Key Insights

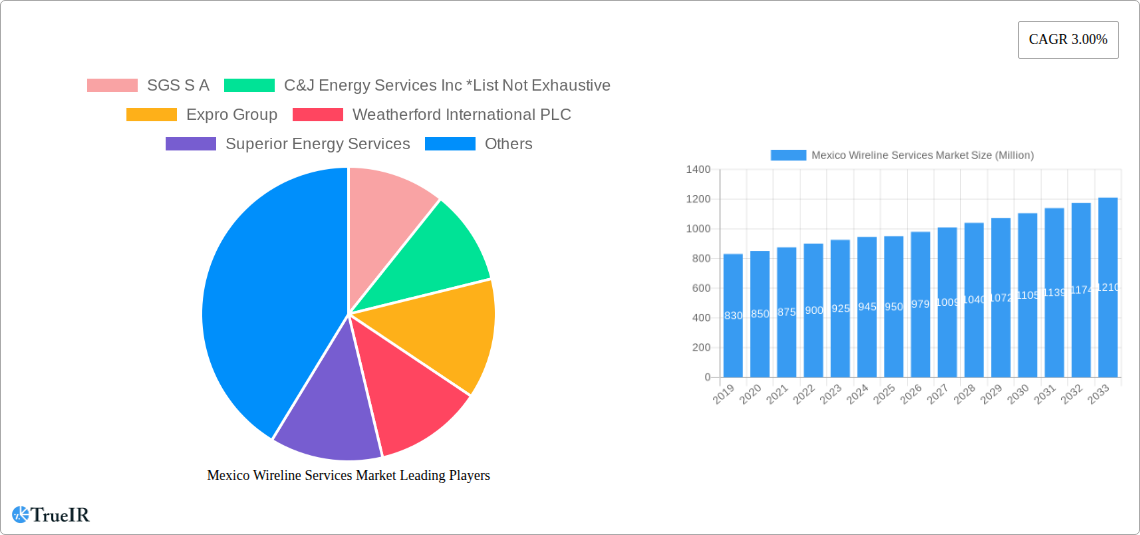

The Mexico Wireline Services Market is forecast to reach USD 11.14 billion by 2025, driven by a CAGR of 3.3% from 2025 to 2033. Key growth factors include increasing demand for enhanced oil recovery (EOR), ongoing exploration and development of hydrocarbon reserves, and the necessity for regular well maintenance and integrity assessments. The market is segmented by service type into Electric Line and Slick Line, with Electric Line expected to lead due to its advanced data acquisition and intervention capabilities. Deployment locations are categorized as Onshore and Offshore. Technological advancements in wireline tools are essential for improving efficiency and reducing operational costs, thus supporting market expansion.

Mexico Wireline Services Market Market Size (In Billion)

Market growth faces challenges including oil price volatility, which impacts exploration and production investments, and evolving environmental regulations alongside the global transition to renewable energy. However, Mexico's established oil and gas infrastructure and continued energy reliance, combined with the persistent need for efficient well management, are expected to maintain market growth. Leading companies such as Schlumberger Limited, Baker Hughes Company, Halliburton Company, and Weatherford International PLC are key participants, providing comprehensive wireline solutions and contributing to technological advancements within the Mexican oil and gas industry.

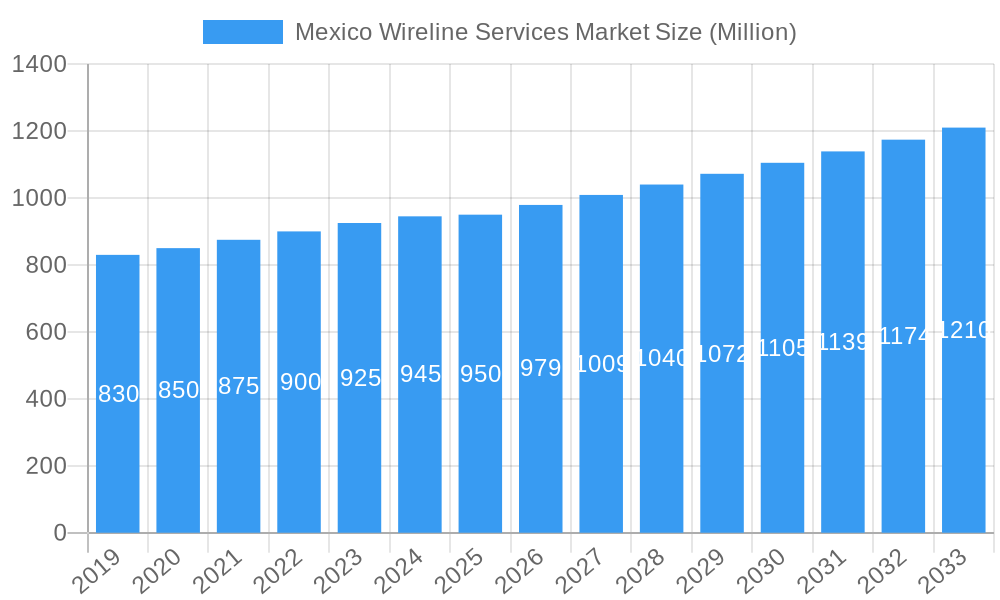

Mexico Wireline Services Market Company Market Share

Gain comprehensive market intelligence on the Mexico Wireline Services Market. This report analyzes market structure, trends, key segments, and the competitive environment from 2019 to 2033, with a base year of 2025. It is an indispensable resource for oil and gas operators, service providers, investors, and policymakers seeking to understand the evolving landscape of Mexico's oilfield services sector.

Mexico Wireline Services Market Market Structure & Competitive Landscape

The Mexico Wireline Services Market exhibits a moderately concentrated structure, with a few key players dominating the scene, including industry giants like Schlumberger Limited, Halliburton Company, and Baker Hughes Company. These companies leverage extensive operational expertise, advanced technological portfolios, and established customer relationships to maintain their market share. Innovation is a significant driver, spurred by the continuous demand for more efficient and cost-effective well intervention and completion solutions. Regulatory impacts, while present, are generally focused on safety and environmental standards, with a stable framework supporting market operations. Product substitutes are limited in the core wireline services segment, underscoring the specialized nature of these offerings. End-user segmentation primarily revolves around upstream oil and gas exploration and production (E&P) companies, with a growing focus on mature field revitalization and unconventional resource development. Mergers and acquisitions (M&A) activity, though not at peak historical levels, remains a strategic tool for market consolidation and technology acquisition. For instance, recent consolidations within the broader oilfield services sector hint at a potential for further streamlining within the wireline segment. The market's competitive intensity is maintained through technological differentiation and service quality.

Mexico Wireline Services Market Market Trends & Opportunities

The Mexico Wireline Services Market is poised for significant expansion driven by a confluence of technological advancements, evolving industry demands, and strategic investments in the nation's hydrocarbon sector. With an estimated market size projected to reach $XXX million by 2033, growing at a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period (2025-2033), the market's trajectory is clearly upward. This growth is fundamentally underpinned by the sustained exploration and production activities in both conventional and unconventional reservoirs across Mexico. Operators are increasingly relying on sophisticated wireline services for crucial operations such as well diagnostics, production logging, perforating, and setting or retrieving downhole tools. The drive for enhanced oil recovery (EOR) and optimized production from existing wells is a primary catalyst, necessitating precise and reliable wireline interventions.

Technological shifts are profoundly influencing the market landscape. The adoption of advanced digital technologies, including real-time data acquisition and analysis, artificial intelligence (AI)-driven diagnostics, and automation in wireline operations, is becoming paramount. These innovations not only improve operational efficiency and reduce downtime but also enhance safety standards and the accuracy of data gathered from the wellbore. The demand for specialized wireline tools capable of operating in extreme downhole conditions—such as high temperatures, high pressures, and corrosive environments—is also on the rise, reflecting the challenging nature of many Mexican oil and gas fields.

Consumer preferences are increasingly leaning towards integrated service solutions. Clients are seeking wireline service providers who can offer a comprehensive suite of services, from planning and execution to data interpretation and actionable recommendations. This preference for end-to-end solutions fosters strategic partnerships and joint ventures among service companies, aiming to present a unified front to the end-user. Furthermore, the growing emphasis on environmental sustainability and emissions reduction is driving demand for wireline techniques that minimize well interventions and their associated environmental footprint.

The competitive dynamics within the Mexico Wireline Services Market are characterized by intense competition among established global players and emerging local service providers. Differentiation through superior technology, specialized expertise, cost-effectiveness, and a strong commitment to health, safety, and environment (HSE) protocols will be key to capturing market share. The ongoing liberalization of Mexico's energy sector continues to present opportunities for both domestic and international companies to participate in this vital market. The market penetration rate for advanced wireline technologies is expected to climb as operators recognize their value in maximizing resource extraction and operational efficiency.

Dominant Markets & Segments in Mexico Wireline Services Market

The Onshore deployment segment is anticipated to dominate the Mexico Wireline Services Market throughout the forecast period (2025-2033). This dominance is primarily attributed to the vast number of existing onshore oil and gas fields in Mexico, many of which are mature and require continuous intervention for production optimization and maintenance. The extensive onshore infrastructure, coupled with a higher concentration of exploration and production activities in these regions, naturally leads to a greater demand for wireline services.

Electric Line services are also expected to hold a significant market share within the Type segment. Electric line operations, characterized by their use of a multi-conductor cable for real-time data transmission and power delivery, are crucial for sophisticated logging, formation evaluation, and wellbore surveying. The increasing complexity of reservoir characterization and the need for precise data acquisition in both conventional and unconventional plays fuel the demand for electric line services. Furthermore, advancements in electric line technology, enabling operations in deeper and more challenging wellbores, further solidify its leading position.

Key Growth Drivers for Onshore Dominance:

- Mature Field Revitalization: A substantial portion of Mexico's oil and gas production comes from mature onshore fields that necessitate regular wireline interventions for artificial lift optimization, production logging, and recompletion operations.

- Unconventional Resource Development: While still in its nascent stages, the exploration and production of unconventional resources, such as shale gas and tight oil, are primarily onshore and rely heavily on advanced wireline techniques for reservoir evaluation and hydraulic fracturing support.

- Infrastructure and Accessibility: The established onshore infrastructure, including well pads and transportation networks, makes accessing and servicing these wells more logistically feasible and cost-effective compared to offshore environments.

- Government Support for Domestic Production: Policies aimed at boosting domestic energy production often prioritize the development and optimization of existing onshore assets.

Key Growth Drivers for Electric Line Dominance:

- High-Resolution Data Acquisition: Electric line's capability to transmit high-resolution data in real-time is indispensable for detailed formation evaluation, reservoir modeling, and production optimization.

- Complex Wellbore Diagnostics: Modern wireline tools deployed via electric line can perform intricate tasks such as identifying downhole leaks, assessing cement bond integrity, and conducting production profiling with unparalleled accuracy.

- Technological Advancements: Continuous innovation in electric line tools, including miniaturization, increased robustness, and enhanced sensor capabilities, allows for operations in increasingly challenging well conditions.

- Integrated Solutions: The integration of electric line services with other downhole tools and analytics platforms provides operators with a comprehensive view of well performance, driving efficiency and decision-making.

While Offshore deployment and Slick Line services represent smaller segments in comparison, they are crucial for specific operations and are expected to witness steady growth. Offshore wireline operations are vital for deepwater exploration and production, requiring specialized vessels and equipment. Slick line services, which are typically used for simpler interventions like setting and retrieving plugs, gauges, and performing fishing operations, remain essential for routine well maintenance and can be more cost-effective for certain tasks. The development of new offshore blocks and the ongoing production from existing ones will ensure a consistent, albeit secondary, demand for these services.

Mexico Wireline Services Market Product Analysis

The Mexico Wireline Services Market is characterized by a strong focus on enhancing operational efficiency, data accuracy, and safety through continuous product innovation. Electric line services, with their advanced logging tools, provide high-resolution data for formation evaluation and production monitoring. Slick line services offer efficient solutions for routine well interventions, including tool setting and retrieval. Key competitive advantages lie in the development of specialized tools capable of withstanding extreme downhole environments, real-time data transmission capabilities, and integrated diagnostic platforms that offer actionable insights. Technological advancements are driving the development of miniaturized tools, intelligent sensors, and automated deployment systems, all aimed at reducing rig time, minimizing well intervention costs, and maximizing hydrocarbon recovery for operators.

Key Drivers, Barriers & Challenges in Mexico Wireline Services Market

Key Drivers:

- Technological Advancements: Continuous innovation in wireline tools and data analytics enhances efficiency, accuracy, and safety in well interventions. For example, the development of real-time downhole measurement tools.

- Exploration and Production Activities: Ongoing and planned exploration and production projects, particularly in mature onshore fields and potential offshore developments, directly fuel the demand for wireline services.

- Enhanced Oil Recovery (EOR) Initiatives: The drive to maximize output from existing reservoirs necessitates frequent and sophisticated wireline interventions for EOR operations.

- Cost Optimization Efforts: Operators are seeking cost-effective solutions, and advanced wireline services can offer more efficient alternatives to traditional workovers.

Barriers & Challenges:

- Regulatory Complexities: Navigating evolving environmental regulations and permitting processes can impact project timelines and operational costs.

- Supply Chain Disruptions: Global and regional supply chain issues can affect the availability of specialized equipment and spare parts, leading to potential delays and increased costs.

- Skilled Workforce Shortages: The demand for highly skilled wireline operators and technicians can outpace the available talent pool, posing a recruitment and retention challenge.

- Price Volatility of Crude Oil: Fluctuations in global oil prices can impact operator investment decisions and, consequently, the demand for wireline services.

- Security Concerns: In certain regions, security concerns can add complexity and cost to operations.

Growth Drivers in the Mexico Wireline Services Market Market

The Mexico Wireline Services Market is propelled by several critical growth drivers. Technological innovation remains paramount, with advancements in real-time data acquisition, downhole diagnostics, and automation significantly improving operational efficiency and well performance. The continued focus on maximizing production from mature onshore fields across Mexico is a sustained driver, requiring regular wireline interventions for optimization and maintenance. Furthermore, the exploration of new reserves, both onshore and potentially offshore, will create demand for well logging and completion services. Government policies aimed at bolstering domestic energy production and attracting investment also play a crucial role. The drive towards cost-effective solutions by operators further favors specialized wireline services that can reduce overall well intervention costs and minimize downtime.

Challenges Impacting Mexico Wireline Services Market Growth

Several challenges can impede the growth of the Mexico Wireline Services Market. Regulatory hurdles and compliance requirements can introduce complexities and delays, particularly concerning environmental standards and permitting. Supply chain volatility, which can affect the availability of specialized equipment, spare parts, and skilled personnel, poses a significant risk to project execution and cost management. Intense competition among service providers can lead to price pressures, impacting profitability. The inherent price volatility of crude oil directly influences operator spending on exploration and production, and thus, on wireline services. Additionally, security concerns in specific operational areas can add layers of logistical and operational complexity, increasing costs and potentially restricting access.

Key Players Shaping the Mexico Wireline Services Market Market

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International PLC

- C&J Energy Services Inc

- Superior Energy Services

- Expro Group

- SGS S A

Significant Mexico Wireline Services Market Industry Milestones

- September 2021: Helix Energy Solutions Group Inc., an American oil and gas services company, has been awarded a two-year riser-based well intervention scope of work by a major operator for the charter of the Helix Q5000 and 15K Intervention Riser System in the United States Gulf of Mexico. This significant award highlights the demand for advanced well intervention capabilities and specialized riser systems within the broader North American energy services sector, indirectly influencing technology development and service provider strategies relevant to the Mexico market.

Future Outlook for Mexico Wireline Services Market Market

The future outlook for the Mexico Wireline Services Market is positive, driven by sustained demand for optimizing hydrocarbon production and ongoing exploration efforts. Strategic opportunities lie in the adoption of digital transformation, including AI and IoT, for enhanced data analytics and predictive maintenance. The market will likely witness increased collaboration between service providers and operators to deliver integrated solutions. Focus will remain on developing and deploying wireline technologies that offer improved efficiency, cost-effectiveness, and environmental sustainability. The continued maturation of existing fields, coupled with the potential for new discoveries, will ensure a robust demand for specialized wireline services, positioning Mexico as a key market for growth in the upstream oilfield services sector.

Mexico Wireline Services Market Segmentation

-

1. Type

- 1.1. Electric Line

- 1.2. Slick Line

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

Mexico Wireline Services Market Segmentation By Geography

- 1. Mexico

Mexico Wireline Services Market Regional Market Share

Geographic Coverage of Mexico Wireline Services Market

Mexico Wireline Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing demand for natural gas and developing gas infrastructure4.; Increasing offshore oil and Gas Exploration Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Cleaner Alternatives

- 3.4. Market Trends

- 3.4.1. Offshore Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Wireline Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electric Line

- 5.1.2. Slick Line

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 C&J Energy Services Inc *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Expro Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Weatherford International PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Superior Energy Services

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Baker Hughes Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Halliburton Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Schlumberger Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 SGS S A

List of Figures

- Figure 1: Mexico Wireline Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Wireline Services Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Wireline Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Mexico Wireline Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 3: Mexico Wireline Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Wireline Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Mexico Wireline Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 6: Mexico Wireline Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Wireline Services Market?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Mexico Wireline Services Market?

Key companies in the market include SGS S A, C&J Energy Services Inc *List Not Exhaustive, Expro Group, Weatherford International PLC, Superior Energy Services, Baker Hughes Company, Halliburton Company, Schlumberger Limited.

3. What are the main segments of the Mexico Wireline Services Market?

The market segments include Type, Location of Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.14 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing demand for natural gas and developing gas infrastructure4.; Increasing offshore oil and Gas Exploration Activities.

6. What are the notable trends driving market growth?

Offshore Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Adoption of Cleaner Alternatives.

8. Can you provide examples of recent developments in the market?

September 2021: Helix Energy Solutions Group Inc., an American oil and gas services company, has been awarded a two-year riser-based well intervention scope of work by a major operator for the charter of the Helix Q5000 and 15K Intervention Riser System in the United States Gulf of Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Wireline Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Wireline Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Wireline Services Market?

To stay informed about further developments, trends, and reports in the Mexico Wireline Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence