Key Insights

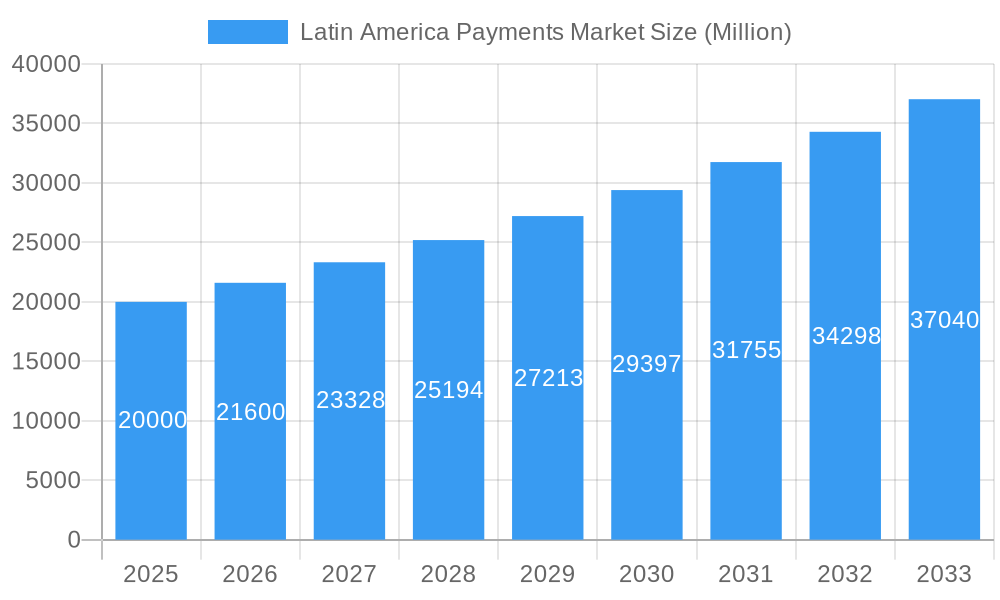

The Latin American payments market is experiencing significant expansion, propelled by increasing smartphone adoption, burgeoning e-commerce, and a thriving fintech ecosystem. Projections indicate a compound annual growth rate (CAGR) of 10.13%, highlighting substantial market opportunities. This growth is largely attributed to the region's young, digitally-native population readily embracing cashless transactions and digital financial services. Leading fintech innovators are driving this transformation with solutions tailored to local consumer and business needs. The market segmentation across payment methods, transaction types, and geographies offers diverse avenues for investment and strategic expansion. Government initiatives promoting financial inclusion and digital infrastructure development are expected to further accelerate market growth.

Latin America Payments Market Market Size (In Billion)

While facing regulatory complexities and the imperative to address data security and fraud, the Latin American payments market demonstrates a robust growth trajectory. The projected market size for 2025 is estimated at 787.74 billion, underscoring the significant potential driven by increasing digital literacy and the wider acceptance of alternative payment methods. Continuous investment in fintech innovation and digital infrastructure is paramount to realizing this market's full potential.

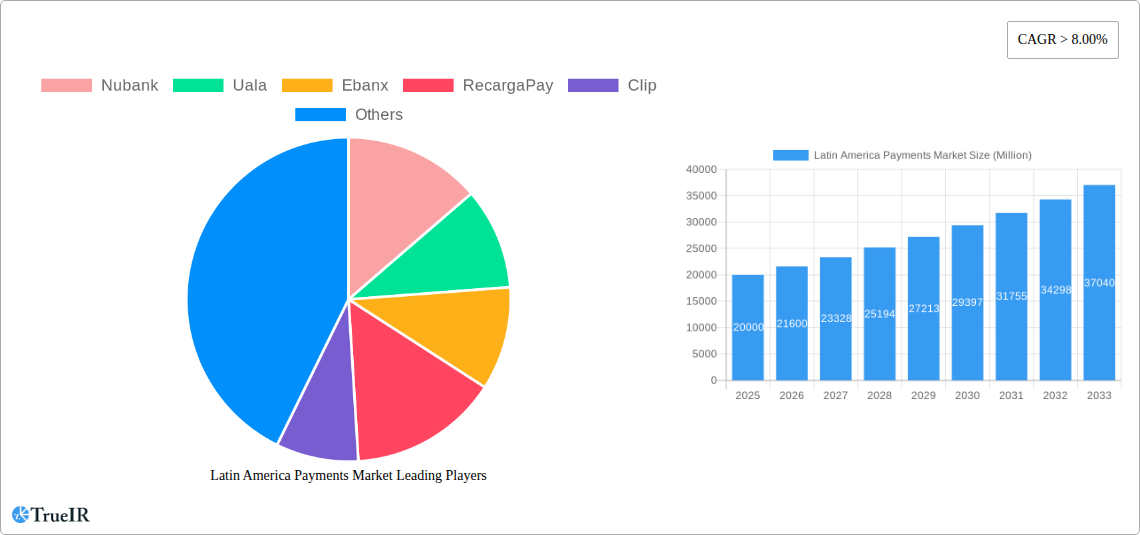

Latin America Payments Market Company Market Share

Latin America Payments Market Analysis: Size, Trends, and Forecast (2019-2033)

This comprehensive report provides critical insights into the Latin America payments market for investors, businesses, and stakeholders. Covering the period from 2019 to 2033, with 2025 as the base year, the analysis forecasts market dynamics through 2033, building upon historical data from 2019-2024. The report utilizes targeted keywords for optimal industry visibility.

Latin America Payments Market Market Structure & Competitive Landscape

The Latin American payments market is a vibrant and evolving ecosystem, defined by the strategic interplay between deeply entrenched legacy financial institutions and agile, forward-thinking fintech startups. While market concentration is currently moderate, with an estimated Herfindahl-Hirschman Index (HHI) of [Insert HHI Value Here] in 2025, it presents a landscape ripe for both strategic consolidation and sustained, vigorous competition. The rapid proliferation of smartphones, coupled with burgeoning internet accessibility and a surging demand for sophisticated digital financial services, acts as a potent catalyst for innovation. Navigating this market requires a nuanced understanding of diverse regulatory frameworks, which vary considerably across the region, presenting both significant opportunities and intricate challenges. The constant emergence of novel payment methodologies and technologies means that product substitution is a prominent feature, continually reshaping the competitive arena. The end-user base is remarkably diverse, encompassing individual consumers and businesses of all scales, from micro-enterprises to multinational corporations. In recent years, the market has witnessed substantial Mergers and Acquisitions (M&A) activity, with an estimated [Insert M&A Value Here] Million in M&A deals finalized in 2024. This trend is anticipated to persist, driven by larger entities seeking to augment their market share and acquire cutting-edge technological capabilities.

- Market Concentration: Moderate (HHI: [Insert HHI Value Here] in 2025), indicating potential for both consolidation and ongoing competitive dynamics.

- Key Innovation Drivers: Accelerated by increasing smartphone penetration, expanding internet usage, and a growing consumer appetite for seamless digital financial services.

- Regulatory Environment: Highly fragmented across different countries, presenting a complex but navigable landscape for market participants.

- Product Substitution Dynamics: Characterized by the continuous introduction of innovative payment methods that challenge and complement traditional systems.

- End-User Segmentation: Broad and diverse, including individual consumers, small and medium-sized enterprises (SMEs), and large corporations.

- Mergers & Acquisitions (M&A) Trends: Robust activity, with an estimated [Insert M&A Value Here] Million in deals concluded in 2024, signaling strategic consolidation and growth.

Latin America Payments Market Market Trends & Opportunities

The Latin American payments market is poised for remarkable expansion, with a projected Compound Annual Growth Rate (CAGR) of [Insert CAGR Value Here]% anticipated between 2025 and 2033. The market size is forecasted to reach [Insert Market Size Value Here] Million by 2033, a growth trajectory significantly influenced by the deepening penetration of financial inclusion initiatives, the escalating adoption of e-commerce platforms, and the widespread proliferation of mobile money solutions. Technological advancements, especially in the realms of mobile payments and digital wallets, are fundamentally transforming the payment landscape. Consumer preferences are increasingly gravitating towards payment solutions that prioritize convenience, robust security, and cost-effectiveness. Competitive dynamics are exceptionally intense, with a spirited contest for market share unfolding between established financial institutions and agile fintech disruptors. Digital payment penetration rates are on a consistent upward trend, estimated at [Insert Penetration Rate Value Here]% in 2025 and projected to exceed [Insert Future Penetration Rate Value Here]% by 2033. Significant opportunities await companies adept at understanding and catering to the nuanced requirements of the diverse Latin American consumer base, while skillfully navigating the intricate regulatory terrain. The market is further delineated by payment types (e.g., credit/debit cards, mobile wallets, bank transfers), transaction types (e.g., peer-to-peer, business-to-consumer), and user categories (e.g., individual consumers, merchants).

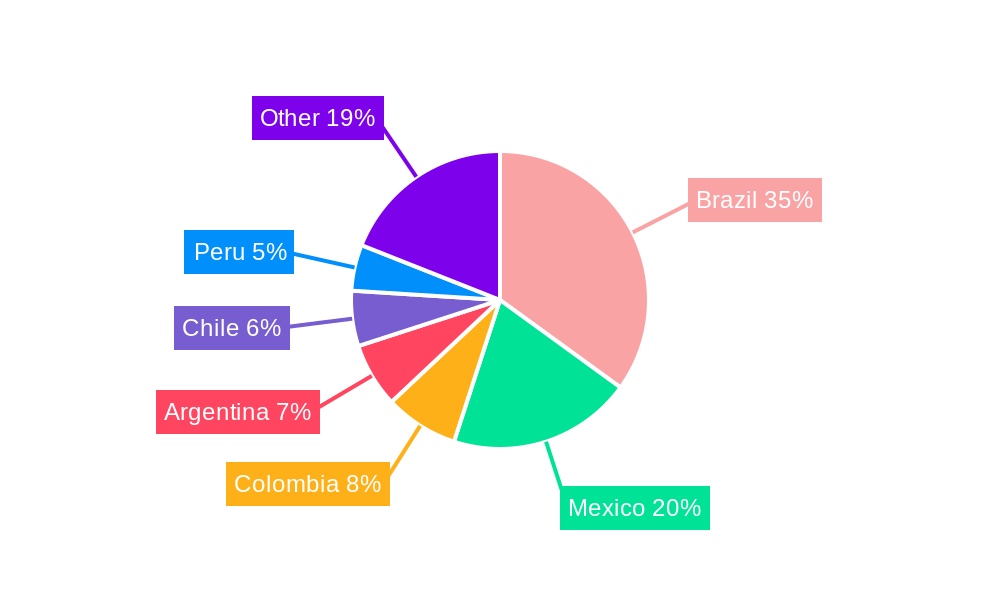

Dominant Markets & Segments in Latin America Payments Market

Brazil and Mexico currently dominate the Latin American payments market, accounting for a combined xx% of the total market value in 2025. Their dominance stems from factors such as larger populations, higher levels of economic activity, and relatively advanced digital infrastructure. However, other countries, such as Colombia, Argentina, and Chile are experiencing rapid growth, fueled by increasing smartphone penetration and financial inclusion initiatives.

- Brazil: Large population, high economic activity, advanced digital infrastructure.

- Mexico: Large market size, increasing e-commerce adoption.

- Colombia, Argentina, Chile: Rapid growth, increasing smartphone penetration, financial inclusion initiatives.

Latin America Payments Market Product Analysis

The Latin American payments market is characterized by a diverse range of products, including credit and debit cards, mobile wallets, online payment gateways, and real-time payment systems. Recent technological advancements have led to the introduction of innovative products such as biometric authentication, blockchain-based solutions, and AI-powered fraud detection systems. These innovations are enhancing the security, efficiency, and convenience of payment transactions, while also catering to the specific needs of different market segments. The market is increasingly characterized by a move towards open banking and the integration of various payment methods within a unified platform.

Key Drivers, Barriers & Challenges in Latin America Payments Market

Key Drivers: The market's expansion is significantly propelled by rapid technological advancements, including the rise of innovative mobile payment solutions and broader fintech breakthroughs. Economic growth across the region, coupled with concerted efforts to enhance financial inclusion and supportive government policies championing digitalization, are also pivotal growth catalysts.

Challenges: The primary impediments to seamless growth include the complex and fragmented regulatory landscape that varies country by country, a notable lack of financial literacy within certain demographic segments, and persistent infrastructure limitations in various geographical areas. Furthermore, escalating cybersecurity threats and the fierce competition from both incumbent players and agile new entrants pose significant hurdles. These challenges can collectively lead to payment delays and elevated operational costs for businesses, while simultaneously restricting access to financial services for underbanked populations.

Growth Drivers in the Latin America Payments Market Market

The sustained growth of the Latin American payments market is fundamentally driven by the pervasive increase in smartphone ownership, a surge in e-commerce transactions, proactive efforts to expand financial inclusion, and conducive government regulations that actively promote the adoption of digital payment methods. Technological innovation, particularly the evolution of mobile money and sophisticated digital wallets, serves as a significant accelerant for this expansion. Moreover, robust economic growth, especially within key economic powerhouses like Brazil and Mexico, directly stimulates the demand for efficient and modern payment solutions.

Challenges Impacting Latin America Payments Market Growth

Significant challenges include regulatory inconsistencies across Latin American nations, uneven internet and mobile infrastructure hindering widespread adoption, and the persistent reliance on cash in some regions. Furthermore, cybersecurity threats and a lack of financial literacy in certain demographics pose obstacles to market expansion.

Key Players Shaping the Latin America Payments Market Market

- Nubank

- Uala

- Ebanx

- RecargaPay

- Clip

- Bitso

- Konfio

- Wilobank

- Addi

- Vortx (List Not Exhaustive)

Significant Latin America Payments Market Industry Milestones

- June 2021: Conductor, a prominent player in the Latin American payments and banking-as-a-service arena, strategically launched its advanced technological platform in Mexico, marking a crucial step in its international expansion strategy.

- July 2021: Z1, a digital banking initiative specifically targeting the Gen Z demographic in Latin America, successfully secured USD 2.5 Million in funding. This investment is earmarked to bolster financial independence initiatives for young individuals across Brazil and other regional markets.

Future Outlook for Latin America Payments Market Market

The Latin America payments market is poised for continued strong growth, driven by sustained technological innovation, expanding digital infrastructure, and increasing financial inclusion. Strategic opportunities abound for companies that can adapt to evolving consumer preferences, navigate the regulatory landscape effectively, and provide secure, reliable, and user-friendly payment solutions. The market's potential is immense, with significant opportunities for both established players and innovative startups.

Latin America Payments Market Segmentation

-

1. Service Proposition

- 1.1. Money Transfer and Payments

- 1.2. Savings and Investments

- 1.3. Digital Lending & Lending Marketplaces

- 1.4. Online Insurance & Insurance Marketplaces

- 1.5. Others

Latin America Payments Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Payments Market Regional Market Share

Geographic Coverage of Latin America Payments Market

Latin America Payments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1 Brazil and Mexico

- 3.4.2 are Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Payments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 5.1.1. Money Transfer and Payments

- 5.1.2. Savings and Investments

- 5.1.3. Digital Lending & Lending Marketplaces

- 5.1.4. Online Insurance & Insurance Marketplaces

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service Proposition

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nubank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Uala

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ebanx

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RecargaPay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Clip

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bitso

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Konfio

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wilobank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Addi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vortx**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nubank

List of Figures

- Figure 1: Latin America Payments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Payments Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Payments Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 2: Latin America Payments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Latin America Payments Market Revenue billion Forecast, by Service Proposition 2020 & 2033

- Table 4: Latin America Payments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Brazil Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Argentina Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Chile Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Colombia Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Peru Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Venezuela Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Ecuador Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Bolivia Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Paraguay Latin America Payments Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Payments Market?

The projected CAGR is approximately 10.13%.

2. Which companies are prominent players in the Latin America Payments Market?

Key companies in the market include Nubank, Uala, Ebanx, RecargaPay, Clip, Bitso, Konfio, Wilobank, Addi, Vortx**List Not Exhaustive.

3. What are the main segments of the Latin America Payments Market?

The market segments include Service Proposition.

4. Can you provide details about the market size?

The market size is estimated to be USD 787.74 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Brazil and Mexico. are Dominating the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2021 - Z1, a digital bank geared at Latin American GenZers based in Sao Paulo, has secured USD 2.5 million in a round led by Homebrew in the United States. Z1 is a digital banking software designed specifically for teenagers and young people. The company was formed on the idea that Brazilian and Latin American teenagers may become more financially independent by using its app and linked prepaid card. Z1 is focused on Brazil but the startup has plans to expand into other countries in Latin America over time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Payments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Payments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Payments Market?

To stay informed about further developments, trends, and reports in the Latin America Payments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence