Key Insights

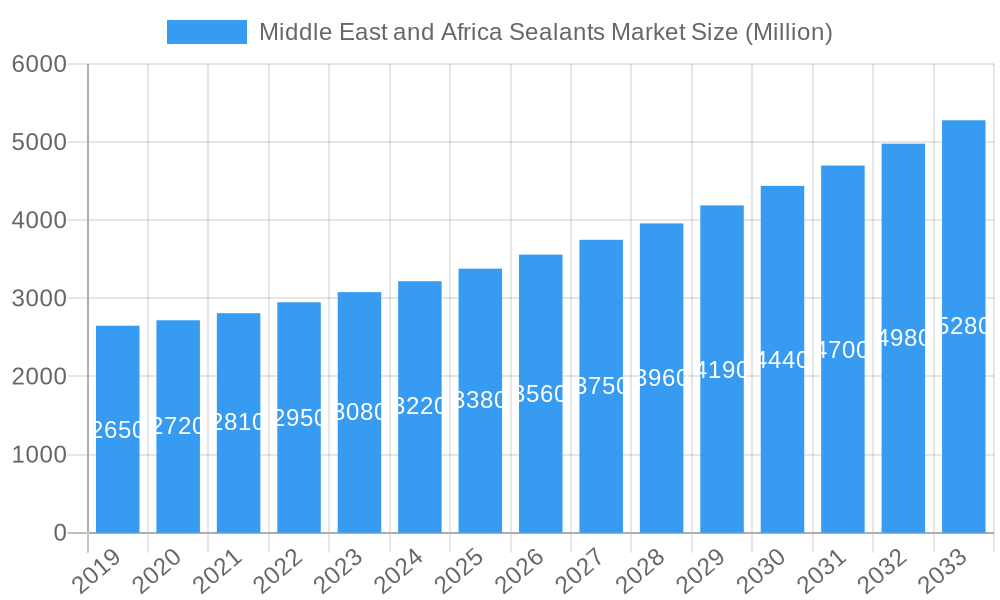

The Middle East and Africa (MEA) Sealants Market is poised for significant expansion, projecting a market size of approximately USD 3,500 million in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) exceeding 5.30% through 2033. This growth is primarily propelled by dynamic drivers such as extensive infrastructure development initiatives across the region, including mega-projects in Saudi Arabia and the broader Middle East, and the increasing demand for energy-efficient buildings. The automotive sector's recovery and expansion, coupled with the growing healthcare industry's need for advanced sealing solutions, also contribute substantially to market demand. Furthermore, trends like the adoption of sustainable and eco-friendly sealant formulations, driven by environmental regulations and consumer preference, are shaping market dynamics. The increasing use of advanced resin types, including epoxy and polyurethane, in high-performance applications across aerospace and automotive industries is a key growth enabler.

Middle East and Africa Sealants Market Market Size (In Billion)

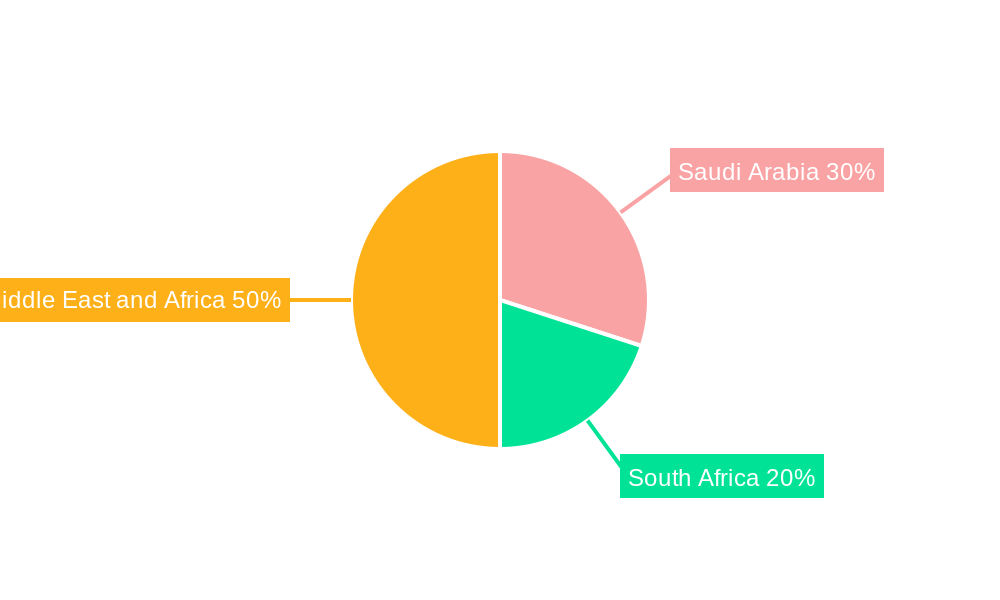

Despite this positive outlook, certain restraints may temper growth. These include fluctuating raw material prices, particularly for key components like petrochemical derivatives, which can impact manufacturing costs and profit margins for sealant producers. The availability of skilled labor for application and installation, especially in developing regions within Africa, and stringent regulatory frameworks in some countries, although often driving innovation, can also present challenges. Geographically, Saudi Arabia is expected to lead the market due to its ambitious Vision 2030 projects, while South Africa and the Rest of the Middle East and Africa are anticipated to witness steady growth driven by urbanization and industrialization. Key players like Henkel, 3M, and Sika AG are strategically investing in innovation and expanding their regional presence to capitalize on these opportunities, focusing on product development that addresses specific regional needs and environmental standards.

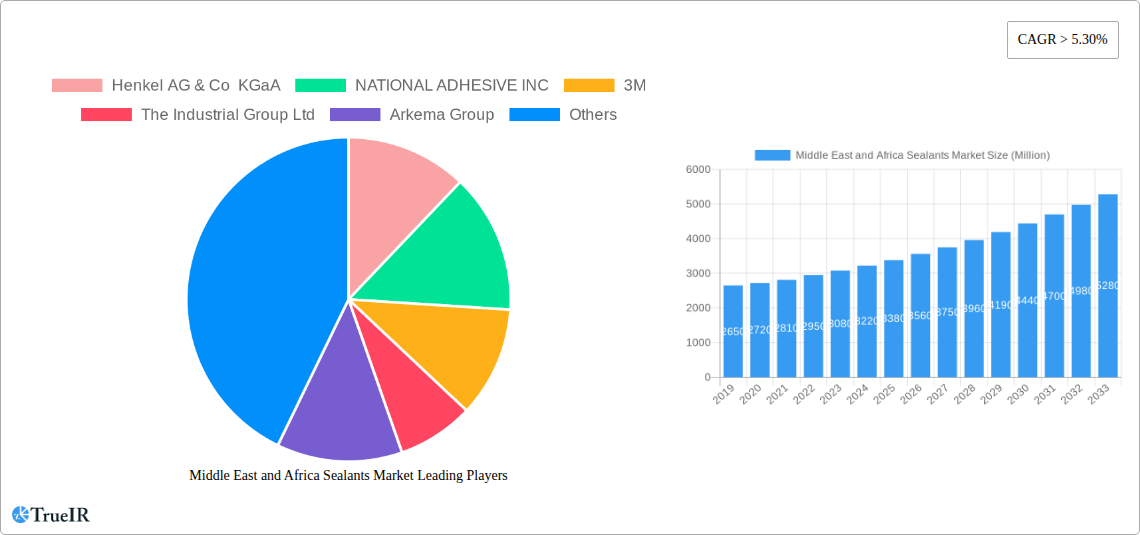

Middle East and Africa Sealants Market Company Market Share

This in-depth report provides a dynamic and SEO-optimized analysis of the Middle East and Africa (MEA) Sealants Market. Leveraging high-volume keywords relevant to the industry, this comprehensive study offers unparalleled insights into market structure, trends, opportunities, and future outlook. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report is essential for stakeholders seeking to understand and capitalize on the burgeoning MEA sealants landscape.

Middle East and Africa Sealants Market Market Structure & Competitive Landscape

The Middle East and Africa Sealants Market exhibits a moderately concentrated structure, with a mix of global giants and regional players actively vying for market share. Innovation serves as a key differentiator, driven by the increasing demand for high-performance, sustainable, and specialized sealant solutions across diverse end-user industries. Regulatory frameworks, while evolving, play a crucial role in shaping product development and market access, particularly concerning environmental standards and building codes. The threat of product substitutes, while present in certain applications, is generally mitigated by the unique performance characteristics of specialized sealants. End-user segmentation reveals a significant reliance on the building and construction sector, followed by automotive and other industrial applications. Mergers and acquisitions (M&A) are anticipated to become more prevalent as companies seek to expand their geographical reach, product portfolios, and technological capabilities. For instance, the estimated volume of M&A activities in the MEA construction chemicals sector has seen a consistent upward trajectory, signaling consolidation and strategic expansion.

Middle East and Africa Sealants Market Market Trends & Opportunities

The MEA Sealants Market is poised for robust growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This expansion is fueled by significant urbanization, infrastructure development projects, and an increasing focus on energy-efficient buildings across the region. Technological advancements are at the forefront of market trends, with a rising demand for advanced sealant formulations offering superior adhesion, flexibility, weather resistance, and environmental sustainability. The growing preference for eco-friendly and low-VOC (Volatile Organic Compound) sealants aligns with global environmental consciousness and increasingly stringent regulations in countries like the UAE and South Africa. Consumer preferences are shifting towards smart sealants that offer enhanced functionalities, such as self-healing properties or improved insulation.

The competitive dynamics are intensifying, with key players investing heavily in research and development to introduce innovative products that cater to specific application needs. The market penetration of advanced sealant technologies, particularly in the construction and automotive sectors, is expected to witness a substantial increase. The demand for specialized sealants in niche applications like aerospace and healthcare is also on an upward trajectory, presenting lucrative opportunities for market players. Furthermore, the growing adoption of modular construction techniques and prefabricated building components is creating a demand for specialized sealants that can ensure effective and efficient sealing in these assembly-line processes. Opportunities also lie in developing cost-effective solutions tailored to the unique economic landscapes of various MEA countries.

Dominant Markets & Segments in Middle East and Africa Sealants Market

The Building and Construction end-user industry stands as the dominant segment within the Middle East and Africa Sealants Market, driven by extensive infrastructure development, residential construction booms, and commercial building projects across the region. Saudi Arabia and South Africa are identified as leading geographical markets due to their significant investments in urban development and industrial expansion.

Building and Construction Dominance:

- Key Growth Drivers: Large-scale government-backed infrastructure projects, including smart city initiatives, transportation networks (metro systems, airports), and housing developments, are propelling the demand for a wide array of sealants used in facades, windows, joints, and roofing.

- Policies and Regulations: Stricter building codes mandating improved insulation, waterproofing, and structural integrity further boost sealant consumption. The push towards sustainable construction practices also favors the adoption of advanced, energy-efficient sealant solutions.

- Market Insight: The residential construction sector, particularly in developing economies within the region, is a significant contributor, driven by population growth and increasing disposable incomes.

Dominant Resin Segments:

- Silicone Sealants: Highly favored for their excellent UV resistance, flexibility, and durability, silicone sealants are extensively used in construction and automotive applications. Their ability to withstand extreme temperatures makes them ideal for the diverse climatic conditions in MEA.

- Polyurethane Sealants: Offering superior adhesion, mechanical strength, and abrasion resistance, polyurethane sealants are crucial for structural bonding and weatherproofing in demanding construction projects.

Leading Geographic Markets:

- Saudi Arabia: Driven by Vision 2030 initiatives, the Kingdom is undergoing massive infrastructure and real estate development, creating substantial demand for sealants in its mega-projects.

- South Africa: With a more established industrial base and ongoing urban regeneration projects, South Africa represents a mature yet growing market for various sealant applications.

- Rest of Middle-East and Africa: Emerging economies in this segment present untapped potential, with rapid industrialization and urbanization gradually increasing sealant consumption.

Middle East and Africa Sealants Market Product Analysis

The MEA Sealants Market is characterized by continuous product innovation focused on enhanced performance, sustainability, and ease of application. Key developments include the introduction of advanced formulations in silicone, polyurethane, and epoxy resins, offering superior adhesion to diverse substrates, increased durability, and improved resistance to environmental factors like extreme temperatures and UV radiation. Innovations are also geared towards addressing specific industry needs, such as high-temperature resistant sealants for automotive applications or specialized formulations for healthcare environments. The growing emphasis on green building initiatives is driving the development of low-VOC and water-based sealants, aligning with regulatory demands and consumer preferences for environmentally friendly products.

Key Drivers, Barriers & Challenges in Middle East and Africa Sealants Market

Key Drivers: The MEA Sealants Market is propelled by robust infrastructure development fueled by government initiatives and private investments. The burgeoning construction sector, driven by urbanization and population growth, is a primary growth engine. Technological advancements leading to the development of high-performance, eco-friendly, and specialized sealants are creating new market opportunities. Economic diversification efforts across the region are also contributing to increased industrial activity, thereby boosting demand for industrial sealants.

Barriers & Challenges: Supply chain disruptions and logistical complexities within the vast and diverse MEA region pose significant challenges. Volatile raw material prices, particularly for petrochemical derivatives, can impact manufacturing costs and pricing strategies. Stringent and often varied regulatory landscapes across different countries can create hurdles for market entry and product standardization. Intense competition from both global and local players can lead to price pressures. Furthermore, a lack of skilled labor for specialized sealant application in some parts of the region can hinder the adoption of advanced solutions.

Growth Drivers in the Middle East and Africa Sealants Market Market

Key growth drivers in the Middle East and Africa Sealants Market are predominantly economic and infrastructure-driven. Significant investments in smart city projects, tourism infrastructure, and residential developments across countries like Saudi Arabia, UAE, and Egypt are creating immense demand for construction sealants. The automotive industry's expansion, coupled with increasing vehicle production and aftermarket services, is another major catalyst. Furthermore, a growing awareness and adoption of energy-efficient building practices are driving the demand for high-performance sealants that enhance insulation and reduce energy consumption. Supportive government policies promoting industrialization and manufacturing in countries like South Africa and Nigeria are also contributing to market growth.

Challenges Impacting Middle East and Africa Sealants Market Growth

Challenges impacting the Middle East and Africa Sealants Market growth include significant supply chain complexities and logistical hurdles inherent in serving a vast and geographically diverse region. Fluctuations in the prices of key raw materials, such as petrochemical derivatives, can lead to cost volatility and impact profit margins for manufacturers. Regulatory fragmentation across different MEA countries, with varying standards and approval processes, can create barriers to market entry and product harmonization. Intense competition, both from established global brands and emerging local players, often leads to pricing pressures and necessitates continuous innovation and cost optimization strategies. Additionally, the availability of skilled labor for the proper application of specialized sealants remains a concern in certain sub-regions.

Key Players Shaping the Middle East and Africa Sealants Market Market

- Henkel AG & Co KGaA

- NATIONAL ADHESIVE INC

- 3M

- The Industrial Group Ltd

- Arkema Group

- Dow

- H B Fuller Company

- Soudal Holding N V

- MAPEI S p A

- Sika AG

- Wacker Chemie AG

- Permoseal (Pty) Ltd

Significant Middle East and Africa Sealants Market Industry Milestones

- January 2020: H.B. Fuller Company introduced a new range of Gorilla professional-grade adhesives and sealants for MRO industrial applications, expanding its product portfolio for the industrial maintenance sector.

- December 2020: Wacker Chemie AG launched renewables-based silicone sealants, extending its portfolio with more sustainable and environmentally friendly solutions.

Future Outlook for Middle East and Africa Sealants Market Market

The future outlook for the Middle East and Africa Sealants Market is highly promising, driven by sustained economic growth and ongoing infrastructure development. Strategic opportunities lie in catering to the increasing demand for sustainable and high-performance sealants in the construction sector, particularly within the context of green building initiatives and energy efficiency mandates. The expanding automotive and aerospace industries in key MEA nations will continue to be significant demand generators. Furthermore, untapped potential exists in emerging economies within the region, offering avenues for market penetration through localized product offerings and distribution networks. Companies that focus on innovation, product differentiation, and building strong regional partnerships are well-positioned to capitalize on the market's upward trajectory.

Middle East and Africa Sealants Market Segmentation

-

1. Resin

- 1.1. Acrylic

- 1.2. Epoxy

- 1.3. Polyurethane

- 1.4. Silicone

- 1.5. Other Resins

-

2. End-User Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Building and Construction

- 2.4. Healthcare

- 2.5. Other End-user Industries

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. Rest of Middle-East and Africa

Middle East and Africa Sealants Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle East and Africa Sealants Market Regional Market Share

Geographic Coverage of Middle East and Africa Sealants Market

Middle East and Africa Sealants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand from the Construction Industry in Saudi Arabia; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Pandemic on Global Economy

- 3.4. Market Trends

- 3.4.1. The Construction End-User Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Sealants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Acrylic

- 5.1.2. Epoxy

- 5.1.3. Polyurethane

- 5.1.4. Silicone

- 5.1.5. Other Resins

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Building and Construction

- 5.2.4. Healthcare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Saudi Arabia Middle East and Africa Sealants Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin

- 6.1.1. Acrylic

- 6.1.2. Epoxy

- 6.1.3. Polyurethane

- 6.1.4. Silicone

- 6.1.5. Other Resins

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Aerospace

- 6.2.2. Automotive

- 6.2.3. Building and Construction

- 6.2.4. Healthcare

- 6.2.5. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Resin

- 7. South Africa Middle East and Africa Sealants Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin

- 7.1.1. Acrylic

- 7.1.2. Epoxy

- 7.1.3. Polyurethane

- 7.1.4. Silicone

- 7.1.5. Other Resins

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Aerospace

- 7.2.2. Automotive

- 7.2.3. Building and Construction

- 7.2.4. Healthcare

- 7.2.5. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Resin

- 8. Rest of Middle East and Africa Middle East and Africa Sealants Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin

- 8.1.1. Acrylic

- 8.1.2. Epoxy

- 8.1.3. Polyurethane

- 8.1.4. Silicone

- 8.1.5. Other Resins

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Aerospace

- 8.2.2. Automotive

- 8.2.3. Building and Construction

- 8.2.4. Healthcare

- 8.2.5. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Resin

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Henkel AG & Co KGaA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 NATIONAL ADHESIVE INC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 3M

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 The Industrial Group Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Arkema Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Dow

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 H B Fuller Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Soudal Holding N V

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 MAPEI S p A

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Sika AG

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Wacker Chemie AG*List Not Exhaustive

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Permoseal (Pty) Ltd

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Middle East and Africa Sealants Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Sealants Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Sealants Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: Middle East and Africa Sealants Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East and Africa Sealants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Sealants Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Sealants Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 6: Middle East and Africa Sealants Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 7: Middle East and Africa Sealants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Sealants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Sealants Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 10: Middle East and Africa Sealants Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 11: Middle East and Africa Sealants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Sealants Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Sealants Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 14: Middle East and Africa Sealants Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Middle East and Africa Sealants Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Sealants Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Sealants Market?

The projected CAGR is approximately > 5.30%.

2. Which companies are prominent players in the Middle East and Africa Sealants Market?

Key companies in the market include Henkel AG & Co KGaA, NATIONAL ADHESIVE INC, 3M, The Industrial Group Ltd, Arkema Group, Dow, H B Fuller Company, Soudal Holding N V, MAPEI S p A, Sika AG, Wacker Chemie AG*List Not Exhaustive, Permoseal (Pty) Ltd.

3. What are the main segments of the Middle East and Africa Sealants Market?

The market segments include Resin, End-User Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand from the Construction Industry in Saudi Arabia; Other Drivers.

6. What are the notable trends driving market growth?

The Construction End-User Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Pandemic on Global Economy.

8. Can you provide examples of recent developments in the market?

In Jan 2020, H.B. Fuller Company introduced a new range of Gorilla professional-grade adhesives and sealants for MRO industrial applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Sealants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Sealants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Sealants Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Sealants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence