Key Insights

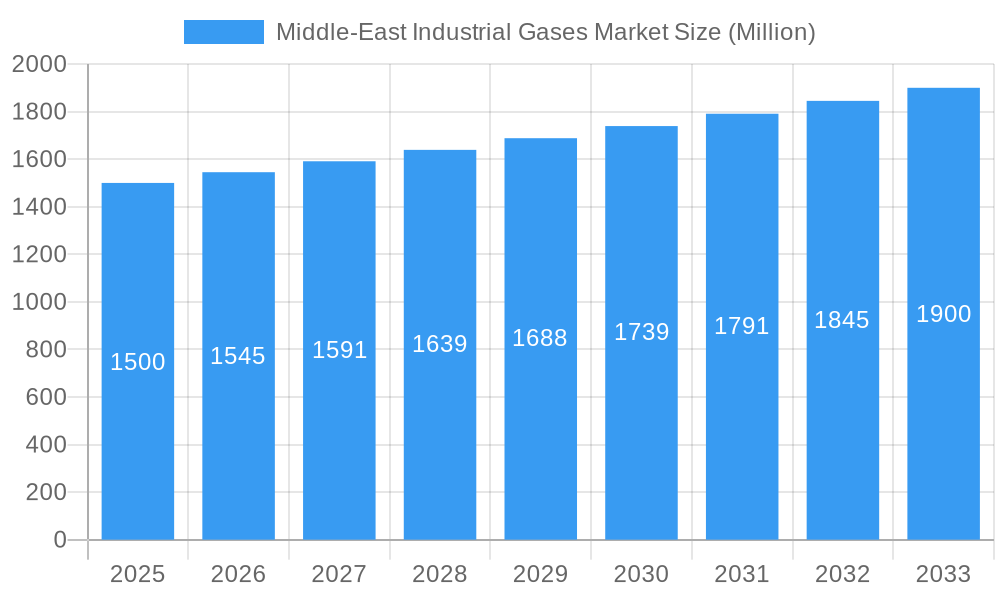

The Middle East industrial gases market is poised for significant expansion, projected to reach $9,907.04 million by 2024, with a Compound Annual Growth Rate (CAGR) of 6.4%. This growth is propelled by the region's dynamic petrochemical and manufacturing sectors, amplified by substantial investments in infrastructure and energy diversification strategies. Key growth catalysts include the expansion of downstream industries such as fertilizers, steel, and electronics, supported by favorable government initiatives for industrial development and advancements in gas production and distribution technologies. The sustained demand for essential gases like nitrogen, oxygen, and argon across diverse applications, from chemical processing to healthcare, further underpins market growth. Despite potential challenges like raw material price volatility and regulatory adherence, the market outlook remains highly favorable.

Middle-East Industrial Gases Market Market Size (In Billion)

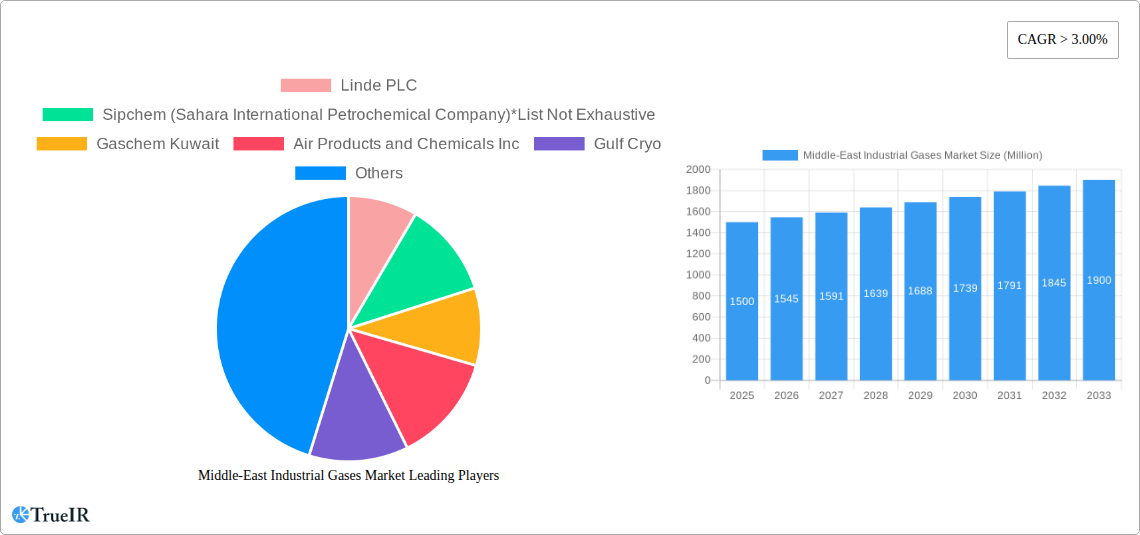

Market penetration is anticipated to vary regionally, with Saudi Arabia and the UAE expected to lead due to their robust industrial infrastructure and extensive large-scale projects. The growing emphasis on sustainable practices and energy-efficient technologies is also influencing market dynamics, encouraging investments in eco-friendly production methods and carbon footprint reduction. Intense competition among established global entities such as Linde PLC, Air Products and Chemicals Inc., and Air Liquide, alongside emerging regional players, fosters innovation and competitive pricing. Market segmentation by product type and end-user reveals robust demand opportunities, particularly within chemical processing, oil and gas, and metal manufacturing. Future growth trajectories will be shaped by technological innovations in gas separation and purification, evolving energy policies, and the expansion of interconnected industries.

Middle-East Industrial Gases Market Company Market Share

Middle East Industrial Gases Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East industrial gases market, covering market size, segmentation, competitive landscape, key drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders. With a focus on high-growth segments and key players, this report is an essential resource for strategic decision-making. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Middle-East Industrial Gases Market Market Structure & Competitive Landscape

The Middle East industrial gases market exhibits a moderately concentrated structure, with key players like Linde PLC, Air Products and Chemicals Inc., Air Liquide, and several regional players holding significant market share. The market is characterized by both intense competition and strategic collaborations. Innovation in gas production technologies, particularly for environmentally friendly solutions, is a key driver. Regulatory frameworks concerning safety, environmental protection, and gas distribution significantly influence market dynamics. Product substitutes, such as on-site gas generation systems, pose a growing challenge. The market is segmented by product type (Nitrogen, Oxygen, Carbon dioxide, Hydrogen, Helium, Argon, Ammonia, Methane, Propane, Butane, Other Product Types) and end-user industry (Chemical Processing and Refining, Electronics, Food and Beverage, Oil and Gas, Metal Manufacturing and Fabrication, Medical and Pharmaceutical, Automotive and Transportation, Energy and Power, Other End-user Industries).

The market has witnessed several mergers and acquisitions (M&A) in recent years. For example, the Air Products acquisition of Air Liquide's industrial merchant gases business in the UAE significantly altered the competitive landscape. The volume of M&A activity reflects the strategic importance of the regional market and the consolidation trend amongst major players. While precise figures on M&A volume are unavailable, a qualitative assessment reveals increased activity, driven by the desire for expansion, enhanced market access, and technological synergies. The concentration ratio (CR4) is estimated to be around xx%, indicating a moderately concentrated market. This is further compounded by the varying levels of government regulation in different Middle Eastern countries.

Middle-East Industrial Gases Market Market Trends & Opportunities

The Middle East industrial gases market is currently experiencing a period of robust and sustained growth. This expansion is primarily propelled by the rapid industrialization and diversification efforts across the region, with significant contributions from the burgeoning petrochemicals, manufacturing, and energy sectors. The increasing requirement for high-purity gases across a multitude of critical applications, from advanced manufacturing processes to specialized medical treatments, is a key catalyst for market growth.

Technological innovation plays a pivotal role, with a strong emphasis on the adoption of advanced gas separation, purification, and on-site generation technologies. These advancements are not only enhancing operational efficiency and reducing production costs but also enabling customized gas solutions for diverse industrial needs. Furthermore, a growing consumer and industrial preference for sustainable and environmentally responsible gas production and distribution methods is opening up exciting new avenues for innovative players and eco-friendly solutions.

The competitive landscape is becoming increasingly dynamic, characterized by intensified competition among both established domestic players and ambitious international corporations vying for a larger market share. Strategic collaborations, mergers, and acquisitions are becoming more common as companies seek to consolidate their positions and expand their geographical reach.

The market size is estimated at approximately [Insert specific value in Millions] in 2025 and is projected to surge to [Insert specific value in Millions] by 2033, demonstrating a substantial Compound Annual Growth Rate (CAGR) of [Insert specific CAGR percentage]%. It is important to note that market penetration rates can vary significantly across different industrial segments and individual countries within the region, with higher adoption typically observed in more industrialized and economically developed nations.

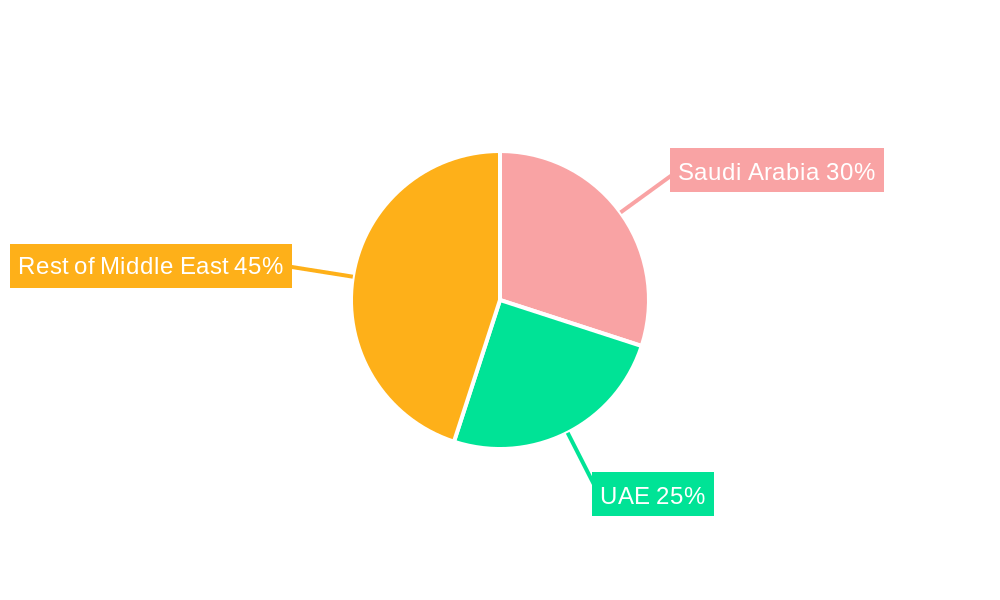

Dominant Markets & Segments in Middle-East Industrial Gases Market

Dominant Region: The GCC (Gulf Cooperation Council) countries, particularly Saudi Arabia and the UAE, constitute the dominant region due to their substantial industrial base and ongoing infrastructure development.

Dominant Country: Saudi Arabia, due to its massive petrochemical and refining industries, holds the largest market share.

Dominant Product Type: Nitrogen and oxygen, owing to their wide applications in various industrial processes, dominate the product type segment.

Dominant End-user Industry: The chemical processing and refining sector consumes the largest volume of industrial gases, followed by the oil and gas sector.

Key Growth Drivers:

- Rapid industrialization and infrastructure development: The continuous expansion of industrial sectors fuels demand.

- Government initiatives and investments: Supportive policies and investments are fostering market growth.

- Rising demand from downstream industries: Growth in sectors like petrochemicals and manufacturing boosts gas consumption.

Middle-East Industrial Gases Market Product Analysis

The Middle East industrial gases market is characterized by continuous innovation and a dynamic evolution of product offerings. Leading companies are heavily investing in the development and supply of a wide array of products, including ultra-high-purity gases essential for sensitive applications like electronics and pharmaceuticals, tailored specialty gas mixtures for precise industrial processes, and flexible on-site gas generation systems designed to meet the unique and evolving demands of individual customers. Technological advancements, particularly in membrane separation, pressure swing adsorption (PSA), and cryogenic distillation techniques, are instrumental in achieving greater separation efficiency, purity levels, and cost-effectiveness.

The market's receptiveness to these innovations is exceptionally strong, driven by the unwavering industrial demand for superior product quality, enhanced process reliability, and significant cost-saving opportunities. As industries across the Middle East continue to modernize and adopt more sophisticated production methods, the demand for advanced and specialized industrial gas solutions is expected to grow exponentially.

Key Drivers, Barriers & Challenges in Middle-East Industrial Gases Market

Key Drivers:

- Industrial Expansion and Diversification: The significant growth of energy-intensive industries, coupled with government-led initiatives for economic diversification beyond oil and gas, is a primary driver.

- Downstream Sector Growth: Rising demand from various downstream sectors, including manufacturing, construction, healthcare, and food & beverage, directly fuels the need for industrial gases.

- Government Investments and Policies: Substantial government investments in infrastructure development and the implementation of supportive industrial policies create a favorable environment for market expansion.

- Technological Advancements: Continuous innovation in gas separation, purification, and on-site generation technologies leads to improved efficiency, cost reduction, and broader application possibilities.

- Increased Focus on High-Purity Gases: The growing demand for ultra-high-purity gases in specialized industries like semiconductors, research, and healthcare is a significant growth catalyst.

Challenges & Restraints:

- Price Volatility of Raw Materials: Fluctuations in global oil and gas prices can directly impact the cost of raw materials and, consequently, the production costs of industrial gases.

- Regulatory and Safety Standards: Navigating complex and stringent regulatory frameworks and adhering to high safety standards can increase operational complexities and compliance costs.

- Intense Market Competition: The presence of well-established domestic and international players leads to intense competition, potentially impacting profit margins, especially for new entrants.

- Geopolitical Instability and Supply Chain Disruptions: Regional geopolitical uncertainties and potential supply chain disruptions can pose significant risks to the consistent and timely delivery of gases and raw materials.

- Infrastructure Development Gaps: In some developing areas, a lack of adequate infrastructure for gas transportation and storage can hinder market penetration and accessibility.

Growth Drivers in the Middle-East Industrial Gases Market Market

The Middle East industrial gases market is propelled by a confluence of powerful growth drivers. Foremost among these is the surge in industrial activity across key sectors, significantly boosted by ambitious government strategies aimed at economic diversification and industrial self-sufficiency. Supportive governmental policies, including incentives for foreign investment and the establishment of industrial zones, further accelerate this growth trajectory. Technological advancements remain a critical factor, with ongoing developments in gas production, purification, and distribution technologies enhancing efficiency and expanding the scope of applications.

The substantial expansion of the refining and petrochemical sectors, a cornerstone of many Middle Eastern economies, directly translates into increased demand for a wide range of industrial gases. Simultaneously, a growing emphasis on sustainability and the development of renewable energy projects are also stimulating market expansion, as these sectors often require specialized gases for their operations and infrastructure.

Challenges Impacting Middle-East Industrial Gases Market Growth

Supply chain volatility, price fluctuations, and regulatory complexities are major challenges. Stringent safety regulations increase operational costs, while competition from established players and potential substitutes limits market growth.

Key Players Shaping the Middle-East Industrial Gases Market Market

- Linde PLC

- Sipchem (Sahara International Petrochemical Company)

- Gaschem Kuwait

- Air Products and Chemicals Inc

- Gulf Cryo

- Abdullah Hashim Industrial Gases & Equipment (AHG)

- BASF SE

- SABIC

- Buzwair Industrial Gases Factories

- Air Liquide

- Dubai Industrial Gases

Significant Middle-East Industrial Gases Market Industry Milestones

- January 2022: Air Products completed the acquisition of Air Liquide's industrial merchant gases business in the UAE and its majority share in MECD in Bahrain, expanding its market presence and product portfolio.

- December 2022: Air Products signed an agreement with Saudi Ground Services (SGS) to demonstrate hydrogen for mobility at Dammam Airport, showcasing the potential of hydrogen as a fuel source in the transportation sector and potentially driving demand for hydrogen gas.

Future Outlook for Middle-East Industrial Gases Market Market

The Middle East industrial gases market is poised for sustained growth, driven by ongoing industrial expansion and infrastructure development. The increasing adoption of clean energy technologies and diversification into new applications, such as hydrogen for mobility, present lucrative opportunities for market players. Strategic partnerships, technological innovation, and proactive adaptation to regulatory changes will be crucial for success in this dynamic market.

Middle-East Industrial Gases Market Segmentation

-

1. Product Type

- 1.1. Nitrogen

- 1.2. Oxygen

- 1.3. Carbon dioxide

- 1.4. Hydrogen

- 1.5. Helium

- 1.6. Argon

- 1.7. Ammonia

- 1.8. Methane

- 1.9. Propane

- 1.10. Butane

- 1.11. Other Product Types (Fluorine and Nitrous oxide)

-

2. End-user Industry

- 2.1. Chemical Processing and Refining

- 2.2. Electronics

- 2.3. Food and Beverage

- 2.4. Oil and Gas

- 2.5. Metal Manufacturing and Fabrication

- 2.6. Medical and Pharmaceutical

- 2.7. Automotive and Transportation

- 2.8. Energy and Power

- 2.9. Other En

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. Rest of Middle East

Middle-East Industrial Gases Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. Rest of Middle East

Middle-East Industrial Gases Market Regional Market Share

Geographic Coverage of Middle-East Industrial Gases Market

Middle-East Industrial Gases Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Oil and Gas Industry; Growing Need for Alternate Energy Sources; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Environmental Regulations and Safety Issues; Other Restraints

- 3.4. Market Trends

- 3.4.1. Oil and Gas Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Nitrogen

- 5.1.2. Oxygen

- 5.1.3. Carbon dioxide

- 5.1.4. Hydrogen

- 5.1.5. Helium

- 5.1.6. Argon

- 5.1.7. Ammonia

- 5.1.8. Methane

- 5.1.9. Propane

- 5.1.10. Butane

- 5.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Chemical Processing and Refining

- 5.2.2. Electronics

- 5.2.3. Food and Beverage

- 5.2.4. Oil and Gas

- 5.2.5. Metal Manufacturing and Fabrication

- 5.2.6. Medical and Pharmaceutical

- 5.2.7. Automotive and Transportation

- 5.2.8. Energy and Power

- 5.2.9. Other En

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. Rest of Middle East

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Nitrogen

- 6.1.2. Oxygen

- 6.1.3. Carbon dioxide

- 6.1.4. Hydrogen

- 6.1.5. Helium

- 6.1.6. Argon

- 6.1.7. Ammonia

- 6.1.8. Methane

- 6.1.9. Propane

- 6.1.10. Butane

- 6.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Chemical Processing and Refining

- 6.2.2. Electronics

- 6.2.3. Food and Beverage

- 6.2.4. Oil and Gas

- 6.2.5. Metal Manufacturing and Fabrication

- 6.2.6. Medical and Pharmaceutical

- 6.2.7. Automotive and Transportation

- 6.2.8. Energy and Power

- 6.2.9. Other En

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. Rest of Middle East

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Nitrogen

- 7.1.2. Oxygen

- 7.1.3. Carbon dioxide

- 7.1.4. Hydrogen

- 7.1.5. Helium

- 7.1.6. Argon

- 7.1.7. Ammonia

- 7.1.8. Methane

- 7.1.9. Propane

- 7.1.10. Butane

- 7.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Chemical Processing and Refining

- 7.2.2. Electronics

- 7.2.3. Food and Beverage

- 7.2.4. Oil and Gas

- 7.2.5. Metal Manufacturing and Fabrication

- 7.2.6. Medical and Pharmaceutical

- 7.2.7. Automotive and Transportation

- 7.2.8. Energy and Power

- 7.2.9. Other En

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. Rest of Middle East

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Nitrogen

- 8.1.2. Oxygen

- 8.1.3. Carbon dioxide

- 8.1.4. Hydrogen

- 8.1.5. Helium

- 8.1.6. Argon

- 8.1.7. Ammonia

- 8.1.8. Methane

- 8.1.9. Propane

- 8.1.10. Butane

- 8.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Chemical Processing and Refining

- 8.2.2. Electronics

- 8.2.3. Food and Beverage

- 8.2.4. Oil and Gas

- 8.2.5. Metal Manufacturing and Fabrication

- 8.2.6. Medical and Pharmaceutical

- 8.2.7. Automotive and Transportation

- 8.2.8. Energy and Power

- 8.2.9. Other En

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. Rest of Middle East

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East Middle-East Industrial Gases Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Nitrogen

- 9.1.2. Oxygen

- 9.1.3. Carbon dioxide

- 9.1.4. Hydrogen

- 9.1.5. Helium

- 9.1.6. Argon

- 9.1.7. Ammonia

- 9.1.8. Methane

- 9.1.9. Propane

- 9.1.10. Butane

- 9.1.11. Other Product Types (Fluorine and Nitrous oxide)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Chemical Processing and Refining

- 9.2.2. Electronics

- 9.2.3. Food and Beverage

- 9.2.4. Oil and Gas

- 9.2.5. Metal Manufacturing and Fabrication

- 9.2.6. Medical and Pharmaceutical

- 9.2.7. Automotive and Transportation

- 9.2.8. Energy and Power

- 9.2.9. Other En

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. Rest of Middle East

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Linde PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sipchem (Sahara International Petrochemical Company)*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gaschem Kuwait

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Air Products and Chemicals Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Gulf Cryo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abdullah Hashim Industrial Gases & Equipment (AHG)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SABIC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Buzwair Industrial Gases Factories

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Air Liquide

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dubai Industrial Gases

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Linde PLC

List of Figures

- Figure 1: Global Middle-East Industrial Gases Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Saudi Arabia Middle-East Industrial Gases Market Revenue (million), by Product Type 2025 & 2033

- Figure 3: Saudi Arabia Middle-East Industrial Gases Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Saudi Arabia Middle-East Industrial Gases Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 5: Saudi Arabia Middle-East Industrial Gases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Saudi Arabia Middle-East Industrial Gases Market Revenue (million), by Geography 2025 & 2033

- Figure 7: Saudi Arabia Middle-East Industrial Gases Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Saudi Arabia Middle-East Industrial Gases Market Revenue (million), by Country 2025 & 2033

- Figure 9: Saudi Arabia Middle-East Industrial Gases Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: United Arab Emirates Middle-East Industrial Gases Market Revenue (million), by Product Type 2025 & 2033

- Figure 11: United Arab Emirates Middle-East Industrial Gases Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: United Arab Emirates Middle-East Industrial Gases Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 13: United Arab Emirates Middle-East Industrial Gases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: United Arab Emirates Middle-East Industrial Gases Market Revenue (million), by Geography 2025 & 2033

- Figure 15: United Arab Emirates Middle-East Industrial Gases Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: United Arab Emirates Middle-East Industrial Gases Market Revenue (million), by Country 2025 & 2033

- Figure 17: United Arab Emirates Middle-East Industrial Gases Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Qatar Middle-East Industrial Gases Market Revenue (million), by Product Type 2025 & 2033

- Figure 19: Qatar Middle-East Industrial Gases Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Qatar Middle-East Industrial Gases Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 21: Qatar Middle-East Industrial Gases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Qatar Middle-East Industrial Gases Market Revenue (million), by Geography 2025 & 2033

- Figure 23: Qatar Middle-East Industrial Gases Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Qatar Middle-East Industrial Gases Market Revenue (million), by Country 2025 & 2033

- Figure 25: Qatar Middle-East Industrial Gases Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Middle East Middle-East Industrial Gases Market Revenue (million), by Product Type 2025 & 2033

- Figure 27: Rest of Middle East Middle-East Industrial Gases Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of Middle East Middle-East Industrial Gases Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 29: Rest of Middle East Middle-East Industrial Gases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Rest of Middle East Middle-East Industrial Gases Market Revenue (million), by Geography 2025 & 2033

- Figure 31: Rest of Middle East Middle-East Industrial Gases Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Middle East Middle-East Industrial Gases Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of Middle East Middle-East Industrial Gases Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Global Middle-East Industrial Gases Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Global Middle-East Industrial Gases Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Global Middle-East Industrial Gases Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Global Middle-East Industrial Gases Market Revenue million Forecast, by Country 2020 & 2033

- Table 17: Global Middle-East Industrial Gases Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 18: Global Middle-East Industrial Gases Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Middle-East Industrial Gases Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: Global Middle-East Industrial Gases Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East Industrial Gases Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Middle-East Industrial Gases Market?

Key companies in the market include Linde PLC, Sipchem (Sahara International Petrochemical Company)*List Not Exhaustive, Gaschem Kuwait, Air Products and Chemicals Inc, Gulf Cryo, Abdullah Hashim Industrial Gases & Equipment (AHG), BASF SE, SABIC, Buzwair Industrial Gases Factories, Air Liquide, Dubai Industrial Gases.

3. What are the main segments of the Middle-East Industrial Gases Market?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 9907.04 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Oil and Gas Industry; Growing Need for Alternate Energy Sources; Other Drivers.

6. What are the notable trends driving market growth?

Oil and Gas Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Regulations and Safety Issues; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Air Products announced that it had signed an agreement with Saudi Ground Services (SGS) to demonstrate Hydrogen for Mobility at Dammam Airport, Saudi Arabia. Saudi Ground Services provides a wide range of ground handling services throughout the entire network of airlines in Saudi Arabia, from passenger services and baggage handling to fleet solutions and cargo services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East Industrial Gases Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East Industrial Gases Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East Industrial Gases Market?

To stay informed about further developments, trends, and reports in the Middle-East Industrial Gases Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence