Key Insights

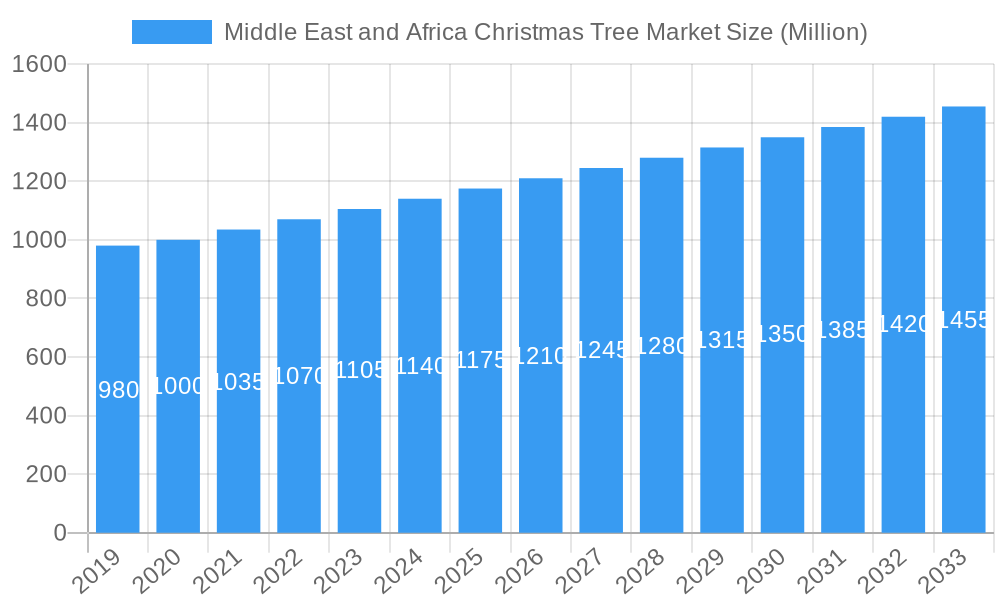

The Middle East and Africa Christmas Tree Market is projected for significant growth, estimated to reach $225 million by 2024, with a Compound Annual Growth Rate (CAGR) of 4.7% through 2032. This expansion is largely driven by increased upstream oil and gas exploration and production activities throughout the region. As Middle Eastern and African nations continue to depend on hydrocarbon resources, there's a consistent demand for advanced wellhead control systems, commonly referred to as Christmas trees. Investments in improving production efficiency and extending the operational life of existing oil and gas fields further support market momentum. The modernization of aging infrastructure and the adoption of new technologies for safer and more efficient extraction are also contributing to the market's positive outlook, indicating sustained demand for these essential oilfield components.

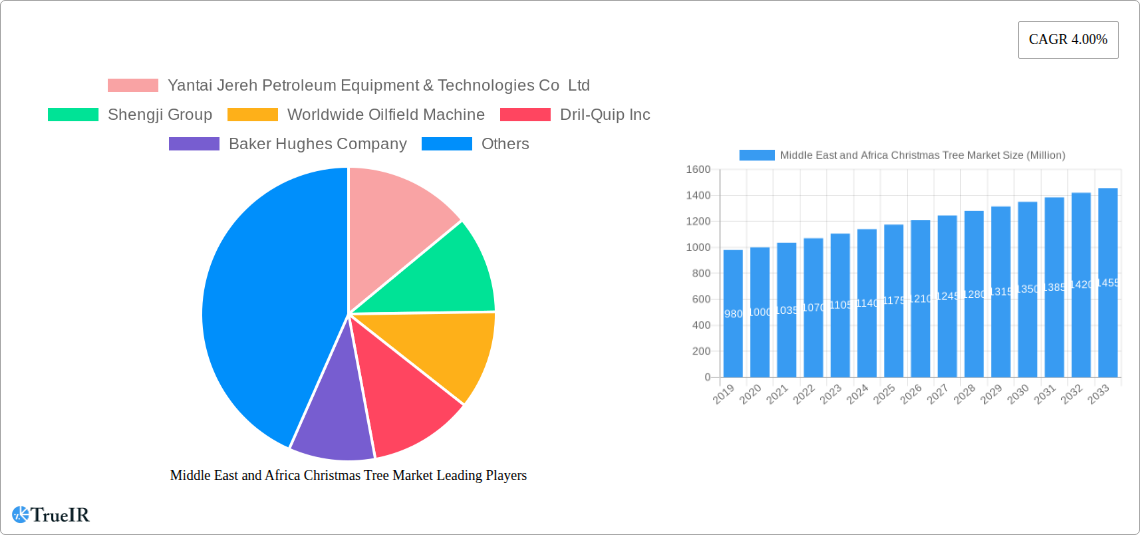

Middle East and Africa Christmas Tree Market Market Size (In Million)

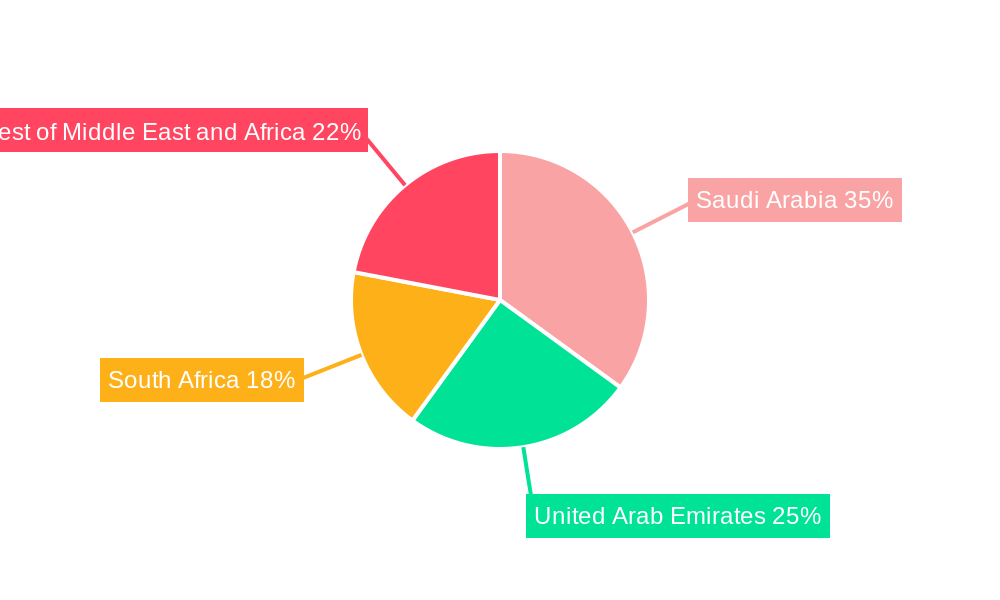

Market segmentation highlights key areas of growth. Horizontal Trees are expected to lead demand due to their adaptability across diverse well configurations. Geographically, Saudi Arabia is anticipated to hold the largest market share, driven by its prominent oil production status and ongoing investments in the oil and gas sector. The United Arab Emirates and South Africa are also significant contributors, with ongoing offshore and onshore projects, respectively. Emerging markets within the "Rest of Middle East and Africa" offer growth opportunities, fueled by new exploration activities and increased foreign investment. Leading companies such as Schlumberger, Baker Hughes, and TechnipFMC are actively involved, providing innovative solutions and advanced technologies. While challenges like strict environmental regulations and volatile crude oil prices exist, they are being addressed through technological advancements and strategic collaborations, demonstrating the market's resilience and adaptability.

Middle East and Africa Christmas Tree Market Company Market Share

Unveiling the Middle East and Africa Christmas Tree Market: A Comprehensive Analysis

This report offers an in-depth examination of the Middle East and Africa Christmas Tree Market, providing critical insights into its structure, trends, and future trajectory. Designed for industry stakeholders, this SEO-optimized report leverages high-volume keywords to enhance searchability and deliver actionable intelligence for strategic decision-making. Dive into a detailed analysis of market dynamics, key players, and growth opportunities within this vital sector.

Middle East and Africa Christmas Tree Market Market Structure & Competitive Landscape

The Middle East and Africa Christmas Tree Market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share, alongside a growing number of regional and specialized manufacturers. Innovation drivers are primarily fueled by the demand for enhanced subsea capabilities, increased operational efficiency, and robust safety features in exploration and production activities across the region. Regulatory impacts, while varying by country, are largely focused on environmental standards and local content development, influencing manufacturing and procurement strategies. Product substitutes are limited in the context of essential wellhead control, but advancements in digital integration and remote monitoring systems represent a form of technological substitution for certain traditional operational approaches. End-user segmentation is heavily skewed towards national oil companies and major international oil companies, reflecting the significant upstream investments in the region. Mergers and acquisitions (M&A) activity, while not overtly high in recent years, remains a potential avenue for consolidation and market expansion, particularly for companies seeking to bolster their technological portfolios or geographical reach. Industry developments are closely monitored, with a keen eye on evolving drilling technologies and the increasing focus on marginal field development. The overall market structure is characterized by a balance between established global suppliers and emerging regional capabilities, driven by the continuous need for reliable and advanced wellhead solutions in both conventional and unconventional resource plays.

Middle East and Africa Christmas Tree Market Market Trends & Opportunities

The Middle East and Africa Christmas Tree Market is poised for substantial growth, driven by a confluence of economic, technological, and geopolitical factors. The estimated market size for the base year 2025 is projected to reach XX Million, with a robust Compound Annual Growth Rate (CAGR) of XX% anticipated throughout the forecast period of 2025–2033. This expansion is intrinsically linked to the sustained high levels of oil and gas exploration and production activities across the Middle East and Africa. A key trend is the increasing demand for intelligent and digitally integrated Christmas tree systems. These advanced solutions offer enhanced monitoring, control, and data analytics capabilities, leading to improved operational efficiency, reduced downtime, and better reservoir management. The shift towards more complex and challenging offshore environments, including deepwater and ultra-deepwater fields, further fuels the need for sophisticated and reliable subsea Christmas trees. Technologically, advancements in materials science are enabling the development of lighter, more durable, and corrosion-resistant trees, crucial for harsh operating conditions.

Consumer preferences are evolving towards integrated solutions that encompass not only the Christmas tree itself but also associated services, such as installation, maintenance, and lifecycle support. This creates opportunities for service providers to offer comprehensive packages, fostering stronger customer relationships and recurring revenue streams. Competitive dynamics within the market are intensifying, with both established global players and emerging regional manufacturers vying for market share. Companies are focusing on product differentiation through technological innovation, cost-effectiveness, and localized manufacturing capabilities. The growing emphasis on environmental sustainability and stringent safety regulations also presents opportunities for companies that can offer solutions with a reduced environmental footprint and superior safety performance. The expansion of natural gas production, particularly in regions like the Eastern Mediterranean and North Africa, is another significant growth catalyst, driving demand for specialized gas well Christmas trees. Furthermore, the ongoing drive to maximize production from existing fields through enhanced oil recovery (EOR) techniques necessitates the deployment of advanced wellhead equipment, contributing to market expansion. The Middle East and Africa Christmas Tree Market is therefore a dynamic arena, offering significant potential for companies that can adapt to technological advancements, meet evolving customer needs, and navigate the region's unique operating landscape.

Dominant Markets & Segments in Middle East and Africa Christmas Tree Market

The Middle East and Africa Christmas Tree Market is characterized by distinct regional dominance and segment preferences, heavily influenced by the geographical distribution of hydrocarbon reserves and ongoing upstream development projects.

Dominant Regions and Countries:

- Saudi Arabia: This nation stands as a cornerstone of the Middle East and Africa Christmas Tree Market, driven by its colossal oil reserves and continuous investment in maintaining and expanding its production capacity. The sheer scale of its onshore and offshore operations necessitates a constant demand for a wide array of Christmas trees. Government initiatives aimed at maximizing oil production and exploring new fields further bolster its market leadership.

- United Arab Emirates (UAE): Another significant player, the UAE, particularly Abu Dhabi, boasts substantial offshore reserves and a strategic focus on both oil and gas production. The development of complex offshore fields, including those in deeper waters, fuels the demand for advanced horizontal and vertical Christmas tree solutions. The UAE's proactive approach to energy diversification also indirectly supports the broader oil and gas infrastructure, including wellhead equipment.

- Rest of Middle East and Africa: This expansive category encompasses several burgeoning markets. Countries like Qatar, with its massive natural gas reserves, are major consumers of specialized gas well Christmas trees. Neighboring nations in the Middle East continue to invest in their upstream sectors. In Africa, countries such as Nigeria, Angola, and Mozambique are critical for offshore oil and gas production, driving demand for subsea Christmas trees. Emerging markets in North Africa and East Africa also present growing opportunities.

Dominant Segments:

- Horizontal Tree: This segment is witnessing robust growth, particularly in offshore applications and in mature fields where space constraints or reservoir characteristics favor horizontal completions. The ability of horizontal trees to provide better wellbore access and drainage points makes them increasingly attractive for optimizing production. Technological advancements in horizontal drilling and completion techniques directly correlate with the rising demand for these specialized trees.

- Vertical Tree: While horizontal trees gain traction, vertical trees remain a vital component of the Middle East and Africa Christmas Tree Market. They are widely used in traditional onshore and offshore vertical well completions and continue to be the preferred choice for many applications due to their established reliability and cost-effectiveness. Their dominance is particularly pronounced in onshore operations and in less technically demanding offshore environments.

- Onshore Deployment: The vast majority of oil and gas production historically, and still significantly, occurs onshore across the Middle East and parts of Africa. This naturally translates to a dominant position for onshore Christmas tree applications. The sheer volume of wells drilled and maintained onshore ensures a consistent and substantial demand for these systems. Infrastructure development and exploration in new onshore basins further fuel this segment.

- Offshore Deployment: While onshore deployment holds a larger market share in terms of volume, the offshore segment is characterized by higher value and a greater reliance on advanced technologies. The development of deepwater and ultra-deepwater fields in the Gulf of Mexico, Brazil, and increasingly in the Eastern Mediterranean and West Africa, drives the demand for sophisticated subsea Christmas trees. Investments in offshore production capacity are a key growth driver for this segment.

The interplay between these regions and segments creates a dynamic market where companies must tailor their offerings and strategies to capitalize on specific opportunities and address local demands.

Middle East and Africa Christmas Tree Market Product Analysis

The Middle East and Africa Christmas Tree Market is characterized by a strong focus on product reliability, safety, and increasingly, digital integration. Key innovations revolve around advanced materials offering superior corrosion resistance and pressure containment, essential for the region's diverse and often harsh operating environments. Horizontal trees are seeing advancements in sealing technologies and actuation mechanisms for greater operational flexibility. Vertical trees continue to benefit from incremental improvements in valve design and monitoring systems. The application scope spans both conventional oil and gas wells and increasingly, unconventional plays requiring specialized wellhead configurations. Competitive advantages are derived from robust performance in challenging conditions, compliance with stringent international standards (e.g., API, ISO), and the ability to offer customizable solutions tailored to specific field requirements.

Key Drivers, Barriers & Challenges in Middle East and Africa Christmas Tree Market

Key Drivers:

- Sustained Oil and Gas Demand: The region's significant hydrocarbon reserves and ongoing global energy demand necessitate continuous upstream exploration and production, directly driving the need for Christmas trees.

- Technological Advancements: The development of more sophisticated, intelligent, and subsea Christmas trees enhances operational efficiency, safety, and reservoir management, making them attractive investments.

- Infrastructure Development: Investments in new fields, expansion of existing production, and the development of marginal fields create consistent demand for wellhead equipment.

- Favorable Government Policies: Many Middle Eastern and African nations are actively promoting foreign investment and local content development in their oil and gas sectors, creating a conducive environment for market growth.

Barriers & Challenges:

- Price Volatility of Crude Oil: Fluctuations in global oil prices can impact investment decisions by oil companies, potentially slowing down new project development and equipment procurement.

- Geopolitical Instability: Political uncertainties and regional conflicts in certain areas can disrupt operations, deter investment, and pose logistical challenges.

- Supply Chain Disruptions: Global supply chain issues, including raw material availability and transportation logistics, can lead to extended lead times and increased costs for Christmas tree manufacturers and operators.

- Regulatory Complexity: Navigating diverse and evolving regulatory frameworks across multiple countries can be challenging for companies operating in the region.

Growth Drivers in the Middle East and Africa Christmas Tree Market Market

The Middle East and Africa Christmas Tree Market is propelled by several key growth drivers. Technologically, the increasing demand for intelligent well completions, featuring integrated sensors and remote monitoring capabilities, is a significant catalyst. This allows for real-time data acquisition, predictive maintenance, and optimized production, leading to enhanced efficiency and reduced operational costs. Economically, the persistent global demand for oil and gas, coupled with the region's vast reserves, ensures sustained investment in upstream activities. Governments are actively promoting the sector through favorable policies and incentives, encouraging both domestic and international players to expand exploration and production. Furthermore, the development of marginal fields and the need to extend the life of existing mature fields necessitate the deployment of advanced and reliable Christmas tree systems, contributing to market growth.

Challenges Impacting Middle East and Africa Christmas Tree Market Growth

Despite the positive outlook, several challenges impact the Middle East and Africa Christmas Tree Market growth. Regulatory complexities and differing standards across various countries can create hurdles for market entry and operational standardization. Supply chain disruptions, exacerbated by global events, can lead to extended lead times and increased costs for critical components, affecting project timelines. Competitive pressures from both established global manufacturers and emerging local players necessitate continuous innovation and cost optimization. Furthermore, the inherent price volatility of crude oil can lead to unpredictable investment cycles, potentially impacting the pace of new project development and equipment procurement.

Key Players Shaping the Middle East and Africa Christmas Tree Market Market

- Yantai Jereh Petroleum Equipment & Technologies Co Ltd

- Shengji Group

- Worldwide Oilfield Machine

- Dril-Quip Inc

- Baker Hughes Company

- Aker Solutions

- INTERA Ltd

- Schlumberger Limited

- TechnipFMC PLC

Significant Middle East and Africa Christmas Tree Market Industry Milestones

- 2019: Increased focus on subsea developments in the Eastern Mediterranean, driving demand for advanced subsea Christmas trees.

- 2020: Introduction of new intelligent Christmas tree models with enhanced digital integration and remote monitoring capabilities by leading manufacturers.

- 2021: Several major oil and gas discoveries in Africa, particularly in Nigeria and Angola, signaling significant future demand for offshore Christmas trees.

- 2022: Growing emphasis on localized manufacturing and service centers by international players to meet local content requirements in countries like Saudi Arabia.

- 2023: Advancements in materials science leading to the development of lighter and more corrosion-resistant Christmas tree components for harsh environments.

- 2024: Increased M&A activity speculated as companies look to consolidate their market position and expand technological portfolios.

- 2025 (Estimated): Launch of next-generation, AI-enabled Christmas tree systems promising predictive maintenance and unprecedented operational optimization.

Future Outlook for Middle East and Africa Christmas Tree Market Market

The future outlook for the Middle East and Africa Christmas Tree Market remains exceptionally bright, fueled by sustained upstream investment and technological innovation. The growing emphasis on maximizing production from existing reserves, coupled with the exploration of new hydrocarbon frontiers, will continue to drive demand. The increasing adoption of digital technologies and intelligent well completions will shape product development, offering enhanced efficiency and safety. Furthermore, the region's strategic importance in the global energy landscape positions it as a consistent growth engine for the Christmas tree market. Companies that can offer reliable, cost-effective, and technologically advanced solutions, alongside comprehensive service support, are poised for significant success in this dynamic market.

Middle East and Africa Christmas Tree Market Segmentation

-

1. Type

- 1.1. Horizontal Tree

- 1.2. Vertical Tree

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Rest of Middle East and Africa

Middle East and Africa Christmas Tree Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Christmas Tree Market Regional Market Share

Geographic Coverage of Middle East and Africa Christmas Tree Market

Middle East and Africa Christmas Tree Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adopting of Alternative Clean Energy Sources (Ex

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Horizontal Tree

- 5.1.2. Vertical Tree

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Horizontal Tree

- 6.1.2. Vertical Tree

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Horizontal Tree

- 7.1.2. Vertical Tree

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Horizontal Tree

- 8.1.2. Vertical Tree

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle East and Africa Christmas Tree Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Horizontal Tree

- 9.1.2. Vertical Tree

- 9.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.2.1. Onshore

- 9.2.2. Offshore

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Yantai Jereh Petroleum Equipment & Technologies Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shengji Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Worldwide Oilfield Machine

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dril-Quip Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Baker Hughes Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aker Solutions

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 INTERA Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schlumberger Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TechnipFMC PLC

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Yantai Jereh Petroleum Equipment & Technologies Co Ltd

List of Figures

- Figure 1: Middle East and Africa Christmas Tree Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Christmas Tree Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 4: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 5: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 10: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 12: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 13: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 18: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 20: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 21: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 26: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 28: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 29: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 30: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Type 2020 & 2033

- Table 34: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Type 2020 & 2033

- Table 35: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Location of Deployment 2020 & 2033

- Table 36: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Location of Deployment 2020 & 2033

- Table 37: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Christmas Tree Market Revenue million Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Christmas Tree Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Christmas Tree Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Middle East and Africa Christmas Tree Market?

Key companies in the market include Yantai Jereh Petroleum Equipment & Technologies Co Ltd, Shengji Group, Worldwide Oilfield Machine, Dril-Quip Inc, Baker Hughes Company, Aker Solutions, INTERA Ltd, Schlumberger Limited, TechnipFMC PLC.

3. What are the main segments of the Middle East and Africa Christmas Tree Market?

The market segments include Type, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 225 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Investments in Offshore Wind Power Projects4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar. Hydro).

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Christmas Tree Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Christmas Tree Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Christmas Tree Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Christmas Tree Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence