Key Insights

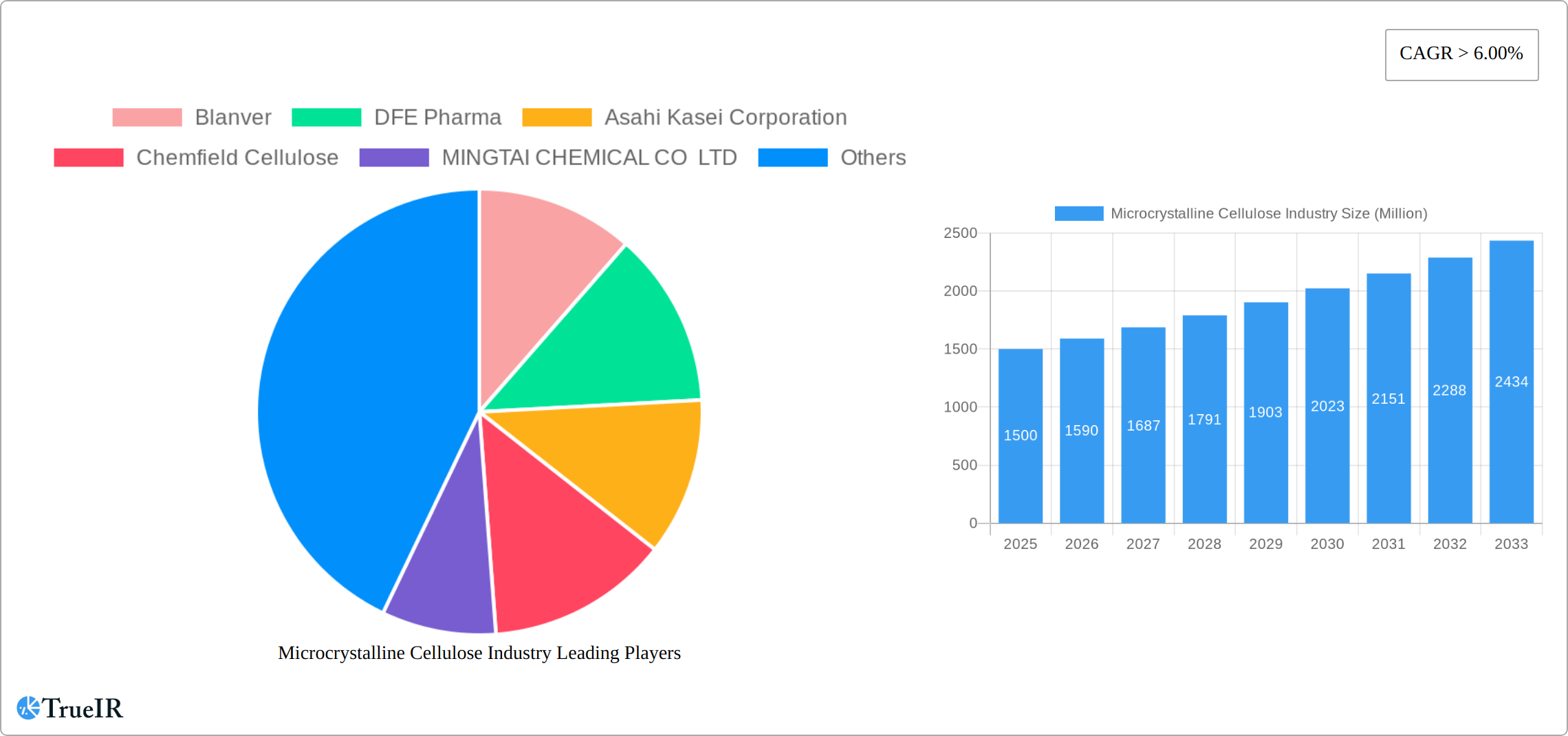

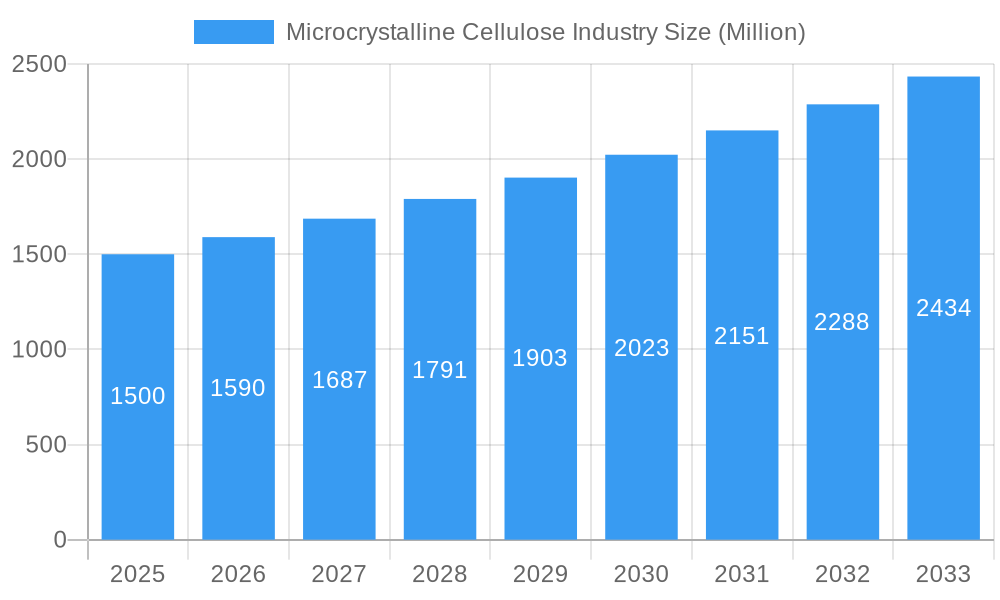

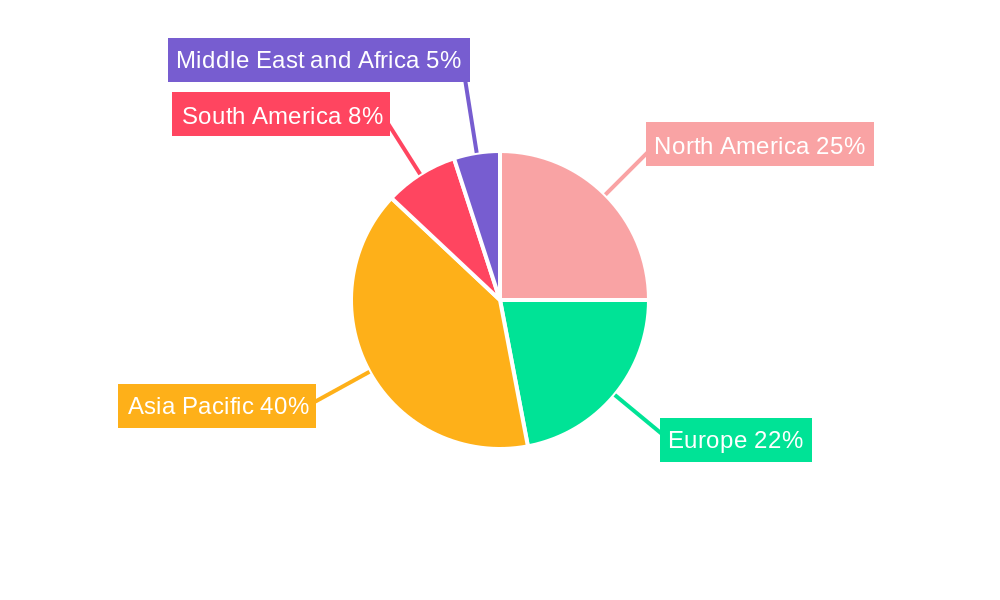

The global microcrystalline cellulose (MCC) market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 7.8%. This robust growth trajectory, expected from a base year of 2025, is primarily propelled by escalating demand across pivotal end-user industries, notably pharmaceuticals, food, and cosmetics. The pharmaceutical sector's reliance on MCC as an essential binder, diluent, and disintegrant in tablet formulations is a key market driver. In the food industry, MCC's functionality as a stabilizer, thickener, and texturizing agent in diverse products contributes substantially to market growth. Similarly, the cosmetics industry benefits from MCC's absorbent and textural properties in skincare and personal care formulations. The market is segmented by production methods including reactive extrusion, enzyme-mediated processes, steam explosion, and acid hydrolysis, and by raw material sources such as wood-based and non-wood-based materials. Currently, wood-based MCC holds a dominant position; however, non-wood-based alternatives are gaining traction, driven by increasing sustainability mandates and potential cost efficiencies. While regulatory landscapes and raw material price volatility present certain challenges, advancements in production technologies and burgeoning demand from emerging economies are anticipated to mitigate these constraints. Leading market participants such as Blanver, DFE Pharma, and Asahi Kasei Corporation are actively shaping market dynamics through continuous product development and strategic alliances. The Asia-Pacific region is projected to exhibit the most significant growth, supported by escalating consumerism and expanding manufacturing capabilities in nations like China and India.

Microcrystalline Cellulose Industry Market Size (In Billion)

The competitive arena is characterized by a dynamic interplay between established multinational enterprises and agile regional players. Companies are strategically prioritizing product quality enhancement, geographical market penetration, and the development of novel applications to secure and fortify their competitive standing. The market is anticipated to witness an uptick in consolidation activities, including mergers and acquisitions, as firms aim to broaden their product offerings and increase market share. Furthermore, the intensifying focus on sustainable and eco-friendly manufacturing practices is expected to foster innovation in MCC sourcing and processing, presenting lucrative opportunities for environmentally conscious enterprises. Future market expansion will be contingent upon several critical factors, including technological breakthroughs, raw material accessibility, evolving regulatory frameworks, and overall economic prosperity in key global regions. The projected market size is 1255.1 million.

Microcrystalline Cellulose Industry Company Market Share

Microcrystalline Cellulose Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global microcrystalline cellulose (MCC) industry, covering market size, trends, competitive landscape, and future outlook from 2019 to 2033. The study period spans from 2019-2024 (Historical Period), with 2025 serving as both the Base Year and Estimated Year, and the forecast period extending to 2033. This report is invaluable for businesses, investors, and researchers seeking to understand and navigate this dynamic market.

Microcrystalline Cellulose Industry Market Structure & Competitive Landscape

The global microcrystalline cellulose market exhibits a moderately concentrated structure, with several key players holding significant market shares. The market's competitive intensity is shaped by factors including innovation in production processes, stringent regulatory landscapes impacting the pharmaceutical and food sectors, the availability of substitute materials, and fluctuating raw material prices. The market exhibits diverse end-user segmentation, primarily pharmaceutical, food, and cosmetics industries. Over the past few years, the market has witnessed xx million in M&A activity, driven primarily by strategic acquisitions to expand product portfolios and geographic reach. Concentration ratios, particularly the Herfindahl-Hirschman Index (HHI), indicate a relatively competitive market structure, albeit with notable players exerting considerable influence.

- Market Concentration: Moderately concentrated, with a HHI of xx.

- Innovation Drivers: Development of novel production methods, functionalized MCC variants.

- Regulatory Impacts: Stringent regulations, particularly within the pharmaceutical sector, influence product quality and safety standards.

- Product Substitutes: Other cellulose derivatives and binding agents present competitive pressure.

- End-User Segmentation: Pharmaceutical (xx%), Food (xx%), Cosmetics (xx%), Other (xx%).

- M&A Trends: xx million in M&A activity over the last 5 years, primarily driven by geographic expansion and product diversification.

Microcrystalline Cellulose Industry Market Trends & Opportunities

The global microcrystalline cellulose market is poised for robust growth throughout the forecast period (2025-2033), driven by increasing demand from various end-user industries and continuous innovation in production and application technologies. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological advancements, including the development of more efficient production processes such as reactive extrusion and enzyme-mediated methods, are playing a significant role. The rise in health-conscious consumerism and the burgeoning pharmaceutical industry are also key factors driving market growth. Market penetration in emerging economies is increasing, driven by rising disposable incomes and increased awareness of the benefits of MCC. The competitive landscape is evolving with companies focusing on product differentiation, mergers and acquisitions, and strategic partnerships.

Dominant Markets & Segments in Microcrystalline Cellulose Industry

The pharmaceutical sector remains the largest consumer of microcrystalline cellulose (MCC), comprising approximately [Insert Percentage]% of global demand. This dominance is particularly pronounced in the Asia-Pacific region, which leads the global market due to its robust pharmaceutical and food industries, coupled with a substantial and growing population. Within manufacturing processes, Reactive Extrusion maintains a significant market share, exceeding other methods like Enzyme-Mediated processing. The primary source material for MCC production continues to be wood-based cellulose, accounting for roughly [Insert Percentage]% of the total volume.

- Key Growth Drivers in Asia-Pacific:

- Exponential growth of the pharmaceutical industry, fueled by increasing healthcare expenditure and a rising prevalence of chronic diseases.

- Surging demand for functional foods, dietary supplements, and other health-conscious products, driving the need for MCC as a versatile excipient and additive.

- Supportive government regulations and initiatives promoting the growth of the food processing and pharmaceutical sectors within the region.

- Expansion of the middle class, resulting in increased disposable incomes and a greater willingness to invest in health and wellness.

- Government investments in research and development for new pharmaceutical products and advanced manufacturing technologies.

- Market Leadership: The Asia-Pacific region holds a commanding position in both the production and consumption of MCC. The pharmaceutical industry's consistent high demand is a key driver of this market leadership. Reactive Extrusion's efficiency and cost-effectiveness solidify its status as the preferred production method. Furthermore, [mention specific countries within Asia-Pacific contributing significantly].

Microcrystalline Cellulose Industry Product Analysis

The microcrystalline cellulose market is characterized by continuous innovation, with a strong focus on enhancing product functionality, purity, and cost-effectiveness. Significant advancements in processing techniques are resulting in MCC with superior properties, including improved flowability, compressibility, and binding capabilities. These improvements are particularly beneficial in the pharmaceutical sector, where the demand for controlled-release formulations and advanced drug delivery systems is constantly rising. This ongoing innovation provides manufacturers with the opportunity to offer tailored MCC solutions to meet the specific requirements of diverse end-users, fostering a competitive landscape.

Key Drivers, Barriers & Challenges in Microcrystalline Cellulose Industry

Key Drivers: The expanding pharmaceutical, food, and cosmetics sectors are major drivers, alongside technological advancements in MCC production that continuously reduce costs and improve product quality. Stringent regulations are also a significant driver as they increase demand for high-purity MCC.

Challenges: Volatility in raw material (wood pulp) prices poses a significant risk. Intense competition from substitute materials, particularly in niche applications, requires manufacturers to demonstrate a clear value proposition. Strict regulatory compliance across different geographical markets presents a significant hurdle, as does the risk of supply chain disruptions that can severely impact production and delivery timelines. The estimated annual economic impact of supply chain issues on market growth is approximately [Insert Amount] million.

Growth Drivers in the Microcrystalline Cellulose Industry Market

The growth of the microcrystalline cellulose industry is fueled by rising demand from the pharmaceutical and food industries, increasing health awareness, and technological advancements leading to more efficient production methods. Regulatory compliance, while a challenge, also drives growth by encouraging the adoption of higher quality, purified MCC. The growing use of MCC in innovative applications further contributes to market expansion.

Challenges Impacting Microcrystalline Cellulose Industry Growth

Several key factors impede the growth of the microcrystalline cellulose industry. Price fluctuations of raw materials, primarily wood pulp, create uncertainty in production costs. Competition from substitute materials, especially in specific applications, necessitates ongoing innovation and differentiation. The stringent regulatory landscape varies across different regions, requiring manufacturers to adapt to diverse compliance requirements. Finally, supply chain disruptions can significantly hamper production and delivery, impacting market stability and overall growth. These combined factors create a complex and challenging environment for producers.

Key Players Shaping the Microcrystalline Cellulose Industry Market

- Blanver

- DFE Pharma

- Asahi Kasei Corporation

- Chemfield Cellulose

- MINGTAI CHEMICAL CO LTD

- JUKU ORCHEM PVT LTD

- Sigachi Industries Limited

- J RETTENMAIER & SÖHNE GmbH + Co KG

- DuPont

- GUJARAT MICROWAX PVT LTD

- VWR International LLC (Avantor Inc)

- Accent Microcell

- Huzhou City Linghu Xinwang Chemical Co Ltd

Significant Microcrystalline Cellulose Industry Milestones

- July 2021: DFE Pharma launched Pharmacel MCC 90, a silicified microcrystalline cellulose, expanding its product portfolio.

- November 2022: DFE Pharma partnered with Azelis for distribution in the EMEA region, enhancing market reach.

Future Outlook for Microcrystalline Cellulose Industry Market

The microcrystalline cellulose market is expected to witness continued growth, driven by ongoing technological advancements, expansion into new applications, and increasing demand from key end-user segments. Strategic partnerships, product diversification, and geographical expansion will play crucial roles in shaping the market's future. The focus on sustainability and eco-friendly production methods will also influence industry trends.

Microcrystalline Cellulose Industry Segmentation

-

1. Source

- 1.1. Wood-based

- 1.2. Non -wood-based

-

2. Process

- 2.1. Reactive Extrusion

- 2.2. Enzyme Mediated

- 2.3. Steam Explosion

- 2.4. Acid Hydrolysis

-

3. End-User Industry

- 3.1. Pharmaceutical

- 3.2. Food

- 3.3. Cosmetics

- 3.4. Other End-User Industries

Microcrystalline Cellulose Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Microcrystalline Cellulose Industry Regional Market Share

Geographic Coverage of Microcrystalline Cellulose Industry

Microcrystalline Cellulose Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Microcrystalline Cellulose from Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Production Cost

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Pharmaceutical Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Microcrystalline Cellulose Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Wood-based

- 5.1.2. Non -wood-based

- 5.2. Market Analysis, Insights and Forecast - by Process

- 5.2.1. Reactive Extrusion

- 5.2.2. Enzyme Mediated

- 5.2.3. Steam Explosion

- 5.2.4. Acid Hydrolysis

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Pharmaceutical

- 5.3.2. Food

- 5.3.3. Cosmetics

- 5.3.4. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Asia Pacific Microcrystalline Cellulose Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Wood-based

- 6.1.2. Non -wood-based

- 6.2. Market Analysis, Insights and Forecast - by Process

- 6.2.1. Reactive Extrusion

- 6.2.2. Enzyme Mediated

- 6.2.3. Steam Explosion

- 6.2.4. Acid Hydrolysis

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Pharmaceutical

- 6.3.2. Food

- 6.3.3. Cosmetics

- 6.3.4. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. North America Microcrystalline Cellulose Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Wood-based

- 7.1.2. Non -wood-based

- 7.2. Market Analysis, Insights and Forecast - by Process

- 7.2.1. Reactive Extrusion

- 7.2.2. Enzyme Mediated

- 7.2.3. Steam Explosion

- 7.2.4. Acid Hydrolysis

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Pharmaceutical

- 7.3.2. Food

- 7.3.3. Cosmetics

- 7.3.4. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Europe Microcrystalline Cellulose Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Wood-based

- 8.1.2. Non -wood-based

- 8.2. Market Analysis, Insights and Forecast - by Process

- 8.2.1. Reactive Extrusion

- 8.2.2. Enzyme Mediated

- 8.2.3. Steam Explosion

- 8.2.4. Acid Hydrolysis

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Pharmaceutical

- 8.3.2. Food

- 8.3.3. Cosmetics

- 8.3.4. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. South America Microcrystalline Cellulose Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Source

- 9.1.1. Wood-based

- 9.1.2. Non -wood-based

- 9.2. Market Analysis, Insights and Forecast - by Process

- 9.2.1. Reactive Extrusion

- 9.2.2. Enzyme Mediated

- 9.2.3. Steam Explosion

- 9.2.4. Acid Hydrolysis

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Pharmaceutical

- 9.3.2. Food

- 9.3.3. Cosmetics

- 9.3.4. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Source

- 10. Middle East and Africa Microcrystalline Cellulose Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Source

- 10.1.1. Wood-based

- 10.1.2. Non -wood-based

- 10.2. Market Analysis, Insights and Forecast - by Process

- 10.2.1. Reactive Extrusion

- 10.2.2. Enzyme Mediated

- 10.2.3. Steam Explosion

- 10.2.4. Acid Hydrolysis

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Pharmaceutical

- 10.3.2. Food

- 10.3.3. Cosmetics

- 10.3.4. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Blanver

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DFE Pharma

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Asahi Kasei Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chemfield Cellulose

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MINGTAI CHEMICAL CO LTD

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JUKU ORCHEM PVT LTD

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sigachi Industries Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 J RETTENMAIER & SÖHNE GmbH + Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DuPont

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GUJARAT MICROWAX PVT LTD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 VWR International LLC (Avantor Inc )*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Accent Microcell

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huzhou City Linghu Xinwang Chemical Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Blanver

List of Figures

- Figure 1: Global Microcrystalline Cellulose Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Microcrystalline Cellulose Industry Revenue (million), by Source 2025 & 2033

- Figure 3: Asia Pacific Microcrystalline Cellulose Industry Revenue Share (%), by Source 2025 & 2033

- Figure 4: Asia Pacific Microcrystalline Cellulose Industry Revenue (million), by Process 2025 & 2033

- Figure 5: Asia Pacific Microcrystalline Cellulose Industry Revenue Share (%), by Process 2025 & 2033

- Figure 6: Asia Pacific Microcrystalline Cellulose Industry Revenue (million), by End-User Industry 2025 & 2033

- Figure 7: Asia Pacific Microcrystalline Cellulose Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: Asia Pacific Microcrystalline Cellulose Industry Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Microcrystalline Cellulose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Microcrystalline Cellulose Industry Revenue (million), by Source 2025 & 2033

- Figure 11: North America Microcrystalline Cellulose Industry Revenue Share (%), by Source 2025 & 2033

- Figure 12: North America Microcrystalline Cellulose Industry Revenue (million), by Process 2025 & 2033

- Figure 13: North America Microcrystalline Cellulose Industry Revenue Share (%), by Process 2025 & 2033

- Figure 14: North America Microcrystalline Cellulose Industry Revenue (million), by End-User Industry 2025 & 2033

- Figure 15: North America Microcrystalline Cellulose Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: North America Microcrystalline Cellulose Industry Revenue (million), by Country 2025 & 2033

- Figure 17: North America Microcrystalline Cellulose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Microcrystalline Cellulose Industry Revenue (million), by Source 2025 & 2033

- Figure 19: Europe Microcrystalline Cellulose Industry Revenue Share (%), by Source 2025 & 2033

- Figure 20: Europe Microcrystalline Cellulose Industry Revenue (million), by Process 2025 & 2033

- Figure 21: Europe Microcrystalline Cellulose Industry Revenue Share (%), by Process 2025 & 2033

- Figure 22: Europe Microcrystalline Cellulose Industry Revenue (million), by End-User Industry 2025 & 2033

- Figure 23: Europe Microcrystalline Cellulose Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Europe Microcrystalline Cellulose Industry Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Microcrystalline Cellulose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Microcrystalline Cellulose Industry Revenue (million), by Source 2025 & 2033

- Figure 27: South America Microcrystalline Cellulose Industry Revenue Share (%), by Source 2025 & 2033

- Figure 28: South America Microcrystalline Cellulose Industry Revenue (million), by Process 2025 & 2033

- Figure 29: South America Microcrystalline Cellulose Industry Revenue Share (%), by Process 2025 & 2033

- Figure 30: South America Microcrystalline Cellulose Industry Revenue (million), by End-User Industry 2025 & 2033

- Figure 31: South America Microcrystalline Cellulose Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: South America Microcrystalline Cellulose Industry Revenue (million), by Country 2025 & 2033

- Figure 33: South America Microcrystalline Cellulose Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Microcrystalline Cellulose Industry Revenue (million), by Source 2025 & 2033

- Figure 35: Middle East and Africa Microcrystalline Cellulose Industry Revenue Share (%), by Source 2025 & 2033

- Figure 36: Middle East and Africa Microcrystalline Cellulose Industry Revenue (million), by Process 2025 & 2033

- Figure 37: Middle East and Africa Microcrystalline Cellulose Industry Revenue Share (%), by Process 2025 & 2033

- Figure 38: Middle East and Africa Microcrystalline Cellulose Industry Revenue (million), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Microcrystalline Cellulose Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Microcrystalline Cellulose Industry Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Microcrystalline Cellulose Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Source 2020 & 2033

- Table 2: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Process 2020 & 2033

- Table 3: Global Microcrystalline Cellulose Industry Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Source 2020 & 2033

- Table 6: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Process 2020 & 2033

- Table 7: Global Microcrystalline Cellulose Industry Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Source 2020 & 2033

- Table 15: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Process 2020 & 2033

- Table 16: Global Microcrystalline Cellulose Industry Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 17: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Country 2020 & 2033

- Table 18: United States Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Canada Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Source 2020 & 2033

- Table 22: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Process 2020 & 2033

- Table 23: Global Microcrystalline Cellulose Industry Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 24: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Country 2020 & 2033

- Table 25: Germany Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: France Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Italy Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Source 2020 & 2033

- Table 31: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Process 2020 & 2033

- Table 32: Global Microcrystalline Cellulose Industry Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 33: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Country 2020 & 2033

- Table 34: Brazil Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Source 2020 & 2033

- Table 38: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Process 2020 & 2033

- Table 39: Global Microcrystalline Cellulose Industry Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 40: Global Microcrystalline Cellulose Industry Revenue million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Microcrystalline Cellulose Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Microcrystalline Cellulose Industry?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Microcrystalline Cellulose Industry?

Key companies in the market include Blanver, DFE Pharma, Asahi Kasei Corporation, Chemfield Cellulose, MINGTAI CHEMICAL CO LTD, JUKU ORCHEM PVT LTD, Sigachi Industries Limited, J RETTENMAIER & SÖHNE GmbH + Co KG, DuPont, GUJARAT MICROWAX PVT LTD, VWR International LLC (Avantor Inc )*List Not Exhaustive, Accent Microcell, Huzhou City Linghu Xinwang Chemical Co Ltd.

3. What are the main segments of the Microcrystalline Cellulose Industry?

The market segments include Source, Process, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1255.1 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Microcrystalline Cellulose from Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Increasing Demand from Pharmaceutical Industry.

7. Are there any restraints impacting market growth?

High Manufacturing and Production Cost.

8. Can you provide examples of recent developments in the market?

November 2022: DFE Pharma partnered with Azelis, which is a service provider in the specialty chemicals and food ingredients industry, for the distribution of its products in the EMEA region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Microcrystalline Cellulose Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Microcrystalline Cellulose Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Microcrystalline Cellulose Industry?

To stay informed about further developments, trends, and reports in the Microcrystalline Cellulose Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence