Key Insights

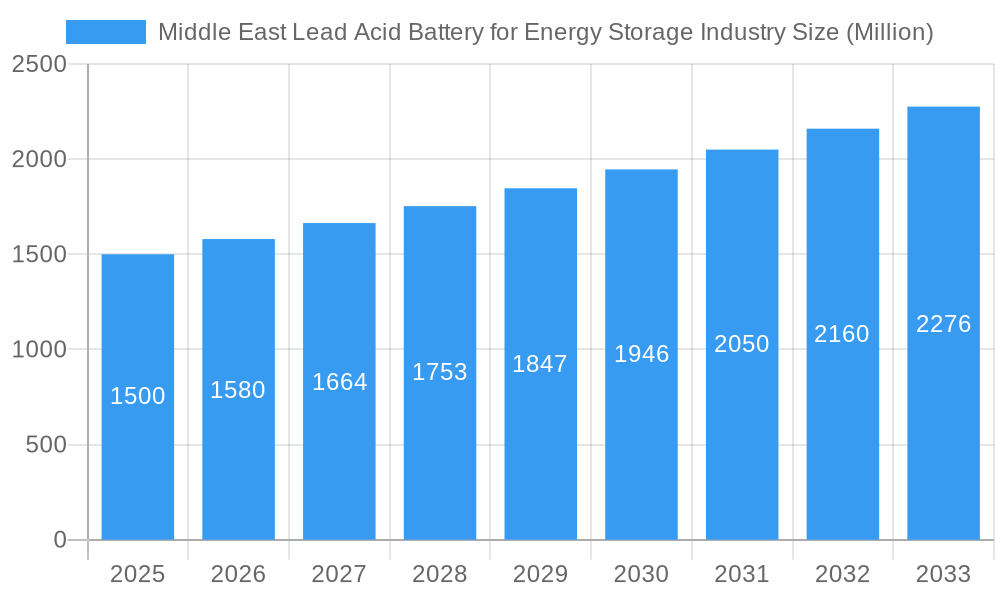

The Middle East lead-acid battery market for energy storage is experiencing robust growth, driven by increasing demand for reliable and cost-effective energy solutions across residential, commercial, industrial, and utility sectors. The region's burgeoning renewable energy sector, coupled with efforts to enhance grid stability and address power outages, significantly fuels this expansion. A compound annual growth rate (CAGR) exceeding 5.20% from 2019 to 2024 indicates a strong historical trajectory. While lead-acid batteries are a mature technology, their affordability and readily available infrastructure contribute to their continued relevance, particularly in applications requiring shorter durations of energy storage. However, the market faces constraints including the environmental impact of lead-acid battery production and disposal, alongside competition from emerging technologies such as lithium-ion batteries. Nevertheless, the substantial investment in infrastructure projects across the region, particularly in the UAE and Saudi Arabia, is poised to drive significant market expansion throughout the forecast period (2025-2033). The segmentation by application (residential, commercial & industrial, utility) and technology (lead-acid, Li-ion, others) allows for a nuanced understanding of market dynamics and potential for future growth. Key players, including established international corporations and regional businesses, are actively participating in the market, reflecting the growing importance of energy storage solutions in the Middle East.

Middle East Lead Acid Battery for Energy Storage Industry Market Size (In Billion)

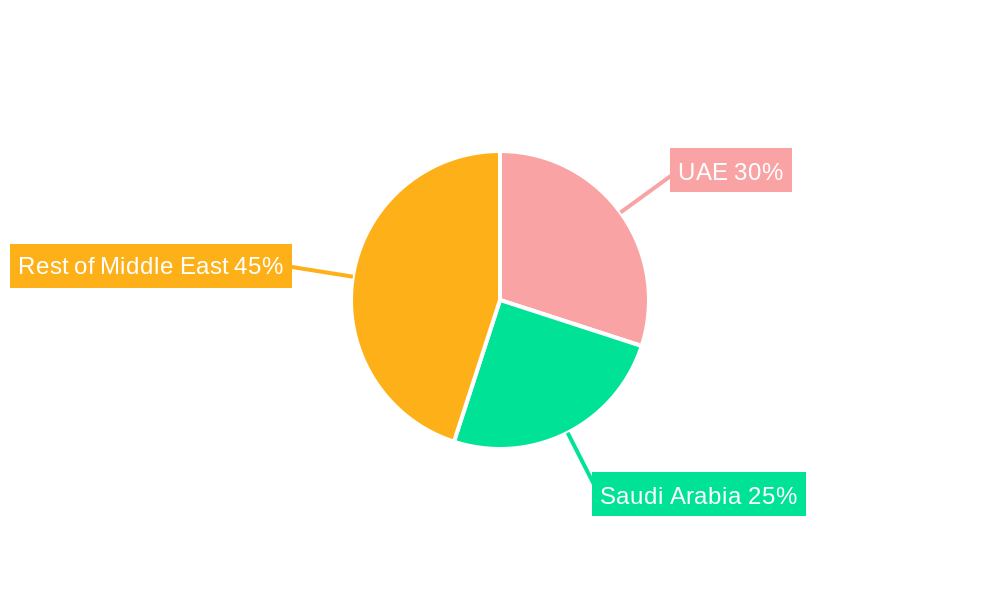

The forecast period (2025-2033) anticipates continued growth, although the CAGR might moderate slightly as the market matures and alternative technologies gain traction. The dominance of lead-acid batteries is expected to persist in price-sensitive segments like residential and some commercial applications, but the higher-end utility and industrial sectors will see increased adoption of lithium-ion batteries. Government initiatives promoting renewable energy integration and energy efficiency will further influence market expansion, particularly in countries like the UAE and Saudi Arabia, where significant investments in solar and wind power projects are underway. The market's trajectory will be shaped by the ongoing balance between the cost-effectiveness of lead-acid technology and the increasing appeal of advanced battery chemistries, as well as regulatory measures concerning environmental sustainability. Detailed regional analysis considering individual country contexts within the Middle East (UAE, Saudi Arabia, Qatar, Israel, Egypt, Oman) will provide a more precise understanding of market opportunities and challenges.

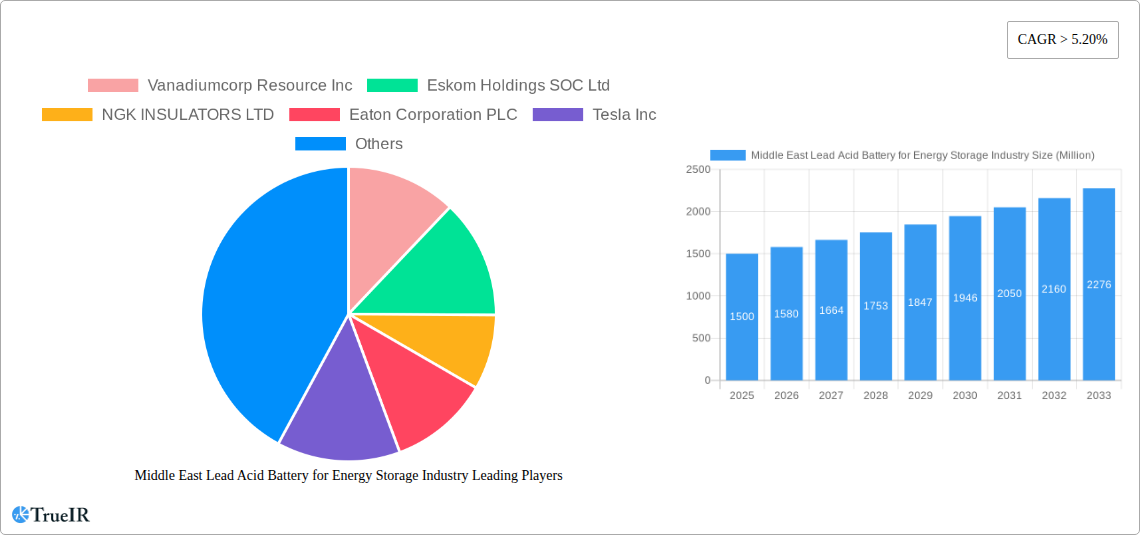

Middle East Lead Acid Battery for Energy Storage Industry Company Market Share

Middle East Lead Acid Battery for Energy Storage Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Middle East lead acid battery market for energy storage, offering invaluable insights for industry stakeholders. With a focus on market structure, competitive landscape, key trends, and future projections, this report is an essential resource for strategic decision-making. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market size estimations are presented in millions of USD.

Middle East Lead Acid Battery for Energy Storage Industry Market Structure & Competitive Landscape

This section analyzes the competitive dynamics of the Middle East lead acid battery market for energy storage. We explore market concentration, innovation drivers, regulatory influences, and the role of product substitutes. The analysis includes a detailed examination of end-user segmentation (Residential, Commercial & Industrial, Utility) and an assessment of recent mergers and acquisitions (M&A) activity.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a relatively competitive landscape.

- Innovation Drivers: Ongoing advancements in lead-acid battery technology, such as improved energy density and lifespan, are driving market growth. Furthermore, the increasing demand for reliable and cost-effective energy storage solutions is fueling innovation.

- Regulatory Impacts: Government policies promoting renewable energy integration and energy efficiency are positively influencing market expansion. However, stringent environmental regulations may pose challenges for some manufacturers.

- Product Substitutes: The market faces competition from alternative energy storage technologies, including Li-ion batteries. However, the cost-effectiveness and proven reliability of lead-acid batteries continue to ensure their relevance.

- End-User Segmentation: The Utility segment is projected to dominate the market, driven by the increasing need for grid stabilization and renewable energy integration. The Commercial & Industrial segment is also experiencing significant growth, fueled by the rising adoption of energy storage solutions for backup power and peak shaving.

- M&A Trends: The past five years have witnessed xx M&A transactions in the Middle East lead acid battery market, primarily driven by strategic acquisitions to expand market reach and technological capabilities.

Middle East Lead Acid Battery for Energy Storage Industry Market Trends & Opportunities

This section explores the key market trends and opportunities within the Middle East lead acid battery market for energy storage. We analyze market size growth, technological shifts, evolving consumer preferences, and competitive dynamics. Key performance indicators (KPIs) such as the Compound Annual Growth Rate (CAGR) and market penetration rates are incorporated.

The Middle East lead acid battery market for energy storage is experiencing robust growth, driven by factors such as increasing electricity demand, expanding renewable energy capacity, and government initiatives to promote energy security. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market size of $xx million by 2033. Technological advancements in lead-acid battery technology, coupled with decreasing manufacturing costs, are enhancing market competitiveness. Consumer preferences are shifting towards longer-lasting, higher-performing batteries, stimulating innovation in product design and functionality. The competitive landscape is characterized by both established players and emerging companies vying for market share, fostering innovation and price competition. The market penetration rate for lead-acid batteries in the energy storage sector is currently estimated at xx% and is expected to increase to xx% by 2033.

Dominant Markets & Segments in Middle East Lead Acid Battery for Energy Storage Industry

This section identifies the leading regions, countries, and segments within the Middle East lead acid battery market for energy storage, based on Application (Residential, Commercial and Industrial, Utility) and Technology (Li-ion Battery, Lead Acid Battery, Others).

- Dominant Segment: The Utility segment is currently the largest and fastest-growing segment, driven by the significant investments in renewable energy projects and the increasing need for grid stabilization and reliability.

- Dominant Technology: Lead-acid batteries maintain a significant market share due to their cost-effectiveness and mature technology. However, Li-ion batteries are gaining traction, particularly in niche applications requiring higher energy density.

- Key Growth Drivers:

- Expanding Renewable Energy Capacity: The region's ambitious renewable energy targets are creating a significant demand for energy storage solutions.

- Government Initiatives: Supportive government policies and incentives are accelerating the adoption of energy storage technologies.

- Infrastructure Development: Ongoing infrastructure projects are driving demand for reliable and cost-effective energy storage solutions.

- Technological Advancements: Advancements in battery technology are improving the performance and lifespan of lead-acid batteries.

Middle East Lead Acid Battery for Energy Storage Industry Product Analysis

The Middle East lead acid battery market offers a range of products tailored to diverse energy storage needs. Innovations focus on increasing energy density, extending lifespan, and enhancing safety features. These advancements improve the overall value proposition, ensuring market fit and competitiveness against alternative technologies like Li-ion batteries. The focus on cost-effectiveness, coupled with robust reliability, maintains the strong market position of lead-acid batteries in specific applications, especially within the Utility sector.

Key Drivers, Barriers & Challenges in Middle East Lead Acid Battery for Energy Storage Industry

Key Drivers: The Middle East lead acid battery market is propelled by the rapid expansion of renewable energy sources like solar and wind power, requiring effective energy storage solutions. Government initiatives promoting energy security and sustainability, along with declining battery costs, further stimulate market growth. Technological advancements continuously enhance battery performance and longevity, attracting wider adoption.

Key Challenges & Restraints: The market faces challenges from the increasing competition from Li-ion batteries, which boast higher energy density but often come at a higher price. Supply chain disruptions, particularly concerning raw materials, can impact production and pricing. Stringent environmental regulations may increase production costs and require manufacturers to adapt their processes.

Growth Drivers in the Middle East Lead Acid Battery for Energy Storage Industry Market

The market’s growth is primarily driven by substantial investments in renewable energy infrastructure across the region. Government policies promoting clean energy and energy efficiency initiatives are key catalysts. Furthermore, the increasing demand for reliable backup power in both residential and commercial sectors fuels market expansion. The cost-competitiveness of lead-acid batteries compared to alternative technologies remains a significant advantage.

Challenges Impacting Middle East Lead Acid Battery for Energy Storage Industry Growth

Challenges include the competition from advanced battery technologies like Li-ion, which, despite higher costs, offer superior energy density. Supply chain complexities and potential disruptions can affect production and pricing. Stricter environmental regulations increase manufacturing costs and necessitate process adaptations.

Key Players Shaping the Middle East Lead Acid Battery for Energy Storage Industry Market

- Vanadiumcorp Resource Inc

- Eskom Holdings SOC Ltd

- NGK INSULATORS LTD

- Eaton Corporation PLC

- Tesla Inc

- Sumitomo Corporation

- Philadelphia Solar LTD

Significant Middle East Lead Acid Battery for Energy Storage Industry Industry Milestones

- December 2022: Sungrow and ACWA Power sign MoU for a 536 MW/600 MWh energy storage system in NEOM city, Saudi Arabia.

- December 2022: Eskom begins construction on its first 8 MW/32 MWh battery energy storage system (BESS) in South Africa, costing USD 630 million.

- November 2022: ALEC Energy completes installation of Azelio's TES.POD thermal energy storage system in Dubai's MBR Solar Complex.

Future Outlook for Middle East Lead Acid Battery for Energy Storage Industry Market

The Middle East lead acid battery market for energy storage is poised for continued growth, driven by sustained investments in renewable energy projects and supportive government policies. Strategic opportunities exist for companies focusing on innovation, cost optimization, and expanding into new markets. The market's future potential is significant, particularly considering the region's ambitious renewable energy targets and the increasing need for reliable and cost-effective energy storage solutions.

Middle East Lead Acid Battery for Energy Storage Industry Segmentation

-

1. Technology

- 1.1. Li-Ion Battery

- 1.2. Lead Acid Battery

- 1.3. Others

-

2. Application

- 2.1. Residential

- 2.2. Commercial and Industrial

- 2.3. Utility

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Egypt

- 3.5. Rest of Middle-East and Africa

Middle East Lead Acid Battery for Energy Storage Industry Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Egypt

- 5. Rest of Middle East and Africa

Middle East Lead Acid Battery for Energy Storage Industry Regional Market Share

Geographic Coverage of Middle East Lead Acid Battery for Energy Storage Industry

Middle East Lead Acid Battery for Energy Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increasing Amount of Waste Generation

- 3.2.2 Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living4.; Increasing Focus on Non-fossil Fuel Sources of Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Expensive Nature of Incinerators

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Li-Ion Battery

- 5.1.2. Lead Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial and Industrial

- 5.2.3. Utility

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Egypt

- 5.3.5. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Egypt

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United Arab Emirates Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Li-Ion Battery

- 6.1.2. Lead Acid Battery

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential

- 6.2.2. Commercial and Industrial

- 6.2.3. Utility

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Egypt

- 6.3.5. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Saudi Arabia Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Li-Ion Battery

- 7.1.2. Lead Acid Battery

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential

- 7.2.2. Commercial and Industrial

- 7.2.3. Utility

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Egypt

- 7.3.5. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. South Africa Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Li-Ion Battery

- 8.1.2. Lead Acid Battery

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential

- 8.2.2. Commercial and Industrial

- 8.2.3. Utility

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Egypt

- 8.3.5. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Egypt Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Li-Ion Battery

- 9.1.2. Lead Acid Battery

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential

- 9.2.2. Commercial and Industrial

- 9.2.3. Utility

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Egypt

- 9.3.5. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Rest of Middle East and Africa Middle East Lead Acid Battery for Energy Storage Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Li-Ion Battery

- 10.1.2. Lead Acid Battery

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential

- 10.2.2. Commercial and Industrial

- 10.2.3. Utility

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. United Arab Emirates

- 10.3.2. Saudi Arabia

- 10.3.3. South Africa

- 10.3.4. Egypt

- 10.3.5. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vanadiumcorp Resource Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Eskom Holdings SOC Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NGK INSULATORS LTD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eaton Corporation PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tesla Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sumitomo Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Philadelphia Solar LTD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Vanadiumcorp Resource Inc

List of Figures

- Figure 1: Middle East Lead Acid Battery for Energy Storage Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Lead Acid Battery for Energy Storage Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 10: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 11: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 19: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 35: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 42: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 43: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 46: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Middle East Lead Acid Battery for Energy Storage Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Middle East Lead Acid Battery for Energy Storage Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Lead Acid Battery for Energy Storage Industry?

The projected CAGR is approximately 2.68%.

2. Which companies are prominent players in the Middle East Lead Acid Battery for Energy Storage Industry?

Key companies in the market include Vanadiumcorp Resource Inc, Eskom Holdings SOC Ltd, NGK INSULATORS LTD, Eaton Corporation PLC, Tesla Inc, Sumitomo Corporation, Philadelphia Solar LTD.

3. What are the main segments of the Middle East Lead Acid Battery for Energy Storage Industry?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Amount of Waste Generation. Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living4.; Increasing Focus on Non-fossil Fuel Sources of Energy.

6. What are the notable trends driving market growth?

Lithium-ion Battery Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Expensive Nature of Incinerators.

8. Can you provide examples of recent developments in the market?

December 2022: China-based clean power provider Sungrow signed a Memorandum of Understanding with Saudi Arabia-based power generation company ACWA Power to deliver an energy storage system for NEOM city. Sungrow will deliver a 536 megawatt/600 megawatt-hour plant for the Giga project under the provisions of the MoU.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Lead Acid Battery for Energy Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Lead Acid Battery for Energy Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Lead Acid Battery for Energy Storage Industry?

To stay informed about further developments, trends, and reports in the Middle East Lead Acid Battery for Energy Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence