Key Insights

The Middle East and Africa (MEA) bunker fuel market is projected to experience significant growth, reaching $172.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. This expansion is fueled by increasing global trade and shipping volumes within the MEA region, a critical nexus for international maritime routes. The implementation of International Maritime Organization (IMO) regulations, such as the IMO 2020 sulfur cap, is accelerating the adoption of cleaner fuels like Very-Low Sulfur Fuel Oil (VLSFO) and Liquefied Natural Gas (LNG). VLSFO is a preferred choice due to its cost-effective compliance for shipowners. Enhanced bunkering infrastructure and port development across MEA nations are further bolstering market expansion.

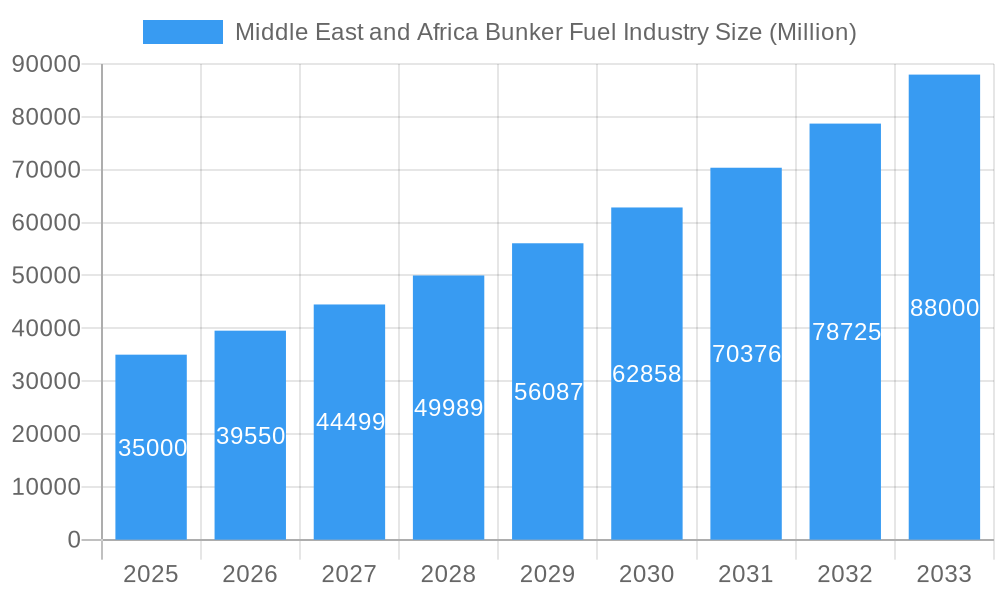

Middle East and Africa Bunker Fuel Industry Market Size (In Billion)

Key market drivers include robust economic growth in MEA countries, leading to higher import/export activities and consequently, increased maritime traffic. Fleet modernization and new vessel construction also contribute to sustained fuel demand. However, market growth is tempered by challenges such as fluctuating crude oil prices, which impact operational costs, and geopolitical instability that can disrupt supply chains. While environmental regulations promote cleaner fuel adoption, compliance costs can be substantial for older fleets. High Sulfur Fuel Oil (HSFO) is being superseded by VLSFO and Marine Gas Oil (MGO). LNG is emerging as a promising future fuel, supported by infrastructure investments and growing environmental awareness. Container ships, tankers, and bulk carriers are the primary consumers of bunker fuel. The United Arab Emirates and Saudi Arabia are expected to lead the market as major bunkering hubs, leveraging their advanced port facilities and strategic maritime positioning.

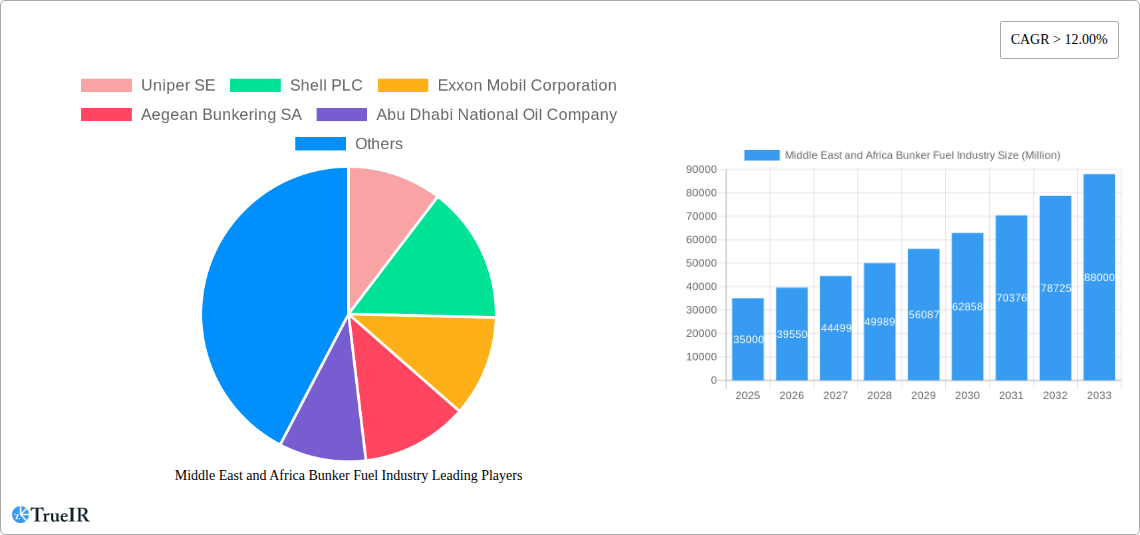

Middle East and Africa Bunker Fuel Industry Company Market Share

Middle East and Africa Bunker Fuel Industry: Comprehensive Market Analysis and Future Projections (2019-2033)

This in-depth report offers a dynamic and SEO-optimized analysis of the Middle East and Africa (MEA) bunker fuel industry, providing critical insights for stakeholders navigating this evolving market. Leveraging high-volume keywords such as "MEA bunker fuel," "marine fuel," "LNG bunkering," "low sulfur fuel oil," and "shipping industry," this report targets industry professionals, investors, and policymakers. Our comprehensive study, spanning from 2019 to 2033 with a base and estimated year of 2025, meticulously dissects market structure, competitive dynamics, emerging trends, and future outlook.

Middle East and Africa Bunker Fuel Industry Market Structure & Competitive Landscape

The Middle East and Africa bunker fuel market exhibits a moderately concentrated structure, characterized by the significant presence of international oil majors and prominent regional players. Key innovation drivers stem from the increasing demand for environmentally compliant fuels, such as Very-Low Sulfur Fuel Oil (VLSFO) and Liquefied Natural Gas (LNG), spurred by stringent IMO regulations. Regulatory impacts are profound, influencing fuel choices and port infrastructure development. Product substitutes are emerging, with biofuels and methanol gaining traction as alternative marine fuels, though their widespread adoption in MEA is still in early stages. End-user segmentation is driven by vessel type, with Containers and Tankers representing the largest consumers due to high voyage frequencies and capacities. Mergers and acquisitions (M&A) activity, while not as prolific as in some other energy sectors, are strategic, aimed at expanding geographical reach, securing supply chains, and enhancing service offerings. For instance, the integration of bunkering operations with broader maritime logistics services is a growing trend. The market’s competitive advantage hinges on reliable supply, competitive pricing, and adherence to evolving environmental standards.

Middle East and Africa Bunker Fuel Industry Market Trends & Opportunities

The Middle East and Africa bunker fuel industry is poised for significant growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This upward trajectory is fundamentally driven by the robust expansion of global trade routes that traverse the region, particularly along the Suez Canal and key shipping lanes in the Arabian Gulf and the Red Sea. The burgeoning economic development across many African nations is further stimulating maritime activity, leading to increased demand for bunker fuels across various vessel types.

Technological shifts are a dominant force reshaping the industry. The global push towards decarbonization is accelerating the adoption of cleaner fuel alternatives. While High Sulfur Fuel Oil (HSFO) still holds a considerable market share, especially in regions with less stringent enforcement, the demand for Very-Low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO) is escalating rapidly to comply with International Maritime Organization (IMO) 2020 regulations and subsequent amendments. Furthermore, the long-term trend points towards the increased adoption of Liquefied Natural Gas (LNG) as a viable alternative, with several MEA countries investing in LNG bunkering infrastructure to cater to a growing fleet of LNG-powered vessels. This presents a significant opportunity for early movers in developing and expanding LNG supply capabilities.

Consumer preferences are evolving in tandem with regulatory pressures and corporate sustainability goals. Shipowners and operators are increasingly prioritizing fuel suppliers that can guarantee consistent availability of compliant fuels, alongside competitive pricing and robust logistical support. The demand for integrated services, including fuel management, risk assessment, and potentially financing solutions, is also on the rise.

Competitive dynamics are intensifying. Established international oil companies and independent bunker suppliers are actively vying for market share, often through strategic partnerships, port expansions, and diversification into alternative fuels. The recent industry developments highlight a strategic focus on port infrastructure development and economic zone creation, which indirectly supports and enhances bunker fuel demand. For instance, the development of new ports and logistical hubs in countries like Morocco and Sudan signifies a long-term commitment to expanding maritime trade, which will invariably translate into increased bunker fuel consumption. The geographical dispersion of opportunities within the MEA region, from the established markets of the United Arab Emirates and Saudi Arabia to the rapidly developing coastlines of Africa, offers diverse avenues for growth and market penetration.

Dominant Markets & Segments in Middle East and Africa Bunker Fuel Industry

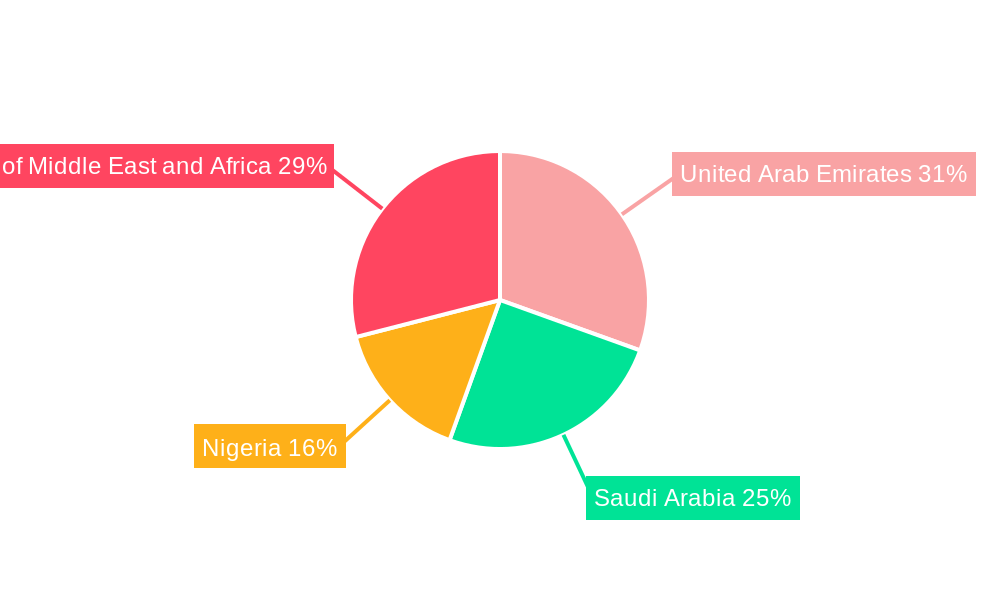

The Middle East and Africa bunker fuel industry is characterized by distinct geographical and fuel type dominance, driven by established trade routes, port infrastructure, and regulatory landscapes.

Dominant Geographies:

- The United Arab Emirates (UAE): This nation stands as a preeminent hub for bunkering in the Middle East, leveraging its strategic location along major shipping lanes and its world-class port facilities, particularly in Dubai and Fujairah. The UAE benefits from sophisticated logistics, established supply chains, and a proactive approach to adopting cleaner fuel standards. Its role as a major trading and refining center further bolsters its bunkering capabilities.

- Saudi Arabia: As another significant player in the Middle East, Saudi Arabia's bunker fuel industry is bolstered by its extensive coastline along the Red Sea and the Arabian Gulf, its substantial oil production capacity, and ongoing investments in port modernization and industrial development. Ports like Jeddah and Ras Tanura are crucial for bunkering operations serving regional and international trade.

- Rest of the Middle-East and Africa: This vast and diverse segment encompasses a multitude of markets with varying levels of maturity. However, countries with strategic port locations and increasing trade volumes, such as South Africa (Durban), Egypt (Suez Canal ports), Kenya (Mombasa), and Senegal (Dakar), are emerging as significant bunkering centers, driven by both regional and intercontinental shipping. The growth in these regions is often linked to infrastructure development projects and expanding economic ties.

Dominant Fuel Types:

- Very-Low Sulfur Fuel Oil (VLSFO): This fuel type currently dominates the MEA bunker market due to the global regulatory mandate for low sulfur content in marine fuels. The demand for VLSFO is directly driven by IMO 2020 compliance requirements, making it the primary choice for most vessel operators seeking to avoid penalties.

- Marine Gas Oil (MGO): MGO is a high-quality distillate fuel with very low sulfur content, often used by vessels requiring flexibility and for operations in Emission Control Areas (ECAs) or for specific engine types. Its demand is strong, particularly for smaller vessels, ferries, and as a complement to VLSFO.

- High Sulfur Fuel Oil (HSFO): While its market share is declining globally, HSFO remains relevant in certain parts of the MEA region, particularly where regulatory enforcement is less stringent or for vessels equipped with exhaust gas cleaning systems (scrubbers). However, its long-term future in the mainstream market is uncertain.

Dominant Vessel Types:

- Containers: The burgeoning container trade, facilitated by the region's expanding port infrastructure and its role as a global transshipment hub, makes container vessels a primary consumer of bunker fuel. Their frequent voyages and large fuel capacities contribute significantly to overall demand.

- Tankers: With the Middle East being a major producer and exporter of oil and gas, tanker vessels, including crude oil tankers, product tankers, and chemical tankers, are significant consumers of bunker fuel as they transport vital commodities across global routes.

Key Growth Drivers:

- Infrastructure Development: Continuous investment in port expansion, deepening of channels, and modernization of bunkering facilities across the UAE, Saudi Arabia, Egypt, and key African nations.

- Regulatory Compliance: The imperative to adhere to IMO sulfur regulations drives the demand for VLSFO and MGO, creating opportunities for suppliers of these compliant fuels.

- Trade Route Significance: The MEA region's strategic location as a nexus for global maritime trade routes, including the Suez Canal and the Arabian Gulf, ensures a steady flow of vessels requiring bunkering services.

- Economic Growth and Diversification: Expanding economies in the region are leading to increased industrial output and trade, thereby boosting maritime traffic and bunker fuel demand.

Middle East and Africa Bunker Fuel Industry Product Analysis

The MEA bunker fuel industry is witnessing a significant evolution driven by product innovation and the increasing demand for environmentally compliant fuels. While traditional fuel oils remain prevalent, the market is shifting towards Very-Low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO) to meet stringent regulatory requirements. Key product innovations focus on enhancing fuel quality, reducing emissions, and improving combustion efficiency. For instance, advanced additive packages are being incorporated into VLSFO to ensure engine compatibility and minimize operational issues. The emerging interest in Liquefied Natural Gas (LNG) as a bunker fuel represents a substantial technological leap, offering a cleaner alternative with significant reductions in SOx and NOx emissions. Competitive advantages in this segment are increasingly tied to the ability to supply a reliable and consistent stream of compliant fuels, supported by robust logistical networks and competitive pricing.

Key Drivers, Barriers & Challenges in Middle East and Africa Bunker Fuel Industry

Key Drivers:

The Middle East and Africa bunker fuel industry is propelled by several powerful drivers. Technological advancements in fuel production and distribution, coupled with the increasing adoption of cleaner marine fuels like VLSFO and LNG, are pivotal. Economic growth across the region, leading to expanded trade volumes and maritime traffic, directly fuels demand. Furthermore, supportive government policies aimed at developing port infrastructure and establishing the region as a global shipping hub play a crucial role. The strategic importance of major shipping lanes traversing the MEA, such as the Suez Canal, ensures a consistent demand for bunkering services.

Barriers & Challenges:

Despite robust growth prospects, the industry faces significant challenges. Regulatory complexities and inconsistent enforcement across different MEA countries can create an uneven playing field. Supply chain disruptions, exacerbated by geopolitical factors and infrastructure limitations in certain sub-regions, pose a constant threat to reliable delivery. Price volatility of crude oil and refined products directly impacts bunker fuel costs, creating uncertainty for both suppliers and consumers. Intense competitive pressures from established global players and the emergence of new market entrants also necessitate strategic maneuvering. The high capital investment required for developing LNG bunkering infrastructure remains a considerable barrier to its widespread adoption.

Growth Drivers in the Middle East and Africa Bunker Fuel Industry Market

The Middle East and Africa bunker fuel market is experiencing robust growth fueled by a confluence of factors. Technological advancements, particularly in the development and distribution of Very-Low Sulfur Fuel Oil (VLSFO) and the nascent but growing adoption of Liquefied Natural Gas (LNG), are critical. Economically, the expansion of international trade and the region's increasing role as a global logistics hub are driving higher shipping volumes. Supportive regulatory frameworks aimed at decarbonization and the modernization of port infrastructure further encourage investment and operational efficiency. Specific examples include the UAE's continuous investment in its port capacities and Saudi Arabia's Vision 2030 initiatives that enhance its maritime sector.

Challenges Impacting Middle East and Africa Bunker Fuel Industry Growth

The growth trajectory of the Middle East and Africa bunker fuel industry is tempered by several significant challenges. Regulatory complexities and inconsistent enforcement across diverse national frameworks create operational hurdles and potential compliance risks. Supply chain vulnerabilities, including limited storage facilities and logistical bottlenecks in certain African nations, can lead to delivery delays and increased costs. Price volatility of crude oil and its derivatives directly impacts bunker fuel pricing, creating financial uncertainty for market participants. Furthermore, intense competitive pressures from established global players and the high initial investment required for emerging technologies like LNG bunkering present substantial barriers to entry and market expansion.

Key Players Shaping the Middle East and Africa Bunker Fuel Industry Market

- Uniper SE

- Shell PLC

- Exxon Mobil Corporation

- Aegean Bunkering SA

- Abu Dhabi National Oil Company

- Gulf Agency Company Ltd

- Chevron Corporation

- TotalEnergies SE

Significant Middle East and Africa Bunker Fuel Industry Industry Milestones

- May 2022: The European Bank for Reconstruction and Development (EBRD) provided a USD 41.6 million loan to Agence Nationale des Ports (ANP) for the development of Moroccan ports. This was supplemented by an investment grant of USD 5.7 million from the Global Environment Facility (GEF), signaling increased investment in regional port infrastructure crucial for bunkering.

- December 2022: Sudan signed a USD 6 billion agreement with a consortium led by the United Arab Emirates' AD Ports Group and Invictus Investment to develop a new port and economic zone in the Red Sea. This landmark deal highlights significant strategic investment in new maritime gateways, poised to influence future bunkering demand and supply in the region.

Future Outlook for Middle East and Africa Bunker Fuel Industry Market

The future outlook for the Middle East and Africa bunker fuel industry is characterized by sustained growth and transformative shifts. The continued expansion of global trade, coupled with the region's strategic importance as a maritime crossroads, will drive consistent demand for bunker fuels. The increasing adoption of VLSFO and MGO will remain dominant, while the long-term transition towards alternative fuels, particularly LNG, presents substantial growth catalysts. Investments in port infrastructure and the development of new bunkering hubs, especially in emerging African markets, will unlock significant market potential. Strategic opportunities lie in offering integrated fuel solutions, embracing digitalization for enhanced supply chain efficiency, and building robust partnerships to navigate the evolving regulatory and technological landscape. The MEA region is poised to solidify its position as a critical global bunkering market in the coming years.

Middle East and Africa Bunker Fuel Industry Segmentation

-

1. Fuel Type

- 1.1. High Sulfur Fuel Oil (HSFO)

- 1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 1.3. Marine Gas Oil (MGO)

- 1.4. Liquefied Natural Gas (LNG)

- 1.5. Other Fuel Types

-

2. Vessel Type

- 2.1. Containers

- 2.2. Tankers

- 2.3. General Cargo

- 2.4. Bulk Carrier

- 2.5. Other Vessel Types

-

3. Geography

- 3.1. The United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. Nigeria

- 3.4. Rest of the Middle-East and Africa

Middle East and Africa Bunker Fuel Industry Segmentation By Geography

- 1. The United Arab Emirates

- 2. Saudi Arabia

- 3. Nigeria

- 4. Rest of the Middle East and Africa

Middle East and Africa Bunker Fuel Industry Regional Market Share

Geographic Coverage of Middle East and Africa Bunker Fuel Industry

Middle East and Africa Bunker Fuel Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Penetration of Other Energy Sources

- 3.4. Market Trends

- 3.4.1. VLSFO to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 5.1.1. High Sulfur Fuel Oil (HSFO)

- 5.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 5.1.3. Marine Gas Oil (MGO)

- 5.1.4. Liquefied Natural Gas (LNG)

- 5.1.5. Other Fuel Types

- 5.2. Market Analysis, Insights and Forecast - by Vessel Type

- 5.2.1. Containers

- 5.2.2. Tankers

- 5.2.3. General Cargo

- 5.2.4. Bulk Carrier

- 5.2.5. Other Vessel Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. The United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. Nigeria

- 5.3.4. Rest of the Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. The United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. Nigeria

- 5.4.4. Rest of the Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6. The United Arab Emirates Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 6.1.1. High Sulfur Fuel Oil (HSFO)

- 6.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 6.1.3. Marine Gas Oil (MGO)

- 6.1.4. Liquefied Natural Gas (LNG)

- 6.1.5. Other Fuel Types

- 6.2. Market Analysis, Insights and Forecast - by Vessel Type

- 6.2.1. Containers

- 6.2.2. Tankers

- 6.2.3. General Cargo

- 6.2.4. Bulk Carrier

- 6.2.5. Other Vessel Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. The United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. Nigeria

- 6.3.4. Rest of the Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7. Saudi Arabia Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 7.1.1. High Sulfur Fuel Oil (HSFO)

- 7.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 7.1.3. Marine Gas Oil (MGO)

- 7.1.4. Liquefied Natural Gas (LNG)

- 7.1.5. Other Fuel Types

- 7.2. Market Analysis, Insights and Forecast - by Vessel Type

- 7.2.1. Containers

- 7.2.2. Tankers

- 7.2.3. General Cargo

- 7.2.4. Bulk Carrier

- 7.2.5. Other Vessel Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. The United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. Nigeria

- 7.3.4. Rest of the Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8. Nigeria Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 8.1.1. High Sulfur Fuel Oil (HSFO)

- 8.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 8.1.3. Marine Gas Oil (MGO)

- 8.1.4. Liquefied Natural Gas (LNG)

- 8.1.5. Other Fuel Types

- 8.2. Market Analysis, Insights and Forecast - by Vessel Type

- 8.2.1. Containers

- 8.2.2. Tankers

- 8.2.3. General Cargo

- 8.2.4. Bulk Carrier

- 8.2.5. Other Vessel Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. The United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. Nigeria

- 8.3.4. Rest of the Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9. Rest of the Middle East and Africa Middle East and Africa Bunker Fuel Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 9.1.1. High Sulfur Fuel Oil (HSFO)

- 9.1.2. Very-Low Sulfur Fuel Oil (VLSFO)

- 9.1.3. Marine Gas Oil (MGO)

- 9.1.4. Liquefied Natural Gas (LNG)

- 9.1.5. Other Fuel Types

- 9.2. Market Analysis, Insights and Forecast - by Vessel Type

- 9.2.1. Containers

- 9.2.2. Tankers

- 9.2.3. General Cargo

- 9.2.4. Bulk Carrier

- 9.2.5. Other Vessel Types

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. The United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. Nigeria

- 9.3.4. Rest of the Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Fuel Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Uniper SE

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shell PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Exxon Mobil Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aegean Bunkering SA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Abu Dhabi National Oil Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Gulf Agency Company Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Chevron Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 TotalEnergies SE

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Uniper SE

List of Figures

- Figure 1: Middle East and Africa Bunker Fuel Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Bunker Fuel Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 2: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 3: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 4: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 5: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 7: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Region 2020 & 2033

- Table 9: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 10: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 11: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 12: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 13: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 18: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 19: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 20: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 21: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 26: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 27: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 28: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 29: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 31: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2020 & 2033

- Table 33: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Fuel Type 2020 & 2033

- Table 34: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Fuel Type 2020 & 2033

- Table 35: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Vessel Type 2020 & 2033

- Table 36: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Vessel Type 2020 & 2033

- Table 37: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Bunker Fuel Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Bunker Fuel Industry Volume metric tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Bunker Fuel Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Middle East and Africa Bunker Fuel Industry?

Key companies in the market include Uniper SE, Shell PLC, Exxon Mobil Corporation, Aegean Bunkering SA, Abu Dhabi National Oil Company, Gulf Agency Company Ltd, Chevron Corporation, TotalEnergies SE.

3. What are the main segments of the Middle East and Africa Bunker Fuel Industry?

The market segments include Fuel Type, Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost of Solar PV Installations4.; Supportive Government Policies For Renewable Energy.

6. What are the notable trends driving market growth?

VLSFO to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Penetration of Other Energy Sources.

8. Can you provide examples of recent developments in the market?

May 2022: European Bank for Reconstruction and Development (EBRD) provided a USD 41.6 million loan to Agence Nationale des Ports (ANP) for the development of Moroccan ports. The loan will be supplemented by an investment grant of USD 5.7 million from the Global Environment Facility (GEF).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Bunker Fuel Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Bunker Fuel Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Bunker Fuel Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Bunker Fuel Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence