Key Insights

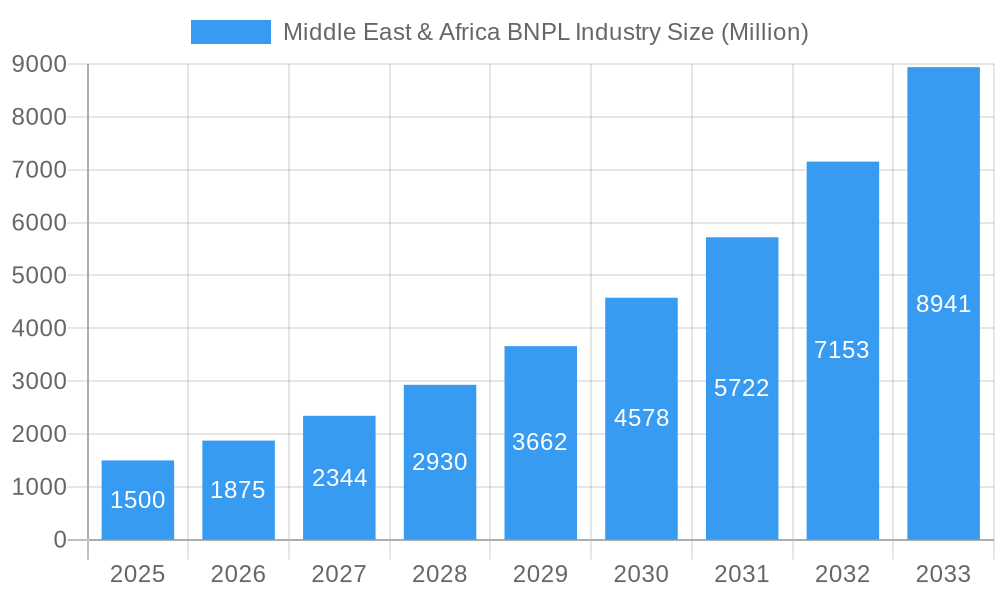

The Middle East and Africa (MEA) Buy Now, Pay Later (BNPL) market is poised for significant expansion, driven by increasing smartphone adoption, a burgeoning e-commerce sector, and a young, tech-oriented demographic. The market, valued at approximately $44858.18 million in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 20.7% between 2025 and 2033. This robust growth is underpinned by evolving consumer demand for flexible payment solutions, the rise of innovative BNPL platforms offering tailored services, and favorable regulatory frameworks in key MEA markets. Strategic alliances between BNPL providers and merchants are also broadening service accessibility, further accelerating adoption. Despite potential regulatory complexities and consumer debt management considerations, the MEA BNPL market presents substantial opportunities across e-commerce, travel, and healthcare segments.

Middle East & Africa BNPL Industry Market Size (In Billion)

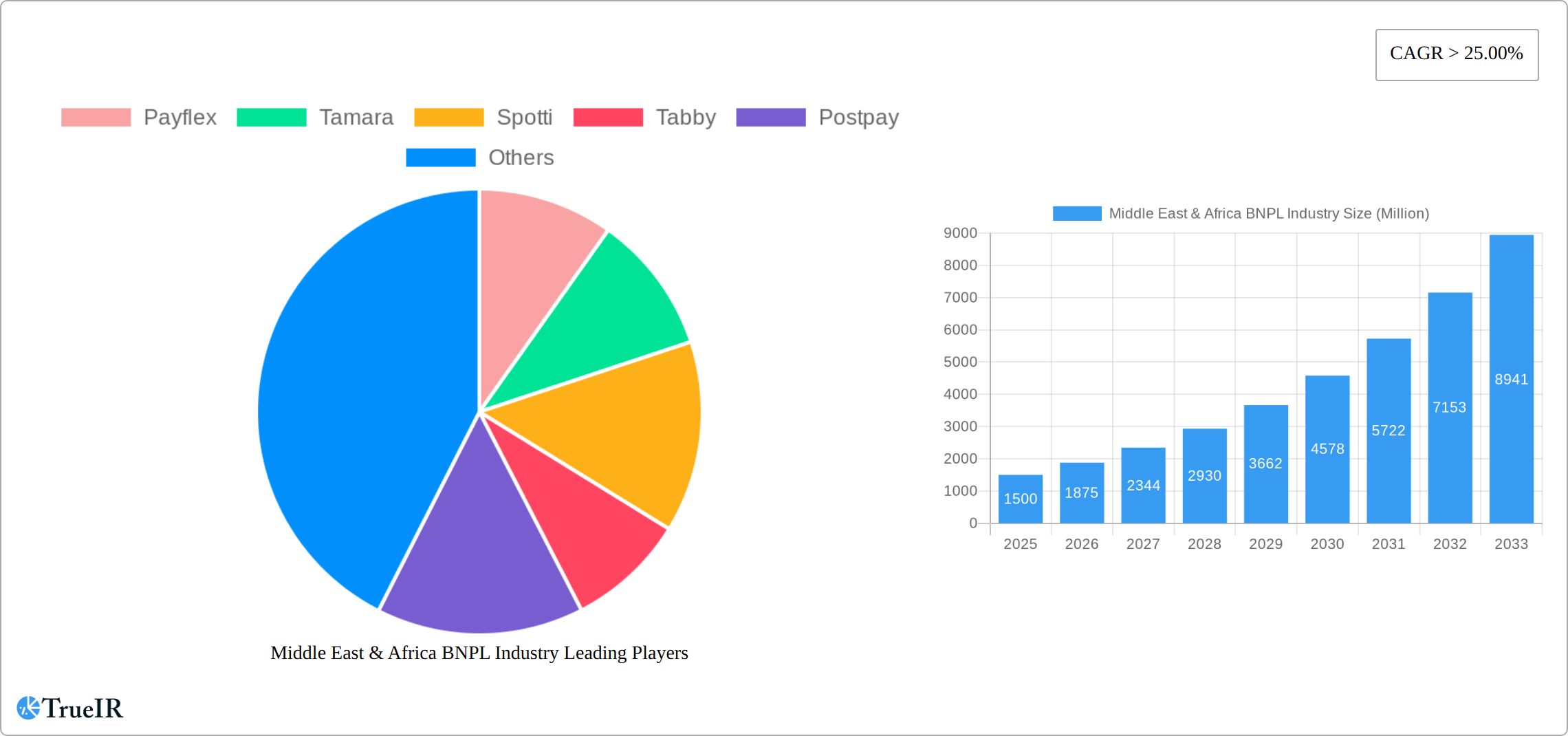

The competitive environment is characterized by the presence of global leaders such as Payflex and Tamara, alongside prominent regional players including Spotti, Tabby, and Lipa Later. Differentiation strategies emphasize adaptable repayment terms, competitive interest rates or interest-free periods, and seamless integration with e-commerce platforms. Market success hinges on effective risk management, financial sustainability, and agility in responding to shifting consumer preferences and technological advancements. Future growth will be shaped by enhanced financial inclusion, rising digital literacy, and the development of advanced risk assessment tools. The coming decade is expected to witness considerable consolidation and innovation within the MEA BNPL sector as companies strive to capture its considerable growth potential.

Middle East & Africa BNPL Industry Company Market Share

Middle East & Africa BNPL Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning Buy Now, Pay Later (BNPL) industry in the Middle East and Africa, covering the period 2019-2033. It offers invaluable insights into market structure, competitive dynamics, growth drivers, challenges, and future prospects, making it an essential resource for investors, businesses, and industry stakeholders. The report leverages extensive data analysis and expert insights to deliver a clear understanding of this rapidly evolving landscape. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024.

Middle East & Africa BNPL Industry Market Structure & Competitive Landscape

The Middle East & Africa Buy Now, Pay Later (BNPL) market is a dynamic and rapidly evolving landscape, characterized by a blend of established international players, regional fintech disruptors, and emerging startups. Market concentration, while moderate in 2025 (with a Herfindahl-Hirschman Index (HHI) estimated at [Insert HHI value]), suggests significant opportunities for both consolidation and expansion. Innovation is a key differentiator, with companies continuously developing new features, such as embedded finance integrations, and expanding into related financial services like micro-lending and digital wallets. Regulatory landscapes vary considerably across the region, presenting both challenges and opportunities, and impacting the speed and manner of market development. BNPL faces competitive pressures from traditional payment methods such as credit cards and installment plans, yet its inherent convenience and accessibility are fueling substantial market share gains, particularly amongst younger demographics and higher income segments. Mergers and acquisitions (M&A) activity has been notable over the past five years (2019-2024), with [Insert Number] transactions recorded, primarily involving smaller players seeking to enhance their technological capabilities, geographic reach, or customer base. This trend is poised to continue, with larger players potentially strategically acquiring smaller, specialized businesses to integrate complementary technology or access underserved customer segments.

Middle East & Africa BNPL Industry Market Trends & Opportunities

The Middle East & Africa BNPL market is experiencing phenomenal growth, with the market size projected to reach USD xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including increasing smartphone penetration, rising e-commerce adoption, and a growing preference for flexible payment options among consumers. Technological advancements, such as improved risk assessment models and AI-powered fraud detection systems, are further accelerating market expansion. Consumer preferences are shifting towards seamless, digital-first experiences, favoring BNPL platforms that offer user-friendly interfaces and a wide range of integration with e-commerce merchants. Competitive dynamics are intensifying, with players focusing on strategic partnerships, product differentiation, and geographic expansion to gain a larger market share. Market penetration rates are expected to increase significantly in the coming years, driven by increasing financial inclusion and broader awareness of BNPL services.

Dominant Markets & Segments in Middle East & Africa BNPL Industry

While the entire region is experiencing robust growth, certain markets and segments stand out as particularly dominant.

Leading Regions: The UAE, Egypt, Kenya, and South Africa are currently leading the market, driven by their comparatively developed e-commerce sectors and higher smartphone penetration rates. Nigeria is also showing significant growth potential, though regulatory challenges remain.

Key Growth Drivers:

- Rapid growth of e-commerce.

- Increasing smartphone and internet penetration.

- Growing adoption of digital financial services.

- Favorable demographics (young, tech-savvy population).

- Government initiatives promoting financial inclusion.

- Relatively underdeveloped traditional credit infrastructure.

The dominance of these markets is further solidified by their supportive regulatory environments and established financial infrastructure. However, other nations are catching up quickly, presenting significant untapped potential for expansion. The increasing demand for convenient payment methods across various sectors, such as retail, travel, and healthcare, is further boosting the growth of specific market segments within this region. The focus on developing innovative financial products that cater to the evolving needs of consumers in these diverse markets is also contributing to the growth of the BNPL market.

Middle East & Africa BNPL Industry Product Analysis

BNPL offerings in the Middle East and Africa are becoming increasingly sophisticated, leveraging advanced technologies such as artificial intelligence (AI) and machine learning (ML) to refine risk assessment, enhance fraud detection, and personalize the customer experience. The seamless integration of BNPL solutions with popular e-commerce platforms and mobile wallets has significantly improved accessibility and user adoption. Competitive advantages increasingly hinge on factors such as rapid onboarding processes, flexible and customizable repayment options, superior customer support, and strong data security protocols. The industry is witnessing a strong trend toward product personalization, with providers tailoring solutions to meet the diverse needs of specific customer segments. This includes offering customized repayment plans, flexible credit limits, loyalty programs, and tiered reward systems. The successful integration of BNPL into broader digital ecosystems, combined with robust risk management, is essential for long-term success in this competitive and rapidly evolving sector. Furthermore, the rise of embedded finance is creating opportunities for BNPL solutions to be integrated directly into various non-financial platforms, broadening their reach and impact.

Key Drivers, Barriers & Challenges in Middle East & Africa BNPL Industry

Key Drivers:

- Exponential E-commerce Growth: The burgeoning online retail sector in the region fuels the consistent demand for convenient and accessible payment methods.

- Ubiquitous Smartphone Penetration: High rates of mobile phone adoption create a large and readily accessible market for BNPL services.

- Government-led Financial Inclusion Initiatives: Government support and investment in digital financial infrastructure are driving wider adoption of digital financial tools and services.

- Technological Advancements in Risk Management: Ongoing advancements in AI, ML, and alternative credit scoring are mitigating risks and expanding access to credit for a larger population.

- Growing Middle Class and Disposable Income: A rising middle class with increasing disposable income fuels greater demand for consumer goods and services, increasing the market for BNPL.

Key Challenges:

- Regulatory Fragmentation and Uncertainty: Varying regulations across different countries create compliance complexities and hinder standardized operations.

- High Default Rates and Credit Risk Management: The lack of comprehensive credit history and scoring systems in some regions poses significant challenges in managing default risks.

- Intense Competition from Established Payment Methods: The presence of traditional players like credit card companies and existing installment plans creates constant pressure on market share.

- Supply Chain Vulnerabilities and Merchant Network Reliance: Disruptions to merchant networks or supply chains can impact transaction success and customer experience. Losses related to these issues were estimated at USD [Insert Value] Million in 2024.

- Data Privacy and Security Concerns: Growing concerns about data privacy and security necessitate robust security measures and compliance with regulations.

Growth Drivers in the Middle East & Africa BNPL Industry Market

The key drivers remain the burgeoning e-commerce sector, increasing smartphone penetration, and a growing preference for flexible payment options. Government initiatives promoting financial inclusion and technological advancements in risk assessment and fraud prevention are also significant contributors to market growth. The rapid expansion of digital financial services and the rising adoption of mobile wallets create a fertile ground for the growth of the BNPL sector in this region.

Challenges Impacting Middle East & Africa BNPL Industry Growth

The main challenges impacting the growth of the Middle East and Africa BNPL industry are multifaceted and interconnected. Regulatory uncertainty across diverse markets, the inherent risk of high default rates, competition from deeply entrenched traditional payment systems, and potential disruptions in merchant networks or supply chains all significantly impact customer acquisition, operational efficiency, and overall profitability. Addressing these challenges effectively requires sophisticated risk management strategies, strategic partnerships with merchants and financial institutions, and a proactive approach to regulatory compliance. Overcoming these obstacles will be key to unlocking the considerable growth potential of this market.

Significant Middle East & Africa BNPL Industry Industry Milestones

- January 2022: Lipa Later secures USD 12 Million in pre-series A funding, fueling expansion across Africa.

- February 2022: Postpay secures debt financing from Commercial Bank of Dubai, enhancing its product portfolio.

These milestones highlight the growing investor confidence in the sector and the increasing collaboration between fintechs and traditional financial institutions.

Future Outlook for Middle East & Africa BNPL Industry Market

The future of the Middle East and Africa BNPL industry remains exceptionally promising, driven by sustained e-commerce growth, widespread smartphone penetration, accelerating financial inclusion, and a growing young, digitally native population. Strategic partnerships with merchants and financial institutions, enhanced risk management through technological advancements, and innovative product development to meet diverse customer needs will be essential for sustained growth and market share capture. The market is poised for substantial expansion, offering significant opportunities for both established players and new entrants to capitalize on the evolving landscape. The focus on developing tailored and personalized financial products that address the specific requirements of consumers across various market segments will play a decisive role in shaping the industry’s future trajectory.

Middle East & Africa BNPL Industry Segmentation

-

1. Channel

- 1.1. Online

- 1.2. POS

-

2. Enterprises Size

- 2.1. Large Enterprises

- 2.2. Small & Medium Enterprises

-

3. End User

- 3.1. Consumer Electronics

- 3.2. Fashion & Garments

- 3.3. Healthcare

- 3.4. Leisure & Entertainment

- 3.5. Retail

- 3.6. Others

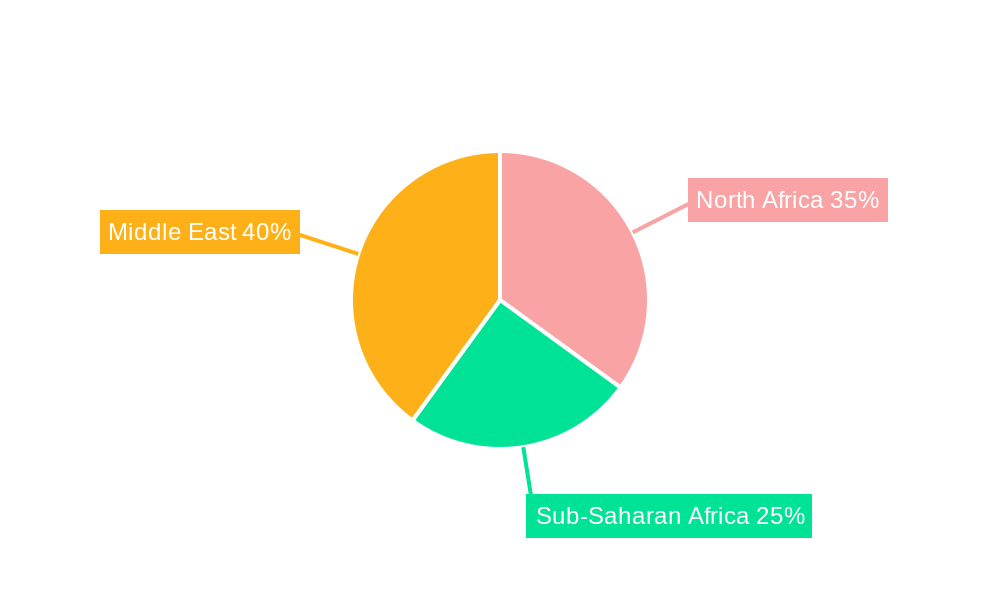

Middle East & Africa BNPL Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East & Africa BNPL Industry Regional Market Share

Geographic Coverage of Middle East & Africa BNPL Industry

Middle East & Africa BNPL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Growth in E-commerce in Middle East and Africa is increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa BNPL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. POS

- 5.2. Market Analysis, Insights and Forecast - by Enterprises Size

- 5.2.1. Large Enterprises

- 5.2.2. Small & Medium Enterprises

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Consumer Electronics

- 5.3.2. Fashion & Garments

- 5.3.3. Healthcare

- 5.3.4. Leisure & Entertainment

- 5.3.5. Retail

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Payflex

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tamara

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spotti

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tabby

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Postpay

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shahry

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lipa Later

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sympl

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chari

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ThankUCash*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Payflex

List of Figures

- Figure 1: Middle East & Africa BNPL Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East & Africa BNPL Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East & Africa BNPL Industry Revenue million Forecast, by Channel 2020 & 2033

- Table 2: Middle East & Africa BNPL Industry Revenue million Forecast, by Enterprises Size 2020 & 2033

- Table 3: Middle East & Africa BNPL Industry Revenue million Forecast, by End User 2020 & 2033

- Table 4: Middle East & Africa BNPL Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Middle East & Africa BNPL Industry Revenue million Forecast, by Channel 2020 & 2033

- Table 6: Middle East & Africa BNPL Industry Revenue million Forecast, by Enterprises Size 2020 & 2033

- Table 7: Middle East & Africa BNPL Industry Revenue million Forecast, by End User 2020 & 2033

- Table 8: Middle East & Africa BNPL Industry Revenue million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East & Africa BNPL Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa BNPL Industry?

The projected CAGR is approximately 20.7%.

2. Which companies are prominent players in the Middle East & Africa BNPL Industry?

Key companies in the market include Payflex, Tamara, Spotti, Tabby, Postpay, Shahry, Lipa Later, Sympl, Chari, ThankUCash*List Not Exhaustive.

3. What are the main segments of the Middle East & Africa BNPL Industry?

The market segments include Channel, Enterprises Size, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 44858.18 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Growth in E-commerce in Middle East and Africa is increasing.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022 - Lipa Later, a Kenyan BNPL startup, has secured USD 12 million in pre-series A funding to grow across Africa. This new capital, according to the firm, would allow them to supply their buy-now-pay-later services to their current pipeline of users, strengthen their presence in current markets (Kenya, Uganda, and Rwanda), and expand into new markets such as Nigeria, South Africa, Ghana, and Tanzania.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa BNPL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa BNPL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa BNPL Industry?

To stay informed about further developments, trends, and reports in the Middle East & Africa BNPL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence