Key Insights

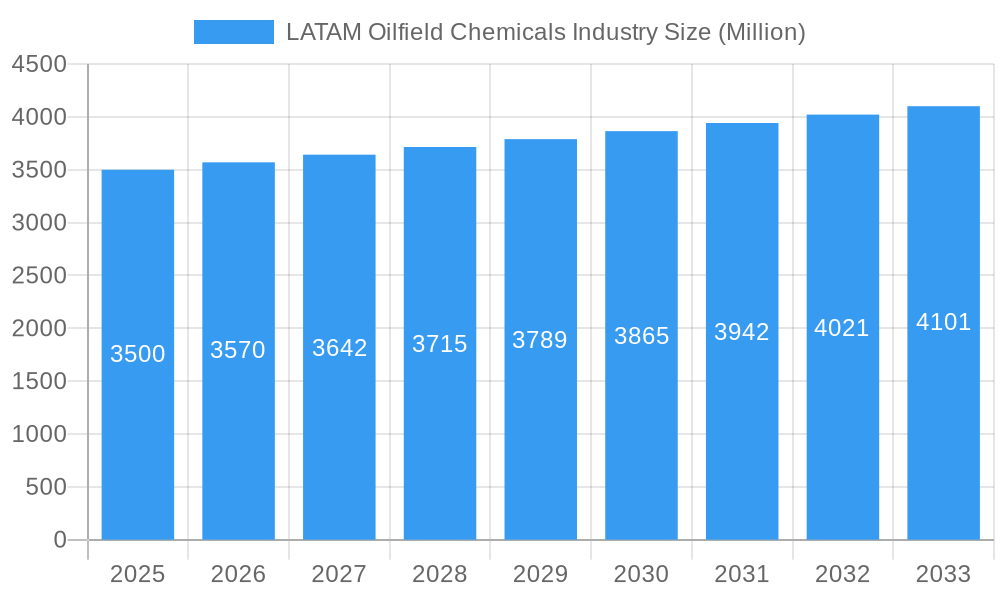

The Latin American oilfield chemicals market is projected for substantial expansion, with a market size of $2758.4 million in 2025, and a compound annual growth rate (CAGR) of 2.8% expected through 2033. This growth is fueled by increased upstream activities and the rising demand for enhanced oil recovery (EOR) techniques. Key drivers include the optimization of drilling and cementing operations to ensure well productivity. The escalating need for advanced corrosion and scale inhibitors is also a significant factor, as operators aim to extend infrastructure lifespan and minimize operational disruptions. Furthermore, the adoption of sophisticated production chemicals that enhance hydrocarbon extraction efficiency is contributing to the market's upward trajectory. While opportunities abound, fluctuating crude oil prices and stringent environmental regulations may present challenges.

LATAM Oilfield Chemicals Industry Market Size (In Billion)

The LATAM oilfield chemicals market is segmented by application and chemical type. Production chemicals are anticipated to dominate the market share, driven by efforts to maximize output from both existing and new wells. Enhanced Oil Recovery (EOR) applications represent a critical growth segment, essential for extracting reserves from mature fields prevalent in Latin America. Drilling and cementing chemicals remain fundamental for exploration and development. Key chemical types include biocides for microbial contamination control, and corrosion and scale inhibitors for asset integrity. Polymers and surfactants are vital for EOR and specialized applications. Major industry players such as Schlumberger, Halliburton, Baker Hughes, and Dow Inc. are actively investing in innovation and regional expansion to capture market share in this strategically important sector. The competitive landscape features both global leaders and local providers, addressing unique operational challenges across countries like Brazil, Mexico, and Colombia.

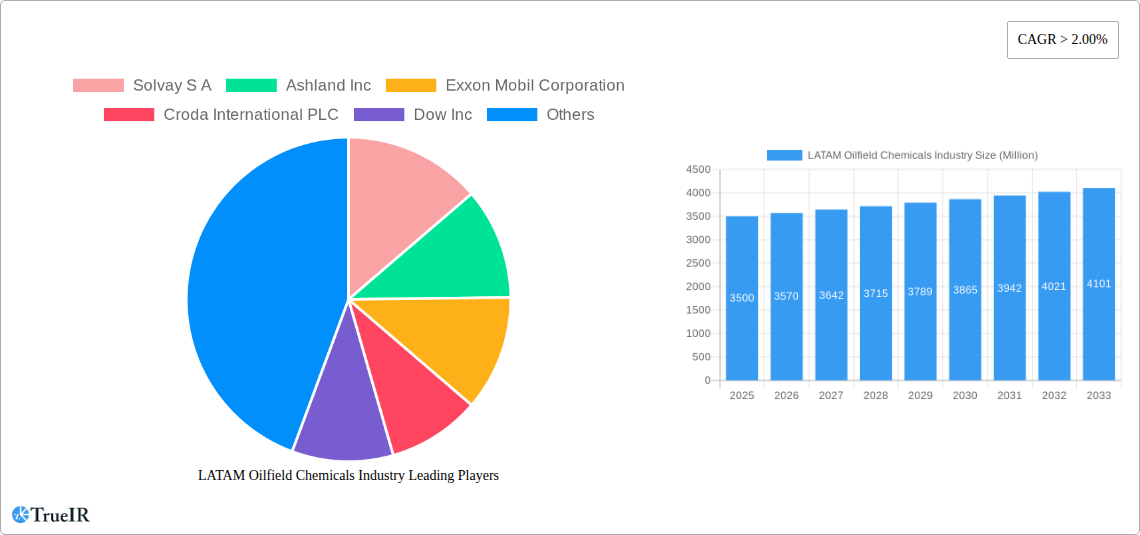

LATAM Oilfield Chemicals Industry Company Market Share

This report offers a comprehensive analysis of the LATAM Oilfield Chemicals industry, providing critical insights into market dynamics, competitive strategies, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 serving as the base year for projections. Keywords optimized for SEO include "oilfield chemicals LATAM," "drilling fluids," "EOR chemicals," "production chemicals," and "well stimulation chemicals," ensuring maximum industry engagement. Discover key players, market segments, technological advancements, and strategic imperatives shaping this vital sector of the Latin American energy landscape.

LATAM Oilfield Chemicals Industry Market Structure & Competitive Landscape

The LATAM Oilfield Chemicals Industry is characterized by a moderately concentrated market structure, with a significant presence of multinational corporations alongside established regional players. Innovation remains a key differentiator, driven by the need for specialized solutions that enhance operational efficiency, mitigate environmental impact, and optimize recovery rates in diverse geological formations across Latin America. Regulatory frameworks, while evolving, play a crucial role in shaping market entry and operational standards. The market exhibits robust competition, with companies actively pursuing product differentiation and cost-effectiveness. The threat of product substitutes, particularly in niche applications, necessitates continuous research and development. End-user segmentation primarily revolves around upstream oil and gas operations, with drilling, production, and well intervention being key demand drivers. Mergers and acquisitions (M&A) trends, while not as prevalent as in some other mature markets, are observed as companies strategically consolidate portfolios or seek to expand their geographical reach and technological capabilities. For instance, the industry witnessed an estimated xx million USD in M&A activities within the historical period, indicating a strategic consolidation.

LATAM Oilfield Chemicals Industry Market Trends & Opportunities

The LATAM Oilfield Chemicals Industry is poised for substantial growth, projected to reach a market size of approximately xxx Million USD by 2033, expanding at a Compound Annual Growth Rate (CAGR) of xx.x% from 2025 to 2033. This expansion is fueled by a confluence of factors, including the increasing demand for oil and gas in emerging economies, the exploration of new reserves in challenging offshore and onshore environments, and the growing emphasis on sustainable and environmentally friendly chemical solutions. Technological advancements are at the forefront of this evolution, with a particular focus on the development of high-performance polymers for enhanced oil recovery (EOR), advanced biocides to combat microbial contamination, and sophisticated corrosion and scale inhibitors designed for extreme operating conditions. Consumer preferences are shifting towards integrated chemical solutions that offer enhanced performance, reduced environmental footprint, and cost optimization throughout the entire oilfield lifecycle. Competitive dynamics are intensifying, with established players investing heavily in R&D to maintain their market share and new entrants vying for opportunities in specific application areas. The rising adoption of digital technologies in oilfield operations also presents an opportunity for chemical suppliers to offer intelligent chemical management systems and data-driven solutions. Furthermore, the increasing focus on operational efficiency and cost reduction in the face of fluctuating commodity prices is driving demand for specialized chemicals that can deliver superior performance at a lower cost. The market penetration rate of advanced EOR chemicals is expected to grow by xx% over the forecast period, indicating a significant shift towards more sophisticated recovery techniques. The exploration of unconventional oil and gas resources, such as shale oil and gas in Argentina and Brazil, is also a significant trend that is driving demand for specialized drilling and completion fluids. The growing awareness of environmental regulations is prompting a demand for biodegradable and low-toxicity oilfield chemicals, creating opportunities for innovation in this space.

Dominant Markets & Segments in LATAM Oilfield Chemicals Industry

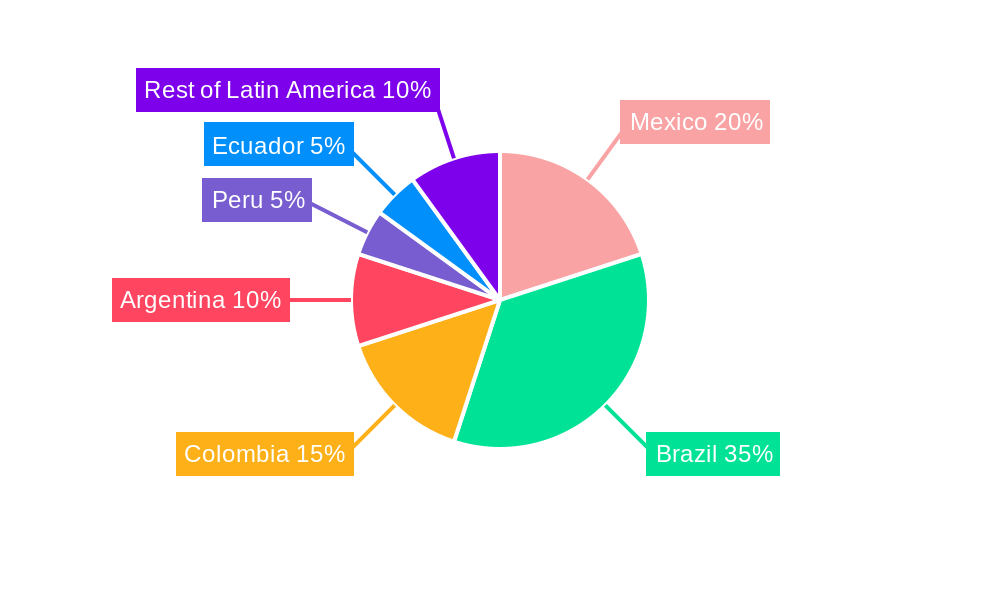

Brazil and Mexico stand out as the dominant markets within the LATAM Oilfield Chemicals Industry, driven by their substantial proven oil reserves and ongoing exploration and production activities. Brazil, in particular, with its vast pre-salt discoveries, represents a significant demand hub for high-performance oilfield chemicals. The Production application segment is projected to be the largest, accounting for approximately xx% of the market share by 2033. This dominance is attributed to the continuous need for chemicals that ensure efficient hydrocarbon flow, prevent equipment failure, and maximize recovery from mature fields.

- Key Growth Drivers in Dominant Markets & Segments:

- Infrastructure Development: Significant investments in offshore platforms and onshore processing facilities in Brazil and Mexico are directly translating into increased demand for a wide array of oilfield chemicals.

- Government Policies & Incentives: Favorable regulatory environments and production-sharing agreements in these countries encourage exploration and production, thereby boosting the demand for essential chemicals.

- Technological Advancements: The adoption of advanced EOR techniques and sophisticated drilling technologies in these regions necessitates specialized chemical formulations.

- Mature Field Revitalization: Efforts to enhance production from aging fields are driving demand for production and well stimulation chemicals.

Within the Chemical Type segmentation, Surfactants are expected to witness the highest growth rate, driven by their extensive use in demulsification, enhanced oil recovery, and drilling fluid formulations. Polymers are also crucial, particularly for EOR applications, while Corrosion and Scale Inhibitors remain essential for maintaining asset integrity in aggressive operational environments. The Well Stimulation application segment is also showing robust growth, fueled by the increasing need to optimize production from existing wells and unlock reserves in unconventional formations.

LATAM Oilfield Chemicals Industry Product Analysis

Product innovation in the LATAM Oilfield Chemicals Industry is primarily focused on developing environmentally sustainable and high-performance chemical solutions. Advancements in Demulsifiers are leading to more efficient separation of oil and water, reducing processing costs and environmental impact. Biocides are being engineered to offer broader spectrum efficacy against a wider range of microorganisms, minimizing reservoir souring and equipment corrosion. The development of novel Polymers with improved thermal stability and viscosity profiles is enhancing the effectiveness of EOR operations. Competitive advantages are increasingly derived from the ability to offer tailor-made chemical packages that address specific field challenges, backed by strong technical support and a deep understanding of local operating conditions.

Key Drivers, Barriers & Challenges in LATAM Oilfield Chemicals Industry

The LATAM Oilfield Chemicals Industry is propelled by several key drivers. Technological advancements, such as the development of biodegradable drilling fluids and more efficient EOR chemicals, are critical. Economic factors, including the sustained global demand for energy and fluctuating oil prices that influence exploration and production budgets, also play a significant role. Policy-driven factors, such as government incentives for domestic production and stricter environmental regulations, are shaping market dynamics.

- Growth Drivers:

- Increasing upstream investments in major LATAM economies.

- Demand for enhanced oil recovery techniques to maximize production from mature fields.

- Stricter environmental regulations promoting the use of eco-friendly chemicals.

- Exploration and development of unconventional hydrocarbon resources.

However, the industry faces notable barriers and challenges. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities in remote operational areas, can lead to delays and increased costs. Regulatory hurdles, including varying compliance standards across different countries and the lengthy approval processes for new chemical formulations, can impede market entry and product deployment. Competitive pressures from both global giants and agile local players necessitate continuous innovation and cost optimization.

- Challenges Impacting Growth:

- Volatility in oil prices impacting exploration and production budgets.

- Complex and inconsistent regulatory landscapes across different LATAM nations.

- Logistical challenges and infrastructure limitations in remote oilfield locations.

- Intensifying competition leading to price pressures.

Key Players Shaping the LATAM Oilfield Chemicals Industry Market

- Solvay S A

- Ashland Inc

- Exxon Mobil Corporation

- Croda International PLC

- Dow Inc

- Weatherford International Plc

- BASF SE

- Huntsman International LLC

- Baker Hughes Company

- Halliburton

- Ecolab Inc

- Petrolab Industrial E Comercial Ltda

- Schlumberger Limited

- Clariant AG

Significant LATAM Oilfield Chemicals Industry Industry Milestones

- August 2022: Baker Hughes expanded its presence in Asia by establishing a new oilfield services chemicals manufacturing facility in Singapore, allowing for manufacturing optimization and faster delivery of fit-for-purpose chemical solutions. The 40,000-square-meter facility will manufacture, store, and distribute chemical solutions for the upstream, midstream, downstream, and adjacent industries. (Impact: Enhanced global supply chain capabilities, potential for LATAM supply chain integration and optimization through regional hubs).

- March 2022: Halliburton opened The Halliburton Chemical Reaction Plant, the first of its kind in Saudi Arabia, producing a wide range of specialty oilfield chemicals for the entire oil and gas value chain. The facility expands Halliburton's manufacturing footprint in the Eastern Hemisphere and strengthens the company's ability to serve Middle Eastern customers' chemical needs. (Impact: Demonstrated commitment to expanding manufacturing capacity and regional supply, signaling potential for similar strategic expansions in other key markets like LATAM to serve local demand efficiently).

Future Outlook for LATAM Oilfield Chemicals Industry Market

The future outlook for the LATAM Oilfield Chemicals Industry is exceptionally promising, driven by ongoing technological innovation and a sustained demand for energy resources in the region. Strategic opportunities lie in the development and deployment of sustainable, high-performance chemicals that address the unique challenges of offshore exploration, unconventional resource extraction, and mature field revitalization. Companies that can offer integrated chemical solutions, coupled with advanced digital services for real-time monitoring and optimization, will be well-positioned for success. The increasing emphasis on environmental stewardship will further fuel the demand for eco-friendly alternatives, creating a fertile ground for green chemistry innovations. The market is expected to witness continued growth, with a focus on enhancing operational efficiency, reducing environmental impact, and maximizing hydrocarbon recovery across the diverse geological landscapes of Latin America.

LATAM Oilfield Chemicals Industry Segmentation

-

1. Chemical Type

- 1.1. Biocide

- 1.2. Corrosion and Scale Inhibitor

- 1.3. Demulsifier

- 1.4. Polymer

- 1.5. Surfactant

- 1.6. Other Chemical Types

-

2. Application

- 2.1. Drilling and Cementing

- 2.2. Enhanced Oil Recovery

- 2.3. Production

- 2.4. Well Stimulation

- 2.5. Workover and Completion

LATAM Oilfield Chemicals Industry Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Colombia

- 4. Argentina

- 5. Peru

- 6. Ecuador

- 7. Rest of Latin America

LATAM Oilfield Chemicals Industry Regional Market Share

Geographic Coverage of LATAM Oilfield Chemicals Industry

LATAM Oilfield Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Offshore activities in Brazil

- 3.2.2 Mexico & Argentina

- 3.3. Market Restrains

- 3.3.1. Downfall of Venezuela Economy

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Drilling and Cementing Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Biocide

- 5.1.2. Corrosion and Scale Inhibitor

- 5.1.3. Demulsifier

- 5.1.4. Polymer

- 5.1.5. Surfactant

- 5.1.6. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Drilling and Cementing

- 5.2.2. Enhanced Oil Recovery

- 5.2.3. Production

- 5.2.4. Well Stimulation

- 5.2.5. Workover and Completion

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Colombia

- 5.3.4. Argentina

- 5.3.5. Peru

- 5.3.6. Ecuador

- 5.3.7. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. Mexico LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Biocide

- 6.1.2. Corrosion and Scale Inhibitor

- 6.1.3. Demulsifier

- 6.1.4. Polymer

- 6.1.5. Surfactant

- 6.1.6. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Drilling and Cementing

- 6.2.2. Enhanced Oil Recovery

- 6.2.3. Production

- 6.2.4. Well Stimulation

- 6.2.5. Workover and Completion

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. Brazil LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Biocide

- 7.1.2. Corrosion and Scale Inhibitor

- 7.1.3. Demulsifier

- 7.1.4. Polymer

- 7.1.5. Surfactant

- 7.1.6. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Drilling and Cementing

- 7.2.2. Enhanced Oil Recovery

- 7.2.3. Production

- 7.2.4. Well Stimulation

- 7.2.5. Workover and Completion

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Colombia LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Biocide

- 8.1.2. Corrosion and Scale Inhibitor

- 8.1.3. Demulsifier

- 8.1.4. Polymer

- 8.1.5. Surfactant

- 8.1.6. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Drilling and Cementing

- 8.2.2. Enhanced Oil Recovery

- 8.2.3. Production

- 8.2.4. Well Stimulation

- 8.2.5. Workover and Completion

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Argentina LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Biocide

- 9.1.2. Corrosion and Scale Inhibitor

- 9.1.3. Demulsifier

- 9.1.4. Polymer

- 9.1.5. Surfactant

- 9.1.6. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Drilling and Cementing

- 9.2.2. Enhanced Oil Recovery

- 9.2.3. Production

- 9.2.4. Well Stimulation

- 9.2.5. Workover and Completion

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Peru LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Biocide

- 10.1.2. Corrosion and Scale Inhibitor

- 10.1.3. Demulsifier

- 10.1.4. Polymer

- 10.1.5. Surfactant

- 10.1.6. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Drilling and Cementing

- 10.2.2. Enhanced Oil Recovery

- 10.2.3. Production

- 10.2.4. Well Stimulation

- 10.2.5. Workover and Completion

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Ecuador LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11.1.1. Biocide

- 11.1.2. Corrosion and Scale Inhibitor

- 11.1.3. Demulsifier

- 11.1.4. Polymer

- 11.1.5. Surfactant

- 11.1.6. Other Chemical Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Drilling and Cementing

- 11.2.2. Enhanced Oil Recovery

- 11.2.3. Production

- 11.2.4. Well Stimulation

- 11.2.5. Workover and Completion

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12. Rest of Latin America LATAM Oilfield Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12.1.1. Biocide

- 12.1.2. Corrosion and Scale Inhibitor

- 12.1.3. Demulsifier

- 12.1.4. Polymer

- 12.1.5. Surfactant

- 12.1.6. Other Chemical Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Drilling and Cementing

- 12.2.2. Enhanced Oil Recovery

- 12.2.3. Production

- 12.2.4. Well Stimulation

- 12.2.5. Workover and Completion

- 12.1. Market Analysis, Insights and Forecast - by Chemical Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Solvay S A

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Ashland Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Exxon Mobil Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Croda International PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dow Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Weatherford International Plc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BASF SE

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Huntsman International LLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Baker Hughes Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Halliburton

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ecolab Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Petrolab Industrial E Comercial Ltda

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Schlumberger Limited

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Clariant AG

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Solvay S A

List of Figures

- Figure 1: LATAM Oilfield Chemicals Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: LATAM Oilfield Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 2: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 3: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 8: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 9: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 14: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 15: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 17: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 18: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 20: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 21: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 22: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 26: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 27: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 28: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 30: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 32: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 33: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 34: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 35: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 37: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 38: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 39: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 40: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 41: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 42: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Chemical Type 2020 & 2033

- Table 44: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Chemical Type 2020 & 2033

- Table 45: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Application 2020 & 2033

- Table 46: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 47: LATAM Oilfield Chemicals Industry Revenue million Forecast, by Country 2020 & 2033

- Table 48: LATAM Oilfield Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LATAM Oilfield Chemicals Industry?

The projected CAGR is approximately 2.8%.

2. Which companies are prominent players in the LATAM Oilfield Chemicals Industry?

Key companies in the market include Solvay S A, Ashland Inc, Exxon Mobil Corporation, Croda International PLC, Dow Inc, Weatherford International Plc, BASF SE, Huntsman International LLC, Baker Hughes Company, Halliburton, Ecolab Inc, Petrolab Industrial E Comercial Ltda, Schlumberger Limited, Clariant AG.

3. What are the main segments of the LATAM Oilfield Chemicals Industry?

The market segments include Chemical Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2758.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Offshore activities in Brazil. Mexico & Argentina.

6. What are the notable trends driving market growth?

Increasing Demand from the Drilling and Cementing Segment.

7. Are there any restraints impacting market growth?

Downfall of Venezuela Economy.

8. Can you provide examples of recent developments in the market?

August 2022: Baker Hughes expanded its presence in Asia by establishing a new oilfield services chemicals manufacturing facility in Singapore, allowing for manufacturing optimization and faster delivery of fit-for-purpose chemical solutions. The 40,000-square-meter facility will manufacture, store, and distribute chemical solutions for the upstream, midstream, downstream, and adjacent industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LATAM Oilfield Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LATAM Oilfield Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LATAM Oilfield Chemicals Industry?

To stay informed about further developments, trends, and reports in the LATAM Oilfield Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence