Key Insights

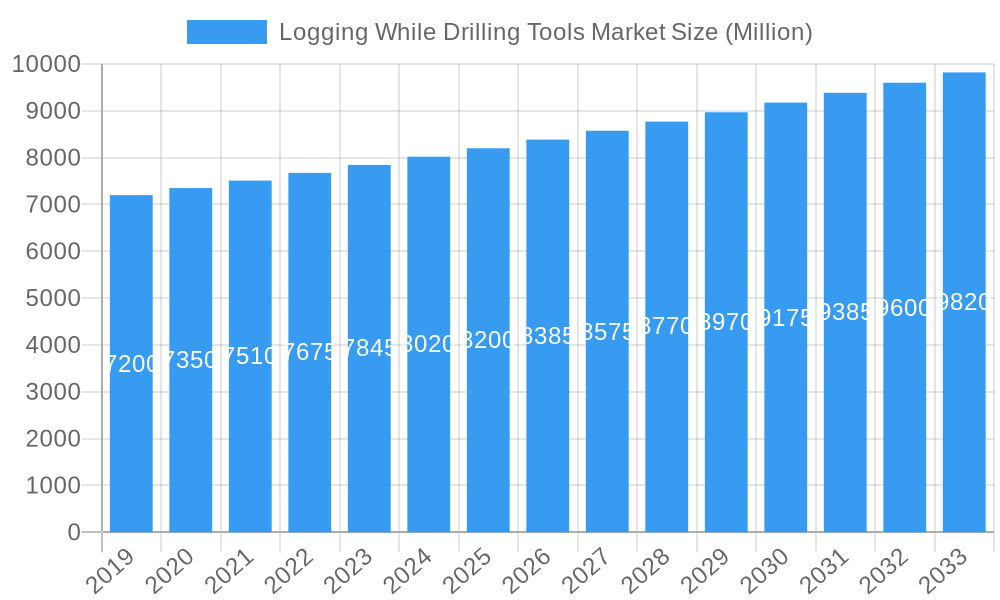

The Global Logging While Drilling (LWD) Tools Market is projected to achieve significant growth, estimated to reach USD 5.02 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.66% through 2033. This expansion is driven by increasing oil and gas exploration and production activities, particularly in demanding offshore environments. Innovations in sensor technology, real-time data acquisition, and advanced analytics are enhancing LWD service efficiency and accuracy, proving vital for reservoir characterization, precise wellbore placement, and operational optimization. The increasing complexity of unconventional reservoirs and the imperative to maximize hydrocarbon recovery are accelerating the adoption of sophisticated LWD solutions. Continued investment in energy infrastructure, especially in emerging economies, alongside stringent environmental regulations mandating precise wellbore control, will further bolster market growth. The market's positive trajectory is supported by ongoing technological advancements and sustained global energy demand.

Logging While Drilling Tools Market Market Size (In Billion)

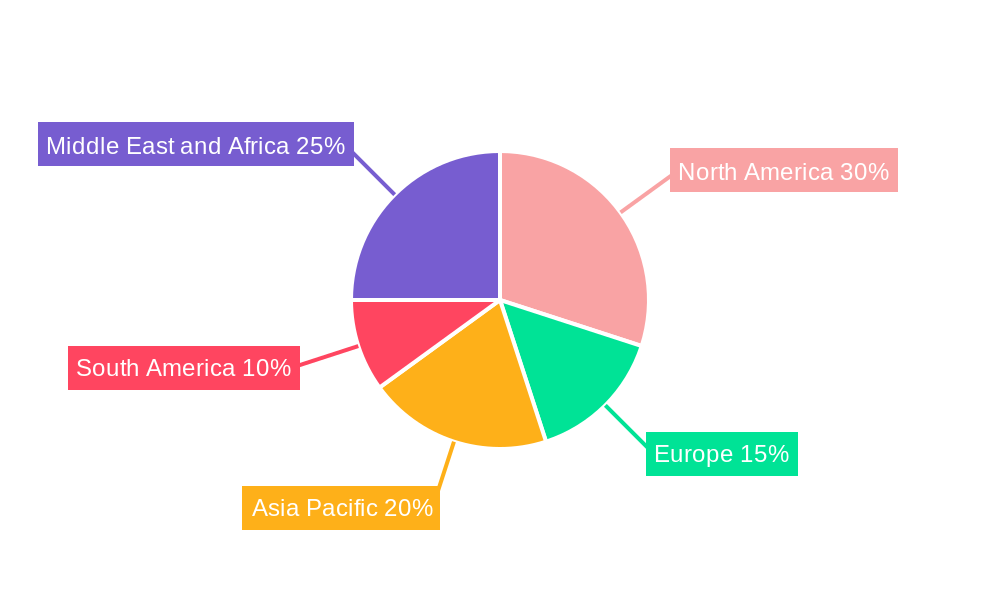

Market segmentation highlights key growth areas. Offshore deployments are anticipated to be a major growth catalyst, fueled by expanding exploration in deepwater and ultra-deepwater reserves. Concurrently, Onshore applications will maintain a substantial market share, driven by conventional drilling and the necessity for enhanced oil recovery in mature fields. Leading industry participants, including Schlumberger Limited, Halliburton Company, and Baker Hughes Company, are spearheading innovation through significant R&D investments to deliver advanced LWD tools offering comprehensive subsurface insights. Potential market challenges may arise from volatile oil prices and the growing transition to renewable energy sources. However, the essential role of LWD tools in ensuring efficient and safe drilling operations, coupled with the enduring lifecycle of oil and gas infrastructure, guarantees sustained market relevance and growth. Regional dynamics, with North America and the Middle East and Africa leading due to substantial oil and gas reserves and ongoing exploration, are also shaping the market's evolution.

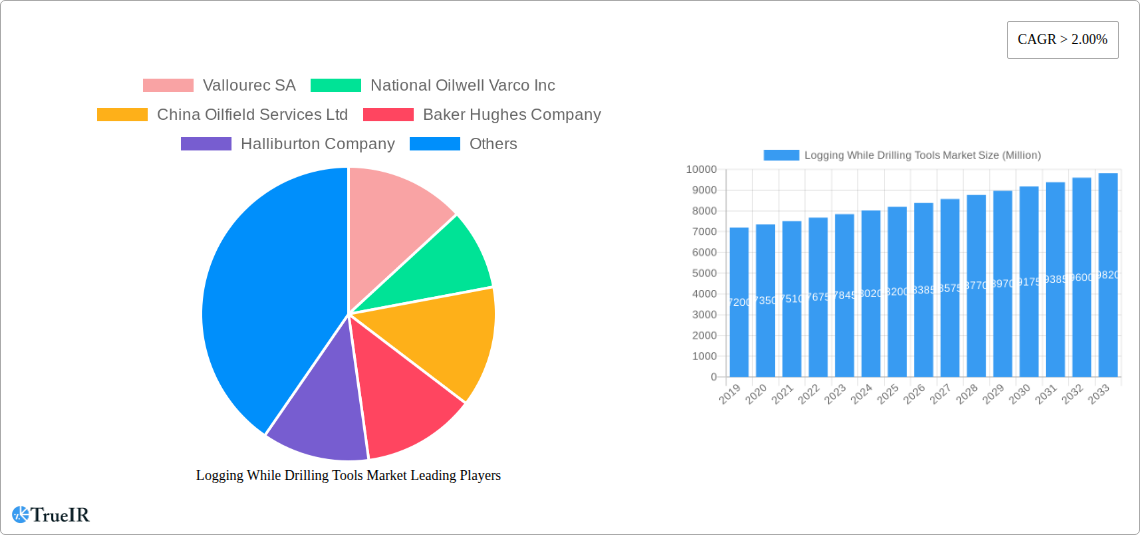

Logging While Drilling Tools Market Company Market Share

Discover key insights into the Logging While Drilling (LWD) Tools Market, including market size, growth trends, and future forecasts. This dynamic and SEO-optimized report provides a comprehensive overview for stakeholders.

Logging While Drilling Tools Market Market Structure & Competitive Landscape

The Logging While Drilling (LWD) tools market exhibits a moderately concentrated structure, with a few key players dominating a significant share of the global revenue. In 2025, the top five companies – Schlumberger Limited, Halliburton Company, Baker Hughes Company, National Oilwell Varco Inc., and China Oilfield Services Ltd. – are projected to collectively hold over 65% of the market. Innovation is a critical driver, with continuous advancements in sensor technology, data transmission, and real-time analytics shaping competitive advantages. For instance, the development of advanced downhole sensors for formation evaluation and the integration of AI for predictive maintenance are key areas of focus.

The regulatory landscape, primarily influenced by environmental standards and safety protocols in the oil and gas industry, plays a crucial role in product development and market entry. Companies must adhere to stringent compliance measures, impacting R&D investments and operational costs. Product substitutes, though less direct, include wireline logging services, which are typically employed after drilling operations. However, the efficiency and real-time data provided by LWD tools offer a distinct advantage, limiting the direct substitution threat for many applications. End-user segmentation is primarily driven by the exploration and production activities of oil and gas companies, with national oil companies and supermajors being key consumers. Mergers and acquisitions (M&A) trends are moderately active, characterized by strategic collaborations and acquisitions aimed at expanding technological capabilities and geographic reach. For example, the market has witnessed several partnerships focused on integrated drilling and logging solutions.

Logging While Drilling Tools Market Market Trends & Opportunities

The global Logging While Drilling (LWD) Tools Market is poised for robust expansion, projected to reach a valuation of approximately $5,800 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period of 2025–2033. This growth is propelled by several interconnected trends and opportunities that are redefining the oil and gas exploration and production (E&P) landscape. The increasing demand for energy, coupled with the need to access unconventional reserves and mature fields, is a fundamental driver for LWD tools. As conventional reserves become scarcer, companies are increasingly investing in complex geological formations that require sophisticated downhole data acquisition for successful extraction.

Technological advancements are at the forefront of this market evolution. The continuous miniaturization and enhancement of sensor technologies are enabling LWD tools to collect more comprehensive and accurate data in real-time, covering parameters such as formation resistivity, porosity, permeability, and fluid saturation. The integration of artificial intelligence (AI) and machine learning (ML) algorithms with LWD data is a significant trend, allowing for immediate interpretation, predictive analytics for drilling optimization, and enhanced reservoir characterization. This shift towards data-driven decision-making reduces drilling risks, optimizes well placement, and improves overall operational efficiency, directly impacting the economic viability of E&P projects.

Furthermore, the growing focus on enhanced oil recovery (EOR) techniques and the exploration of deep-sea and challenging terrains (e.g., Arctic regions) are creating new avenues for LWD tool deployment. Offshore operations, in particular, are witnessing a surge in demand for reliable and high-performance LWD solutions due to the inherent complexities and higher operational costs associated with these environments. The development of specialized LWD tools designed for harsh downhole conditions, high temperatures, and high pressures is crucial for unlocking these opportunities.

Consumer preferences are evolving towards integrated solutions that offer seamless data flow from the wellbore to the surface, enabling faster and more informed decision-making. This includes a demand for high-bandwidth data transmission capabilities and user-friendly interfaces for data analysis. The competitive dynamics are characterized by an intense focus on research and development (R&D) to introduce innovative products and services. Companies are also increasingly adopting strategic partnerships and collaborations to leverage complementary expertise and expand their market reach. The drive for cost optimization in the E&P sector is also influencing the market, with a growing demand for LWD solutions that can demonstrably reduce overall drilling costs and improve well productivity. The market penetration rates of advanced LWD technologies are steadily increasing as operators recognize their value proposition in de-risking exploration and maximizing hydrocarbon recovery.

Dominant Markets & Segments in Logging While Drilling Tools Market

The global Logging While Drilling (LWD) Tools Market is significantly influenced by geographical regions and deployment locations, with distinct growth drivers and market dominance patterns. Among the deployment locations, the Offshore segment is projected to exhibit a stronger growth trajectory, driven by the increasing complexity of offshore exploration and production activities and the demand for higher precision in data acquisition in these challenging environments. This segment is expected to contribute a substantial portion of the market's revenue over the forecast period.

Key Growth Drivers for Offshore Segment:

- Deepwater and Ultra-Deepwater Exploration: The push to explore new hydrocarbon reserves in deep and ultra-deepwater regions necessitates advanced LWD capabilities for accurate formation evaluation and wellbore stability monitoring.

- Complex Subsurface Structures: Offshore environments often present complex geological formations and fault lines that require sophisticated LWD tools for precise drilling and reservoir characterization.

- Harsh Operating Conditions: The ability of LWD tools to withstand high pressures, extreme temperatures, and corrosive conditions prevalent in offshore operations is a critical factor driving their adoption.

- Cost Efficiency in Remote Locations: While offshore operations are inherently expensive, the real-time data provided by LWD tools helps in optimizing drilling operations, reducing non-productive time (NPT), and ultimately enhancing cost-efficiency, particularly in remote and inaccessible locations.

- Technological Advancements for Offshore: Continuous innovation in areas like high-resolution imaging, advanced measurements, and improved data transmission specifically tailored for offshore challenges is fueling market growth.

The Onshore segment, while historically larger, is also experiencing steady growth, particularly in regions with significant unconventional resource development and mature field revitalization.

Detailed Analysis of Market Dominance:

The dominance of the Offshore segment is underscored by substantial investments in offshore exploration and production infrastructure by supermajors and national oil companies. The inherent risks and high costs associated with offshore drilling make real-time data from LWD tools indispensable for decision-making, thereby driving demand for high-end solutions. Companies are increasingly deploying multi-component LWD systems that integrate various measurement types to provide a comprehensive understanding of the reservoir.

In the Onshore segment, the growth is primarily fueled by the shale revolution, particularly in North America, where LWD tools are critical for optimizing horizontal drilling and hydraulic fracturing operations. The need to accurately assess reservoir properties, monitor wellbore placement, and ensure fracture network effectiveness drives the demand for advanced LWD technologies in these unconventional plays. Furthermore, the revitalization of mature onshore fields globally, requiring improved reservoir understanding for enhanced oil recovery (EOR) techniques, also contributes to the sustained demand in this segment. However, the comparative cost-effectiveness of onshore operations can sometimes lead to a higher adoption rate of less sophisticated LWD solutions where applicable.

Geographically, North America is expected to maintain its leading position due to its extensive onshore unconventional resource development and a mature offshore sector. Asia Pacific is emerging as a significant growth market, driven by increasing exploration activities in both offshore and onshore regions, alongside substantial investments in energy infrastructure. The Middle East continues to be a strong market for LWD tools, owing to its vast conventional reserves and ongoing offshore development projects.

Logging While Drilling Tools Market Product Analysis

The Logging While Drilling (LWD) Tools market is characterized by continuous product innovation, focusing on enhancing data acquisition accuracy, real-time processing, and downhole reliability. Key product advancements include the development of multi-sensor tools capable of simultaneously measuring formation resistivity, porosity, gamma ray, and acoustic properties, providing a comprehensive view of subsurface formations. Innovations in telemetry systems are enabling faster and more robust data transmission from the drill bit to the surface, crucial for immediate decision-making. Applications span from formation evaluation and reservoir characterization to wellbore placement and drilling optimization, offering critical insights that reduce operational risks and improve hydrocarbon recovery. Competitive advantages are increasingly being derived from integrated solutions that combine advanced sensors with sophisticated software for data interpretation and analysis.

Key Drivers, Barriers & Challenges in Logging While Drilling Tools Market

Key Drivers:

- Growing Global Energy Demand: The escalating need for hydrocarbons fuels upstream exploration and production, directly increasing the demand for LWD tools to optimize well performance.

- Technological Advancements: Innovations in sensor technology, data analytics, and real-time communication are enhancing the capabilities and efficiency of LWD tools.

- Accessing Unconventional and Deep Offshore Reserves: The complexity of these reserves necessitates advanced LWD solutions for accurate formation evaluation and safe drilling.

- Focus on Operational Efficiency and Cost Reduction: LWD tools provide real-time data that helps minimize non-productive time (NPT) and optimize drilling operations, leading to significant cost savings.

Barriers & Challenges:

- Volatility in Oil Prices: Fluctuations in crude oil prices can impact E&P budgets, leading to reduced capital expenditure on new drilling projects and LWD tool procurement.

- Stringent Environmental Regulations: Compliance with evolving environmental standards and safety protocols adds to operational costs and can influence the adoption of new technologies.

- Supply Chain Disruptions: Geopolitical events and logistical challenges can disrupt the supply of critical components and impact the timely delivery of LWD tools.

- Intense Competition: A highly competitive market necessitates continuous innovation and price adjustments, challenging profit margins for smaller players.

- Technical Complexity and Skilled Workforce: The operation and maintenance of advanced LWD tools require a highly skilled workforce, which can be a limiting factor in some regions.

Growth Drivers in the Logging While Drilling Tools Market Market

The Logging While Drilling (LWD) Tools Market is primarily driven by the persistent global demand for energy, which underpins upstream oil and gas exploration and production activities. Technological innovation is a pivotal growth catalyst, with ongoing advancements in sensor fidelity, data transmission speeds, and artificial intelligence integration enabling more precise and real-time reservoir characterization. The increasing necessity to access challenging unconventional reserves, such as shale gas and oil, and to explore deepwater and ultra-deepwater environments necessitates sophisticated LWD solutions for safe and efficient drilling. Furthermore, the continuous drive within the oil and gas industry for enhanced operational efficiency and cost optimization makes LWD tools indispensable for minimizing non-productive time and improving well productivity. Regulatory frameworks that promote efficient resource extraction and environmental stewardship also indirectly foster growth by encouraging the adoption of advanced technologies.

Challenges Impacting Logging While Drilling Tools Market Growth

Several factors present significant challenges to the growth of the Logging While Drilling (LWD) Tools Market. The inherent volatility of global oil and gas prices directly impacts exploration and production (E&P) budgets, often leading to delayed or canceled projects, thereby curtailing demand for LWD services. Stringent and evolving environmental regulations and safety standards necessitate substantial investments in compliance and can sometimes slow down the adoption of new technologies. Supply chain vulnerabilities, exacerbated by geopolitical instability and logistical complexities, can lead to component shortages and delivery delays, impacting project timelines. The highly competitive nature of the market also poses a challenge, with companies constantly pressured to innovate while maintaining competitive pricing. Moreover, the increasing technical sophistication of LWD tools requires a specialized and skilled workforce, the availability of which can be a limiting factor in certain regions, thus presenting a human capital challenge.

Key Players Shaping the Logging While Drilling Tools Market Market

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- National Oilwell Varco Inc.

- Vallourec SA

- Weatherford International Ltd

- China Oilfield Services Ltd

- Scientific Drilling International Inc

Significant Logging While Drilling Tools Market Industry Milestones

- 2019: Introduction of advanced downhole sensor arrays with improved spectral resolution for enhanced formation evaluation.

- 2020: Increased integration of AI and machine learning for real-time data interpretation and predictive analytics in LWD operations.

- 2021: Development of higher bandwidth telemetry systems to support the transmission of larger datasets from the wellbore.

- 2022: Expansion of LWD tool capabilities for complex wellbore trajectory control and real-time geosteering.

- 2023: Focus on miniaturization of components to enable smaller and more versatile LWD tool designs for challenging formations.

- 2024: Strategic partnerships formed to offer integrated drilling and logging solutions, aiming to streamline operations and reduce costs.

Future Outlook for Logging While Drilling Tools Market Market

The future outlook for the Logging While Drilling (LWD) Tools Market is exceptionally promising, driven by an anticipated surge in global energy demand and the continuous need to explore and extract hydrocarbons from increasingly complex geological formations. Strategic opportunities lie in the further development of autonomous drilling systems, where LWD data will be paramount for real-time decision-making and well control. Advancements in real-time seismic data acquisition while drilling and the integration of electromagnetic and acoustic logging technologies will unlock deeper insights into reservoir heterogeneity. The market potential is significant as oil and gas operators worldwide prioritize efficiency, risk reduction, and maximized recovery, making LWD tools a non-negotiable component of modern drilling operations. Furthermore, the exploration of frontier regions and the need for more sustainable drilling practices will continue to spur innovation and demand for sophisticated LWD solutions.

Logging While Drilling Tools Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

Logging While Drilling Tools Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Logging While Drilling Tools Market Regional Market Share

Geographic Coverage of Logging While Drilling Tools Market

Logging While Drilling Tools Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Cost of Solar PV Installations4.; Supportive Government Policies for Renewable Energy

- 3.3. Market Restrains

- 3.3.1. Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Logging While Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. North America Logging While Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Europe Logging While Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Asia Pacific Logging While Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. South America Logging While Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Middle East and Africa Logging While Drilling Tools Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vallourec SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 National Oilwell Varco Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China Oilfield Services Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Baker Hughes Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Halliburton Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Weatherford International Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Schlumberger Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Scientific Drilling International Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Vallourec SA

List of Figures

- Figure 1: Global Logging While Drilling Tools Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Logging While Drilling Tools Market Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 3: North America Logging While Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 4: North America Logging While Drilling Tools Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Logging While Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Logging While Drilling Tools Market Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 7: Europe Logging While Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 8: Europe Logging While Drilling Tools Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Logging While Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Logging While Drilling Tools Market Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 11: Asia Pacific Logging While Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 12: Asia Pacific Logging While Drilling Tools Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Logging While Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Logging While Drilling Tools Market Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 15: South America Logging While Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 16: South America Logging While Drilling Tools Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Logging While Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Logging While Drilling Tools Market Revenue (billion), by Location of Deployment 2025 & 2033

- Figure 19: Middle East and Africa Logging While Drilling Tools Market Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 20: Middle East and Africa Logging While Drilling Tools Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Logging While Drilling Tools Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Logging While Drilling Tools Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: Global Logging While Drilling Tools Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Logging While Drilling Tools Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 4: Global Logging While Drilling Tools Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Logging While Drilling Tools Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 6: Global Logging While Drilling Tools Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Logging While Drilling Tools Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 8: Global Logging While Drilling Tools Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Logging While Drilling Tools Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 10: Global Logging While Drilling Tools Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Logging While Drilling Tools Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 12: Global Logging While Drilling Tools Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Logging While Drilling Tools Market?

The projected CAGR is approximately 8.66%.

2. Which companies are prominent players in the Logging While Drilling Tools Market?

Key companies in the market include Vallourec SA, National Oilwell Varco Inc, China Oilfield Services Ltd, Baker Hughes Company, Halliburton Company, Weatherford International Ltd, Schlumberger Limited, Scientific Drilling International Inc.

3. What are the main segments of the Logging While Drilling Tools Market?

The market segments include Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Declining Cost of Solar PV Installations4.; Supportive Government Policies for Renewable Energy.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Logging While Drilling Tools Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Logging While Drilling Tools Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Logging While Drilling Tools Market?

To stay informed about further developments, trends, and reports in the Logging While Drilling Tools Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence