Key Insights

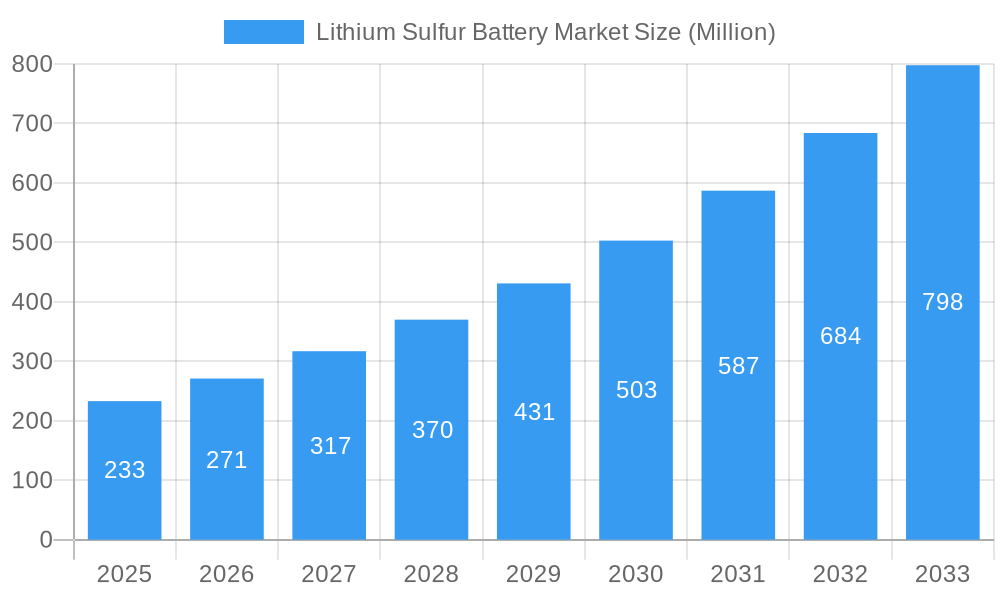

The global Lithium Sulfur Battery market is experiencing robust growth, projected to reach a substantial market size with a Compound Annual Growth Rate (CAGR) of 16.50%. This impressive expansion is primarily fueled by the inherent advantages of lithium-sulfur (Li-S) battery technology, including its high theoretical energy density, lighter weight, and the abundance and low cost of sulfur as a cathode material. These attributes make Li-S batteries a compelling alternative to traditional lithium-ion batteries, particularly for applications where weight and energy storage capacity are paramount. Key market drivers include the escalating demand for advanced energy storage solutions across various sectors. The aerospace industry, for instance, benefits from the lightweight nature of Li-S batteries, enabling longer flight times and increased payload capacity. Similarly, the electronics sector seeks more compact and longer-lasting power sources for portable devices. The automotive industry's push towards electrification, especially for longer-range electric vehicles, also presents a significant growth opportunity. Emerging trends point towards ongoing research and development focused on enhancing cycle life and addressing the polysulfide shuttle effect, a common challenge in Li-S battery technology. Innovations in electrolyte formulations and cathode materials are actively being pursued to overcome these limitations and unlock the full potential of Li-S batteries.

Lithium Sulfur Battery Market Market Size (In Million)

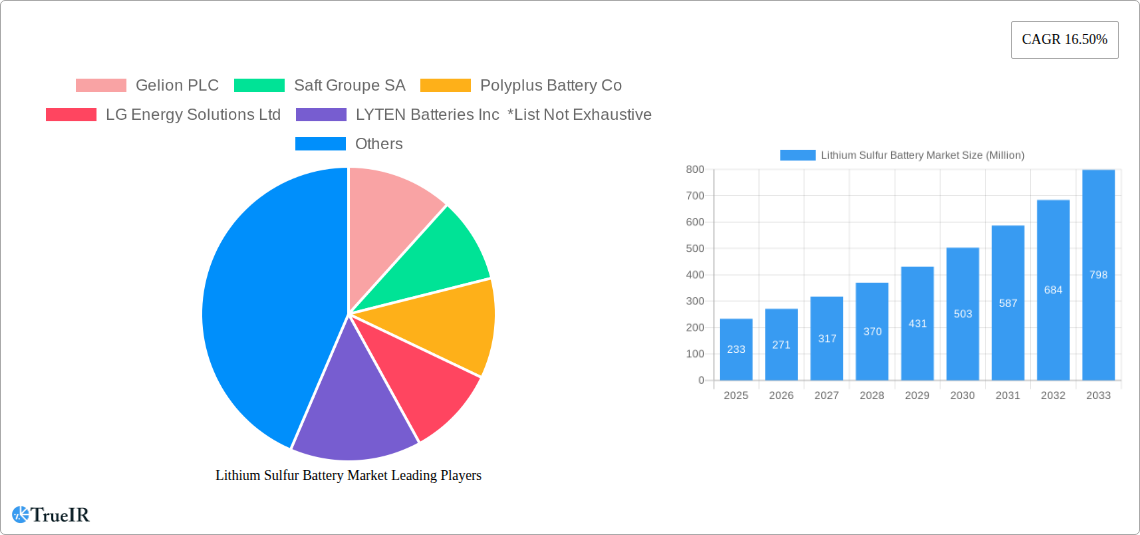

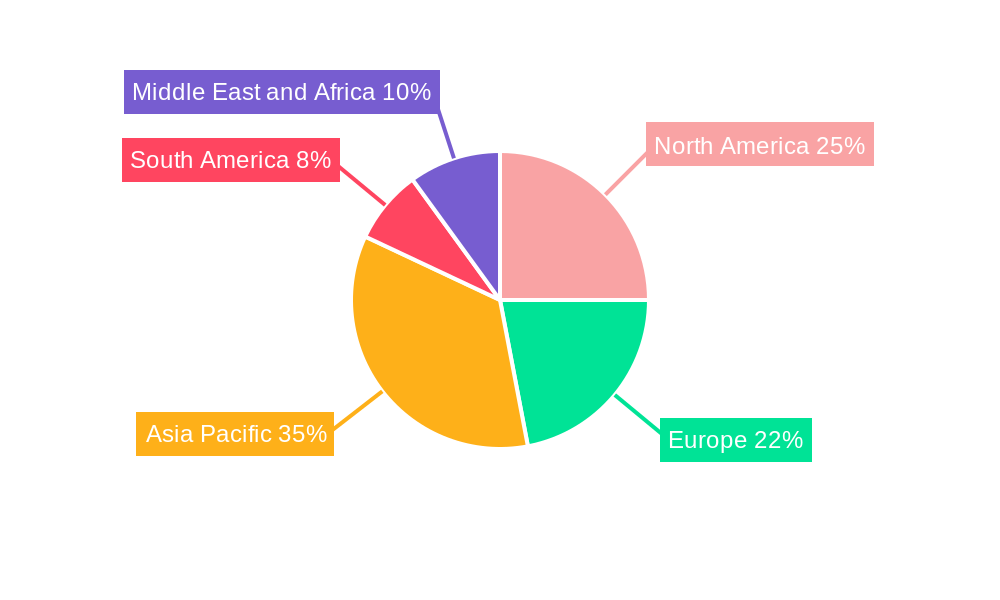

The market faces certain restraints, including the current developmental stage of the technology compared to mature lithium-ion alternatives, which can lead to higher initial costs and manufacturing complexities. However, as production scales up and technological advancements mature, these restraints are expected to diminish. The market is segmented across diverse end-user industries, with Aerospace, Electronics, Automotive, and the Power Sector emerging as primary growth engines. Other end-users also contribute to market diversification. Geographically, the Asia Pacific region, particularly China, is anticipated to be a dominant force in both production and consumption due to its established battery manufacturing infrastructure and burgeoning demand for electric vehicles and consumer electronics. North America and Europe are also significant markets, driven by strong investments in research and development and a growing emphasis on sustainable energy solutions. Leading companies such as Gelion PLC, Saft Groupe SA, LG Energy Solutions Ltd, and Sion Power Corporation are at the forefront of innovation, investing heavily in bringing this promising battery technology to commercial viability. The projected study period from 2019 to 2033, with a base year of 2025, indicates a dynamic and evolving market landscape poised for substantial expansion.

Lithium Sulfur Battery Market Company Market Share

Unlock the Future of Energy Storage: Comprehensive Lithium Sulfur Battery Market Report (2019-2033)

Gain unparalleled insights into the rapidly evolving Lithium Sulfur (Li-S) Battery Market, a pivotal segment poised for explosive growth in advanced energy storage solutions. This in-depth report, spanning the historical period of 2019–2024 and forecasting through 2033 with a base and estimated year of 2025, provides a strategic roadmap for stakeholders. Dive deep into the market's structure, competitive landscape, groundbreaking trends, dominant segments, and critical growth drivers, essential for understanding the trajectory of this transformative technology. We meticulously analyze market size, CAGR, innovation, regulatory impacts, and end-user adoption across key sectors like Aerospace, Electronics, Automotive, and the Power Sector. With detailed analysis of key players, industry milestones, and future outlook, this report is your definitive guide to navigating and capitalizing on the burgeoning Li-S battery market.

Lithium Sulfur Battery Market Market Structure & Competitive Landscape

The Lithium Sulfur Battery Market is characterized by a dynamic and evolving competitive landscape, driven by intense innovation and a growing demand for high-energy-density storage solutions. Market concentration is currently moderate, with several key players investing heavily in research and development to overcome technical hurdles and achieve commercial viability. Innovation drivers are primarily centered around enhancing cycle life, improving volumetric energy density, and reducing manufacturing costs. Regulatory impacts, while still nascent, are expected to become more significant as the technology matures and finds wider applications, potentially favoring sustainable and ethically sourced materials. Product substitutes, such as advanced Lithium-ion chemistries and solid-state batteries, present ongoing competition, necessitating continuous improvement and cost reduction in Li-S battery technology.

End-user segmentation plays a crucial role in shaping market strategies, with the Aerospace and Electronics sectors being early adopters due to their stringent weight and energy density requirements. The Automotive and Power Sector segments represent significant future growth potential. Mergers, acquisitions, and strategic partnerships are becoming increasingly prevalent as companies seek to consolidate expertise, secure supply chains, and accelerate market penetration. M&A volumes are projected to increase, reflecting the high growth potential and strategic importance of this market.

Lithium Sulfur Battery Market Market Trends & Opportunities

The Lithium Sulfur Battery Market is on an upward trajectory, fueled by an insatiable global demand for lighter, more powerful, and longer-lasting energy storage solutions. The market size is projected to experience significant growth, with a compelling Compound Annual Growth Rate (CAGR) as the technology matures and addresses its inherent challenges. Technological shifts are at the forefront, with continuous advancements in electrolyte formulations, cathode materials, and anode designs aiming to boost energy density, extend cycle life, and enhance safety. Current estimates suggest that lithium-sulfur batteries can offer up to five times the energy density of traditional lithium-ion batteries, a critical differentiator for applications where weight and space are paramount.

Consumer preferences, particularly in portable electronics and electric vehicles, are increasingly leaning towards devices with extended battery life and reduced weight, creating a fertile ground for Li-S battery adoption. Competitive dynamics are intensifying, with a race among established battery manufacturers and innovative startups to achieve cost-effective mass production. Key opportunities lie in niche applications such as aerospace, drones, and portable medical devices where the gravimetric energy density advantage of Li-S batteries is indispensable. As manufacturing processes become more refined and economies of scale are realized, the market penetration rate of lithium-sulfur batteries is expected to surge, displacing or complementing existing battery technologies. The development of semi-solid-state Li-S battery technology, offering nearly double the gravimetric energy density of Li-ion cells, represents a significant leap forward, opening new avenues for high-performance applications. The overall market landscape is ripe with opportunities for companies that can effectively navigate technological development, supply chain optimization, and market entry strategies, capitalizing on the unique advantages of this promising battery chemistry.

Dominant Markets & Segments in Lithium Sulfur Battery Market

The Lithium Sulfur Battery Market exhibits distinct regional strengths and segment dominance, driven by specific end-user needs and supportive industry policies.

Aerospace Segment Dominance

- Key Growth Drivers: The Aerospace sector is a significant driver of the lithium-sulfur battery market. The unparalleled gravimetric energy density offered by Li-S batteries is a critical advantage for aircraft and satellite applications, where every kilogram saved translates to substantial performance improvements and cost efficiencies.

- Detailed Analysis: The demand for lighter, more compact, and longer-endurance power sources in defense, commercial aviation, and space exploration makes lithium-sulfur batteries an ideal candidate. Reduced payload weight allows for increased fuel efficiency, extended mission durations, or enhanced maneuverability. The inherent safety characteristics and high power output potential also align with the stringent requirements of this industry. Early adoption in satellite constellations and unmanned aerial vehicles (UAVs) further solidifies the aerospace segment's leading position.

Electronics Segment Growth

- Key Growth Drivers: The ubiquitous demand for portable and high-performance Electronics fuels the growth of the Li-S battery market. Consumer electronics, including laptops, smartphones, and wearable devices, constantly seek higher energy densities to enable thinner designs and longer battery life.

- Detailed Analysis: While currently a smaller segment compared to aerospace, the potential for Li-S batteries to revolutionize consumer electronics is immense. The ability to offer significantly more power in a lighter package could lead to a new generation of devices with unprecedented capabilities. The challenge lies in scaling production to meet the high-volume demands of the electronics industry while maintaining cost-competitiveness and ensuring long-term reliability.

Automotive Sector Potential

- Key Growth Drivers: The global shift towards electric mobility positions the Automotive sector as a future cornerstone of the lithium-sulfur battery market. The need for longer driving ranges and faster charging times in electric vehicles (EVs) makes the high energy density of Li-S batteries highly attractive.

- Detailed Analysis: While Li-ion batteries currently dominate the EV market, Li-S technology holds the promise of overcoming some of their limitations. Reduced battery weight can lead to improved vehicle efficiency and performance. Furthermore, the potential for lower material costs associated with sulfur could make EVs more accessible. The development of pilot lines for automotive applications indicates a strong industry interest and a clear path towards integration.

Power Sector Applications

- Key Growth Drivers: The Power Sector, encompassing grid-scale energy storage and renewable energy integration, presents a substantial long-term opportunity for lithium-sulfur batteries. The need for efficient and cost-effective energy storage solutions to manage the intermittency of renewable sources like solar and wind power is growing rapidly.

- Detailed Analysis: While the initial focus might be on gravimetric energy density, the potential for lower cost and higher energy output of Li-S batteries could make them viable for large-scale grid storage applications. Their ability to store more energy per unit volume compared to some traditional storage solutions could also be advantageous in space-constrained urban environments.

Other End Users

- Key Growth Drivers: A diverse range of Other End Users, including defense applications, industrial robotics, and portable power tools, also contribute to the lithium-sulfur battery market.

- Detailed Analysis: These sectors often demand specialized battery solutions that can operate reliably in challenging environments or provide high power output for specific tasks. The unique properties of Li-S batteries make them well-suited for these varied and demanding applications.

Lithium Sulfur Battery Market Product Analysis

Lithium-sulfur battery technology is characterized by ongoing product innovations aimed at maximizing energy density and lifespan. Key advancements include the development of advanced sulfur-infused cathodes that can accommodate the volume changes during cycling and the creation of novel electrolyte compositions that enhance ionic conductivity and suppress polysulfide shuttling. These innovations are leading to products with significantly higher gravimetric energy densities – nearly double that of current lithium-ion cells – and comparable volumetric energy densities, offering a distinct competitive advantage. Applications are expanding from niche sectors like aerospace and defense to encompass high-performance consumer electronics and potentially electric vehicles, driven by the promise of lighter, more powerful, and longer-lasting energy storage.

Key Drivers, Barriers & Challenges in Lithium Sulfur Battery Market

Key Drivers: The primary forces propelling the Lithium Sulfur Battery Market are the relentless pursuit of higher energy density solutions for weight-sensitive applications, particularly in aerospace and defense, and the increasing demand for extended battery life in portable electronics and electric vehicles. Technological advancements in sulfur cathode integration and electrolyte stability are crucial enablers. Government initiatives supporting clean energy and advanced battery research also play a significant role, fostering innovation and accelerating development. The inherent cost advantage of sulfur as a raw material compared to some components in lithium-ion batteries presents a compelling economic driver for future mass adoption.

Barriers & Challenges: Key challenges impacting Lithium Sulfur Battery Market growth include limited cycle life compared to mature lithium-ion technologies and the "polysulfide shuttle" phenomenon, which degrades performance over time. Manufacturing scalability and cost-effectiveness remain significant hurdles, requiring substantial investment in new production infrastructure and processes. Supply chain issues related to sourcing specialized materials and ensuring consistent quality can also pose restraints. Regulatory hurdles, while not as prominent as in some other battery chemistries, may emerge as safety and environmental standards are established for large-scale production and deployment. Competitive pressures from rapidly advancing lithium-ion and solid-state battery technologies necessitate continuous innovation and performance improvements to maintain market relevance.

Growth Drivers in the Lithium Sulfur Battery Market Market

The Lithium Sulfur Battery Market is propelled by significant technological breakthroughs and escalating demand for superior energy storage. The primary growth drivers include the inherent advantage of sulfur as a low-cost, abundant element, offering the potential for substantially higher gravimetric energy densities compared to conventional lithium-ion batteries. This makes them exceptionally attractive for weight-sensitive applications such as aerospace, drones, and portable electronics, where extended operational time and reduced payload are critical. Ongoing research and development focused on improving cycle life, mitigating polysulfide dissolution, and enhancing electrode stability are continuously expanding the addressable market. Furthermore, increasing global investment in electrification across various sectors, including automotive and renewable energy storage, creates a strong underlying demand for advanced battery chemistries like lithium-sulfur. Supportive government policies and incentives for clean energy technologies also play a vital role in fostering innovation and accelerating commercialization.

Challenges Impacting Lithium Sulfur Battery Market Growth

Despite its promising potential, the Lithium Sulfur Battery Market faces several critical challenges that impact its growth trajectory. The primary technical hurdle remains achieving a long cycle life comparable to established lithium-ion batteries. The dissolution of polysulfides, a byproduct of the electrochemical reaction, leads to capacity fading and reduced battery lifespan, requiring innovative solutions in electrode and electrolyte design. Manufacturing scalability and achieving cost-competitiveness with mass-produced lithium-ion batteries represent significant commercial challenges. The complexity of the sulfur cathode and the need for specialized manufacturing processes require substantial capital investment. Supply chain issues, including the consistent sourcing of high-purity materials and the development of robust recycling infrastructure, also pose potential restraints. Furthermore, the need for rigorous safety testing and certification as the technology moves towards broader applications, especially in consumer-facing markets, adds to the developmental timeline.

Key Players Shaping the Lithium Sulfur Battery Market Market

- Gelion PLC

- Saft Groupe SA

- Polyplus Battery Co

- LG Energy Solutions Ltd

- LYTEN Batteries Inc

- Li-S Energy Limited

- GS Yuasa Corporation

- Sion Power Corporation

Significant Lithium Sulfur Battery Market Industry Milestones

- June 2023: Lyten Inc., a United States-based battery manufacturer, announced the commissioning of its lithium-sulfur battery pilot line in Silicon Valley. The lithium-sulfur pilot line is expected to start delivering commercial battery cells by the end of 2023 to early adopting customers within the defense, logistics, automotive, and satellite sectors.

- May 2023: The Australian battery technology company Li-S Energy announced the development of 20-layer battery cells utilizing third-generation semi-solid-state lithium-sulfur battery technology. Compared to current lithium-ion (Li-ion) cells, this performance is nearly double the gravimetric energy density and a comparable volumetric energy density.

Future Outlook for Lithium Sulfur Battery Market Market

The future outlook for the Lithium Sulfur Battery Market is exceptionally bright, driven by relentless innovation and a burgeoning global demand for high-performance energy storage. Strategic opportunities lie in the continued advancement of battery chemistry to achieve ultra-high energy densities and extended cycle lives, paving the way for widespread adoption in electric vehicles, advanced aerospace applications, and next-generation portable electronics. The potential for lower manufacturing costs due to the abundance of sulfur positions Li-S batteries to become a disruptive force in the energy storage landscape. As pilot lines scale up and manufacturing efficiencies improve, market penetration is projected to accelerate, offering significant growth catalysts for key players and stakeholders poised to capitalize on this transformative technology. The market is anticipated to witness substantial growth, fueled by ongoing research breakthroughs and increasing commercial viability.

Lithium Sulfur Battery Market Segmentation

-

1. End User

- 1.1. Aerospace

- 1.2. Electronics

- 1.3. Automotive

- 1.4. Power Sector

- 1.5. Other End Users

Lithium Sulfur Battery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Lithium Sulfur Battery Market Regional Market Share

Geographic Coverage of Lithium Sulfur Battery Market

Lithium Sulfur Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Electric Vehicles4.; Increasing Demand for Energy Storage Systems (ESS)

- 3.3. Market Restrains

- 3.3.1. Limited Cycle Life and Durability

- 3.4. Market Trends

- 3.4.1. Aerospace Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lithium Sulfur Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Aerospace

- 5.1.2. Electronics

- 5.1.3. Automotive

- 5.1.4. Power Sector

- 5.1.5. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Lithium Sulfur Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Aerospace

- 6.1.2. Electronics

- 6.1.3. Automotive

- 6.1.4. Power Sector

- 6.1.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Lithium Sulfur Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Aerospace

- 7.1.2. Electronics

- 7.1.3. Automotive

- 7.1.4. Power Sector

- 7.1.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Lithium Sulfur Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Aerospace

- 8.1.2. Electronics

- 8.1.3. Automotive

- 8.1.4. Power Sector

- 8.1.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. South America Lithium Sulfur Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Aerospace

- 9.1.2. Electronics

- 9.1.3. Automotive

- 9.1.4. Power Sector

- 9.1.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East and Africa Lithium Sulfur Battery Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Aerospace

- 10.1.2. Electronics

- 10.1.3. Automotive

- 10.1.4. Power Sector

- 10.1.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Gelion PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saft Groupe SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Polyplus Battery Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LG Energy Solutions Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LYTEN Batteries Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Li-S Energy Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GS Yuasa Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sion Power Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Gelion PLC

List of Figures

- Figure 1: Global Lithium Sulfur Battery Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Lithium Sulfur Battery Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Lithium Sulfur Battery Market Revenue (Million), by End User 2025 & 2033

- Figure 4: North America Lithium Sulfur Battery Market Volume (K Unit), by End User 2025 & 2033

- Figure 5: North America Lithium Sulfur Battery Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Lithium Sulfur Battery Market Volume Share (%), by End User 2025 & 2033

- Figure 7: North America Lithium Sulfur Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Lithium Sulfur Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Lithium Sulfur Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Lithium Sulfur Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Lithium Sulfur Battery Market Revenue (Million), by End User 2025 & 2033

- Figure 12: Europe Lithium Sulfur Battery Market Volume (K Unit), by End User 2025 & 2033

- Figure 13: Europe Lithium Sulfur Battery Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: Europe Lithium Sulfur Battery Market Volume Share (%), by End User 2025 & 2033

- Figure 15: Europe Lithium Sulfur Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Lithium Sulfur Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Lithium Sulfur Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Lithium Sulfur Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Lithium Sulfur Battery Market Revenue (Million), by End User 2025 & 2033

- Figure 20: Asia Pacific Lithium Sulfur Battery Market Volume (K Unit), by End User 2025 & 2033

- Figure 21: Asia Pacific Lithium Sulfur Battery Market Revenue Share (%), by End User 2025 & 2033

- Figure 22: Asia Pacific Lithium Sulfur Battery Market Volume Share (%), by End User 2025 & 2033

- Figure 23: Asia Pacific Lithium Sulfur Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Lithium Sulfur Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Lithium Sulfur Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Lithium Sulfur Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Lithium Sulfur Battery Market Revenue (Million), by End User 2025 & 2033

- Figure 28: South America Lithium Sulfur Battery Market Volume (K Unit), by End User 2025 & 2033

- Figure 29: South America Lithium Sulfur Battery Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: South America Lithium Sulfur Battery Market Volume Share (%), by End User 2025 & 2033

- Figure 31: South America Lithium Sulfur Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Lithium Sulfur Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Lithium Sulfur Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Lithium Sulfur Battery Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Lithium Sulfur Battery Market Revenue (Million), by End User 2025 & 2033

- Figure 36: Middle East and Africa Lithium Sulfur Battery Market Volume (K Unit), by End User 2025 & 2033

- Figure 37: Middle East and Africa Lithium Sulfur Battery Market Revenue Share (%), by End User 2025 & 2033

- Figure 38: Middle East and Africa Lithium Sulfur Battery Market Volume Share (%), by End User 2025 & 2033

- Figure 39: Middle East and Africa Lithium Sulfur Battery Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Lithium Sulfur Battery Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East and Africa Lithium Sulfur Battery Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Lithium Sulfur Battery Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lithium Sulfur Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 3: Global Lithium Sulfur Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Lithium Sulfur Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Global Lithium Sulfur Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Rest of North America Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of North America Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Lithium Sulfur Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: Global Lithium Sulfur Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: France Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Global Lithium Sulfur Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 29: Global Lithium Sulfur Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: China Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: China Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: India Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Japan Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: South Korea Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Korea Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Rest of Asia Pacific Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Global Lithium Sulfur Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 43: Global Lithium Sulfur Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: Brazil Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Brazil Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Argentina Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Argentina Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Rest of South America Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of South America Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Global Lithium Sulfur Battery Market Revenue Million Forecast, by End User 2020 & 2033

- Table 52: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 53: Global Lithium Sulfur Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Lithium Sulfur Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 55: Saudi Arabia Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Saudi Arabia Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: United Arab Emirates Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: United Arab Emirates Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Africa Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Africa Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East and Africa Lithium Sulfur Battery Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East and Africa Lithium Sulfur Battery Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lithium Sulfur Battery Market?

The projected CAGR is approximately 16.50%.

2. Which companies are prominent players in the Lithium Sulfur Battery Market?

Key companies in the market include Gelion PLC, Saft Groupe SA, Polyplus Battery Co, LG Energy Solutions Ltd, LYTEN Batteries Inc *List Not Exhaustive, Li-S Energy Limited, GS Yuasa Corporation, Sion Power Corporation.

3. What are the main segments of the Lithium Sulfur Battery Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 233 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Electric Vehicles4.; Increasing Demand for Energy Storage Systems (ESS).

6. What are the notable trends driving market growth?

Aerospace Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Limited Cycle Life and Durability.

8. Can you provide examples of recent developments in the market?

June 2023: Lyten Inc., a United States-based battery manufacturer, announced the commissioning of its lithium-sulfur battery pilot line in Silicon Valley. The lithium-sulfur pilot line is expected to start delivering commercial battery cells by the end of 2023 to early adopting customers within the defense, logistics, automotive, and satellite sectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lithium Sulfur Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lithium Sulfur Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lithium Sulfur Battery Market?

To stay informed about further developments, trends, and reports in the Lithium Sulfur Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence