fakkan port in the UAE emirate of Sharjah to provide B2 biofuel to the VLGC that Astomos had rented. This event demonstrates the international reach of Japanese companies in pioneering and supplying advanced biofuels for maritime operations.

Future Outlook for Japan Bunker Fuel Market Market

The future outlook for the Japan bunker fuel market is characterized by a strong emphasis on sustainability and technological innovation. Growth catalysts include the continued regulatory push for decarbonization, leading to an accelerated shift towards alternative fuels such as LNG, methanol, and advanced biofuels. Strategic opportunities lie in the expansion of bunkering infrastructure to support these cleaner fuels, particularly in major Japanese ports like Tokyo Bay, Yokohama, and Kobe. The market is expected to see increased collaboration between fuel suppliers, technology providers, and shipowners to develop and implement scalable solutions for a low-carbon maritime future. The demand for integrated maritime services, including emissions tracking and compliance management, will also rise. Overall, the Japan bunker fuel market is poised for significant transformation, with a focus on environmental responsibility and the adoption of next-generation marine fuels.

Japan Bunker Fuel Market Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

Japan Bunker Fuel Market Segmentation By Geography

- 1. Japan

Japan Bunker Fuel Market Regional Market Share

Geographic Coverage of Japan Bunker Fuel Market

Japan Bunker Fuel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing LNG Trade4.; Rising Marine Transportation

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuations in Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Very Low Sulfur Fuel Oil (VLSFO) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Bunker Fuel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 1 Cosco Shipping Lines Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 2 Ocean Bunkering Services (Pte) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 6 The Great Eastern Shipping Co Ltd*List Not Exhaustive 6 4 Market Ranking/Share Analysi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 4 Equatorial Marine Fuel Management Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 5 Shell Eastern Trading (Pte) Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ship Owners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fuel Suppliers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3 Sentek Marine & Trading Pte Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 3 Parakou Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 PetroChina Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 2 Orient Overseas Container Line (OOCL)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 5 Mediterranean Shipping Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 4 Nan Fung Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 1 Cosco Shipping Lines Co Ltd

List of Figures

- Figure 1: Japan Bunker Fuel Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Bunker Fuel Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 2: Japan Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 3: Japan Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2020 & 2033

- Table 4: Japan Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 5: Japan Bunker Fuel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Bunker Fuel Market Volume metric tonnes Forecast, by Region 2020 & 2033

- Table 7: Japan Bunker Fuel Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Japan Bunker Fuel Market Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 9: Japan Bunker Fuel Market Revenue Million Forecast, by Vessel Type 2020 & 2033

- Table 10: Japan Bunker Fuel Market Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 11: Japan Bunker Fuel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Japan Bunker Fuel Market Volume metric tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Bunker Fuel Market?

The projected CAGR is approximately 9.11%.

2. Which companies are prominent players in the Japan Bunker Fuel Market?

Key companies in the market include 1 Cosco Shipping Lines Co Ltd, 2 Ocean Bunkering Services (Pte) Ltd, 6 The Great Eastern Shipping Co Ltd*List Not Exhaustive 6 4 Market Ranking/Share Analysi, 4 Equatorial Marine Fuel Management Services, 5 Shell Eastern Trading (Pte) Ltd, Ship Owners, Fuel Suppliers, 3 Sentek Marine & Trading Pte Ltd, 3 Parakou Group, 1 PetroChina Company Limited, 2 Orient Overseas Container Line (OOCL), 5 Mediterranean Shipping Company, 4 Nan Fung Group.

3. What are the main segments of the Japan Bunker Fuel Market?

The market segments include Fuel Type, Vessel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.46 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing LNG Trade4.; Rising Marine Transportation.

6. What are the notable trends driving market growth?

Very Low Sulfur Fuel Oil (VLSFO) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Fluctuations in Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

July 2023: Asahi Tanker completed bunkering with marine biofuel (B24) and liquefied natural gas (LNG) for the oceangoing LPG tanker Buena Reina. Marine biofuel comprises roughly 24% of biofuel and conventional bunker fuel oil (VLSFO). The most significant port in Japan, Tokyo Bay, hosted the operation of Buena Reina, which Marubeni Corporation chartered.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Bunker Fuel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Bunker Fuel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Bunker Fuel Market?

To stay informed about further developments, trends, and reports in the Japan Bunker Fuel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence